-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Announces Raft Of Key Nominations

BRIEF: EU-Mercosur Deal In Final Negotiations - EC

MNI BRIEF: Limited Economic Impact Of French Crisis - EC

MNI US MARKETS ANALYSIS - Ouster of Barnier Leaves Little Dent

MNI EUROPEAN OPEN: What Will Pass?

EXECUTIVE SUMMARY

- BIDEN SEEKS $1.9 TRILLION FOR RELIEF IN FIRST ECONOMIC PLAN (BBG)

- FED'S POWELL: FED SHOULDN'T DEBATE QE EXIT TOO SOON

- FED'S POWELL: FED WANTS INFLATION ABOVE 2% 'FOR A TIME'

- ITALY'S EMBATTLED CONTE DOUBLES DOWN ON BID FOR MORE CRISIS DEBT (BBG)

- PBOC NET DRAINS LIQUIDITY FROM MARKET VIA 1-YEAR MLF

- CHINA MAY ALLOW IMPORTS OF SOME STRANDED AUSTRALIAN COAL CARGOES (BBG)

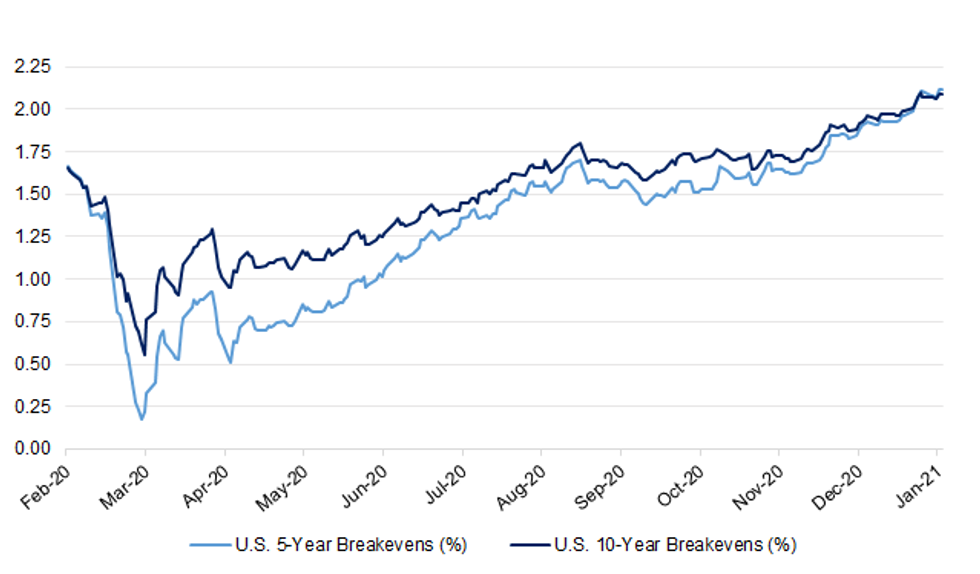

Fig. 1: U.S. 5- & 10-Year Breakevens (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Britain could have enough coronavirus vaccines to give jabs to more than 500,000 people each day next week, under plans to dramatically accelerate the UK programme that were revealed in a Scottish government document. The document suggests that Britain should have secured enough Covid-19 vaccines to inoculate most of the 15m most-vulnerable people that the government is aiming to offer the jab to by mid-February — if the NHS programme works effectively. (FT)

CORONAVIRUS: All over-50s could be vaccinated by the end of March under plans to increase the provision of coronavirus jabs. The government is preparing to more than double the pace of the programme next week with vaccines for as many as half a million people a day. Ministers believe they will have enough doses to hit Boris Johnson's target of inoculating the 15 million most vulnerable people by February 15. A senior Whitehall source told The Times they were increasingly confident that all 32 million over-50s could receive their first vaccine dose by mid to late March. (The Times)

CORONAVIRUS: Boris Johnson's plans to test millions of schoolchildren for coronavirus every week appear to be in disarray after the UK regulator refused to formally approve the daily testing of pupils in England, the Guardian has learned. The Medicines and Healthcare products Regulatory Agency (MHRA) told the government on Tuesday it had not authorised the daily use of 30-minute tests due to concerns that they give people false reassurance if they test negative. (Guardian)

CORONAVIRUS/POLITICS: A Conservative MP warned the prime minister that his leadership would be "on the table" if he did not set out a "clear plan" for the end of coronavirus restrictions, before later backing away from his perceived threat. Steve Baker, a member of the COVID Recovery Group of Tory lockdown opponents, wrote to members of the group and urged them to put pressure on the party's chief whip over the prospect of continuing COVID-19 restrictions. (Sky)

FISCAL: Chancellor of the Exchequer Rishi Sunak came under pressure from a powerful bloc of Conservative lawmakers and one of the U.K.'s biggest business groups to step up coronavirus assistance, with the U.K. mired in its third lockdown. Sunak should extend tax breaks and a temporary uplift in benefits, as well as borrow money to help fund an "infrastructure revolution," 50 Tory lawmakers in the Northern Research Group said late Thursday in a letter to the chancellor. The group warned of a series of "cliff edges" faced by families and businesses, with various support programs due to close. (BBG)

