-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: U.S. Fiscal Chatter Dominates, Familiar Risks Eyed Elsewhere

EXECUTIVE SUMMARY

- ARCHEGOS BREAKS SILENCE, SAYING 'ALL PLANS ARE BEING DISCUSSED' (BBG)

- WALL STREET BANKS SUMMONED BY REGULATORS AFTER HWANG'S BLOWUP (BBG)

- TURKEY NAMES MORGAN STANLEY BANKER CENTRAL BANK DEPUTY GOV (BBG)

- FTSE RUSSELL CONFIRMS CHINESE BONDS TO JOIN WGBI, INCLUSION PERIOD EXTENDED

- FOCUS ON POTENTIAL UPSIZING OF BIDEN'S FISCAL/INFRASTRUCTURE SUPPORT LINGERS

- U.S. 10-YEAR YIELDS BACK NEAR RECENT HIGHS, USD/JPY TESTING Y110.00

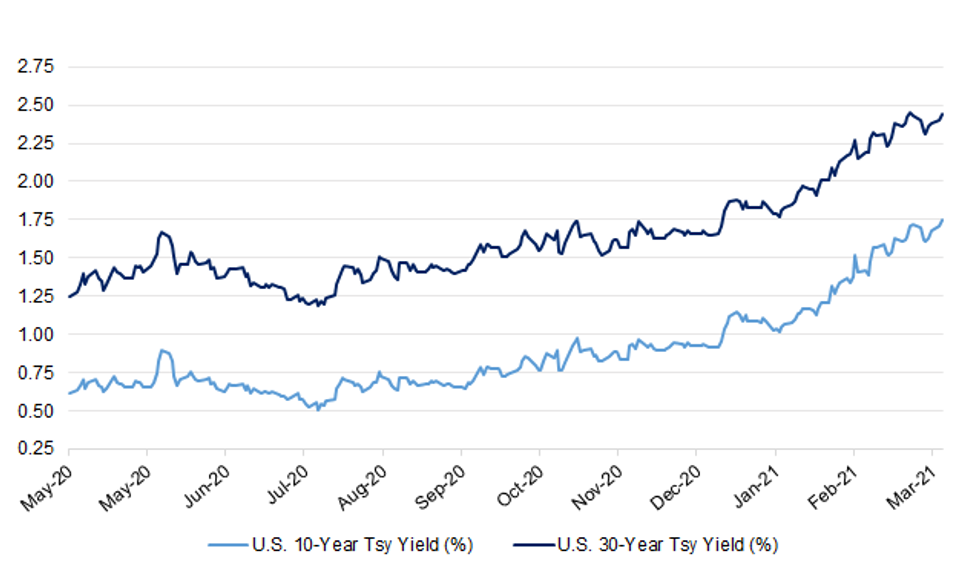

Fig. 1: U.S. 10- & 30-Year Tsy Yields (%)

Source: MNI - Markets News/Bloomberg

Source: MNI - Markets News/Bloomberg

UK

CORONAVIRUS: Prime Minister Boris Johnson said the U.K. is on track to lift pandemic restrictions entirely over the next three months and is "hopeful" he will not need to put the country into lockdown again. With infection rates at their lowest in six months, there is nothing in the data so far to suggest the government will need to keep restrictions in place for longer than planned, the premier said at a televised press conference Monday. (BBG)

CORONAVIRUS: The prime minister has admitted "we don't know... how strong our fortifications now are" against a fresh COVID wave - while the chief medical officer has warned of a "leaky wall" of vaccine defence. Speaking at a Downing Street news conference on Monday - as people in England saw lockdown restrictions eased slightly - Boris Johnson urged the need for caution as COVID rules are lifted. (Sky)

CORONAVIRUS: GlaxoSmithKline Plc agreed to help manufacture as many as 60 million U.K. doses of a Covid-19 vaccine from Novavax Inc. as the government looks to shore up supplies amid tensions with the European Union. The British pharmaceutical company will provide the fill-finish capacity -- putting the vaccine into vials and packaging -- for the Novavax shot at its Barnard Castle site in Durham, England, Glaxo said in a statement Monday. Novavax is expected to apply for U.K. approval of its vaccine in the second quarter, with production at the Glaxo plant starting as early as May. (BBG)

