-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Early Risk Bid Lacks Depth, GBP Outperforms On Brexit Talk Extension

EXECUTIVE SUMMARY

- BREXIT TALKS EXTENDED

- FIRST BATCH OF COVID-19 VACCINE IN U.S. SHIPS OUT FROM PFIZER FACILITY (AXIOS)

- CONGRESSIONAL LEADERS WEIGH NARROW COVID-19 RELIEF BILL (BBG)

- MERKEL ORDERS GERMANY INTO HARD LOCKDOWN AS INFECTIONS SWELL (BBG)

- RUSSIAN SPIES BEHIND BROAD HACKING CAMPAIGN THAT BREACHED U.S. AGENCIES (WASHINGTON POST)

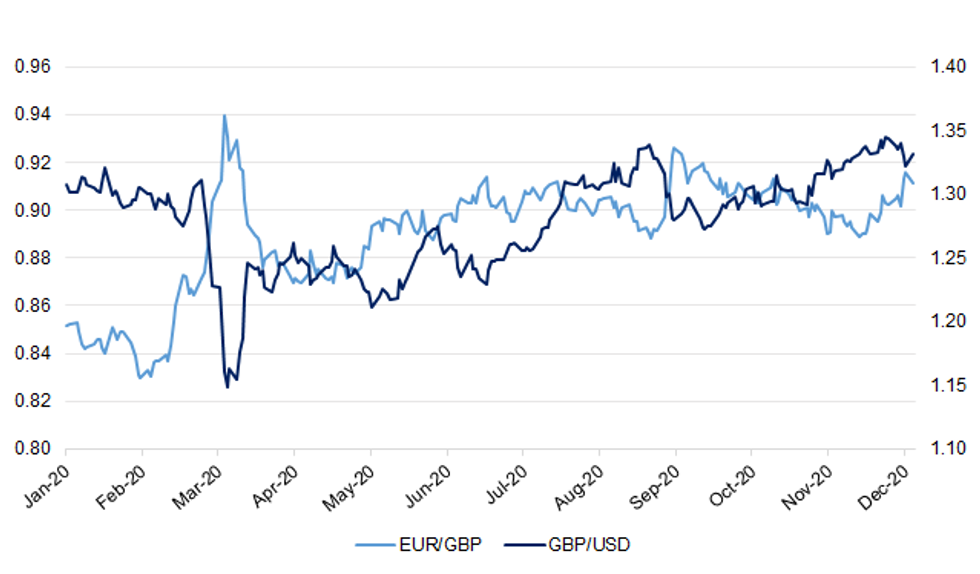

Fig. 1: EUR/GBP vs. GBP/USD

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BREXIT: The UK and EU have agreed to carry on post-Brexit trade talks after a call between leaders earlier on Sunday. In a joint statement, Boris Johnson and European Commission President Ursula von der Leyen said it was "responsible at this point to go the extra mile". The pair discussed "major unresolved topics" during their call. The two sides had said Sunday was the deadline for a decision on whether to continue with talks, with the UK set to leave EU rules at the end of the month. The leaders agreed to tell negotiators to carry on talks in Brussels "to see whether an agreement can even at this late stage be reached". They did not say how long these latest talks would continue, but the ultimate deadline is 31 December, and time must be allowed for the UK and European Parliaments to vote on any deal that emerges before then. (BBC)

BREXIT: The European Union's chief Brexit negotiator Michel Barnier will brief ambassadors from the bloc on Monday morning about the state of negotiations with Britain after the two sides agreed to keep talking in search of a trade agreement. "EU Chief negotiator Michel Barnier will brief EU Ambassadors tomorrow at 8.30 a.m. on the state of play of EU-UK negotiations," said Sebastian Fischer, an EU spokesman for Germany, which holds the bloc's presidency, on Twitter. "Ambassadors will then review the situation." (RTRS)

BREXIT: A no-deal Brexit would be wonderful for Britain, Boris Johnson said as he gave his gloomiest assessment yet of the prospects of a trade agreement with Brussels. On a visit to the northeast, the prime minister said that while ending the transition period without a deal was not what he had "set out to achieve", it would allow Britain to "do exactly what we want from January". He attacked the European Union for its negotiating stance and said that he could not accept its demands on competition rules and fishing. (The Times)

BREXIT: Boris Johnson's declaration that he would go to Paris, travel to Berlin, "do whatever it takes to reach a deal" was quietly rebuffed again by the EU on Friday. (BBC)

BREXIT: Mr Johnson insisted on Sunday no deal was still the "most likely" outcome but Ms von der Leyen said a phone call between the two leaders had been "constructive and useful". There was mounting speculation on Sunday evening Brussels is preparing to back down over one of the key obstacles to a deal. The EU is reportedly ready to drop its demand for the right to impose immediate "lightning tariffs" on the UK if it unilaterally decided the terms of a deal had been broken. Both sides said progress had been made at the weekend. In a joint statement, the two leaders said they had agreed to "go the extra mile" to try to get a deal, and Mr Johnson said Britain "certainly won't be walking away from the talks". (Telegraph)

BREXIT: Brussels has warned EU governments not to break ranks or entertain the idea of side deals with Britain should trade talks fail, urging a firm line in order to force the UK back to the negotiation table "as soon as possible" after January 1. According to a diplomatic note seen by the Financial Times, EU member states were warned by Brussels not to do anything that would ease the consequences of a no-deal end to the Brexit transition period on January 1. One EU official familiar with the discussion said Brussels was under "no illusion" that a no-deal Brexit would be highly unpredictable. "Everyone understands there are no guarantees the British come back to the table." (FT)

BREXIT: Irish Deputy Prime Minister Leo Varadkar said on Friday that he would not be surprised if negotiations between Britain and the European Union drag on for a few more days and there is a last-minute trade deal. "It's very often the case that these deals are done at the last moment because everyone needs to be sure it was the best deal possible and there is nothing else left on the table," Varadkar told reporters. "I wouldn't be surprised if it drags on for a few days and the deal is only clinched at the last minute," Varadkar said, sharing the Irish foreign minister's hopes earlier on Friday that a deal can still be done. (RTRS)

BREXIT: Boris Johnson has chaired a meeting of senior officials to discuss post-December 31 readiness, after warning that a no-deal Brexit is "looking very, very likely". Downing Street confirmed the meeting was held to take stock of no-deal plans, with Cabinet Office minister Michael Gove present. It followed the prime minister's visit to Blyth in Northumberland where he warned a breakthrough in the deadlocked talks would need to be a "big offer, a big change" before Sunday's deadline for a decision. He added that he had "yet to see it". (Sky)

BREXIT: Boris Johnson has put four Royal Navy patrol ships on standby to stop European fishing vessels if they encroach on British waters in the event of a no-deal Brexit in the latest escalation of tensions between the UK and the EU. The move is the latest visible sign of preparations for the UK leaving the EU without a trade deal between the two sides after days of negotiations without a breakthrough. (FT)

