-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: It's Beginning To Feel A Lot Like Christmas

EXECUTIVE SUMMARY

- BARNIER'S NARROW PATH, A BREXIT DEAL COULD BE DONE THIS WEEK (BBG)

- UK SOURCE: BREXIT TALKS REMAIN DIFFICULT, NO SIG. PROGRESS IN RECENT DAYS (SKY)

- CHINESE ECONOMIC ACTIVITY DATA IMPROVES IN NOV, MATCHING EXP.

- PBOC NET INJECTS CNY350BN VIA 1-YEAR MLF

Fig. 1: USD/CNH

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BREXIT: The European Union's chief negotiator, Michel Barnier, told a private meeting of ambassadors that a trade deal with the U.K. could be completed as soon as this week, but there are still significant differences to be bridged. The U.K. has made concessions on the level playing field and is now pushing the bloc to soften its demands on fisheries, Barnier told envoys from the EU's 27 member states on Monday, according to two diplomats with knowledge of the meeting. A compromise on the latter subject could unlock the accord, Barnier said. (BBG)

BREXIT: Brexit trade talks "remain difficult" and "have not made significant progress in recent days", a UK government source has said. The UK's chief negotiator, Lord Frost, and his EU counterpart, Michel Barnier, continued discussions on a post-Brexit trade deal on Monday in the hope of breaking months of deadlock. It comes after Prime Minister Boris Johnson and European Commission President Ursula von der Leyen decided to scrap Sunday's deadline for a final decision on whether an agreement will be possible, in order for talks to resume. (Sky)

BREXIT: MNI SOURCES: EU And UK Exploring LPF Landing Zone

- The two sides in the protracted Brexit trade talks appear to be trying harder to find a breakthrough on the critical issue of fair competition rules and their enforcement to unlock a post-transition trade deal in the coming days, European Union and UK sources indicate to MNI - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FISCAL: As much as £21bn of taxpayer-backed Covid lending is sitting unused in firms' bank accounts after businesses raced to shore up their finances when the pandemic hit. Borrowers are hoarding around half of the £42bn doled out under the Government's Bounce Back Loan scheme for small companies, according to senior executives from HSBC, Lloyds Bank and Natwest. Bank chiefs also said that significant numbers of bounce back applications for small firms were rejected because the applicant could not prove that their businesses existed or because they did not pass fraud checks. (Telegraph)

EUROPE

FRANCE: France has ordered a dozen public and private bodies to keep their deposits at the Treasury, government documents show, as it quietly builds up safeguards to reinforce its cash flow during the pandemic and ahead of Brexit. In a finance ministry document, dated Dec. 2, a government edict or ordinance shows that the public bodies include the national unemployment agency and the bank deposit guarantee fund. "In the context of a sharp increase in debt resulting from public intervention in the face of the health crisis, this ordinance aims to extend the obligation to keep deposits at the Treasury to certain bodies that were exempted until now," a finance ministry document accompanying the ordinance said. (RTRS)

ITALY/BTPS: Treasury to buy back the following issues on Dec 16:

- CTZ IT0005371247 - Jun-21

- CTZ IT0005388928 - Nov-21

- BTP IT0004695075 - 4.75 % Sep21

- BTP IT0005348443 - 2.30 % Oct-21

- BTP IT0005216491 - 0.35 % Nov-21

NETHERLANDS: The Dutch government is imposing stricter lockdown measures for five weeks in an effort to reverse a jump in daily cases and hospital admissions. Non-essential shops will be shuttered until at least Jan. 19, Prime Minister Mark Rutte said in a televised speech on Monday, the first time that's happened since the pandemic began. Publicly accessible spaces such as zoos, amusement parks and cinemas will also close, while supermarkets and pharmacies will remain open, Rutte said. The new measures will come on top of a partial lockdown in place since the middle of October that forced bars and restaurants to halt operations. While daily numbers retreated for a while, they have risen steeply in recent days, prompting the Dutch government to follow neighboring Germany in taking tougher measures. (BBG)

NORWAY: The watchdog overseeing Norway's central bank may investigate its handling of security clearances, after a deputy governor was suddenly forced to resign this month when his clearance was withdrawn. Jon Nicolaisen, deputy to Norges Bank Governor Oystein Olsen and the official at the bank overseeing Norway's $1.2 trillion wealth fund, resigned on Dec. 4 after failing to get the necessary security clearance. Nicolaisen, who had been deputy governor since 2014 and was supervising the fund since April this year, said he was told the decision was tied to his Chinese wife, who resides in China and receives financial support from him. (BBG)

U.S.