BREXIT: The government has rejected a report that following Brexit, it plans to tear up employment protections based in EU law – a strategy that Labour has called "a disgrace". Proposals include an end to the 48-hour maximum working week, changes to rules about breaks at work, and removing overtime pay when calculating certain holiday pay entitlements, the Financial Times said. Another proposal would be to get rid of the current requirement for businesses to log information about daily working hours, to save on administration costs. (Guardian)

BOE: It will take more than two years for Britain's economy to recover to its pre-COVID-19 level, a Reuters poll found, but the Bank of England was still expected to keep rates steady until at least 2024 and to avoid negative borrowing costs. (RTRS)

RATINGS: Sovereign rating reviews of note scheduled for after hours on Friday include:

- Fitch on the United Kingdom (current rating: AA-; Outlook Negative)

EUROPE

ECB: The European Central Bank won't need to boost its monetary stimulus again to pull the euro-area economy out of its current crisis, according to a Bloomberg survey. The latest pandemic lockdowns and a likely double-dip recession for the euro zone aren't enough to push officials into revamping the ultra-loose policies they set in December, economists said. That means the 1.85 trillion-euro ($2.25 trillion) emergency bond-buying program is seen coming to a halt as scheduled in March 2022. Most said the bond-buying package will be fully used -- the ECB has stated that it might not spend everything -- and none of them expected a rise in interest rates for at least another two years. (BBG)

ECB: Euro-area banks should maintain "a prudent approach" to dividends since the impact of the pandemic hasn't been fully reflected on their balance sheets and they continue to benefit from public support, European Central Bank policy maker Pablo Hernandez de Cos tells Spanish officials and investors during a speech in Madrid. (BBG)

CORONAVIRUS: The European Union may secure an extra 50 million doses of the Covid-19 vaccine produced by Moderna Inc. as the bloc seeks to accelerate inoculations, according to people familiar with the matter. The deal being arranged by the European Commission would bring to 210 million the total number of vaccine doses from Moderna for EU countries, with the additional supply costing 33% more than the 160 million doses covered by the original accord, said one of the people. (BBG)

GERMANY: Chancellor Angela Merkel wants to tighten Germany's lockdown as the country's confirmed virus cases since the start of the pandemic surged past 2 million. Merkel aims to meet with regional leaders soon to discuss additional curbs amid fears that a more contagious virus variant may cause infections to spiral out of control, a government official said. There is no consensus yet with the state premiers -- who have to agree on such measures in Germany's federal system -- about further restrictions, the person added, asking not to be identified discussing private deliberations. (BBG)

FRANCE: France will extend tighter curfew measures across the country. The 6 p.m. curfew already in place across much of eastern France will become nationwide from Saturday, Prime Minister Jean Castex said at a news conference on Thursday. It will last at least 15 days. (BBG)

FRANCE: Finance Minister Bruno Le Maire said financial support for businesses was being increased to up to 200,000 euros per month and would last as long as needed. He said the additional support would cost 4 billion euros per month. Companies which had received state-guaranteed loans would receive an additional year to pay them back, he said. (RTRS)

ITALY: Italian Prime Minister Giuseppe Conte resisted calls to resign on Thursday after a junior coalition party pulled out of his government, stripping him of a parliamentary majority in the midst of the COVID-19 pandemic. Instead, Conte signalled he wanted to take his fight for survival to parliament, with his main coalition partners backing plans to try to find so-called "responsible" lawmakers from among opposition ranks to prop up the administration. On Monday he will address the Chamber of Deputies on the crisis and what is sure to be a fiery debate will be followed by a vote of confidence that should provide an indication of whether he can battle on. (RTRS)

ITALY: Italy's embattled government is pushing for an even bigger- than-expected deficit expansion just as the euro-zone's third-biggest economy reels from a resurgent coronavirus outbreak and a deepening political crisis. The bid by Prime Minister Giuseppe Conte's team for a 32 billion-euro ($39 billion) increase in debt, agreed by the cabinet on Thursday evening, is a third larger than the amount Finance Minister Roberto Gualtieri touted in an interview last weekend. (BBG)

RATINGS: Sovereign rating reviews of note scheduled for after hours on Friday include:

- Moody's on Finland (current rating: Aa1; Outlook Stable)

- DBRS Morningstar on Slovenia (current rating: A (high), Stable Trend)

U.S.

FED: MNI BRIEF: Powell Says Fed Shouldn't Debate QE Exit Too Soon

- Federal Reserve Chairman Jerome Powell said Thursday policy makers are going to be careful about communicating to markets "well in advance" of starting to reduce the pace of its bond buys. "We know we need to be very careful about communicating about asset purchases," Powell said, adding that the "taper tantrum" experience of 2013 showed a "real sensitivity" for markets - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FED: MNI BRIEF: Powell: Fed Wants Inflation Above 2% 'For a Time'

- Federal Reserve Chair Jerome Powell on Thursday reaffirmed the central bank's commitment to a new policy framework that seeks to make up for past inflation misses. "The public will need to see us allow inflation to move moderately above 2% for a time before the new framework will be seen as fully credible," he told a webinar, adding he was encouraged by market signals so far - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FED: Federal Reserve Bank of San Francisco President Mary Dalysaid that inflation "math" might see price pressures spiking above the central bank's 2% inflation target during this year but that would not represent a problem or that it had achieved its mandate for price stability. (BBG)