EUROPE

ECB: The European Central Bank must be cautious when it shifts away from its emergency stimulus even if the economy rebounds from the pandemic as predicted, according to outgoing policy maker Vitas Vasiliauskas. The Governing Council member and head of Lithuania's central bank, who steps down from those roles next month, said in an interview that the ECB should draw on its earlier experiences of tightening too soon. That means switching back to more-standard monetary tools only gradually. Even after inflation is back to its pre- pandemic trajectory, policy makers will need to keep quantitative easing in place for "quite a while," he predicted. (BBG)

ITALY: Italy's budget deficit is likely to be close to 10% of gross domestic product for a second year as successive lockdowns force the country to boost spending, according to people with knowledge of the matter. Such a projection may feature in Prime Minister Mario Draghi's new public-finance targets in mid-April, which will also include a higher debt tally for 2021, pushing towards 159% of output, said the people, who declined to be identified discussing undisclosed government forecasts. The figures aren't final and could still change before they're unveiled. (BBG)

ITALY/BTPS: Italy Third Issuance of BTP Futura Bonds April 19-23. Bonds aimed at financing economic recovery from the coronavirus pandemic and vaccination campaign will be exclusively for retail investors. Duration will be 16 years. (BBG)

U.S.

FED: MNI BRIEF: Yields Rise Reflects Good Economy: Fed's Waller

- The recent rise in yields is a good sign, reflecting the economy's improvement, Federal Reserve Governor Christopher Waller said Monday in a Q&A session following his maiden Fed speech. "This is actually a good sign," said Waller. "They don't appear to be going up in a bad fashion. They're going up, the economy's improving, that's good. That's what should happen when an economy improves, and the last thing we'd want to do is necessarily stop that from happening, since it's kind of reflecting a good performance of the economy" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: MNI BRIEF: Unanchored Expectations Would Be Overheating-Waller

- Federal Reserve Governor Christopher Waller said Monday he will be looking at inflation expectations and whether they become unanchored to the upside to determine whether the economy is overheating. "Where I would be concerned, is if somehow inflation expectations appeared to suddenly become unanchored to the upside," he said in a Q&A session at the Peterson Institute following his maiden speech. "Then I would think that would signal something about overheating" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: Sen. Patrick Toomey is taking aim at the Federal Reserve, expressing concern in a letter Monday about the central bank's foray into social issues such as climate change, race and health insurance. Specifically, the Pennsylvania Republican cited research from the Fed's San Francisco district about a host of issues that he said exceed the central bank's traditional mandates on employment, inflation and bank supervision. (CNBC)

FISCAL: When President Biden's team began putting together his infrastructure and jobs package this February, the White House National Economic Council circulated an internal proposal calling for about $3 trillion in new spending and $1 trillion in new tax hikes, according to three people with knowledge of the matter. But soon enough, some members of the economic team second-guessed themselves, concerned that the plan could jeopardize the nation's long-term financial stability. The officials worried that the large gap between spending and revenue would widen the deficit by such a large degree that it could risk triggering a spike in interest rates, which could in turn cause federal debt payments to skyrocket, said the people familiar with the matter. The two-pronged package Biden will begin unveiling this week includes higher amounts of federal spending but also significantly more in new tax revenue - with possibly as much as $4 trillion in new spending and more than $3 trillion in tax increases, said the people, who spoke on the condition of anonymity to describe private dynamics. One person familiar with the matter said that the early infrastructure draft did not include every tax increase the White House was eventually considering including in its ultimate proposal, and that the administration believes the tax hikes can also advance its goal of reducing income inequality. (Washington Post)

FISCAL: U.S. President Joe Biden will outline how he would pay for his $3 trillion to $4 trillion plan to tackle America's infrastructure needs on Wednesday, the White House confirmed on Monday, a proposal likely to include tax increases first laid out on the campaign trail. Biden will lay out the plan, which is aimed at rebuilding roads and bridges as well as tackling climate change and domestic policy issues like income equality, in Pittsburgh, Pennsylvania. (RTRS)

