-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI EUROPEAN OPEN: A Smooth Transition

EXECUTIVE SUMMARY

- TRUMP CONCEDES BIDEN WILL TAKE OFFICE, CONDEMNS CAPITOL ATTACK (BBG)

- FED'S BOSTIC: FED'S BOND TAPER MAY BE EARLIER THAN EXPECTED (BBG)

- FED'S MESTER: MORE FISCAL ACTION WON'T JUSTIFY FED PULL-BACK (BBG)

- BIDEN EYING 2K PAYMENTS AND INFRASTRUCTURE/TAX PACKAGE (AXIOS)

- PFIZER/BIONTECH VACCINE APPEARS EFFECTIVE AGAINST COVID MUTATION

- FAUCI SAYS COVID VARIANTS THREATEN SOME TREATMENTS MORE THAN VACCINES (AXIOS)

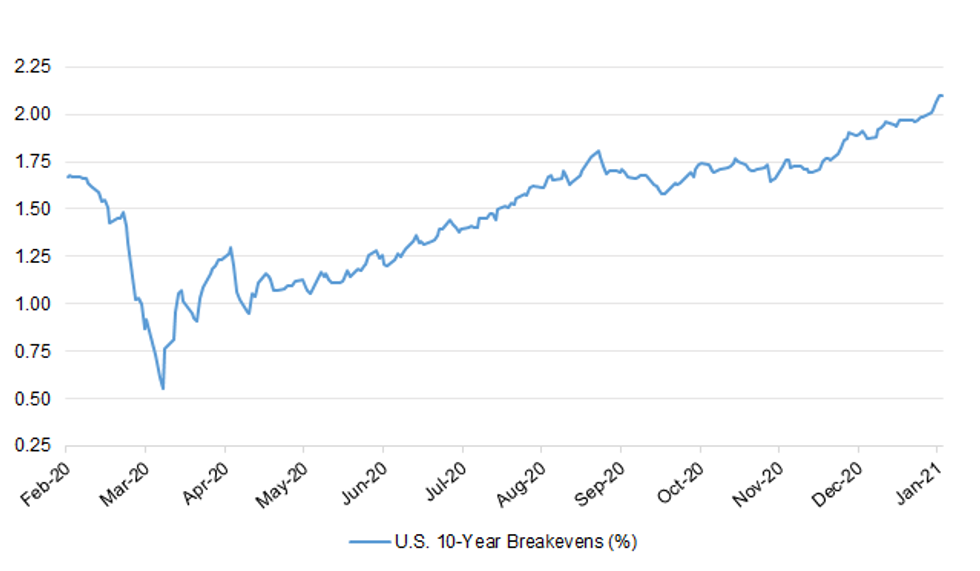

Fig. 1: U.S. 10-Year Breakevens (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: All travellers to England from overseas will need to test negative for coronavirus before they are allowed to enter the country, the government has announced. The test will need to be taken up to 72 hours before their departure - and failure to comply will result in an immediate £500 fine. Arrivals by boat, plane and train are covered by the new regulations, which also apply to UK nationals. (Sky)

CORONAVIRUS: An arthritis drug that cuts the risk of death for the sickest Covid-19 patients by 24 per cent could save thousands of lives just as the NHS starts to be overwhelmed. Tocilizumab was also found to reduce the time that critically ill patients spent in intensive care by up to ten days, offering help to hospitals facing what the head of the health service called last night an "incredibly serious situation". (The Times)

CORONAVIRUS: British medics will be able to give Covid-19 shots to hundreds of thousands of people everyday by Jan. 15, Prime Minister Boris Johnson said. "We are in a race against time, but we are doing everything we can to vaccinate as many people as possible across the U.K.," Johnson said at a televised press conference. (BBG)

ECONOMY: MNI Brief: UK Demand For Staff Up For First Time In 3 Months

- The demand for staff rose modestly in the UK as permanent placements edged up marginally in December due to increased market activity and optimistic vaccine news, according to the latest KPMG/REC jobs report. Temporary billings rose at the sharpest rate since October 2018, signalling that companies are still looking at short-term workers due to uncertainty regarding the pandemic and Brexit. Wages for both permanent and temporary placements increased for the first time since March, although at a slow rate. Nevertheless, the report noted another increase in the availability of workers with recruiters connecting the rise in staff supply to redundancies and worries over job security - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

