-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Sino-U.S. Mutterings Dominate Headlines

EXECUTIVE SUMMARY

- BIDEN SIGNS RELIEF BILL, CHECKS TO HIT AS SOON AS THE WEEKEND

- U.S. SLAMS CHINA'S HK MOVE, TO RAISE XINJIANG GENOCIDE CHARGE IN TALKS (RTRS)

- U.S. IMPOSES NEW 5G LICENSE LIMITS ON SOME HUAWEI SUPPLIERS (BBG)

- ECB DOESN'T INTEND FASTER BOND-BUYING TO LEAD TO MORE STIMULUS (BBG)

- J&J SEES EU VACCINE DELIVERY TO BEGIN SECOND HALF OF APRIL (BBG)

- BOJ MULLING DITCHING OF ETF TARGET (MAINICHI)

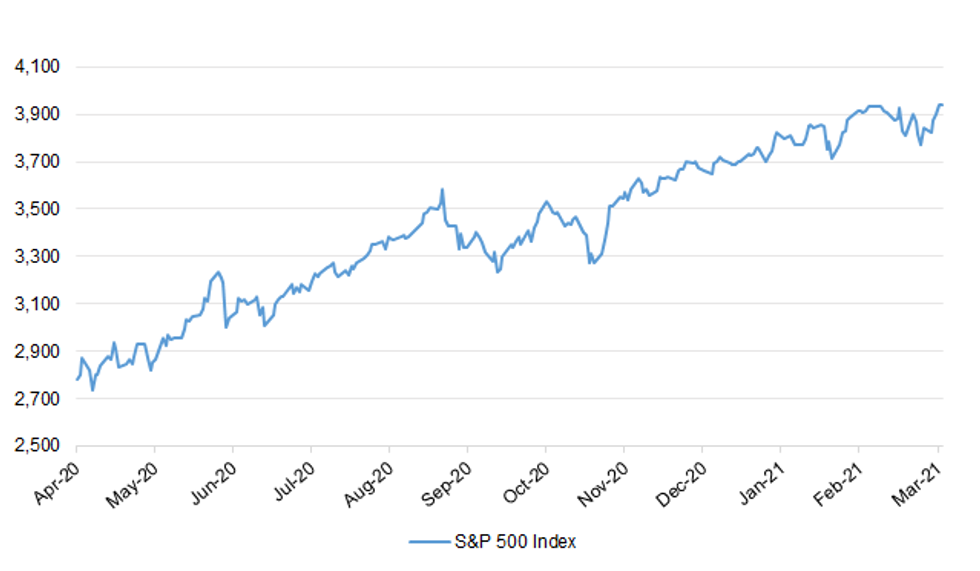

Fig. 1: S&P 500 Index

Source: MNI - Markets News/Bloomberg

Source: MNI - Markets News/Bloomberg

UK

CORONAVIRUS: The highly contagious coronavirus variant first identified in the U.K. is associated with a 64% higher risk of dying from Covid-19, according to a study published in the British Medical Journal. Researchers analyzed data from more than 100,000 patients, comparing death rates among people infected with B.1.1.7, the variant from the U.K., and those infected with other previously circulating strains. People infected with B.1.1.7 were between 32% and 104% more likely to die, researchers said. That translates to a central estimate of 64%, they added. (CNBC)

CORONAVIRUS: The "stay at home" order in Wales will be lifted and replaced by a "stay local" message this weekend - with people allowed to socialise outdoors in small groups. From Saturday, four people from two households will be able to meet outdoors to socialise, including in gardens. Outdoor sports facilities, including basketball courts, tennis courts and golf courses, will also be able to reopen, and indoor care home visits will restart for single designated visitors. (Sky)

BREXIT: The U.K. has floated plans to hold a meeting of Group of Seven trade ministers in Northern Ireland in May, ruffling feathers among some European diplomats, according to a person familiar with the British plans. The idea of taking G-7 trade talks to Northern Ireland has raised eyebrows, the official said, because the U.K. is embroiled in a dispute with the European Union over whether Prime Minister Boris Johnson will honor his commitment under the Brexit agreement to establish checks for goods moving between the province and the rest of the U.K. While it's not clear whether the suggested location was a deliberate provocation, the U.K. has inflamed tensions with the EU by saying it will unilaterally change rules on trade across the Irish Sea that were part of the post-Brexit accord. Britain has said it will waive customs paperwork on food entering Northern Ireland until October, ignoring the April deadline agreed with the EU. The EU has said the move would be a breach of international law and that it will take legal action. (BBG)

BREXIT: Thousands of companies in Britain were forced to stop trading with the European Union in January because of disruption caused by Brexit, research suggests (James Dean writes). Nearly one in five company directors whose organisations generally trade with the EU said that they had halted trade with the bloc that month, according to a poll of 905 members of the Institute of Directors. The institute has 25,000 members, of which about three quarters usually conduct business with the EU. Of the 17 per cent polled who said that their organisations had halted EU trade in January, 48 per cent said that this had been temporary and 42 per cent said it was permanent. (The Times)

FISCAL: A rise in global interest rates that could destabilise the UK's public finances is one of the risks that keeps him up at night, chancellor Rishi Sunak told MPs on Thursday. Giving evidence to the House of Commons Treasury committee on the Budget he outlined last week, Sunak said it was too soon to tell how much long-term damage the economy would sustain from the coronavirus pandemic. But the other big threat to the UK's fiscal outlook was the risk that a long-term decline in interest rates — which has allowed governments to increase borrowing at much lower cost than in the past — might go into reverse. "The public finances are much more sensitive to changes in interest rates and inflation than they were previously," Sunak told MPs. (FT)

