-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI EUROPEAN OPEN: What Will Biden Deliver?

EXECUTIVE SUMMARY

- BIDEN AIDES TELL CONGRESS ALLIES AID PLAN MAY BE ABOUT $2TN (CNN)

- CLARIDA: NO RATE LIFTOFF UNTIL U.S. SEES 2% INFLATION FOR A YEAR (BBG)

- FED'S HARKER WANTS INFLATION OVER 2% BEFORE TAPER TALK (MNI)

- AMERICANS WON'T BE BANNED FROM INVESTING IN ALIBABA, TENCENT & BAIDU (WSJ)

- J&J COVID VACCINE IS SAFE & GENERATES PROMISING RESPONSE IN EARLY TRIAL (CNBC)

- ITALY GOVERNMENT ON VERGE OF COLLAPSE AS RENZI PARTY QUITS (BBG)

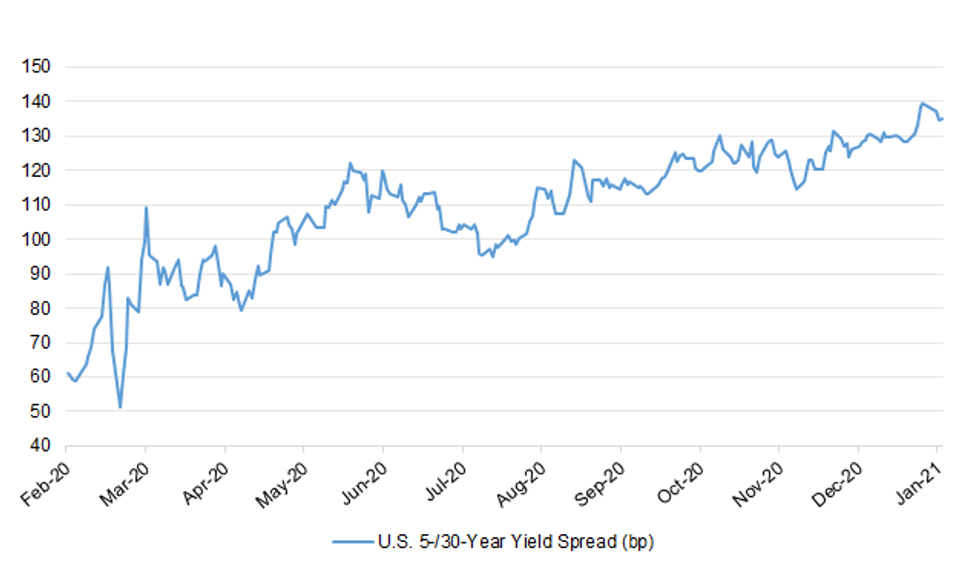

Fig. 1: U.S. 5-/30-Year Yield Spread (bp)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: The UK has recorded the highest daily increase in its coronavirus death toll since the start of the pandemic. The nation reported an additional 1,564 deaths within 28 days of a positive Covid-19 test. More than 1,000 of the new deaths reported on Wednesday occurred over the prior four days, though some date back to the last week of December. (RTRS)

ECONOMY: The City of London wants to foster growth in sectors such as green finance, fintech and the creative industries, according to a post-pandemic recovery plan for the financial district. (FT)

BREXIT: Deliveries of Scottish seafood to the EU from smaller companies have been halted until Monday, 18 January, after post-Brexit problems with health checks, IT systems and customs documents caused a huge backlog. (Guardian)

BOE: The Bank of England will improve the way it communicates about how it stimulates the economy through quantitative easing, a response to an internal report that found the method is poorly understood. (BBG)

EUROPE

CORONAVIRUS: Johnson & Johnson could deliver the first doses of its COVID-19 vaccine to Europe in April, an EU official told Reuters on Wednesday after a top lawmaker said the U.S. healthcare company was likely to seek EU regulatory approval in February. (RTRS)

FRANCE: The French are increasingly willing to get the Covid-19 shot as the alarming spread of the coronavirus overcomes their skepticism of a vaccine.The share of the population that plans to get vaccinated has increased to 47%, up 9 points from a week earlier, according to an Elabe survey on Wednesday. While vaccine resistance is a "French specificity," acceptance of the Covid shot is growing, Prime Minister Jean Castex said in response to Senate questions. (BBG)

ITALY: Italy's government led by Prime Minister Giuseppe Conte risks collapsing in the middle of the Covid-19 pandemic after a junior coalition partner pulled out. Former Premier Matteo Renzi said his Italy Alive party is quitting the coalition, attacking Conte for failing to do enough to tackle the country's problems. Though the party is tiny, Conte relies on it to maintain his majority in Parliament. Renzi's decision sparks a government crisis which could last days or even weeks, and has no clear solution in sight. (BBG)