ECONOMY: MNI BRIEF: UK Retail Footfall Down 43.4% in 2020

- The BRC-Shoppertrak footfall montitor improved 19.3pp to -46.1% in December as restrictions eased in England after November's lockdown, data released Friday showed. Footfall in retail parks fell by 17.3%, recording the shallowest decline, while high street footfall dropped by 49.5%, the worst performing location for a fifth consecutive month. Shopping centre footfall declined by 47.3% in December. The report noted that the pre-Christmas "golden quarter" recorded a drop of 48.4% in footfall compared to 2019. Over 2020 as a whole, footfall fell by 43.4% - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

EUROPE

CORONAVIRUS: The World Health Organization warned on Thursday of a "tipping point" in the fight against Covid-19 amid surging cases in Europe and a mutating virus. "We were prepared for a challenging start to 2021 and it has been just that," the WHO's regional director for Europe, Hans Kluge, said during a virtual press conference broadcast from Copenhagen. (FT)

GERMANY: CDU's Spahn considering running for Chancellor. (Spiegel)

FRANCE: France will keep gyms, theaters and ski lifts closed until the end of January, and bars and restaurants until at least mid-February, as the country's coronavirus situation remains "fragile," Prime Minister Jean Castex said. The government confirmed restaurant owners' concerns, pushing back a Jan. 20 reopening date as the situation rules out a return of out-of-home dining. French winter resorts, which had counted on reopening of lifts this week, will be forced to delay the downhill skiing season. (BBG)

FRANCE: French health authorities have recommended delaying the second doses of Pfizer and BioNTech's vaccine, Health Minister Olivier Veran said on Thursday. Veran told reporters that the second shot of the vaccine could be delayed to six weeks after the first instead of three as had been planned so far. (RTRS)

ITALY: Italian Prime Minister Giuseppe Conte wants to make full use of the European Union's recovery package, according to a draft spending plan seen by Bloomberg. The latest government plan earmarks 222 billion euros ($272 billion) for investment and other projects to revive an economy that was struggling to grow even before the coronavirus pandemic. Conte's revised draft aims to soothe his fractious coalition, after a junior party criticized his handling of an unprecedented spending opportunity for cash-strapped Italy. (BBG)

ITALY/BTPS: Italy plans to sell 7 billion euros ($8.6 billion) of bills due Jan 14, 2022 in an auction on Jan 12. (BBG)

RATINGS: Sovereign rating reviews of note scheduled for after hours on Friday include:

- DBRS Morningstar on Malta (current rating A (high), Stable Trend)

ITALY: Italy's medicines regulator AIFA said on Thursday it approved the use of a coronavirus vaccine developed by Moderna Inc. , paving the way for its roll-out across Italy. (RTRS)

U.S.

FED: Federal Reserve Bank of Atlanta President Raphael Bostic said the U.S. economy could be stronger than expected by midyear, which could lead to an earlier-than-expected tapering of bond purchases. (BBG)

FED: Federal Reserve Bank of Cleveland President Loretta Mestersaid she didn't believe ramped up fiscal stimulus under the incoming Democratic administration of President-elect Joe Biden would pave the way for a pull-back on monetary policy this year. "I don't really see it impacting the need for monetary policy to support the recovery because I don't think we're going to be necessarily back to our goals," Mester said Thursday evening in an interview with Kathleen Hays on Bloomberg Television. (BBG)

FED: MNI BRIEF: Evans - May Be 2024 Before Rates Start to Rise

- Chicago Federal Reserve President Charles Evans said Thursday it may be until 2024 before the employment and inflation outlook justifies increases in interest rates. Evans also said the recent trend in the pandemic suggests near term economic momentum may slow, while affirming his view GDP will rise about 4% this year and unemployment will decline to around 5% - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FED: MNI BRIEF: Evans - Too Soon to Judge on Adjusting QE

- Chicago Federal Reserve President Charles Evans said Thursday it will likely be until the spring before there's clear evidence for considering a change to asset purchases, and a shift could go in either direction. Evans said he remains worried for example about drags such as job market scarring and a persistence of slow inflation. "I am just not going to forecast victory on inflation until we see it," he told reporters - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FED: MNI BRIEF: Bullard Says Too Soon To Talk About Taper Timing

- St. Louis Fed President James Bullard told reporters Thursday it's too soon to talk about when the Fed might start to reduce the pace of its bond buys. "I don't think it's prudent to talk about when we're going to make a decision because there's just too much uncertainty," Bullard said, despite offering an optimistic outlook for the economy in a presentation preceding the press call. "It's too soon to try to pin down dates on this" - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FED: San Francisco Federal Reserve President Mary Daly on Thursday said it would be dangerous to pick just one benchmark against which to measure the U.S. central bank's full employment goal, because it could drive the Fed to raise interest rates before the economy reaches its full potential. (RTRS)

