-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Christmas Set To Bring Brexit Deal

EXECUTIVE SUMMARY

- BREXIT DEAL EXPECTED TO BE ANNOUNCED AT SOME POINT ON THURSDAY MORNING

- HOUSE GOP POISED TO BLOCK PELOSI'S BID FOR $2,000 RELIEF CHECKS (BBG)

- CHINESE CLAMPDOWN ON ALIBABA DEEPENS

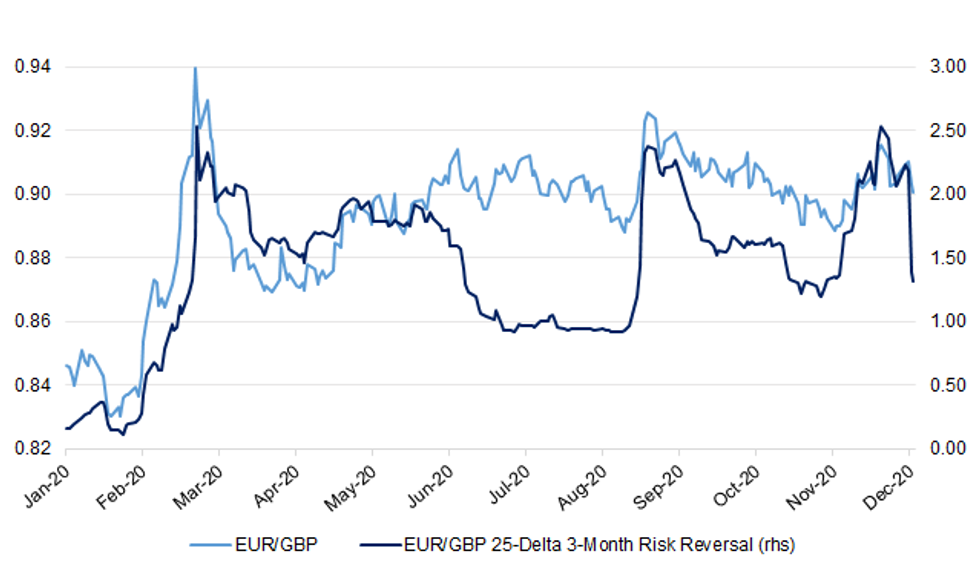

Fig. 1: EUR/GBP Vs. EUR/GBP 25-Delta 3-Month Risk Reversals

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BREXIT: Britain and the European Union were last night on the verge of signing a Brexit deal that will define their relationship for decades. They are understood to have reached political agreement on the remaining sticking points and the shape of the overall deal has been signed off by Boris Johnson and member states. However, despite hope that the agreement would be announced yesterday evening it was delayed as lawyers and negotiators attempted to translate the final compromises, particularly on fishing, into binding legal text. Downing Street sources said the deal would give British companies "zero-tariff, zero-quota" access to EU markets with no role for the European Court of Justice in policing the agreement. It would be the biggest trade deal signed by either side, worth £668 billion. (The Times)

BREXIT: A DEAL between the UK and EU is expected this morning after negotiations went on into the early hours of Christmas Eve. Boris Johnson is expected to make the announcement in a press conference at around 11am. European Commission spokesman Eric Mamer said last night that talks on a post-Brexit trade deal would continue overnight. The PM also summoned his top team of ministers to a Zoom call to update them on "a brilliant breakthrough." Sources on the call told The Sun that Mr Johnson "lavished praise" on former rival Brexiteer Michael Gove. (The Sun)

BREXIT: MNI BRIEF: Provisional Approval Likely For Any Brexit Deal

- The European Parliament would vote on any potential EU-UK post-Brexit trade deal in 2021, but the agreement would be approved provisionally in the meantime, MNI understands - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

BREXIT: Sir Keir Starmer is preparing to urge his shadow cabinet to back a Brexit trade deal today, The Daily Telegraph understands, in a move that risks angering a group of hardline Labour Remainers. In a bid to move his party beyond Brexit and rebuild bridges with voters in the party's former Leave heartlands, the Labour leader is set to convene an urgent meeting of his frontbench to hammer out a final position on whether to vote for legislation expected to be put to Parliament next week. Although the party insists a decision on whipping will not be made until the deal is announced and the text of the treaty has been reviewed, multiple sources have told The Telegraph that Sir Keir is determined to back it. (Telegraph)