BREXIT/FISCAL: Cabinet ministers are drawing up a multibillion-pound bail-out package to bolster industries hardest hit by a no-deal Brexit, The Sunday Telegraph can disclose. The proposals, compiled by Whitehall departments, include resilience deals for sheep farmers, fishermen, car manufacturers and chemical suppliers who face trade disruption or being hit with punishing EU tariffs after Jan 1. (Telegraph)

BREXIT: Crucial updates to IT systems that will enable smooth trade between the UK and the EU from January are being delayed because of continually missed Brexit deadlines, likely heaping further chaos onto already struggling ports. (Telegraph)

BREXIT: Supermarkets are this weekend stockpiling food and other goods after being told by ministers that a no-deal Brexit is on the cards. (Sunday Times)

BREXIT: Households have been warned not to stockpile food and toilet roll ahead of 1 January when the UK stops trading under EU rules. On Sunday, the UK and the EU agreed to extend a deadline aimed at reaching a deal on post-Brexit trade. The British Retail Consortium (BRC) said ongoing uncertainty made it harder for firms to prepare for the New Year. But it said shops had plenty of supplies and shoppers must not buy more food than usual. (BBC)

BREXIT: Business, food and farming leaders have implored Boris Johnson to rule out a no-deal departure from the EU, saying it would be "catastrophic" for employment, supermarket supply chains and farming. The food industry said it was "just bonkers" that UK businesses did not know what the trading conditions would be in 12 working days' time. Ian Wright, the chief executive of the Food and Drink Federation, said the threat of tariffs "was not a trivial thing" and that if the UK left the EU without a trade deal on 1 January, consumers could expect to see price rises of between 5% and 15% in the supermarkets from mid-January. (Guardian)

BREXIT: The UK civil service has more than 2,000 vacancies for Brexit-related roles, prompting fears of departmental understaffing ahead of potential widespread disruption in the case of a no-deal Brexit next month. Officials in some critical functions have been ordered to avoid taking holidays in January or February as Whitehall faces one of the biggest challenges in its history. (FT)

BREXIT: Justin Trudeau's government expects to take stopgap regulatory measures to prevent the imposition of tariffs on U.K. products as it waits for Canada's parliament to ratify a new trade pact between the countries, according to a senior government official. (BBG)

FISCAL: The UK government is planning to launch a permanent replacement for the £65bn Covid loans programme with new state-backed guarantees to support lending by banks to a broad range of small to medium-sized business. Under plans still being finalised by Treasury officials, the new loan scheme could carry a guarantee of up to 80 per cent for loans of up to £10m for businesses that are deemed viable but unable to obtain finance from their lender, according to industry and Whitehall figures. (FT)

CORONAVIRUS: The vast majority of rural towns and areas will see their hopes of being "decoupled" from neighbouring Covid hotspots in higher tiers dashed this week, Matt Hancock has suggested, as senior ministers appeared resigned to London entering Tier 3. (Telegraph)

CORONAVIRUS: Boris Johnson has been warned by NHS chiefs that easing coronavirus restrictions threatens to spark a third wave of infections in January. Last month, the prime minister promised millions of people living under the toughest tier 3 restrictions that their areas would be downgraded to tier 2 this week — followed by a further easing of rules for five days over Christmas. (Sunday Times)

CORONAVIRUS: Britain could be "back to normal" by summer as long as it avoids a third wave after Christmas, the British scientist behind a Covid vaccine has said. Sarah Gilbert, the lead researcher on the Oxford vaccine, said "people's behaviour in the coming weeks is going to have a big impact" on when masks and social distancing requirements can be dropped. She added that a spike in coronavirus cases next month would disrupt vaccination programmes. (The Times)

CORONAVIRUS: It is "inevitable" London will go into Tier 3, health sources say, amid warnings the latest data on infections in the capital is "catastrophic". MPs from London and the surrounding areas are due to be briefed on Monday on figures that show the rate of infection is now doubling every four days. It comes as one London council ordered all its schools to close on Monday – in defiance of orders from the Education Secretary. Officials are working on national plans which could see some parts of the country "decoupled" from neighbours, potentially freeing a small number of rural areas from the heaviest restrictions. (Telegraph)

ECONOMY: Britain's manufacturing industry warned of a potential 'knockout blow' if Prime Minister Boris Johnson is unable to secure a trade deal with the European Union before temporary transition arrangements end on Dec. 31. Make UK, the trade body for British manufacturers, said it was slashing its growth forecast for the sector in 2021 to 2.7% from 5.1% just three months ago - roughly half the rate of growth it sees for the broader economy. "Combined with the pandemic, many in industry are feeling like an exhausted boxer in the final round of a bout, with a 'no deal' exit from the EU potentially landing a knockout blow," Make UK's chief executive Stephen Phipson said. (RTRS)

POLITICS: More Leave voters than Remainers have swung from the Tories to Labour since the last election, according to a major polling project that suggests Keir Starmer, the Labour leader, has made some early progress in bridging the Brexit divide. (Observer)

EQUITIES: Hedge funds are betting that UK stocks are set for a rebound, despite concerns over whether a trade deal can be reached with the EU before the end-of-year deadline. After a largely miserable performance during the coronavirus crisis, some fund managers believe that UK stocks offer one of the last places to find bargains in a world where ultra-loose monetary policy has driven up asset prices. That optimism comes despite growing uncertainty over whether the UK and EU will reach agreement before the Brexit transition period expires at the end of this month. (FT)

EUROPE

ECB: Europe's top financial regulators are putting the finishing touches to new recommendations allowing the region's strongest banks to restart dividend payments within strict limits, ending a nine-month hiatus imposed due to the coronavirus crisis. The European Central Bank's supervisory board, which oversees the 117 biggest banks in the eurozone, plans to announce the conditions under which it will accept some lenders restarting their dividend payments after its meeting on Tuesday. (FT)

GERMANY: Germany will enter a hard lockdown from Wednesday, with non-essential stores shuttered, employers urged to close workplaces and school children encouraged to remain at home. The tighter restrictions -- including a ban on gatherings over the New Year -- will last until at least Jan. 10 as a looser shutdown failed to halt a surge in daily coronavirus infections and deaths. (BBG)

GERMANY: Germany's lower house of parliament approved a budget for next year that allows new borrowing of up to 180 billion euros ($218 billion) to help finance pandemic-related spending. Chancellor Angela Merkel's administration nearly doubled the debt it had projected earlier this year as it extended additional financial aid to companies to help offset the fallout from a pandemic that has become more fierce than in the spring. (BBG)

FRANCE: Covid-19 patients in intensive-care units in France increased for the first time in almost four weeks, rising by 10 to 2,871, according to the Health Ministry. Hospitalizations for illness related to the virus, which include ICUs, climbed by 259, the most in three weeks. The seven-day rolling average of new cases rose for a sixth straight day, topping 12,000 for the first time since Nov. 27. By contrast, deaths increased by 150, the least in seven weeks. (BBG)

ITALY: Italy plans to start vaccinating its population in mid-January, coronavirus emergency chief Domenico Arcuri said. The country is facing a potential third wave of new cases after the Christmas holidays, unless citizens continue to follow restrictions, virologist Massimo Galli said in an interview with Il Messaggero. (BBG)

