-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: PBoC Conducts Net Drain Of Liquidity Ahead Of LNY

EXECUTIVE SUMMARY

- ITALY'S PARTIES ENTHUSE OVER DRAGHI AFTER TALKS TO FORM GOVERNMENT (RTRS)

- UK SCIENTISTS LABEL COVID MUTATION FOUND IN BRISTOL AS 'VARIANT OF CONCERN' (SKY)

- PBOC CONDUCTS NET DRAIN OF LIQUIDITY AHEAD OF LNY

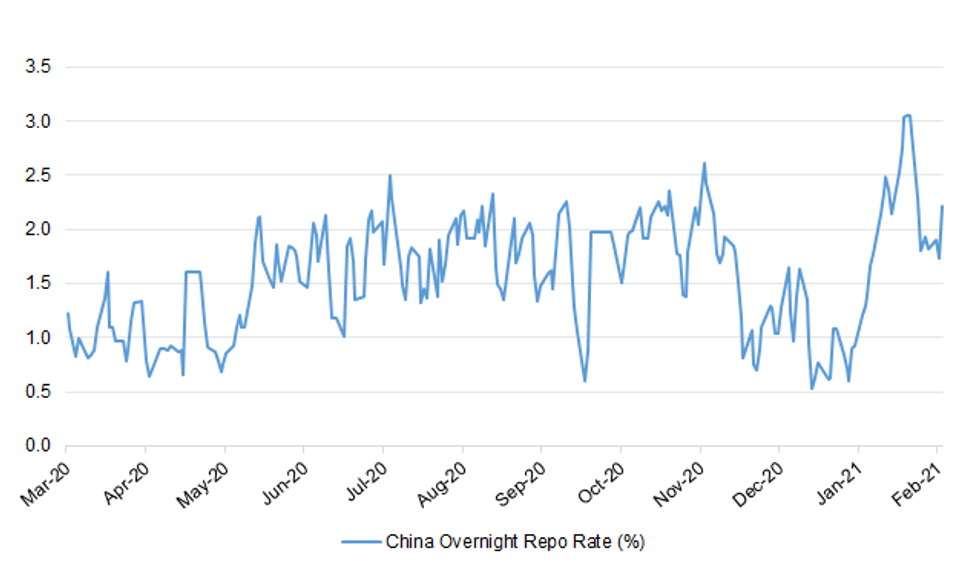

Fig. 1: China Overnight Repo Rate (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: A virus threats advisory group has classed a mutation of the Kent COVID strain found in Bristol as a "variant of concern". NERVTAG - The New and Emerging Respiratory Virus Threats Advisory Group - fears the so-called Kent strain may be highly transmissible - but could also possibly interfere with the vaccine. There have been 14 cases in Bristol, four in Manchester, and three other scattered cases. (Sky)

BREXIT: The U.K. government said its relations with the European Union have been "problematic" since Brexit, following disputes over issues including vaccines, trade and Northern Ireland. "It's been more than bumpy in the last six weeks," David Frost, the U.K. representative for Brexit and International Policy, told a parliamentary committee Tuesday. "I hope we'll get over this. It is going to require a different spirit, probably, from the EU." (BBG)

BREXIT: The European Union is expected to ask for more time to ratify the Brexit trade deal, the UK's chief Brexit negotiator has said as he laid the blame for continuing UK-EU tensions at the door of Brussels. (Guardian)

BREXIT: The Irish government has said talks are ongoing with the European Commission to work out how to avoid more controversy involving Northern Ireland. Their talks follow the commission's decision last month to attempt to stop Covid-19 vaccines made in the EU arriving in Northern Ireland. After condemnation from London, Dublin and Belfast, Brussels made a U-turn. There are reports that any new EU laws will be checked early on to see if it has implications for Northern Ireland. (BBC)

BREXIT: French fishermen could face lengthy delays before gaining access to the UK's fishing waters under retaliatory measures being discussed if Brussels refuses to cave on its live shellfish ban, The Daily Telegraph has learnt. In a bid to force an EU climb down over "indefensible" trade barriers to British fishermen, it is understood that the granting of new licences for vessels hoping to fish in the UK's six to 12 mile nautical zone could be slowed down. The UK has already issued licences beyond the 12-mile range but applications those inside are still being processed, suggesting the row could backfire on the European Commission and France, which is suspected of fuelling it. "There are things we could do to make their life difficult," a Whitehall insider said, although a Downing Street source said they did not recognise the proposal. (Telegraph)

EUROPE

ITALY: On Tuesday, 5-Star's leader Vito Crimi said it had received important reassurances from Draghi over his intentions on welfare policy and the transition to renewable energy, two priorities dear to the party. Draghi also gave no suggestion he planned to apply for a loan from the euro zone's bailout fund, something 5-Star staunchly opposes, Crimi said after the last of Draghi's meetings with all the groups in Parliament. Previously, Draghi had secured the virtually unconditional backing of the right-wing League, the centre-left Democratic Party and the conservative Forza Italia led by the 84-year-old, four-time former premier Silvio Berlusconi. All the party chiefs said they were pleased with Draghi's ideas on how to stimulate economic growth, safeguard the environment and tackle the coronavirus crisis. (RTRS)