CORONAVIRUS: Swaths of England will move into tougher tiers of coronavirus restrictions on Boxing Day following the rapid spread of the new, more transmissible, variant of Covid-19, health secretary Matt Hancock has announced. Mr Hancock told a Downing Street press conference that large areas of southern and eastern England would join London, Kent and some neighbouring districts in the toughest tier 4 — where non-essential shops are closed and household mixing is banned — from one minute after midnight on December 26. They include the whole of Sussex, Oxfordshire, Suffolk, Norfolk and Cambridgeshire. (FT)

CORONAVIRUS: Northern Ireland confirmed a positive test for the new variant of the SARS-CoV-2 virus. (CNBC)

CORONAVIRUS: The U.K. will temporarily stop flights and arrivals entering England from South Africa from 9am Thursday, Travel Minister Grant Shapps says in a tweet. (BBG)

CORONAVIRUS: The UK is facing days more disruption at the main English Channel crossing as thousands of lorry drivers remain stranded in Britain while waiting for coronavirus tests to enable them to enter France. The atmosphere on the south coast of England turned tense on Wednesday as a crowd of frustrated drivers eager to cross the Channel were involved in scuffles with police at the entrance to the Port of Dover. Many European lorry drivers are facing the prospect of spending Christmas in the UK stuck inside their vehicles, with limited access to food and washing facilities. On Wednesday evening some lorries whose drivers had tested negative for Covid-19 were allowed on to ferries at Dover that were bound for Calais in France, according to the Road Haulage Association, a trade body. (FT)

CORONAVIRUS: Supermarkets and their suppliers are planning an unprecedented airlift of fresh fruit and vegetables into the UK next week amid fears the lifting of a French blockade will not prevent some shortages in stores. (Guardian)

EUROPE

ITALY: Italy's Economy and Finance Ministry announces planned treasury bond sales for 1Q. At least EU9b of 3-year bonds. At least EU10b of 5-year bonds. At least EU10b of 7-year bonds. The Treasury will consider issuance of short-term bonds with maturity of 18-30 months. (BBG)

ITALY: Italy plans to sell 6.5 billion euros ($7.9 billion) of bills due Jun 30, 2021 in an auction on Dec 29. (BBG)

SPAIN: Spain plans to vaccinate about 2.3 million people over a 12-week period starting on Dec. 27. Spain will receive 4.5 million doses of Pfizer/BioNTech vaccines arriving in weekly batches from Dec. 26, Health Minister Salvador Illa said on Wednesday. The vaccine campaign will mark the beginning of the end of the pandemic just as cases begin to rise again in Spain after a steady decline in the infection rate over the past few months, he said. (BBG)

IRELAND: Irish health authorities said a variant of the coronavirus has arrived from the U.K., and warned the situation was at its most worrying since March. Almost 1,000 new cases were recorded Wednesday, the latest in a spike in numbers which has prompted the government to introduce new restrictions, including closing bars and restaurants on Christmas Eve for at least three weeks. (BBG)

U.S.

FED: The Trimmed Mean PCE inflation rate over the 12 months ending in November was 1.7 percent. According to the BEA, the overall PCE inflation rate was 1.1 percent on a 12-month basis, and the inflation rate for PCE excluding food and energy was 1.4 percent on a 12-month basis. (Dallas Fed)

FISCAL: House Minority Leader Kevin McCarthy told fellow Republicans Wednesday that House Speaker Nancy Pelosi's attempt to pass a bill boosting stimulus payments for individuals to $2,000 will fail, according to a person who participated in a private call with GOP House members. Pelosi swiftly took up President Donald Trump's demand for larger payments to individuals in the coronavirus relief package Congress passed Monday night, seeking to approve it in the House on Thursday. Pelosi's plan to seek unanimous consent to increase the direct payments to $2,000 from the $600 in Monday's bill can be blocked by a single lawmaker. Republicans planned to halt her attempt. (BBG)