AUSTRIA: Austria is easing limits for gatherings to allow as many as 10 people to meet on Christmas Eve and Christmas Day, Chancellor Sebastian Kurz told journalists on Friday. After that and including New Year's Eve, the limit will revert to a maximum of two families. Also, provincial governments are getting the option to impose mandatory face coverings in highly popular outdoor locations. (BBG)

SWEDEN: Finland and Norway have offered medical assistance to Sweden, as their neighbour faces an increasingly severe second wave of coronavirus that has stretched clinical staff and intensive care capacity to the limit in some areas. Sweden has yet to formally ask for outside help but authorities in Stockholm have requested assistance from the country's military and could get aid from less hard-hit regions. (FT)

SWEDEN: Sweden's foreign minister Ann Linde said she won't advise against traveling within the European Union over Christmas and New Year. The emphasis should be on distancing and hygiene, because trips themselves aren't the main issue, Linde said in an interview with Swedish Radio P1 on Saturday. (BBG)

RATINGS: Sovereign rating reviews of note from Friday included:

- Fitch affirmed Switzerland at AAA; Outlook Stable

- Fitch affirmed Spain at A-; Outlook Stable

- S&P affirmed Slovenia at AA-; Outlook Stable

U.S.

ECONOMY: About 63% of U.S. adults reported that they've been using all or most of their income to cover their monthly expenses since the outbreak of Covid-19, according to a recent survey by Highland Solutions of roughly 2,000 U.S. adults. Prior to the pandemic, 53% of respondents said they were not living paycheck to paycheck. (CNBC)

ECONOMY: MNI INTERVIEW: US Hiring Slowdown Will Last Into Spring – ADP

- U.S. hiring will potentially remain weak into the second quarter of next year as the surge in Covid-19 closes shops and hurts consumer spending, ADP chief economist Nela Richardson told MNI - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FISCAL: President Donald Trump signed a one-week government funding extension Friday as Congress rushes to reach spending and coronavirus relief deals. The Senate passed the measure in a voice vote earlier in the day, and the House approved it this week. Funding would have lapsed Saturday if Washington failed to pass a spending plan. (CNBC)

FISCAL: A bipartisan group of lawmakers will unveil a $908 billion coronavirus pandemic relief bill on Monday, although there's "no guarantee" Congress will pass it, one of the key negotiators said. "We were on a call all day yesterday, we'll get on a call again this afternoon to finish things up," Senator Joe Manchin, a West Virginia Democrat, said on "Fox News Sunday." "We'll have a bill produced for the American people tomorrow, $908 billion." (BBG)

CORONAVIRUS: The first U.S. batch of the Pfizer-BioNTech COVID-19 vaccine left a Pfizer facility in Kalamazoo, Michigan, on Sunday, per CNN, days after the FDA issued an emergency use authorization for the inoculation. Driving the news: UPS and FedEx will deliver 2.9 million doses of the vaccine to about 150 locations in all 50 states by Monday and to another 450 sites between Tuesday and Wednesday, said Army Gen. Gustave Perna, who is with Operation Warp Speed. (Axios)

CORONAVIRUS: The U.S. government will buy an additional 100 million doses of a vaccine candidate known as mRNA-1273 from Moderna Inc. If authorized by the FDA for emergency use, the vaccine would being shipping immediately and be provided at no cost to Americans, the Department of Health and Human Services said in a statement. Securing 200 million doses provides for continuous delivery through next June, according to HHS. (BBG)

CORONAVIRUS: Stephen Hahn, the head of the U.S. Food and Drug Administration, disputed a news report that he was told to step down if the agency didn't authorize the Pfizer-BioNTech vaccine on Friday. (BBG)

CORONAVIRUS: As many as eight in 10 people in the U.S. could be vaccinated by next summer, according to Moncef Slaoui, who heads the government's push to approve and distribute vaccines. After the FDA authorized emergency use of the Pfizer- BioNTech shot, a Moderna Inc. vaccine "likely will be approved by Friday," Slaoui said on "Fox News Sunday." "We need to have immunized about 75% to 80% of the U.S. population before herd immunity can really be established," he said. "We hope to reach that point between the month of May and the month of June." (BBG)

CORONAVIRUS: President Donald Trump and other top U.S. officials will be offered the newly-approved coronavirus vaccine within days as part of a plan to ensure continuity in government amid the pandemic, people familiar with the effort said Sunday. The vaccinations will be offered to critical personnel in all three branches of government deemed essential and could start as soon as Monday. (BBG)

CORONAVIRUS: A slowing of new Covid-19 cases in the U.S. Midwest and West offers "hopeful signs," even as infections on the east and west coasts are accelerate, former Food and Drug Administration head Scott Gottlieb said on CBS's "Face the Nation." Even with the imminent start of vaccinations in the U.S., "we need to keep the health-care system from getting maxed out," Gottlieb said. "They're not going to see peak burden on hospital resources probably until mid January, late January." (BBG)

CORONAVIRUS: New York Gov. Andrew Cuomo announced Friday that restaurants in New York City have to close indoor dining sections as new daily coronavirus cases across the state recently eclipsed 10,000 for the first time since the spring and Covid-19 hospitalizations soar. The Democratic governor said restaurants can continue to operate outdoor dining areas and offer take-out and delivery beginning Monday. Cuomo warned earlier this week that the state could close indoor dining if the city's hospitalization rate didn't stabilize. (CNBC)

CORONAVIRUS: Mississippi is suspending elective surgeries in hospitals statewide starting Dec. 15, State Health Officer Thomas Dobbs said Friday. (BBG)

CORONAVIRUS: In a metropolitan area where one in 20 people have been infected with Covid-19, Los Angeles Mayor Eric Garcetti presented another warning: they're dying too. "This week, every 20 minutes someone in L.A. County is dying from Covid-19," he said in a tweet, adding in a separate post that "our hospitals are running dangerously low on intensive care unit beds. It's time for urgent action." (BBG)

CORONAVIRUS: Nebraska relaxed some coronavirus-related restrictions on Saturday, increasing the capacity limit for indoor gatherings to 50% from 25% and allowing some elective surgeries to resume. While groups in bars and restaurants will still be limited to eight patrons, they'll no longer be required to stay six feet (1.83 meters) apart. Distancing requirements for gyms, health clubs and spas were lifted. (BBG)

POLITICS: The Senate approved a colossal defense policy bill Friday despite multiple threats from President Donald Trump that he would veto the measure. At least 75 members of the Republican-led Senate voted for the sweeping $740 billion annual defense bill, a number larger than the two-thirds majority that would be needed to defeat Trump's promised veto. (CNBC)

POLITICS: Rudy Giuliani, President Trump's personal attorney, indicated the president's legal team will continue filing lawsuits to subvert the election results even after the Supreme Court shot down an effort to overturn the vote count in four swing states. (The Hill)

POLITICS: A federal judge in Wisconsin on Saturday bluntly dismissed a lawsuit filed by President Donald Trump challenging Joe Biden's win in that state, further cementing Biden's victory in the national presidential election. (CNBC)

POLITICS: President Trump has expressed interest in pursuing the appointment of a special counsel to investigate allegations of fraud in the November elections and issues related to Hunter Biden, according to people familiar with the matter. (WSJ)