ITALY: "That's a move that could put at risk all the reforms that Italy is working on," Democratic Party head Nicola Zingaretti said in an interview with state tv Rai on Thursday. (BBG)

ITALY: Italy's opposition centre-right bloc called on Prime Minister Giuseppe Conte to resign on Wednesday after the small Italia Viva party pulled its ministers from the cabinet, pushing the ruling coalition towards collapse. In a joint statement, the League, Brothers of Italy and Forza Italia, said that the best way to guarantee stable government at this point would be early elections. Nicola Zingaretti, the head of the co-ruling coalition Democratic Party (PD) denounced Italia Viva's move as a "serious mistake", saying it ran counter to Italy's best interests. (RTRS)

PORTUGAL: The Portuguese government tightened restrictions while keeping all schools open. Shops will have to close with several exceptions including supermarkets and other food stores, Prime Minister Antonio Costa said in Lisbon on Wednesday. From Friday, people will have a duty to stay at home and remote working will be mandatory when possible. Those measures may have to be in place for a month, he said. (BBG)

U.S.

FED: Federal Reserve Vice Chair Richard Clarida, in a discussion about the Fed's new framework, says the central bank will not raise interest rates until inflation has been at 2% for a year. "I went into this quite skeptical about makeup strategies as a practical tool for central banks. And you'll see that there really is not much of a make-up element in this at all, other than we're not going to lift off until we get 2% inflation for a year." (BBG)

FED: MNI POLICY: Fed's Brainard Sees USD120B QE Pace For Some Time

- Federal Reserve Governor Lael Brainard expects the U.S. central bank to keep buying assets at the current pace of USD120 billion a month "for some time" as the economy sees damage from the winter Covid surge before vaccinations underpin a faster expansion later this year - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FED: MNI INTERVIEW: Harker Wants Inflation Over 2% Before Taper Talk

- Federal Reserve Bank of Philadelphia President Patrick Harker wants to see inflation heading above 2% before possibly dialing back asset purchases, calling for patience as the economic rebound from the coronavirus pandemic accelerates this year, he told MNI in an interview Wednesday. "I'd like to see inflation moving above 2% or on its path to moving above 2% before I would consider" starting to taper purchases, Harker said. "Low unemployment and inflation, that's our dual mandate, but a lot of this is dictated by seeing movement in inflation" - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FED: The U.S. economy could face significant weakness over the next couple of months until coronavirus vaccines are widely distributed, but those vaccines, combined with the increased odds for fiscal stimulus under President-elect Joe Biden, could boost the economy in the long run, Boston Federal Reserve Bank President Eric Rosengren said on Wednesday. (RTRS)

FED: MNI BRIEF: Most Fed Districts Saw Modest Increase in Activity

- U.S. economic activity expanded gradually in the past few weeks, "although conditions remained varied," the Federal Reserve's Beige Book report said Wednesday - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FISCAL: President-elect Joe Biden is expected to unveil a major Covid-19 relief package on Thursday and his advisers have recently told allies in Congress to expect a price tag in the ballpark of $2 trillion, according to two people briefed on the deliberations. The Biden team is taking a "shoot for the moon" approach with this package, one lawmaker in close contact with them told CNN, though they added that the price tag could still change. The proposal will include sizable direct payments to American families, significant state and local funding -- including for coronavirus vaccine distribution and other emergency spending measures -- to help those struggling during the pandemic. Biden is set to announce the details of his plan in Wilmington, Delaware, Thursday evening. (CNN)

FISCAL: Incoming Senate Majority Leader Chuck Schumer has pressed President-elect Joe Biden to propose more than $1.3 trillion in spending for his initial round of Covid-19 relief, according to a person familiar with the matter. (BBG)

FISCAL: The U.S. government posted a December budget deficit of $144 billion - a record for the month - due to far higher outlays with coronavirus relief spending and unemployment benefits, while revenues ticked slightly higher, the Treasury Department said on Wednesday. The Treasury said the December deficit compares with a $13 billion deficit in December 2019, before the COVID-19 pandemic started in the United States. Receipts for the month rose 3% from a year earlier to $346 billion, while outlays were up 40% to $490 billion. (RTRS)

FISCAL: MNI POLICY: Sell Debt Past 30Y, Spend to Restore Jobs- Rubin

- The U.S. should sell debt beyond the longest existing maturity of 30 years to lock in low interest rates and press ahead with deficit spending until full employment is restored, former Treasury Secretary Robert Rubin said Thursday - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