FISCAL: President-elect Joe Biden will ask Congress for $1.9 trillion to fund immediate relief for the pandemic-wracked U.S. economy, a package that risks swift Republican opposition over big-ticket spending on Democratic priorities including aid to state and local governments. "We have to act and we have to act now," Biden said Thursday night in Wilmington, Delaware. He said he would lay out a second, broader economic recovery plan next month at a joint session of Congress next month. That initiative will include money for longer-term development goals such as infrastructure and climate change, the transition team said. (BBG)

FISCAL: MNI INTERVIEW: Biden May Extend UI Before Top-Up- Ex BLS Chief

- President-elect Joe Biden will have more success convincing Congress to extend jobless benefits than any push for topping up those payouts, former Bureau of Labor Statistics commissioner Katharine Abraham told MNI - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

ECONOMY: MNI REALITY CHECK: US Dec Retail Sales Growth Seen Stalling

- U.S. retail sales growth was likely stagnant in December, figures due Friday should show, as increasing virus cases and still-dampened consumer confidence muted holiday spending and mobility, industry experts told MNI - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

CORONAVIRUS: A major New York hospital system alerted its physicians that it hadn't yet been allocated Covid-19 vaccine doses for next week and can't continue its vaccination program without them. NYU Langone Health has given about 30,000 shots to date, a hospital official said. As of Thursday morning, the health system told its physicians that it hadn't gotten commitments from New York state or New York City for new supplies next week, according to an email reviewed by Bloomberg News and confirmed by the hospital. (BBG)

CORONAVIRUS: California on Thursday reported more than 500 coronavirus fatalities, among the biggest daily increases in its death toll, as the availability of intensive care unit beds statewide hit a record low. (FT)

CORONAVIRUS: Ohio is coping with a shortage in vaccines and will begin inoculating those 80 and older Jan. 19, before adding other age groups through phases. Governor Mike DeWine, who released the state's vaccination schedule on Twitter, said there are 750,000 provider locations to distribute about 100,000 vaccines. The state has given out 361,603 doses so far, DeWine said. (BBG)

CORONAVIRUS: The Biden administration's plan to release nearly every available dose of Pfizer's and Moderna's coronavirus vaccines shouldn't cause issues with people getting their second shot on time, a member of President-elect Joe Biden's Covid-19 advisory board said. "That's not something we're too worried about," Dr. Celine Gounder told the Johns Hopkins Bloomberg School of Public Health during a webcast. "If you look at the timeline for production, they are actually going to be releasing more and more doses over time, so that really does open things up significantly." (CNBC)

CORONAVIRUS: Dr. Scott Gottlieb emphasized the importance of getting as many people vaccinated as possible, and warned of a potentially dire spring and summer without protective immunity as new Covid variants appear across the globe. "If we can't get more protective immunity into the population, we could be facing a situation where we have, sort of, a perpetual infection heading into the spring and summer as these variants get a foothold here," said the former FDA chief in the Trump administration in an interview on CNBC's "The News with Shepard Smith" on Thursday evening. (CNBC)

HOUSING: The Treasury Department has decided not to restructure the taxpayers' stake in Fannie Mae and Freddie Mac , effectively ending the Trump administration's push to ensure that the mortgage giants are eventually returned to private hands. The announcement by the Treasury Department and the companies' federal regulator leaves it to the incoming Biden administration to decide the future of the firms, which were put under government control during the 2008-09 financial crisis through a process known as conservatorship. (WSJ)

OTHER

GLOBAL TRADE: The U.S. Commerce Department on Thursday issued interim rules aimed at the securing the nation's communication and technology supply chain that would prohibit certain transactions with Russia, China, Iran, Venezuela, North Korea and Cuba. The rule will become effective in 60 days, it said in a statement. (RTRS)

GLOBAL TRADE: President Donald Trump on Thursday issued a proclamation to extend measures meant to safeguard U.S. producers of large residential washers from import competition. The proclamation extends tariff-rate quotas on the washers and some washer parts that were first applied in January 2018. (RTRS)

U.S./CHINA: The Trump administration on Thursday added nine Chinese firms to a blacklist of alleged Chinese military companies, including planemaker Comac and mobile phone maker Xiaomi, according to a document seen by Reuters. The companies will be subject to a new U.S. investment ban which forces American investors to divest their holdings of the blacklisted firms by Nov. 11, 2021. (RTRS)

U.S./CHINA: The Trump administration is unlikely to add more companies to its blacklist of alleged Chinese military companies in its final days in office after Thursday's designation of nine firms by the Department of Defense, a senior official at the State Department said. Speaking in a briefing with reporters, Keith Krach, Undersecretary for Economic Growth, Energy and Environment also said Chinese tech giants Alibaba, Tencent and Baidu are "highly strategic" to the Chinese military. On Wednesday, sources said the Trump administration scrapped plans to blacklist Alibaba, Tencent and Baidu. (RTRS)

U.S./CHINA: Treasury Department issues general license authorizing U.S. exchanges to engage in transactions involving securities of China military cos. Transactions allowed from midnight Jan. 14 for a year after the entity was added to Treasury's Chinese military cos. List. (BBG)