POLITICS: Several Trump allies, led by Rep. Mo Brooks (R-Ala.), plan on challenging the election results on Jan. 6, when Congress convenes to officially tally the votes from the Electoral College and certify Joe Biden as the President-elect. (Axios)

POLITICS: The chairman of the Texas Republican Party suggested the formation of a "Union of states that will abide by the constitution" on Friday after the U.S. Supreme Court rejected Texas' bid to throw out voting results in four states that President-elect Joe Biden won in November's presidential election. Texas GOP Chairman Allen West said the Supreme Court's order had established "a precedent that says states can violate the U.S. Constitution and not be held accountable." (RTRS)

POLITICS: Conservative groups claiming without evidence that the Nov. 3 election was stolen from President Donald Trump staged protests across the country on Saturday, with one in Washington turning violent at times as police broke up sporadic clashes after dark. (RTRS)

EQUITIES: Even if everyone agrees that vaccines will ignite the economy next year, Wall Street's collective consciousness has no idea what it will mean for stocks. Forecasts among the people paid to fashion such estimates are all over the map -- to an almost historic degree. The most bullish, Dubravko Lakos-Bujas at JPMorgan, predicts the return to normal will serve up a 20% rally, with the S&P 500 ending next year at 4,400. Less-optimistic ones, such as Citigroup's Tobias Levkovich and Savita Subramanian at Bank of America, worry the gains are already priced in. They both forecast the benchmark will reach 3,800, or just a 3.7% advance. (BBG)

EQUITIES: Big tech firms such as Google and Facebook will face fines of up to 6% of turnover if they do not do more to tackle illegal content and reveal more about advertising on their platforms under draft European Union rules. The EU's tough line, which is due to be announced next week, comes amid growing regulatory scrutiny worldwide of tech giants and their control of data and access to their platforms. EU digital chief Thierry Breton, who has stressed that large companies should bear more responsibility, will present the draft rules known as the Digital Services Act (DSA) on Dec. 15. (RTRS)

EQUITIES: California asked to join the U.S. Department of Justice's antitrust lawsuit against Google on Friday, making the state's attorney general the first Democrat to openly support the litigation. (RTRS)

EQUITIES: The announcement caps the long-awaited addition of the automaker as investors around the world plan for the S&P 500 Index changes to take effect on Dec. 21. While companies are dropped and added to the index regularly, the process has attracted immense attention this time due to Tesla's hugely anticipated entry into the group. Tesla will also be added to the S&P 100, replacing Occidental Petroleum Corp., S&P said on Friday. Occidental will remain in the S&P 500, and Apartment Income REIT Corp. will replace Dunkin' Brands Group Inc. in the S&P MidCap 400 Index. (BBG)

OTHER

U.S./CHINA/HONG KONG: The U.S. Treasury Department said Friday it hasn't identified any banks or other financial institutions linked to a group of people sanctioned in October over China's crackdown on Hong Kong. The decision, announced in a report required by Congress, is likely to come as a relief to major banks that had sought to unwind any connection to those sanctioned for fear of facing punishment. "At this time, Treasury has not identified any FFI that has knowingly conducted a significant transaction with a foreign person" identified by the State Department, the Treasury report said, referring to "foreign financial institutions." It added that "Treasury will continue to monitor for any activity that meets these criteria." (BBG)

U.S./CHINA/HONG KONG: U.S. Secretary of State Pompeo tweeted the following on Friday: "Hong Kong's National Security Law makes a mockery of justice. @JimmyLaiApple's only "crime" is speaking the truth about the Chinese Communist Party's authoritarianism and fear of freedom. Charges should be dropped and he should be released immediately." (MNI)

GEOPOLITICS: China should downplay ideological differences with western powers and not fall into the trap laid by the U.S., which intends to protect its hegemony, said Global Times in an editorial. China should not escalate value-based frictions with other countries but instead focus on economic interests, the newspaper said. (MNI)

GEOPOLITICS: Four soldiers from Azerbaijan have been killed in clashes in the disputed Nagorno-Karabakh region, Azerbaijan's defence ministry says. The reports come only weeks after a six-week war over the territory which ended when Azerbaijan and Armenia signed a ceasefire. Armenia meanwhile said six of its own troops were wounded in what it called an Azerbaijani military offensive. (BBC)

CORONAVIRUS: The Food and Drug Administration has approved Pfizer and BioNTech's coronavirus vaccine for emergency use, a monumental turning point in the once-in-a-century pandemic that has taken nearly 300,000 American lives in less than a year and wreaked havoc on the U.S. economy. (CNBC)

CORONAVIRUS: A key U.S. Centers for Disease Control and Prevention panel voted unanimously to recommend Pfizer-BioNTech's Covid-19 vaccine for people 16 years and older on Saturday, clearing another pivotal hurdle for the drug before vaccinations begin in the coming days. (CNBC)

CORONAVIRUS: European Council President Charles Michel expects the first Covid vaccines to be approved in the European Union "in the coming weeks, maybe even before the end of the year," he said in a France Inter radio interview on Sunday. The EU decided to follow its regulatory process and "not to play" with approval, Michel said, adding that the U.K. used a loophole to clear the Covid vaccine from Pfizer Inc. and BioNTech SE ahead of the European Medicines Agency. (BBG)

CORONAVIRUS: Some of Moderna Inc.'s vaccine doses will be delivered to Europe this month even though they can't be distributed until approvals have been received, Chief Executive Officer Stephane Bancel told Schweiz am Wochenende newspaper. Not all doses are meant for the U.S., the paper said. The company is just behind Pfizer Inc. in the approval process in the U.K., Bancel was cited as saying. (BBG)

CORONAVIRUS: China National Biotec Group (CNBG), a subsidiary of Sinopharm, said Saturday that it expects the production capacity of its COVID-19 vaccine to reach 1 billion doses next year. It has carried out phase III clinical trials in 10 countries and regions worldwide, with 60,000 subjects included in the testing, Beijing Daily reported. (Global Times)

CORONAVIRUS: Peru suspended trials for China's Sinopharm COVID-19 vaccine due to a "serious adverse event" that occurred with one of the volunteers for the study, the Peruvian government said in a statement on Saturday. (RTRS)

CORONAVIRUS: The first human trial of Iran's locally developed vaccine will get underway within two weeks, according to a statement by Setad, a state-controlled foundation in charge of the development, the official IRIB News reported. (BBG)

CORONAVIRUS: The World Health Organization will review vaccines by Pfizer, BioNTech, Moderna and AstraZeneca over the "next couple of weeks" to determine whether to grant them emergency-use licenses, WHO Chief Scientist Soumya Swaminathan said Friday. Several countries and global procurement agencies such as UNICEF rely on WHO's pre-qualification services for vaccines and drugs, Swaminathan said. (BBG)

JAPAN: The Tokyo Metropolitan Government plans to ask stores to keep their reduced opening hours in place until Jan. 11, Japan's public broadcaster NHK reported, citing an unidentified person. The Japanese government will hold a meeting as soon as Monday to discuss whether to exclude Tokyo and Nagoya cities from the "Go To" travel campaign, NHK said. (BBG)

