-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Risk Bid In Asia

EXECUTIVE SUMMARY

- YELLEN TO HIGHLIGHT U.S. ECONOMY'S INEQUALITY IN SENATE REMARKS (BBG)

- ITALY'S CONTE FACES SENATE SHOWDOWN AFTER WIN IN LOWER HOUSE (BBG)

- ITALY'S CONTE DETERMINED TO HOLD ON TO POWER AFTER SENATE VOTE (BBG)

- NDRC: NO SHARP TURN IN CHINA'S MACRO POLICIES THIS YEAR (BBG)

- SASAC: CHINA TO FOCUS ON STABILIZING LEVERAGE AT SOES (BBG)

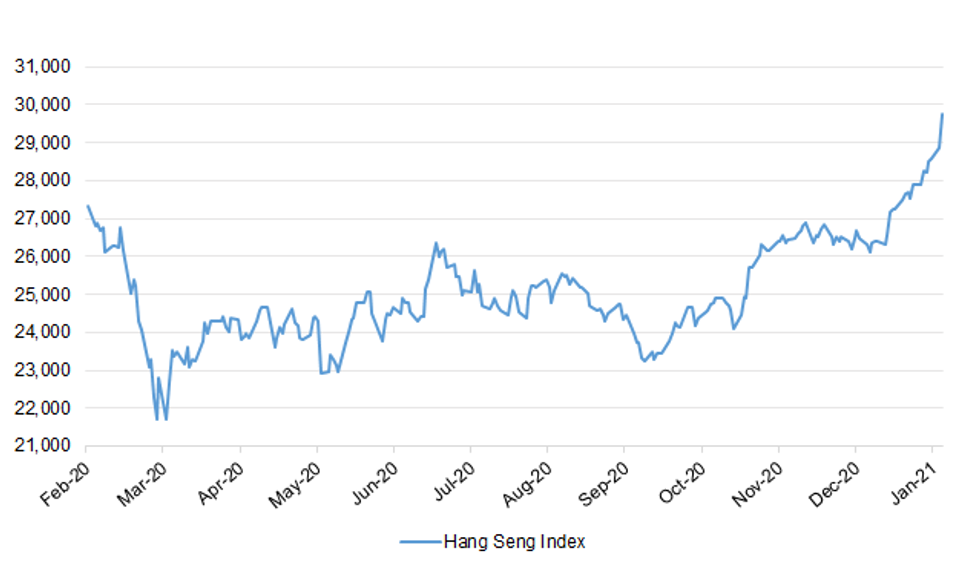

- RISK SUPPORTED PRE-YELLEN, HANG SENG SURGES ON TECHNICAL BREAK & INFLOWS FROM CHINA

Fig. 1: Hang Seng Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Coronavirus jabs will be diverted to areas falling behind on vaccinating the over-80s amid concerns about regional disparities in the programme. Matt Hancock, the health secretary, said that stocks would be prioritised for areas with a large number of unprotected over-80s, despite a promise yesterday to let GPs begin vaccinating younger patients. More than four million people across Britain have received a first dose of the vaccine after 1.8 million were reached in the seven days to Sunday. (The Times)

CORONAVIRUS: A reporter with The Times tweeted the following on Monday: "Will Easter be the new Xmas, albeit a thin one? This is the PM's new hope, I'm told. He has privately shared an aspiration to see restrictions begin to ease by Good Friday (April 2), to allow families some small contact again. But there is tension with Chris Whitty though. It is weeks away yet, but ministers have begun to put together a plan for the unlock. The CMO is adamant any end to the lockdown must be 1. conditions dependent (deaths down, pressure off the NHS etc), and 2. very careful and in slow degrees with pauses to test them. That means no dates stated, and no promise of Easter offered. This tension emerged briefly during last Friday's press conference when Whitty and Johnson clashed briefly in public over the definition of 'Spring' - is it pre or post Easter. Whitty is backed by Matt Hancock and other Cabinet 'doves'. One source close to the PM said Whitty "is being a bit wet" as tens millions of vaccinations will have cut the fatality risk a lot by then (aides insist this is not the PM's view and he has deep respect for the CMO). Others in Government say there is a grim dawning realisation emerging that heavy restrictions - Tier 4 and 3 - are likely to have to remain in place in the big cities through April and even into May because current cases are so high and will take many weeks to decrease. That's with or without the success of the vaccination programme, whose early huge success has even stunned No10. Senior Cabinet ministers' biggest worry now is another mutant variant that requires a new vaccine for everyone afresh." (MNI)

BREXIT: Freight firms are refusing to carry goods from France to the U.K. almost as often as during the pre-Christmas Dover crisis, high-frequency data show, illustrating additional costs from Brexit. The rejection rate for cross-Channel cargo rose again last week to 168% of the third-quarter average. It had peaked for 2020 near the end of the year -- when France shut its borders to U.K. hauliers for 48 hours to contain a new coronavirus strain -- before falling over the holiday period. (BBG)