ITALY: The Bank of Italy's Daniele Franco is emerging as a possible candidate to take over as the country's next finance minister, as the race intensifies over who will be premier-designate Mario Draghi's pick to start reviving the staggering economy. Franco, director-general at the central bank, is one name that keeps popping up in reference to the Treasury job as Draghi draws up the list of names for his cabinet, which may be revealed later this week, according to officials who asked not to be named discussing confidential talks. (BBG)

GREECE: The Greek government has reintroduced a stricter lockdown in Athens and the surrounding Attica region in a bid to curb a recent spike in new coronavirus cases and hospitalizations. The area accounts for around half of Greece's population of almost 11 million. (BBG)

NETHERLANDS: A majority in the lower house of Dutch parliament agreed with a government proposal to extend a nighttime curfew until early March. (BBG)

U.S.

FISCAL: President Joe Biden met Tuesday with business leaders as he sought to build support for his stimulus package aimed at countering the impact of the COVID-19 pandemic. "The American people are hurting, a lot of people are in real, real trouble," Biden told reporters in the Oval Office during a meeting that included JP Morgan chief executive Jamie Dimon; Marvin Ellison, CEO of Lowe's and U.S. Chamber of Commerce CEO Tom Donohue. The meeting comes as Biden tries to sell both Congress and the public on his American Rescue Plan, a package meant to address the coronavirus pandemic and strengthen a damaged American economy. As part of his ongoing effort to pitch the legislation to the public, Biden will travel to Wisconsin next week and participate in a CNN town hall to talk about his domestic agenda. "We have kids not in school. We have a whole range of issues, but they are solvable," he said. Ahead of the meeting, White House press secretary Jen Psaki pushed back on Republican critics who have slammed Biden's $1.9 trillion COVID-19 relief package as too costly. She said that rather than scaling back the package, one way to address deficit concerns would be to roll back the Trump administration's tax cuts on the wealthiest Americans – something Biden proposed during his campaign. "There's kind of a newfound concern about deficit reduction among some who supported those tax cuts, so that's one suggestion," Psaki said. (USA Today)

FISCAL: President Joe Biden said on Tuesday he agreed with a proposal by Democratic lawmakers that would send $1,400 stimulus checks to Americans earning up to $75,000 in income and households making up to $150,000. "Yes," Biden said when asked if he supported the proposal. Biden, speaking during a meeting with business leaders in the Oval Office, said he had been in touch with Republican leaders about the package. "I think we're in a position to ... think big," Biden said. (RTRS)

FISCAL: College students, disabled Americans and other adult dependents are set to get a $1,400 stimulus check in the next Covid-19 relief package. (CNBC)

FISCAL: House Oversight Committee bill proposes $350bn in state & local aid. (BBG)

FISCAL: The U.S. government must keep a close eye on inflationary pressures, but the Federal Reserve has tools to deal with inflation and interest rates, Neera Tanden, President Joe Biden's nominee as budget director, said on Tuesday. Asked about concerns that Biden's $1.9 trillion relief plan would cause overheating in the U.S. economy, Tanden said it was vital now to provide aid to Americans suffering as a result of the COVID-19 pandemic and avoid long-term economic scarring. (RTRS)

CORONAVIRUS: The number of US coronavirus hospitalisations has dropped below 80,000 for the first time since mid-November. There were 79,179 people in US hospitals with coronavirus, according to Covid Tracking Project data released on Tuesday, down from 80,055 on Monday. It was the first time since November 18 that hospitalisations have been below 80,000. Hospitalisations are down about 40 per cent from the country's peak in early January. Sustained downward trends for hospital patients are evident in almost every US state, according to a Financial Times analysis of CTP data. States reported an additional 92,986 infections, up from a three-month low on Monday of 77,737. Including Sunday's tally of 95,994 infections — the first time since November 2 that new cases were below 100,000 — Tuesday marked the first time since late October that new cases have been below that threshold for three days in a row. Authorities attributed a further 2,795 fatalities to coronavirus, up from Monday's two-month low of 1,309. (FT)

CORONAVIRUS: The White House is increasing the supply of coronavirus vaccines beginning next week, with an aim to ensure the equity of the distribution of doses. Dr. Marcella Nunez-Smith, the chair of the White House's COVID-19 equity task force, says that the federal government is devoting 1 million doses to begin distributing vaccines at 250 community health centers. It's meant to be a first phase of a program to expand vaccinations to the more than 1,300 federally supported community health centers, which primarily care for low-income and uninsured populations. COVID-19 coordinator Jeff Zients says, "Efficiency and equity are both central to what we're doing." Zients also announced states will see their allocation of doses rise to 11 million per week beginning next week, up more than 2 million since President Joe Biden took office. (AP)