FISCAL: It was not clear whether Mr. Trump would actually veto the package, but given how late it is in the 116th Congress, even refusing to sign it could ensure that the bill dies with the Congress on Jan. 3 and must be taken up again next year. Frustration with Mr. Trump boiled over on Wednesday during a private conference call of House Republicans, many of whom had joined in his baseless lawsuit to try to overturn the results of election. Representative Kevin McCarthy of California, the Republican leader, told members he had spoken to the president and that he had not yet committed to a veto of the bill. But Mr. McCarthy conceded, "This bill has been tainted," according to a person on the call. (New York Times)

CORONAVIRUS: The US tallied more than 3,000 new Covid-19 deaths for a second day running on Wednesday, as hospitalisations climbed to another record high. There were 3,379 new known fatalities reported, compared with 3,166 the day before, according to Financial Times analysis of Covid Tracking Project data. The US has had 317,513 deaths attributed to Covid-19 since the start of the pandemic. Current hospitalisations for the virus rose to 119,463 from 117,761 on Tuesday, the previous record high. (FT)

CORONAVIRUS: New York Governor Andrew Cuomo said he will extend the state's moratorium on evictions, which is set to expire Jan. 1. Cuomo also implored federal officials to do more to stop or contain the spread of the new Covid-19 variant reported in the U.K, such as blocking flights from that country or requiring those passengers to test negative before boarding planes. Meanwhile, the state is talking with the Buffalo Bills football team about using rapid testing to allow 6,700 fans into the team's upcoming playoff game. (BBG)

CORONAVIRUS: The CDC said just 1,008,025 shots had been administered as of Wednesday at 9 a.m. ET. That's roughly 19 million doses shy of earlier projections from public health officials for December. It leaves public officials less than two weeks — about 8 days — to try to close that gap. Two vaccines – from Pfizer and Moderna – have been authorized for use by the Food and Drug Administration, and the U.S. has shipped a total of 9,465,725 doses across the nation, according to CDC data. (CNBC)

CORONAVIRUS: States are beginning to split with the Centers for Disease Control and Prevention's guidance on who should receive the Covid-19 vaccine first. The CDC said Sunday that everyone over 74 years old as well as front-line essential workers like agricultural workers, police and teachers should get the Covid vaccine in the so-called phase 1b; that comes after health-care workers and long-term care residents are vaccinated first in phase 1a. (CNBC)

POLITICS: U.S. President Donald Trump vetoed a bipartisan defense policy bill on Wednesday and raised the prospect that the United States could face a government shutdown during a pandemic, stirring new turmoil in Washington as he headed to Florida for Christmas. (RTRS)

POLITICS: US President Donald Trump has pardoned former campaign manager Paul Manafort, ex-adviser Roger Stone and the father of Mr Trump's son-in-law. (BBC)

POLITICS: President Donald Trump's personal lawyer Rudy Giuliani and White House counsel Pat Cipollone both have reportedly been sent letters by defamation attorneys directing them to save all records related to claims that Dominion Voting Systems played a key role allegedly swindling Trump out of an election win. (CNBC)

AUTOS: The coronavirus pandemic is expected to cause a 15% decline in U.S. sales in 2020, which would mark one of the worst declines for the industry since 1980. Despite the rapid drop, however, auto analysts say it could have been a far worse year for sales if it hadn't been for the resiliency of sales to retail customers. (CNBC)

OTHER

EU/CHINA: EU leaders should sign a business investment agreement with China despite opposition to the pact from European MPs and members of the incoming Biden administration, according to the head of the European Chamber of Commerce in China. On Tuesday, Jake Sullivan, whom President-elect Joe Biden has selected as his national security adviser, said the new administration would welcome discussions with the EU on "our common concerns about China's economic practices". Critics of the China-EU Comprehensive Agreement on Investment, which is nearing completion after seven years of negotiations, said it would hand President Xi Jinping a strategic victory on the eve of Mr Biden's inauguration. They said the deal did not address concerns about the use of forced labour in the world's second-largest economy, especially in the north western region of Xinjiang. (FT)