FISCAL: President Joe Biden will on Wednesday unveil a transportation-focused plan of initiatives to rebuild U.S. infrastructure, as part of his broader long-term economic program, the president of the United Steelworkers said. The announcement in Pittsburgh will focus on efforts to rebuild American roads, bridges, waterways and dams over the next decade, according to Tom Conway, the USW president, who said he has discussed the matter with the administration. (BBG)

FISCAL: U.S. Transportation Secretary Pete Buttigieg ruled out plans on Monday to increase in the federal gas tax or charge drivers a fee based on miles driven to pay for the Biden administration's $3 trillion infrastructure plan. "That's not part of the conversation about this infrastructure bill," Buttigieg told CNN on Monday when asked about implementing a vehicle-miles-traveled fee in lieu of taxes paid at the gas pump. "Just want to make sure that's really clear," he added. "But you will be hearing a lot more details in the coming days about how we envision to be able to fund this." (BBG)

FISCAL: Leaders of the finance industry and other businesses in New York are pushing President Joe Biden and Senate Majority Leader Chuck Schumer, who represents the state, to bring back the full state and local tax deduction, according to people familiar with the matter. Schumer, who is up for reelection in 2022, has heard from business leaders across New York on multiple calls in recent weeks, these people added. Some of these people have also held talks with advisors to Biden. Schumer, these people noted, signaled as recently as Friday that he plans to bring up the return of the full deduction when negotiations begin over reforming the tax code as a means to pay for Biden's next initiatives, including rebuilding the nation's infrastructure. (CNBC)

CORONAVIRUS: President Joe Biden on Monday urged governors and local leaders who dropped sweeping mask mandates to reinstate their orders, indicated some states should wait to reopen their economies while condemning "reckless behavior" likely to spur more infections. "Our work is far from over. The war against Covid-19 is far from won," Biden said at a press briefing, where he announced a series of plans to vastly expand access to the vaccines in the coming weeks. "This is deadly serious." (CNBC)

CORONAVIRUS: Centers for Disease Control and Prevention Director Rochelle Walensky went off script at a briefing Monday and made an emotional plea to Americans not to let up on public health measures amid fears of a fourth wave. "I'm going to reflect on the recurring feeling I have of impending doom," Walensky said, appearing to hold back tears. "We do not have the luxury of inaction. For the health of our country, we must work together now to prevent a fourth surge." (Axios)

CORONAVIRUS: President Joe Biden said 90% of adults in the U.S. will be eligible for Covid-19 shots by April 19 and will be able to get them within five miles of their home under an expanded vaccination plan he announced Monday. Roughly 40,000 pharmacies will distribute the vaccine, up from 17,000, Biden said, and the U.S. is setting up a dozen more mass vaccination sites by April 19. (CNBC)

CORONAVIRUS: New York is expanding its Covid vaccine eligibility to everyone 30 and older beginning Tuesday, followed by all residents 16 and older on April 6, Gov. Andrew Cuomo announced Monday. The move comes nearly a month before President Joe Biden's May 1 deadline for states to vastly open up their supplies to all residents. (CNBC)

CORONAVIRUS: The White House said it expected the private sector to take the lead on verification of COVID-19 vaccines, or so-called vaccine passports, and would not issue a federal mandate requiring everyone to obtain a single vaccination credential. The Biden administration was reviewing the issue and would make recommendations, White House press secretary Jen Psaki said on Monday, but she added, "We believe it will be driven by the private sector." (RTRS)

CORONAVIRUS: New Jersey Governor Phil Murphy said he is increasing the outdoor gathering limit, in hopes of encouraging people to convene outside. (BBG)

EQUITIES: Bill Hwang's Archegos Capital Management is breaking its silence after soured bets prompted investment banks to hastily unwind its positions. "This is a challenging time for the family office of Archegos Capital Management, our partners and employees," Karen Kessler, a spokesperson for the firm, said late Monday in an emailed statement. "All plans are being discussed as Mr. Hwang and the team determine the best path forward." The massive liquidation of Archegos's positions have rocked the stock market and left Wall Street buzzing. Kessler works at Evergreen Partners, which specializes in crisis communications and reputation management, according to its website. (BBG)