JAPAN: Japan may stop the travel campaign in Tokyo and Nagoya because of rising coronavirus cases, local media reported Sunday. The government will hold talks with governors of regions where infections are rising, Economy Minister Yasutoshi Nishimura told NHK. The program to the two cities may be suspended until Dec. 25, FNN reported, without saying where it got the information. (BBG)

JAPAN: Japanese government bond issuance will increase to a record of more than 112 trillion yen ($1.08 trillion) in the current fiscal year, the Nikkei reported. The government plans to issue additional deficit-covering bonds, the Nikkei said, without specifying where it got the information. (BBG)

AUSTRALIA: Australian fruit growers on Monday urged state governments to set up travel bubbles with coronavirus-free Pacific island nations and bring in seasonal agricultural workers to avoid rotting crops and food price rises. (FT)

AUSTRALIA: Victoria's tourism authorities plan to issue another 30,000 vouchers on Monday for travel within the Australian state after demand for its initial offer crashed the government website. The vouchers are aimed to help alleviate the tourism pause and resulting economic slump caused by the coronavirus pandemic. (FT)

AUSTRALIA/CHINA: China's top economic planner on Saturday gave approval to power plants to import coal without clearance restrictions, except for Australia, in a bid to stabilize coal purchase prices. Analysts said that China has various sources of coal, including Mongolia, Indonesia and Russia. Moreover, China is reducing coal use to curb carbon emissions, which will mean lower demand for coal in the next few decades. (Global Times)

AUSTRALIA/CHINA: Efforts by Chinese companies to buy Australian assets are being left to languish or rejected under temporary restrictions to foreign investment that experts claim are further aggravating relations between Canberra and Beijing. (ABC)

AUSTRALIA/NEW ZEALAND: New Zealand's cabinet has agreed to establish a quarantine-free travel bubble with Australia in the first quarter of 2021, the prime minister, Jacinda Ardern, has said. The Australian health minister Greg Hunt enthusiastically greeted the in-principle announcement, saying it was the "first step" in normalising international travel and anticipated the Australian government was "absolutely" likely to grant the necessary approvals. (Guardian)

NEW ZEALAND: The latest NZIER Consensus Forecasts show a substantial upward revision to growth forecasts over the coming year. The consensus is clearly for a 'V' shaped economy recovery in New Zealand. (NZIER)

SOUTH KOREA: South Korean President Moon Jae-in says the country is facing an "emergency situation" as the daily coronavirus count exceeds the late February peak. "We plan to extensively expand drive-through and walk-through coronavirus testing methods ... as preemptive measures to track down infected people and block the spread," Moon said on Facebook. (Nikkei)

SOUTH KOREA: South Korean prime minister Chung Sye-kyun has called for stronger vigilance against a third wave of Covid-19 infections as the government is considering raising movement and social restrictions to the highest level to contain the outbreaks. Mr Chung said on Monday the government "won't hesitate in making a bold decision" when needed, after the country reported record new cases despite tougher distancing measures adopted last week. (FT)

ASIA: The foreign exchange market is making Asian exporters anxious as the U.S. dollar continues to fall relative to leading currencies, reducing the competitiveness of regional products in the American market. (Nikkei)

CANADA: Prime Minister Justin Trudeau is urging Canadians to reduce their in-person contacts as new modelling shows COVID-19 cases are continuing to grow and the country readies for its first vaccinations. (Globe & Mail)

CANADA: The first COVID-19 vaccines landed on Canadian soil on Sunday, Prime Minister Justin Trudeau said, and some Canadians are expected to roll up their sleeves for a shot as soon as Monday. (RTRS)

MEXICO: Mexico's central bank won a respite when a bill that could force it to buy drug money was left off the congressional agenda for Monday. Banco de Mexico also got a boost on when a group of private banks on Sunday came out in support of its efforts to kill the legislation. The law could still pass, though that appears less likely because the Lower House won't debate the bill on Monday, according to a copy of its agenda seen by Bloomberg News. Since congress goes into recess for the Christmas holidays on Tuesday, this may mean that the bill gets pushed to next year. (BBG)

MEXICO: Private banks in Mexico including Banco Santander de Mexico, Banco Bilbao Vizcaya Argenta and Grupo Financiero Banorte issued a joint statement opposing a bill that would oblige the central bank to buy dollars. The proposed legislation would increase the risk of money laundering and terrorist financing in the Mexican financial system, the banks say in a statement they each separately sent to Bloomberg. (BBG)

BRAZIL: Half of Brazilians wouldn't take the Covid-19 vaccine being developed by China's Sinovac Biotech Ltd. with Instituto Butantan in Sao Paulo, a Datafolha poll shows. The Chinese vaccine, known as CoronaVac, has the highest rejection rate among those polled, at 50%, according to data published Saturday by the Folha de S. Paulo newspaper. More than a third wouldn't take a vaccine developed by Russia and a quarter would reject one produced by the U.K. The lowest rejection rate, of 23%, is for a U.S.-developed vaccine. (BBG)

RUSSIA: The Russian government hackers who breached a top cybersecurity firm are behind a global espionage campaign that also compromised the Treasury and Commerce departments and other government agencies, according to people familiar with the matter, who requested anonymity because of the sensitivity of the matter. The FBI is investigating the campaign by a hacking group working for the Russian foreign intelligence service, SVR. (Washington Post)

RUSSIA: A Russian nuclear submarine on Saturday successfully test-fired four intercontinental ballistic missiles in a show of readiness of Moscow's nuclear forces amid tension with the U.S. The Defense Ministry said that the Vladimir Monomakh submarine of the Pacific Fleet launched four Bulava missiles in quick succession from an underwater position in the Sea of Okhotsk. Their dummy warheads hit their designated targets on the Chiza shooting range in the Arkhangelsk region in northwestern Russia more than 5,500 kilometers (over 3,400 miles) away, the ministry said in a statement. (BBG)

RUSSIA: The Kremlin's challenge, however, is convincing 70 per cent of Russia's 143m population — who Sputnik V's manufacturers say must be inoculated to stop the virus spreading — that the vaccine is safe and effective. A deep-rooted suspicion of authority and the proliferation of anti-vaccine content online mean 61 per cent of Russians do not trust official data on coronavirus, while 59 per cent do not plan to get the vaccine, according to a poll by the independent Levada Center in November. (FT)

SOUTH AFRICA: President Cyril Ramaphosa will address the nation on Monday evening over the latest developments in the country's response to the coronavirus pandemic. The exact time of the President's address will be announced on Monday. (Independent Online)

IRAN: Iran's Foreign Ministry summoned the ambassadors of Germany and France after they denounced the Islamic Republic's execution of a dissident journalist, the semi-official Iranian Students' News Agency reported on Sunday. (BBG)

MIDDLE EAST: An explosion rocked a ship off Saudi Arabia's port city of Jiddah on the Red Sea, authorities said Monday, without elaborating. The kingdom did not immediately acknowledge the blast, which struck off a crucial port and distribution center for its oil trade. (Associated Press)