CORONAVIRUS: A study by British researchers said the new coronavirus variant found in the country is 56% more contagious, which may require tighter control measures, including closing schools, and an accelerated vaccine rollout to contain its spread, the New York Times reported. The study by the Center for Mathematical Modeling of Infectious Diseases at the London School of Hygiene and Tropical Medicine found no evidence that the variant was more deadly than others. To reduce the burden on hospitals, Britain may need to increase its vaccination rate to 2 million people a week, from the current pace of 200,000, the report said. (BBG)

CORONAVIRUS: The U.S. is trying to obtain samples of the mutant strain of SARS-CoV-2 that's arisen in the U.K. for testing at the National Institutes of Health, according to Anthony Fauci, the government's top infectious-disease doctor. "We at the NIH are in communication with our colleagues in the U.K. to try and get the isolate to work with," Fauci said in a taped interview that will air on Bloomberg Television. "We need to take this seriously and we need to investigate it much further." (BBG)

CORONAVIRUS: Moderna Inc says it expects its COVID-19 vaccine to protect people against the new mutant British variant of the coronavirus. The new strain, known as SARS-CoV-2 VUI 202012/01, is feared to be 70 percent more contagious and to spread more easily among children. Moderna's jab works by coding for the spike protein on the outside of the virus that it uses to enter and infect human cells. (Daily Mail)

CORONAVIRUS: Brazilian researchers said on Wednesday the COVID-19 vaccine developed by China's Sinovac Biotech is more than 50% effective based on preliminary data, but withheld full results of their late-stage trial again at Sinovac's request. Brazil is the first country to complete a late-stage trial of the vaccine, called CoronaVac, but a release of the results, first set for early December, has now been delayed three times. (RTRS)

JAPAN: As Japan readies a record 106 trillion yen ($1.02 trillion) budget for fiscal 2021, the ruling party's fiscal conservatives have fallen silent, choosing not to block pandemic relief that could deliver a win for the party in a general election next year. Prime Minister Yoshihide Suga's government and the ruling Liberal Democratic Party agree that generous spending is needed to support an economy pummelled by the pandemic. But now the country's long-term goal of fiscal consolidation appears to be under threat. Two separate meetings on Dec. 8 illustrate this point. On the agenda was the government's budget policy for fiscal 2021, which conspicuously dropped the target of achieving a primary surplus in fiscal 2025. The goal of balancing the budget excluding debt-servicing costs had been included in the policy each previous year. (Nikkei)

JAPAN: Japan's government virus panel believes it's a matter of course that bars and restaurants in Tokyo should be asked to close earlier than the current voluntary time now set at 10 p.m., government adviser Shigeru Omitold reporters. (BBG)

JAPAN: Prosecutors said Thursday they decided not to indict former Prime Minister Shinzo Abe over allegations his camp illegally paid millions of yen for dinner receptions held for supporters. They will instead issue a summary indictment of one of Abe's state-paid secretaries, Hiroyuki Haikawa, 61, and seek a fine for his alleged failure to keep records of income and expenditures related to the dinner functions as required by law. (Kyodo)

AUSTRALIA: The cluster of Covid-19 infections in Sydney's Northern Beaches has grown to 104, according to authorities, who urged residents to limit their movements help curb the spread of the virus. New South Wales state recorded seven new cases linked to the cluster and are investigating a further two cases, Premier Gladys Berejiklian told reporters Thursday. "The virus is circulating in parts of the community," she said. "There are potential chains of transmission that we are not on top of." (BBG)

AUSTRALIA/CHINA: Nearly 9,000 litres of Australian craft beer was stopped from entering one Chinese port last month, while another 8,000kg of frozen beef from a suspended abattoir was detained in Shanghai, the latest Chinese customs data showed. The 8,794kg of craft beer exported by manufacturer and distributor Sydney Beer Co. was held at the south eastern Chinese port city of Xiamen in November due to incorrect labelling, although there are no indications the company itself has been banned. The data also revealed that 8,356kg of the boneless and bone-in beef products from Meramist, the Queensland abattoir suspended by Chinese customs two weeks ago, was stopped at Nanjing port over mismatched certifications. At the time of the ban, Chinese customs did not reveal the reasons for the suspension. (SCMP)