SCOTLAND: Boris Johnson will make clear on Sunday that he will not grant a second Scottish independence referendum, even if the SNP wins a majority in May's Holyrood elections. In a speech to the Scottish Conservative Party conference, the Prime Minister will argue holding a referendum during the Covid-19 pandemic would be reckless. The defiant message comes as Whitehall increasingly focuses on how to counter the prospect of 'Scexit' – Scottish exit from the Union – in the coming months and years. Ministers have agreed there should be no new version of Better Together, the pro-UK campaign in the 2014 referendum, instead relying on an existing web of Unionist bodies. A billion-pound spending drive is under way which will see the UK Government invest directly in Scottish transport and infrastructure, circumventing the SNP-run Scottish Government. Other eye-catching ideas are being pushed from inside the Cabinet, such as the House of Commons sitting in Scotland, Wales or Northern Ireland for a fortnight each September. (Telegraph)

MARKETS: The Treasury is drawing up plans to overhaul rules that have tightly governed London's capital markets, looking to counter fears that the City is losing its place as a global financial centre after Brexit. The proposals are expected to largely target Mifid II, the EU's main financial services legislation, that set tough and often prescriptive rules to improve markets after the 2008 crisis, according to two people with knowledge of the plans. Introduced in 2018 to inject more transparency and competition, executives have complained that large sections of Mifid II have had only marginal benefit and created layers of red tape. (FT)

EUROPE

ECB: Most European Central Bank policy makers have no intention of expanding their 1.85 trillion-euro ($2.2 trillion) emergency stimulus program despite their pledge on Thursday to step up the pace of bond buying to keep yields in check, according to officials familiar with the matter. The Governing Council's decision to make purchases at a "significantly higher pace" over the next three months means buying debt at a faster rate than the program's timeline suggests, the officials said, asking not to be identified. Buying would then be slowed if the economic outlook allows. The pandemic purchase program is due to run until at least the end of March 2022, and has almost 1 trillion euros of firepower left. The ECB says it can be "recalibrated" -- ie increased -- if needed. (BBG)

CORONAVIRUS: Johnson & Johnson comments after receiving conditional marketing authorization from the European Commission. Company aims to begin delivery of its vaccine to the EU in the second half of April. J&J sees supplying 200 million doses to the EU, Norway and Iceland in 2021. (BBG)

CORONAVIRUS: The European Union's drugs regulator said the benefits of AstraZeneca Plc's Covid-19 vaccine continue to outweigh the risks, and the shot can still be administered while investigations of possible blood clots are ongoing. The European Medicines Agency reiterated that there is currently no indication that the Astra vaccine caused these conditions, which aren't listed as side effects. The EMA issued the statement as Denmark, Italy and Norway joined other European countries in temporarily suspending use of some or all of their Astra Covid shots. The regulator is investigating the concerns. (BBG)

CORONAVIRUS: AstraZeneca Plc will deliver less than half the planned umber of Covid-19 vaccines to the European Union in the second quarter after attempts to tap the company's global supply chain were unsuccessful. The pharmaceutical giant will deliver about 76 million out of a planned 180 million doses to the bloc in the three-month period through June, according to data based on delivery projections for one member state seen by Bloomberg. The national figures were extrapolated to the EU level based on the European Commission's methodology for distributing supplies. (BBG)

FRANCE: French Health Minister Olivier Veran said on Thursday the COVID-19 situation in the greater Paris region was especially worrying, with a high number of people in intensive care units (ICUs) for the disease. During a weekly briefing, Veran said that if the pandemic continued at its current rhythm in the area, the government would take "the necessary measures" to rein it in. (RTRS)

FRANCE: French Health Minister Olivier Veran said on Thursday that French health authorities see no reason to suspend the use of AstraZeneca COVID-19 vaccinations. "The benefits of the AstraZeneca vaccine are higher than the risks," Veran said at the goverment's weekly coronavirus briefing. (RTRS)

SPAIN: Spain's government plans to dedicate around two-thirds of an 11 billion-euro ($13 billion) fiscal package on direct aid to struggling firms, according to an administration official. Madrid plans to channel around 7 billion euros in transfer payments directly to companies, 3 billion euros toward a restructuring of state-backed loan guarantees and one billion for a separate restructuring fund. Socialist Prime Minister Pedro Sanchez announced the package last month but didn't provide details on how the funds would be distributed. Government officials have been hammering out the specifics and are expected to announce the details publicly after an extraordinary cabinet meeting on Friday. (BBG)

PORTUGAL: Portugal plans to open nursery schools on March 15 as the government starts to gradually ease confinement measures adopted to contain one of the world's worst outbreaks, Prime Minister Antonio Costa said. People will continue to have a duty to stay at home until the Easter holiday weekend, and remote working will remain mandatory when possible, Costa said at a press conference on Thursday. Controls on the land border with Spain will also remain in place for now. Secondary schools and restaurants will be able to open from April 19, the prime minister said. (BBG)

RATINGS: Potential sovereign rating reviews of note scheduled for after hours on Friday include:

- S&P on Austria (current rating: AA+; Outlook Stable), Luxembourg (current rating: AAA; Outlook Stable), Malta (current rating: A-; Outlook Stable), Norway (current rating: AAA; Outlook Stable) & Portugal (current rating: BBB; Outlook Stable)

U.S.

FED: MNI BRIEF: Fed Balance Sheet Near Record High, +$22B to $7.58T

- The Fed's balance sheet climbed USD22 billion over the last week to USD7.58 trillion, data released Thursday showed, as a Treasury cash balance drawdown drove bank system reserves to a fresh record high - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: U.S. household net worth soared in the closing months of 2020 to a fresh record, driven by rising stock prices and residential real estate values after the government took unprecedented steps to ease the financial fallout from the pandemic. Household net worth increased by $6.9 trillion, or 5.6%, to $130.2 trillion in the fourth quarter, a Federal Reserve report out Thursday showed. Household debt increased at an annual rate of 6.5%, the fastest in 13 years, according to data compiled by Bloomberg. Record-low mortgage rates attracted first-time homebuyers as well as those looking for more space. A measure of home prices in 20 U.S. cities surged by more than 10% in December from a year earlier. At the same time, stocks continued to rally.

