-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Optimism Outweighs Negatives In Asia

EXECUTIVE SUMMARY

- ECB'S REHN: YIELD CURVE CONTROL NONSENSICAL FOR EURO AREA (BBG)

- EU HIT BY DELAY TO OXFORD/ASTRAZENECA VACCINE DELIVERY (FT)

- TOP ADVISER: FRANCE PROBABLY NEEDS NEW LOCKDOWN AS EARLY AS FEBRUARY (RTRS)

- SANDERS SAYS DEMOCRATS WILL PUSH CORONAVIRUS RELIEF PACKAGE THROUGH WITH SIMPLE MAJORITY (AXIOS)

- U.S STATE DEP'T URGES BEIJING TO CEASE MILITARY, DIPLOMATIC & ECONOMIC PRESSURE AGAINST TAIWAN (RTRS)

- PBOC MAY USE CRA TO STABILIZE LIQUIDITY BEFORE HOLIDAY (CSJ)

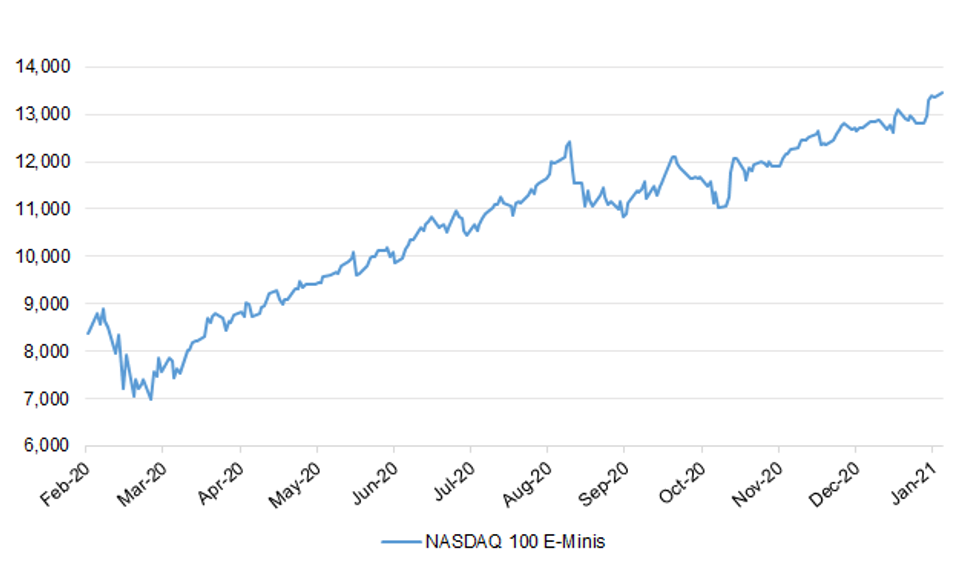

Fig. 1: NASDAQ 100 E-Minis

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Britain faces a three-month lockdown "halfway house" after Easter, with a full reopening delayed until all over-50s have had their second dose of the vaccine, The Telegraph understands. Ministers are considering proposals to begin reopening swathes of the economy in April under similar restrictions to those in place over the summer, with "rule of six" and social distancing measures in force in pubs and restaurants. A return to full normality will be delayed for at least 12 to 14 weeks to allow for all over-50s to have their second dose of the vaccine, according to a source familiar with the discussions. (Telegraph)

CORONAVIRUS: The Government has quietly extended lockdown laws to give councils the power to close pubs, restaurants, shops and public spaces until July 17 this year. (Telegraph)

CORONAVIRUS: A record 491,970 people received their first coronavirus vaccinations on Saturday, a pace that if maintained would allow the government to beat its target for covering the most vulnerable people in society. The prime minister has pledged to offer a first jab to 14.6 million people by February 15. This would include the over-70s, frontline health workers, care home staff and older residents and others with clinical conditions that put them at extreme risk. (The Times)

CORONAVIRUS: Boris Johnson will approve a new border crackdown on Tuesday that could ban foreign passport-holders from countries where the coronavirus is mutating from entering Britain. New arrivals, including British citizens who come home from Covid hotspots, would be met at point of entry and escorted to isolation hotels, where they will have to stay at their own expense. The proposals will have to be approved by a cabinet Committee. (Sunday Times)

CORONAVIRUS: The U.K.'s health minister warned that coronavirus vaccines may be less effective against new variants of the disease, such as those found in South Africa and Brazil, and that stricter border controls are therefore justified. (BBG)

CORONAVIRUS: Up to half a million fewer doses of Covid vaccine will be supplied to the NHS next week as Whitehall sources admitted the target of vaccinating priority groups by mid-February was increasingly "tight". Deliveries of the Pfizer vaccine will be cut by between 15 and 20 per cent next week after the US firm announced delays in shipments because of work to increase capacity at its Belgian processing plant, sources said. (Telegraph)

CORONAVIRUS: A major British doctors' group says the U.K. government should "urgently review" its decision to give people a second dose of the Pfizer-BioNTech coronavirus vaccine up to 12 weeks after the first, rather than the shorter gap recommended by the manufacturer and the World Health Organization. (Associated Press)

CORONAVIRUS: Schoolchildren have become the pandemic's "forgotten victims", Tory MPs have warned Boris Johnson, amid a growing backlash against plans that could keep classrooms closed until Easter. (Telegraph)

FISCAL: Rishi Sunak has told Tory MPs that coronavirus handouts "can't go on forever" as he considers a second budget in the autumn to raise taxes. The Chancellor has begun rolling the pitch for revenue-raising measures but is understood to want to wait until later in the year when the economic outlook is clearer and the recovery in train before making many key decisions about taxes. (Telegraph)

FISCAL: Rishi Sunak has doubled his offer of a one-off payment to millions of universal credit claimants to £1,000 to replace the weekly £20 uplift, and stave off a growing rebellion among Tory MPS. (Telegraph)

FISCAL: Ministers are under mounting pressure to further extend the Government's £2bn scheme to tackle youth unemployment despite throwing it open to more employers today. (Telegraph)

BREXIT: The EU is set to ask Britain for more time to ratify their new trade deal despite the UK urging Brussels to press ahead quickly, with the issue becoming a fresh point of tension between the two sides. Diplomats said national ambassadors from EU countries at a meeting on Friday backed an extension to the current end of February ratification deadline, amid concerns that legally approved versions of the trade treaty in all of the bloc's 24 official languages will not be ready by then. (FT)

BREXIT: British businesses that export to the continent are being encouraged by government trade advisers to set up separate companies inside the EU in order to get around extra charges, paperwork and taxes resulting from Brexit, the Observer can reveal. (Observer)

ECONOMY: British employers made plans to cut 795,000 jobs last year, a record number, as Covid lockdowns took their toll on the economy. More than 10,000 firms planned job cuts, however the pace of planned cuts slowed at the end of the year. Without the government's furlough scheme, designed to protect jobs, the numbers might have been higher still. The figures were obtained in response to a BBC Freedom of Information request to the Insolvency Service. (BBC)