BREXIT: Cargo moving through Dublin port fell by about 50% after the U.K.'s exit from the European Union, in part because truckers are sidestepping the U.K. to reach mainland Europe. (BBG)

BREXIT: Businesses experiencing problems exporting to the EU "through no fault of their own" will receive compensation, the prime minister has said. Boris Johnson said he "understands the frustrations" of businesses exporting to the continent who have run into issues since new post-Brexit UK-EU trading rules came into effect. (Sky)

FISCAL: The government is under mounting pressure from business leaders to provide more support to the economy before the budget in early March. The CBI has written to Rishi Sunak, the chancellor, calling for the furlough scheme, the business rates holiday and the deferral of VAT to be extended until at least the summer. Tony Danker, director-general of the lobby group, said that business resilience was at a "sobering new low" and added that staff morale had taken a hit from the latest lockdown restrictions. (The Times)

FISCAL: The U.K. may not have to raise taxes to repair the Coronavirus-battered public finances if the economy stages a strong rebound, a Treasury minister suggested on Monday. An optimistic scenario set out by the Office for Budget Responsibility in November shows gross domestic product returning to the growth path projected before the pandemic struck, Financial Secretary to the Treasury Jesse Norman told the House of Commons Treasury Committee. "It's not absolutely obvious therefore that there may be any future need for consolidation, depending on the view you take for taxes," he said. (BBG)

FISCAL: MPs have urged Boris Johnson to extend benefit increases worth £20 a week. A non-binding Labour motion calling for the universal credit top-up to be kept in place beyond 31 March passed by 278 votes to none after a Commons debate. Six Tory MPs defied party orders to abstain and voted with Labour, adding to the pressure on the PM on the issue. (BBC)

FISCAL: Boris Johnson signalled yesterday that the government could extend emergency universal credit payments beyond March as he pledged to "look after people throughout the pandemic". Amid growing evidence of a government climbdown the prime minister said he would "make sure people don't suffer" as lockdown restrictions continued. (The Times)

ECONOMY: The UK has an opportunity to reform regulation that is derived from EU law, but won't deliberately antagonise its biggest trading partner immediately after the Brexit deal. That was one of the key messages sent to around 30 business leaders in a meeting led by the Prime Minister, the Chancellor and the Secretaries of State of Business and International Trade. One business leader told the BBC that the government, "in the absence of enormous government spending power, given the state of the public finances, should look at whether deregulation could do some of the post-Brexit, post-Covid heavy lifting to stimulate business". (BBC)

ECONOMY: Boris Johnson has told business leaders that efficient delivery of the coronavirus vaccine is Britain's best economic recovery tool as he promised a sustainable fightback from the worst recession in 300 years. The prime minister chaired the first meeting of a new business council designed to coordinate the government's economic response to Covid-19 with leaders from the country's biggest companies. (guardian)

ECONOMY: Chancellor of the Exchequer Rishi Sunak promised business chiefs he will invest in major building projects, skills and innovation to drive the U.K. economy out of the pandemic crisis. In a call with executives of 30 firms on Monday, the finance minister said the three priorities are at the heart of the government's plan to return the economy to growth. (BBG)

EUROPE

FISCAL: Euro zone finance ministers pledged continued fiscal support for their economies on Monday and discussed the design of post-pandemic recovery plans as the European Commission warned the COVID crisis was making the bloc's economic imbalances worse. (RTRS)

GERMANY: The newly-elected chief of Chancellor Angela Merkel's party was given a rude welcome by the leading contender to form a government after September elections. Robert Habeck, head of Germany's Green Party, criticized Armin Laschet as lacking vision and vowed to fight the Christian Democrats for voters before considering any chances of a coalition. The comments indicate a tough campaign as Germany prepares for a political reshuffle after 16 years under Merkel. "Laschet is someone who puts brakes on political concepts," Habeck said Monday during an online news conference. "The question is whether you can govern with brakes on." (BBG)

FRANCE: France remains open to foreign investment after Canada's Alimentation Couche-Tard's possible takeover of France's Carrefour unravelled after running into opposition from the government, French Finance Minister Bruno Le Maire said on Monday. "Our economic policy remains open to foreign investments... The political meaning of this economic decision (to oppose a possible takeover) was that I believe in food sovereignty," Le Maire told RTL Radio. (RTRS)

ITALY: Giuseppe Conte's ambition to continue as Italy's prime minister faces a crucial test Tuesday with a confidence vote in the Senate, after he won a similar vote in the lower house of parliament late Monday. A narrow win in the Senate would allow the premier to stay in power, even if his support fell short of an outright majority. A defeat would force him to offer his resignation to President Sergio Mattarella. Conte secured a comfortable majority in a confidence vote in the lower house Monday evening, securing votes of support from 321 of the 629 lawmakers. (BBG)