CORONAVIRUS: The US on Wednesday reported more than 4,000 coronavirus deaths in a single day for the third time, propelled once again by California and Texas. (FT)

CORONAVIRUS: Researchers in the US have discovered two new variants of coronavirus, one of which they say became the dominant strain in the Ohio state capital Columbus within just three weeks. Scientists at Ohio State University said on Wednesday they had discovered the new variants from patients in the state, warning the mutations could make the disease more easily spread from one person to another. (FT)

CORONAVIRUS: New York has turned the Javits Convention Center in Manhattan into a mass Covid-19 vaccination site, a key step toward speeding up the rollout of the life-saving doses. The center was commissioned as an emergency hospital in the early days of the pandemic. (CNBC)

CORONAVIRUS: California Gov. Gavin Newsom said the state will expand its vaccine eligibility to include everyone over the age of 65. The shift follows a guideline change from the CDC and similar moves by New York and New Jersey. (CNBC)

CORONAVIRUS: Montana's new Republican governor, Greg Gianforte, reversed Covid-19 restrictions imposed by his Democratic predecessor, the Billings Gazette reported. Gianforte is lifting restrictions on capacity and hours of operation at bars, restaurants, casinos, breweries, distilleries and other businesses, effective Jan. 15, the newspaper said. With a population just over 1 million, Montana has reported 1,069 virus deaths, according to the state's online dashboard. (BBG)

CORONAVIRUS: Johnson & Johnson's highly anticipated single-dose Covid-19 vaccine may not be authorized for use until March, weeks later than U.S. officials have suggested. (BBG)

CORONAVIRUS: The Centers for Disease Control and Prevention is weighing new measures that could allow expanded travel after unveiling testing requirements for people flying into the U.S. Lifting travel restrictions on countries such as Brazil and EU countries is part of ongoing discussions, Martin Cetron, director of the agency's division of global migration and quarantine, said in an interview. Whether to make allowances in the future for people who have been vaccinated is also under debate, he said. (BBG)

POLITICS: President Donald Trump has become the first president in US history to be impeached twice. This time around, the president was charged with inciting the riot at the US Capitol last week, which left five people dead. Ten Republicans in the House of Representatives broke party ranks and voted to impeach Trump. It's a marked change from 2019's proceedings when no Republicans voted to impeach. (BBC)

POLITICS: Senate Majority Leader Mitch McConnell told other Republican senators he's reached no decision on whether he'll vote to impeach President Donald Trump but a spokesman said he's rejected a call by Democratic leader Chuck Schumer to convene in an emergency session to quickly start proceedings. His decision to reject a swift trial for Trump on an article of impeachment, expected to be approved Wednesday by the House, almost certainly won't get under way before Trump's term ends in the early afternoon on Jan. 20. (BBG)

POLITICS: Republican leadership in the U.S. Senate is mulling the possibility of beginning an impeachment trial of President Donald Trump as early as Friday if the House of Representatives approves one article of impeachment, according to a source. The senior Senate Republican aide, who asked not to be identified, stressed that no decisions had yet been made on whether to take that step. Aides to Senate Majority Leader Mitch McConnell were not immediately available for comment. McConnell had taken the position that since the Senate's next regular meeting is set for Tuesday he could not bring the Senate back sooner for a work session without the consent of all 100 senators. (RTRS)

POLITICS: Money raised for Trump's campaign, post-election efforts may be used for his legal bills: Gasparino. Sources tell FOX Business' Charlie Gasparino that Trump raised hundreds of millions in soft money and those funds can be put to many uses. (FOX Business)

POLITICS: One week after his supporters stormed Capitol Hill in a deadly riot, and hours after his second impeachment in the House, President Donald Trump on Wednesday delivered his clearest condemnation yet of the Jan. 6 violence. "I want to be very clear. I unequivocally condemn the violence that we saw last week, violence and vandalism have absolutely no place in our country, and no place in our movement," Trump said in a video posted by the White House's official Twitter account. Trump took no responsibility for the attacks. (CNBC)

POLITICS: Top allies of President Trump in the House Republican conference circulated a petition on Wednesday demanding that Rep. Liz Cheney (R-Wyo.) resign from her leadership position over her support for Trump's Impeachment. (Axios)

OTHER

U.S/CHINA: The U.S. government is expected to let Americans continue to invest in Chinese technology giants Alibaba Group Holding Ltd. , Tencent Holdings Ltd. and Baidu Inc., after weighing the firms' alleged ties to China's military against the potential economic impact of banning them. New York-listed Alibaba and Baidu, and Hong Kong-listed Tencent, were among a dozen companies being examined for inclusion in a Defense Department list of firms deemed to support China's military, intelligence and security services, according to people familiar with the matter. U.S. investors have until November to divest their holdings of any firm on the list. (WSJ)