ECONOMY: The London Stock Exchange is hatching plans to create a £300m listed vehicle aimed at bolstering the survival chances of companies hit hard by the coronavirus pandemic. Sky News has learnt that David Schwimmer, the London Stock Exchange Group (LSEG) chief executive, has been spearheading talks with top City figures and the Treasury about establishing an investment trust called the UK Growth and Resilience Fund. The scheme, which would principally invest in unquoted companies, is said to have been under discussion for months. (Sky)

BOE: The Bank of England is under pressure to rethink its financial backing of oil and gas companies after being warned by an influential group of MPs that it risks creating a "moral hazard". The Commons' environmental audit committee has written to Andrew Bailey, governor of the Bank, warning that the institution threatens to undermine Britain's efforts to tackle climate change by buying bonds issued by oil and gas companies. The warning comes ahead of the United Nations' COP26 climate conference, which Britain is hosting in November. (The Times)

UK: Nicola Sturgeon has accused Boris Johnson of being "frightened of democracy" and said she will seek a "legal referendum" on Scottish independence. Scotland's first minister claimed the prime minister "fears the verdict and the will of the Scottish people" over his refusal to agree to another independence vote. Meanwhile the leader of the devolved administration in Northern Ireland, Arlene Foster, said a referendum on whether the country should stay part of the UK or unify with Ireland would be "divisive" and "reckless". (Sky)

UK: The UK is facing a constitutional crisis that will strain the Union as new polls reveal a majority of voters in Scotland and Northern Ireland want referendums on the break-up of Britain. A four-country survey we commissioned, based on separate polls in Scotland, Northern Ireland, England and Wales, also found that the sense of British identity that once bound the country together is disintegrating. (Sunday Times)

EUROPE

ECB: There are better ways than yield curve control to achieve favorable financing conditions in the euro area, given the differences between its 19 member states, according to European Central Bank Governing Council member Olli Rehn. Yield curve control, proposed as one option to consider by, among others, Spanish central bank Governor Pablo Hernandez de Cos, "would be a rather mechanical approach" to the question of financing conditions, and "not sensible" given the euro area has at least 19 different yield curves, Rehn said in an interview on Finland's YLE TV1. (BBG)

ECB: The European Central Bank's newest German policymaker is emerging as a crucial intermediary between its more conservative council members and president Christine Lagarde, who has vowed to seek consensus over its multitrillion-euro stimulus programme. Isabel Schnabel, a former economics professor at the University of Bonn who became one of the ECB's six executive board members a year ago, played a pivotal role in last month's compromise which led to the expansion of its main stimulus programme, according to several members of its governing council. (FT)

CORONAVIRUS: AstraZeneca has warned EU countries to expect significant shortfalls to early deliveries of its coronavirus vaccine, in a fresh blow to the rollout of the bloc's immunisation programme, European officials have said. The EU was expecting 100m doses of the jab in the first quarter of the year. But people with knowledge of the discussions said the company may fail to deliver even half that amount, although they stressed that final figures had not been established. AstraZeneca insisted there was no "scheduled delay" to the start of shipments of its vaccines, but said "initial volumes" would "be lower than originally anticipated due to reduced yields at a manufacturing site within our European supply chain". "We will be supplying tens of millions of doses in February and March to the EU, as we continue to ramp up production volumes," the company said, adding that the change in expected volumes did not affect the UK. Details of the revised first-quarter deliveries to the EU were still being worked out but they could be less than 40m, several European officials said. Part of the reason for the uncertainty is that the provisional timetables are dependent on when the vaccine receives regulatory approval, which could happen next week. (FT)

CORONAVIRUS: European Council President Charles Michel on Sunday called on pharmaceutical companies to provide clarity about the reasons behind delays in vaccine deliveries, according to a report in L'Echo. "We intend to enforce the contracts that have been validated by the pharmaceutical companies," Michel said. (BBG)

GERMANY: Germany tightened entry restrictions on Sunday for visitors from almost 30 countries with particularly high infection rates or dangerous virus variants, making tests mandatory before entry. High-risk areas include the US, the neighbouring Czech Republic and several holiday destinations such Portugal, Spain and Egypt. (FT)

GERMANY: German health minister Jens Spahn has ordered a coronavirus medication based on antibodies, which was used to treat former U.S. President Donald Trump after he tested positive for Covid-19 last year. "Germany has bought 200.000 doses for 400 million euro," Spahn told the Sunday edition of tabloid Bild. Germany would be the first EU country to use this treatment. (BBG)

FRANCE: France probably needs to move into a third lockdown, perhaps as early as the February school holidays, because of the circulation of new variants of the virus, the government's top medical adviser on COVID-19 policy said on Sunday. French schoolchildren have two weeks off in February, but the entire month is a holiday month as three different zones stagger the start of their holidays by one week, with the first starting on Feb. 6. "We probably need to go towards a confinement. Whether that needs to be a very strict confinement like the first one in March or a softer form like in November, that is a political decision," Jean-François Delfraissy, head of the scientific council that advises the government on COVID-19 response, told BFM television. (RTRS)

FRANCE: France's top health authority is recommending a doubling of the time between the two required Covid-19 vaccine shots as a way to stretch supplies and inoculate as many people as possible. Giving the second injection six weeks after the initial one would allow at least 700,000 more people to be protected during the first month. The French advice follows guidance two days ago by the U.S. Centers for Disease Control and Prevention that said follow-up doses could be given up to six weeks later if it's not feasible to get them in the recommended interval. (BBG)

ITALY: Italian Prime Minister Giuseppe Conte is doing everything he can to wrangle Senate support ahead of a crucial vote this week with the future of his government at stake. Conte has been defying calls to quit since the defection earlier this month of Italy Alive, a junior coalition party led by former premier Matteo Renzi, and he still needs a handful of extra votes before a Senate ballot on the annual report of his justice minister, most likely Wednesday or Thursday. If his government is defeated, Conte's position may become untenable. (BBG)

ITALY: Italian Prime Minister Giuseppe Conte says a delay in the supply of coronavirus vaccines from Pfizer and AstraZeneca is "unacceptable". Both companies have warned they will not be able to deliver vaccines to the EU as agreed due to production issues.Mr Conte has accused them of serious contract violations. A senior Italian health official has warned that the country will have to rethink its vaccination programme if supply issues continue. (BBC)

ITALY: Italy's Lombardy region and the central government exchanged blame on Saturday over the release of COVID-19 data that wrongly condemned the region to stricter restrictions. (RTRS)

ITALY/BTPS: Italy plans to sell 7 billion euros ($8.5 billion) of bills due Jul 30 in an auction on Jan 27. (BBG)

SPAIN: Spain's Madrid region brought forward its curfew by an hour to 10 p.m. to rein in coronavirus infections. Shops, bars and restaurants will have to close an hour earlier at 9 p.m. when the new restrictions take effect on Jan. 25, the regional government said. Home visits will also be prohibited unless for tasks such as caring for children or the elderly. (BBG)

PORTUGAL: Travel is being allowed for voting in Portugal's presidential election on Sunday, even after the country reported a record number of coronavirus cases on Saturday. (BBG)

PORTUGAL: Portuguese President Marcelo Rebelo de Sousa will serve a second term after winning more than 50% of the vote in Sunday's election, avoiding a runoff, exit polls showed. Rebelo de Sousa, 72, took between 57% and 62% of the vote, according to the exit poll by the Catholic University for RTP television. Two other exit polls for television channels SIC and TVI also show the president winning more than 50% of the vote. Portuguese presidents have usually served two terms and the last runoff election was in 1986. (BBG)