ECONOMY: MNI REALITY CHECK: US Dec Job Gains May Slow, But Mask Strength

- U.S. payrolls growth likely slowed again in December as new virus shutdowns stalled service-sector employment growth, recruiters and industry leaders told MNI, though Friday's payrolls report could paint an artificially bleak picture of the economy as it fails to account for a new Covid relief package passed at the tailend of the month and continuing struggles for employers trying to hire staff - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

ECONOMY: MNI INTERVIEW: US Service Recovery To Continue - ISM's Nieves

- The U.S. service sector is likely to see further recovery in coming months as fiscal aid keeps small businesses afloat and a Covid vaccine restores normalcy sooner than expected, Institute for Supply Management Chair Anthony Nieves told MNI Thursday - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FISCAL: Joe Biden is considering asking Congress to help suffering Americans in two steps: give them the balance of their coveted $2,000 coronavirus payments, followed by a $3 trillion tax and infrastructure package, Axios' Hans Nichols has learned. (Axios)

CORONAVIRUS: The US had its deadliest day of the pandemic on Thursday, reporting more than 4,000 coronavirus deaths for the first time, following a surge in cases and hospitalisations to record levels through the holiday season. (FT)

CORONAVIRUS: A new and more contagious strain of the coronavirus that was first discovered in the United Kingdom could force New York into another economic shutdown if it spreads unchecked and weakens the state's hospitals, Gov. Andrew Cuomo said on Thursday. (CNBC)

CORONAVIRUS: Eight governors are demanding the federal government start distributing Covid-19 vaccines in reserve immediately. The leaders of California, Illinois, Kansas, Michigan, Minnesota, Washington and Wisconsin called on federal officials to release more doses held by the government to states. "The failure to distribute these doses to states who request them is unconscionable and unacceptable," the governors said in a letter dated Jan. 8. (BBG)

POLITICS: President Donald Trump, in a video message on Thursday night, condemned the storming of the U.S. Capitol -- which occurred after he urged his angry supporters to take action -- and said he would prepare for the administration of President-elect Joe Biden. "The demonstrators who infiltrated the Capitol have defiled the seat of American democracy," Trump said of the violence, which left several people dead. "To those who engage in the acts of violence and destruction: you do not represent our country. And to those who broke the law: you will pay." (BBG)

POLITICS: House Speaker Nancy Pelosi and Senate Democratic leader Chuck Schumer demanded that President Donald Trump's cabinet immediately remove him from office and threatened a new drive to impeachment him if they don't act. (BBG)

POLITICS: Democratic lawmakers circulated articles of impeachment on Thursday to remove President Donald Trump from office after his supporters attacked the U.S. Capitol in a violent breach, Representative David Cicilline said. "I am circulating Articles of Impeachment that @RepTedLieu, @RepRaskin and I have prepared to remove the President from office following yesterday's attack on the U.S. Capitol," Cicilline said on Twitter. (RTRS)

POLITICS: America's president-elect has condemned Donald Trump's behaviour and called those who stormed the US Capitol "domestic terrorists". Joe Biden said Wednesday's astonishing scenes were an "assault on our liberty". Of the demonstrators, he said: "Don't dare call them protesters - they were a riotous mob, insurrectionists." (Sky)

POLITICS: Vice President Mike Pence is opposed to a call by Democrats in Congress and some Republicans to invoke the 25th Amendment to strip President Trump of his powers before his term ends, a person close to the vice president said. (New York Times)

POLITICS: As President Donald Trump stood idly by with violent protestors ransacking the U.S. Capitol on Wednesday, at least two of his top officials and closest allies conferred with staff about the possibility of invoking the 25th Amendment. Secretary of State Mike Pompeo and Treasury Secretary Steven Mnuchin held informal conversations within their own agencies about the contours of the 25th Amendment, the invocation of which would begin a process to remove Trump from office, according to three sources familiar with the matter. (CNBC)

POLITICS: Mnuchin didn't discuss 25th Amendment with staff, according to people familiar. (BGB)

POLITICS: Maryland Governor Larry Hogan on Thursday called for President Donald Trump to resign the White House or be removed from office, saying Vice President Mike Pence should take over to ensure a peaceful transfer of power to Democratic President-elect Joe Biden. (RTRS)