FISCAL: A bipartisan group of US senators on Monday presented a new fiscal stimulus compromise worth $748bn in an attempt to fuel a final push for economic relief legislation in the coming days. The proposal — which includes aid to small businesses and funding for unemployment benefits — represents the last chance for an agreement on government support for the world's largest economy in the midst of the latest coronavirus surge. In order to make it more palatable to both parties on Capitol Hill, lawmakers stripped out two highly contested provisions, on liability protections for businesses and assistance for states and local governments, lowering the price tag of the package from $908bn. (FT)

FISCAL: MNI EXCLUSIVE: US Fiscal Relief Will Lose Potency If Delayed

- A fiscal package delivering relief to Americans would be stronger before year-end, former officials and business groups say, because dollars spent months from now would lose potency in preventing more labor market scarring. The fiscal package may "have a less than 50% probability before year-end," said Nathan Sheets, a former top Fed and Treasury official. "A relief package coming later will not provide support in a period of economic softness and avoid labor market scarring" - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FISCAL: Lawmakers approached an agreement on the omnibus spending bill by agreeing to keep the Veterans Affairs Mission Act under the $1.4 trillion budget cap, a significant victory for House Republicans who insisted on this provision, according to two congressional aides The $12.5 billion for VA health care improvements will be paid for with savings elsewhere in the budget. One Democratic aide called the pay-fors "gimmicks," which don't harm spending in vital programs. The White House had resisted the Democratic proposal to designate the money as an emergency and thereby evade the cap. This agreement will be part of the 12-bill package needed to keep the government running after funding runs out Dec. 18, and this legislation represents the best chance to pass virus- related stimulus this year. (BBG)

FISCAL: Democratic U.S. House of Representatives Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin discussed a massive government spending bill meant to avert a government shutdown and a fresh round of COVID-19 relief on Monday, a Pelosi spokesman said. Pelosi reiterated Democratic concerns about liability provisions in the COVID-19 relief bill, and told Mnuchin that remaining unresolved items in the spending bill could be resolved easily, Pelosi spokesman Drew Hammill wrote on Twitter. "Recognizing the need to advance a final agreement on both matters together and quickly this week, the Speaker and the Secretary discussed the urgency of the committees finishing their work as soon as possible," Hammill said. (RTRS)

FISCAL: "Congress has two critical items to tackle this week: funding the government and delivering crucial COVID relief to families, workers, and businesses across the country," Senate Majority Leader Mitch McConnell and House Republican Leader Kevin McCarthy say in joint statement. "It is time for Republicans and Democrats in the Senate and House to find consensus on COVID relief before the holidays. We hope our Democrat counterparts share our sense of urgency". (BBG)

FISCAL: "It's getting close. It includes a lot of things in our package and number-wise it's less than what it was last week," said Senate Majority Whip John Thune. "It's trending in the right direction." (POLITICO)

CORONAVIRUS: The coronavirus has killed more than 300,000 people across the country as U.S. officials ship out the first of nearly 3 million doses of Pfizer's Covid-19 vaccine to distribution centers in all 50 states. (CNBC)

CORONAVIRUS: The head of Operation Warp Speed says the U.S. government is currently in talks to purchase more doses of Pfizer Inc's coronavirus vaccine for Americans. (Daily Mail)

CORONAVIRUS: U.S. officials said Monday they plan to ship just under 6 million doses of Moderna's Covid-19 vaccine once the Food and Drug Administration issues an approval for emergency use, which could come as early as Friday. (CNBC)

CORONAVIRUS: Americans will have to wait a few more months before they can walk into their neighborhood drugstore or grocery store and get a Covid-19 vaccine. In interviews with CNBC, CVS Health and Walgreens executives said they expect to give shots to customers at stores in the early spring. (CNBC)

CORONAVIRUS: Boston Mayor Marty Walsh announced on Monday that the city is moving back to a modified Phase 2, Step 2 in its reopening plan in order to slow surging COVID cases in the city. As a result, a number of businesses will be forced to close for at least three weeks. Walsh made the announcement during his Monday COVID-19 press briefing. (CBS)

POLITICS: President-elect Joe Biden called on Americans to "turn the page" on a hard-fought election and work together to tackle the country's mounting crises, marking his Electoral College victory even as President Donald Trump refuses to accept its results. "We the people voted. Faith in our institutions held. The integrity of our elections remains intact," Biden said in a speech in Wilmington, Delaware. "And so, now it is time to turn the page. To unite. To heal." Biden's 306-to-232 Electoral College win over Trump was finalized Monday after electors in each state voted. Congress will count the votes on Jan. 6. Trump and his allies are still protesting the result, but with more than 50 post-election lawsuits rejected, including by the U.S. Supreme Court, they have no viable path to overturn it. (BBG)

POLITICS: A narrowly divided Wisconsin Supreme Court on Monday rejected President Donald Trump's lawsuit attempting to overturn his election loss in the battleground state about an hour before the Electoral College cast Wisconsin's 10 votes for Democrat Joe Biden. In the 4-3 ruling, the court's three liberal justices were joined by conservative swing Justice Brian Hagedorn who said three of Trump's four claims were filed too late and the other was without merit. The ruling ends Trump's legal challenges in state court. (ABC)

POLITICS: In-person early voting began Monday in Georgia for the crucial Jan. 5 special election that will decide control of the Senate. Polling locations opened Monday morning as more than 1.2 million Georgians had already requested absentee ballots and more than 200,000 voters had returned their mail ballots, according to data compiled by the U.S. Elections Project. (CNBC)

POLITICS: Rep. Paul Mitchell of Michigan quit the Republican Party on Monday over the GOP's refusal to admit that President Donald Trump lost the election to President-elect Joe Biden. Mitchell, in a scathing letter to GOP leaders, wrote that Trump's baseless claims alleging widespread ballot fraud, and the Republican Party's tolerance of those claims, threatened "long-term harm to our democracy." (CNBC)

