-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK ANALYSIS - Week Ahead 2-8 December

MNI EUROPEAN OPEN: No Fresh Narratives In Asia

EXECUTIVE SUMMARY

- KAPLAN: IF U.S. CONTINUES TO RECOVER, RISING BOND YIELDS WOULD BE ENCOURAGING SIGN (DJ)

- U.S.: WANG YI'S COMMENTS FIT PATTERN OF BEIJING SEEKING TO AVERT BLAME (RTRS)

- ECB'S VILLEROY: NO RISK OF OVERHEATING IN EURO ZONE (RTRS)

- BOE'S VLIEGHE DOUBTS HE WILL EVER SEE RATES BACK AT 5% (RTRS)

- CHINA GDP RECOVERY PAVES WAY FOR MONETARY POLICY NORMALIZATION (ECO INFO DAILY)

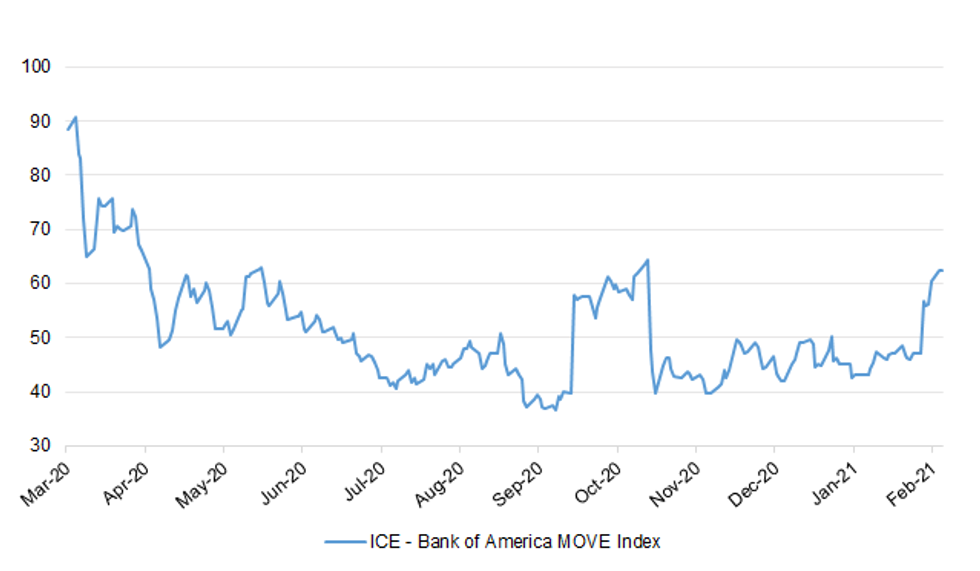

Fig. 1: ICE - Bank of America MOVE Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Proposals for a major easing of lockdown before Easter were dropped after scientists warned the Government that it could lead to an extra 55,000 deaths, it emerged on Monday. (Telegraph)

CORONAVIRUS: Lockdown-sceptic Conservative MPs have lambasted Boris Johnson over the timetable of his roadmap out of Covid restrictions, declaring it a "hammer blow" to a number of sectors. (Telegraph)

ECONOMY: Businesses have cautiously welcomed news that the non-essential retail sector could reopen as soon as 12 April but warned, for some, it will be too late. It came after Prime Minister Boris Johnson outlined his roadmap for England's path out of lockdown. Helen Dickinson, chief executive of the British Retail Consortium, said: "While we are encouraged by a plan for non-essential stores to reopen, the heavy impact of the pandemic means some may never be able to. "The cost of lost sales to non-food stores during lockdown is now over £22bn and counting. "Every day that a shop remains closed increases the chances that it will never open again - costing jobs and damaging local communities." (Sky)

FISCAL: Furlough support for workers will continue beyond next month, Boris Johnson signalled yesterday as he pledged not to "pull the rug out" from under the economy while the lockdown restrictions were being eased. The scheme is due to run out at the end of the financial year but Rishi Sunak, the chancellor, is expected to extend this until at least May when he delivers his budget a week tomorrow. After that, government sources suggest, furlough support will be gradually wound down. Sunak is looking at reinstating a government scheme to pay one-off bonuses to companies that take back furloughed workers. There is likely to be sector-specific support for industries such as aviation, which may take longer to reopen. (The Times)