BONDS: A growing number of companies around the world are unable to repay their debts or make interest payments due to the coronavirus. Data show that 223 companies have defaulted on their corporate bonds so far in 2020, double the number that defaulted the previous year. The increase in defaults despite historically low interest rates is due to the rising number of heavily indebted companies in the U.S. and Europe over the past few years. If the bond market frets over these companies and yields rise, more bankruptcies will follow. Corporate bond defaults are spreading in China. Since November, the total amount of corporate bonds that have been postponed or canceled is over 200 billion yuan (about $30.5 billion). (Nikkei)

OIL: Iran is planning to produce 4.5 million b/d of crude oil and condensate in its next year that starts March 21 and export 2.3 million b/d of it if current US sanctions are lifted, state news agency IRNA reported Dec 13. (Platts)

OIL: Firefighters were working to put out a blaze after a pipeline carrying crude oil to Iran's second largest refinery ruptured and burst into flames on Sunday, Iranian news agencies reported. "The fire has not been contained but is under control. Its smoke is irritating, but it is not enough to injure anyone, and flames have not reached people's homes," Khosro Kiani, an emergency official in southwestern Iran, where the blaze occurred, told the semi-official news agency Tasnim. Kiani said the oil had spilled down a hard-to-access valley, which firefighting equipment could not reach. (RTRS)

OIL: Iraq has put out a fire at one of two oil wells in a small northern field that were set ablaze by explosives four days ago, the Oil Ministry said on Sunday. Technical crews from the state-run North Oil Co. were still trying to extinguish a second well blazing at the Khabbaz field near the city of Kirkuk, the statement said. (RTRS)

OIL: Mexico is wrapping up purchases for the 2021 edition of an oil hedging program that insures its revenues from oil sales, sources familiar with the legendarily opaque trade said, following a particularly challenging year. Negotiations to purchase the bulk of the financial contracts that protect Mexico against oil price crashes have now been concluded or are nearing conclusion, two sources with direct knowledge of the matter and three market sources who follow volumes and flows of such contracts closely said. (RTRS)

CHINA

POLICY: A key task for China's leadership is to toughen rules against anti-trust practices to curtail rampant expansion and prevent financial risks, the China Securities Journal wrote in an editorial following a Dec. 11 Politburo meeting. Fintech activities need to be included into the regulatory system as soon as possible as activity in this sector can suppress competition due to data and capital advantages, the Journal said. Operations spanning different industries can introduce complex and contagious risks, and regulators must guide capital and conduct financial risk prevention, the newspaper wrote. (MNI)

ECONOMY: The Chinese economy is expected to expand by 8.2 percent in 2021, according to the median of the 20 experts surveyed by the Global Times. That would be at its fastest pace since 2011 when the growth rate was above 8 percent for the last time and would signify a remarkable comeback from what is expected to be its slowest pace in over four decades of around 2.1 percent this year. (Global Times)

CORONAVIRUS: COVID-19 outbreaks with unknown sources of infection are taking place in at least four Chinese cities - Dongning and Suifenhe in Northeast China's Heilongjiang Province, Turpan in Northwest China's Xinjiang Uygur Autonomous Region, and Chengdu in Southwest China's Sichuan Province. To fight the virus, the cities have all rolled out massive nucleic acid testing programs and three have entered quasi-lockdown mode. (Global Times)

CORONAVIRUS: China is under little pressure to take mass vaccination of Chinese residents against COVID-19 in the foreseeable future, as the nation has brought the disease largely under control, but in the medium to long term, there exists a need to inoculate the residents, Zhang Wenhong, Shanghai-based infectious disease expert and leader of the Shanghai COVID-19 control group, said on Saturday. (Global Times)

BONDS: The PBOC will strive to raise the standard of rating agencies in the domestic bond market and toughen its supervision, Xinhua News Agency reported on Sunday citing Deputy Governor Pan Gongsheng. Credit rating standards need improvement as too many bonds were overrated and there is a lack of differentiation that accurately reflects the underlying risks, Pan said. MNI notes that Pan spoke after defaults by state-owned companies, perceived as low-risk given government ownership, have roiled China's financial markets in the last month. (MNI)

EQUITIES: Britain's AstraZeneca has agreed to buy U.S. drugmaker Alexion Pharmaceuticals for $39 billion in its largest ever deal, diversifying away from its fast-growing cancer business in a bet on rare-disease and immunology drugs. (RTRS)

FINTECH: China CBIRC rolls out regulations on online insurance business. Such businesses can only be operated by insurance companies and insurance intermediaries, according to a statement from China Banking and Insurance Regulatory Commission. Insurance intermediaries include bank-affiliated agencies, and Internet companies that have obtained licenses to operate as insurance agencies, Measures will take effect from Feb. 1. (BBG)

OVERNIGHT DATA

CHINA NOV NEW HOME PRICES +0.12% M/M; OCT +0.15%

JAPAN Q4 TANKAN LARGE M'FING INDEX -10; MEDIAN -15; Q3 -27

JAPAN Q4 TANKAN LARGE M'FING OUTLOOK -8; MEDIAN -11; Q3 -17

JAPAN Q4 TANKAN LARGE NON-M'FING INDEX -5; MEDIAN -7; Q3 -12

JAPAN Q4 TANKAN LARGE NON-M'FING OUTLOOK -6; MEDIAN -7; Q3 -11

JAPAN Q4 TANKAN LARGE ALL INDUSTRY CAPEX -1.2%; MEDIAN +0.1%; Q3 +1.4%

JAPAN Q4 TANKAN SMALL M'FING INDEX -27; MEDIAN -35; Q3 -44

JAPAN Q4 TANKAN SMALL M'FING OUTLOOK -26; MEDIAN -33; Q3 -38

JAPAN Q4 TANKAN SMALL NON-M'FING INDEX -12; MEDIAN -19; Q3 -22

JAPAN Q4 TANKAN SMALL NON-M'FING OUTLOOK -20; MEDIAN -22; Q3 -27

MNI DATA IMPACT: BOJ Dec Tankan: Sentiment Rises, Weaker Capex

- Japanese business sentiment has improved over the last three months as exports and production have recovered with expectations of further improvement in early 2021, according to the Bank of Japan's December Tankan business sentiment survey published on Monday - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

MNI DATA IMPACT: BOJ Dec Tankan: Longer-CPI Outlook Higher

- Longer-term inflation expectations at Japanese firms rose slightly in the three months to December although the one-year outlook was unchanged from the September reading, according to the latest Bank of Japan Tankan survey released on Monday - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