POLITICS: Attorney General William Barr, the head of the Department of Justice, will leave office before Christmas, President Donald Trump said Monday. The widely anticipated announcement of Barr's departure came just moments after President-elect Joe Biden's victory over Trump was formalized by the Electoral College. The shake-up, in the twilight of Trump's tenure in the White House, also followed weeks of public clashes between Barr and the president. (CNBC)

EQUITIES: Boeing Co. has expanded inspections of newly produced 787 Dreamliners after finding a previously disclosed manufacturing defect in sections of the jet where it hadn't been initially detected, according to industry and government officials. (WSJ)

EQUITIES: Apple plans to produce up to 96 million iPhones for the first half of 2021, a nearly 30% year-on-year increase, after demand for its first-ever 5G handsets surged amid the pandemic, Nikkei Asia learned. (Nikkei)

EQUITIES: California is taking Amazon to court to force the online retail giant to cooperate with a months-long investigation into whether the company is doing enough to protect its workers from the coronavirus, Atty. Gen. Xavier Becerra said Monday. (Los Angeles Times)

EQUITIES: The top U.S. privacy regulator ordered some of the biggest technology companies, including Amazon.com Inc., Facebook Inc. and Google's YouTube, to hand over information about how they collect and use information from users. The Federal Trade Commission said Monday it is issuing sweeping demands for information to the companies, saying their use of consumer data is "shrouded in secrecy." The move intensifies the U.S. government's scrutiny of the tech industry's business practices. (BBG)

OTHER

U.S./CHINA: FCC launches proceedings revoking China Telecom's authorization. (BBG)

CORONAVIRUS: The Trump administration anticipates two more vaccine developers could seek FDA authorization for their shots by the end of February. That would mean the U.S. would have four Covid-19 vaccines available — including the first vaccine to only require one shot — to meet its goal of immunizing 100 million people by the end of March. The timeline: The first results from Johnson & Johnson's late-stage U.S. trial could come in the beginning of January, said Moncef Slaoui, the chief adviser to Operation Warp Speed, at a Monday press conference. By late January, the company could have enough safety data to submit an application to FDA for emergency use. Johnson & Johnson cut its enrollment in its last-stage clinical trial from 60,000 to 40,000 because the virus is so widespread that data on efficacy is coming in faster than the company expected. J&J has so far enrolled more than 42,000 people and will stop recruiting participants later this week, Slaoui said. The vaccine is the only one among the frontrunners that is given as a single dose. "Because it's a one dose vaccine, they can really scale up very quickly," Slaoui said. The first efficacy readout of AstraZeneca's vaccine could come in the second half of January, Slaoui estimated, and the company could potentially file for emergency use later in February. (POLITICO)

CORONAVIRUS: European Medicines Agency is working "around the clock" on the first Covid-19 vaccine and a decision may be forthcoming before the envisaged Dec. 29, EMA's Executive Director Emer Cooke says in Handelsblatt interview published Tuesday. (BBG)

CORONAVIRUS: The World Health Organization is aware of a genetic variant of the virus identified in about 1,000 individuals in the U.K., Executive Director Michael Ryan said during a press briefing on Monday. "This virus evolves and changes over time, and we've seen different variants emerge," Ryan said. "The question is whether there is significance in public health terms," since mutations of the virus are "quite common." The WHO is working with an international laboratory network to see if the variant is becoming more prevalent internationally, he adds. (BBG)

HONG KONG: Hong Kong's government plans to submit funding proposal for new round of coronavirus relief measures to support industries affected by social distancing restrictions to Legislative Council before Christmas, Chief Executive Carrie Lam says at a briefing. (BBG)

BOJ: Bank of Japan is planning to extend its corporate financing program designed to help businesses hit by the coronavirus pandemic by 6 months to end-Sept., Nikkei reports, without attribution. The central bank is likely to decide on the extension at its two-day policy meeting this week. (BBG)

BOJ: MNI POLICY: Tankan Eases BOJ Worries On Wider Retail Price Cut

- The medium-term inflation view of businesses in the Bank of Japan's December Tankan survey has eased BOJ concerns of an increase in the number of firms lowering retail prices, MNI understands. BOJ officials are paying attention to the risk that a prolonged weakness in demand and consumer prices will increase the number of businesses lowering retail prices, although they judge that price cuts which aim at stimulating demand have not so far been widely observed - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

JAPAN: The approval rating of Japanese Prime Minister Yoshihide Suga's cabinet sank by 14ppts to 42% as the majority of Japanese people expressed discontent over the administration's coronavirus response, according to a NHK poll taken Dec. 11-13. Disapproval rating rose 17ppts to 36%. (BBG)

RBA: MNI POLICY:"Prepared To Do More" On QE

- The Reserve Bank of Australia is keeping the size of its bond purchase program under review and is "prepared to do more if necessary," minutes from the bank's last board meeting show.