BOE: Bank of England policymaker Gertjan Vlieghe said on Monday that he did not expect British interest rates to return to levels common before the 2008 financial crisis during his lifetime, due to long-term demographic pressures. Vlieghe, 49, said that increasing life expectancy and longer periods of retirement had boosted demand for assets, pushing down long-run interest rates in most Western economies, including Britain. Asked by students at Durham University when interest rates might return to the level of around 5% common before the financial crisis, Vlieghe replied: "Maybe not in my lifetime." (RTRS)

BREXIT: The NI Protocol has "the potential to cause political instability" and the British government must act to remove it, a senior DUP MP has said. Sir Jeffrey Donaldson was speaking during a debate in Westminster triggered by a DUP e-petition. The e-petition is part of the DUP's five-point plan to scrap the protocol. But the government's NI Minister Robin Walker insisted the problems could be resolved by "sensible implementation" of the protocol. (BBC)

EUROPE

ECB: There is no risk of overheating in the euro zone economy and no risk of a lasting pick up of inflation, European Central Bank policymaker François Villeroy de Galhau said on Monday. Villeroy, who is also the Bank of France governor, told BFM Business TV the ECB was "monitoring" borrowing costs, echoing earlier comments from ECB chief Christine Lagarde. "Financing conditions remain very favorable (...) we'll see to it that stays that way", Villeroy said. (RTRS)

CORONAVIRUS: Greece's tourism minister has called on EU leaders to "move more quickly" to embrace the vaccine certificates that could allow mass travel to resume, as Athens seeks to repair a holiday industry that has been battered by the coronavirus pandemic. "Looking at the reaction of some countries to vaccination certificate proposals, I feel there's a lot of short sightedness. There's more to be done now to prepare ourselves," minister Harry Theocharis told the Financial Times. "Some countries are very much preoccupied with now" he said, as northern European nations, in particular, were unwilling to look ahead and plan for an economic recovery in the summer. "We need to move more quickly." (FT)

ITALY/BTPS: Italy plans to sell up to 5 billion euros ($6.1 billion) of 0 percent bonds due Apr 1, 2026 in an auction on Feb 25. Italy plans to sell up to 1.25 billion euros ($1.5 billion) of floating bonds due Dec 15, 2023 in an auction on Feb 25. (BBG)

U.S.

FED: Dallas Fed leader Robert Kaplan suggested rising yields don't require any response from the Fed. "It wouldn't surprise me that if we continue to grow" and the momentum picks up as expected, "I think it might even be a healthy, encouraging sign to see Treasury yields back up some," Mr. Kaplan said. (Dow Jones)

FISCAL: The House on Monday moved forward with its $1.9 trillion coronavirus relief package, setting the stage for passage later this week. The chamber's Budget Committee advanced the bill in a 19-16 vote as Democrats rush to beat a March 14 deadline to extend key unemployment programs. The party is trying to pass the proposal through budget reconciliation, which allows it to get through the evenly split Senate without Republican support. (CNBC)

CORONAVIRUS: The US on Monday reported its smallest daily increase in new coronavirus cases in more than four months, continuing recent glimmers of hope for the country's management of the pandemic. States reported an additional 52,530 infections, down from 58,702 on Sunday, according to Covid Tracking Project. It was the smallest one-day increase in cases since October 18. Over the past week, the US has averaged 64,034 new cases a day, which is the lowest the rate since late October. This represents a drop of 74 per cent from a peak rate in early January of more than 247,000 cases a day. However, Rochelle Walensky, director of the US Centers for Disease Control and Prevention, cautioned at the White House's coronavirus response briefing on Monday afternoon that while the average has been declining for the past five weeks, it is still "high" and on par with the summer surge when states in the sunbelt were among the most afflicted. Casting a shadow over Monday's figures, the US death toll topped 500,000 for the first time, according to Johns Hopkins University. Covid Tracking Project, whose data the Financial Times use for analysis, put the death toll at 490,382. (FT)

CORONAVIRUS: White House Covid advisor Andy Slavitt said Monday the vaccine shipments that were delayed last week by the historic winter storm will be delivered by the middle of the week, CNBC's Will Feuer reported. "I reported on Friday that we would catch up on deliveries by the end of this week," Slavitt said at a White House press briefing. "We now anticipate that all backlogged doses will be delivered by midweek." In total, about 7 million vaccines are expected to be delivered this week, Slavitt said. That number includes shots originally scheduled to go out this week and some of the backlogged doses. To be sure, Slavitt said it will take some time for vaccination sites to recover from the delays. (CNBC)