EQUITIES: Wall Street banks grappling with the implosion of Bill Hwang's investment firm spent Monday briefing U.S. regulators as Washington starts to dig into one of the biggest fund blow-ups in years. The Securities and Exchange Commission summoned the banks for hasty meetings on what triggered the forced sale of more than $20 billion of stocks linked to Hwang's Archegos Capital Management, said people with knowledge of the matter who asked not to be named in discussing private conversations. The calls also involved the Financial Industry Regulatory Authority, with officials quizzing brokerages about any impacts on their operations, potential credit risks and other threats, said one of the people. Hwang's brokers included Credit Suisse Group AG, Nomura Holdings Inc., Goldman Sachs Group Inc. and Morgan Stanley. The speed at which Archegos ran into trouble and Wall Street's swiftness in liquidating its positions shocked traders, while prompting a race at U.S. agencies to keep up with events. (BBG)

EQUITIES: The U.S. Securities and Exchange Commission has been monitoring the forced liquidation of more than $20 billion in holdings linked to Bill Hwang's investment firm that has roiled stocks from Baidu Inc. to ViacomCBS Inc. "We have been monitoring the situation and communicating with market participants since last week," an SEC spokesperson said in emailed statement. Hwang's New York-based Archegos Capital Management is at the center of a margin call that led to the forced liquidation on Friday, according to people familiar with the transactions. Among the companies sold were GSX Techedu Inc. and Discovery Inc. (BBG)

EQUITIES: Stocks valued at $2.64 billion changed hands in a flurry of block trades Monday as tumult from the wind-down of Bill Hwang's Archegos Capital Management extended into a new week. Five block trades valued at a combined $2.14 billion were executed by Wells Fargo & Co., according to a person familiar with the matter. The bank solicited interest from investors in 18 million ViacomCBS Inc. shares at $48 apiece before the market opened Monday, said the person, who asked not to be named because the matter is private. (BBG)

EQUITIES: A block of 20m shares in Rocket Cos Inc. was being offered on Monday through Morgan Stanley, according to people familiar with the matter. (BBG)

EQUITIES: Morgan Stanley sold $15 billion in shares over a few days, avoiding significant losses, CNBC's Leslie Picker reported. (CNBC)

EQUITIES: Nomura Holdings Inc. has begun assessing the cause of the possible loss tied to a U.S. client and it's too early to say how it might impact profit, an executive said. The executive, who asked not to be identified, spoke a day after Japan's biggest brokerage warned that it faces a "significant" potential loss stemming from transactions with the client, which Bloomberg has identified as Bill Hwang's Archegos Capital Management. It's hard to tell when Nomura might determine the amount of any loss and whether it would book a charge for the current quarter, the executive said. (BBG)

EQUITIES: Alarms were blaring inside Wall Street's corridors of power in the middle of last week, as executives realized they might be facing the biggest hedge fund blowup since Long-Term Capital Management in the 1990s. Global investment banks, gathering in a hastily arranged call, needed a swift truce to deal with Bill Hwang's Archegos Capital Management if they were to head off billions of dollars in losses for banks and a potential chain reaction across markets. Yet by Friday, it was everyone for themselves. The forced liquidation that sent bellwether stocks tumbling last week and continues to send shock waves across capital markets, was preceded by bickering in the highest rungs of international finance that quickly devolved into finger-pointing and now fury, according to people with knowledge of situation. Banks are just starting to tally the carnage. (BBG)

EQUITIES: A hedge fund run by a former analyst for Bill Hwang, the investor at the center of massive forced stock sales, told clients that banks haven't liquidated his assets. Teng Yue Partners founder Tao Li also said in a brief note over the weekend that he has ample liquidity and sees a lot of buying opportunities, according to a fund investor. (BBG)