SOUTH KOREA: South Korea's coronavirus transmission rate showed further signs of stabilising on Thursday following the deployment of the government's toughest-yet distancing and protection measures. Health officials reported 985 new cases, down from 1,090 on Wednesday and marking the third day this week that infections have been in triple-digits after hovering above 1,000 for most of the week prior. (FT)

SOUTH KOREA: Bank of Korea, finance ministry and state-run KDB decide to extend special purpose vehicle's corporate bonds and CP purchase for 6 months to July 13. BOK and govt will also allow the corporate bond purchase entity to buy more bonds with A-BBB ratings by raising purchase ratio to 75% from 70%. (BBG)

BOC: MNI POLICY: BOC Paper Says Negative Rates Risky, Reviews Tools

- Bank of Canada staff believe negative interest rates could backfire, and that a "helicopter money" approach to policy poses major risks and lacks historical precedent, according to an informal discussion paper published Wednesday - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

MEXICO: Mexico plans to vaccinate 2,975 health care workers in Covid-19 units on Dec. 24, Deputy Health Minister Hugo Lopez- Gatell said on Wednesday night, after the nation received 3,000 doses of the Pfizer vaccine earlier in the day. The next shipment will be 50,000 doses, with periodic deliveries to reach 1.4 million by the end of January. Lopez-Gatell said the vaccine will be free and universal in Mexico. Mexico's Health Ministry reported 11,653 new Covid-19 cases, pushing its total above 1.35 million. (BBG)

BRAZIL: Brazil's outgoing lower house Speaker Rodrigo Maia anointed the leader of one the country's largest centrist parties to go up against an ally of President Jair Bolsonaro for the top post in the lower house. Representative Luiz Felipe Baleia Tenuto Rossi, 48, a businessman and president of the Brazilian Democratic Movement, will run in a February election for the house speakership with the backing of 11 parties that could deliver 281 votes, according to the bloc's estimates. The group comprises a wide range of ideologies, from the communists to the Social Liberal Party, under whose banner Bolsonaro swept to election in 2018. (BBG)

BRAZIL: Brazil's monetary council eased a resolution that restricted the distribution of results from financial institutions, such as the payment of dividends. Rule undertaken to ensure banks had liquidity during Covid-19 pandemic; has now been eased as banks have gone through Covid-19 economic challenge with adequate capital cushion, the Central Bank said in a statement. Central bank estimates amount that released for distribution at about 6b reais. (BBG)

RUSSIA: The United States is urging European allies and private companies to halt work that could help build the Nord Stream 2 natural gas pipeline and is preparing wider sanctions on the Russian project in coming weeks, senior Trump administration officials said on Wednesday. The outgoing Trump administration is readying a fresh round of congressionally mandated sanctions "in the very near future" that it believes could deal a fatal blow to the Russia-to-Germany project led by state gas company Gazprom , three officials said. (RTRS)

RUSSIA: The U.S. cybersecurity agency said on Wednesday that a sprawling cyber espionage campaign made public earlier this month is affecting state and local governments, although it released few additional details. (RTRS)

RUSSIA: White House National Security Adviser Robert O'Brien held a call on Tuesday with his counterparts in an international intelligence sharing alliance to discuss the suspected Russian cyberattack on US government agencies and propose a joint statement condemning the breach, according to a senior administration official and two officials from the other nations. (CNN)

IRAN: U.S. President Trump tweeted the following on Wednesday: "Our embassy in Baghdad got hit Sunday by several rockets. Three rockets failed to launch. Guess where they were from: IRAN. Now we hear chatter of additional attacks against Americans in Iraq. Some friendly health advice to Iran: If one American is killed, I will hold Iran responsible. Think it over." (MNI)

IRAQ: The United States is considering closing its embassy in Baghdad after a series of rocket attacks on Iraq's Green Zone by Iranian-backed militias, according to two sources familiar with the discussions. The move, among several options being considered, could be a prelude to retaliation against Iran, which President Trump and Secretary of State Mike Pompeo have branded a state sponsor of terror. The embassy has also played a pivotal role in supporting a shaky Iraqi government. (Axios)