JAPAN OCT, F INDUSTRIAL OUTPUT +4.0% M/M; FLASH +3.8%

JAPAN OCT CAPACITY UTILISATION +6.0% M/M; SEP +6.4%

JAPAN OCT TERTIARY INDUSTRY INDEX +1.0% M/M; MEDIAN +1.2%; SEP +2.3%

NEW ZEALAND NOV SERVICES PMI 46.7; OCT 50.8

BusinessNZ's executive director for manufacturing Catherine Beard said that the sector has now remained in positive territory for the sixth consecutive month, despite swings in the actual activity levels. "The key indices of production (55.4) and new orders (57.6) both displayed healthy levels of expansion during November, while employment (51.5) eased back to September levels. Interestingly, finished stocks (59.0) recorded its highest value since the survey began, which may be due to COVID related delayed activity and distribution issues that has plagued 2020". "Overall, the sector is shaping up to end 2020 on a positive note, which would be a considerable contrast to what was seen during the first half of the year". BNZ Senior Economist, Doug Steel said that "as a measure of change, the PMI suggests that the manufacturing sector continues to move in the right direction after getting hit hard earlier in the year by COVID related restrictions". (BNZ)

NEW ZEALAND OCT NET MIGRATION +884; SEP +595

UK DEC RIGHTMOVE HOUSE PRICES +6.6% Y/Y; NOV +6.3%

UK DEC RIGHTMOVE HOUSE PRICES -0.6% M/M; NOV -0.5%

CHINA MARKETS

PBOC NET DRAINS CNY30BN VIA OMOS MONDAY

The People's Bank of China (PBOC) injected CNY20 billion via 7-day reverse repos with rates unchanged at 2.2% on Monday. This drained a net of CNY30 billion due to the maturity of CNY50 billion in reverse repos, according to Wind Information.

- The operation aims to maintain the liquidity in the banking system at a reasonable and ample level, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.2000% at 09:26 am local time from the close of 2.1281% on last Friday.

- The CFETS-NEX money-market sentiment index closed at 41 last Friday vs 57 last Thursday. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.5361 MON VS 6.5405

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.5361 on Monday, compared with the 6.5405 set on Friday.

MARKETS

SNAPSHOT: Early Risk Bid Lacks Depth, GBP Outperforms On Brexit Talk Extension

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 98.68 points at 26750.41

- ASX 200 up 17.619 points at 6660.2

- Shanghai Comp. up 10.167 points at 3359.573

- JGB 10-Yr future up 9 ticks at 152.15, yield down 0.4bp at 0.010%

- Aussie 10-Yr future up 2.0 ticks at 98.978, yield down 1.9bp at 0.965%

- U.S. 10-Yr future -0-04 at 137-31, yield up 0.83bp at 0.905%

- WTI crude up $0.27 at $46.84, Gold down $5.27 at $1834.58

- USD/JPY up 1 pip at Y104.05

- BREXIT TALKS EXTENDED

- FIRST BATCH OF COVID-19 VACCINE IN U.S. SHIPS OUT FROM PFIZER FACILITY (AXIOS)

- CONGRESSIONAL LEADERS WEIGH NARROW COVID-19 RELIEF BILL (BBG)

- MERKEL ORDERS GERMANY INTO HARD LOCKDOWN AS INFECTIONS SWELL (BBG)

- RUSSIAN SPIES BEHIND BROAD HACKING CAMPAIGN THAT BREACHED U.S. AGENCIES (WASHINGTON POST)

BOND SUMMARY: Core FI Calm After Initial Flurries

A lack of meaningful concrete developments re: some of the early risk positive factors, namely the extension of Brexit discussions and the U.S. fiscal impasse, ultimately limited trading after the initial flurry of flow surrounding the respective market re-opens. While the initial deployment of Pfizer's COVID-19 vaccine in the U.S. is a positive, that was at least partially negated by the aforementioned sources of uncertainty and short term COVID-19 pain, in addition to pockets of geopolitical unrest. That left T-Notes -0-04 at 137-31, a little off lows and within a 0-03 range after the small gap lower at the open, while cash Tsys have seen some light bear steepening, with 30s 1.4bp cheaper on the day.

- JGB futures have coiled, last +7, while the long end of the cash JGB curve lagged a little in early trade this week, given the slight underperformance in longer dated U.S. Tsys during Friday's session and generally risk-positive start to today's session (although the broad risk-positive move has faded from extremes and wasn't particularly fierce). The latest BoJ Tankan survey saw all of the major survey metrics edge closer to the neutral 0 level, although they all remained in negative territory. Meanwhile, the large firms' CapEx estimates missed expectations, surprisingly printing in negative territory. Participants now look to a government meeting re: COVID-19, which will be held after hours today.

- Aussie bonds saw a brief blip higher to new highs of the day for XM on the back of the previously flagged Westpac view re: RBA QE extension, although the move has faded, with YM last +0.4 & XM +2.9 based on the H1 contracts. Outside of that move, residual roll volume continues to dominate, given the lack of headline news flow, after swings in the broader risk tone dictated price action early on.

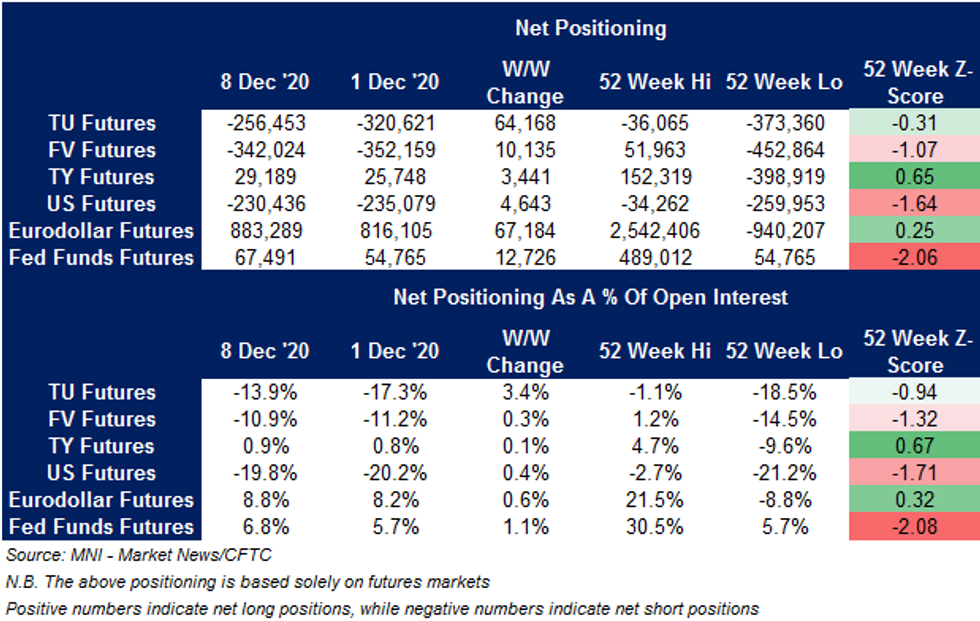

US TSYS: Little Significance In CFTC CoT Moves, Uniform In Direction

Little of any real significance in the latest weekly CFTC CoT report, with a relatively marginal, albeit broad, narrowing of net short positions/lengthening of net long positions seen across the major Tsy and STIR futures contracts.

EQUITIES: Risk Positive Headlines Support In Asia, But Ranges Quite Contained

Positive developments surrounding the initial deployment of Pfizer's COVID-19 vaccine in the U.S., the extension of Brexit talks and the seemingly impending unveiling of the bi-partisan fiscal stimulus proposal in DC (although that doesn't go anywhere near guaranteeing its passage) supported risk sentiment in early Asia trade.