CORONAVIRUS: The global death toll from Covid-19 could reach somewhere from 2.2 million to 5.1 million by the beginning of March while cases can rise to 110 to 170 million by that time, according to a study by researchers from the Chinese Center for Disease Control and Prevention, and other research institutes and those affiliated with the Chinese military. (BBG)

CORONAVIRUS: Moderna plans to test a booster shot of its Covid-19 vaccine a year after the initial two-dose immunization as the duration of protection from the brand new vaccines is still unclear. (CNBC)

JAPAN: Yields on Japan's government debt have stayed low despite a lot of new debt issuance, thanks to help from the country's central bank and its citizens, finance minister Taro Aso tells reporters Friday in Tokyo. (BBG)

BOJ: The Bank of Japan's upcoming policy assessment is likely to signal a pause in the bank's buying of exchange-traded funds as long as stocks stay buoyant, according to a key author of the BOJ's ramped up asset-purchase plan to fight the pandemic. "The BOJ is likely to make a more comprehensive judgment on the amount and frequency of its purchases that considers the level and trend of the stock market," said former BOJ executive director Eiji Maeda, who led the central bank's crisis response before stepping down in May. (BBG)

AUSTRALIA/CHINA: China is considering accepting some stranded Australian coal cargoes, an effort that would help ease a logjam of vessels that have stacked up off its coast for months. The shipments that could be cleared are those that arrived before a ban on Australian coal went into effect, said a person familiar with the situation, who asked not to be identified as the discussions are private. The deliberations are at an initial stage and any decision would need the approval of more senior Chinese leaders, the person said. The broader prohibition on Australian coal remains in place, and ideally the cargoes would be resold to buyers in other countries, the person said. China's customs administration didn't immediately respond to a fax seeking comment. (BBG)

AUSTRALIA/CHINA: The China-U.S. relationship may improve under a new U.S. president, giving Canberra a chance to repair the relationship with China, the China Daily said in an editorial. Canberra followed the outgoing US administration's lead to be tough on China and this had ruined the past China-Australia economic cooperation which was characterized by mutual benefits, the newspaper said. A recent decision to block the Chinese acquisition of an Australian construction company for national security reasons only worsened the soured relationship, the editorial said. (MNI)

RBNZ: The Governor of the Reserve Bank of New Zealand, Adrian Orr, says the recent malicious and illegal breach of a file sharing application used by the Bank is significant, and has our full attention. Mr Orr says New Zealand's financial system and institutions remain sound, and Te Pūtea Matua is open for business. The standalone File Transfer Application system that was breached has been secured and closed. "We apologise unreservedly to all of those impacted by the breach. Personally, I own this issue and I am disappointed and sorry," Mr Orr says. (RBNZ)

BOK: MNI REVIEW: BOK Keeps Rate Unch at 0.5%; Will Act For Economy

- The Bank of Korea kept monetary policy settings unchanged on Friday, maintaining the Base Rate at the historic low of 0.5% but indicating that the bank was prepared to act to support the economy and stabilize the inflation rate if required. The decision had been widely expected, as seen in MNI's preview published Wednesday. The next policy meeting is scheduled on February 25 - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

SOUTH KOREA: South Korea will put priority on increasing housing supply by lowering construction regulations in the densely populated urban area and supporting redevelopment projects to stabilize the housing market, the finance minister said Friday. Finance Minister Hong Nam-ki said housing stability is one of the government's most pressing tasks, vowing to make use of all available policy measures to rein in the heated market. "The government will put priority on supplying new housing units this year," Hong said at a pan-governmental meeting on the real estate market. (Yonhap)

NORTH KOREA: North Korea confirmed it held military parade at Kim Il Sung Square on Thursday; Kim Jong Un attended. North Korea said that during military parade it showed submarine- launch ballistic missiles and rockets possessing "powerful striking capability for thoroughly annihilating enemies in a preemptive way outside the territory". (BBG)

MEXICO: Lawmakers in the Senate and Lower House still need to set up a schedule to start "technical" discussions about a bill that would make the Mexican central bank a dollar buyer of last resort for local financial institutions, a top ruling party senator said on Thursday. (BBG)

MEXICO: Covid contagion and deaths continue to rise, setting up Mexico for "chilling" numbers in 1Q, central bank deputy governor Jonathan Heath says in tweet. Tighter lockdown will mean higher unemployment and more economic damage. Mexico needs "balanced" measures to face pandemic. (BBG)

BRAZIL: Brazilian biomedical center Fiocruz has put back filing its request to register the COVID-19 vaccine developed by AstraZeneca PLC until next week, its vice president Marco Krieger said. Fiocruz had originally planned to file the request on Friday, but Krieger said it was best to wait for the emergency authorization request it expects health regulator Anvisa to grant on Sunday. (RTRS)

RUSSIA: Russia to review open skies treaty participation. (Kommersant)

RUSSIA/RATINGS: Sovereign rating reviews of note scheduled for after hours on Friday include:

- S&P on Russia (current rating: BBB-; Outlook Stable)

ARGENTINA: "There is nothing more regressive for Argentina than a devaluation," Economy Minister Martin Guzman said in a speech to university students in Entre Rios province. Government must move toward fiscal balance, Guzman said. (BBG)