IRELAND: An extension of Ireland's coronavirus lockdown throughout February is likely after prime minister Micheál Martin said the latest wave of the pandemic was too severe to lift restrictions that had been due to expire at the end of January. (FT)

SWEDEN: Swedish Prime Minister Stefan Lofven said his government should have taken more aggressive steps and moved more quickly to stop the spread of the pandemic, and he takes full responsibility for the initial strategy that led the country to suffer a disproportionately high number of deaths. In an interview with Dagens Nyheter, Lofven said the government's response to the spread of the virus among the elderly was inadequate, and that testing should have begun earlier. "As prime minister, I take full responsibility for the strategy that we have," Lofven said. (BBG)

SWEDEN/NORWAY: weden has introduced a travel ban with neighboring Norway that starts at midnight on Monday and runs until Feb. 14. The country has also extended its temporary entry bans from the U.K. and Denmark until Feb. 14, Interior Minister Mikael Damberg said at a press conference on Sunday. "A feared outbreak of the mutated variant in Olso, in combination with the extensive shutdowns may entail a risk of a flood of people to the Swedish side of the border," he said. (BBG)

NORWAY: Norway extended tougher restrictions beyond the Oslo area amid uncertainty about how quickly and widely the U.K. variant is spreading. Authorities said there's a big risk, and now is the time to act as the infection-rate curve is trending downward. The restrictions will apply through the end of January. (BBG)

RATINGS: Sovereign rating reviews of note from Friday included:

- Fitch affirmed the Czech Republic at AA-; Outlook Stable

- Fitch affirmed the European Financial Stability Facility at AA

- Fitch affirmed the European Stability Mechanism at AAA; Outlook Stable

- Fitch affirmed Greece at BB; Outlook Stable

- S&P affirmed Slovakia at AA+; Outlook revised to Stable from Negative

- DBRS Morningstar confirmed the European Financial Stability Facility at AAA, Stable Trend

- DBRS Morningstar confirmed the European Stability Mechanism at AAA, Stable Trend

- DBRS Morningstar confirmed the Netherlands at AAA, Stable Trend

- DBRS Morningstar confirmed Switzerland at AAA, Stable Trend

U.S.

FISCAL: White House economic adviser Brian Deese was asked Sunday by Republican and Democratic lawmakers for justification for the $1.9 trillion price tag of the administration's Covid-19 relief plan. "Part of what we're asking for is more data -- where did you get the number?" said Senator Angus King, a Democratically-aligned Maine independent who participated in Deese's call. King was referring to the potential cost of the package's components, versus the total price-tag. (BBG)

FISCAL: MNI EXCLUSIVE: Biden's Relief Plan Likely To Be Slimmed To $1T

- U.S. President Joe Biden's fiscal aid proposal will likely be slashed to around USD1 trillion before it stands a chance at becoming law, despite the White House's push for bipartisan support on ambitious Democratic priorities, former officials from both political parties told MNI - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FISCAL: Sen. Bernie Sanders (I-Vt.), incoming chair of the Senate Budget Committee who caucuses with the Democrats, told CNN's "State of the Union" on Sunday that Democrats plan to push a coronavirus relief package through the chamber with a simple majority vote. (Axios)

FISCAL: As President Joe Biden advocates for sending additional stimulus checks to millions of Americans, he is also moving help those who missed out on earlier payments. On Friday, Biden issued an executive order asking the Treasury Department to re-evaluate its delivery structure for stimulus checks to make sure all Americans who are entitled to the payments receive them. (CNBC)

FISCAL: A FOX reporter tweeted the following on Friday: "GOP lobbyists tell @FoxBusiness that they plan to water down progressive aspects of @JoeBiden's agenda including Covid stimulus by working three moderate Dems up for re-election in 2024." (MNI)

CORONAVIRUS: US states reported the lowest number of new cases in eight weeks as emerging infections declined across all regions of the country, according to Covid Tracking Project data. The new case level of 143,000 is the lowest figure since December 1, with the exception of Christmas Day when much data were delayed. For the first time since November 3, no state has more than 600 people per million in hospital with Covid-19, the data aggregator and analysis provider said. On Sunday, US states recorded a total of 110,628 people receiving hospital treatment for Covid-19, down from 114,000 people on Saturday and the lowest number since December 14. (FT)

CORONAVIRUS: President Joe Biden has painted a bleak picture of the nation's coronavirus outbreak in his first few days in office, warning that it will take months to turn around the pandemic's trajectory and that fatalities are expected to dramatically rise over the next few weeks. "A lot of America is hurting. The virus is surging. We're 400,000 dead expected to reach well over 600,000," Biden said on Friday before signing two executive orders designed to reduce hunger and bolster workers' rights amid the pandemic. (CNBC)

CORONAVIRUS: President Joe Biden will sign a travel ban Monday on most non-U.S. citizens entering the country who were recently in South Africa, where a new strain of Covid-19 has been identified, a person familiar with the situation told CNBC. Biden will also reinstate travel restrictions on the entry of non-U.S. citizens from the U.K. and Brazil, where new Covid strains have emerged. The restrictions will also apply to Ireland and much of Europe. President Donald Trump had rescinded the restrictions just before Biden took office. (CNBC)

CORONAVIRUS: The U.S. government, including the Pentagon, is stepping up surveillance of coronavirus variants to monitor their impact on Covid-19 vaccines and therapeutics, the new head of the Centers for Disease Control and Prevention said. (BBG)

CORONAVIRUS: Follow-up doses of the Covid-19 vaccines could be given up to six weeks later if it's not feasible to get them in the recommended interval, the Centers for Disease Control and Prevention said, with the U.S. Food and Drug Administration also offering some flexibility for "modest delays." (BBG)

CORONAVIRUS: White House chief of staff Ron Klain said Sunday that it's not possible for U.S. states to purchase Covid-19 vaccines directly from manufacturers, as some have sought to do, under the emergency use authorization issued by the Food and Drug Administration. "As a matter of law, this vaccine is under an emergency use authorization," Klain told NBC's "Meet the Press," when asked about the requests. "I don't think that's possible." (CNBC)

CORONAVIRUS: U.S. governors are stepping up their complaints that the federal government is not giving them enough vaccine -- and it could be months before they inoculate those currently eligible. "I'm not as worried about running out as I am about not getting enough," New Jersey Governor Phil Murphy said Friday on CNN. He said he could use as much as four times the 100,000 doses the state now is allotted a week. On Saturday, Governor Andrew Cuomo said it would take 17 weeks to get through the 7 million New Yorkers eligible to receive the vaccine. Nebraska Governor Pete Ricketts said on Friday the general population may have to wait four months before being eligible for a vaccine. "Supply is our primary issue," Kentucky Governor Andy Beshear tweeted Saturday.

