-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Mixed Findings For Novavax Vaccine, U.S. Retail Trading Matters Eyed

- NOVAVAX SHOT MORE EFFECTIVE IN UK THAN IN SOUTH AFRICA (BBG)

- ITALY'S RENZI READY TO SUPPORT NEW GOVERNMENT TO AVOID SNAP VOTE (BBG)

- EU RAMPS UP VACCINE BATTLE (BBG)

- REGULATORS & GOV'T LOOKING AT U.S. RETAIL TRADING

- KLAIN: BIDEN RELIEF PROPOSAL GAINING MOMENTUM IN CONGRESS (CBS)

- PBOC MAY EXPAND LIQUIDITY INJECTION BEFORE HOLIDAY (FIN. NEWS)

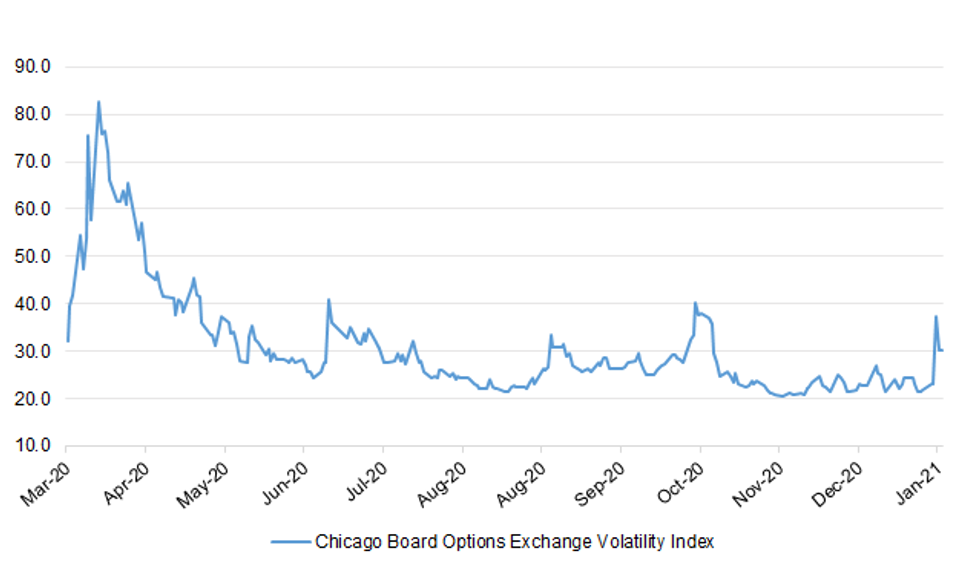

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Nicola Sturgeon has been accused of siding with the EU in its battle with the UK over vaccine doses, with the Scottish First Minister pledging to publish confidential vaccine data despite warnings that the information could jeopardise the UK's supply. (Telegraph)

ECONOMY: More than one in eight UK workers were furloughed at the end of December while nearly £6 billion was claimed in the last two months of the year. Government data shows that 13 per cent of employees across the country were furloughed under the coronavirus job retention scheme on December 31, and that more than one in three employers were claiming money to pay their staff as part of the scheme. The figures for last month, when just under £3 billion was claimed, were down from November but still higher than October. (The Times)

BREXIT: The U.K.'s five main business lobby groups said British companies face "substantial" post-Brexit difficulties in trading with the European Union after holding a call with Cabinet Minister Michael Gove. The so-called B5 -- the British Chambers of Commerce, Confederation of British Industry, Federation of Small Businesses, Institute of Directors and Make UK -- described the call among members of the government's Brexit Business Taskforce as "productive" in a joint statement issued late Thursday. (BBG)

EUROPE

ECB: European Central Bank Executive Board member Isabel Schnabel said the mutual interdependence of banks and governments can boost economic growth after the pandemic -- in contrast to the bloc's sovereign debt crisis when it was seen as fundamental problem. "Contrary to the vicious 'sovereign-bank' nexus that plagued the euro area throughout most of the last decade, the current nexus, if managed properly, can be an engine for a faster recovery, which also supports the ECB's price-stability mandate," she said at online conference on Thursday. Such a view is a departure from years of trying to break the mutual reliance of governments and banks on each other. During the last euro-zone crisis, investor doubts over the sustainability of government debt plunged lenders intro trouble as their bond holdings collapsed in value. That in turn required bailouts that further strained public finances. (BBG)

ECB: European Central Bank Management Committee Martins Kazaks said on Thursday that there is no need to cut policy interest rates at this time because there are better tools to support the hard-hit euro zone economy. The euro zone financial market was hit by market speculation that the European Central Bank might further lower deposit interest rates in the negative range in order to curb the euro's rise this week, but investors quickly ignored this statement. Responding to a question about the "not impossible" rate cut, Kazaks said that he does not think it is necessary to cut interest rates. "There is no need to lower interest rates now," Kazaks said. "In the current situation, there are other more suitable tools." (RTRS)