CHINA

PBOC: China will establish a modern central banking system prioritizing currency stability, sound employment, financial stability and balance of payments, PBOC Governor Yi Gang wrote in the People's Daily. China needs to take a market-based monetary and regulatory approach with the PBOC sustaining a healthy balance sheet, wrote Yi. China will prevent fiscal deficit monetization by building an independent central bank financial budget management system, and corporate credit risks must not impact the PBOC's balance sheet and the currency, wrote Yi. (MNI)

INFLATION: China may see rising inflation in 2H of 2021 on strong growth and soaring prices of raw materials, YiCai reported citing Shen Jianguang, chief economist of JD Finance. The PBOC should focus more on core inflation to maintain the continuity and stability of its policies, the newspaper said, citing Zhang Jun, chief economist of Morgan Stanley Huaxin Securities. (MNI)

EQUITIES: China's anti-trust investigation into Alibaba Group is to better regulate and guide the healthy development of the company and its internet peers as top policymakers mull the risks of a few large companies dominating the market, the People's Daily said. The State Administration of Market Regulation this week launched an anti-competition probe into Alibaba for allegedly forcing wholesalers to choose one of two competing platforms. China remains supportive of the online economy, the People's Daily said. (MNI)

EQUITIES: Moutai Group plans to transfer 4% stake in Kweichow Moutai to a state-owned capital operation company controlled by the Guizhou provincial government, according to a statement to Shanghai stock exchange late Wednesday. Moutai Group's stake in Kweichow Moutai will be cut to 54% after the transfer, which is upon request of the state-owned asset regulator of Guizhou government. (BBG)

OVERNIGHT DATA

CHINA NOV SWIFT GLOBAL PAYMENTS CNY 2.00%; OCT 1.66%

JAPAN NOV PPI SERVICES -0.6% Y/Y; MEDIAN -0.6%; OCT -0.5%

CHINA MARKETS

PBOC NET INJECTS CNY30BN VIA OMOS THU

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos and CNY30 billion via 14-day reverse repos with rates unchanged on Thursday. This resulted in a net injection of CNY30 billion given the maturity of CNY10 billion of reverse repos today, according to Wind Information.

- The operations aim to maintain stable liquidity at the end of the year, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.2000% at 09:30 am local time from 1.6478% at Wednesday's close.

- The CFETS-NEX money-market sentiment index closed at 31 on Wednesday vs 35 on Tuesday. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.5361 THU VS 6.5558

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.5361 on Thursday, compared with the 6.5558 set on Wednesday.

MARKETS

SNAPSHOT: Christmas Set To Bring Brexit Deal

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 104.76 points at 26629.82

- ASX 200 up 21.666 points at 6664.8

- Shanghai Comp. down 7.113 points at 3375.207

- JGB 10-Yr future down 14 ticks at 152.00, yield up 0.4bp at 0.016%

- Aussie 10-Yr future down 6.5 ticks at 98.955, yield up 6.6bp at 0.994%

- U.S. 10-Yr future +0-00+ at 137-25, yield up 0.33bp at 0.946%

- WTI crude up $0.31 at $48.43, Gold up $3 at $1875.82

- USD/JPY down 1 pip at Y103.56

- BREXIT DEAL EXPECTED TO BE ANNOUNCED AT SOME POINT ON THURSDAY MORNING

- HOUSE GOP POISED TO BLOCK PELOSI'S BID FOR $2,000 RELIEF CHECKS (BBG)

- CHINESE CLAMPDOWN ON ALIBABA DEEPENS

BOND SUMMARY: Winding Into Christmas

A very limited Asia-Pac session for U.S. Tsys, with the cash market little changed at typing, while T-Notes sit +0-01 at 137-25+, sticking to a 0-02+ range. Trade was non-committal as we moved towards the Christmas break, with continued focus on Brexit and the fiscal situation in DC.