ITALY: Prime Minister Giuseppe Conte aims to maintain his grip on power in Italy even if he falls short of an outright majority in a crucial Senate vote on Tuesday, according to people familiar with his thinking. (BBG)

SPAIN: Spain has reported some of the highest coronavirus infection rates since the beginning of the pandemic, as the country continues to resist calls for a new lockdown. In figures released on Monday, the country reported an infection rate more than three times higher than a month before, at 689 cases per 100,000 over the previous 14 days. As of Friday, the equivalent figure was 575 cases; on December 18, it was 214. (FT)

PORTUGAL: The Portuguese government reintroduced travel restrictions between municipalities on weekends. Most stores that are still allowed to stay open will have to close by 8 p.m. on weekdays and 1 p.m. on weekends, Prime Minister Antonio Costa said at a press conference on Monday. The government also limited certain takeaway services. (BBG)

IRELAND: Ireland reported its fewest new coronavirus cases since Jan. 1, in a sign that one of the world's worst outbreaks is beginning to slow. The country reported 2,121 new cases -- the fourth day in a row cases have fallen -- with eight deaths. The positivity rate fell to 10.2% from 25% a fortnight ago. Still, case numbers are not close to being at an acceptable level, Chief Medical Officer Tony Holohan told reporters in Dublin. "We've made a lot of progress, but not nearly as much as we need to take," he said. (BBG)

U.S.

FISCAL: Treasury Secretary nominee Janet Yellen to tell Senate Finance Committee that U.S. economy suffered from growing inequality even before outbreak of pandemic. Long before arrival of Covid-19, "we were living in a K-shaped economy, one where wealth built on wealth while working families fell further and further behind," according to prepared text of Yellen remarks at committee's Jan. 19 hearing. "This is especially true for people of color". "Neither the President-elect, nor I, propose this relief package without an appreciation for the country's debt burden. But right now, with interest rates at historic lows, the smartest thing we can do is act big." (BBG)

CORONAVIRUS: The number of people receiving hospital treatment for Covid-19 in the US fell to 123,848 on Monday, dropping for the sixth consecutive day. Figures from the Covid Tracking Project showed the number of hospitalisations for the disease had fallen from 124,387 a day earlier, while the seven-day average nudged lower to 127,468. The number of people receiving hospital treatment for the virus has fallen in recent days after climbing above 130,000 in early January. States reported a total of 1,393 deaths, down from 2,044 a day earlier. The daily tally of fatalities climbed above 4,000 in early January, but this has also slowed in recent days. (FT)

CORONAVIRUS: New York Gov. Andrew Cuomo asked Pfizer CEO Albert Bourla Monday for the ability to buy Covid-19 vaccine doses directly from the company. But the company in a statement said the Department of Health and Human Services would need to approve such a model first. (BBG)

CORONAVIRUS: President-elect Joe Biden's Covid Advisory Board member Dr. Celine Gounder slammed the Trump administration's piecemeal Covid response as some states across the U.S. scramble to get the vaccine doses they need. "I think we've already had too much of a patchwork response across the states," Gounder said in a Monday evening interview on "The News with Shepard Smith." (CNBC)

CORONAVIRUS: Aiming to boost the slow pace of administering Covid-19 vaccines, Washington Gov. Jay Inslee said Monday the state has turned to Starbucks for help streamlining logistics and setting a new goal to dole out 45,000 doses a day. Starbucks has assigned 11 employees with expertise in labor and deployment, operations and research and development to work full-time on vaccine distribution in its home state, the company said. Inslee said the state is also arranging for over 2,000 pharmacies to administer vaccines, and setting up drive-by vaccination sites. Microsoft, another Seattle-based corporation, will also set up a vaccine site to perform 5,000 vaccinations a day, he said. (NBC)

CORONAVIRUS: The incoming Biden administration on Monday said it won't lift a entry ban on most visitors from Europe, the U.K. and Brazil, shortly after President Donald Trump ordered an end to the Covid-19 travel restrictions. "With the pandemic worsening, and more contagious variants emerging around the world, this is not the time to be lifting restrictions on international travel," tweeted President-elect Joe Biden's spokeswoman Jen Psaki. (CNBC)

POLITICS: President Trump is expected to issue between 50 and 100 commutations and pardons before he leaves office this week, two sources familiar with the list told Fox News. The sources told Fox News that the announcement of the pardons will likely come in one large batch on Tuesday, but there is a slight chance the White House will wait to make them official Wednesday morning. The president has until noon on Wednesday to do so. Fox News has learned that there was a meeting at the White House on Sunday afternoon to finalize the growing list of pardons and commutations. But sources with knowledge of the process say Trump is not expected to grant protective pardons for any members of his family, nor is he expected to attempt to issue a pardon for himself. (Fox)