ECB: MNI INTERVIEW: ECB May Be In Liquidity Trap - Bank Of Greece No2

- The European Central Bank may have lost its ability to boost inflation via monetary policy, the deputy governor of the Central Bank of Greece told MNI in an interview, saying the eurozone was in secular stagnation and that the only way to boost aggregate demand was via public spending - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FRANCE: France confirmed 23,770 new cases and recorded 348 deaths due to the virus in the last 24 hours. The French government is considering another lockdown as new variants of the virus are becoming more common. Still, the number of deaths and new cases on Thursday is similar to the increases recorded Wednesday. The seven-day rolling average of new cases rose slightly on Thursday to 20,381 from 20,249. (BBG)

ITALY: Italy's former premier Matteo Renzi, who triggered the collapse of Italy's government, said he wants a new cabinet soon to avoid new elections. Renzi prompted Prime Minister Giuseppe Conte's resignation by pulling his tiny Italy Alive party out of the ruling coalition, but left the door ajar for Conte to return after meeting with President Sergio Mattarella, who's responsible for choosing a new premier-designate. "Going to elections in this phase would be an error for Italy and for Italians," Renzi told reporters at the presidential palace in Rome. "We need a government quickly." (BBG)

IRELAND: Ireland expects the overall increase in public borrowing since the coronavirus pandemic struck in 2020 will advance to €35bn this year, but Paschal Donohoe, finance minister, expressed confidence that the government can sustain the debt. (FT)

RATINGS: Sovereign rating reviews of note scheduled for after hours on Friday include:

- Fitch on Lithuania (current rating: A, Outlook Stable)

- Moody's on Germany (current rating: AAA; Outlook Stable)

- DBRS Morningstar on Austria (current rating: AAA, Stable Trend) & Ireland (current rating: A (high), Stable Trend)

U.S.

FISCAL: White House chief of staff Ron Klain dismissed concerns that President Joe Biden's proposed $1.9 trillion coronavirus relief bill is dead in the water. Some Republicans have balked at the price tag as Democrats consider other ways to pass the legislation without Republican support. "It's hardly dead in the water," Klain told "CBS Evening News" anchor and managing editor Norah O'Donnell on Thursday. "I think it's gaining a lot of momentum on Capitol Hill. I think you'll see action in the House on it, the first parts of it starting next — the first phases of the legislative process starting next week." (CBS)

FISCAL: House Speaker Nancy Pelosi said Democrats will start the process next week to approve another coronavirus relief bill — with or without Republican support. The chamber plans to pass a budget resolution, a step toward using reconciliation. Through the process, Democrats could pass an aid package without any GOP votes. (CNBC)

FISCAL: Yellen on Thursday took part in a virtual session with owners of small businesses to talk about the public health and economic consequences of the coronavirus pandemic. The secretary, who was confirmed by the Senate on Monday, "listened to the individual stories and painful concerns of these leaders," the Treasury Department said in a statement. Yellen underscored the importance of Biden's relief proposal in the meeting with the seven business people, who came from the Midwest, the South and the West. She also "emphasized how investing in institutions like Community Development Financial Institutions and Minority Depository Institutions can help small businesses left behind during this crisis -- and traditionally excluded from access to capital -- get the resources they need," according to the statement. (BBG)

CORONAVIRUS: US coronavirus hospital admissions on Thursday fell to their lowest level since early December, although the country still reported another day of more than 4,000 deaths. The number of people in US hospitals with coronavirus dropped to 104,303, according to Covid Tracking Project data. That is the lowest number of hospitalisations since December 7. (FT)

CORONAVIRUS: Irritated by the sweeping use of executive orders during the Covid-19 crisis, state lawmakers around the U.S. are moving to curb the authority of governors and top health officials to impose emergency restrictions such as mask rules and business shutdowns. The push is underway in such states as Arizona, Michigan, Ohio, Maryland, Kentucky, Indiana and Pennsylvania, where legislators are seeking a constitutional amendment to strip the governor of many of his emergency powers. (CNBC)

CORONAVIRUS: South Carolina reported two cases of the coronavirus variant first detected in South Africa -- the first cases found in the U.S., the state's Department of Health and Environmental Control reported. The department said the infected people had no known history of travel, and there was no connection between the two cases. (BBG)

CORONAVIRUS: Ohio's statewide curfew was moved to 11 p.m. from 10 p.m., in a relaxing of restrictions because fewer than 3,500 people were hospitalized for Covid-19 for seven consecutive days. "We will look at these numbers again in 2 weeks to potentially move to a midnight curfew or eliminate the curfew completely," Governor Mike DeWine tweeted. States around the nation have begun rolling back restrictions as new infections and hospitalizations have fallen in the last few weeks. (BBG)

EQUITIES: The White House on Thursday declined to weigh in on calls by some U.S. lawmakers to investigate Robinhood's decision to restrict trading in GameStop and other stocks. White House Press Secretary Jen Psaki twice referred reporters to a Wednesday statement from the Securities and Exchange Commission, which said it was monitoring "the ongoing market volatility in the options and equities markets." "We're not going to have additional comment from here," Ms. Psaki said at a White House press briefing. (Dow Jones)