CORONAVIRUS: Johnson & Johnson can deliver 20 million doses of its single-shot coronavirus vaccine to the U.S. government by the end of March, an executive will testify tomorrow. "Assuming necessary regulatory approvals relating to our manufacturing processes, our plan is to begin shipping immediately upon emergency use authorization, and deliver enough single-doses by the end of March to enable the vaccination of more than 20 million Americans," Johnson & Johnson's Richard Nettles, vice president of medical affairs for the company's pharmaceutical unit Janssen, will tell a House Energy & Commerce subcommittee Tuesday. The company has applied to the Food and Drug Administration for emergency authorization. FDA is expected to grant that as early as this weekend, after an expert FDA panel convenes Friday to discuss the effectiveness and safety of J&J's vaccine. White House officials had cautioned that initial supply of the Johnson & Johnson vaccine would be limited because of production problems, although the company has said it will meet its agreement to supply the U.S. with 100 million doses by the end of June. (POLITICO)

CORONAVIRUS: Moderna Inc. has received positive feedback from U.S. regulators on a proposal to expand the number of doses of its Covid-19 vaccine in each vial, the company said, a move that could help expand supplies. In prepared testimony for a Congressional hearing on Tuesday, Moderna said the U.S. Food and Drug Administration could allow it to put as many as 15 doses of its Covid-19 shot into each vial. Currently, its vials hold 10 doses. (BBG)

CORONAVIRUS: Drugmakers won't have to perform giant efficacy trials for new vaccines or booster shots developed to combat new variants of the coronavirus, the U.S. Food and Drug Administration said. (BBG)

CORONAVIRUS: Movie theaters in New York City will be allowed to open starting on March 15, Governor Andrew Cuomo said Monday. (BBG)

EQUITIES: A Fox reporter tweeted the following on Monday: "Sources tell @FoxBusiness that @RobinhoodApp faces inquiries from as many as 10 AGs over $GME trading frenzy forcing trading platform to slow walk IPO plans. Much of focus involves its ties to @citsecurities." (MNI)

OTHER

U.S./CHINA: U.S. State Department spokesman Ned Price said on Monday that recent remarks by senior Chinese diplomat Wang Yi reflect a continued pattern of Beijing seeking to avert blame for its actions. Price made the comment at a regular press briefing. Wang, a Chinese state councillor and foreign minister, earlier on Monday said China was ready to reopen dialogue with the United States, but urged Washington to respect China's core interests, and stop "smearing" the ruling Communist Party. (RTRS)

G20: The European Union will call on financial leaders of the world's 20 biggest economies this week to keep pumping money into the global economy as long as is needed for it to recover from the COVID-19 pandemic, a document prepared for the meeting showed. Finance ministers and central bank governors of the world's top 20 economies, called the G20, will hold a video-conference on Friday and the global response to the unprecedented havoc wreaked by the coronavirus on the economy will top the agenda. (RTRS)

CORONAVIRUS: Cases of coronavirus and deaths caused by it will be a problem in the next few winters to come in Britain even with widespread vaccinations, England's chief medical officer, Chris Whitty, said on Monday. "I think people need to see it in that way ... this is something where the vaccination will take the rates right down but they will not get rid of this," he told a news conference. "This is something we have to see for the long term and it is my view that it is likely to be a problem in the winter for the next few winters." (RTRS)

CORONAVIRUS: People in certain countries who experience serious side effects from Covid-19 vaccines via the Covax programme are eligible for compensation under a new deal signed by the World Health Organization. The agreement will allow individuals from Covax's Advance Market Commitment-eligible countries, a group of 92 low-and-middle-income economies, which experience "rare but serious adverse events" associated with vaccines distributed by the programme — the global initiative to supply shots to developing countries — to seek compensation. (FT)

HONG KONG: Hong Kong's leader said it is "crystal clear" that Beijing needs to reform the financial hub's electoral system, just a day after China's top official for the city signaled major changes were coming. Chief Executive Carrie Lam said political unrest in the former British colony, including massive protests in 2019, have forced Beijing to ensure the city is governed by patriotic officials. "It is crystal clear we have reached a stage where the central authorities will have to take action to address the situation, including electoral reform," Lam said at a press conference Tuesday morning. "I can understand that the central authorities are very concerned. They don't want the situation to deteriorate further." (BBG)