CORONAVIRUS: San Francisco's goal of vaccinating all residents against the coronavirus by June hinges on getting enough shots, which are currently in short supply, Mayor London Breed said. (BBG)

CORONAVIRUS: Deborah Birx, who served as White House coronavirus response coordinator under former President Trump, described on Sunday disarray, a lack of communication and the spread of misinformation inside Trump's White House as it attempted to handle the Covid-19 crisis. (Axios)

POLITICS: MNI BRIEF: Trump Impeachment Trial to Start Feb 8- Schumer

- The Senate will start former President Donald Trump's second impeachment trial during the week of February 8, Democratic Senate Majority Leader Charles Schumer announced on Friday - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

POLITICS: U.S. Senate Majority Leader Chuck Schumer said on Sunday that former President Donald Trump's approaching second impeachment trial in the Senate will be fair but move at a relatively fast pace. "It will be a fair trial but it will move relatively quickly," Schumer, a Democrat, told a news conference in New York. He said it should not take up too much time because "we have so much else to do." (RTRS)

POLITICS: Senate Majority Leader Chuck Schumer (D-N.Y.) on Saturday called for the Justice Department inspector general to investigate an alleged plan by former President Trump and a DOJ lawyer to remove the acting attorney general and replace him with someone more willing to investigate unfounded claims of election fraud. (Axios)

EQUITIES: Hedge funds have fallen back in love with technology giants after spending the final months of last year cutting back on these stocks. Just days before earnings land from the likes of Apple Inc. and Amazon.com Inc., professional investors turned more upbeat the industry. On Tuesday, the cohort made its largest net buying in a month, according to data compiled by Goldman Sachs Group Inc.'s prime brokerage. As a result, their net exposure in tech megacaps jumped at one of the fastest paces in recent years. (BBG)

BONDS: The high-yield bond market is wrapping up what's likely to be the busiest January on record next week as investors continue to pour cash into risky assets as they hunt for higher RETURNS. Sales stand just about $1.2 billion below the current January peak of $37 billion, which was set in the first month of 2020. Yields on CCC debt, the riskiest of junk bonds, hit an all-time low Thursday as investors have moved down in credit quality in search for returns. More than $13 billion of high-yield notes priced this week with debt rated in the CCC tier representing about a third of the volume. (BBG)

OTHER

U.S./CHINA: Looking to reset the troubled U.S.-China relationship, Beijing is pressing for a meeting of its top diplomat with senior aides to President Biden to explore a summit between the two nations' leaders, according to people with knowledge of the initiative. Beijing raised the idea starting in December of dispatching Yang Jiechi, a member of the Politburo, the Communist Party's top decision-making body, to Washington. The proposal, made soon after President Xi Jinping congratulated Mr. Biden on his election victory, was through letters by the Chinese ambassador to the U.S., Cui Tiankai, and through conversations with intermediaries. (WSJ)

U.S./CHINA: U.S. President Joe Biden's administration this week will release more policies it believes are needed to tackle climate change and is urging China to toughen one of its targets on greenhouse gas emissions, his top climate advisers said on Saturday. (RTRS)

U.S./CHINA/TAIWAN: Chinese air force planes including 12 fighter jets entered Taiwan's air defence identification zone for a second day on Sunday, Taiwan said, as tensions rise near the island just days into U.S. President Joe Biden's new administration. (RTRS)

U.S./CHINA/TAIWAN: The new Biden administration in Washington should send out a clear signal to differentiate itself from the previous administration's policy on Taiwan, the Global Times said in an editorial. The editorial urged the restoration of control over the Taiwan Straits on the basis of the one-China principle after fighter jets of the People's Liberation Army conducted warning exercises to the southwest airspace of the island. The Global Times warned that if the new White House follows the extreme policies of its predecessor, the situation was doomed to deteriorate and PLA jets were likely to appear over Taiwan. (MNI)

U.S./UK: President Biden and British Prime Minister Boris Johnson discussed on Saturday issues including trade, NATO and the coronavirus pandemic in their first phone call since the U.S. leader's inauguration. (Axios)

GEOPOLITICS: China's passed a controversial law that gives the coast guard more freedom to fire on foreign vessels, a move that could fuel the risk of military miscalculation in the Western Pacific. The law is aimed at "safeguarding national sovereignty, security and maritime rights," the official Xinhua News Agency said in a report early Saturday. The law will take effect from Feb. 1. (BBG)

GLOBAL TRADE: Britain will court the new administration in Washington by stepping up its attack on the Chinese state's warping of global markets with subsidies. Liz Truss, the Trade Secretary, is to push the case for reform of the global trading system in an address to the virtual Davos summit next week and is bidding to join an international alliance to intensify the pressure on the authoritarian state. The US, European Union and Japan hit out at China's vast system of subsidies a year ago and have pressed for tougher rules against the trade-distorting practices to be imposed by the World Trade Organisation. (Telegraph)

GLOBAL TRADE: Taiwan's Economic Ministry is asking domestic chip manufacturers such as Taiwan Semiconductor Manufacturing Co. to help "like-minded" economies alleviate the global shortage of automotive-related chips. (Nikkei)

GLOBAL TRADE: China overtook the U.S. as the world's top destination for new foreign direct investment last year, as the Covid-19 pandemic amplifies an eastward shift in the center of gravity of the global economy. New investments by overseas businesses into the U.S., which for decades held the No. 1 spot, fell 49% in 2020, according to U.N. figures released Sunday, as the country struggled to curb the spread of the new coronavirus and economic output slumped. China, long ranked No. 2, saw direct investments by foreign companies climb 4%, the United Nations Conference on Trade and Development said. Beijing used strict lockdowns to largely contain Covid-19 after the disease first emerged in a central Chinese city, and China's gross domestic product grew even as most other major economies contracted last year. (WSJ)

CORONAVIRUS: Early evidence suggests the variant of coronavirus that emerged in the UK may be more deadly, Prime Minister Boris Johnson said. However, there remains huge uncertainty around the numbers - and vaccines are still expected to work. The data comes from mathematicians comparing death rates in people infected with either the new or the old versions of the virus. The new more infectious variant has already spread widely across the UK. (BBC)

CORONAVIRUS: Pfizer will provide up to 40 million doses of its Covid-19 vaccine, which it developed alongside BioNTech, to a global alliance aiming to provide poor nations with coronavirus vaccines, the head of the World Health Organization said on Friday. WHO's Director-General Tedros Adhanom Ghebreyesus said the deal will allow Covax — co-led by the WHO — to begin delivering vaccine doses to participating countries in February. The program aims to provide 2 billion doses of vaccines to participating countries, which includes low- to-middle income nations, by the end of this year. (CNBC)

CORONAVIRUS: A team of Canadian researchers believe they have found the first oral weapon against Covid-19 in a drug already used for other diseases. Colchicine, a remedy for gout, is the first "effective oral drug to treat out-of-hospital patients", said Jean-Claude Tardif, director of the Montreal Heart Institute and professor of medicine at the Université de Montréal. (FT)

CORONAVIRUS: Researchers at Oxford University are planning the first, large high-quality trial of a cheap drug that has been credited with dramatically reducing Covid-19 deaths in the developing world. The Principle trial is hunting for treatments that could be used at home soon after symptoms appear. The aim is to find a medicine that makes an impact during the earliest stages of disease, preventing severe illness. The next batch of medicines it will assess will include ivermectin. Used for decades to treat livestock and people infested with parasitic worms, it has been hailed as a Covid "wonder drug" by supporters. However, many other scientists say that it is yet to be properly evaluated. (The Times)