EQUITIES: New York Attorney General Letitia James announced she is looking into recent activity on Robinhood after the trading platform restricted trading of certain securities Thursday, resulting in multiple lawsuits against the company. "We are aware of concerns raised regarding activity on the Robinhood app, including trading related to the GameStop stock," James said in a statement. "We are reviewing this matter." (FOX Business)

EQUITIES: Popular online brokerages restricted trading in highflying stocks including GameStop Corp. and AMC Entertainment Holdings Inc., sapping some of the euphoria around shares of companies that individual investors have sent skyrocketing in recent days. The restrictions, from brokerages including Robinhood Markets Inc., Webull Financial LLC, E*Trade Financial Corp. and Interactive Brokers Group Inc., left traders hoping to capitalize on this week's eye-popping gains with only two options: hold or sell. They also fueled a firestorm of criticism among users and even some members of Congress who have called for hearings on the matter. (WSJ)

EQUITIES: Robinhood Markets told users of its popular stock trading app that it may close out some of their positions as part of measures it's taking to reduce account risks. "Unprecedented volatility" surrounding shares of GameStop Corp. and AMC Entertainment Holdings Inc. and increased risks related to their trading prompted Robinhood to make the move, a spokesperson for the brokerage said. (BBG)

EQUITIES: Robinhood Markets, the trading app that's popular with investors behind this month's wildest stock swings, has drawn down some of its credit lines with banks, according to people with knowledge of the matter. The firm has tapped at least several hundred million dollars, one of the people said. The company's lenders include JPMorgan Chase & Co. and Goldman Sachs Group Inc., according to data compiled by Bloomberg. Representatives for Robinhood and those banks declined to comment.. (BBG)

EQUITIES: Noted short seller Citron Research tweeted the following on Thursday: "Tom morning at 9am EST Citron will be presenting a major announcement that all individual investors should watch. Free Speech and Cautious Investing to all" (MNI)

OTHER

GLOBAL TRADE: U.S. Treasury Secretary Janet Yellen on Thursday told French Finance Minister Bruno Le Maire that she would "re-engage actively" in OECD international tax discussions to forge a timely agreement, the Treasury said in a statement. The call to Le Maire was one of several this week that Yellen has made to her counterparts in allied countries. Treasury said Yellen has discussed U.S. cooperation on ending the pandemic, supporting a strong global recovery, and fighting income inequality and climate change. (RTRS)

CORONAVIRUS: Irish officials are not convinced the so-called U.K. variant of the virus is more deadly than other strains, with no sign that it is more threatening so far. While the variant is more transmissible, there is "no signal in the Irish data that the increasing prevalence of the U.K. variant, the B.1.1.7 variant, was associated with any increase in mortality," health ministry adviser Philip Nolan told reporters in Dublin. (BBG)

CORONAVIRUS: The European Union is poised to tighten rules on the export of Covid-19 vaccines, risking a major escalation in the global battle to secure access to the life-saving shots. With EU governments under fire over the shortfall in deliveries from drugmakers including AstraZeneca Plc, the EU's executive arm will on Friday require companies seeking to ship the inoculations outside the bloc to obtain prior authorization. European Council President Charles Michel has also raised the prospect of effectively seizing control of vaccine production if those measures fail to get the program back on track, a European official said. (BBG)

CORONAVIRUS: A new Covid-19 vaccine from Novavax Inc. was effective in big trials in both the U.K. and South Africa, but the effectiveness appeared to be reduced in South Africa where a worrisome mutation is prevalent. The results indicated that a another highly potent vaccine could soon be available to help ameliorate the pandemic, in addition to existing vaccines from Pfizer Inc., Moderna Inc., and AstraZeneca Plc that are authorized in various countries. But the South Africa results also suggested that the virus is starting to mutate in ways that could make vaccines less effective over time. (BBG)

CORONAVIRUS: Prime Minister Boris Johnson said on Thursday that it was good news the Novavax vaccine for COVID-19 had proved effective in trials in the United Kingdom. "Our medicines regulator will now assess the vaccine, which will be made in Teesside. If approved, we have 60m (million) doses on order," Johnson said on Twitter. (RTRS)

CORONAVIRUS: Boris Johnson and Britain's medicines regulator say they are confident the Oxford-Astrazeneca vaccine works for over-65s after Germany decided not to use it for the age group. The German advisory committee published data suggesting clinical trials had not been able to show that it was effective for older patients, in a challenge to Britain's vaccination strategy. British regulators have acknowledged "uncertainty" about the effects in the older population because of a lack of data. However, they insist it has been shown to be safe and that there is no good reason to think it will stop working once people reach 65. (The Times)

CORONAVIRUS: Results of tests into the efficacy of AstraZeneca Plc's vaccine against the coronavirus variant first identified in South Africa should be known next week. "Studies are being done in South African labs and next week we will have the data on AstraZeneca efficacy with the new variant," said Helen Rees, chairwoman of the World Health Organization's African Region Immunization Technical Advisory Group, on a Webinar on Thursday. (BBG)