OIL: The U.S. Energy Department plans to sell crude from the Strategic Petroleum Reserve over a multi-month period in FY21, with deliveries expected to start in May, or as early as April, depending on market conditions. Sale of slightly more than 10m bbls during FY21 is required by law. As many as 10m bbls of additional sales are allowed to raise as much as $450m for infrastructure modernization at the SPR. DOE welcomes industry input on FY21 sales and plans to assess appropriate timing and amount of 2021 sales in early March. (BBG)

OIL: Iraqi oil minister Ihsan Abdul Jabbar told state TV in an interview on Thursday that Saudi Arabia's voluntary output cut of 1 million bpd helps stabilize the market, and he expected steady oil prices that should reach around $57 per barrel in the first quarter. Oil minister said Iraq is in "heavy talks" with OPEC and allied oil producers to allow Iraq to postpone compensating for earlier overproduction. "OPEC members and allies were understanding to Iraq's situation and its financial crisis," oil minister said in an interview with state TV. Abdul Jabbar said requesting delaying compensation of overproduction doesn't not mean Iraq would evade complying with its commitment to OPEC+ cut deal and will abide by cutting its production to preserve market stability. Non-commitment of Iraqi Kurdistan to its share of the production cut is the main reason of reaching a recent low compliance of 79% of pledged cuts under the OPEC+ deal, said Ihsan Abdul Jabbar. (RTRS)

CHINA

CORONAVIRUS: China reported 135 new locally transmitted symptomatic Covid-19 infections on Friday, as strict lockdowns and sweeping testing struggle to stem the country's worst outbreak in months. A new wave of infections centred in Shijiazhuang, the capital of northwest Hebei province about three hours drive south of Beijing, has now infected more than 1,000 people and resulted in the first death in over eight months. (FT)

ECONOMY: China's GDP growth in 2020 Q4 may have accelerated past 6.2% from 4.9% in Q3 as strong exports aided the economic recovery and increased domestic demand, the Economic Information Daily reported citing Hua Changchun, chief economist from Guotai Junan Securities. Annual fixed asset investment is expected to have expanded 3.2% supported by real estate as well as manufacturing, which benefited from policy support and improving profitability, the newspaper reported citing Li Chao, chief economist of Zheshang Securities. (MNI)

FINTECH: Investors including BlackRock, GIC and Silver Lake have been left holding illiquid stakes in Ant Group after pouring billions of dollars into the Chinese payments company before its $37bn initial public offering was scuttled. People directly familiar with the matter said the sovereign wealth funds, private equity and asset managers had been left in limbo after investing $10.3bn into Ant International, a subsidiary of the group owned by Jack Ma, in a highly selective, offshore pre-IPO fundraising round in 2018. But since the blockbuster offering was halted at the last minute by Beijing in November, the people said, these investors had not been given any clarity on when the IPO may be revived, or what its valuation and business would look like after a restructuring that has been demanded by Chinese regulators. (FT)

OVERNIGHT DATA

CHINA DEC NEW HOME PRICES +0.12% M/M; NOV +0.12%

JAPAN NOV TERTIARY INDUSTRY INDEX -0.7% M/M; MEDIAN +0.3%; OCT +1.6%

AUSTRALIA NOV HOME LOANS VALUE +5.6% M/M; MEDIAN +1.2%; OCT +0.7%

AUSTRALIA NOV OWNER-OCCUPIER LOAN VALUE +5.5% M/M; OCT +0.8%

AUSTRALIA NOV INVESTOR LOAN VALUE +6.0% M/M; OCT +0.3%

NEW ZEALAND DEC REINZ HOUSE SALES +36.6% Y/Y; NOV +29.6%

NEW ZEALAND DEC FOOD PRICE INDEX +0.1% M/M; NOV -0.9%

CHINA MARKETS

PBOC NET INJECTS CNY197BN VIA MLF AND REPOS FRIDAY

The People's Bank of China (PBOC) injected CNY500 billion via one-year medium-term lending facility (MLF) with the rate unchanged at 2.95% on Tuesday. This aims to roll over the CNY300 billion of MLFs maturing today and CNY240.5 billion of Targeted Medium-term Lending Facilities (TMLF) maturing later this month, the PBOC said on its website. The PBOC also injected CNY2 billion via 7-day reverse repos. In total, the central bank net injected CNY197 billion as CNY5 billion repos mature today.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.1781% at 09:30 local time from the close of 1.9488% on Thursday: Wind Information.

- The CFETS-NEX money-market sentiment index stayed flat at 36 on Thursday when the market closed. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.4633 FRI VS 6.4746

People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4633 on Friday. This compares with the 6.4746 set on Thursday.

MARKETS

SNAPSHOT: What Will Pass?