POLITICS: Rep. Adam Kinzinger (R-Ill.) on Thursday called on members of the Cabinet to invoke the 25th Amendment, which would remove President Trump from office for not being able to perform his duties and replace him with Vice President Pence until the end of the term. (Axios)

POLITICS: The top federal prosecutor in Washington, D.C., on Thursday pointedly did not rule out charging President Donald Trump in connection with inciting a riot where his supporters invaded the U.S. Capitol complex a day earlier. Acting U.S. Attorney Michael Sherwin said the Department of Justice will consider lodging criminal charges against anyone who played a role in the riot, which for hours delayed the certification by Congress of Joe Biden's election as the next president. (CNBC)

POLITICS: President Trump has suggested to aides he wants to pardon himself in the final days of his presidency, according to two people with knowledge of the discussions, a move that would mark one of the most extraordinary and untested uses of presidential power in American history. (New York Times)

POLITICS: Senate Majority Leader Mitch McConnell says he requested and has received Senate Sergeant at Arms Michael Stenger's immediate resignation. The position, as the highest-ranked law enforcement officer in the Senate, will be filled by Jennifer Hemingway, the current Deputy Sergeant at Arms. (NPR)

POLITICS: Education Secretary Betsy DeVos resigned Thursday night, blaming President Donald Trump for rhetoric that fueled the "unconscionable" invasion of the U.S. Capitol by a mob of his supporters. (CNBC)

POLITICS: The mayor of Washington, D.C., called on Congress to establish a panel to investigate the security lapses that enabled a mob to penetrate the U.S. Capitol Complex and threaten lawmakers. (CNBC)

EQUITIES: Goldman Sachs CEO David Solomon is preparing for more stock market volatility, particularly in the near term, and currently sees some "excess in markets," he told Axios in a phone call this week. Solomon is the latest in a long list of high-profile CEOs, fund managers and investment strategists to warn that stock prices may be running away from reality. (Axios)

EQUITIES: Boeing agreed to pay more than $2.5 billion to settle criminal charges with the U.S. Justice Department, which accused the company of concealing information about its 737 Max airplane that was involved in two crashes that claimed 346 lives, federal prosecutors announced Thursday. (CNBC)

EQUITIES: Federal Communications Commission (FCC) Chairman Ajit Pai will not move forward to set any new rules sought by outgoing U.S. President Donald Trump to limit key social media liability protections, a spokesman for the agency confirmed. Trump last year demanded the FCC set new rules to limit protections for social media firms under Section 230, a provision of the 1996 Communications Decency Act that shields social media companies from liability for content posted by their users and allows them to remove lawful but objectionable posts. Pai had said on Oct. 15 he would move forward to set new rules but the FCC confirmed he told C-SPAN Thursday there was not enough time before President-elect Joe Biden takes office on Jan. 20 to proceed. (RTRS)

EQUITIES: The Federal Trade Commission said Thursday it has settled with mobile advertising company Tapjoy over claims it used false advertising offers for the promise of in-game rewards that weren't given. But regulators also said Apple and Google helped create the environment that squeezes mobile gaming industry players and incentivizes them to find other monetization models that may have unsavory consequences for consumers. (CNBC)

EQUITIES: Apple Inc. will take at least half a decade to launch an autonomous, electric vehicle because development work is still at an early stage, according to people with knowledge of the efforts. (BBG)

OTHER

U.S./CHINA: MSCI Inc. will remove China's three major telecommunications companies from its benchmark indexes, adding fresh selling pressure to stocks that have swung wildly this week on confusion over whether they should be included in a U.S. ban on investments in Chinese companies with military ties. (BBG)

U.S./CHINA/HONG KONG: China may require the US Consulate General in Hong Kong to slash staff, register with the Chinese authorities, and restrict its activities, and it may also consider investigating some Americans or American enterprises, if the US imposes more sanctions over Hong Kong, Chinese analysts said. (Global Times)

GLOBAL TRADE: The U.S. will suspend a plan to hit $1.3 billion of French goods with tariffs in retaliation for the European country's tax on the revenue of global tech companies -- many of them American -- de-escalating the transatlantic trade dispute just two weeks before President Donald Trump leaves office. "The U.S. Trade Representative has decided to suspend the tariffs in light of the ongoing investigation of similar DSTs adopted or under consideration in 10 other jurisdictions," it said in a statement Thursday, referring to digital services taxes. "A suspension of the tariff action in the France DST investigation will promote a coordinated response in all of the ongoing DST investigations." (BBG)