CORONAVIRUS: The government of German Chancellor Angela Merkel warned of possible attacks by opponents of vaccinations or coronavirus skeptics on vaccine facilities. Due to "great media attention as well as the high dynamics and emotion" surrounding the topic, there is the threat of physical or cyber attacks on vaccination centers, transportation companies and producers, the German Interior Ministry said in a paper seen by Bloomberg. (BBG)

HONG KONG: Hong Kong signaled more lockdowns in the future after deeming its first such measure, imposed on an area of Kowloon over the weekend, successful in detecting 13 new cases. The lockdown, which affected 10,000 people, was in effect for two days in Kowloon's Yau Ma Tei and Jordan areas where about 7,000 residents were tested. The order was effective in identifying infected patients and isolating them and their close contacts quickly, said Food and Health Secretary Sophia Chan on Sunday at a media briefing. "If there is such a need, obviously we do not rule out the possibility of any future operation like this," she said. (BBG)

JAPAN: Japanese companies are cutting capital investment by 2.9% from initial plans for the fiscal year ending March 31, a Nikkei survey shows, as the coronavirus drives the largest drop since such data was first collected in the 1990s. Yet some businesses are defying the trend as they continue to make long-term investments in decarbonization, medicine and digitization. The revised investment plans total 24 trillion yen ($232 billion), the survey of 958 major listed corporations found at the end of November. This represents a decline of 3.5% from the previous year, the largest annual decrease in four years. Manufacturers cut their plans by 3.8%, while nonmanufacturing sectors sliced spending by 1.7%. Of all 32 industries surveyed, 24 had cuts. The chemical, air transport and rubber sectors saw particularly big reductions. (Nikkei)

AUSTRALIA: Australia's drug regulator provisionally approved the Covid-19 vaccine developed by Pfizer Inc. and BioNTech SE, clearing the way for the country's first jabs in late February. Aged-care and disability-care residents and workers, front- line healthcare workers, quarantine and border workers will receive the vaccine first, Prime Minister Scott Morrison said in a statement. (BBG)

AUSTRALIA: The Australian states of Victoria and Tasmania have signed a quarantine agreement to allow seasonal workers from Pacific Island nations to work on farms this year. Under the deal between the two governments an initial 1,500 workers will be quarantined in Tasmania before arriving in Victoria for harvest work. (FT)

AUSTRALIA/CHINA: After loading up with coal the DZ Weihai slipped into the turquoise waters off the coast of Australia this month and began a 14-day voyage to the southern Chinese port of Yangpu. How long the ship waits to discharge its cargo upon arrival is anyone's guess. Despite a Chinese ban on coal imports from Australia that's left about 70 ships, 1,400 seafarers and 6.4 million tons of the fuel in offshore limbo, some vessels continue to make the voyage. While the stranded cargoes and crew are trapped between authorities who won't let them unload and buyers who won't let them leave, perhaps most curious of all is what is driving additional shipments. While mundane matters like contractual commitments play a role, traders are likely motivated by a mixture of hope and money. China is considering accepting cargoes that arrived before the ban boosting optimism restrictions could ease. If they do, a windfall awaits as the gap between Chinese and Australian coal prices has widened to a record. (BBG)

NEW ZEALAND: A 56-year-old woman who fell ill several days after leaving a quarantine facility in Auckland earlier this month is confirmed to be infected with the South African variant of the coronavirus, New Zealand's Minister for Covid Response Chris Hipkins said Monday. The source of the infection is highly likely to be a fellow returnee during the person's quarantine. The woman occupied a room in close proximity, on the same floor of the hotel. "I am advised by officials that the contact was a direct one, and that there is no other missing link in between those two people," the minister said. There are 79 active cases of Covid-19 in New Zealand as of Jan. 24. (BBG)

SOUTH KOREA: Chung Sye-kyun, South Korea's prime minister, on Monday expressed concern over a large-scale cluster infection at an unauthorised missionary school as the country's daily coronavirus infections bounced back to more than 400. The rebound came as 127 new cases were reported at a religious boarding school in the central city of Daejeon, 164km south of Seoul. (FT)

SOUTH KOREA: South Korea's ruling Democratic Party weighs seeking both cash handout payment to all citizens and compensating small businesses for losses from shutdown on social distancing rules, Chosun Ilbonewspaper reports, citing an unidentified official at the party. Discussion on cash handout will begin after Lunar New Year holiday if virus spread contained. Compensation for business shutdown will be discussed at parliament in Feb. (BBG)

SOUTH KOREA: The Bank of Korea (BOK) has expressed optimism for the super-expansionary fiscal policy of U.S. President Joe Biden's new administration. "The planned implementation of new pump-priming measures by the Biden administration will mitigate weak consumption in the first half of the year," the central bank said in a report on the global economy, Sunday. The BOK said hopes for a U.S. economic recovery would have a positive impact for a rebound of other major economies across the globe throughout 2021. (Korea Times)

NORTH KOREA: The top U.S. intelligence officer for North Korea warned on Friday the country sees diplomacy only as a means to advance its nuclear weapons development, even as the new Biden administration says it will look for ways to bring Pyongyang back to talks. President Joe Biden's nominee for secretary of state, Antony Blinken, said on Tuesday the new administration planned a full review of the U.S. approach to North Korea to look at ways to increase pressure on it to return to the negotiating table. (RTRS)

TURKEY: Turkish President Tayyip Erdogan reaffirmed his strong opposition to high interest rates on Friday, a day after the central bank said it would maintain a tight monetary policy for "an extended period". Calls by Erdogan, a self-described "enemy" of interest rates, for lower borrowing costs have rattled investors in the past and prompted concerns about the independence of the central bank. (RTRS)

TURKEY: If the EU decides to impose further sanctions against Turkey it will ruin the dialogue between Ankara and Brussels, said Turkish Foreign Minister Mevlüt Çavuşoğlu. However, if the EU opts to avoid sanctions and reenergize accession talks, then Ankara is ready to meet all the criteria, Çavuşoğlu told POLITICO in an interview during a two-day visit to Brussels this week, where he met with top EU officials including European Commission President Ursula von der Leyen and European Council President Charles Michel, as well as some MEPs and NATO Secretary-General Jens Stoltenberg. (POLITICO)

TURKEY/RATINGS: Sovereign rating reviews of note from Friday included:

- S&P affirmed Turkey at B+; Outlook Stable.