OTHER

GLOBAL TRADE: China is adjusting its tariffs and making efforts it agreed to under the RCEP trade agreement, Shanghai Securities News reported citing Gao Feng, the spokesperson for the Ministry of Commerce. The Ministry will brief local governments, industry organizers and companies with obligations and development prospects under RCEP through various online trainings, said Gao. (MNI)

U.S./CHINA: President Donald Trump on Monday signed an executive order directing U.S agencies to prioritize removing Chinese-made drones from American government fleets and to assess any security risks. Trump directed all U.S. agencies to outline security risks posed by the existing government drone fleet from drones built by Chinese companies or by other countries deemed foreign adversaries. Last month, the U.S. Commerce Department added China's SZ DJI Technology Co, the world's largest drone maker, to the American government's economic blacklist, along with dozens of other Chinese companies. (RTRS)

CORONAVIRUS: An independent panel established by the World Health Organization has criticized missteps in the global handling of the Covid-19 pandemic. Led by former New Zealand Prime Minister Helen Clark and former Liberian President Ellen Johnson Sirleaf, the panel recounted in an interim report issued Monday that critical elements of the global pandemic alert system are "slow, cumbersome and indecisive." (BBG)

CORONAVIRUS: California's state epidemiologist is urging a halt to more than 300,000 coronavirus vaccine doses by Moderna because some people who received it needed medical treatment for possible severe allergic reactions. Dr. Erica S. Pan is recommending that vaccine providers stop using one lot of the Moderna vaccine pending completion of an investigation. She says less than 10 people who were inoculated at a single vaccination site needed medical attention. But she also said serious reactions to vaccinations are extremely rare. (Associated Press)

HONG KONG: Hong Kong will extend social-distancing measures, expand mandatory testing and introduce new restrictions in certain neighborhoods to battle an extended wave of coronavirus cases. The moves come after the Asian financial hub reported 107 daily Covid-19 infections on Monday, the most in a month, Hong Kong Chief Executive Carrie Lam told a weekly news briefing Tuesday. "This shows that we still have transmission chains across the territory," Lam said. "So what we need to do now is join hands and curb transmission as much as possible." (BBG)

JAPAN: Takeda Pharmaceutical plans to start the clinical trials of Novavax's Covid vaccine candidate around Feb. 20, Yomiuri reported, citing the Japanese drugmaker. (BBG)

JAPAN: Japan's latest stimulus package is more targeted to helping needier households, rather than providing universal benefits, finance minister Taro Aso tells reporters Tuesday in Tokyo. Not planning another universal cash handout. The government's last handout to all households turned out to be harder to execute than hoped for and slower. (BBG)

JAPAN: The Japanese government will set a record R&D spending target of 30t yen in the science and technology policy plan for fiscal 2021- 2025, Yomiuri reports, without attribution. The government will develop human resources and back innovative research for its 2050 carbon neutral target. The cabinet will approve plan by end-March. (BBG)

JAPAN: Japan's Okinawa prefecture is making final arrangements to ask the central government to declare a state of emergency for the region to contain the coronavirus infections, Yomiuri reports, without attribution. Japanese broadcaster FNN separately reports that the prefecture will seek to have it designated as a zone akin to being placed under a state of emergency. (BBG)

AUSTRALIA: Economy-wide, the ABS said payroll jobs dropped 5.5 per cent in the fortnight to January 2 and 6.1 per cent since mid-March 2020. However, the ABS went to great lengths to explain the decline was due to seasonal factors, noting payroll jobs had actually recovered to pre-pandemic levels in the first two weeks of December. Unlike the monthly labour force figures, the weekly payroll jobs report are not seasonally adjusted. (The West Australian)

NEW ZEALAND: The latest NZIER Quarterly Survey of Business Opinion (QSBO) shows a further improvement in business confidence in the final quarter of 2020, as businesses held onto the recovery in sales seen in September. A net 16 percent of businesses expect a deterioration in general economic conditions over the coming months, on a seasonally adjusted basis – lower than the 38 percent in the previous quarter, and well below the 68 percent of businesses feeling pessimistic in March 2020. When it comes to firms' own trading activity, a net 1 percent reported reduced demand on a seasonally adjusted basis. This measure suggests a rebound in annual GDP growth to around 2 percent at the end of 2020 from the lockdown lows in mid-2020. (NZIER)

NEW ZEALAND: New Zealand is seeking to get a small batch of vaccine to protect at-risk workers, TVNZ reports, citing Covid-19 Response Minister Chris Hipkins. (BBG)