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 142.99 points at 28555.27

- ASX 200 up 0.048 points at 6715.4

- Shanghai Comp. down 25.598 points at 3540.307

- JGB 10-Yr future up 3 ticks at 151.87, yield down 1.0bp at 0.031%

- Aussie 10-Yr future up 1.5 ticks at 98.905, yield down 1.4bp at 1.083%

- U.S. 10-Yr future +0-06+ at 136-24+, yield down 3.07bp at 1.099%

- WTI crude down $0.17 at $53.4, Gold up $5.45 at $1851.98

- USD/JPY unch. at Y103.80

- BIDEN SEEKS $1.9 TRILLION FOR RELIEF IN FIRST ECONOMIC PLAN (BBG)

- FED'S POWELL: FED SHOULDN'T DEBATE QE EXIT TOO SOON

- FED'S POWELL: FED WANTS INFLATION ABOVE 2% 'FOR A TIME'

- ITALY'S EMBATTLED CONTE DOUBLES DOWN ON BID FOR MORE CRISIS DEBT (BBG)

- PBOC NET DRAINS LIQUIDITY FROM MARKET VIA 1-YEAR MLF

- CHINA MAY ALLOW IMPORTS OF SOME STRANDED AUSTRALIAN COAL CARGOES (BBG)

BOND SUMMARY: Better Bid On Questions Re: The Passage Of Biden's Support Plan

U.S. Tsys have rallied during Asia-Pac hours with the move extending further in the wake of U.S. President elect Biden's address re: his COVID support plan (which was initially outlined in the NY-Asia crossover). There was nothing in the way of surprises within the plan given the countless source reports released on Thursday, perhaps allowing the extension of the early sell the rumour buy the fact theme in the space after Biden's address came to an end. Now questions surrounding the prospect of the support package's passage through the Senate are at the fore i.e. will members of the more moderate Democratic wing support the scheme, if not it may be watered down. T-Notes last +0-06 at 136-24, a touch back from best levels of the day and still within the confines of yesterday's range, while cash trade sees bull flattening, with 30s sitting a little over 3.0bp richer vs. the close. Flow was also supportive. With a 10.0k block buyer of the TYH1 137.50 and 138.00 calls, which appeared to be new bullish positions for the timezone, and smaller block buying of FVH1 futures.

- JGB futures stuck to a narrow range, with early afternoon trade seeing the strong cover at the 5-15.5 Year JGB liquidity enhancement auction provide support, although there was only a brief breach of the overnight/Tokyo morning highs, with futures now back from best levels of the day, last +4.

- Aussie bonds drew support from the impetus in Tsys, with the AOFM's issuance update also providing some support. The typical weekly bond issuance notional guidance was lowered owing to the well ahead of task run rate (which was expected), while no imminent ACGB Nov '32 syndication and confirmation that particular line will represent the only new launch during the remainder of the current FY also provided support. YM +1.0, XM +1.5. Pricing of corporate deals provided nothing in the way on tangible pressure for the space.

JGBS AUCTION: Japanese MOF sells Y5.4468tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y5.4468tn 3-Month Bills:- Average Yield -0.0926% (prev. -0.0883%)

- Average Price 100.0231 (prev. 100.0218)

- High Yield: -0.0902% (prev. -0.0851%)

- Low Price 100.0225 (prev. 100.0210)

- % Allotted At High Yield: 78.9288% (prev. 53.1682%)

- Bid/Cover: 3.358x (prev. 3.106x)

JGBS AUCTION: Japanese MOF sells Y497.6bn of 5-15.5 Year JGBs in liquidity enhancement auction:

The Japanese Ministry of Finance (MOF) sells Y497.6bn of 5-15.5 Year JGBs in a liquidity enhancement auction:- Average Spread: -0.008% (prev. -0.008%)

- High Spread: -0.008% (prev. -0.007%)

- % Allotted At High Spread: 57.7176% (prev. 64.4760%)

- Bid/Cover: 4.597x (prev. 3.931x)

JAPAN: Domestic Money Markets Dominate Weekly International Security Flow Data

There was little in the way of sizeable headline net flows witnessed in the latest round of Japanese weekly international security flow data, although Japanese investors flipped to net buying of foreign bonds after logging 2 consecutive weeks of net sales.

- Looking under the hood of the data revealed that Japanese short-term debt instruments saw the largest round of weekly foreign inflows on record (Y8.0677tn) although this came after the largest ever round of weekly sales 2 weeks prior (Y4.9210tn). The inflows seen in the most recent week were likely aided by foreign participants (namely in the U.S.) exploiting FX-hedged yield pickups available in that particular space (which are attractive when compared to comparable assets' yield levels on offer domestically in the U.S.).

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 730.7 | -291.6 | 679.8 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | 282.9 | 159.9 | -413.1 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | -245.0 | 61.6 | -3069.3 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 580.8 | -85.5 | 28.0 |

Source: MNI - Market News/Japanese Ministry Of Finance

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance schedule:

- On Wednesday 20 January it plans to sell A$1.8bn of the 1.50% 21 June 2031 Bond.

- On Thursday 21 January it plans to sell A$750mn of the 21 May 2021 Note & A$750mn of the 23 July 2021 Note.

- On Friday 22 January it plans to sell A$700mn of the 3.25% 21 April 2025 Bond.

AUSSIE BONDS: AOFM: 2020-21 Issuance Program Update

The AOFM notes the following:- This notice provides updated details of planned issuance of Australian Government Securities by the Australian Office of Financial Management (AOFM) for the remainder of 2020-21.