- Minutes from the December 1 meeting were released today and show that although the RBA believes the domestic economic recovery is under way and recent data has been "better than expected," the recovery was still dependent on "significant policy support" - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

AUSTRALIA: Australia said on Tuesday it has secured another 20m doses of the AstraZeneca Covid-19 vaccine, moving closer to its whole-of-population vaccination goal. The extra doses will be made locally by CSL, bringing the total supply of AstraZeneca doses to 53.8m, enough for Australia's 25m people. (FT)

AUSTRALIA: Payroll jobs rose 0.4 per cent across the fortnight to 28 November, according to figures released by the Australian Bureau of Statistics (ABS) today. Bjorn Jarvis, head of Labour Statistics at the ABS, said: "More than three quarters (76 per cent) of payroll jobs lost to mid-April had been regained by the end of November, however they remained 2.0 per cent lower than mid-March." "Nationally, payroll jobs rose in both the Accommodation and food services (1.2 per cent) and Arts and recreation services (0.4 per cent) industries across the fortnight to 28 November. "In South Australia payroll jobs in these industries fell over the period, by 4.0 per cent and 7.0 per cent, which also coincided with the brief reintroduction of additional COVID-19 restrictions. "Across the fortnight to 28 November, the largest increases in payroll jobs within states and territories were seen in Tasmania (1.1 per cent), New South Wales (0.6 per cent), Victoria (0.4 per cent) and Western Australia (0.4 per cent)." "By the end of November, the variation in payroll jobs lost since 14 March has narrowed across states and territories." (ABS)

AUSTRALIA: Australia's banking system is well-positioned to withstand a very severe economic downturn, while still supporting the broader economy by providing credit to businesses and households, says the country's prudential regulator. This was determined, it says, after conducting stress tests based on very severe forward-looking economic assumptions, well beyond Covid-19 conditions. The scenario was of a very large fall in economic activity, with GDP falling by 15%, unemployment rising to over 13% and national house prices falling by over 30%. "The banks are assumed to not take any mitigating actions in response to the stress under this scenario," says APRA. While it says, there was impact on bank profitability and capital, the system still remained above minimum capital requirements throughout the stress period. (Dow Jones)

AUSTRALIA/CHINA: Australian Prime Minister Scott Morrison said any shift by China away from imports of high quality Australian coal would be a "lose-lose" for the environment and trading relationship. Chinese media outlets including The Global Times and Caixin on Monday reported China's top economic planner had granted approval to power plants to import coal without clearance restrictions, except for Australia. Australia on Tuesday urged China to clarify the reports, which it said would breach international trade rules if true. (Nikkei)

AUSTRALIA/CHINA: Australia's Trade Minister Simon Birmingham says he is "deeply troubled" by reports that China has formally banned imports of Australian coal, in the latest sign the dispute between the nations is worsening. More than 50 ships carrying Australian coal have been stranded off China after ports were verbally told in October not to offload such shipments. That ban appears to have been formalized, with the National Development and Reform Commission on Saturday giving power plants approval to import coal without restrictions, except from Australia, the Global Times reported. If true that would "indicate discriminatory trade practices," Birmingham said. "The risk profile of trading with China has grown significantly during the course of this year." (BBG)

SOUTH KOREA: South Korea's prime minister Chung Sye-kyun has urged people to abide by distancing rules as health authorities struggle to contain the country's largest wave of coronavirus infections. The government is considering raising restrictions to the highest level in order to curb the fast spread of infections but has refrained from imposing a nationwide lockdown, given the adverse impact it will have on Asia's fourth-largest economy. (FT)

NORTH KOREA: South Korea and U.S. intel authorities are closely monitoring over possibility that North Korea will hold military parade in Jan, a spokesman of South Korea's Joint Chiefs of Staff says in regular briefing on Tuesday. South Korea believes North Korea has started scheduled winter military drills. There is speculation that North Korea may hold military parade in Jan. when it holds party meeting. (BBG)

SINGAPORE: Singapore will start a new travel lane for "business, official and high economic value travelers" that will allow people to come to the city-state without quarantine for short- term stays and reside in a dedicated "bubble" facility near the airport. (BBG)

TURKEY: The Trump administration slapped sanctions on Turkey on Monday over a multibillion-dollar acquisition of a Russian missile system. The long-anticipated move is expected to further stoke tensions between Washington and Ankara in the weeks ahead of President-elect Joe Biden's ascension to the White House and send a message to foreign governments considering future weapons deals with Russia. (CNBC)

TURKEY: President Tayyip Erdogan said on Monday Turkey was working to bring interest rates down to "appropriate" levels for markets and he called on Turks, who have snapped up hard currencies at record levels, to convert their savings to lira. Turkey's central bank last month hiked its key rate by 475 points to 15% to contain a record lira fall and double-digit inflation. Erdogan said he expects foreign investing in Turkish assets to ramp up. In an address after a cabinet meeting, Erdogan also said he will bring promised economic and judicial reforms to parliament after budget talks conclude. (RTRS)

TURKEY: Turkey will impose a four-day nationwide curfew spanning the traditional calendar New Year holiday in a bid to curb the country's persistently high daily coronavirus infections. The lockdown will last from 9 pm on December 31 to 5am on January 4, Recep Tayyip Erdogan, Turkey's president, told reporters after a cabinet meeting in Ankara on Monday. "We have started to see the positive effects of the restrictions," he said. (FT)