FISCAL: Some Americans will receive new coronavirus stimulus checks as soon as this weekend, the White House said Thursday. The news from White House press secretary Jen Psaki came minutes after President Joe Biden signed the $1.9 trillion Covid relief bill. (CNBC)

FISCAL: President Joe Biden wants his infrastructure overhaul plan to win bipartisan support, but lawmakers behind the scenes are starting to draw battle lines around what should be in the legislation – and how to pay for it. In recent meetings with Biden and his top aides, lawmakers from both parties suggested breaking up the bill along different lines, according to some attendees. (CNBC)

FISCAL: On Thursday, a bipartisan group of lawmakers introduced the Paycheck Protection Program Extension Act, which would move the deadline to May 31. The program, run by the Small Business Administration, is set to expire on March 31 if it isn't extended by Congress. Beyond extending the deadline, the bill would give the SBA the authority to continue to process pending applications for an additional 30 days after the end of the program. (CNBC)

FISCAL: Democrats are getting an early start on their tax-increase agenda. They've tucked a trio of little-noticed tax hikes on the wealthy and big corporations into their coronavirus relief package that together are worth $60 billion. One takes away deductions for publicly traded companies that pay top employees more than $1 million. Another provision cracks down on how multinational corporations do their taxes. A third targets how owners of unincorporated businesses account for their losses. It's surprising because Democrats were widely expected to put off their tax-increase plans until later. Many lawmakers are wary of hiking them now, when the economy is still struggling with the coronavirus pandemic. If anything, when it came to their stimulus plan, Democrats were focused on cutting taxes, not increasing them. (POLITICO)

CORONAVIRUS: Every US state has detected at least one variant of coronavirus after South Dakota confirmed the presence of a strain that was first identified in the UK. According to data from the US Centers for Disease Control and Prevention last updated on March 9, South Dakota and Vermont were the only two states to not have confirmed coronavirus variants that were first identified in the UK (B.1.1.7), South Africa (B.1.351) or Brazil (P.1). (FT)

CORONAVIRUS: One-quarter of American adults have now received at least one coronavirus shot, putting the US vaccine rollout on the cusp of surpassing 100m doses in total. More than 64m people have been given either one or two doses, covering 19.3 per cent of the overall population and 25.1 per cent of those over 18 years old, the US Centers for Disease Control and Prevention said on Thursday. (FT)

CORONAVIRUS: The federal government will open more than 100 new vaccination sites in New York City, US Senate majority leader Chuck Schumer said on Thursday. He said vaccination access would be "supercharged" in the city with a programme to provide free jabs using community health centres. (FT)

CORONAVIRUS: Los Angeles on Thursday expanded vaccination eligibility to transport workers and cleaners, just as it deploys the one-shot Johnson & Johnson jab. (FT)

CORONAVIRUS: Florida Governor Ron DeSantis plans to open up Covid-19 vaccines to residents 55 and up "soon," and they could be available to all adults at some point next month. DeSantis had already announced he would expand eligibility by five years to everyone 60-and-over starting on Monday. But speaking Thursday in Lake City, Florida, he suggested further expansion was on the horizon. He said the state didn't anticipate any extra Johnson & Johnson vaccine for this week or next, but probably the week starting March 21. "If the supply floodgates really open up, we could be in a position some time in April where it's just available and people can get it," he said. (BBG)

CORONAVIRUS: Just 10 per cent of Manhattan's 1m office workers had returned to the workplace by early March, according to a study indicating that most of them will still be working remotely by September. The survey of large employers by the Partnership for New York City, a business advocacy group, suggests that Manhattan offices are still as empty as they were last October. Expectations for returning to the office have slipped since then, however: while employers polled last October expected to bring back 48 per cent of their office staff by July, they now anticipate having just 45 per cent back at their desks by September. (FT)

CORONAVIRUS: Texas Attorney General Ken Paxton said he would sue leaders of the Austin area for defying a state executive order and enforcing mask mandates. "I told Travis County & The City of Austin to comply with state mask law," Paxton tweeted. "They blew me off. So, once again, I'm dragging them to court." Governor Greg Abbott rescinded the state's mask mandate and banned enforcement of any local mask ordinances, starting Wednesday. Nonetheless, Austin Mayor Steve Adler and Judge Andy Brown of surrounding Travis County said they would continue to enforce mask rules to contain the virus's spread. (BBG)

RATINGS: Moody's changed its outlook for U.S. states to stable from negative. (MNI)

OTHER

U.S./CHINA: The Biden administration has informed some suppliers to China's Huawei Technologies Co. of tighter conditions on previously approved export licenses, prohibiting items for use in or with 5G devices, according to people familiar with the move. The 5G ban is effective as of this week, according to the people, who asked not to be identified to discuss nonpublic communications. The rules create a more explicit prohibition on the export of components like semiconductors, antennas and batteries for Huawei 5G devices, making the ban more uniform among licensees. Some companies had previously received licenses that allowed them to keep shipping components to Huawei that the Chinese company may have then used in 5G equipment, while other companies were already subject to tighter restrictions. (BBG)

U.S./CHINA: The United States on Thursday condemned Chinese moves to change Hong Kong's electoral system and forecast "difficult" talks with Beijing's top diplomats next week, when the genocide Washington says China is committing against minority Muslims will be an issue the U.S. side plans to raise. White House spokeswoman Jen Psaki said Secretary of State Antony Blinken and national security adviser Jake Sullivan would not hold back when they meet with the Chinese diplomats in Alaska on March 18 and 19, "whether it's on Taiwan, or ... efforts to push back democracy in Hong Kong, or on concerns we have about the economic relationship." "Addressing the genocide against Uighur Muslims is something that will be a topic of discussion with the Chinese directly next week," she added. (RTRS)