- Little in the way of consistent movement was seen across the JGB curve, with yields marginally mixed, while futures extended on their overnight losses, last 14 ticks below yesterday's settlement levels. News flow has generally been light, with continued focus on the situation surrounding former PM Abe that we flagged earlier (although there has been little spill over for markets on that front). A firm enough 2-Year JGB auction was seen, with the low price topping dealer expectations at the margin (BBG survey pointed to 100.450), while the cover ratio moved back towards more normal levels and the tail narrowed, although we must stress that last month's 2-Year offering was poorly received, which muddies the usual comparative benchmarking. Real yield dynamics and collateral matters likely helped takedown.

- The overnight bear steepening for Aussie bond futures ultimately held/extended in a holiday shortened Sydney session, with little in the way of notable macro headline flow evident. That left YM -1.0 at the close, with XM -6.5, as the latter ticked to fresh lows into the closing bell. The move wasn't all offshore driven, with the AU/U.S. 10-Year yield spread widening by ~2bp. The cash curve ran steeper, with swaps tightening across the curve in the main. Bills finished unchanged to -1 through the reds, with 3-Month BBSW fixing unchanged, at all-time lows of 0.010%.

JGBS AUCTION: Japanese MOF sells Y2.5624tn 2-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.5624tn 2-Year JGBs:- Average Yield -0.129% (prev. -0.139%)

- Average Price 100.458 (prev. 100.481)

- High Yield: -0.127% (prev. -0.134%)

- Low Price 100.455 (prev. 100.470)

- % Allotted At High Yield: 65.4173% (prev. 30.8217%)

- Bid/Cover: 4.180x (prev. 3.212x)

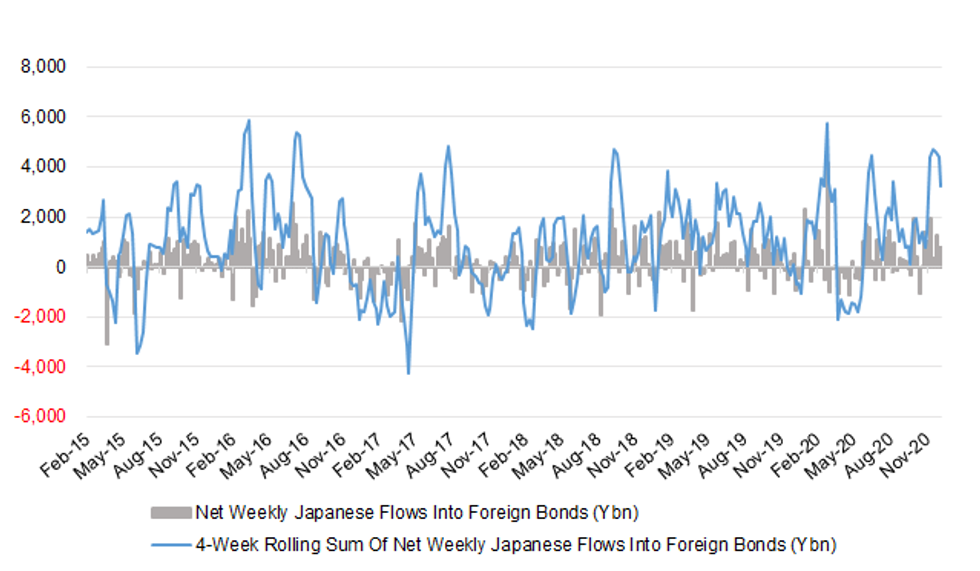

JAPAN: Little Of Note In Weekly International Security Flow Data

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 802.4 | 771.8 | 3203.8 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -771.8 | -585.2 | -2884.3 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 15.0 | 947.1 | 568.0 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | -504.3 | 156.4 | 152.3 |

Source: MNI - Market News/Japanese Ministry Of Finance

Little in the way of any true stand-out flow in the latest round of weekly Japanese international security flow data.

- Japanese investors racked up an eighth consecutive week of net purchases of foreign bonds and a sixth straight week of net sales of foreign equities, but the net levels weren't anything outside of the recent norms (potential portfolio rebalancing into calendar year-end).