MEXICO: The lower house of Mexico's Congress on Tuesday will debate a hotly contested bill that critics say would force Mexico's central bank to absorb money from drug gangs, lawmakers said on Monday, and the measure could go to a vote the same day. The Bank of Mexico (Banxico) and some lawmakers, including members of the ruling National Regeneration Movement (MORENA), had pushed for debate on the proposal to be delayed until Congress begins a new session in February. Supporters say the law would help Mexicans with poor access to the financial system, such as migrants and hospitality sector workers paid in dollars, to save cash. Critics, including Central Bank Governor Alejandro Diaz de Leon, say it could force Banxico to launder money and get the bank in trouble with international authorities. (RTRS)

MEXICO: Santiago Nieto, head of Mexico's financial intelligence unit, said in tweet that a bill that would force the country's central bank to buy dollars from questionable sources has to be discussed more broadly. (BBG)

BRAZIL: Legislation that would make Mexico's central bank buy dollars from the nation's banks will be debated in the lower house Tuesday, despite an outcry from policy makers that the bill could force them to hold cash from illicit sources. The bill, which has yet to pass the chamber's Finance Committee, is backed by the Morena party of President Andres Manuel Lopez Obrador, which holds a majority in the lower house. The bill already won Senate approval last week despite pushback from the central bank, the nation's largest private banks and the most influential business lobby, CCE. (BBG)

BRAZIL: Brazil once again risks losing its vote at the United Nations if it doesn't pay a portion of what it owes to the global organization, which is facing a growing cash crunch as the Covid-19 crisis puts pressure on budgets worldwide. Brazil needs to make a minimum payment of $113 million toward its total debt of $391 million by the end of the month in order to keep its vote in the General Assembly, UN Assistant Secretary-General Chandramouli Ramanathan wrote in a letter to Brazil's UN mission seen by Bloomberg News. Brazil's economy ministry said in a statement that a bill approving new payments to the UN and other international organizations will soon be voted on in Congress. (BBG)

RUSSIA: A team of sophisticated hackers believed to be working for the Russian government won access to internal communications at the U.S. Department of Homeland Security, according to people familiar with the matter. The breach was part of the campaign reported Sunday that penetrated the U.S. departments of Treasury and Commerce. DHS is a massive bureaucracy responsible for border security, cybersecurity and most recently the secure distribution of the COVID-19 vaccine. (RTRS)

SOUTH AFRICA: South Africa's government will curb alcohol sales and close some of the nation's beaches at the height of the summer-holiday season, among a series of new restrictions to rein in surging coronavirus infections. The government declared the start of a second wave of the Covid-19 pandemic on Dec. 10 as the number of daily new cases doubled this month. The country is fast-approaching 1 million infections, with 866,127 people having contracted the disease so far, President Cyril Ramaphosa said on Monday. (BBG)

OIL: US shale volumes and new well productivity per rig are both expected to fall month-over-month in January as the industry enters the winter season and the number of drilled, but uncompleted wells continues to decline, the US Energy Information Administration said in its Dec. 14 drilling productivity report. US unconventional oil output is projected to dip another 137,000 b/d to 7.438 million b/d in January, according to the EIA, after peaking at about 9.1 million b/d at the beginning of 2020 before the coronavirus pandemic waged war on global oil demand. The EIA revised up its December estimates from 7.513 million b/d from its November report to 7.575 million b/d. (Platts)

CHINA

ECONOMY: MNI POLICY: China's Recovery Needs Policy Continuity: Official

- China's Q4 GDP is expected to rise above trend following Q3's 4.9% pace and the economy may see a relatively fast growth rate next year due to the low base this year, said Fu Linghui, the spokesman of the National Bureau of Statistic at a briefing on Tuesday, adding that the recovery would need continuity and effectiveness of policies. "Any policy adjustment should be targeted," said Fu, when asked if monetary and fiscal policies should gradually be normalised amid the strong growth expectations. In the next phase, consumption will still be the main driver of the economy with greater employment and higher incomes, Fu added - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

ECONOMY: China's economy may grow 7.8% in 2021 given this year's lower base of comparison, with retail sales gaining as much as 5% as consumption strengthens, the Economic Information Daily reported citing researcher Li Xuesong of the Chinese Academy of Social Sciences. Li's projection compares with a forecast of 8.2% by the IMF, which along with other global bodies has raised China's 2021 outlook, the newspaper said. However, the service sector, consumption, incomes and demand remain the weak links in the recovery, the Daily said citing Li's Academy colleague Chai Fang. (MNI)

POLICY: Foreign missions and companies must hire members of the Chinese Communist Party if they seek to expand in China as members of the CCP also make up a high proportion of the available talent in China, the party-run Global Times said in an editorial. In response to Australian and British media reports that identified more than a million CCP members, including those employed by foreign operations, the editorial said that treating CCP members as infiltrators and intelligence agents is the result of extreme ideological views against China. (MNI)

PROPERTY: Real estate development has been used to drive growth over the last 20 years but China should stop using this growth model, the Economic Information Daily said in an editorial. As the impact of the pandemic accelerates the digital economy and reduces the advantages of older industries, China should regulate the property market according to specific locations and prevent a contagion of financial risks from real estate market volatility, the Daily said. (MNI)