U.S./CHINA: The U.S. should not seek to dominate the planned diplomatic talks with China to be held in Anchorage on March 18, but be prepared to listen and pursue mutual benefits, the Global Times said in an editorial. China and the U.S. should create a framework for coexistence, allowing time to resolve differences while engaging in peaceful competition, the newspaper said. (MNI)

EU/CHINA: The European Union is set to target China with sanctions for the first time since the 1989 Tiananmen Square crackdown, blacklisting four people and one entity over human rights abuses in Xinjiang, several diplomats said. Senior EU officials agreed to use its new human rights sanctions regime to target the Chinese officials on Thursday, after long negotiations this week once again exposed the bloc's divisions on how to approach Beijing. The sanctions, which include a travel ban and asset freezes, are being imposed because of Beijing's actions in Xinjiang that the U.S. and some European capitals have labeled a genocide against the Uyghur Muslim minority. (WSJ)

U.S./JAPAN: Japanese Prime Minister Yoshihide Suga will visit the U.S. in the first half of April at the earliest for a meeting with President Joe Biden, which is likely to be his first get-together with a foreign leader since he took office in January, Japanese Chief Cabinet Secretary Katsunobu Kato told a news conference on Friday. (Nikkei)

GLOBAL TRADE: Renesas Electronics Corp.'s top executive warned that a global shortage of auto semiconductors may persist into the second half, joining other industry leaders in bracing for a chip crunch to snarl production of cars and gadgets well past the summer. (BBG)

CORONAVIRUS: In the UK, the Medicines and Healthcare products Regulatory Agency (MHRA) said there was no evidence the vaccine had caused problems, and people should still go and get vaccinated when asked to do so. "Blood clots can occur naturally and are not uncommon. More than 11 million doses of the Covid-19 AstraZeneca vaccine have now been administered across the UK," said Phil Bryan of the MHRA. (BBC)

CORONAVIRUS: Swiss health officials have identified 597 reports of suspected adverse reactions to Covid-19 vaccines, of which 21 resulted in death. Swissmedic, the national health agency, said the average age of those who died was 85, "and the majority of them had serious pre-existing conditions". Officials said 343 reports involve the Pfizer/BioNTech's Comirnaty vaccine, while 251 are associated with Moderna's vaccine. The vaccine was not specified in three cases. Women accounted for more than two-thirds of the adverse reaction reports. "The majority of the reports — 70.4 per cent — were not serious," Swissmedic concluded. The reactions most commonly reported were fever, shortness of breath, existing Covid-19, nausea, headaches and migraines, and recurrence of shingles. (FT)

CORONAVIRUS: Novavax Inc.'s Covid-19 vaccine was 96.4% effective against mild, moderate and severe symptoms of the disease in the final analysis of a late-stage trial in the U.K. The company also released final results of a mid-stage trial from South Africa showing that its vaccine was 55.4% effective against a variant circulating there that's already been shown to partially elude the effects of some shots. (BBG)

CORONAVIRUS: Johnson & Johnson's chief scientist said the company expects to produce up to 3 billion doses of its COVID-19 vaccine next year, after the European Union approved the one-shot immunization on Thursday. The company is bringing on three manufacturing plants to produce the key drug substance. It also will have seven plants globally that will handle final production steps and bottling into vials known as fill and finish. "All these will function together to deliver the 1 billion by the end of the year," Dr. Paul Stoffels, J&J's chief scientific officer, said in an interview. (RTRS)

CORONAVIRUS: AstraZeneca has asked the Biden administration to let it lend American doses to the European Union, but the administration, for now, has denied the request, one official said. As of Wednesday, 30 cases of obstructive blood clots had been reported among nearly five million people vaccinated with the AstraZeneca vaccine in the European Economic Area — a rate no higher than in the general population, the European Medicines Agency said. The agency, Europe's main drug regulator, said there was no indication that the vaccine "has caused these conditions" and that its benefits outweigh any risks. (New York Times)

HONG KONG: Concern spread among Hong Kong's business and expatriate community as a coronavirus outbreak linked to a gym widened and hundreds of people were taken to government centers for quarantine that can last 14 days. While the cluster is smaller than previous flareups such as one linked to dance halls in November, it has engulfed a tightly-knit world of mostly Western expatriates who work for global financial institutions and whose children attend international schools with annual fees of HK$250,000 ($32,000) or more. (BBG)

BOJ: The Bank of Japan is mulling the scrapping of its annual guideline for buying stock funds at its policy review next week, according to the Mainichi newspaper. The central bank is likely to eliminate its annual target to buy 6 trillion yen ($55 billion) of exchange-traded funds while keeping a ceiling of 12 trillion yen on possible annual purchases, according to the report. Jettisoning the target would give the central bank more flexibility in its buying, the report said. (BBG)

AUSTRALIA: The action will avoid Australia being designated a harmful tax regime by the OECD and the European Union, Treasurer Josh Frydenberg said in a statement. The OBU, established in 1992, provides a more attractive tax rate for offshore banking activity conducted by Australian registered banks. The government will use this time to consult with industry on alternative measures to support the industry and ensure activity remains in Australia once the two year grandfathering period ends. (BBG)

NEW ZEALAND: New Zealand Prime Minister Jacinda Ardern says Auckland will move to alert level 1 at midday Friday, meaning social distancing requirements will be lifted. The outbreak in the city has been contained and it has been 14 days since the last exposure event, Ardern said at a news conference Friday. (BBG)

NEW ZEALAND: New Zealand's "unsustainable" house price rises could trigger a pronounced correction, the International Monetary Fund (IMF) warned in its staff report on Friday. The country's success in managing COVID-19 has enabled a faster economic recovery than other countries, but a slew of monetary and fiscal stimulus measures has super-charged property market values. IMF's warning comes as median prices for residential property across New Zealand rose by a record 22.8% in February, according to latest statistics from the Real Estate Institute of New Zealand (REINZ) released on Thursday. Median house prices in its biggest city, Auckland, increased by a record 24.3% to NZ$1,100,000 ($794,750.00). The IMF said financial stability concerns have been heightened by speculative demand for housing, which along with historically low interest rates and structural housing supply shortages are amplifying the house price surge. (RTRS)