HONG KONG: The Pfizer Inc.-BioNTech SE vaccine procured by the Hong Kong government will arrive in the city as soon as Thursday, HK01 reported, citing unidentified sources. (BBG)

HONG KONG: Unemployed Hong Kongers will be offered low-interest bank loans – capped at HK$80,000 – under an unprecedented budget measure targeting more than 250,000 jobless workers, the Post has learned. Financial Secretary Paul Chan Mo-po will announce the one-off loan scheme, fully guaranteed by the government, for the benefit of individuals for the first time in his budget speech on Wednesday. In previous budgets, such measures were devised only for small to medium-sized companies. A total of HK$10 billion would be set aside for the loans, a source close to the budget formulation process said. The scheme was said to be a more targeted measure to help those who had lost their jobs, with the city's economy devastated by the Covid-19 pandemic. The city's unemployment rate has hit 7 per cent, close to a 17-year high, meaning more than 250,000 people are out of work. (SCMP)

JAPAN: Japan is planning to lift the state of emergency in places outside the Tokyo metropolitan area earlier than planned, with falling numbers of coronavirus cases easing the strain on hospitals, the Asahi newspaper reported Tuesday. The government is considering lifting the emergency in six prefectures including Osaka and Kyoto at the end of the month, rather than waiting until the planned end date of March 7, the report said, citing several government officials it didn't name. The decision could come as soon as Friday after meetings Wednesday to assess the situation, the Asahi said. Governors of Osaka, Kyoto and Hyogo prefectures on Tuesday plan to ask the central government to lift the emergency, the report said. (BBG)

AUSTRALIA: A lawmaker in Australia's ruling conservative Liberal party has quit the party but will remain in parliament as an independent. Craig Kelly, first elected in 2013 representing the lower-house seat of Hughes in Sydney's southern fringes, told the party-room meeting on Tuesday of his decision to resign, he later told Sky News. He said he would support the government on matters of supply and confidence. Kelly said he would move to the cross bench, which is comprised of independent or minor-party lawmakers not tied to the major political parties. (BBG)

AUSTRALIA: Facebook will restore news pages in Australia days after restricting them. The decision follows negotiations between the tech giant and the Australian government. (CNBC)

SOUTH KOREA: Uncertainties surrounding global economy remain high as Covid-19 still continues to spread while there's chance of vaccination delays, Bank of Korea says in a statement to parliament. BOK to heed changes in financial stability risks, including money flow into asset markets and rising household debt. BOK to seek to stabilize bond markets with measures such as plans to buy government bonds if volatility in interest rates rise. BOK to monitor closely impact of vaccinations and virus on macro-economy. Conditions for supplying foreign currency remain favorable. (BBG)

SOUTH KOREA: BOK maintains its view that the idea of direct purchases of government bonds is "undesirable," the central bank's Governor Lee Ju-yeol says during a parliament session. Direct purchases may harm the government's financial soundness and the central bank's credibility. BOK will continue to play a role in stabilizing bond markets as bond supply is expected to grow. (BBG)

BRAZIL: Brazil's Lower House speaker Arthur Lira said on Monday that the government's 2021 budget will be ready for a floor vote by March 25. In a post on Twitter, Lira also said that he expects administrative reform, a bill to simplify and reduce the cost of the public sector, will be approved in the first half of this year. (RTRS)

BRAZIL: Former General Joaquim Silva e Luna, appointed as Petrobras new CEO by President Jair Bolsonaro, said president promised him that will not act directly in Petrobras' pricing policy, according to O Globo columnist Miriam Leitao, without revealing how she obtained the information. One of the ideas under study to provide more predictability on prices change is to create a stabilization fund to mitigate the periods of high and falling prices. Silva e Luna have heard from experts that the fund is difficult to implement and works well during periods of high, but poorly in periods of fall. Silva e Luna also said to investors that Bolsonaro promised him freedom to work, story said. (BBG)