GLOBAL TRADE: China will push forward tri-lateral free trade negotiations with South Korea and Japan, seek deals with Israel and Norway, while preparing to join the CPTPP after concluding the China-E.U. investment treaty, the newly appointed Minister of Commerce Wang Wentao said in an interview with Xinhua News Agency. The ministry will also promote consumption by boosting auto sales, including giving credit for trade-in vehicles and tapping into rural demand, Wang said. (MNI)

CORONAVIRUS: Pfizer Inc and BioNTech's COVID-19 vaccine appeared to work against a key mutation in the highly transmissible new variants of the coronavirus discovered in the UK and South Africa, according to a laboratory study conducted by the U.S. drugmaker. The not-yet peer reviewed study by Pfizer and scientists from the University of Texas Medical Branch indicated the vaccine was effective in neutralizing virus with the so-called N501Y mutation of the spike protein. (RTRS)

CORONAVIRUS: The COVID-19 variants first detected in the U.K. and South Africa and now circulating globally aren't a current threat to the effectiveness of the first vaccines, but mutations will be closely monitored because "they could be an issue," NIAID director Anthony Fauci tells Axios. (Axios)

JAPAN: Japan's FSA to allow extension of report deadlines on virus. (BBG)

JAPAN/SOUTH KOREA: A South Korean court ruled on Friday that Tokyo must pay damages to wartime sex slavery victims in the first ruling of its kind, which is likely to inflict more damage on the already fraught relations between the two neighbouring nations. The Seoul Central District Court ordered Japan to make financial reparations of 100 million won (US$91,300) each to 12 "comfort women" who were dragged away from their homes and forced to work in front-line military brothels for Japanese soldiers during World War II. "Evidence, relevant materials and testimonies show that the victims suffered from extreme, unimaginable mental and physical pain due to the illegal acts by the accused. But no compensation has been made for their suffering" the court said in a verdict. (Yonhap)

AUSTRALIA: The government of Australia has signed an advanced agreement to purchase 51 million doses of Novavax Inc's experimental COVID-19 vaccine, the company disclosed in a regulatory filing on Thursday. Australia will have the option to purchase up to an additional 10 million doses, with the initial doses expected to be delivered by mid-2021, the company said. (RTRS)

AUSTRALIA: Australia is slashing the number of international travellers allowed to enter the country for at least six weeks and making pre-flight Covid-19 tests a condition of entry in a bid to stop the spread of highly infectious strains of the virus. (FT)

AUSTRALIA: Australia's Queensland state imposed a three-day lockdown of its capital, Brisbane, after the U.K. variant of the coronavirus was detected in the city. Residents across the metropolitan area will have to stay home except for essential work, services and exercise and wear masks if they do go out, state Premier Annastacia Pałaszczuk told reporters Friday. (BBG)

NORTH KOREA: North Korean leader Kim Jong-un has reviewed inter-Korean relations and declared a policy stand for "comprehensibly" expanding external ties during a rare party congress, state media reported Friday. Kim announced the policy line in a report to the third-day session of the eighth congress of the ruling Workers' Party held in Pyongyang the previous day, citing "the prevailing situation and the changed times," according to the Korean Central News Agency (KCNA). (Yonhap)

CANADA: MNI INTERVIEW: Canada Faces Prolonged Weakness - Ivey PMI Chief

- Canada's economy may remain weak most of this year as the pandemic's second wave slows business spending and deliveries, the head of the Ivey Purchasing Managers Index told MNI on Thursday - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

BRAZIL: Terms presented to the Brazilian government are in line with agreements signed in other countries, including some in Latin America, Pfizer said in a statement. Company has already presented 3 contract proposals to the government, the first one in Aug. 2020 for delivery in Dec. 2020, according to the statement. Pfizer still awaits a decision by the Brazilian government on the supply contract based on conditions and terms needed for a definitive deal, the firm added. (BBG)

RUSSIA: The electronic filing system used by federal courts has likely been compromised in the massive SolarWinds hack, federal judiciary officials said, extending to another branch of government the impact of a suspected Russian cyber-espionage campaign that has breached more than half a dozen Trump administration agencies. (WSJ)

EQUITIES: Samsung Electronics on Friday said its operating profit for the quarter that ended in December likely rose 26% from a year ago to 9 trillion Korean won ($8.22 billion). It was mostly in line with analysts' estimate of 9.1 trillion won, according to Refinitiv SmartEstimate. (CNBC)