CORONAVIRUS: A fourth COVID-19 vaccine could be approved for use in the UK within weeks after late-stage trials suggested it was 89% effective in preventing coronavirus. The prime minister has said the Novavax jab is now going to be assessed by the Medicines and Healthcare products Regulatory Agency (MHRA). If approved, the vaccine would start to be rolled out in the second half of 2021. The UK has already ordered 60 million doses, which are going to be manufactured in Stockton-on-Tees. (Sky)

BOJ: MNI POLICY: BOJ Opinions: Flexible 10-Yr; Side-Effects Eyed

- At least two Bank of Japan board members supported the view that the BOJ would tolerate wider movement in yields on the 10-year Japanese government bond at the January 20-21 policy meeting, according to a summary of opinions at the meeting released on Thursday. One member said: "While monetary easing is expected to be prolonged, allowing 10-year Japanese government bond (JGB) yields to move upward and downward to some extent will meet the investment-management needs of financial institutions through market functioning, and thereby will contribute to financial system stability." A different member said: "Even in a situation where 10-year JGB yields are allowed to move to some extent, the effects on economic activity are likely to be limited, since the proportion of funds that are affected by long-term interest rates is not high among those raised by firms and households" - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

JAPAN: The U.S. government's fiscal situation is clearly worsening and Japan needs to keep watching the market impact, finance minister Taro Aso tells reporters Friday in Tokyo. It's possible that the U.S. dollar could suddenly strengthen and the yen weaken, or vice versa; bond yields could also move. On new U.S Treasury Secretary Janet Yellen, Aso said he generally agrees with the direction of her comments and that she hasn't changed her stance from the past. (BBG)

NEW ZEALAND: New Zealand is mulling tighter restrictions on international arrivals after three people tested positive for Covid-19 despite completing a mandatory quarantine without showing signs of the virus. People may have to self isolate even after finishing two weeks in a government-managed quarantine facility, Director-General of Health Ashley Bloomfield said. People may also be required to have another Covid test, meaning some could face as many as five tests in less than a month. Authorities don't know how the three cases were infected but said they are linked, suggesting they may have contracted the virus while in the hotel. (BBG)

NEW ZEALAND: Ministry of Business, Innovation and Employment publishes jobs online report for three months through September, on website. Trend measure of all vacancies index rises 6.4% q/q. Follows revised 5.1% gain in 3q -- was previously reported as a 9.9% Decline. Seven of nine industries posted q/q increases with business services, hospitality showing declines. From a year earlier, index falls 7.9%. (BBG)

RBNZ: The Reserve Bank of New Zealand – Te Pūtea Matua has released the Terms of Reference for an independent KPMG review of Bank processes following the malicious illegal breach of a third-party file sharing application. Governor Adrian Orr says the review is in addition to the forensic and criminal investigations still under way with a focus on improving systems and work practices. (RBNZ)

SOUTH KOREA: The ruling Democratic Party (DP) has been discussing measures to provide a new round of a COVID-19 relief fund as stringent social distancing rules continue to weigh on small businesses and the self-employed, party officials said. (Yonhap)

MEXICO: Mexico President Andres Manuel Lopez Obrador's Covid-19 case is progressing well and he's practically asymptomatic, Deputy Health Minister Hugo Lopez-Gatell said at a press conference Thursday night. (BBG)

BRAZIL: President Jair Bolsonaro dismissed social distancing measures just as Brazil recorded more than 9 million cases of Covid-19, suggesting that the population will need to learn how to live with the virus. "This issue of Covid will continue for life," he said at his weekly live webcast on social media, adding that local authorities' efforts to reimpose restrictive measures will "lead nowhere." (BBG)

BRAZIL: Brazil's emergency aid adopted last year amid Covid-19 pandemic pushed Brazil's debt capacity to the limit, President Jair Bolsonaro said during webcast. (BBG)

BRAZIL: Brazil's Central Bank sees a rising trend in core inflation, but the move is considered an effect of temporary price shocks, the institution's President Roberto Campos Neto said in a virtual event. Some members of the central bank's board displayed concern about the inflation surge, but agreed to wait for more data to make interest rate decisions. (BBG)

OIL: Russian state oil major Rosneft is courting investments from global trading houses to help develop one of the world's biggest oil deposits, after talks with other possible partners stalled following a collapse in oil prices, four sources familiar with the discussions told Reuters. Rosneft is in discussions with Vitol, Glencore and Gunvor, among others, over investments in its Vostok Oil project in the Arctic, having already secured a deal with Swiss-based Trafigura, which took a 10% stake at the end of last year. (RTRS)

OIL: The U.S. oil industry is seeking to forge an alliance with the nation's corn growers and biofuel producers to lobby against the Biden administration's push for electric vehicles, but is so far meeting a cool reception, according to multiple sources familiar with the discussions. (RTRS)