SOUTH KOREA: South Korea will extend current social distancing rules, including ban on gathering of 5 or more people, for another two week as daily virus cases still hovering around 300-400 levels, Prime Minister Chung Sye-kyun says in meeting on Friday. Chung said it is very worrisome that the third wave of infections which began in greater Seoul area, where more than half of the Korean people live, hasn't been controlled and the spread is still continuing. (BBG)

SOUTH KOREA: Inflation may temporarily accelerate in 2Q on base effect and also on signs prices of oil, raw material and grain may rise on global demand recovery and extreme weather situation, Vice Finance Minister Kim Yongbeom says in a meeting. Government will do its best to manage prices. (BBG)

CANADA: Ontario's infections caused by Covid-19 variant strains have roughly quadrupled since the beginning of February, a provincial government advisory panel reported Thursday. "Our ability to control the rate of spread will determine whether we return to normal or face a third wave of infection," the advisers wrote. (BBG)

CANADA: Health Canada says it will move forward with administering the Oxford-AstraZeneca COVID-19 vaccine despite at least nine European countries stopping its use. Health Canada spokesperson Tammy Jarbeau said the agency is aware of reports of adverse events in Europe and would "like to reassure Canadians that the benefits of the vaccine continue to outweigh its risks." "Health Canada authorized the vaccine based on a thorough, independent review of the evidence and determined that it meets Canada's stringent safety, efficacy and quality requirements," Jarbeau said. (Global News)

CANADA: MNI REALITY CHECK: Canada Job Market Frayed by Supply Upheaval

- Canadian industry leaders told MNI the job market will remain challenged by disruptions to supply chains and health restrictions that are hurting demand for some products and making it hard to bring in workers for industries that want to expand. Employment may rise by 100,000 in February to offset just part of the 266,000 jobs lost in the prior two months during the second wave of Covid-19 lockdowns. The unemployment rate is also expected to decline to 9.2% from 9.4% in a Statistics Canada report due Friday at 830am EST - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

CANADA: MNI POLICY: Canada Needs Debt-GDP Target After Pandemic-OECD

- Canada needs to restore a specific fiscal target such as debt-to-GDP after the burst of deficits to fight the pandemic is no longer needed or risk a loss of investor confidence, the OECD said, joining a growing chorus of calls for clarity on rebalancing the government's books. For now the focus must remain on the substantial rescue package, because a strong economic restart will help slim the deficit as emergency spending ends and tax revenue ramps up, the Paris-group said in a review of the country's economy - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

BOC: Bank of Canada officials were driven by concern about the uneven labor market recovery in deciding this week to maintain extraordinary monetary stimulus. In a speech Thursday aimed at providing insights into the bank's discussions, Deputy Governor Lawrence Schembri said the central bank's governing council spent a lot of time weighing both positive and negative signals in recent economic data, but concluded the economy continues to need support. "Ultimately, Governing Council decided that the economy still requires extraordinary support from our monetary policy," Schembri said Thursday in prepared remarks. He cited the rise in long-term unemployment coupled with uneven impacts of job losses, along with uncertainty around the evolution of the virus. (BBG)

MEXICO: President Andres Manuel Lopez Obrador's new law that prioritizes Mexico's state utility over private companies has hit its first major judicial hurdle two days after it was ratified, when a court granted a provisional suspension to at least two companies. In the decision, which was handed to Eoliatec del Pacifico SAPI de CV and another unnamed company, the federal district court said the suspension should apply country-wide. Eoliatec del Pacifico is a wind farm partnership between divisions of France's Electricite de France and Japan's Mitsui & Co. The ruling is a major setback for the president, who has sought to protect the embattled state utility Comision Federal de Electricidad from private competition. The law determines which producers have priority in distributing power, starting with state hydroelectric plants and other government facilities. Only then can private solar and wind farms be allowed to supply the network. (BBG)

MEXICO: Mexico's government will study the need for a tax reform this year and is talking to regional authorities about their fiscal requirements to see if it is warranted, Finance Minister Arturo Herrera told Reuters on Thursday. While Mexico has long suffered from a weak tax take, leftist President Andres Manuel Lopez Obrador pledged not to increase the overall tax burden in the first three years of his government, a period which ends in December. Noting that the coronavirus pandemic had put an extra load on the public health system, Herrera said the tax issue would be taken up after midterm elections in June, offering one of the clearest indications so far that an overhaul is possible. (RTRS)

MEXICO: Mexico's yield curves performed favorably during the pandemic compared with emerging markets, Banxico Governor Alejandro Diaz de Leon said at the Mexican Banking Association Conference Thursday. Diaz de Leon reiterated the bank's responsibility is to manage monetary policy prudently and orderly. Finance Minister Arturo Herrera said at event that vaccination campaign will lead to exit from crisis caused by coronavirus pandemic. (BBG)

BRAZIL: Unemployment is a direct side-effect of lockdown measures taken to curb the spread of coronavirus in Brazil, President Jair Bolsonaro said in his weekly live on social media. Bolsonaro again criticized restrictions adopted by governors and mayors througout the country, adding that states where businesses were closed should also pay emergency aid. "If (Fernando) Haddad or Ciro (Gomes) were governing, Brazil would be shutdown," he said. Bolsonaro also compared restrictive measures with dictatorial regimes, calling himself a guardian of democracy. Printed vote amendment bill should be voted soon, he added, noting that he has already discussed the matter with Lower House Speaker Arthur Lira. (BBG)

BRAZIL: A measure to renew billions of dollars in emergency aid for millions of Brazilians struggling amid the COVID-19 pandemic passed in the lower house of Congress on Thursday, though lawmakers were still working on the details. The bill, already approved by the Senate, allows for a maximum spending of 44 billion reais — $7.9 billion — though the initial measure did not specify how much families would receive, or for how long. Economy Minister Paulo Guedes earlier said it should be between $175–$375, for up to four months. (AP)