- Still, the shorter-term impact of COVID-19, pockets of geopolitical worry and continued lack of ultimate progress/end games surrounding the previously flagged risk-positive moves meant that the early risk-positive flows didn't see much in the way of follow-through, as e-minis meandered through Asia hours.

- FTSE 100 futures also backed away from their early high, and last sit a mere 12 points better off on the day.

- Nikkei 225 +0.5%, Hang Seng -0.1%, CSI 300 +0.6%, ASX 200 +0.7%.

- S&P 500 futures +20, DJIA futures +196, NASDAQ 100 futures +53.

OIL: A Melting Pot Of News Flow

The major crude benchmarks chopped around in early trade this week, with Brent struggling for direction around the $50.00 mark. Still, both WTI & Brent have manged to register modest gains thus far, last printing ~$0.20 above settlement levels.

- As we have mentioned elsewhere, risk-positive headline flow from the weekend was countered by the a lack of firm progress re: most of the matters that saw favourable headlines, while geopolitical tension and the short-term pain of COVID-19 further limited any exuberance witnessed in early trading.

- In terms of crude specific news flow, the week saw Iran continue to point to a fairly immediate ramping up of crude production, while neighbour Iraq continued to fight fires at oilfields.

- Elsewhere, a RTRS source report did the rounds suggesting that "Mexico is wrapping up purchases for the 2021 edition of an oil hedging program that insures its revenues from oil sales."

- Middle East tensions were also at the fore, as Asia-Pac hours saw the Associated Press report that "an explosion rocked a ship off Saudi Arabia's port city of Jiddah on the Red Sea, authorities said Monday, without elaborating. The kingdom did not immediately acknowledge the blast, which struck off a crucial port and distribution center for its oil trade."

GOLD: As You Were

Spot gold is little changed vs. this time on Friday, operating around $1,835/oz, virtually unchanged vs. Friday's closing levels. U.S. real yields are unchanged to a touch higher vs. comparable times on Friday, with the DXY still hovering a little above cycle lows. Elsewhere, total known ETF holdings of gold operate ~4% off their recent all-time peak.

- The EUA of Pfizer's COVID-19 vaccine in the U.S. has been welcomed but hasn't really had any meaningful impact on broader markets, with continued focus on the broader COVID picture (near term pain), Brexit dynamic, fiscal situation in DC and pockets of geopolitical risk evident in early trade this week.

- The technical lines in the sand are unchanged.

FOREX: Ready To Go Extra Mile

Sterling went bid in Asia after the Johnson/vdL duo agreed to scrap Sunday's deadline for breaking the Brexit impasse and instructed their negotiating teams to continue attempts at striking a deal. The leaders refrained from setting a fresh deadline, while the FT reported that talks may continue until Christmas. EU Chief Brexit Negotiator Barnier will brief EU Ambassadors on the "state of play of EU-UK negotiations" this morning, while European Commission chief von der Leyen will head to Paris to discuss the matter with French Pres Macron. Sterling remained comfortably the best performer in G10 FX space, even as it pared some of its initial gains. EUG/GBP gapped lower at the re-open, but closed the gap later in the session.

- Brexit news added to broader optimism inspired by the $908bn draft stimulus package to be presented by a bipartisan group of U.S. lawmakers today (although its passage is not guaranteed) & the emergency approval of Pfizer's Covid-19 jab, which cleared the way for its rollout as soon as today. Resultant risk-on flows moderated somewhat, as caveats/foreign cyberattack on U.S. Tsy countered earlier enthusiasm.

- That being said, USD & JPY remained on the back foot, struggling to erase initial losses. NZD joined them at the bottom of the G10 scoreboard, despite little in the way of local catalysts.

- The AUD also underperformed, hampered by developments in China, the key among these were comments from China's Iron and Steel Association over the weekend saying the price of iron ore has diverged from fundamentals, and blaming speculation. This is a move that could pave the way for intervention.

- USD/Asia generally softened, with USD/CNH shedding ~160 pips & testing last Friday's low. IDR lagged its peers from the region as well as the greenback ahead of Thursday's monetary policy meeting from Bank Indonesia.

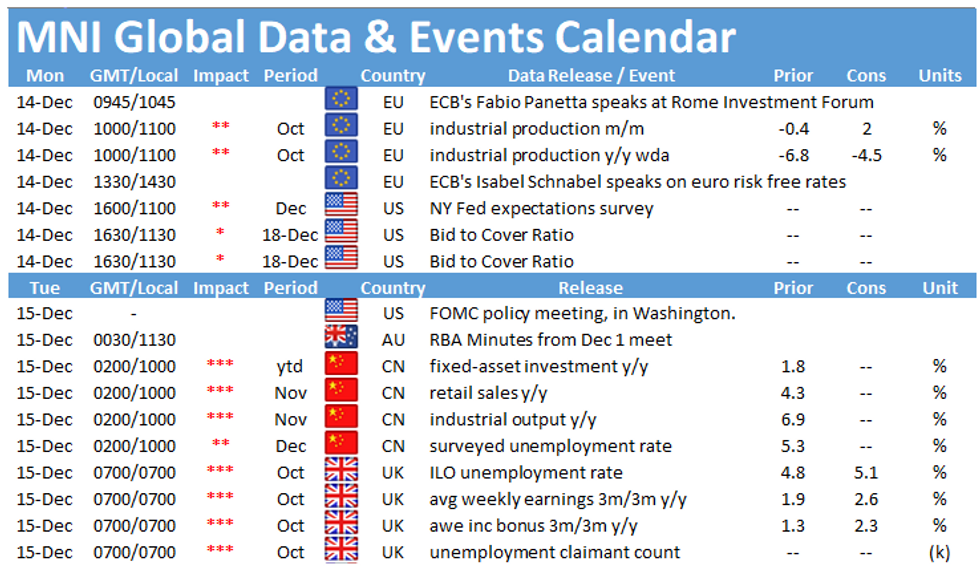

- On that note, central bank activity picks up this week, with more than a dozen of monetary policy decisions due. Meanwhile today's economic docket is rather unimpressive, with just EZ industrial output & comments from ECB's de Cos coming up.

FOREX OPTIONS: Expiries for Dec14 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1900(E521mln), $1.2000(E1.1bln), $1.2050-60(E664mln), $1.2175(E860mln-EUR puts), $1.2240-50(E614mln-EUR puts)

- USD/JPY: Y103.00-10($800mln), Y103.50-55($878mln), Y104.00($557mln), Y104.94-00($519mln), Y105.15($500mln), Y106.00($2.1bln)

- EUR/JPY: Y126.00(E606mln)

- GBP/USD: $1.3300(Gbp400mln), $1.3500(Gbp545mln), $1.3600(Gbp657mln)

- EUR/GBP: Gbp0.8800-20(E540mln), Gbp0.9015-25(E564mln)

- AUD/USD: $0.7450(A$607mln-AUD puts)

- AUD/JPY: Y78.30-35(A$574mln-AUD calls)

- AUD/NZD: N$1.0623(A$678mln-AUD puts)

- USD/CAD: C$1.3300($692mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.