NEW ZEALAND: Government is extending pre-departure testing to all passengers to New Zealand except from Australia, Antarctica and most Pacific Island with effect for flights landing after 11:50pm on Jan 25, Covid-19 Response Minister Chris Hipkins says in emailed statement. (BBG)

SOUTH KOREA: South Korea's Financial Services Commission says it could adopt 40-year mortgages for youths, newlywed couples and first-time home buyers as pilot project while monitoring housing market situation. (BBG)

SOUTH KOREA: The rise in long-term government bond yields and a widening gap between short-term and long-term bond yields are "noteworthy," South Korean Vice Finance Minister Kim Yongbeom says in a meeting. The rise in long-term bond yields is due to reasons including increase in U.S. interest rate, note of caution over South Korean government bond supply and demand, as well as easing of risk-off sentiment following improvement in local and overseas economic indicators. Government to monitor the change in environment both local and overseas, long-term bond yield movements while taking note of possible increase in market volatility; will seek to stabilize financial sector. (BBG)

NORTH KOREA: Satellite images suggest preparations could be underway for a test launch of a ballistic missile at a naval base in the port city of Nampo on North Korea's west coast, Washington Post reports, citing weapons experts. (BBG)

BRAZIL: Brazil accelerated plans to vaccinate its population against the coronavirus after an early start by the state of Sao Paulo added pressure on President Jair Bolsonaro to move faster to stem an incipient loss of popularity. (BBG)

RUSSIA: The United States has informed Germany that it plans to impose sanctions on a Russian pipe-laying ship involved in construction of the Russian-led Nord Stream 2 gas pipeline from Russia to Germany, the German Economy Ministry said on Monday. (RTRS)

SOUTH AFRICA: South Africa's coronavirus epidemic may have passed a second peak after new cases started to fall over the last week, according to Health Minister Zweli Mkhize. A resurgence led by a more transmissible new variant of the virus led to a far more severe wave than the initial one seen in July, he said in a televised address. However, a 23% week-on-week drop in the number of reported new infections is cause for optimism, he said. The decline "could be attributable to many factors, including enhanced physical distancing facilitated by lockdown regulations," Mkhize said. "Having said that, the health-care system continues to experience significant strain." (BBG)

IRAQ: Multiple explosions were heard early Tuesday at locations controlled by the Iran-backed Kataib Hezbollah militia near the town of Jurf al-Sakhar to the south of Baghdad, al-Arabiya television reports. The cause of these explosions was not yet clear, it says. (BBG)

MIDDLE EAST: Qatar has urged Gulf Arab nations to enter a dialog with Iran, saying the time was right for Doha to broker negotiations now the neighbors have begun to patch up their own differences. Qatari Foreign Minister Sheikh Mohammed bin Abdulrahman Al Thani, who's long called for a summit between leaders of the six-member Gulf Cooperation Council and the Islamic Republic, said his government was "hopeful that this would happen and we still believe this should happen." "This is also a desire that's shared by other GCC countries," he told Bloomberg TV in an interview. (BBG)

METALS: Rio Tinto Group is targeting increased shipments of iron ore this year amid a price surge driven by strong demand from China, though cautioned the regulatory impact from the Juukan Gorge heritage site controversy remained unknown. Shipments could be as much as 2.8% higher than last year, the company said Tuesday in a production report, setting a range of 325-340 million tons after notching up 331 million tons in 2020. "China's buying remains robust despite ongoing localized impacts from Covid-19 in some regions." Iron ore futures in Singapore climbed above $170 a ton Monday as economic growth and steel production data in China bolstered sentiment. (BBG)

OIL: Alberta Premier Jason Kenney is urging Prime Minister Justin Trudeau to make a last-minute push to save the Keystone XL pipeline, saying a decision by U.S. president-elect Joe Biden to scrap the project's permits would set a dangerous precedent for the Canadian economy. (Edmonton Journal

OIL: The Canadian province that invested $1.1 billion of taxpayers' money in the controversial Keystone XL project is now considering the sale of pipe and materials to try to recoup some funds. "If the project ends, there would be assets that could be sold, such as enormous quantities of pipe," Alberta Premier Jason Kenney said in a press conference Monday. "That would offset construction costs." (BBG)

CHINA

POLICY: China's macro policies will match the needs for stable economic development this year and a sharp turn is unlikely to happen, National Development and Reform Commission official Yan Pengcheng says at a briefing. Yan denies market speculations about a policy scale-back or exit this year. China still faces some challenges for a stable economic recovery in 2021. China to encourage more consumer spending and improve consumption environment this year. (BBG)

ECONOMY: China's economy still faces structural imbalance despite recording GDP of over 100 trillion yuan in 2020, the Securities Daily said in a commentary. The recovery in consumption needs to be further accelerated as retail sales fell 3.9% from the previous year. However, the recovery is forecast to gather more steam as the digital economy, the digitization of industries, transportation and logistics all enhance production and consumption, the newspaper said. (MNI)

PBOC: MNI BRIEF: PBOC Should Extend Support To Small Firms: Advisor

- The People's Bank of China should extend programs providing credit support to small firms this year as these companies continue to face economic hardship, said Wang Yiming, a vice chairman with China Center for International Economic Exchanges, an official think tank. Fiscal spending in 2021 should remain strong enough to support the economy and monetary policy should aim to keep the macro-leverage ratio relatively stable, he said.