U.S/CHINA: President Donald Trump has signed an amended version of an executive order that bans U.S. investments in alleged Chinese military companies, the White House said on Wednesday. The changes strengthen the initial order by requiring Americans to completely divest their holdings of securities of the blacklisted companies effective Nov. 11, 2021. In the initial version of the order released last November, U.S. investors were only restricted from buying those securities by that date. Reuters had previously reported that the change was under consideration. (RTRS)

U.S/CHINA: The U.S. Chamber of Commerce sees "every indication" that a high-ranking delegation of Chinese officials will visit Washington early in the administration of President-elect Joe Biden, a top Chamber official said on Wednesday. Myron Brilliant, head of international affairs for the business group, told reporters such a visit could help lay the groundwork for improved relations between the United States and China and progress in an expanded trade agreement. "There are some challenges that we have to overcome in the relationship, and it's not going to be a straight line. It's going to be a bumpy road ahead," he said. (RTRS)

U.S/CHINA: The U.S. will bar entry of all cotton products and tomatoes from China's Xinjiang region, where it says Beijing is oppressing Muslim-minority Uighurs. The move is the latest in a series of actions where the U.S. is raising pressure on China over some companies' alleged ill-treatment of workers. The U.S. says the Chinese government has detained more than 1 million Uighurs and other ethnic and religious minorities in "re-education" internment camps, allegations that the Foreign Ministry in Beijing denies. (BBG)

U.S./CHINA: Chinese President Xi Jinping encouraged Starbucks' former chairman Howard Schultz and the coffee company to play an active role in promoting U.S.-China trade cooperation and bilateral ties, state media reported on Thursday. State broadcaster CCTV said Xi made the remarks in a message when replying to Schultz, who also holds the honorary title of Starbucks' chairman emeritus. (RTRS)

U.S./CHINA: China National Offshore Oil Corp. will be ineligible for S&P Dow Jones Indices after the Treasury department's Office of Foreign Assets Control added the company to an updated Non-SDN Communist Chinese Military Companies List. The securities will be removed from impacted indices on or before Feb. 1, S&P Dow Jones Indices said. (BBG)

U.S./CHINA/TAIWAN: Taiwan President Tsai Ing-wen had a video conference with Kelly Craft, U.S. Ambassador to the United Nations, and David Feith, deputy assistant secretary for regional and security policy and multilateral affairs at State Department's Bureau of East Asian and Pacific Affairs, Thursday morning, Presidential Office spokesman Chang Tun-han said in text message. (BBG)

HONG KONG: Hong Kong police have arrested 11 more people for suspected crimes related to helping a group of 12 activists who attempted to escape the city to Taiwan, local media reported on Thursday. A total of eight men and three women have been detained, according to local broadcaster RTHK. They are aged 18 to 72 years. A lawyer and district councilor named Daniel Wong and the mother of a Hong Kong pro-democracy activist were among those arrested, according to early reports. Wong wrote on Facebook that police arrived at his apartment at 6 a.m. local time. (Deutsche Welle)

CORONAVIRUS: Johnson & Johnson's one-dose coronavirus vaccine is safe and appears to generate a promising immune response in both young and elderly volunteers, according to trial data published Wednesday in the New England Journal of Medicine. J&J scientists randomly assigned healthy adults between the ages of 18 and 55 and those 65 and older to receive a high or low dose of its vaccine — called Ad26.COV2.S — or a placebo. Some participants in the 18-to-55 age group were also selected to receive a second dose of the vaccine. (CNBC)

CORONAVIRUS: The CEO of Covid-19 vaccine maker Moderna warned Wednesday that the coronavirus that has brought world economies to a standstill and overwhelmed hospitals will be around "forever." (CNBC)

JAPAN: It's possible Japan may further extend the area covered by its emergency declaration, depending on the infection situation, Japanese Economy Minister Yasutoshi Nishimura told a parliamentary committee. His comments came a day after Prime Minister Yoshihide Suga expanded the declaration from Tokyo and the surrounding region to cover Osaka and other major economic hubs. (BBG)

BOJ: MNI POLICY: BOJ's Kuroda Still Optimistic on Economy

- Bank of Japan Governor Haruhiko Kuroda has maintained his optimistic view on the outlook for Japan's economy despite the second state of emergency, but in remarks on Thursday he said the bank would not hesitate to take further easing measures if necessary - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

BOJ: The Bank of Japan upgrades its economic assessment for three of the country's nine regions, according to its quarterly regional economic report. The bank raises its view for the Hokuriku, Shikoku and Kyushu regions. Hokkaido's assessment was cut, while the rest remained unchanged. (BBG)