CHINA

PBOC: China's central bank may increase liquidity injection via open market operation before the lunar new year holiday to meet demand, Financial News, which is published by the PBOC, cites Bank of China researcher Li Yiju as saying in a front-page report. Pre-holiday liquidity needs are lower than last year as China didn't give local bond quota in advance and residents' cash withdrawal demand will decease as many of them will hold back from traveling due to coronavirus outbreaks, Li says. PBOC is expected to adopt multiple policy tools to keep liquidity reasonably ample, report cites an analyst with China Everbright Bank as saying. (BBG)

PBOC: The PBOC drained CNY150 billion yuan on Thursday, pushing up market rates as regulators hoped to prevent asset inflation and excessive arbitraging through unregulated leveraging, the Financial News reported citing Zhou Maohua, an analyst from China Everbright Bank. The overall liquidity demand before the mid-February Lunar New Year has dropped as issuance of local debt quotas was delayed, while demand for cash slowed due to pandemic protocols, the newspaper wrote citing Li Yiju, a researcher from the Bank of China. The PBOC may still inject through OMOs to meet rising demand during the Lunar New Year, the newspaper reported citing Li. (MNI)

YUAN: The Chinese yuan is likely to appreciate over 2021 as the economy continues to perform, though it may come under pressure if the western economies shake off the effects of the pandemic and withdraw easing measures, Huang Yiping, a former member of the PBOC Monetary Policy Committee, said in an interview with the China Finance 40 Forum. Though the Federal Reserve seems unlikely to substantially adjust its monetary policy this year, China should take precautions from now on to prevent possible capital outflows, rising interest rates and currency devaluation, Huang said. (MNI)

ECONOMY: Expect Chinese domestic consumption to recover in 2021. (BBG)

DEFAULTS: The China Banking and Insurance Regulatory Commission (CBIRC) will improve its systems to resolve bond default risks and strictly forbid debt evasions, the Shanghai Securities News reported citing the agency's annual work meeting. The CBIRC will better regulate private placements to avoid risks such as illegal fundraising and lending, punish malicious behaviors such as fraudulent issuance, financial fraud, and market manipulation. It would also supervise the financial system to close all loopholes, according to the News report. (MNI)

OVERNIGHT DATA

JAPAN JAN TOKYO CPI -0.5% Y/Y; MEDIAN -0.9%; DEC -1.3%

JAPAN JAN TOKYO CORE CPI -0.4% Y/Y; MEDIAN -0.6%; DEC -0.9%

JAPAN JAN TOKYO CORE-CORE CPI +0.2% Y/Y; MEDIAN 0.0%; DEC -0.4%

JAPAN DEC UNEMPLOYMENT 2.9%; MEDIAN 3.0%; NOV 2.9%

JAPAN DEC JOB-TO-APPLICANT RATIO 1.06; MEDIAN 1.05; NOV 1.06

JAPAN DEC, P INDUSTRIAL OUTPUT -3.2% Y/Y; MEDIAN -3.1%; NOV -3.9%

JAPAN DEC, P INDUSTRIAL OUTPUT -1.6% M/M; MEDIAN -1.5%; NOV -0.5%

JAPAN DEC HOUSING STARTS -9.0% Y/Y; MEDIAN -3.9%; NOV -3.7%

JAPAN DEC ANNUALISED HOUSING STARTS 0.784MN; MEDIAN 0.815MN; NOV 0.820MN

JAPAN DEC CONSTRUCTION ORDERS -1.3% Y/Y; NOV -4.7%

JAPAN JAN CONSUMER CONFIDENCE INDEX 29.6; MEDIAN 29.0; DEC 31.8

MNI DATA IMPACT: Japan Consumer Confidence Dips In January

- Japan's consumer confidence index fell for a second straight month in January as optimism declined across all major components, pushing the Cabinet Office to lower its assessment, the data released on Friday showed. The index fell to 29.6 in January from 31.8 in December, the latest Consumer Confidence Survey data showed - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

JAPAN DEC LOANS & DISCOUNTS CORP +7.11% Y/Y; NOV +8.05%

AUSTRALIA DEC PRIVATE SECTOR CREDIT +1.8% Y/Y; MEDIAN +1.7%; NOV +1.7%

AUSTRALIA DEC PRIVATE SECTOR CREDIT +0.3% M/M; MEDIAN +0.2%; NOV +0.1%

AUSTRALIA Q4 PPI -0.1% Y/Y; Q3 -0.4%

AUSTRALIA Q4 PPI +0.5% Q/Q; Q3 +0.4%

NEW ZEALAND JAN ANZ CONSUMER CONFIDENCE INDEX 113.8; DEC 112.0

NEW ZEALAND JAN ANZ CONSUMER CONFIDENCE +1.6% M/M; DEC +4.8%

Consumer confidence lifted 2 points to 114 in January, led by optimism about the future. Consumer confidence is now not far off its historical average of around 120. The proportion of people who believe it is a good time to buy a major household item lifted another 3 points. Inflation expectations lifted slightly, and are historically elevated. (ANZ)

SOUTH KOREA DEC INDUSTRIAL OUTPUT +3.4% Y/Y; MEDIAN -0.6%; NOV +0.5%

SOUTH KOREA DEC INDUSTRIAL OUTPUT +3.7% M/M; MEDIAN +0.8%; NOV +0.3%

SOUTH KOREA DEC CYCLICAL LEADING INDEX CHANGE +0.5; NOV +0.7

UK JAN LLOYDS BUSINESS BAROMETER -7; DEC -4

CHINA MARKETS

PBOC NET INJECTS CNY98BN VIA OMOS FRIDAY

The People's Bank of China (PBOC) injected CNY100 billion via 7-day reverse repos with the rate unchanged on Friday. This results in a net injection of CNY98 billion after the maturity of CNY2 billion reverse repos today, according to Wind Information.