OVERNIGT DATA

CHINA NOV INDUSTRIAL OUTPUT +7.0% Y/Y; MEDIAN +7.0%; OCT +6.9%

CHINA NOV INDUSTRIAL OUTPUT YTD +2.3% Y/Y; MEDIAN +2.3%; OCT +1.8%

CHINA NOV RETAIL SALES +5.0% Y/Y; MEDIAN +5.0%; OCT +4.3%

CHINA NOV RETAIL SALES YTD -4.8% Y/Y; MEDIAN -4.8%; OCT -5.9%

CHINA NOV FIXED ASSETS EX RURAL YTD +2.6% Y/Y; MEDIAN +2.6%; OCT +1.8%

CHINA NOV PROPERTY INVESTMENT YTD +6.8% Y/Y; MEDIAN +6.7%; OCT +6.3%

CHINA NOV UNEMPLOYMENT 5.2%; MEDIAN 5.2%; OCT 5.2%

MNI DATA IMPACT: China Nov Ind Output Near 2-Yr High; Sales Up

- The Chinese economy continued to recover in November, reflecting a robust resilience, said Fu Linghui, the spokesman of the National Bureau of Statistic at a data release briefing on Tuesday - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 111.2; PREV. 109.3

It was yet another upbeat result in the latest survey, with consumer confidence reaching new 2020 highs. Most subindices are now back at or even higher than the pre-pandemic level, with the confidence in future economic conditions at an 18-month high. The exception is current financial conditions, for which sentiment is close to 10% lower than mid-March and still below the neutral level of 100 (if only just). Despite this exception, the rise in confidence bodes well for the holiday season. Last week we noted the sharp jump in inflation expectations. These have pulled back a bit in this week's survey but are still elevated enough to push the 4- week moving average to its highest level since late April. This is still some way below the 4% plus level for expected inflation that was typical prior to the pandemic. (ANZ)

NEW ZEALAND Q4 WESTPAC CONSUMER CONFIDENCE 106.0; Q3 95.1

As 2020 draws to a close, New Zealand households have regained their festive spirit. The Westpac McDermott Miller Consumer Confidence Index rose 10.9 points in December to a level of 106. While that rise still leaves confidence a little below its long run average, it's reversed the falls that we saw earlier in 2020 in the wake of the Covid-outbreak. But this isn't just a case of holiday related cheer. In fact, looking back over history, confidence is just as likely to fall as it is to rise in December. Underlying the lift in household sentiment has been increasing optimism around the economic outlook. Since our last survey in September, domestic economic activity has rebounded and we're seeing signs of growing momentum as we head into the new year. Most importantly, recent weeks have also seen increasingly positive news regarding vaccines. Together, those developments have left households feeling much more optimistic about the state of the economy over the next few years. New Zealanders are also feeling more secure about their personal financial position. (Westpac)

NEW ZEALAND NOV NON-RESIDENT BOND HOLDINGS 49.7%; OCT 48.8%

SOUTH KOREA OCT MONEY SUPPLY L +0.6% M/M; SEP +0.7%

SOUTH KOREA OCT MONEY SUPPLY M2 +1.1% M/M; SEP +0.5%

CHINA MARKETS

PBOC NET INJECTS CNY900BN VIA MLF AND REPOS TUES

The People's Bank of China (PBOC) injected CNY950 billion via one-year medium-term lending facility (MLF) with the rate unchanged at2.95% on Tuesday. This aims to roll over the CNY900 billion of MLFs maturing this month and fully meet liquidity needs, the PBOC said on its website. The PBOC also injected CNY10 billion via 7-day reverse repos. In total, the central bank net injected CNY900 billion as CNY60 billion repos mature today.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.1687% at 09:29 local time from the close of 2.1003% on Tuesday: Wind Information.

- The CFETS-NEX money-market sentiment index closed at 35 on Monday vs 41 on last Friday. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.5434 TUES VS 6.5361

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.5434 on Tuesday, compared with the 6.5361 set on Monday.

MARKETS

SNAPSHOT: It's Beginning To Feel A Lot Like Christmas

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 76.11 points at 26655.93

- ASX 200 down 28.948 points at 6631.3

- Shanghai Comp. down 15.587 points at 3353.96

- JGB 10-Yr future up 3 ticks at 152.15, yield down 0.5bp at 0.006%

- Aussie 10-Yr future up 0.4 tick at 98.983, yield down 0.1bp at 0.963%

- U.S. 10-Yr future +0-00+ at 138-03, yield down 0.66bp at 0.887%

- WTI crude down $0.33 at $46.66, Gold up $8.77 at $1836.13

- USD/JPY up 6 pips at Y104.11

- BARNIER'S NARROW PATH, A BREXIT DEAL COULD BE DONE THIS WEEK (BBG)

- UK SOURCE: BREXIT TALKS REMAIN DIFFICULT, NO SIG. PROGRESS IN RECENT DAYS (SKY)

- CHINESE ECONOMIC ACTIVITY DATA IMPROVES IN NOV, MATCHING EXP.