OTHER

U.S./CHINA: The U.S. will make it harder to engage in talks with China if it keeps existing punitive tariffs, said Global Times. The comments came in an editorial in response to U.S. Trade Representative Katherine Tai suggestion to keep the tariffs as leverage in potential talks. Dropping the tariffs could create a favorable atmosphere to address issues, the government-run newspaper said. The two sides should urgently improve trade relations, something that still tie the two together while political and security issues further divide them, the editorial said. (MNI)

U.S./CHINA/TAIWAN: The Biden administration is preparing to issue guidelines that will make it easier for US diplomats to meet Taiwanese officials by adopting some of the changes introduced by Donald Trump, in a move China is likely to see as a provocation. In one of his final acts, Trump in January significantly loosened constraints that had made it difficult for US diplomats to hold such meetings and experts were waiting to see if Joe Biden would reverse course. But the US is preparing guidelines that would keep many of the Trump changes in place, according to people briefed on the new policy. The limits on contacts between American diplomats and Taiwanese officials had been in effect for decades until Trump loosened them. (FT)

GEOPOLITICS: Japan and the U.S. plan to affirm the importance of stability in the Taiwan Strait when Prime Minister Yoshihide Suga visits Washington next month for a summit with President Joe Biden, Nikkei has learned. (Nikkei)

CORONAVIRUS: The world needs a global settlement like that forged after the Second World War to protect countries in the wake of Covid, Boris Johnson and other world leaders have said. Writing for The Telegraph on Tuesday, Mr Johnson, Emmanuel Macron, the French president, and Angela Merkel, the German chancellor, said the virus pandemic had been "a stark and painful reminder that nobody is safe until everyone is safe". Amid growing international tension over vaccine supplies, they called for an end to isolationism and nationalism in favour of a new era of solidarity. (Telegraph)

GLOBAL TRADE: Maritime traffic is on the move again in Egypt's Suez Canal after a stranded container ship, that had blocked one of the world's most important waterways for nearly a week, was freed. The gigantic Ever Given ship, which had been jammed diagonally across a southern section, was successfully refloated by salvage experts on Monday. (Sky)

GLOBAL TRADE: The Ever Given was pulled free from the Suez Canal on Monday after cutting off traffic in the vital waterway for six days, but experts say the disruptions to global trade will continue to reverberate. "We might celebrate the success of releasing the ship and unblocking the Suez, but that's not the end of the story here," said Douglas Kent, executive vice president of strategy and alliances at the Association for Supply Chain Management. "It's definitely going to continue to backlog ports and other delivery mechanisms as a result, and then of course the chaos that disrupts thereafter," he added. (CNBC)

GLOBAL TRADE: U.S. Trade Representative Katherine Tai on Monday told European officials she wanted to develop "a more positive and productive" trade relationship with Europe, despite disputes over aircraft subsidies and digital services taxes, USTR said. Tai and Spain's Industry Minister Reyes Maroto agreed in a phone call to "strengthen U.S.-Spanish collaboration on mutual interests," including resolving a 17-year dispute over subsidies to Airbus and Boeing, USTR said in a statement. The two also discussed Spain's digital services tax and the problem of excess steel and aluminum capacity that has resulted in U.S. tariffs on imports of the metals, and committed to "finding mutually beneficial outcomes." (RTRS)

GLOBAL TRADE: U.S. Treasury Secretary Janet Yellen spoke on Monday with French Finance Minister Bruno Le Maire about the importance of working together toward a solution in the ongoing OECD discussions on international taxation, the Treasury said in a statement. During their conversation, Yellen emphasized U.S. support for a strong economic recovery and explained the Biden administration's broader plans to support jobs and investment in the United States, Treasury said. "The Secretary also expressed support for measures to promote the global recovery through multilateral mechanisms and support for low-income countries," it said. (RTRS)

GLOBAL TRADE: The UK has urged US president Joe Biden to back away from a tit-for-tat tariff war over Britain's imposition of a "digital services tax" that will hit Silicon Valley tech companies. Liz Truss, UK international trade secretary, said the Biden administration should "desist" from its threat to levy $325m of tariffs on British ceramics, make-up, overcoats, furniture and games consoles. Instead, Truss said the US should engage in international efforts to agree a "fair" way to tax multinational tech companies. "We don't believe that tariffs are the answer to resolving issues," she said. (FT)