- The operation aims to keep the liquidity in the banking system reasonable and ample, as fiscal expenditures have increased significantly by the end of the month, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.3648% at 09:34 am local time from 3.0801% at Thursday's close.

- The CFETS-NEX money-market sentiment index closed at 75 on Thursday vs 62 on Wednesday. A higher index indicates increased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.4709 FRI VS 6.4845

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4709 on Friday. This compares with the 6.4845 set on Thursday.

MARKETS

SNAPSHOT: Mixed Findings For Novavax Vaccine, U.S. Retail Trading Matters Eyed

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 426.67 points at 27774.26

- ASX 200 down 39.694 points at 6608.5

- Shanghai Comp. up 8.195 points at 3513.371

- JGB 10-Yr future down 12 ticks at 151.81, yield up 1.0bp at 0.050%

- Aussie 10-Yr future down 5.0 ticks at 98.865, yield up 4.8bp at 1.126%

- U.S. 10-Yr future unch. at 137-08, yield up 0.34bp at 1.048%

- WTI crude down $0.14 at $52.21, Gold down $0.59 at $1842.54

- USD/JPY up 27 pips at Y104.51

- NOVAVAX SHOT MORE EFFECTIVE IN UK THAN IN SOUTH AFRICA (BBG)

- ITALY'S RENZI READY TO SUPPORT NEW GOVERNMENT TO AVOID SNAP VOTE (BBG)

- EU RAMPS UP VACCINE BATTLE (BBG)

- REGULATORS & GOV'T LOOKING AT U.S. RETAIL TRADING

- KLAIN: BIDEN RELIEF PROPOSAL GAINING MOMENTUM IN CONGRESS (CBS)

- PBOC MAY EXPAND LIQUIDITY INJECTION BEFORE HOLIDAY (FIN. NEWS)

BOND SUMMARY: Cross Currents Result In Mixed Markets

T-Notes have stuck to a 0-04 range, last +0-01 at 137-09, yields little changed across the cash curve. It would seem that some worry surrounding the Novavax COVID vaccine's efficacy re: the South African strain of the virus (which became evident in very late NY trade) limited the steepening impetus that was initially seen after the re-open. A 3.0K screen buyer of TYH1 also helped to support the space. Still, flow was dominated by yet another 10K risk reversal block trade during Asia-Pac hours, this time in the TYJ1 137.00/135.00 strategy, buying the puts to sell the calls (60K worth of TYJ1 risk reversal strategies have crossed over the last week and a half).

- JGB futures sit 11 ticks below settlement levels, which comes on the back of the light pressure seen in core FI during NY hours, while some continue to speculate re: the potential for adjustments to the BoJ's JGB purchase plan for the month of February (which will be released after hours today). Paying flows in swaps also seemed to aid the momentum, with longer dated swap spread widening seen during the morning. There was also some focus on the summary of opinions from the BoJ's January meeting, in which one member of the BoJ board stressed that more flexible management of the Bank's YCC scheme is vital, while one board member also said the same about the Bank's ETF purchases. These are of course assumed to be the central areas in the BoJ's ongoing monetary policy review, with the results set to be released in March. A reminder that local press reports recently suggested that the BoJ will tolerate a wider trading band around the 0% centre point re: 10-Year JGB yields. Elsewhere, the latest round of BoJ Rinban operations saw purchases sizes that were in line with the previous rounds for each respective bucket, while the offer/cover ratios didn't provide any real points of interest.

- Little to pen for the Aussie bond space outside of the aforementioned hedging flow surrounding QTC's A$3.0bn Aug '32 issuance, with a subsequent unwind after the AOFM failed to announce the syndication of a new ACGB Nov '32 within next week's issuance schedule. That leaves the space steeper than settlement, drifting after the two aforementioned swings, with YM -0.5 and XM -5.0, with the latter 1.0 off of worst levels.

JGBS AUCTION: Japanese MOF sells Y5.4434tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y5.4434tn 3-Month Bills:- Average Yield -0.0919% (prev. -0.0922%)

- Average Price 100.0247 (prev. 100.0230)

- High Yield: -0.0875% (prev. -0.0882%)

- Low Price 100.0235 (prev. 100.0220)

- % Allotted At High Yield: 21.2250% (prev. 8.7676%)

- Bid/Cover: 3.787x (prev. 3.164x)

BOJ: Rinban Sizes Unchanged

The BoJ offers to buy a total of Y870bn of JGB's from the market, sizes unchanged from previous operations.