- Net weekly foreign flows into Japanese bonds pull backed to virtually neutral levels, while foreign investors shed Japanese equity holdings, breaking a streak of three consecutive weeks of purchases, unwinding most of the cumulative buying seen over that period in one sweep.

EQUITIES: Equities Nudge Higher Overnight

The major e-mini contracts and regional Asia-Pac equity indices moved higher during a muted round of Christmas Eve trade, with focus on the positive Brexit developments.

- Macro headline flow was light, with participants lacking any sense of meaningful conviction ahead of the festive break.

- Deeper regulatory scrutiny out of China for tech giant Alibaba headlined regional matters, with the company's Hong Kong listing shedding 8% during the Hong Kong morning.

- Nikkei 225 +0.4%, Hang Seng +0.2%, CSI 300 +0.1%, ASX 200 +0.3%.

- S&P 500 futures +5, DJIA futures +63, NASDAQ 100 futures +17.

OIL: Nudging Higher

WTI & Brent sit ~$0.50 above their respective settlement levels, with equities nudging higher during Asia-Pac hours.

- Crude has built on Wednesday's gains that were seemingly driven by Brexit developments and a sense of hope that existing vaccines can counter the recently discovered COVID mutation seen in the UK.

- In terms of crude specifics, Thursday's DoE inventory release saw headline crude stocks provide a shallower drawdown vs. exp., although that was at odds with the surprise build seen in the API equivalent late on Tuesday.

GOLD: Sticking Within The Lines

A slightly softer USD has provided some light support for bullion over the last 24 hours or so, although both the DXY and spot gold have continued to operate within the confines of the respective ranges established earlier in the week. This leaves a relatively stagnant technical picture, with spot last dealing around the $1,875/oz mark.

- Known ETF holdings of gold continue to flatline after the pullback from record highs for the metric, which were lodged back in October.

FOREX: Final Stretch

GBP easily outperformed is G10 peers in thin, pre-holiday trade on the back of reports that the Brexit deal is down to the short strokes, with negotiators rushing to finalise the text of the agreement before its expected announcement in the London morning. Cable added ~50 pips in the Asia-Pac session, building on the solid gains posted Wednesday, albeit neither GBP/USD nor EUR/GBP managed to push through the prior day's extremes. Upside in cable was tempered as EUR/GBP struggles to break through GBP0.9000.

- For the most part, major crosses were happy to hug tight ranges with activity sapped by market closures in the likes of Indonesia and the Philippines. Macro flow was few and far between, providing little to move the needle.

- Brexit positivity supported broader sentiment, applying pressure to USD & JPY, which were among the worst performers in G10 FX space, although the DXY ticked away from lows in the second half of the session. NZD also struggled, unlike AUD, which allowed AUD/NZD to resume gains after snapping its four-day winning streak yesterday.

- The PBOC fixed USD/CNY at 6.5361, 197 pips lower than yesterday's fix as the greenback recedes and the redback advances alongside Asia FX.

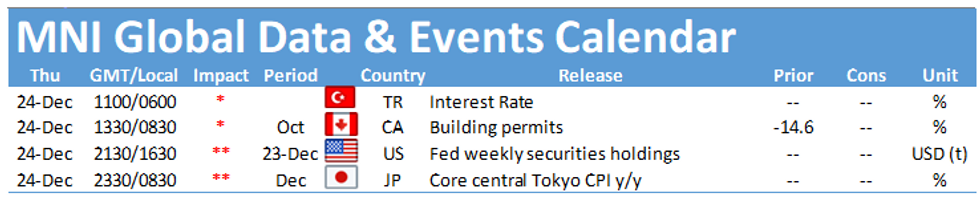

- Remaining points of note on today's thin calendar include Canadian building permits, ECB Economic Bulletin & the latest MonPol decision from the CBRT.

FOREX OPTIONS: Expiries for Dec24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2100(E536mln), $1.2200-20(E1.4bln)

- USD/JPY: Y100.20($1.3bln-USD puts), Y102.50($600mln), Y103.75-85($674mln)

- GBP/USD: $1.3150(Gbp640mln)

- USD/CNY: Cny6.5750($600mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.