AUSTRALIA: The Australian government reaffirmed confidence in its "portfolio approach" to Covid-19 vaccines as the nation prepares to inoculate its population next month. "That has been the best medical advice available to us. What we know with the AstraZeneca vaccine is that it's safe, that it's available, that it can be manufactured here, it can be transported at normal refrigeration levels," Treasurer Josh Frydenberg said Thursday. (BBG)

SOUTH KOREA: South Korea is likely to extend its current social distancing level and ban on private gatherings with five or more people, Yonhap News reported. Senior health ministry official Yoon Tae-ho told reporters he believed the immediate easing of social distancing and measures on small gatherings would be difficult. (BBG)

SOUTH KOREA: South Korea's top court upheld on Thursday a 20-year jail sentence for former President Park Geun-hye on graft charges that led to her downfall, bringing an end to the legal process and so for the first time raising the possibility of a pardon. (RTRS)

TURKEY: Turkey has granted emergency approval to the vaccine developed by Sinovac Biotech Ltd. of CHINA. (BBG)

TURKEY: Turkey's state-owned banks have slashed the gap between their foreign-currency assets and offshore liabilities in a fresh signal that the government will follow through on pledges to reverse unorthodox policies that caused lenders to take on too much risk. The shortfall has narrowed to below $1 billion, the lowest level since December 2019, according to data compiled by the industry regulator. This came as lenders stopped selling dollars and started buying small amounts of greenbacks to reduce the gap, according to four traders, who asked not to be identified because they're not authorized to speak publicly. (BBG)

MEXICO: Finance Minister Arturo Herrera says in Twitter video that Mexico is two days away from approving Russia's Sputnik vaccine for its use in the country. (BBG)

BRAZIL: Brazil's vaccination campaign will start in its capitals, executive secretary of the Health Ministry Elcio Franco told a briefing. The country's territorial extension and diversified means of transport are some of the factors hindering the arrival of vaccines to countryside municipalities in the short term, he said. (BBG)

BRAZIL: Brazil's central bank said on Wednesday that the decisions of its interest rate-setting monetary policy committee, known as 'Copom', will now always be announced after 6:30 p.m. (2130 GMT) on the second day of its two-day meetings. Up to Copom's last meeting on Dec. 8-9, Copom's decision and accompanying statement were published after 6 p.m. on the second day, which is always a Wednesday. The decision on Dec. 9 was announced after 6:30 p.m. In a statement, the central bank said the publication of the Copom minutes will remain 8 a.m. on the Tuesday of the week following the policy decision and statement. (RTRS)

BRAZIL: Brazil's central bankers are worried by mounting signs that a bill protecting their autonomy to set interest rates won't pass through congress after a new lower house speaker is elected next month, according to three people familiar with the matter. Prospects for the proposal, which economists say would eliminate the risk of political interference in the bank, don't look great under neither of the two main candidates: Arthur Lira, backed by President Jair Bolsonaro, has said he is personally against giving more freedom to the central bank; Luiz Felipe Baleia Tenuto Rossi, backed by outgoing Speaker Rodrigo Maia, could put the bill on ice in exchange for votes from left-wing parties that oppose the plan, the people said. (BBG)

OIL: The Libyan National Army will allow the restart and export of oil from fields it controls, al-Arabiya television reports, citing spokesman Ahmed al-Mismari. The army is controlled by strongman General Khalifa Haftar. (BBG)

CHINA

COORNAVIRUS: The northern Chinese province of Hebei bordering Beijing reported 81 locally-transmitted cases of Covid-19 on Wednesday, while the northeast Heilongjiang province near Russia also reported 68, the China Daily reported. However, China is not likely to experience a major resurgence in the upcoming Spring Festival holidays given quick emergency measures including regional lockdowns, although officials are advising against non-essential travel, the Daily reported citing Feng Zijian, deputy director of the Chinese Center for Disease Control and Prevention. (MNI)

CORONAVIRUS: China recorded its first Covid-19 death since April, as clusters in its north continued to swell. (BBG)

PBOC: MNI BRIEF: PBOC Should Avoid Deficit Monetisation: Official

- The People's Bank of China should avoid monetising the fiscal deficit but support fiscal policy to promote employment, industry development, consumption and environmental protection, wrote Sun Guofeng, the head of the PBOC's Monetary Policy Department - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

INVESTMENT: Manufacturing will receive a bigger share of investment in China as traditional infrastructure projects and the real estate sector face growing restrictions and as China's nominal GDP jumps in 2021, the China Securities Journal said in an editorial. China's easing approach to long-term lending and stable inbound capital will help supply the investment demand, the newspaper wrote. (MNI)