CORONAVIRUS: The US drug regulator on Tuesday authorised Eli Lilly & Co's Covid-19 cocktail for emergency use on mild to moderate cases that are likely to worsen. (FT)

CORONAVIRUS: Covid-19 vaccines should be more widely available at pharmacies across the country in the spring, said Rick Gates, Walgreens senior vice president of pharmacy and health care. At CNBC's Healthy Returns Spotlight virtual event, he said he expects to see more doses in late March or early April. (CNBC)

CORONAVIRUS: Nearly half of adult Americans surveyed late last year said they were absolutely certain or very likely they would get vaccinated against Covid-19, an increase from September when 39.4% of survey respondents said they would get the jab, according to a new study from the U.S. Centers for Disease Control and Prevention. (CNBC)

CORONAVIRUS: Not everyone is clamoring for a Covid vaccine. About 60% of employees at nursing homes and assisted living facilities declined the shots, according to Rick Gates, Walgreens senior vice president of pharmacy and healthcare. Vaccine hesitancy was "higher than we expected," he said at CNBC's Healthy Returns virtual event on Tuesday. He said only 20% of residents refused the shots. (CNBC)

POLITICS: The Senate affirmed the constitutional basis of former President Donald Trump's second impeachment trial, clearing the way for arguments to begin on whether he incited an insurrection by inflaming the mob that stormed the U.S. Capitol last month. After four hours of arguments from House impeachment managers and Trump's defense team, the Senate voted 56-44 to proceed with the trial, rejecting the former president's contention that it is unconstitutional to try an official who is no longer in office. (BBG)

LIBOR: CME Group Inc. said it will amend its Eurodollar futures and options contracts to include procedures that will apply in the event of a permanent discontinuation of three-month dollar Libor, the settlement rate for the futures, pending approval by the CFTC, according to a statement. Amendments will "incorporate procedures that will be applied by the Exchange to ensure that open positions in the Contracts are able to transition away from USD LIBOR in an orderly manner if required," statement says. They "provide that, on the effective date of a Fallback Event with respect to USD LIBOR, trading in the Contracts will terminate and CME will convert open positions into positions in the corresponding CME Three-Month SOFR Futures or CME Options on Three-Month SOFR Futures contract, as applicable". "The conversion methodology and contractual fallback procedures have been designed by CME to be aligned closely with the approach to fallbacks for OTC IRS, recently implemented on January 25, 2021 by ISDA (for bilateral contracts) and also by CME Clearing (for cleared OTC IRS)," CME said. (BBG)

MARKETS: Wall Street's main regulator will give more power to its enforcement staff to launch investigations, an early sign that it plans to become more assertive under the Biden administration. The move by the Securities and Exchange Commission allows more enforcement supervisors to authorize investigations, permitting about 36 senior officials at the agency to subpoena companies and individuals for records or testimony. The agency during the Trump administration withdrew that authority from supervisors and allowed only two officials to approve new probes, saying it would result in more consistent decisions about which tips and complaints justified investigations. (WSJ)

MARKETS: Nasdaq Inc. and the New York Stock Exchange sued the Securities and Exchange Commission to block the regulator's plan to overhaul the public data feeds that broadcast stock prices to investors. The plan, which the SEC approved in December, threatens the exchange operator's data revenue, a major part of its business. In parallel court filings, Nasdaq, the NYSE and exchange operator Cboe Global Markets Inc. asked the U.S. Court of Appeals for the District of Columbia Circuit to review the SEC's plan. The filings were dated Friday but only released on the court's website Tuesday. Both the NYSE and Nasdaq had earlier said that the plan was an overreach by the regulator, and Nasdaq had also argued that it would amount to an unconstitutional seizure of its property. (WSJ)

OTHER

GEOPOLITICS: The United States is closely monitoring border disputes between India and China and backs their peaceful resolution through direct dialogue, the State Department said on Tuesday, while stressing that it stands with allies and partners like India. "We note the ongoing talks between the governments of India and China," State Department spokesman Ned Price told a news briefing. (RTRS)

GLOBAL TRADE: In ranging remarks to the Washington International Trade Association, House Ways and Means Committee Chairman Richard Neal (D-MA) says that he would 'very much like' the US to agree a trade deal with the EU, while adding that it 'makes sense' to move on with the US-UK bilateral deal given that the Brexit deal avoided a hard border on the island of Ireland. Says that the US' relationship with China needs to be more 'strategic' given his concerns about China's hard line on Hong Kong, Taiwan. As an aside, this attitude is common among Biden administration and many Congressional Democrats, limiting the prospect for a rapid improvement in Sino-US relations under the new administration. (MNI)

CORONAVIRUS: The most recent wave of Covid-19 is showing early signs it may have peaked. Global average daily deaths have fallen steadily from a pandemic-high of more than 14,200 on January 29 to 12,691 on February 7 according to a Financial Times analysis of the latest figures from across the world. The fall in deaths over the past week is the largest decline since May last year, excluding the dip over the festive period that is likely attributable to delayed reporting. (FT)