CHINA

CORONAVIRUS: Multiple provinces including the capital Beijing have taken measures to limit traveling during the coming Lunar New Year season to contain an apparent rise in coronavirus inflections, including asking state employees to spend the holidays at home, China News Service reported. Shijiazhuang, the capital city of Hebei province bordering Beijing, reported 31 new Covid-19 cases on Thursday, prompting local authorities to implement lockdowns and close off road transportation, the agency said. (MNI)

CORONAVIRUS: More than 4m doses of Sinopharm's Covid vaccine had been administered in China's emergency use as of Jan. 4, Sinopharm said in a statement on its WeChat account Thursday. (BBG)

YUAN: MNI BRIEF: China to Quicken Reforms on Capital Outflow

- China will "properly quicken" reforms to facilitate capital outflows and will continue to facilitate cross-border financing and investment, according to Ye Haisheng, the director of Capital Account Management Department under State Administration of Foreign Exchange (SAFE), in an article published in the administration's magazine. As the yuan broke the key level of 6.5 against the greenback and appreciated at a fast pace at the beginning of this year, Ye's comment may give a sign that Beijing intends to help the acceleration of capital outflows to slow the sharp rally of the currency, MNI understands - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

ECONOMY: China's GDP may have grown 6% in Q4 with the highest forecast at 7% and lowest 4.5%, the Securities Times reported citing the median of projections by 43 agencies. The strong real estate market should support the construction and real estate industries, while the export boom will increase investment in manufacturing and production, the newspaper reported citing Zhang Yu, chief analyst from Huachuang Securities. (MNI)

FISCAL: China's fiscal deficit ratio may fall from 3.6% in 2020 to 3.0%-3.2% in 2021, Securities Times reports, citing Wu Chaoming, economist at Chasing Securities. (BBG)

FINTECH: China's government has told the country's media to censor reporting on an antitrust probe into tech group Alibaba, whose founder Jack Ma has disappeared from public view as misfortunes mount for his business empire, according to people familiar with the matter. (FT)

ASSET MANAGEMENT: The Beijing Bureau of the China Securities Regulatory Commission warned Huarong Securities that it has not made adequate progress in disposing of risky assets, Caixin Global reports. Also says the company's measures to reduce the scale of its asset management business is insufficient. (BBG)

OVERNIGHT DATA

JAPAN NOV HOUSEHOLD SPENDING +1.1% Y/Y; MEDIAN -1.0%; OCT +1.9%

JAPAN NOV, P LEADING INDEX 96.6; MEDIAN 96.6; OCT 94.3

JAPAN NOV, P COINCIDENT INDEX 89.1; MEDIAN 89.4; OCT 89.4

AUSTRALIA DEC FOREIGN RESERVES A$55.8BN; NOV A$58.7BN

SOUTH KOREA NOV BOP CURRENT ACCOUNT BALANCE +$8.9669BN; OCT +$11.6579BN

SOUTH KOREA NOV BOP GOODS BALANCE +$9.5440BN; OCT +$10.1503BN

CHINA MARKETS

PBOC NET INJECTS CNY5BN VIA OMOS FRIDAY

The People's Bank of China (PBOC) injected CNY5 billion via 7-day reverse repos with the rate unchanged on Friday. This resulted in a net injection of CNY5 billion given no maturity of reverse repos today, according to Wind Information.

- The operations aim to maintain the liquidity in the banking system reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2000% at 09:26 am local time from 1.7172% for Thursday's close.

- The CFETS-NEX money-market sentiment index closed at 43 on Thursday vs 36 on Wednesday. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.4708 FRI VS 6.4608

People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4708 on Friday. This compares with the 6.4608 set on Thursday.

MARKETS

SNAPSHOT: A Smooth Transition

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 570.18 points at 28060.5

- ASX 200 up 45.945 points at 6757.9

- Shanghai Comp. down 22.241 points at 3553.964

- JGB 10-Yr future down 3 ticks at 151.76, yield down 0.4bp at 0.036%

- Aussie 10-Yr future down 4.5 ticks at 98.855, yield up 4.3bp at 1.127%

- U.S. 10-Yr future -0-06+ at 136-24, yield up 1.86bp at 1.098%

- WTI crude up $0.15 at $50.98, Gold down $3.94 at $1909.87

- USD/JPY up 6 pips at Y103.87

- TRUMP CONCEDES BIDEN WILL TAKE OFFICE, CONDEMNS CAPITOL ATTACK (BBG)