YUAN/FOREX: The U.S. dollar may enter a phase of weakness if vaccines help bring the pandemic under control and the market shifts to more risk-tolerant assets, the Financial News reported citing Guan Tao, chief economist at BOC International Securities and a former official at China's FX regulatory agency. The dollar will remain a critical global currency even as some observers want to reduce the risks of holding dollar-denominated assets exposed to U.S. government-imposed sanctions, the surging U.S deficit and poor governance, Guan said. The incoming U.S. administration is expected to embrace multilateralism, which may strengthen the dollar's global position, Guan told the newspaper. (MNI)

SOES: China will shift its focus from deleveraging to stabilizing leverage at centrally administrated enterprises, Peng Huagang, the spokesperson of State-owned Assets Supervision and Administration Commission, says at a briefing. SOEs' credit ratings are at good level and their bond size is generally Reasonable. China will strictly cap the proportion of short-term bonds in high-risk companies to prevent repayment risks. (BBG)

SOVEREIGN WEALTH FUND: China's $1 trillion sovereign wealth fund is restructuring how its decides on international investments as it tries to boost efficiency and make better progress on a goal of increasing the share of private assets in its global portfolio. (BBG)

OVERNIGHT DATA

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 108.7; PREV. 108.9

Consumer confidence was close to unchanged over the weekend, consolidating at an above neutral level – though below the long-run average. Sentiment is higher than a year ago, but the comparison reflects the impact of the bushfires in late 2019 and early 2020. Within the detail, 'future financial conditions' stood out with a gain of 2.4% and remain well above the long-run average. Inflation expectations have pulled-back a touch from their recent high. (ANZ)

NEW ZEALAND: Statistics NZ has decided not to publish seasonally adjusted electronic card spending data, citing the impact of the Covid-19 pandemic on seasonal patterns. "The COVID-19 pandemic has introduced unusual patterns to the monthly and quarterly electronic card transaction series. Electronic card transaction series continues to show irregular spending patterns and historical seasonal patterns are no longer evident". "Months from March 2020 will not be published. This approach will continue until an observable seasonal pattern returns to each series". (BBG)

CHINA MARKETS

PBOC NET INJECTS CNY75BN VIA OMOS TUESDAY

The People's Bank of China (PBOC) injected CNY80 billion via 7-day reverse repos with the rate unchanged on Tuesday. This resulted in a net injection of CNY75 billion given the maturity of CNY5 billion reverse repos today, according to Wind Information.

- The operation aims to maintain the liquidity in the banking system reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2103% at 09:28 am local time from 2.1800% for Monday's close.

- The CFETS-NEX money-market sentiment index closed at 56 on Monday vs 39 on Friday. A higher index indicates increased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.4883 TUES VS 6.4845

People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4833 on Tuesday. This compares with the 6.4845 set on Monday.

MARKETS

SNAPSHOT: Risk Bid In Asia

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 424.45 points at 28669.07

- ASX 200 up 79.566 points at 6742.6

- Shanghai Comp. down 3.258 points at 3592.804

- JGB 10-Yr future up 9 ticks at 151.81, JGB 10-Yr yield down 0.9bp at 0.046%

- Aussie 10-Yr future down 3.0 ticks at 98.890, Aussie 10-Yr yield up 2.8bp at 1.096%

- U.S. 10-Yr future down 0-05+ at 136-22, U.S. 10-Yr yield up 3.06bp at 1.1141%

- WTI crude down $0.07 at $52.29, Gold down $1.52 at $1839.93

- USD/JPY up 33 pips at 104.02

- YELLEN TO HIGHLIGHT U.S. ECONOMY'S INEQUALITY IN SENATE REMARKS (BBG)

- ITALY'S CONTE FACES SENATE SHOWDOWN AFTER WIN IN LOWER HOUSE (BBG)

- ITALY'S CONTE DETERMINED TO HOLD ON TO POWER AFTER SENATE VOTE (BBG)

- NDRC: NO SHARP TURN IN CHINA'S MACRO POLICIES THIS YEAR (BBG)

- SASAC: CHINA TO FOCUS ON STABILIZING LEVERAGE AT SOES (BBG)

- RISK SUPPORTED PRE-YELLEN, HANG SENG SURGES ON TECHNICAL BREAK & INFLOWS FROM CHINA

BOND SUMMARY: Mixed Overnight Vs. A Positive Risk Backdrop

Technical breaks and supportive flows from China fed into an extension of the recent leg higher in the Hang Seng, fuelling broader risk-on flows across wider financial markets. Elsewhere, some looked with hope towards Janet Yellen's Tuesday testimony on the Hill, pointing to previous comments during her time as the FOMC Chair, suggesting that she will have no qualms re: running the economy hot for a time if deemed necessary (albeit from a fiscal standpoint). Elsewhere, China's state planning body flagged no sharp turns in the nation's macro policies during '21.