CORONAVIRUS: The lead researcher of the South African trial of AstraZeneca Plc's coronavirus vaccine urged authorities in the country to continue using the shot to cut death and hospitalization rates and the chance of further virus mutations. Early data of a small phase trial showed that AstraZeneca's vaccine has limited efficacy against mild disease caused by the B.1.351 variant that's now dominant in South Africa, prompting the government to suspend plans to give it to health workers. The study didn't determine whether it protects against severe Covid-19 cases and deaths because most participants were "young healthy adults," according to the company. (BBG)

CORONAVIRUS: Johnson & Johnson CEO Alex Gorsky told CNBC that people may need to get vaccinated against Covid-19 annually over the next several years. "Unfortunately, as [the virus] spreads it can also mutate," he told CNBC's Meg Tirrell during a Healthy Returns Spotlight event. "Every time it mutates, it's almost like another click of the dial so to speak where we can see another variant, another mutation that can have an impact on its ability to fend of antibodies or to have a different kind of response not only to a therapeutic but also to a vaccine." (CNBC)

CORONAVIRUS: AstraZeneca Plc's vaccine should protect people against severe disease from the South Africa strain of the virus, according to the company's chief executive officer. Speaking at a World Health Organization meeting Tuesday, Pascal Soriot said that while a recent study showing the vaccine may not prevent mild disease was concerning, that didn't mean more serious illness wouldn't be stopped. (BBG)

CORONAVIRUS: Just one Covid jab offers two-thirds protection against the virus, first official data from the vaccine blitz reveals. Findings — due out in days — will show the Pfizer vaccine starts to work in as little as two weeks and is equally effective in OAPs as younger adults. The Oxford/AstraZeneca jab offers similar protection. (The Sun)

CORONAVIRUS: Pfizer Inc. said it has resumed manufacturing the Covid-19 vaccine it developed in partnership with BioNTech SE at its plant in Belgium after temporarily reducing production to upgrade the facility's production lines. A Pfizer spokeswoman said Tuesday the changes in Puurs, Belgium, have finished, and during the week of Jan. 25 the company resumed its original delivery schedule of doses to the European Union. Pfizer also plans to increase deliveries next week to meet its contractual obligations for the first quarter, the spokeswoman said. (Dow Jones)

HONG KONG: Hong Kong's health authorities are expected to announce on Wednesday how existing social-distancing measures will be relaxed after the Lunar New Year holiday, according to a government source, even as an expert warned the city still faces a high risk of coronavirus infections rebounding. The announcement will coincide with a meeting of the city's advisory panel on Covid-19 vaccines, which will discuss new data provided by Coronavac manufacturer Sinovac. (SCMP)

AUSTRALIA: Australia's Victoria state says Holiday Inn Melbourne Airport is being closed until further notice for terminal cleaning, according to emailed statement. A quarantine worker in her 30s returned a positive Covid-19 test on Feb. 9. (BBG)

RBNZ: Reserve Bank (RBNZ) Governor Adrian Orr says it would be difficult to apply debt-to-income (DTI) restrictions to some residential property buyers - like investors - but not others. Presenting the RBNZ's annual review to Parliament's Finance and Expenditure Committee on Wednesday, Orr reiterated his request for the Finance Minister to add DTIs to the toolkit the RBNZ has to regulate banks. These would enable the RBNZ to restrict bank lending to borrowers seeking a lot of debt relative to their income. (Interest NZ)

NEW ZEALAND/CHINA: New Zealand is urgently seeking clarification from Chinese authorities after Beijing suspended imports from two of its seafood factories. Shipments from a Sanford Ltd. facility that processes mussels and a Sealord Group fish processing plant have been suspended due to "issues around the interpretation of the World Health Organization's Covid guidance, and food safety management," the Ministry for Primary Industries said on Wednesday. New Zealand also approved Pfizer vaccine for those aged 16 and older. (BBG)

JAPAN: Japanese Prime Minister Yoshihide Suga, speaking at a meeting of government and opposition lawmakers, says that coronavirus vaccinations will begin mid-next week, Jiji reports in a flash headline. (BBG)

JAPAN: The Japanese government is planning to keep the state of emergency in the 10 prefectures despite earlier reports that it was considering lifting it in some areas on Friday, broadcaster FNN reports, without attribution. Officials see need to keep the emergency in place to ease pressure on the medical system. (BBG)

BOJ: MNI POLICY: BOJ Nakamura: Policy Affects on Market Function

- The Bank of Japan must pay attention to how easy monetary policy affects the functioning of financial markets, BOJ board member Toyoaki Nakamura said on Wednesday. "The BOJ needs to examine whether the asset purchases and others have produced expected results," Nakamura told business leaders in Kochi City via an online - on MNI Main Wire and email now - for more details please contact sales@marketnews.com..