BRAZIL: Brazil's economic team is considering the likelihood that this year's round of Covid cash handouts may last longer and cost more than what was approved by congress, according to four government officials with knowledge of the matter. The constitutional amendment passed by the lower house late Thursday, known as the emergency bill, allows the government to pay an average of 250 reais to about 40 million vulnerable Brazilians between March and June, at a maximum cost of 44 billion reais ($8 billion). It had already been approved by the senatelast week and will now be published as law by congress President Rodrigo Pacheco. (BBG)

BRAZIL: Brazil made Central Bank autonomous so that price increases that come do not last," said Economy Minister Paulo Guedes in videoconference. It is a transitory and sectorial price pressure, Guedes says. (BBG)

RUSSIA: If situation develops according to the base case scenario, Bank of Russia may shift to neutral policy as soon as this year, Governor Elvira Nabiullina says in Iz.ru interview. Timing of the shift and the cadence will depend on how economy develops, wrong to say Bank of Russia knows what will happen in 3Q-4Q or in 2022. Even if central bank starts raising rates, monetary policy will remain accommodative for some time. Currently central bank is observing steady recovery of economic activity coupled with strengthening inflationary pressure. (BBG)

OIL: Israel has targeted at least a dozen vessels bound for Syria and mostly carrying Iranian oil out of concern that petroleum profits are funding extremism in the Middle East, U.S. and regional officials say, in a new front in the conflict between Israel and Iran. Since late 2019, Israel has used weaponry including water mines to strike Iranian vessels or those carrying Iranian cargo as they navigate toward Syria in the Red Sea and in other areas of the region. Iran has continued its oil trade with Syria, shipping millions of barrels and contravening U.S. sanctions against Iran and international sanctions against Syria. Some of the naval attacks also have targeted Iranian efforts to move other cargo including weaponry through the region, according to U.S. officials. (WSJ)

OIL: Commodities and energy pricing agency Argus Media said some traders looked at switching to the Argus dated Brent when competitor Platts, which sets the benchmark used by the industry, faced backlash after announcing reforms. Dated Brent is a European benchmark used globally and set daily by S&P Global Platts. It is used to price more than half the world's physical oil trades and in the settlement of Brent futures on the Intercontinental Exchange (ICE). It is also used to price gas and in government tax formulas. (RTRS)

CHINA

CORONAVIRUS: MNI BRIEF: China May Be Slow To Open Borders, Advisors Say

- China may be cautious before it reopens its borders year, despite concerns that it may miss out on an economic boost if other countries in the region resume international trade first, policy advisors in Beijing told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

PBOC/MARKETS: China's capital market faces inflated asset prices even as the inflation risk of the real economy is controllable, a website owned by Shanghai United Media Group reported citing Zhang Xiaohui, a former assistant governor of the People's Bank of China. As China normalizes monetary policy, it should maintain stable liquidity so as not to spook the market concerned about a possible tightening, Zhang said as reported on the website cls.cn. The PBOC should also take precautions for rising inflation and interest rates in overseas economies, and increase the efficiency and transparency of its policy decisions to better manage expectations, Zhang said. (MNI)

BANKS: Chinese banks should develop more products to extend credit, bonds and funds to carbon-reduction projects and support the country's push for a greener economy, the Securities Daily reported citing Wang Jingwu, a delegate to the National People's Congress and vice chairman of the Industrial and Commercial Bank of China. Carbon financial derivatives should be launched and the development of carbon pledge, carbon repurchase, carbon custody, and other financing businesses should be promoted, the newspaper said citing Bai Hexiang, head of the Guangzhou Branch of the People's Bank of China. China has said it targets carbon dioxide emissions to peak by 2030. (MNI)

REGULATION: China's market regulator said on Friday it has fined 12 companies related to 10 deals that demonstrated illegal monopolistic behavior. The State Administration for Market Regulation (SAMR) said in a statement on Friday that the companies include Baidu Inc , Tencent Holdings, Didi Chuxing, and a ByteDance-backed firm. Companies were fined 500,000 yuan ($77,078.42) each, according to the statement. Baidu, Tencent, ByteDance and Didi did not immediately respond to requests for comment. (RTRS)

OVERNIGHT DATA

JAPAN Q1 BSI LARGE M'FING +1.6% Q/Q; Q4 +21.6%

JAPAN Q1 BSI LARGE ALL INDUSTRY -4.5% Q/Q; Q4 +11.6%

NEW ZEALAND FEB BUSINESSNZ M'FING PMI 53.4; JAN 58.0

The seasonally adjusted PMI for February was 53.4 (a PMI reading above 50.0 indicates that manufacturing is generally expanding; below 50.0 that it is declining). This was down 4.6 points from January. BusinessNZ's executive director for manufacturing Catherine Beard said that the February result was more in line with the long term average of the PMI (53.0). "The major sub-index values were all down from January, with Production (57.3) leading the way, followed by New Orders (56.2). Both Employment (49.8) and Deliveries (47.6) remained in contraction, with the former reverting back to levels seen in December." "Despite the PMI remaining in expansion, the proportion of those outlining negative comments stood at 54%, compared with 46% in January. Given the second recent partial lockdown, it remains to be seen what impact this will have on the sector over the next few months." BNZ Senior Economist, Craig Ebert said that "supply issues were to the fore from respondents' comments to February's PMI survey. Of those citing negative factors, supply rather than demand problems dominated, with frequent references to supply chains, shipping, freight, costs, and difficulties in finding suitable staff." (BNZ)

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS; LIQUIDITY UNCHANGED FRI

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged on Friday. The liquidity in the banking system is unchanged given the maturity of CNY10 billion of reverse repos today, according to Wind Information.

- The operation aims to maintain reasonable and ample liquidity, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions rose to 2.1806% at 09:39 am local time from 2.0410% at Thursday's close.