FISCAL: China's policymakers may soon Implement property taxes to meet revenue needs, former Minister of Finance Lou Jiwei said during an interview with media outlet Caixin. Lou, interpreting an October 2020 directive from the Fifth Plenum of the Chinese Communist Party, said top decision makers have called for the raising of direct taxes, and since corporate and individual tax rates have little room to increase, the only option is to implement property taxes. (MNI)

OVERNIGHT DATA

CHINA DEC TRADE BALANCE +$78.17BN; MEDIAN +$72.00BN; NOV +$75.40BN

CHINA DEC TRADE BALANCE +CNY516.81BN; MEDIAN +CNY457.80BN; NOV +CNY507.10BN

CHINA DEC EXPORTS +18.1% Y/Y; MEDIAN +15.0%; NOV +21.1%

CHINA DEC EXPORTS CNY +10.9% Y/Y; MEDIAN +7.1%; NOV +14.9%

CHINA DEC IMPORTS +6.5% Y/Y; MEDIAN +5.7%; NOV +4.5%

CHINA DEC IMPORTS CNY -0.2% Y/Y; MEDIAN +0.1%; NOV -0.8%

MNI DATA IMPACT: China 2020 Exports +3.6% Y/Y; Dec +18.1% Y/Y

- China's exports have rapidly recovered from the second half of 2020 and have registered a 3.6% y/y increase for the year after the pandemic impacted global demand and logistics and transportation. The recovery was led by growing orders in medical materials, equipment as well as textile and fabric products, according to data from General Customs released on Thursday - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

JAPAN NOV CORE MACHINE ORDERS -11.3% Y/Y; MEDIAN -15.3%; OCT +2.8%

JAPAN NOV CORE MACHINE ORDERS +1.5% M/M; MEDIAN -6.5%; OCT +17.1%

JAPAN DEC PPI -2.0% Y/Y; MEDIAN -2.2%; NOV -2.3%

JAPAN DEC PPI +0.5% M/M; MEDIAN +0.2%; NOV -0.1%

JAPAN DEC TOKYO AVG OFFICE VACANCIES 4.49; NOV 4.33

NEW ZEALAND NOV BUILDING PERMITS +1.2% M/M; OCT +8.9%

SOUTH KOREA DEC EXPORT PRICE INDEX -5.4% Y/Y; NOV -4.6%

SOUTH KOREA DEC EXPORT PRICE INDEX -0.1% M/M; NOV -0.5%

SOUTH KOREA DEC IMPORT PRICE INDEX -10.2% Y/Y; NOV -10.3%

SOUTH KOREA DEC IMPORT PRICE INDEX +1.8% M/M; MEDIAN 0.0%

SOUTH KOREA DEC BANK LENDING TO HOUSEHOLDS KRW988.8TN; NOV KRW982.2TN

UK DEC RICS HOUSE PRICE BALANCE 65%; MEDIAN 61%; NOV 66%

CHINA MARKETS

PBOC NET DRAINS CNY8BN VIA OMOS THURSDAY

The People's Bank of China (PBOC) injected CNY2 billion via 7-day reverse repos with the rate unchanged on Thursday. This resulted in a net drain of CNY8 billion given the maturity of CNY10 billion of reverse repos today, according to Wind Information.

- The operations aim to maintain the liquidity in the banking system at a reasonable and ample level, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.1258% at 09:28 am local time from 1.9200% at Wednesday's close.

- The CFETS-NEX money-market sentiment index closed at 36 on Wednesday vs 42 on Tuesday. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL ARITY AT 6.4746 THURS VS 6.465

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4746 on Thursday. This compares with the 6.4605 set on Wednesday.

MARKETS

SNAPSHOT: What Will Biden Deliver?

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 171.93 points at 28628.52

- ASX 200 up 28.699 points at 6715.3

- Shanghai Comp. down 12.638 points at 3586.014

- JGB 10-Yr future down 3 ticks at 151.87, yield down 0.9bp at 0.030%

- Aussie 10-Yr future up 1.0 tick at 98.890, yield down 0.8bp at 1.098%

- U.S. 10-Yr future -0-05 at 136-19+, yield up 2.38bp at 1.107%

- WTI crude down $0.06 at $52.85, Gold down $3.86 at $1841.65

- USD/JPY up 10 pips at Y103.99

- BIDEN AIDES TELL CONGRESS ALLIES AID PLAN MAY BE ABOUT $2TN (CNN)

- CLARIDA: NO RATE LIFTOFF UNTIL U.S. SEES 2% INFLATION FOR A YEAR (BBG)