MEXICO: The United States plans to reverse the Trump administration's "draconian" immigration approach while working on policies addressing the causes of migration, President Joe Biden told his Mexican counterpart, the White House said on Saturday. In a Friday call with Mexican President Andrés Manuel López Obrador, Biden outlined his plan to create new legal pathways for immigration and improve the process for people requesting asylum, according to an account of the call released by the White House. Priorities include "reversing the previous administration's draconian immigration policies," the White House said. The two leaders agreed to work together towards reducing "irregular migration," the White House release said. (RTRS)

MEXICO: Leaders from Mexico's senate and the lower house of Congress will hold talks on Monday on a bill that would force the central bank to purchase bulk cash from Mexican lenders who can't get rid of it elsewhere. Lawmakers from both houses will hold a virtual meeting at 5 p.m. local time in Mexico City to form a technical working group on the bill ahead of the next congressional session in February, according to an internal congressional document seen by Bloomberg News. They will vote on launching a public debate on the bill. Last week, President Andres Manuel Lopez Obrador, said lawmakers needed to find a solution that wouldn't affect the central bank's autonomy or risk conflict with international financial organizations. The Banco de Mexico and global lenders have warned the bill in its current form could open the monetary authority to U.S. money laundering sanctions. (BBG)

MEXICO: Mexican President Andres Manuel Lopez Obrador said in a tweet he is infected with Covid-19. He said his symptoms are light and he is receiving treatment. (BBG)

MEXICO: Andrés Manuel López Obrador, Mexico's president, plans to call Russia's Vladimir Putin on Monday morning to discuss the Sputnik V Covid-19 vaccine, the government said. (FT)

BRAZIL: Brazilian protesters took to the streets to call for President Jair Bolsonaro's impeachment as his administration faces criticism over a slow coronavirus vaccination roll-out and a surging death toll from the pandemic. Motorcades clogged main avenues of cities including Rio de Janeiro and Sao Paulo, honking horns and carrying signs calling for the president's removal. Sunday's demonstrations were backed by conservative groups, while Saturday protests were organized by left-wing political parties and labor unions. (BBG)

RUSSIA: The Kremlin played down nationwide protests demanding the release of jailed opposition leader Alexey Navalny -- Russia's biggest since at least 2018 -- as Western governments condemned the detention of thousands of demonstrators. Braving clashes with riot police, freezing temperatures and threats they could face charges of "mass disorder" for the unauthorized gatherings, tens of thousands turned out in dozens of cities across the world's largest country on Saturday. Police detained at least 3,592 people, the OVD-Info monitoring group reported. The U.S. and the European Union urged they be freed. But while one pollster put the number of protesters in Moscow at as many as 35,000, Kremlin spokesman Dmitry Peskov claimed turnout was much smaller, and that backing for President Vladimir Putin remains strong. (BBG)

RUSSIA: Poland's president Andrzej Duda has urged the EU to step up its sanctions on Russia in the wake of the summary arrest and jailing of Alexei Navalny, the anti-corruption activist who has become Vladimir Putin's most prominent critic. (FT)

RUSSIA: A pipe-laying vessel has started work in Danish waters ahead of the resumption of construction of the Nord Stream 2 gas pipeline, the consortium behind the project said on Sunday, amid pressure from the United States and European Union to halt it. (RTRS)

IRAN: Iran urged new U.S. President Joe Biden on Friday to "choose a better path" by returning to a 2015 nuclear deal between Tehran and global powers, but said the opportunity would be lost if Washington insists on further Iranian concessions up front. (RTRS)

MIDDLE EAST: The Saudi-led coalition fighting against Yemen's Houthi movement said it had thwarted an attack by the Houthis on Saturday towards the Saudi capital Riyadh, the kingdom's state-owned broadcaster Al-Hadath TV reported on its Twitter page. Since 2015 the Saudi-led coalition has been fighting the Iran-aligned Houthi movement, which has launched cross-border missile and drone attacks on Saudi cities. (RTRS)

MIDDLE EAST: Israel has agreed to let the U.S. deploy Israeli-made Iron Dome missile defense systems in its military bases in the Persian Gulf, Europe, and elsewhere in Asia, the Haaretz newspaper reported. The unidentified Israeli security officials cited in the report declined to reveal where the batteries will be deployed, the newspaper said. Two have already been delivered, according to Haaretz. (BBG)

SAUDI ARABIA: Saudi Arabia replaced its central bank governor and said that it would more than double the size of its sovereign wealth fund by 2025 in a series of late-night announcements ahead of the crown prince's flagship investment conference. (BBG)

OIL: The Opec+ alliance achieved 99pc compliance with its collective production cut in December, according to two Opec+ sources, down from 101pc in November. The group's 10 participating Opec countries were 103pc compliant with their cut pledges last month, down from 104pc in November, while the 10 non-Opec participants were 93pc compliant, also down on the month from 95pc. (Argus Media)

OIL: Iraq plans to cut oil output in January and February to make up for breaching its OPEC+ quota last year, according to the state company that markets the nation's crude. OPEC's second-biggest producer will pump around 3.6 million barrels daily for the two months, according to Ali Nizar, the deputy head of SOMO. That compares with around 3.85 million in December, according to data compiled by Bloomberg. (BBG)

OIL: Canadian Prime Minister Justin Trudeau on Friday expressed his "disappointment" with President Biden's executive order to rescind permits for the Keystone XL pipeline, in a readout of the president's first official call with a foreign leader. The prime minister has long backed the pipeline meant to carry crude oil from Alberta to Nebraska. Biden, however, campaigned on the cancellation of the Keystone XL pipeline. (Axios)

OIL: Canada's energy minister said the country must "respect" Joe Biden's decision to scrap the controversial Keystone XL pipeline and dismissed calls from provincial politicians to pursue punitive measures against the US. "This was a significant campaign promise by candidate Biden. It is one that he has kept as President Biden," said Seamus O'Regan, the natural resources minister in the federal Liberal government. "We have to respect that." (FT)

OIL: The expansion of Canada's government-owned Trans Mountain pipeline assumes greater importance for the oil sector after the cancellation of rival Keystone XL reduced future options to carry crude, potential buyers say. Trans Mountain Corp, a government corporation, is spending C$12.6 billion ($9.9 billion) to nearly triple capacity to 890,000 barrels per day (bpd), a 14% increase from current total Canadian capacity. (RTRS)

OIL: Libya's resurgent crude exports could face a massive blow, as a militia controlling three key eastern terminals is threatening to shut down shipments in a long-festering salary dispute. The Petroleum Facilities Guard militia group has begun a strike at the Ras Lanuf, Marsa el-Hariga and Es Sider terminals, demanding the immediate "disbursement of all salaries, health insurance payments, and other oilfield-related payments," it said in a Jan. 24 statement. (Platts)

OIL: Libya restarted a pipeline that carries crude oil to its biggest export terminal, after a halt that caused the OPEC member's production to drop to the lowest level in two months. (BBG)

OIL: The European Union plans to use its diplomatic and economic muscle to accelerate global energy transition away from fossil fuels, as the bloc aligns its foreign and security policy with its ambitious climate objectives. (BBG)

OIL: Indonesian authorities said that they seized an Iranian tanker and Panamanian tanker suspected of carrying out the illegal transfer of oil in their country's waters Sunday. The tankers — the Iranian-flagged MT Horse and the Panamanian-flagged MT Frea — were seized in waters off Indonesia's West Kalimantan province, said Wisnu Pramadita, a spokesman for the Indonesian Maritime Security Agency. (Associated Press)

CHINA

CORONAVIRUS: Health authorities in China recorded 117 new cases of Covid-19 within the country on Monday, almost doubling from a day earlier as it battles outbreaks in several provinces. (FT)

POLICY: Chinese Premier Li Keqiang has underscored the importance of precise and effective macro-control policies to address the development needs of market entities and further spur their vitality and social creativity. Li, also a member of the Standing Committee of the Political Bureau of the Communist Party of China (CPC) Central Committee, made the remarks Thursday while presiding over a symposium attended by experts, scholars and entrepreneurs. (Xinhua)