- The CFETS-NEX money-market sentiment index closed at 41 on Thursday vs 40 on Wednesday. A higher index indicates increased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.4845 FRI VS 6.4970

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower for a third day at 6.4845 on Friday, compared with the 6.4970 set on Thursday.

MARKETS

SNAPSHOT: Sino-U.S. Mutterings Dominate Headlines

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 506.32 points at 29716.05

- ASX 200 up 57.976 points at 6771.9

- Shanghai Comp. up 13.028 points at 3449.859

- JGB 10-Yr future down 3 ticks at 151.02, yield up 0.8bp at 0.110%

- Aussie 10-Yr future down 5.2 ticks at 98.257, yield up 4.5bp at 1.699%

- U.S. 10-Yr future -0-04 at 132-15+, yield up 0.69bp at 1.544%

- WTI crude down $0.19 at $65.83, Gold down $3.20 at $1719.39

- USD/JPY up 20 pips at Y108.71

- BIDEN SIGNS RELIEF BILL, CHECKS TO HIT AS SOON AS THE WEEKEND

- U.S. SLAMS CHINA'S HK MOVE, TO RAISE XINJIANG GENOCIDE CHARGE IN TALKS (RTRS)

- U.S. IMPOSES NEW 5G LICENSE LIMITS ON SOME HUAWEI SUPPLIERS (BBG)

- ECB DOESN'T INTEND FASTER BOND-BUYING TO LEAD TO MORE STIMULUS (BBG)

- J&J SEES EU VACCINE DELIVERY TO BEGIN SECOND HALF OF APRIL (BBG)

- BOJ MULLING DITCHING OF ETF TARGET (MAINICHI)

BOND SUMMARY: Core FI Marginally Softer In Asia

Very light pressure crept back into the Tsy space as we moved through Asia-Pac trade, although T-Notes stuck to the confines of the range established in early Asia-Pac daeling, last -0-04+ at 132-15. Cash Tsys now running unchanged to 1.0bp cheaper across the curve. Little in the way of overt headline flow was apparent, with the USD seeing a light uptick. Headlines re: the disbursement of U.S. stimulus checks starting to hit as soon as the weekend were re-aired, this time via Tsy Secretary Yellen, but that was already a known. Eurodollar futures sit unchanged to 1.5 ticks lower through the reds, with overnight flow headlined by ~30K of sales in EDU2

- The wings of the cash JGB curve firmed during the Tokyo morning, while the 3- to 10-Year zone of the curve saw some modest cheapening. It was once again the long end of the curve that outperformed, with super-long paper firming by ~3.0bp vs. yesterday's closing levels during morning trade, before unwinding most of the bid during the early part of the Tokyo afternoon as local equity markets firmed further. The belly of the curve still lags on the day in cash trade, with JGB futures (M1) trading 7 ticks lower on the day. The latest round of BoJ Rinban ops saw the respective purchase sizes of each bucket left at unchanged levels, while the offer to cover ratios revealed little in the way of notable selling pressure ahead of next week's BoJ decision.

- The Aussie bond space looked through the weekly AOFM issuance announcement, with the weekly ACGB issuance task upsized to a more normal A$2.0bn level after 2 weeks at A$1.0bn. The AOFM is seemingly comfortable enough with the calming of bond market volatility that has been witnessed over the last week or so. Still, the AOFM held off from the syndication of the new ACGB Nov '32, which could come in the coming weeks if the bond market continues to act in an orderly manner. YMM1 unchanged, XMM1 -4.6.

JGBS AUCTION: Japanese MOF sells Y5.4615tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y5.4615tn 3-Month Bills:- Average Yield -0.0964% (prev. -0.1035%)

- Average Price 100.0259 (prev. 100.0278)

- High Yield: -0.0930% (prev. -0.1005%)

- Low Price 100.0250 (prev. 100.0270)

- % Allotted At High Yield: 6.4259% (prev. 85.6856%)

- Bid/Cover: 3.277x (prev. 3.158x)

BOJ: Rinban Sizes Unchanged

The BoJ offers to buy a total of Y850bn of JGB's from the market, sizes unchanged from previous operations.

- Y400bn worth of JGBs with 1-3 Years until maturity

- Y420bn worth of JGBs with 5-10 Years until maturity

- Y30bn worth of JGBs with 25+ Years until maturity

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance schedule:

- On Wednesday 17 March it plans to sell A$1.0bn of the 1.50% 21 June 2031 Bond.

- On Thursday 18 March it plans to sell A$500mn of the 25 June 2021 Note & A$500mn of the 24 September 2021 Note.

- On Friday 19 March it plans to sell A$1.0bn of the 0.50% 21 September 2026 Bond.

EQUITIES: Mixed Day In Asia

Asia-Pac bourses are mostly in the green on Friday, major markets opened in the green after US markets hit record highs, but were dragged lower as mainland China gave up early gains. The move lower reversed as the session wore on which helped lift regional indices. The KOSPI is leading the way higher, up around 1.4%, while other tech heavy indices are also seeing gains. In Hong Kong Xiaomi rose up to 8% after announcing a HKD 10bn buyback.

- Futures in Europe and the US are mixed, Dow Jones and S&P500 futures both higher, but the Nasdaq in negative territory. The Dax is in negative territory after the ECB inspired rally yesterday.

OIL: On Track For Weekly Loss

Crude futures are lower in Asia on Friday, WTI dropping around $0.20 from settlement levels, last at $65.82/bbl, Brent shedding around $0.10 from settlement at $69.53/bbl. WTI is on track to decline around 0.4% this week, even as prices hover near the highest level in two years.