BOJ: Japan's parliament approves Noguchi's nomination to BoJ board. (BBG)

NEW ZEALAND: The latest BNZ/SEEK employment report notes that "by increasing 1.4% m/m in January, job advertising started 2021 on a positive note. However, the result also indicated a loss of momentum. Its January gain was the slowest since August, when COVID-19 restrictions were increased to Level 3 in Auckland and Level 2 everywhere else. That job advertising is not thriving (just yet) was also borne out by the fact January's level was 6.3% shy of where it was a year prior." (MNI)

BOK: South Korea's central bank said Wednesday it has provided a net 4.75 trillion won ($4.25 billion) in liquidity to the financial sector to help the flow of money ahead of the Lunar New Year holiday. The Bank of Korea (BOK) said it decreased its money injection by 15.7 percent this year from a year earlier because of social distancing rules amid the coronavirus pandemic. (Korea Herald)

CANADA: Canada will step up its fight against COVID-19 by obliging citizens returning home overland from the United States to show they do not have COVID-19, Prime Minister Justin Trudeau said on Tuesday. (RTRS)

CANADA: Prime Minister Justin Trudeau announced tax relief for beneficiaries of coronavirus-related income support, temporarily clearing a potential economic and political minefield for his government. Canada's revenue agency won't charge people interest on overdue taxes from benefit programs for at least one year, Trudeau said Tuesday. The government will also provide amnesty to self-employed individuals who received benefits without qualifying. (BBG)

TURKEY: Turkey will discuss withdrawing its forces from Libya if other foreign troops are withdrawn first, Turkish President Tayyip Erdogan said on Tuesday. Speaking at an event in Ankara, Erdogan said that Turkish armed forces personnel were deployed in Libya solely to train units loyal to the internationally recognized Government of National Accord (GNA), which is based in Tripoli. (RTRS)

BRAZIL: Brazil's lower house speaker Arthur Lira placed the bill to bevoted immediately after the approval of a fast-track urgency regime. Discussion on Central Bank's autonomy bill is ongoing; voting expected to take place this Tuesday. Fast-track regime was approved by 363 votes in favor and 109 against. If approved in the lower house, bill moves to presidential sanction as it has already being approved by the Senate. (BBG)

SOUTH AFRICA: South Africa allocates 13b rand for job stimulus plan in 2021. Monies are part of government's 100 billion rand Presidential Employment Stimulus announced last April, according to report issued by the presidency. Program aims to protect and create jobs following economic fallout from coronavirus. Remaining 87 billion rand to be allocated over next three years. (BBG)

OIL: The head of the U.S. Senate energy committee, Joe Manchin, on Tuesday urged President Joe Biden to reverse his opposition to the Keystone XL pipeline, saying the project provides union jobs and is safer than transporting the oil via trucks and trains. (RTRS)

OIL: US oil production will continue its coronavirus-driven decline through at least June, according to government forecasts, even as Brent crude prices topped $60 a barrel this week for the first time since the start of the pandemic. US oil output is expected to continue to slide from 11m barrels a day in January to around 10.9m barrels a day in June, the Energy Information Administration said on Tuesday. This is down from a peak of 12.9m barrels a day in the months before the outbreak of the pandemic. (FT)

OIL: Libya's National Oil Corp. will receive part of a total 9 billion dinars (about $2 billion) of stopgap funding that will also help other state institutions cover wage bills and medicine, according to people familiar with the matter. The central bank will provide the funds under the so-called interim financial arrangement for two months until a unified budget is approved for all of 2021, said the people who asked not to be identified as they're not authorized to speak to the media. (BBG)

CHINA

PBOC: The PBOC is less likely to cut banks' required reserve ratios after the sector reported record-high aggregate financing and loans, the Securities Times said citing Wen Bin, the chief analyst with Minsheng Bank. Aggregate financing to the economy surged four times to CNY5.17 trillion from CNY1.72 trillion in December while new loans tripled to CNY3.58 trillion. However, credit data in January could be misleading since banks loaned more for backlog projects from last year, said Zhang Xu, the chief fixed-income analyst with Everbright Securities. Companies' financing demand remains strong and the economy was showing no signs of overheating, the newspaper said citing Zhang. (MNI)

ECONOMY: Consumer demand and the recovery of small businesses could be the main growth drivers for China in 2021, Chen Changsheng, a director from the Development Research Center of the State Council said in an interview with Xinhua News Agency. China should devise policies to raise resident incomes and ensure supply to boost consumer confidence, Xinhua reported citing Chen. The government should maintain stable policies to consolidate growth, Chen said. (MNI)

PROPERTY: China will continue to curb excessive speculation in the real estate market through strengthening regulations, policy reforms, and increasing housing supply, the Xinhua-owned Economic Information Daily said in an editorial. Regulators should closely monitor market changes in cities with growing population, a better economy and active private capital markets and close regulatory loopholes, the newspaper said. China should accelerate its housing land supply system reform and property tax reform to both curb speculation and fulfil real housing needs, the editorial said. (MNI)