IRAN: "Until you get back to talks, both sides are going to take positions ... to elevate the tone. But I don't know that we need to focus on that. Let's see whether they agree to come back to the table," said the U.S. official, speaking on condition of anonymity. The White House said U.S allies in Europe are still waiting for Iran to respond to the European Union's offer to host talks among parties to the nuclear deal, which included Iran, Britain, China, France, Germany, Russia and the United States. "There is no doubt that if we don't reach an understanding, they will continue to expand their nuclear program ... whether it's what he says they will do - 60% - or something else," said the U.S. official. "Both sides are now accumulating leverage, whether it's them with their nuclear steps, or us with the sanctions that have been imposed. That's not really helping either side," the U.S. official added. It would be "very concerning" to Washington if Iran enriched to 60%, but it had not yet done so, the official said. The United States wants to "find a way so that neither side feels a need to escalate but to the contrary wants to get back to the place where both sides are in compliance," the official added. In a sign Iran plans to further reduce its compliance, Tehran said on Monday it will end at 2030 GMT the implementation of the Additional Protocol that allows the U.N. nuclear watchdog to carry out snap inspections at sites not declared to the agency, the semi-official Tasnim news agency reported. The U.N. nuclear watchdog said on Sunday it had struck an agreement with Iran to cushion the blow of steps Tehran plans to take this week, including an end to snap inspections, with both sides agreeing to keep "necessary" monitoring for up to three months. (RTRS)

IRAN: The situation regarding Iran's nuclear programme is "worrying", French Foreign Affairs Minister Jean-Yves Le Drian told his EU colleagues during a meeting in Brussels, his ministry said on Monday. Supreme Leader Ayatollah Ali Khamenei said earlier on Monday that Iran might enrich uranium up to 60% purity if the country needed it and would never yield to U.S. pressure over its nuclear activity, state television reported. (RTRS)

MIDDLE EAST: At least two rockets hit Baghdad's fortified Green Zone on Monday but caused no casualties, the Iraqi military said in a statement. The Green Zone hosts foreign embassies and government buildings and is regularly the target of rockets fired by groups that U.S. and Iraqi officials say are backed by Iran. Most attacks cause no casualties but the latest incident is the third rocket attack in Iraq in just over a week to target areas hosting U.S. troops, diplomats or contractors, including one that killed at least one non-American civilian working with the U.S.-led coalition. (RTRS)

COPPER: Chile's state-owned Codelco, the world's largest copper producer, views the recent spike in the price of the red metal as a "good opportunity" to generate cash for investments and hold down debt, but warned it could also drive up the miner's costs, a senior executive told Reuters on Monday. The price of copper shot above $9,000 a tonne for the first time on Monday since 2011, as a nascent global economic recovery has prompted demand to boom for the commodity, critical to global construction and manufacturing sectors. In Codelco's first public comments on how rising prices could affect its business, vice president of sales Carlos Alvarado said they would help put the company on stronger financial footing, but were unlikely to radically alter its existing plans. (RTRS)

OIL: Much of US oil production has rebounded from the severe winter weather that struck much of the country starting the week of Feb. 14, including large domestic oil plays in Texas and Oklahoma, although an estimated 15% of all crude output still remains offline. That means 3.4 million b/d have been restored of an estimated 4 million b/d that were shut in at peak early last week, Parker Fawcett, North American supply analyst for S&P Global Platts Analytics, said. The shut-ins included a large chunk of the country's largest oil play, the Permian Basin of West Texas and southeast New Mexico, which currently produces about 4.3 million b/d. (Platts)

CHINA

PBOC: China's monetary policy needs to be more prudent given the fast-rising macro-leverage ratio, which increased to 270.1% last year, and the risk of imported inflation, the Economic Information Daily commented on its frontpage. The government should steadfastly promote yuan globalization as the U.S. dollar's expected depreciation, due to its easing policies, endangers China's foreign reserves, the Daily said. China has taken precautionary measures, such as potentially allowing individuals to purchase foreign securities, to deal with the potential spillover effects of monetary easing in other countries, it added. (MNI)

ECONOMY: China's economy expected to grow about 8% in 2021. (Economic Information Daily)

SPECIAL PURPOSE BONDS: China's Ministry of Finance has ordered a thorough monitoring of the use of local government special purpose bonds through better data collection, focusing on project preparation, construction, operations and income, the 21st Century Business Herald reported citing sources. As of Dec. 31 last year, there were CNY12.9 trillion outstanding special-purpose bonds, far exceeding the corresponding fund revenue of CNY9 trillion allocated to service these debts, the newspaper said. Many problems were uncovered in project reserves, reporting and issuance, fund spending and disclosures, the Herald said. (MNI)