- FED'S BOSTIC: FED'S BOND TAPER MAY BE EARLIER THAN EXPECTED (BBG)

- FED'S MESTER: MORE FISCAL ACTION WON'T JUSTIFY FED PULL-BACK (BBG)

- BIDEN EYING 2K PAYMENTS AND INFRASTRUCTURE/TAX PACKAGE (AXIOS)

- PFIZER/BIONTECH VACCINE APPEARS EFFECTIVE AGAINST COVID MUTATION

BOND SUMMARY: Further Modest Pressure For Core FI In Asia

U.S. Tsys were subjected to some light pressure overnight, with U.S. President Trump pledging to work towards a smooth transition for the incoming Biden administration and cautiously optimistic news flow surrounding existing COVID 19 vaccines being effective against the recently discovered variants of the virus at the fore. T-Notes now sit below their Thursday low, with the contract last -0-06+ at 136-24, while the cash curve has been subjected to some bear steepening, with 30s sitting ~2.5bp cheaper on the day at typing.

- There was no reaction in JGB futures to the soft round of 30-Year supply, with the contract sticking to a tight range, last dealing -3 vs. settlement. 30s were also little moved in the wake of supply (unwinding a brief, limited nudge higher in yields), while JGBs are marginally mixed across the curve with no sign of any uniform underperformance in the longer end.

- Aussie bonds have largely taken direction from U.S. Tsys, with YM -1.0 and XM -4.0 at typing, although Sydney ranges have been confined. News of a short-term COVID lockdown for the greater Brisbane area and positive COVID-19 vaccine procurement developments did little for the space.

JGBS AUCTION: Japanese MOF sells Y730.8bn 30-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y730.8bn 30-Year JGBs:- Average Yield 0.648% (prev. 0.648%)

- Average Price 101.30 (prev. 98.80)

- High Yield: 0.652% (prev. 0.650%)

- Low Price 101.20 (prev. 98.75)

- % Allotted At High Yield: 37.7084% (prev. 82.6720%)

- Bid/Cover: 2.977x (prev. 3.487x)

JGBS AUCTION: Japanese MOF sells Y5.9351tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y5.9351tn 3-Month Bills:- Average Yield -0.0883% (prev. -0.0861%)

- Average Price 100.0218 (prev. 100.0210)

- High Yield: -0.0851% (prev. -0.0820%)

- Low Price 100.0210 (prev. 100.0200)

- % Allotted At High Yield: 53.1682% (prev. 82.5825%)

- Bid/Cover: 3.106x (prev. 2.856x)

AUSSIE BONDS: AOFM Weekly Issuance Schedule Released

The AOFM has released its weekly issuance schedule:

- On Thursday 14 January 2021 it plans to sell A$750mn of the 23 April 2021 Note & A$750mn of the 23 July 2021 Note.

- The AOFM also affirmed that Treasury Bond issuance will resume the week beginning 18 January 2021 and that Treasury Indexed Bond issuance will resume in February 2021.

EQUITIES: Chinese Equities Red Against A Broader Sea Of Green

A more passive tone from Trump, as he pledged to work towards a smooth Presidential transition later this month, alongside talk of a Biden infrastructure plan (albeit linked to higher taxes for high earners) and potential positive news on the vaccine front re: COVID-19 mutations supported the majority of the major equity indices during Asia-Pac trade, with the S&P 500 e-mini tapping new highs in the process.

- The CSI 300 was the exception to the rule, with this week's seasonal liquidity withdrawal, MSCI index deletion for the three major Chinese telco names targeted by the Trump executive order and continued policymaker scrutiny of Alibaba hampering A shares.

- Nikkei 225 +1.7%, Hang Seng +1.3%, CSI 300 -1.0%, ASX 200 +0.4%.

- S&P 500 futures +13, DJIA futures +110, NASDAQ 100 futures +28.

OIL: Just Off Cycle Highs

WTI & Brent sit $0.10 above their respective settlement levels after backing off from the fresh cycle highs lodged in the last 24 hours or so, holding to tight ranges over that timeframe, with a lack of crude-specific news flow evident but still leaning on the uptick in broader equity indices.

GOLD: Insulated

Gold has held to a tight range over the last 24 hours, with the uptick in the DXY providing little in the way of meaningful pressure for bullion. Elsewhere, U.S. real yields have been fairly stagnant over the same timeframe, while ETF holdings of gold have flatlined over the last couple of days. Spot last deals little changed, just above $1,910/oz, with no change to the broader technical backdrop.