FDI: China's Jan. FDI rises 4.6% y/y in yuan terms. Non-financial foreign direct investment in China rises to 91.6b yuan in Jan., the Ministry of Commerce said at a press briefing today. (BBG)

OVERNIGHT DATA

CHINA JAN CPI -0.3% Y/Y; MEDIAN 0.0%; DEC +0.2%

CHINA JAN PPI +0.3% Y/Y; MEDIAN +0.3%; DEC -0.4%

MNI DATA IMPACT: China Jan CPI Fell Again; PPI Near 1-Yr High

- China's inflation fell 0.3% y/y in January due to the higher comparison base same period last year, reversing the previous 0.2% gain and roughly in line with the median forecast of -0.2% - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

CHINA JAN FOREIGN DIRECT INVESTMENT CNY +4.6% Y/Y

JAPAN JAN PPI -1.6% Y/Y; MEDIAN -1.6%; DEC -2.0%

JAPAN JAN PPI +0.4% M/M; MEDIAN +0.4%; DEC +0.5%

JAPAN JAN TOKYO AVG OFFICE VACANCIES 4.82; DEC 4.49

AUSTRALIA FEB WESTPAPC CONSUMER CONFIDENCE 109.1; JAN 107.0

AUSTRALIA FEB WESTPAC CONSUMER CONFIDENCE +1.9% M/M; JAN -4.5%

This increase in the Index has recouped around half the loss we saw in January when the Index fell from 112.0 in December to 107.0. Recall that the December print was a ten year high so the bounce-back in February signals that the consumer remains extraordinarily confident. High confidence amongst consumers is critically important for the economy at this juncture. The Federal government is scheduled to phase out the JobKeeper program at the end of March. It is vital that households, which have built up a very large financial buffer through the pandemic (recently estimated by the Reserve Bank at $200 billion or 15% of pre-pandemic annual income), are prepared to now use that buffer to partially offset the impact on the economy of the withdrawal of support programs. No doubt the management of the pandemic locally has had a constructive effect on confidence. The success of contact tracing and 'light-handed' lockdowns has been important in containing a worrying cluster of cases since the last survey in January. The Reserve Bank's surprise extension of its Quantitative Easing program signals ongoing commitment from the monetary authorities to supporting the Australian economy. Consistent positive news on the recovery of the job market would also have boosted confidence. At the time of the survey, Victoria had made important progress in successfully managing the pandemic which resulted in improved confidence in the state (up 4% in February). It has now registered the highest print amongst the states (slightly higher than NSW, which was up 3.5% in February) and the second highest for the state in the last 10 years. (Westpac)

SOUTH KOREA JAN UNEMPLOYMENT 5.4%; MEDIAN 4.5%; DEC 4.5%

SOUTH KOREA JAN BANK LENDING TO HOUSEHOLDS TOTAL KRW996.4TN; DEC KRW988.8TN

CHINA MARKETS

PBOC NET DRAINS CNY80BN VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) injected CNY20 billion via 7-day reverse repos with the rate unchanged on Wednesday. This resulted in a net drain ofCNY80 billion given the maturity of CNY100 billion of reverse repos today, according to Wind Information.

- The operation aims to maintain stable liquidity before the Chinese New Year and fiscal spending increases in the days approaching the holiday, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.2134% at 09:23 am local time from 2.4712% at Tuesday's close.

- The CFETS-NEX money-market sentiment index closed at 41 on Tuesday vs 36 on Monday. A higher index indicates increased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.4391 WEDS VS 6.4533

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower for a third day at 6.4391 on Wednesday. This compares with the 6.4533 set on Tuesday.

MARKETS

SNAPSHOT: PBoC Conducts Net Drain Of Liquidity Ahead Of LNY

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 0.23 points at 29502.34

- ASX 200 up 36.775 points at 6858

- Shanghai Comp. up 37.156 points at 3640.645

- JGB 10-Yr future down 2 ticks at 151.46, yield up 0.3bp at 0.076%

- Aussie 10-Yr future up 0.5 ticks at 98.770, yield down 0.6bp at 1.224%

- U.S. 10-Yr future -0-00+ at 136-22+, yield up 0.17bp at 1.159%

- WTI crude down $0.09 at $58.27, Gold up $5.42 at $1843.73

- USD/JPY down 1 pip at Y104.58

- ITALY'S PARTIES ENTHUSE OVER DRAGHI AFTER TALKS TO FORM GOVERNMENT (RTRS)

- UK SCIENTISTS LABEL COVID MUTATION FOUND IN BRISTOL AS 'VARIANT OF CONCERN' (SKY)

- PBOC CONDUCTS NET DRAIN OF LIQUIDITY AHEAD OF LNY

BOND SUMMARY: TY Put Blocks Headline Narrow Asia-Pac Session For Core FI

Wednesday's pre-Lunar New Year Asia-Pacific session was devoid of any meaningful macro headline flow, with focus on the PBoC's latest net drain via OMOs as we move into the LNY break (physical cash demand is expected to be much lower than the holiday norm in China, given the COVID related travel restrictions that are in place in the country at present).