PBOC: The PBOC is likely to inject liquidity by rolling over maturing MLFs before Feb. 11, prior to the Chinese New Year, the China Securities Journal reported citing analysts. The PBOC will also use reverse repos or even temporary tools such as Contingent Reserve Arrangement (CRA) to inject liquidity, although RRRs are likely to remain unchanged, the newspaper said. More than CNY800 billion liquidity may be siphoned off this week as various monetary instruments expire, the newspaper noted. (MNI)

PROPERTY: Chinese cities with hot real estate markets may follow Shanghai and Shenzhen in moderating house prices through higher transaction costs and boosting the supply of homes, the Chinese Securities Journal reported. Many existing policies on property purchases had been devised five years ago, and they should be reinforced and updated to address new forces driving the markets such as talent-attracting programs, the Journal said. (MNI)

OVERNIGHT DATA

JAPAN DEC TOKYO CONDOMINIUMS FOR SALE +15.2% Y/Y; NOV -15.3%

AUSTRALIA DEC, P TRADE BALANCE +A$8.956BN; NOV +A$5.022BN

AUSTRALIA DEC, P EXPORTS +16% M/M; NOV +3%

AUSTRALIA DEC, P IMPORTS -9% M/M; NOV +10%

CHINA MARKETS

PBOC NET DRAINS CNY240.5BN VIA OMOS MONDAY

The People's Bank of China (PBOC) injected CNY2 billion via 7-day reverse repos with the rate unchanged on Monday. This resulted in a net drain of CNY240.5 billion given the maturity of CNY2 billion of reverse repos and CNY240.5 billion of Targeted Medium-term Lending Facilities (TMLFs) today, according to Wind Information.

- The operation aims to maintain the liquidity in the banking system at a reasonable and ample level, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.2086% at 09:36 am local time from 2.3504% at Friday's close.

- The CFETS-NEX money-market sentiment index closed at 37 on Friday vs 44 on Thursday. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.4819 MON VS 6.4617

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4819 on Monday. This compares with the 6.4617 set on Friday, marking the biggest daily drop in recent five trading days.

MARKETS

SNAPSHOT: Optimism Outweighs Negatives In Asia

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 100.04 points at 28733.84

- ASX 200 up 24.333 points at 6824.7

- Shanghai Comp. up 27.278 points at 3634.028

- JGB 10-Yr future up 3 ticks at 151.89, yield down 1.3bp at 0.036%

- Aussie 10-Yr future up 1.5 ticks at 98.880, yield down 1.4bp at 1.113%

- U.S. 10-Yr future -0-02 at 136-31, yield up 0.85bp at 1.094%

- WTI crude down $0.02 at $52.25, Gold down $0.24 at $1855.38

- USD/JPY down 5 pips at Y103.72

- ECB'S REHN: YIELD CURVE CONTROL NONSENSICAL FOR EURO AREA (BBG)

- EU HIT BY DELAY TO OXFORD/ASTRAZENECA VACCINE DELIVERY

- TOP ADVISER: FRANCE PROBABLY NEEDS NEW LOCKDOWN AS EARLY AS FEBRUARY (RTRS)

- SANDERS SAYS DEMOCRATS WILL PUSH CORONAVIRUS RELIEF PACKAGE THROUGH WITH SIMPLE MAJORITY (AXIOS)

- U.S STATE DEP'T URGES BEIJING TO CEASE MILITARY, DIPLOMATIC & ECONOMIC PRESSURE AGAINST TAIWAN (RTRS)

- PBOC MAY USE CRA TO STABILIZE LIQUIDITY BEFORE HOLIDAY (CSJ)

BOND SUMMARY: Tight Overnight Trade For Core FI

T-Notes have stuck to a narrow range in Asia-Pac trading, with downside limited, even with e-minis bid (NASDAQ 100 futures have tagged fresh all-time highs ahead of this week's earnings slate, which includes quarterly results from Apple, Microsoft & Facebook). The contract last deals -0-02 at 136-31, sticking to a 0-03+ range. Cash trade has seen some light bear steepening, with 30s sitting around 1.0bp cheaper than Friday's closing levels. On the flow side, further fresh TYJ1 downside exposure was seen, once again via the 138.00/133.50 risk reversal (this time hedged with 5.0K FV futures), with 30.0K lots of new Asia-Pac downside exposure via TYJ1 risk reversals established over the last week or so. Elsewhere, BBG sources pointed to a potential multi-tranche round of issuance from 7-Eleven, which could total ~$11bn.

- JGB futures consolidated within their overnight session range during Tokyo trade, operating in familiar territory, last +4 vs. Friday's settlement. Cash trade generally saw a light bid across the curve, with 5- & 10-Year JGBs seeing some light outperformance. There was little to go off for the space, with the size of the latest round of BoJ 1-10 Year Rinban operations left unchanged, while the offer to cover ratios of the operations provided nothing in the way of market moving impetus.

- In Australia, the broader round of muted core FI trade observed during Asia-Pac hours was compounded by the impending Australia Day holiday (which will be observed on Tuesday), leaving local bond futures to stick to the ranges that were established in the final overnight trading session of last week. YM unch., XM +1.5 last. Cash ACGB trade has seen some light bull flattening, with swaps generally wider across the curve.

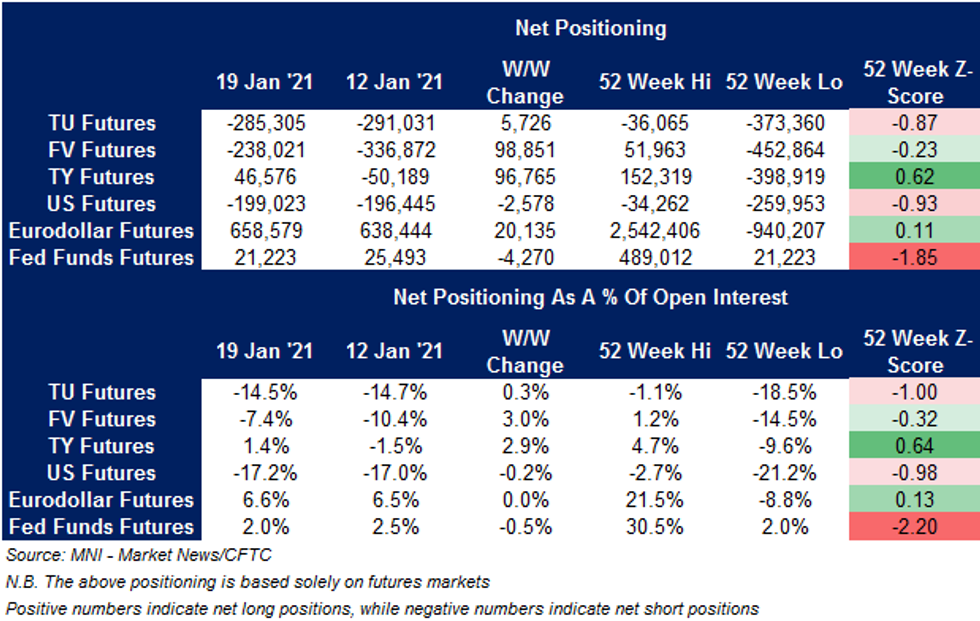

US TSYS: No Standout Moves In Latest CFTC CoT Positioning

Little in the way of decisive movement in overall net positioning for the U.S. FI space in the latest weekly CFTC CoT report, with the re-establishment of overall net long TY exposure (after one week of residing in net short territory) and trimming of FV net shorts providing the highlights. Still, neither of the metrics witnessed jumps outside of their respective established ranges.