- PBOC NET INJECTS CNY350BN VIA 1-YEAR MLF

BOND SUMMARY: Narrow Ranges In Play Overnight, Lack Of Catalysts Noted

T-Notes have stuck to a narrow 0-02+ range, last +0-00+ at 138-03, with cash Tsys sitting unchanged to 1.2bp richer across the curve, as the long end sees some marginal outperformance. The space has shrugged off the release of the latest round of Chinese economic activity data, PBoC MLF activity and comments from U.S. Senate Majority Leader McConnell as he re-affirmed the need for Congress to bridge its differences and come to a deal re: fiscal support before Christmas (this isn't new and McConnell has maintained his well-defined red lines re: the matter in recent days).

- It was a sedate session for JGB futures, with the contract continuing to operate in familiar territory, last +1 on the day. The cash curve has seen some twist steepening, given the potential for additional 40-Year JGB issuance (as outlined by primary JGB dealers at recent MoF meetings and flagged previously), which could be deployed to finance the latest supplementary budget (although, as outlined previously, total issuance requirements for the package will seemingly be in the region of the median view, avoiding the more burdensome end of the scale. The maturity mix of the issuance will be key).

- The Aussie bond space looked through the release of the minutes of the RBA's December monetary policy decision, with YM -0.2 and XM +0.5. There was always a high bar for the release re: its potential to be market moving, with the Bank affirming recent rhetoric from the RBA Governor surrounding the evolution of its QE scheme: "Members agreed to keep the size of the bond purchase program under review. At its future meetings, the Board will closely monitor the effects of the bond purchases on the economy and on market functioning, as well as the evolving outlook for jobs and inflation. The Board is prepared to do more if necessary." Elsewhere, Sino-Aussie tensions remain at the forefront.

JGBS AUCTION: Japanese MOF sells Y3.1060tn 6-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y3.1060tn 6-Month Bills:- Average Yield -0.0922% (prev. -0.0882%)

- Average Price 100.046 (prev. 100.044)

- High Yield: -0.0902% (prev. -0.0861%)

- Low Price 100.045 (prev. 100.043)

- % Allotted At High Yield: 75.7519% (prev. 54.2005%)

- Bid/Cover: 4.163x (prev. 3.614x)

JGBS AUCTION: Japanese MOF sells Y498.0bn of 5-15.5 Year JGBs

The Japanese Ministry of Finance (MOF) sells Y498.0bn of 5-15.5 Year JGBs in a liquidity enhancement auction:

- Average Spread: -0.008% (prev. -0.007%)

- High Spread: -0.007% (prev. -0.005%)

- % Allotted At High Spread: 64.4760% (prev. 14.3529%)

- Bid/Cover: 3.931x (prev. 3.267x)

EQUITIES: Mixed Overnight

E-minis are mixed, with broader risk assets looking through the latest round of Chinese economic data, PBoC liquidity injection via MLF operations and familiar rhetoric from senior policymakers re: fiscal stimulus.

- Meanwhile, the major regional Asia-Pacific indices have ticked lower.

- This comes after the major Wall St. benchmarks gave back their early gains and more on Monday, as focus turned to immediate COVID-19 worry surrounding London and New York.

- Nikkei 225 -0.3%, Hang Seng -0.7%, CSI 300 -0.4%, ASX 200 -0.2%.

- S&P 500 futures +2, DJIA futures +27, NASDAQ 100 futures -9.

OIL: Marginally Lower

WTI & Brent sit $0.20 below their respective settlement levels, with the major regional Asia-Pac equity indices also trading lower, while e-minis have lacked a firm sense of direction.

- This comes after the major crude benchmarks managed to finish a touch higher on Monday, even with questions surrounding demand owing to broader COVID-19 related worry re: New York & London. Geopolitical tensions, most notably in the Middle East, ultimately helped underscore the crude bid, even as equity markets faded on the aforementioned COVID-19 worry.

- In terms of crude specifics, the latest OPEC monthly report saw the cartel mark down its '20 and '21 global crude demand forecasts, the latest indication of issues on that side of the coin. Elsewhere, reports pointing to a marginal uptick in Libyan crude output and worry re: a relatively imminent uptick in Iranian crude supply were noted.

GOLD: Back To Familiar Territory After Look Below Support

Gold pushed through initial technical support on Monday (in the form of the Dec 7 low at $1,822.5/oz), but failed to close below as the early risk positive flows waned and U.S. real yields retraced. Spot has moved back towards the familiar $1,835/oz level, although bears remain focused on yesterday's low of $1,818.90/oz. A break there would expose the Dec 2 low at $1,807.5/oz. To the upside, familiar bullish targets remain in focus.

FOREX: Low Conviction Session In Asia

Headline flow was few and far between in Asia, keeping G10 FX rangebound, with participants awaiting further clarity on U.S. fiscal matters and global restriction tightening. The Antipodeans landed at the bottom of the pile, with simmering Sino-Australian trade tensions eyed.

- AUD/USD blipped higher in early trade, but more than erased gains and last sits down 25 pips at $0.7510. The decline in NZD/USD was shallower, the rate last trades down 7 pips at $0.7074. AUD/NZD retreated after failing to punch through its 200-DMA over the past two days. RBA December meeting minutes release was broadly in line with market expectations.

- JPY crosses were bought into the Tokyo fix, possibly on the back of Gotobi day demand. USD/JPY extended gains thereafter, but AUD/JPY retreated into negative territory.