- As previously advised, Treasury Bond issuance for 2020-21 is expected to be around A$230 billion, of which A$153.5 billion has been completed. Issuance via tender will be at a rate of $2-3 billion in most weeks. A new Treasury Bond line maturing in November 2032 will be launched by syndication. The AOFM does not plan to introduce any further additional Treasury Bond lines (including third calendar year maturities) during 2020-21. As previously advised, the AOFM will not resume Treasury Bond buyback tenders in 2020-21.

- Treasury Indexed Bond issuance of A$2-2.5 billion is expected for 2020-21, of which A$1.25 billion has already been undertaken. Two tenders of A$100-200 million each will be held in most months.

- The AOFM will continue regular issuance of Treasury Notes. Weekly tender volumes will vary according to the AOFM's cash management requirements.

EQUITIES: Most Of The Major Metrics Edge Lower In Asia

E-minis and the major Asia-Pac equity indices trade little changed to a touch lower in the main overnight, with little in the way of notable headline flow to ponder, leaving most to digest U.S.-President elect Biden's COVID support plan (which provided no surprises) and continued Sino-U.S. sabre rattling in the final days of Donald Trump's Presidential term.

- Participants now question how palatable the support plan will be within U.S. Congress and the potential for watering down of the plan.

- Elsewhere, the latest 1-Year liquidity injection from the PBoC came in at the lower end of expectations, resulting in a net drain of liquidity, which may have added some light pressure.

- Nikkei 225 -0.4%, Hang Seng unch., CSI 300 -1.0, ASX 200 +0.2%.

- S&P 500 futures -11, DJIA futures -118, NASDAQ 100 futures -14.

OIL: Marginally Lower In Asia

WTI & Brent sit $0.10-0.20 below their respective settlement levels at typing, giving back a little of yesterday's modest gains as e-minis tick lower in the wake of the release of U.S. President-elect Biden's COVID support plan (perhaps a bit of buy the rumour sell the fact crept in).

- There has been little in the way of meaningful crude-specific headline flow over the last day or so, with the latest OPEC monthly oil report (which covered the month of December) a little outdated given the moves made by OPEC+ in early January.

- Elsewhere, the Iraqi oil minister noted that the country is in "heavy talks" with OPEC+ re: postponing adherence to the compensation scheme for overproduction vs. the quota prescribed in the group's pact. He noted that "OPEC members and allies were understanding to Iraq's situation and its financial crisis," and that the compliance issues stemmed from the non-commitment of the country's Kurdish region.

GOLD: Steady Overnight

Gold has steadied since yesterday's Asia-Pac blip lower and subsequent recovery, with U.S. real yields softer over that horizon, while the DXY is holding at fairly stable levels, a little off of cycle lows. That leaves bullion's technical picture unchanged vs. yesterday, with spot gold last dealing around the $1850/oz mark, $5/oz or so higher on the day.

FOREX: Risk Appetite Wanes After Biden's Fiscal Address

Light risk-off feel crept in as U.S. President-elect Biden unveiled his $1.9tn economic relief plan, with concerns surfacing over potential resistance from GOP lawmakers against generous spending. Simmering Sino-U.S. tensions surrounding the White House's actions vs. Chinese tech companies helped undermine sentiment. Safe haven demand lent support to USD & JPY, while USD/JPY held a tight range wavering around neutral levels, despite today being a Gotobi day.

- Antipodean currencies helped bring up the rear in G10 FX space, alongside the NOK. AUD/USD and NZD/USD still sit a handful of pips lower apiece, albeit the prior day's lows remain intact.

- The PBOC fixed USD/CNY at CNY6.4633, around 113pips lower than yesterday as greenback weakness translates into redback strength – the fix was broadly in-line with sell side estimates. USD/CNH was rangebound through the session.