BOJ: 1-10 Year Rinban Sizes Unchanged

The BoJ offers to buy a total of Y1.29tn of JGB's from the market, sizes unchanged from previous operations.

- Y450bn worth of JGBs with 1-3 Years until maturity

- Y420bn worth of JGBs with 3-5 Years until maturity

- Y420bn worth of JGBs with 5-10 Years until maturity

EQUITIES: U.S. Stimulus Hope Boosts Stocks

A positive start to the week for equity indices; most Asia-Pac bourses are in the green and U.S./European futures have taken the hint with major bourses in the green.

- The early uptick in e-minis/Asia-Pac equities is being linked to weekend comments from U.S. Senator Bernie Sanders (who will chair the Senate Budget Committee). Sanders noted that the Democrats will push through the Covid-19 relief package via the reconciliation approach (simple majority vote, with VP Harris casting the deciding vote in the case of a tie), if required. This stance is broadly in line with expectations, while President Biden has indicated his preference for bipartisan agreement re: the matter we have stressed that the Democrats would likely use reconciliation measures to push through this leg of fiscal support, and as such, only rely on the backing of all of the party's own Senators.

- Elsewhere, news that Hong Kong's partial lockdown (covering some of the district of Kowloon) only unearthed 13 positive Covid cases and has now been relaxed, as scheduled, supported the Hang Seng which gained over 2%. The KOSPI also saw strong gains.

- NASDAQ 100 futures have tagged fresh all-time highs ahead of this week's earnings slate, which include quarterly results from Apple, Microsoft & Facebook

OIL: Lower On Demand Concerns

Oil is lower in Asia, extending losses from Friday. WTI last down $0.06 at $52.51, brent is $0.11 higher at $55.30. Data released on Friday showed headline crude inventories rose 4.35m bbls against expectations of a decline, the increase was the first gain since early December.

- Signs of potentially weaker demand are weighing on markets as coronavirus cases surge. Fresh lockdowns are being imposed around the world and many countries are considering or implementing travel bans.

- Supporting oil prices is the announcement from Iraq that it would reduce January and February output to make up for exceeding its OPEC+ quota last year. Also supporting prices were reports that members of a Libya's oil guards, the paramilitary force responsible for safeguarding oil ports, ordered a halt in crude exports at three eastern terminals during a pay dispute.

GOLD: Narrow

Bullion has steadied in Asia, with U.S. yields rangebound and the broader DXY a touch lower on the day, allowing participants to step back and assess matters after Friday's recovery from intraday lows. Spot last deals little changed around the $1,855/oz mark, with the broader technical picture unchanged from Friday.

FOREX: Risk Sentiment Turns Positive, Commodity-Tied FX Firm Up

Asia-Pac equity benchmarks firmed up at the start to the week, with commodity-tied FX rising in tandem. Sentiment was aided by the relaxation of Hong Kong's partial lockdown and weekend comments from U.S. Senator Sanders, who suggested that Democratic lawmakers may pass the Covid-19 relief package via the reconciliation approach (using a simple majority).

- NZD/USD shook off its initial weakness, seen after New Zealand reported its first community case of Covid-19 in two months, and returned onto the $0.7200 handle. AUD/NZD was trapped within a familiar range, as both Antipodean currencies sat atop the G10 pile.

- Safe havens cheapened amid broader appetite for riskier FX. USD/JPY crept higher into the Tokyo fix, perhaps on the back of Gotobi day demand, before easing off later in the session. The DXY faltered but last Friday's low remained intact.

- PBOC fixed USD/CNY at 6.4816, in line with sell-side estimates.

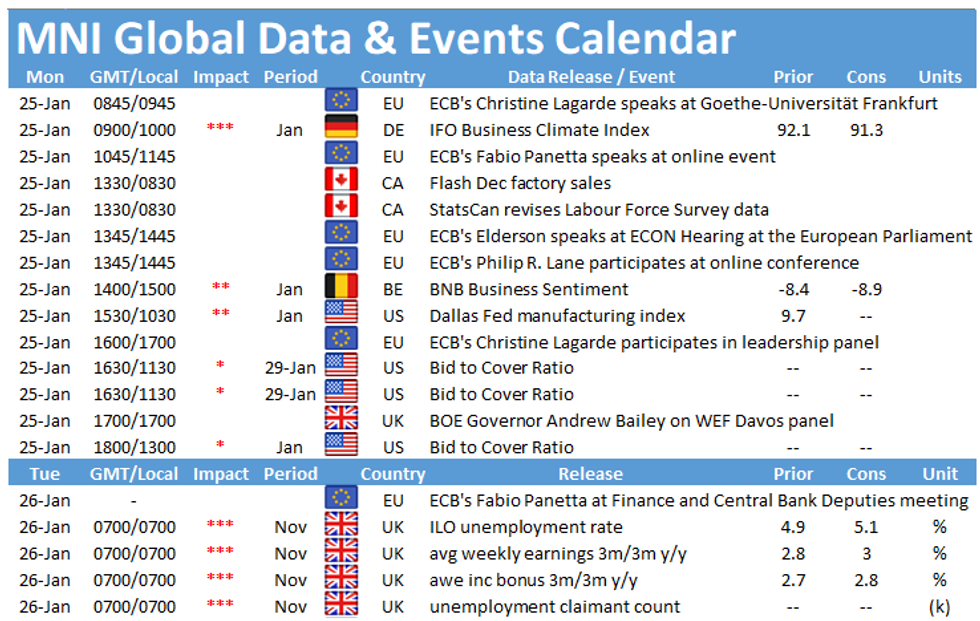

- Coming up today we have German IFO Survey and a speech from EU Justice Commissioner on the rule-of-law mechanism. As a reminder, the World Economic Forum kicks off, adding to the central bank speaker slate. Remarks are due from ECB's Lagarde, Panetta, Lane, Mahklouf & Weidmann, PBoC Gov Yi and BoE Gov Bailey.

FOREX OPTIONS: Expiries for Jan25 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1975(E556mln), $1.2000(E563mln), $1.2050-70(E658mln), $1.2090-1.2100(E519mln), $1.2230-40(E1.2bln-EUR puts), $1.2245-55(E936mln)

- USD/JPY: Y103.25-35($601mln-USD puts)

- GBP/USD: $1.3370-80(Gbp689mln)

- AUD/USD: $0.7550(A$2.8bln), $0.7650(A$1.4bln), $0.7690-0.7700(A$700mln), $0.7750(A$768mln), $0.7800(A$711mln)

- USD/CAD: C$1.2700($603mln-USD puts), C$1.2900($536mln-USD puts)

- USD/CNY: Cny6.5700($1bln)

- USD/MXN: Mxn19.50($550mln), Mxn20.00-01($543mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.