- The PBOC fixed the USD/CNY mid-point at 6.5434, 73pips weaker than Monday, and injected CNY950bn at an unchanged rate of 2.95%, more than offsetting the CNY 300bn of MLF loans that mature tomorrow (Dec 16) and the CNY 300bn that rolled off on Dec 7. USD/CNH extended gains after the cash injection. Chinese economic activity indicators fell in line with expectations.

- The greenback generally outperformed Asian EM FX. KRW, IDR & MYR were the main laggards in the region.

- Focus turns to UK labour mkt report, final French & Italian CPIs, U.S. industrial output & Empire M'fing, Canadian housing starts as well as comments from ECB's Rehn & BoC's Macklem.

FOREX OPTIONS: Expiries for Dec15 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2000(E1.2bln), $1.2100(E1.1bln-EUR puts), $1.2125-35(E1.0bln-EUR puts), $1.2150-55(E486mln-EUR puts), $1.2175(E1.0bln-EUR puts)

- USD/JPY: Y102.90-00($746mln), Y104.00($559mln), Y104.50-55($948mln), Y104.96-105.00($533mln)

- EUR/JPY: Y123.70(E501mln)

- EUR/GBP: Gbp0.8950-58(E1.1bln)

- AUD/USD: $0.7420(A$802mln-AUD puts)

- USD/CNY: Cny6.50($1.8bln), Cny6.5920($690mln), Cny6.65($2.0bln)

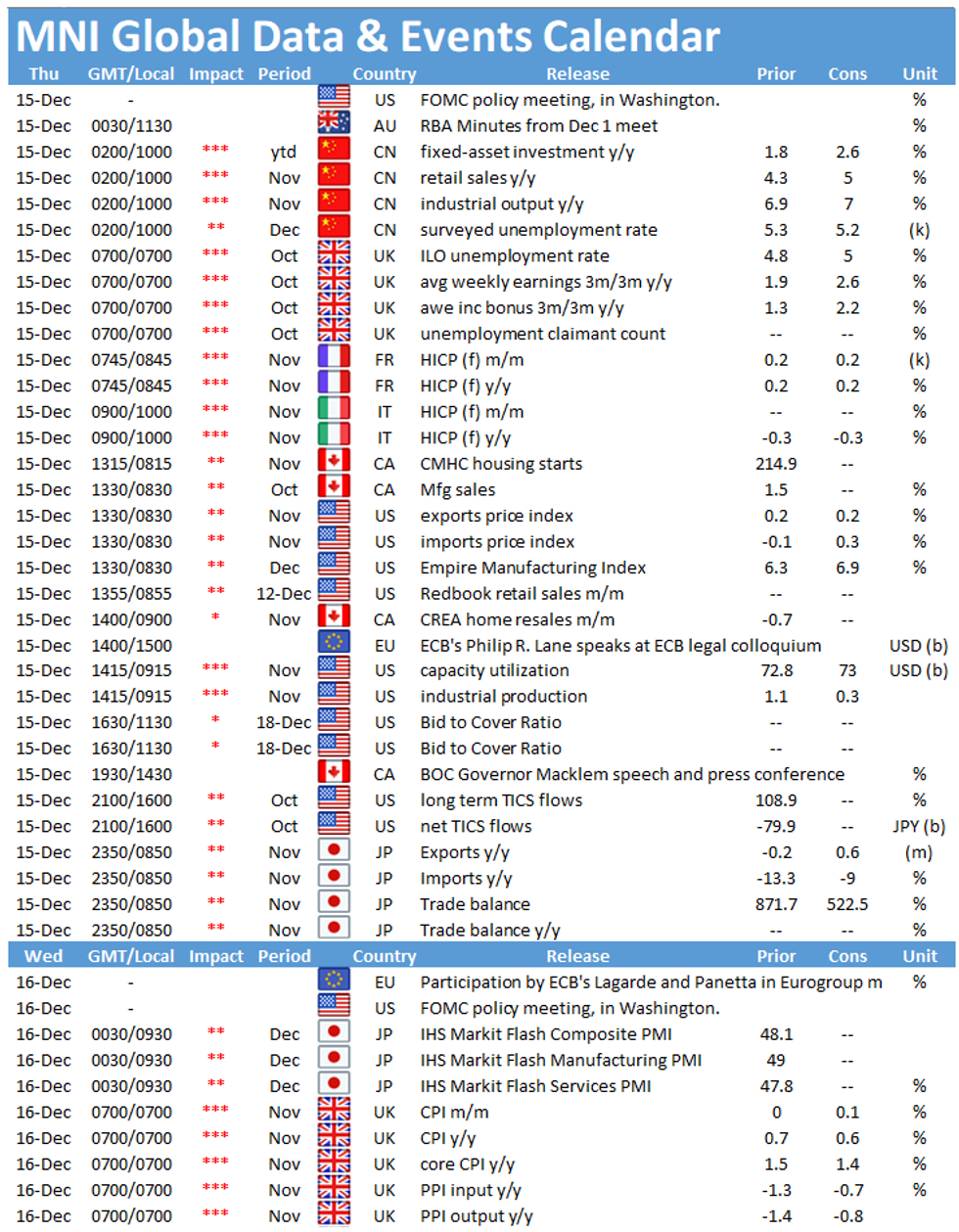

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.