- FED'S HARKER WANTS INFLATION OVER 2% BEFORE TAPER TALK (MNI)

- AMERICANS WON'T BE BANNED FROM INVESTING IN ALIBABA, TENCENT & BAIDU (WSJ)

- J&J COVID VACCINE IS SAFE & GENERATES PROMISING RESPONSE IN EARLY TRIAL (CNBC)

- ITALY GOVERNMENT ON VERGE OF COLLAPSE AS RENZI PARTY QUITS (BBG)

BOND SUMMARY: Talk Of A Larger Than Expected U.S. Fiscal Impulse

T-Notes traded to fresh session lows on the back of a CNN source piece suggesting that U.S. President-elect Biden could table a $2tn COVID relief package later today, which would provide a larger than expected fiscal impulse for the U.S. The contract is last -0-06 at 136-18+. Biden will present his plan on Thursday evening, with the CNN piece noting that "the Biden team is taking a "shoot for the moon" approach with this package, one lawmaker in close contact with them told CNN, though they added that the price tag could still change." The curve bear steepened on the story, with 30s now sitting 2.5bp cheaper vs. closing levels.

- JGB futures also softened on the chatter surrounding the U.S. fiscal impulse, with futures now -2 on the day, a little off lows. Yields are mixed in the cash space, with the long end experiencing some light outperformance in the main. A quick look at the latest round of 1-3 & 25+ Year BoJ Rinban ops (which saw the purchase sizes left unchanged) revealed little movement in the offer to cover ratios vs. prev.

- The Aussie curve unwound its early flattening to sit near unchanged vs. yesterday's settlement levels on the back of the previously flagged Biden stimulus plan chatter, with YM & XM both +0.5. This comes after the latter firstly consolidated and then marginally extended on overnight gains in early Sydney trade. Swaps are wider vs. cash ACGBs across most of the curve, with cash ACGBs showing some light twist steepening. Local news flow has been light.

BOJ: Rinban Sizes Unchanged

The BoJ offers to buy a total of Y480bn of JGB's from the market, sizes unchanged from previous operations:

- Y450bn worth of JGBs with 1-3 Years until maturity

- Y30bn worth of JGBs with 25+ Years until maturity

EQUITIES: Mostly Bid In Asia, But There Are Some Exceptions

Chatter of a larger than expected U.S. fiscal impulse generally provided support for equities in Asia-Pac hours, although the space was mainly higher before the headlines hit as participants looked to the positive lead from Wall St.

- NASDAQ 100 e-minis dipped on sensitivity to higher U.S. yields, while the major Chinese indices lost ground as U.S. President Trump tweaked his previous executive order to force the U.S. divestment of shareholdings of companies linked to Chinese military matters (chances of such a move were outlined via press reports in recent days). Note that the deadline for this divestment falls in November and President-elect Biden may choose to roll back the order before the deadline is reached (although, there are lots of unknowns surrounding the issue). Still, the matter outweighed a more positive WSJ report, which noted that "the U.S. government is expected to let Americans continue to invest in Chinese technology giants Alibaba Group Holding Ltd. , Tencent Holdings Ltd. and Baidu Inc."

- Nikkei 225 +1.8%, Hang Seng +0.5%, CSI 300 -1.1%, ASX 200 +0.5%.

- S&P 500 futures +9, DJIA futures +119, NASDAQ 100 futures -20.

OIL: Tight In Asia

WTI & Brent sit ~$0.10 below their respective settlement levels, adding to Wednesday's modest losses. Crude failed to benefit from talk of a larger than expected U.S. fiscal impulse during Asia-Pac hours, with the resultant uptick in the USD and a relatively muted reaction in equities doing little for the space.

- This comes after Wednesday's DoE crude inventory release revealed a sharper than expected headline drawdown, although the dip wasn't as sharp as the API equivalent.

- Wednesday also saw comments from OPEC Secretary General Barkindo as he noted that the worst is now over for the oil market, although he is still focused on stubbornly high crude stocks.

GOLD: Blip Lower On U.S. Fiscal Matters, But Little Changed For Now

An uptick in the USD and U.S. Tsy yields pressured bullion in Asia-Pac hours, with the move linked to the Biden stimulus chatter that we have flagged elsewhere. Gold has recovered from worst levels and didn't manage to threaten the recent low on the move. Spot last deals ~$5/oz softer on the day at $1,840/oz, with initial support located at the Jan 11 low of $1,817.5/oz. The U.S. fiscal impetus and its impact on U.S. real yields will likely drive bullion in the coming days.