- Y420bn worth of JGBs with 3-5 Years until maturity

- Y420bn worth of JGBs with 5-10 Years until maturity

- Y30bn worth of JGBs with 25+ Years until maturity

AUSSIE BONDS: The AOFM sells A$2.5bn of the 0.25% 21 Nov '24 Bond, issue #TB159:

The Australian Office of Financial Management (AOFM) sells A$2.5bn of the 0.25% 21 November 2024 Bond, issue #TB159:- Average Yield: 0.1793% (prev. 0.1895%)

- High Yield: 0.1800% (prev. 0.1900%)

- Bid/Cover: 4.6000x (prev. 7.0100x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 90.0% (prev. 93.8%)

- bidders 39 (prev. 42), successful 12 (prev. 9), allocated in full 4 (prev. 3)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance schedule:

- On Wednesday 3 February it plans to sell A$1.5bn of the 1.00% 21 December 2030 Bond.

- On Thursday 4 February it plans to sell A$1.0bn of the 23 April 2021 Note & A$500mn of the 27 August 2021 Note.

- On Friday 5 February it plans to sell A$1.0bn of the 0.50% 21 September 2026 Bond.

EQUITIES: Mixed Picture

A mixed picture for stocks in the Asia-Pac time zone to end the week. Bourses in Japan, South Korea and Australia are all down between 1%-2%, but indices in Hong Kong and China are managing to squeeze out some gains.

- US futures are lower, breaching new session lows as we head into the European session after recovering from heavy selling yesterday. While markets initially rebounded after measures were imposed to limit retail traders speculation in meme stocks, the move gave back as some of the stocks in question saw sizeable after hours moves. RobinHood, one of the online brokers, has said it will ease some restrictions on the stocks in question.

- The phenomenon seems to be contagious. The market drama surrounding GameStop is spreading beyond the US as traders look to squeeze heavily shorted stocks. Rakuten and Pigeon Corp. both saw outsized moves in Japan.

- Risk off sentiment is exacerbated by some COVID-19 concerns, the South African strain of coronavirus has now been found in the US, while Germany recommended the AstraZeneca jab not be given to over 65's, and there were reports that the Novavax vaccine is less effective against the new variants.

OIL: WTI Set For Weekly Loss

WTI has been rangebound on Friday, fluctuating around $52.00/bbl, the benchmark last down $0.10 at $52.24. The commodity complex has come under some pressure as the greenback rises and amid general risk off trade in Asia.

- The March brent contract, which expires on today, was up 0.2% to $55.64.

- Demand concerns also weigh with the South Africa strain of coronavirus now found in the US, while Germany recommended the AstraZeneca jab not be given to over 65's, and reports that the Novavax vaccine is less effective against the new variants.

- WTI is down around 0.2% this week, and on track for its second consecutive weekly decline after seeing positive returns for the majority of Q3.

GOLD: Familiar Levels In Play, Despite Thursday Swings

The yellow metal has stuck to familiar territory over the last 24 hours or so, leaving bullion little changed in Asia-Pac trade, with spot sitting a little above $1,840/oz.

- We should flag that the sharp push higher witnessed during Thursday's NY morning was potentially linked to a bid in silver, which in turn was linked to U.S. retail investors seemingly turning their attention to short sellers of the iShares Silver Trust (SLV).

- Bullion then unwound intraday gains during the NY afternoon, even as the dollar softened and U.S. real yields operated on the backfoot (albeit not in a straight line). The DXY is at similar levels vs. this time yesterday, while U.S. real yields sit a little lower in the main.

FOREX: Greenback Firms Up On Month-End Flows, Questions Surrounding Vaccine Effectiveness

USD & CHF gained on safe haven demand, with DXY edging higher amid month-end flows. Concerns over the spread of new strains of the coronavirus and the effectiveness of some Covid-19 vaccines continued to linger, following reports that the Novavax product is less effective against the South African variant of the pathogen & Germany's decision not to administer the AstraZeneca jab to people over 65 years old.

- JPY struggled for any momentum again, despite broader risk aversion. USD/JPY climbed past its 100-DMA, it may have drawn some support from flows ahead of the next Gotobi Day, which falls on a Saturday. Worth noting that $1.3bn worth of options with strikes at Y104.35-45 expire at today's NY cut.

- AUD faltered as iron ore prices remained heavy, while BBG trader source flagged AUD/NZD sales by short-term accounts in reaction to the aforementioned reports re: German doubts over AstraZeneca jab for the elderly. Australia secured 1.2mn doses of the vaccine for Feb, with exp. of 1.6mn more. AUD/NZD dipped under its 100-DMA, with bears hoping for a close below that moving average.

- The kiwi held up relatively well after ANZ Consumer Confidence improved a tad, NZ Tsys financial statements showed narrower deficit than forecast, the RBNZ announced its second QE taper this month, while NZ health officials said they see no evidence of community transmission of Covid-19 in the country.