- This backdrop pressured Tsys during a session that was devoid of major macro headline flow, with 1.0-2.0K clip sellers of TYH1 futures at the fore on the flow front. T-Notes -0-05 at 136-22+ at typing, 0-01+ off lows, while the cash Tsy curve has bear steepened, with 30s sitting ~3.0bp cheaper on the day. Eurodollar futures sit unchanged to -1.0 through the reds, with a 5.0K lift of EDM4/Z4 providing the highlight on the flow front.

- JGB futures held to a narrow range in morning trade, before extending higher during afternoon trade, +8 ticks last. Cash trade saw some outperformance for the super long end, although 20s hovered around unchanged levels. The latest round of 20-Year JGB supply wasn't as soft as December's 20-Year JGB auction, but wasn't strong by any stretch of the imagination. Still, a sense of relief re: the auction not being as bad as December's offering may have allowed futures to rally during afternoon trade.

- The broader environment applied light pressure to the Aussie bond space, with YM -0.5 and XM -2.5 at typing, with A$ issuance likely adding further weight to the space.

JGBS AUCTION: Japanese MOF sells Y978.0bn 20-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y978.0bn 20-Year JGBs:- Average Yield 0.443% (prev. 0.366%)

- Average Price 101.04 (prev. 100.62)

- High Yield: 0.448% (prev. 0.372%)

- Low Price 100.95 (prev. 100.50)

- % Allotted At High Yield: 78.8026% (prev. 14.6471%)

- Bid/Cover: 3.346x (prev. 3.011x)

JGBS AUCTION: Japanese MOF sells Y2.8460tn 1-Year Bills:

The Japanese Ministry of Finance (MOF) sells Y2.8460tn 1-Year Bills:

- Average Yield -0.1128% (prev. -0.1101%)

- Average Price 100.113 (prev. 100.110)

- High Yield: -0.1108% (prev. -0.1081%)

- Low Price 100.111 (prev. 100.108)

- % Allotted At High Yield: 81.7787% (prev. 48.2250%)

- Bid/Cover: 3.495x (prev. 4.099x)

EQUITIES: Hang Seng Soars In Risk On Trade

Broad risk on sentiment in Asia has seen domestic stock indices surge. The Hang Seng leads gains, last up over 3%, morning trade saw southbound net inflows hit 82% of yesterday's record daily level. The bourse seeing inflows for 19 consecutive sessions as Chinese investors snap up stocks that were previously sold off as the US imposed restrictions on China. As a result, Chinese indices are the laggards in the region, CSI 300 down around 0.4%.

- In Australia the ASX 200 is up over 1% as latest testing data shows the latest coronavirus outbreak appears to be under control, consumer discretionary is the best performing sector.

- US stock futures have risen as yields have ticked lower, markets look ahead to an address from President-elect Biden's selection for Tsy Secretary, Janet Yellen, as she appears in front of the Senate Finance Committee in the wake of comments in the WSJ that the US would not pursue a soft dollar policy. European futures are also higher.

OIL: Risk On Sentiment Supports Commodity Complex

WTI and brent have diverged on Tuesday, WTI is down around $0.11 at $52.25 while brent is $0.24 higher at $54.99. Brent is supported by broad risk on sentiment in Asia, while in WTI there was no settlement on Monday as US markets were closed for a public holiday. Front-month February WTI futures expire on Wednesday.

- Data released yesterday showed China's refinery output rose 3% to a new record in 2020, painting a positive picture for the world's top crude oil importer.

- Global demand concerns are capping upside as Japan deals with the latest wave of infections and China reports a flurry of new Covid-19 cases. Data yesterday also showed nascent demand issues in India, sales of transport and cooking fuels over the first two weeks of 2021 declined M/M.

- Market participants will look ahead to the IEA monthly crude inventories report after market today.

GOLD: We've Been Here Before

Bullion has coiled during Asia-Pac trade, with little to flag in the wake of Monday's recovery from the spike lower. The DXY sits a touch lower on net over that horizon, after unwinding the uptick that was seen during yesterday's holiday-thinned session, while U.S. real yields have edged higher, but remain within the confines of their respective recent ranges. That leaves spot bullion little changed on the day, just below $1,840/oz at typing.