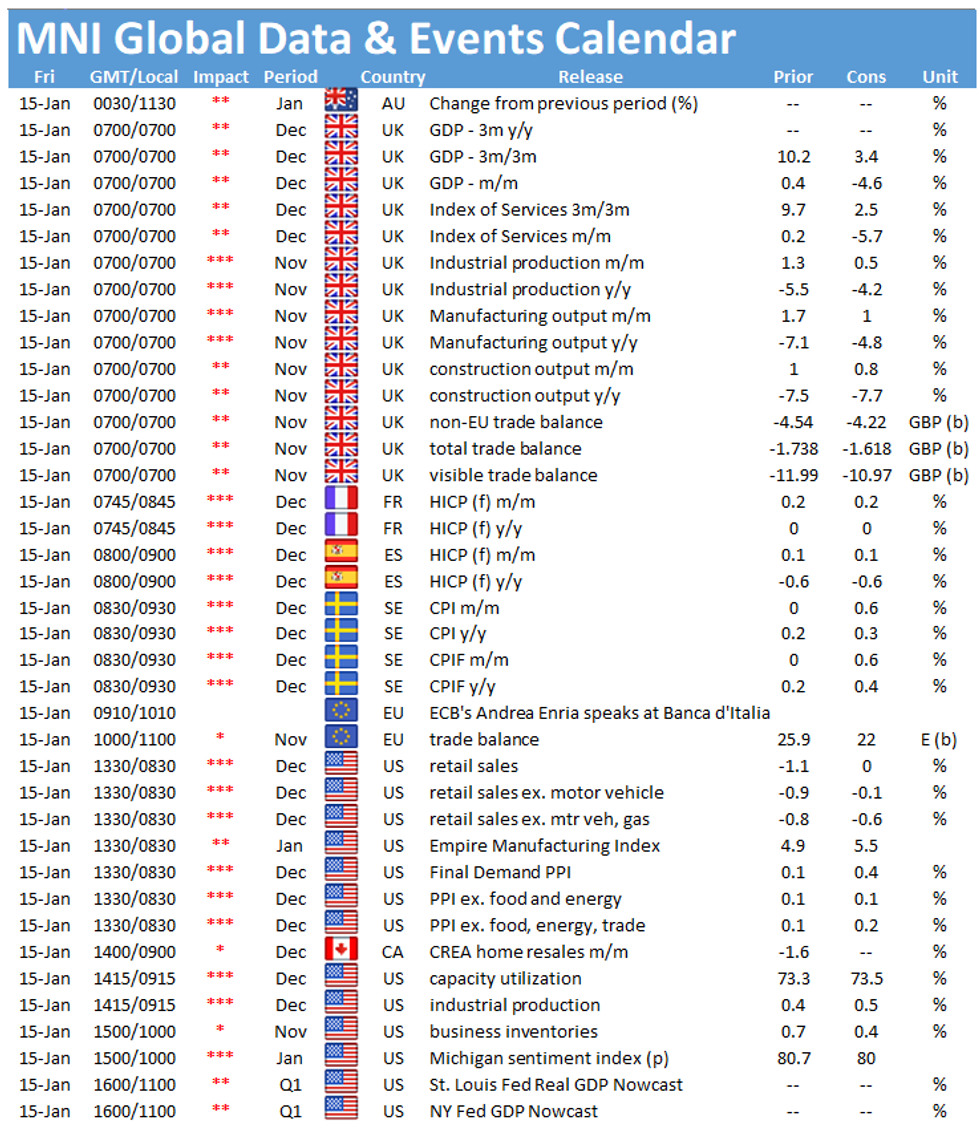

- As we are nearing the end of the week, focus turns to U.S. advance retail sales, Empire M'fing & flash U. of Mich. Setiment, UK economic activity indicators, French & Swedish CPI reports, comments from Fed's Kashkari & ECB's Visco and a panel discussion with ECB's Stournaras, Herodotou, Makhlouf & Vasiliauskas.

FOREX OPTIONS: Expiries for Jan15 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2000(E750mln), $1.2100(E777mln), $1.2135-50(E1.4bln), $1.2175-90(E1.1bln), $1.2195-1.2200(E670mln)

- USD/JPY: Y101.00($610mln), Y103.00-10($694mln), Y103.50-60($1.2bln), Y104.00($1.0bln), Y104.80-00($1.5bln)

- GBP/USD: $1.3400(Gbp677mln), $1.3585-1.3600(Gbp572mln), $1.3700(Gbp453mln)

- EUR/GBP: Gbp0.8650(E1.5bln), Gbp0.8845-60(E2.7bln), Gbp0.8900(E750mln)

- AUD/USD: $0.7695-00(A$705mln)

- USD/MXN: Mxn19.50($1.2bln)

ASIA FX: Inside Day For Most USD/Asia Crosses

The greenback started the Asia session on the back foot but recovered heading into the press conference from US President Elect Biden as he outlined the latest stimulus package and said he would plan another once in office.

- Spot USD/KRW is flat, last changing hands at 1098.20. The BoK kept rates on hold at 0.50% as expected. BoK Gov. Lee said the decision was unanimous and the bank would keep easing stance until stable recovery expected, and noted the bank was cognizant of risks to financial stability.

- USD/IDR re-opened lower today, before trimming losses slightly, and last sits -27 pips at IDR14,030. There was limited reaction to relatively strong exports data so far, with the figure rising 14.63% Y/Y vs. exp. of a deceleration in growth to +6.20% from +9.54%.

- Spot USD/THB trade at THB29.98, just 1 pip shy of neutral levels, as it continues to waver within a narrowing range around the THB30.00 figure. Little in the way of local catalysts to inspire larger price swings.

- Spot USD/PHP remains trapped within a tight range just above PHP48.00, last sitting -2 pips at PHP48.04. Health officials said that the Philippines will tighten Covid restrictions including stricter border controls after a new, more infections variant of coronavirus was detected in the country.

- USD/MYR resumed losses as onshore ringgit trade re-opened today. The pair has shed 13 pips last sits at MYR4.0340. Continued sell-off has allowed the rate to swing into a loss on a weekly basis. Political tensions flare in the country as the decision to declare an emergency over the pandemic draws criticism.

- USD/TWD has ground higher through the session on Friday, the move supported by some resilience in the US dollar. The move higher has spiked volatility in TWD which had fallen amid conjecture that the central bank was attempting to guide the currency. USD/TWD last at 27.981.

- USD/SGD has gradually ground higher through the session. Not much to report domestically, price action dictated by the greenback. The pair last up 2 pips at 1.3257

- The PBOC fixed USD/CNY at 6.4633, around 113pips lower than yesterday as greenback weakness translated into redback strength – the fix was broadly in-line with sell side estimates. USD/CNH saw rangebound trade, last up 25 pips at 6.4668, dragged higher by USD.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.