- The PBOC fixed USD/CNY at CNY6.4709, 38 pips above the CNY6.4671 estimate. The sell side estimates could have been skewed today given the large trading range for the yuan, which has strengthened heading into month-end. The bank injected a net CNY98bn via OMOs after draining around CNY325bn so far this week.

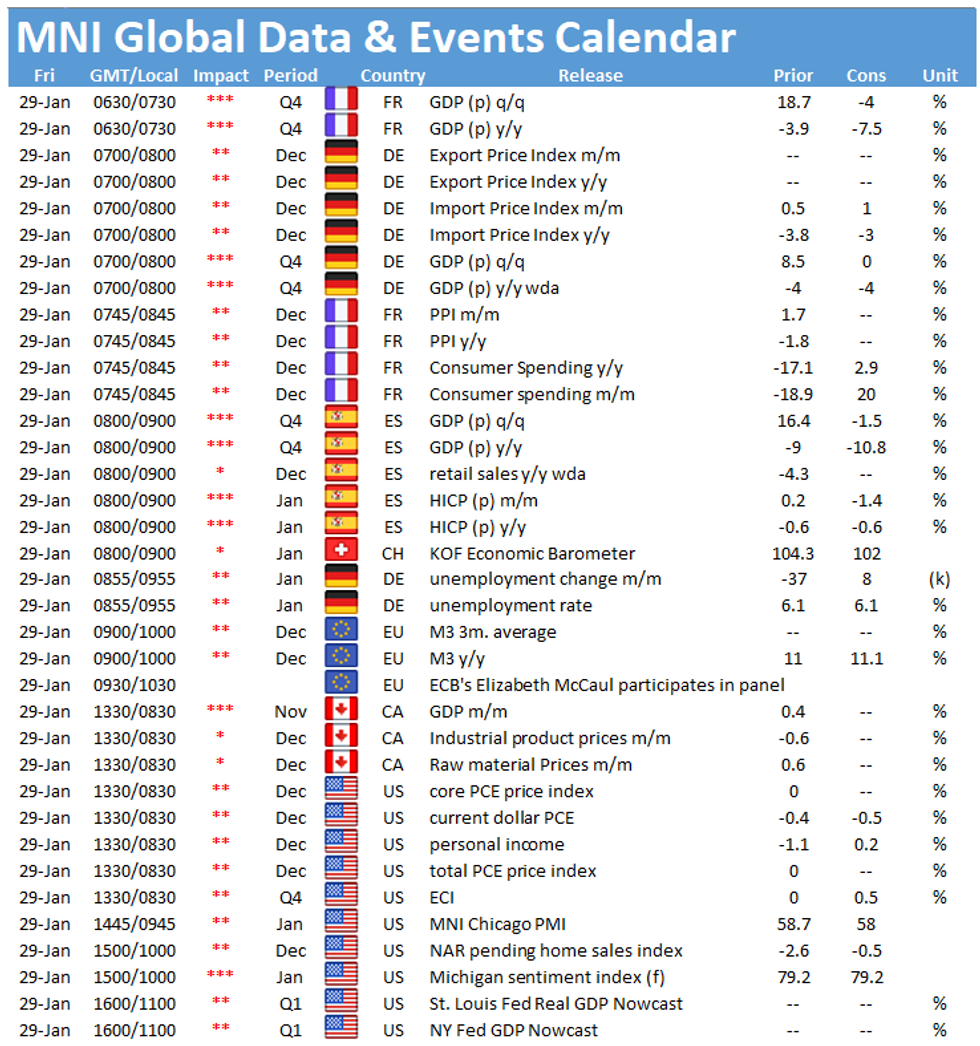

- Personal income/spending, final U. of Mich. Survey & MNI Chicago PMI out of the U.S., German & Norwegian jobless rates as well as German, French & Canadian GDPs take focus on the data front. Central bank speaker slate features Fed's Kaplan & Daly.

FOREX OPTIONS: Expiries for Jan29 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2000(E562mln), $1.2050-60(E826mln-EUR puts), $1.2070-75(E1.0bln), $1.2100(E697mln), $1.2200(E801mln), $1.2300(E953mln)

- USD/JPY: Y103.80-85($593mln), Y104.35-45($1.3bln)

- EUR/GBP: Gbp0.8800(E661mln-EUR puts), Gbp0.8845-60(E1.1bln-EUR puts)

- USD/CHF: Chf0.8800($1.46bln-USD puts)

- AUD/USD: $0.7400(A$541mln), $0.7610-30(A$778mln-AUD puts), $0.7650(A$866mln), $0.7725-35(A$1.0bln-AUD puts), $0.7750-55(A$503mln), $0.7880(A$812mln)

- USD/CAD: C$1.2750-60($830mln-USD puts)

- USD/MXN: Mxn19.80($1.2bln), Mxn20.00($1.4bln)

- USD/CNY: Cny6.45($740mln), Cny6.47($1.1bln), Cny6.50($1.5bln-USD puts), Cny6.55($782mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.