- Yesterday OPEC lowered its forecasts for demand in its MOMR. The coalition reduced its oil demand forecast for Q1 and Q2 by 180k bpd and 310k bpd, respectively. "Oil requirements in H1 2021 are adjusted lower, mainly due to extended measures to control COVID-19 in many key parts of Europe. In addition, elevated unemployment rates in the US slowed the recovery process," OPEC said in the report. For the medium term, the group remained optimistic. It said that oil demand recovery would be backloaded in the second half of the year and it raised its estimates for Q3 and Q4 by 400k bpd and 970k bpd, respectively.

GOLD: Pausing

Spot sits a handful of dollars lower on the day, to last deal around $1,720/oz, a little lower than it was 24 hours or so ago, even with U.S. real yields mixed (the outright cash Tsy curve is steeper over that timeframe) and the DXY lower over that horizon. The technical picture is little changed vs. what has been outlined previously, while ETFs have extended their run of shedding gold holdings.

FOREX: Greenback Takes Lead

USD regained poise in thin, pre-weekend Asia-Pac trade. The DXY crept higher as the greenback outperformed all of its G10 peers, even as a safe haven peer CHF faltered across the board, while JPY was mostly weaker. USD/JPY advanced, though its upswing may have been limited by today's expiry of $2.2bn worth of options with strikes at Y108.30-35.

- The PBOC fixed its USD/CNY mid-point at CNY6.4845, 8 pips below sell side estimates and a third straight lower fix, a rarely seen occurrence amid the PBOC's unspoken preference for a weaker yuan.

- AUD/NZD printed a fresh monthly high after a "golden cross" pattern materialised on the intraday chart. Looking ahead, $1.3bn of AUD puts with strikes at NZ$1.0730 will roll off at today's NY cut.

- On the radar today: U.S. PPI & flash U. of Mich. Sentiment, EZ industrial output, final German CPI, UK monthly economic activity indicators & Canadian unemployment.

FOREX OPTIONS: Expiries for Mar12 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1900(E574mln), $1.1925-30(E1.3bln), $1.1940-50(E475mln), $1.1995-1.2000(E2.56bln, E2.3bln EUR puts), $1.2100-15(E1.2bln), $1.2125-30(E717mln)

- USD/JPY: Y105.95-106.00($2.7bln), Y108.30-35($2.26bln-USD puts), Y108.50($507mln, $497mln-USD puts), Y108.90-109.00($702mln-USD puts)

- EUR/JPY: Y130.00(E431mln-EUR puts)

- USD/NOK: Nok8.45($518mln)

- AUD/USD: $0.7690(A$521mln), $0.7720-25(A$1.1bln-AUD puts), $0.7745-60(A$1.2bln-AUD puts), $0.7925-30(A$616mln)

- AUD/NZD: N$1.0730(A$1.3bln-AUD puts)

- USD/CAD: C$1.2600($510mln)

- USD/MXN: Mxn20.30($1.1bln), Mxn20.55($617mln-USD puts), Mxn20.70($875mln-USD puts), Mxn21.00($630mln)

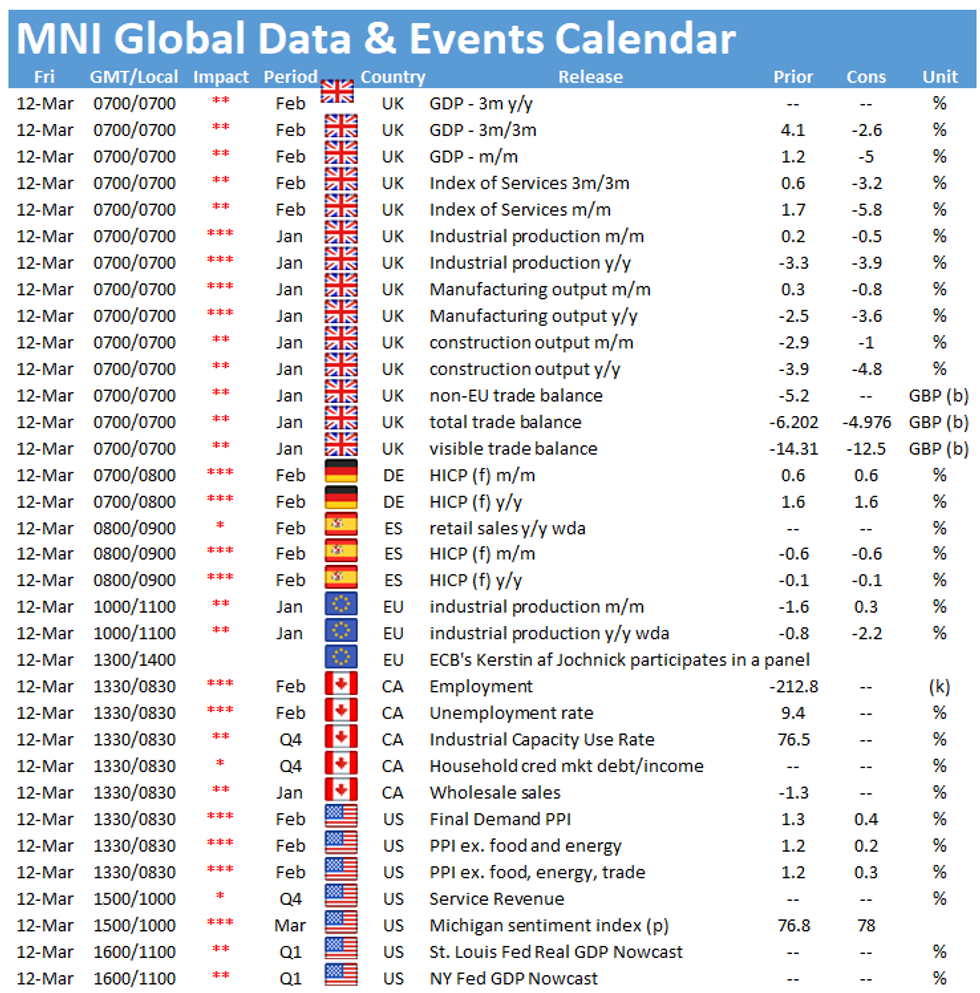

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.