- That backdrop left T-Notes to operate within the confines of a 0-03 range, last -0-00+ at 136-22+, with cash Tsys little changed across the curve. The highlight came via a large TY options block, which initially looked like a 15.0K sale of the TYH1 136.25 puts & 30.0K sale of the TYH1 136.00 puts against buying 10.0K of the 3x1x2 TYJ1 134.50/133.50/133.00 put ladder. However, some have suggested that the blocks represented a 15.0K seller of the 1x2 TYH1 136.25/136.00 put spread against buying 10.0K of the TYJ1 134.50/133.50 put spread & 20.0K of the TYJ1 134.50/133.00 put spread.

- JGB futures are looking to extend on the recent run of weakness (the longest stretch of daily losses going back to '03 has already been realised), with some swap spread widening and modest cheapening evident across most of the JGB curve ahead of the Tokyo close. Futures last -2 after surrendering overnight gains.

- Wednesday provided a particularly narrow round of Sydney trade for the longer end of the Aussie curve, YM -0.5 and XM +0.5 at typing. ACGB Nov '31 supply was easily digested, while the uptick in the latest Australian Westpac consumer confidence reading took the metric back towards the multi-year highs witnessed in December's print.

JGBS AUCTION: Japanese MOF sells Y498.8bn of 15.5-39 Year JGBs in a liquidity enhancement auction:

The Japanese Ministry of Finance (MOF) sells Y498.8bn of 15.5-39 Year JGBs in a liquidity enhancement auction:- Average Spread: 0.002% (prev. -0.002%)

- High Spread: 0.003% (prev. 0.000%)

- % Allotted At High Spread: 60.4151% (prev. 47.0443%)

- Bid/Cover: 3.105x (prev. 2.637x)

AUSSIE BONDS: The AOFM sells A$1.0bn of the 1.00% 21 Nov '31 Bond, issue #TB163:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 1.00% 21 Nov 2031 Bond, issue #TB163:- Average Yield: 1.2719% (prev. 1.0618%)

- High Yield: 1.2750% (prev. 1.0650%)

- Bid/Cover: 5.5150x (prev. 2.6950x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 7.2% (prev. 10.9%)

- bidders 41 (prev. 51), successful 19 (prev. 29), allocated in full 10 (prev. 19)

EQUITIES: Mixed Picture In Asia-Pac

It is a mixed picture in Asia-Pac equity markets; US markets failed to sustain their rally on Tuesday, the S&P 500 snapped a six day winning streak to decline around 0.1% at the close.

- Most equity markets in the region are in negative territory, but shares in mainland China and Hong Kong are soaring. The Hang Seng briefly popped above 30,000 after surrendering the level in January, the upside is impressive considering the trading link to mainland investors is shut for LNY. Mainland China's markets are up around 1.5%, data earlier showed that Chinese CPI fell, while PPI squeezed out a small gain, and aggregate financing and FDI both rose.

- In the US futures are in positive territory, helped by some positive aftermarket earnings from Twitter and Cisco.

OIL: Rally Pauses

Crude futures are lower in Asia, on track to snap a seven day winning streak which saw gains of 12%, the longest run of advances in two years. WTI last trades down $0.10 at $58.26, brent is just below neutral levels at $61.06.

- API inventory data after market yesterday showed a draw in headline crude stocks of 3.5m/bbls, above the 2.7m/bbl decline estimated. The market will look to the US DOE weekly inventory report due later later for further clarity on price direction.

- Some supply concerns evident in downstream products, gasoline stockpiles rose by 4.81m/bbls, if DOE data matches this it would be the biggest build since April.

- There were some concerns over supply, the in its short term energy outlook the EIA said oil explorers are set to boost drilling and production from the second half of this year, with crude prices above breakeven levels. The agency did note that US consumption is unlikely to reach pre-pandemic levels before the end of 2022.

GOLD: Consolidating

The softer DXY and lack of net movement in U.S. real yields witnessed over the last 24 hours or so have combined to leave bullion little changed over that horizon, with spot last dealing just above $1,840/oz, consolidating the gains witnessed in recent sessions. Bulls now look to the 50-day EMA as the next point of technical resistance.

FOREX: Kiwi Falters, Asia-Pac Session Quiet Ahead Of LNY

NZD was the worst G10 performer, edging lower alongside NZGB yields, with BBG trader sources flagging the trimming/squaring of NZD/USD & AUD/USD long positions for short-term accounts. The Aussie was somewhat more resilient than its Antipodean cousin, as Australian Westpac Consumer Confidence improved this month. The news that China suspended imports from two NZ factories may have applied some mild pressure to NZD, with the reinstatement of LVR restrictions also grabbing attention locally. AUD/NZD is poised to extend its winning streak to five days in a row.