FOREX: Risk Switch Flicked To On Ahead Of Yellen's Hearing

Markets switched into a risk-on mode ahead of the much awaited congressional testimony from Tsy Sec nominee Yellen. A market contact flagged speculation surrounding her upcoming address as a potential risk-supportive factor, with her 2016 comments re: running a "high-pressure economy" providing a point of reference. Firmer risk sentiment prompted participants to dump JPY, which landed at the bottom of the G10 pile. USD/JPY attacked the Y104.00 mark but failed to make much headway beyond that level. As a reminder, $1.1bn of options with strikes at Y103.90-104.00 expire at the NY cut, with $1.4bn of options with strikes at Y103.00 also due to roll off.

- The greenback was the second worst performer in the G10 basket, as markets have already discounted yesterday's WSJ piece suggesting that Yellen will advocate a market-determined FX rate.

- Commodity-tied FX gained on the back of better risk appetite. AUD outperformed its G10 peers but the rally in AUD/USD was limited by the imminent expiry of $1.2bn worth of options with strikes at $0.7700.

- USD/CNH edged away from session lows after NDRC head Yan poured cold water on chatter about a potential policy scale-back/exit this year, noting that there will be no sudden shift in monetary policy in 2021. Spot USD/CNH operated within a narrow range just shy of the CNH6.5000 figure.

- Focus turns to German ZEW Survey & final CPI report, as well as comments from BoE's Haldane, in addition to the aforementioned remarks from Janet Yellen.

FOREX OPTIONS: Expiries for Jan19 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1900(E575mln), $1.2000(E1.1bln), $1.2100(E567mln), $1.2150-60(E730mln-EUR puts), $1.2175-80(E769mln-EUR puts), $1.2190-1.2210(E4.7bln-EUR puts), $1.2250(E1.2bln-EUR puts), $1.2300(E1.4bln-EUR puts), $1.2350-55(E1.1bln-EUR puts)

- USD/JPY: Y102.50-55($568mln), Y103.00($1.4bln), Y103.25($735mln), Y103.50-55($787mln), Y103.65-75($775mln), Y103.90-104.00($1.1bln), Y105.00($638mln)

- GBP/USD: $1.3525-35(Gbp512mln), $1.3600-13(Gbp510mln)

- EUR/GBP: Gbp0.9020-25(E648mln)

- AUD/USD: $0.7450(A$1.2bln), $0.7625(A$573mln), $0.7650-55(A$618mln), $0.7700(A$1.2bln)

- AUD/NZD: N$1.0700(A$655mln)

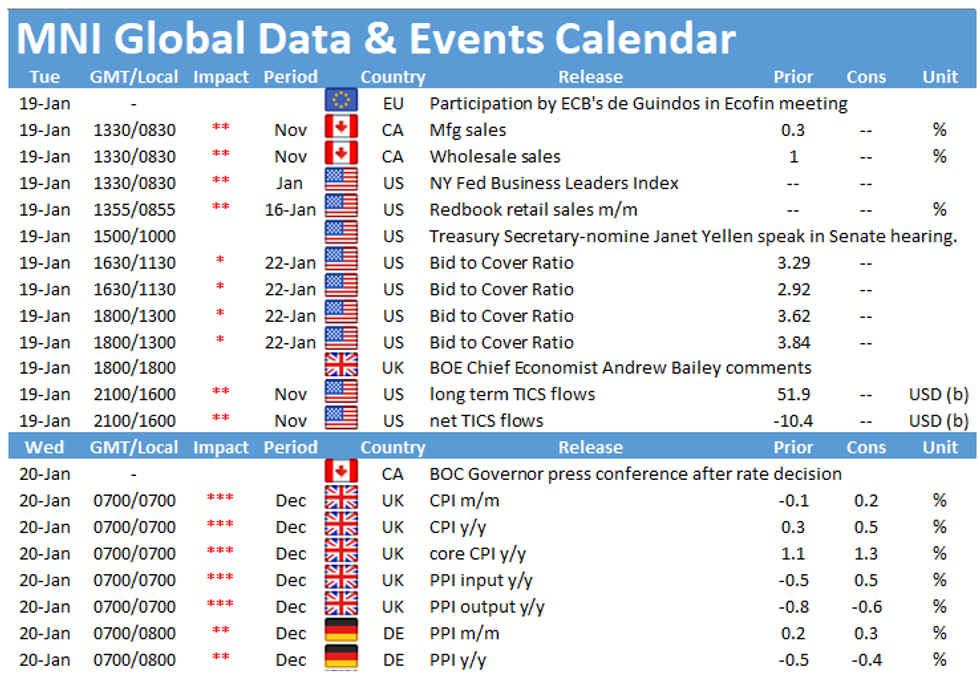

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.