FOREX: Calm Asia Session, USD Strength Continues To Pummel EMFX

Another quiet session for G10 FX with markets welcoming U.S. Pres Trump pledge to work on a "smooth, orderly and seamless transition of power." The greenback drew some support for a continued softening of U.S. Tsys, with 10-Year yield hitting its best levels in almost 10 months. Price action across the G10 FX space was sedate, with the limited data docket providing no notable catalysts.

- NZD firmed up a tad as a BBG trader source cited purchases against AUD after Queensland imposed a three-day lockdown in Brisbane. AUD/NZD is on course for its first weekly loss in five weeks, which occurs after the rejection of resistance from the 61.8% recovery of the 2018 - 2020 sell-off on Monday.

- Dollar strength continued to jolt EMFX, with IDR and KRW becoming the main victims. USD/IDR rallied past the IDR14,000 mark last breached when it gapped lower on Monday. USD/KRW topped out just shy of the KRW1,100 mark but stopped short of attacking the level.

- The redback outperformed its peers from the Asia EM basket and the USD, even as the PBOC fixed USD/CNY at 6.4708, around 100 pips higher than yesterday (roughly in line with expectations). The bank injected CNY 5bn of liquidity, equating to a net drain of CNY 505bn this week - the biggest since October.

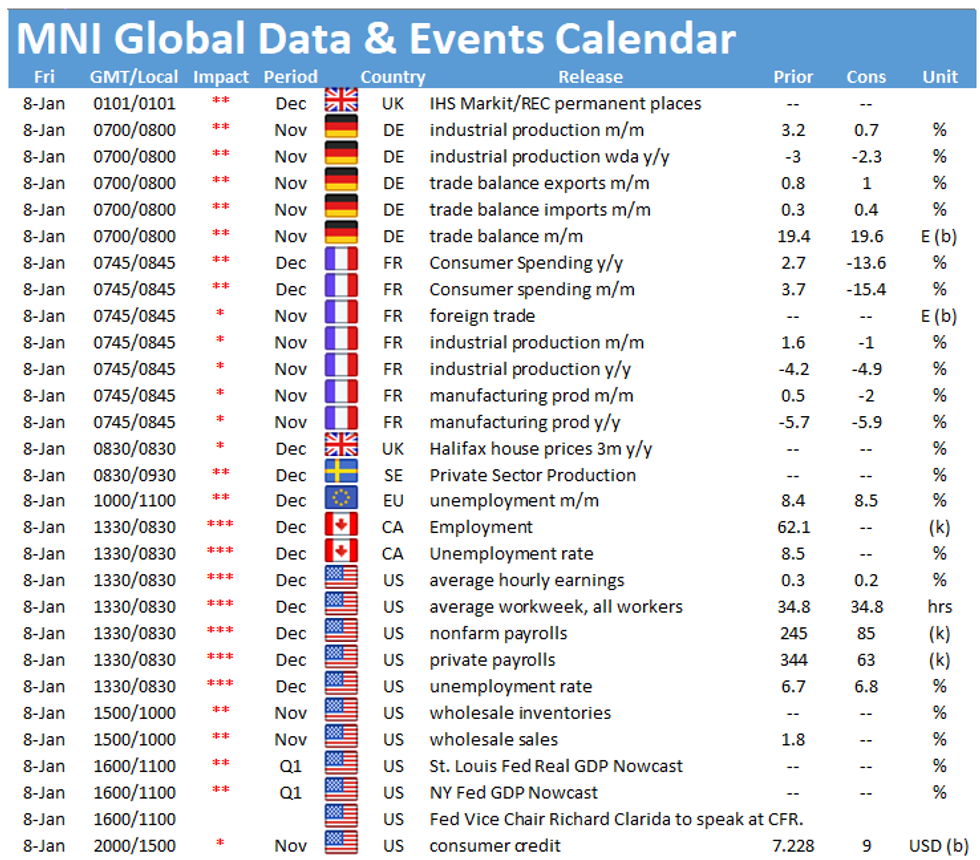

- Focus moves to U.S. NFP report, German, French & Norwegian industrial output figures, German & French trade data, Canadian & EZ jobs reports as well as comments from Fed Vice Chair Clarida.

FOREX OPTIONS: Expiries for Jan08 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2000(E793mln), $1.2175-80(E897mln), $1.2240-60(E870mln), $1.2300(E743mln)

- USD/JPY: Y103.90($790mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.