- The DXY ground lower, moving past yesterday's worst levels, ahead of a speech from the Fed chief & as e-minis advanced, with S&P futures printing fresh record highs. All in all, G10 crosses were rangebound as local players awaited Lunar New Year holidays.

- USD/JPY climbed into the Tokyo fix, perhaps on the back of Gotobi Day flows, but faded the move thereafter. The rate sits marginally shy of neutral levels as we type, struggling to punch through yesterday's low.

- USD/CNH saw a brief spell of slightly increased volatility in reaction to a miss in Chinese CPI. The PBOC fixed USD/CNY at CNY6.4391, 13 pips above sell side estimates.

- KRW soared despite a decent, above-forecast increase in South Korean unemployment, amid speculation that traders were existing short positions ahead of LNY. USD/KRW dived to worst levels in two weeks.

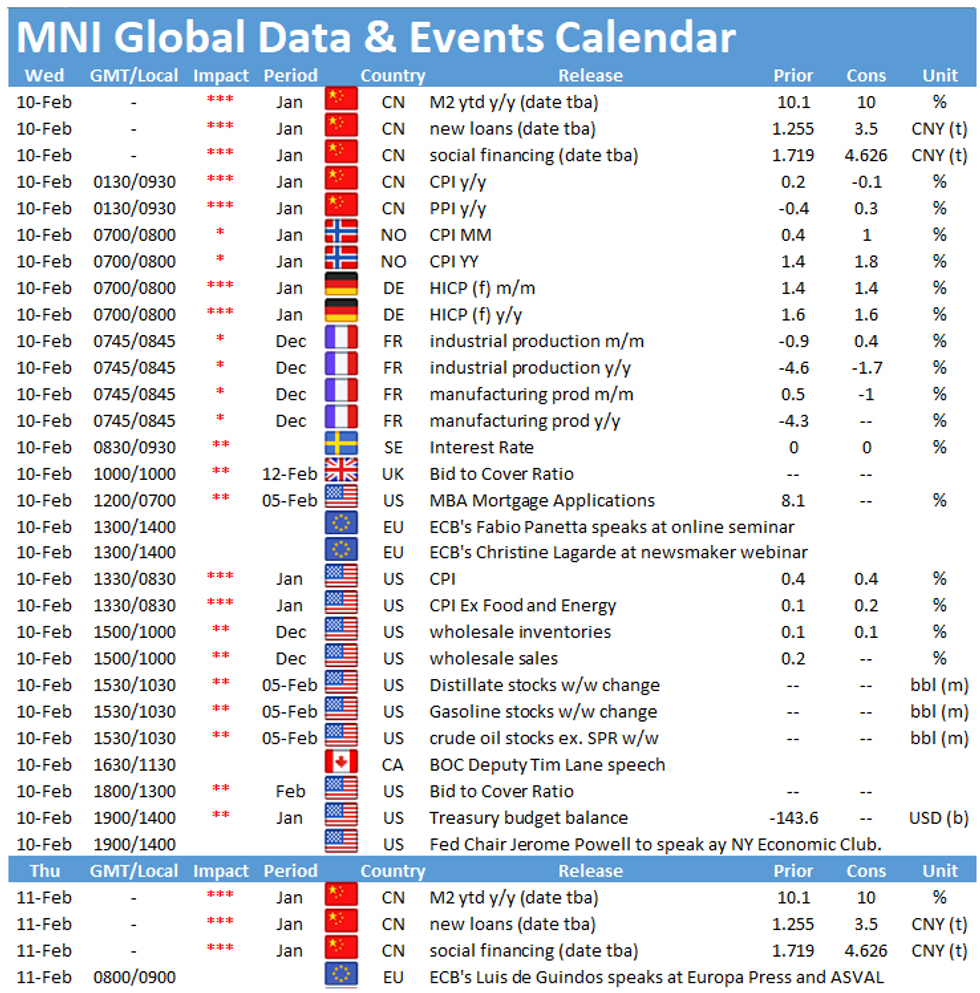

- On the radar today: U.S., German & Norwegian CPIs, French industrial output, Riksbank MonPol decision & comments from Fed Powell, ECB's Lagarde, de Cos, Visco & Panetta, BoC's Lane & BoE's Bailey.

FOREX OPTIONS: Expiries for Feb10 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1905-30(E1.2bln), $1.2020-25(E1.0bln), $1.2065(E1.1bln), $1.2090-10(E799mln), $1.2300(E1.1bln)

- USD/JPY: Y104.50($525mln), Y105.35-50($681mln)

- AUD/USD: $0.7550(A$1.4bln-AUD puts), $0.7650(A$759mln), $0.7750(A$591mln), $0.7780-00(A$671mln)

- USD/CNY: Cny6.40($648mln), Cny6.4050($670mln), Cny6.42($650mln), Cny6.4350($1.0bln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.