CREDIT: The continued rise of interest rates on commercial bill financing in China this year reflected stronger demand for finance by corporates, banks' tightening loan quotas, and may eventually drive up loan rates, the China Securities Journal said in an editorial. A six-month benchmark rate on bill financing surged to the highest since December 2018, the newspaper said citing Wind data. The higher borrowing costs indicate quickening economic activities, in line with other data such as blast furnace operations, the export container price index and automobile purchases, as well as other debt financing activities, the Journal said. (MNI)

POLICY: Chinese central authorities have urged local governments to promote green agriculture, industry and services, improve the recyclability of resources, and build a green supply chain, according to new State Council guidelines on a lower-carbon emission economy published by Xinhua News Agency. China will establish a low-carbon multimodal transport and logistic system, enhance garbage classification and resource recycling, and build up a green trading system under the One Belt One Road initiative, it said. China also plans to expand R&D in green technology and the applications of tech innovation, and develop sound market, law and taxation systems in supporting green economic development, Xinhua reported. (MNI)

INFRASTRUCTURE: China has invested more than 260b yuan in 5G construction and has built 718,000 5G base stations nationwide, representing about 70% of the world's total, MIIT Vice Minister Liu Liehong says at a conference in Shanghai. China also aims to have more international collaboration in information security. (BBG)

OVERNIGHT DATA

CHINA JAN NEW HOME PRICES +0.28% M/M; DEC +0.12%

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 109.2; PREV. 109.9

Consumer confidence has fallen for the third week in a row, despite the easing of lockdown restrictions in Victoria. Indeed, Regional Victoria led the fall with confidence deteriorating 10.5%. This could possibly be a catch-up to last week's surprise rise in regional sentiment. Within the detail, the softness in 'time to buy a major household item' is interesting given the current strength of the housing market. We would expect the two to go hand-in-hand, so the relative softness of this aspect of sentiment may not endure. (ANZ)

NEW ZEALAND Q4 RETAIL SALES EX INFLATION -2.7% Q/Q; MEDIAN -0.5%; Q3 +27.8%

SOUTH KOREA FEB CONSUMER CONFIDENCE 97.4; JAN 95.4

SOUTH KOREA Q4 HOUSEHOLD CREDIT KRW1.7261TN; Q3 KRW1.6818TN

CHINA MARKETS

PBOC NET INJECTS CNY10BN VIA OMOS TUESDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged on Tuesday. This resulted in a net injection of CNY10 billion given no maturity of reverse repos today, according to Wind Information.

- The operation aims to maintain reasonable and ample liquidity in the banking system, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2188% at 09:24 am local time from 2.1709% on Monday.

- The CFETS-NEX money-market sentiment index closed at 48 on Monday vs 35 last Saturday. A higher index indicates increased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.4516 TUES VS 6.4563

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower for a second day at 6.4516 on Tuesday. This compares with the 6.4563 set on Monday.

MARKETS

SNAPSHOT: No Fresh Narratives In Asia

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 is closed

- ASX 200 up 52.504 points at 6833.4

- Shanghai Comp. up 12.327 points at 3654.772

- JGBs are closed

- Aussie 10-Yr future up 3.5 ticks at 98.430, yield down 3.8bp at 1.564%

- U.S. 10-Yr future +0-03 at 135-13+, cash Tsys are closed

- WTI crude up $0.99 at $62.68, Gold up $2.55 at $1812.21

- USD/JPY down 6 pips at Y105.02

- KAPLAN: IF U.S. CONTINUES TO RECOVER, RISING BOND YIELDS WOULD BE ENCOURAGING SIGN (DJ)

- U.S.: WANG YI'S COMMENTS FIT PATTERN OF BEIJING SEEKING TO AVERT BLAME (RTRS)

- ECB'S VILLEROY: NO RISK OF OVERHEATING IN EURO ZONE (RTRS)

- BOE'S VLIEGHE DOUBTS HE WILL EVER SEE RATES BACK AT 5% (RTRS)

- CHINA GDP RECOVERY PAVES WAY FOR MONETARY POLICY NORMALIZATION (ECO INFO DAILY)

BOND SUMMARY: Core FI Supported In Asia, Liquidity Thinned By Japanese Holiday

Core FI was better bid during Asia-Pac trade, although there was little in the way of headline flow to support the move.

- T-Notes +0-03 at 135-13+, with some looking to month-end extensions that are a shade above average. Cash Tsys are closed until London hours owing to the observance of a Japanese holiday.