FOREX: Greenback Gains On Fiscal Chatter

The greenback shook off its initial weakness and popped higher as a CNN piece suggested that U.S. Pres-elect Biden is set to propose a $2.0tn economic relief plan, with more details coming up later in the day. The DXY swung into positive territory, yet the U.S. dollar struggled to gain much traction against its G10 peers.

- Stimulus chatter helped generate light risk-on flows across G10 FX space, pushing the Antipodeans to the top of the G10 pile. JPY underperformed in the basket as hopes for U.S. fiscal package reduced demand for safe haven assets. The yen shrugged off uninspiring comments from BoJ Gov Kuroda.

- EUR/USD briefly ticked higher as a contact flagged demand from a macro account, but the shared currency failed to cling onto gains and faltered, with political risks in the Eurozone eyed.

- The PBOC fixed USD/CNY at CNY6.4746, weakening the yuan by 141 pips. Sell side estimates predicted a fixing some 22 pips weaker for the yuan, but it was much more in line than the 95 pip discrepancy yesterday which markets interpreted as a signal the PBOC were uncomfortable with too much strength in the yuan.

- KRW was comfortably the worst performer in Asia. USD/KRW rallied past its 50-DMA for the first time since Jun 2020 after rejecting that moving average on Tuesday.

- Today's data highlights include U.S. initial jobless claims, Swedish unemployment & German 2020 GDP. Central bank speaker slate features Fed's Powell, Kaplan, Bostic & Rosengren, ECB's de Cos & Riksbank's Ingves. The ECB will publish the minutes from its Dec MonPol meeting.

FOREX OPTIONS: Expiries for Jan14 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2150(E909mln-EUR puts), $1.2200-05(E527mln), $1.2250-70(E739mln)

- USD/JPY: Y102.00($506mln), Y103.90-104.00($694mln-USD puts), Y104.25-40($1.3bln-USD puts)

- AUD/USD: $0.7355(A$606mln)

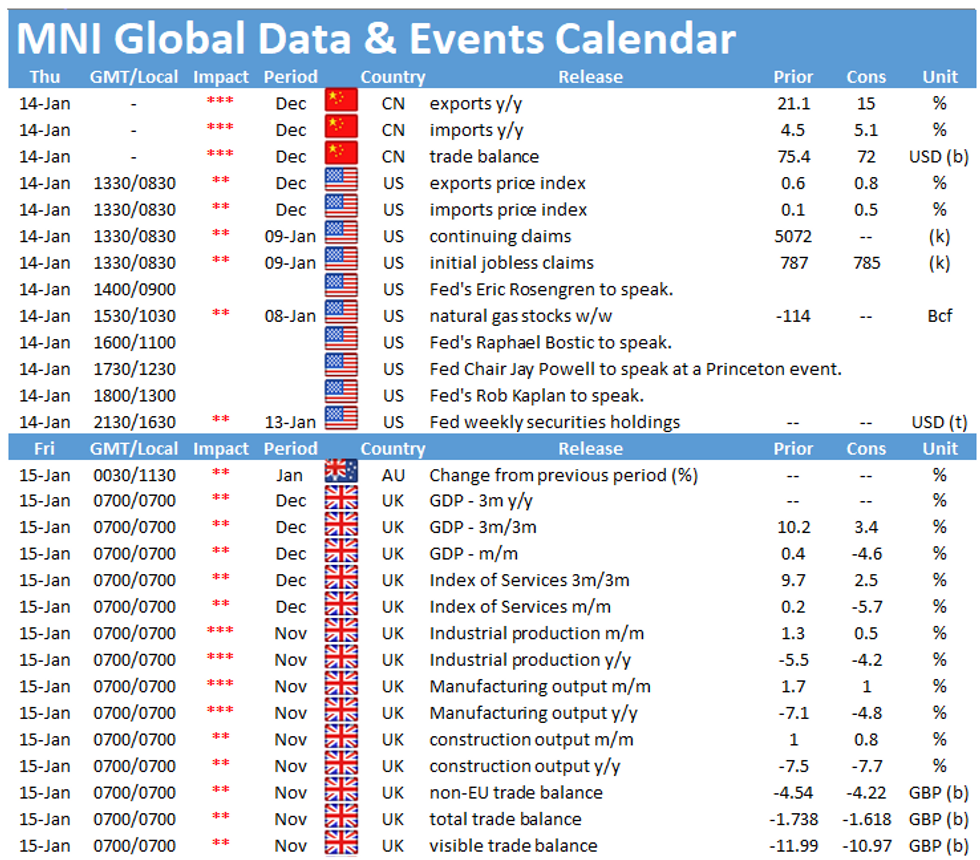

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.