- We suggested that the early bid in the longer end of the ACGB curve could be a result of cross-market plays vs. the U.S., while the bid in the shorter maturity ACGBs/red bill contracts may suggest that participants believe that the recent move lower has gone too far, too fast, meaning that some may be establishing fresh longs after the recent flush out. YM +2.0, XM +4.0 ahead of the close, with the overnight steepening more than unwound. Elsewhere, speculation did the rounds re: the potential for the RBA to become more active with its ACGB purchases in coming days, given the recent sell off and steepening seen between ACGB Apr '24 & Nov '24.

AUSSIE BONDS: The AOFM sells A$150mn of the 2.50% 20 Sep '30 I/L Bond, issue #CAIN408:

The Australian Office of Financial Management (AOFM) sells A$150mn of the 2.50% 20 September 2030 I/L Bond, issue #CAIN408:- Average Yield: -0.4381% (prev. -0.7873%)

- High Yield: -0.4325% (prev. -0.7825%)

- Bid/Cover: 4.7067x (prev. 5.8067x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 100% (prev. 68.8%)

- bidders 34 (prev. 38), successful 10 (prev. 5), allocated in full 10 (prev. 3)

EQUITIES: Asia-Pac Bourses Reverse Early Losses

Stocks in Asia have meandered their way into positive territory, shrugging off a negative lead from the US and reversing the trend after dropping for three consecutive days. Markets in mainland China opened in negative territory but reversed losses as the Hang Seng gained led by casinos. In general risk assets were boosted as the greenback retreated and oil gained. Japanese markets were closed for a public holiday.

- Markets in Taiwan were under pressure, losses in the US were led by the Nasdaq today which has seen some pessimism around demand for tech products. Losses in Taiwan were limited though after Taiwan announced it would relax rules for foreigners visiting the US from March 1.

- Futures in the US and Europe are higher, reversing some of the decline from yesterday, markets look ahead to clues on Fed policy in a speech from FOMC Chair Powell.

OIL: Banks Boost Forecasts

Crude futures have extended gains in Asia on Tuesday; WTI last up $0.75 at $62.46/bbl, brent is up $0.99 at $66.23.

- The gains come as around 15% of crude output remains offline, despite a rebound in production after adverse weather. Flows to the US from Asia have increased during the period, data compiled by Bloomberg shows at least three tankers were booked to ship gasoline and jet fuel from Asia to the West Coast last week, up from just one in the whole of January.

- Banks have been boosting forecasts for crude in the midst of the rally, Morgan Stanley increased its Q3 brent forecast to $70/bbl citing under supply in 2021 of 2.8m bpd, while Goldman Sachs raised Q3 estimates to $73/bbl.

GOLD: Softer DXY Supports, Powell On Deck

A softer DXY has supported bullion over the last 24 hours or so, with the bounce gaining traction after technical support held on Friday. Spot last deals a handful of dollars higher on the day at $1,812/oz.

- Some focus on physical buying out of India has been evident.

- Still, ETF holdings of gold have been on a steady downtrend during the month of February, and now sit at the lowest level seen since July '20, although the measure remains elevated in historical terms.

- The impending round of rhetoric from Fed Chair Powell is set to shape gold's fortunes over the coming couple of sessions.

FOREX: Firmer Crude Supports Oil-Tied FX Albeit Antipodeans Lag

Oil-tied NOK and CAD caught a modest bid on the back of firmer crude oil prices, but the Antipodeans failed to follow suit. AUD/USD had a brief look above yesterday's multi-year highs as a BBG trader source pointed to AUD purchases linked to short-covering/demand from leveraged funds ahead of $0.7900 put strikes. That said, the currency failed to cling onto its initial gains and pulled back later in the session.

- AUD/CAD turned its tail just ahead of a key psychological barrier, with a contact flagging suspected profit taking ahead of C$1.0000. The rate's RSI pulled back below 70, with a bearish divergence taking shape.

- NZD struggled from the off amid positioning in the lead-up to the upcoming RBNZ MonPol decision and following the release of worse than expected NZ retail sales data.

- USD/JPY traded on a slightly softer note, extending its four-day losing streak. Japanese markets were closed for the Emperor's birthday.

- The PBOC fixed its central USD/CNY mid-point at CNY6.4516, 23 pips below sell side estimates, the second lower fix in three days. Offshore yuan strengthened but respected yesterday's range.

- Today's key data releases include final EZ CPI, UK labour market report, U.S. Conf. Board Consumer Confidence and Swedish unemployment.

- Elsewhere, all eyes are on Fed Chair Powell's semi-annual MonPol Report. BoC Gov Macklem & Riksbank's Bremak are also due to speak today.

FOREX OPTIONS: Expiries for Feb23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2135-55(E2.4bln-EUR puts), $1.2195-00(E1.0bln-EUR puts), $1.2300(E788mln-EUR puts)

- USD/JPY: Y103.50-55($772mln), Y104.70-80($760mln), Y104.90-105.00($1.0bln), Y105.75($735mln), Y105.95-00($769mln)

- EUR/GBP: Gbp0.8750(E551mln-EUR puts)

- USD/CHF: Chf0.8870-80($610mln-USD puts)

- AUD/USD: $0.7770-75(A$642mln), $0.7900(A$622mln)

- AUD/JPY: Y83.00(A$494mln)

- USD/CNY: Cny6.42($505mln)

- USD/MXN: Mxn20.60($500mln)

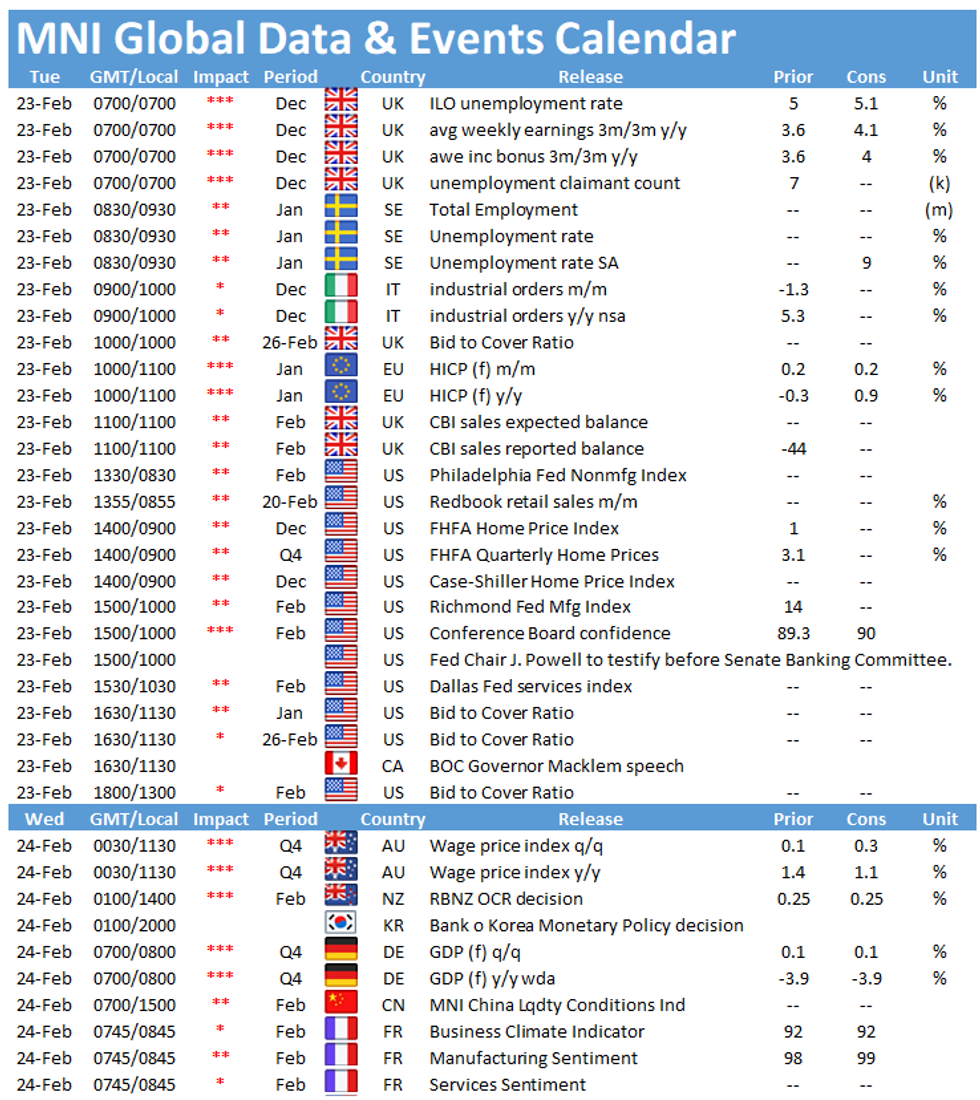

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.