HONG KONG: Beijing has endorsed the most controversial and sweeping overhaul of Hong Kong's electoral system since its return to Chinese rule in 1997, which is expected to slash the number of directly elected seats in the city's legislature from half to one-fifth. Under the reform plan approved unanimously by the National People's Congress Standing Committee on Tuesday, the Election Committee responsible for picking the city's leader was expected to be granted the new power to send 40 representatives to the Legislative Council, which has been expanded from 70 to 90 seats. Details of the proposal had yet to be announced as of Tuesday morning. (SCMP)

BOJ: MNI BRIEF: BOJ To Keep Easy Policy to Meet Challenges; Kuroda

- Bank of Japan Governor Haruhiko Kuroda has indicated that the BOJ will maintain its easy policy in the post-coronavirus economy, saying that the BOJ will provide an accommodative environment to support various challenges, the Asahi Shimbun newspaper reported on Tuesday. In an interview with the newspaper, Kuroda said the BOJ must support post-coronavirus challenges, such as digitalization and climate change, through an accommodative environment - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

RBA: The Reserve Bank of Australia will need to maintain its quantitative easing program for an extended period to prevent the currency rising too high and damaging the economy's recovery, former board member John Edwards said. "I think we are heading towards 80 U.S. cents," Edwards, now a senior fellow at the Lowy Institute, said in an interview with Bloomberg News on the release of his new book Tuesday. "It'll be awkward for us if it goes much over 80 U.S. cents and that means that the RBA has got to stay in the bond-buying business for quite a while." (BBG)

AUSTRALIA: In the year to 13 March 2021, total payroll jobs rose 0.2 per cent, according to figures released by the Australian Bureau of Statistics (ABS) today. Bjorn Jarvis, head of Labour Statistics at the ABS, said: "We now have weekly payroll jobs data for a full year of the pandemic, which present a week by week picture of labour market impacts and recovery. "When we first released these data, we were highlighting the impacts of the nationwide COVID-19 restrictions in late March 2020, which saw payroll jobs fall by 8.5 per cent by mid-April. "The data then showed a steady recovery in payroll jobs until it slowed in mid-July 2020 and we saw second wave impacts in Victoria. "After a seasonal peak and fall across the summer months, payroll jobs at mid-March 2021 were slightly above the levels of a year earlier." By mid-March 2021, most state and territory payroll jobs had either reached or passed levels of a year ago. Tasmania and Victoria were the exceptions, remaining 1.1 per cent and 0.7 per cent below mid-March 2020. Mr Jarvis said the data also highlighted the variations in payroll jobs losses and recovery between industries. "In mid-April 2020, the most impacted industries were Accommodation and food services and Arts and recreation services, with a combined fall in payroll jobs of almost 35 per cent," Mr Jarvis said. "By mid-March 2021, payroll jobs in Arts and recreation services had almost fully recovered (down 0.7 per cent). By comparison, Accommodation and food services remained the most impacted industry, with payroll jobs 11.1 per cent lower than a year ago." (ABS)

AUSTRALIA/RUSSIA: Australia has imposed targeted financial sanctions and travel bans against a Russian individual and four Russian companies over the construction and operation of the Kerch Strait Railway Bridge linking Russia to the illegally annexed territories of the Autonomous Republic of Crimea and the city of Sevastopol, Ukraine. (BBG)

NORTH KOREA: Kim Yo Jong, the sister of North Korean leader Kim Jong Un, slammed South Korea's president for calling the North's recent missile test "concerning" and suggesting Seoul, Pyongyang and Washington should not create hurdles for talks, state media KCNA reported on Tuesday. (RTRS)

NORTH KOREA: U.S. President Joe Biden does not intend to meet with North Korean leader Kim Jong Un, the White House said on Monday. Asked if Biden's diplomatic approach to North Korea would include "sitting with President Kim Jong Un" as former President Donald Trump had done, White House press secretary Jen Psaki said, "I think his approach would be quite different and that is not his intention," she said. (RTRS)

NORTH KOREA: China and North Korea are preparing to resume trade mid-April, according to multiple sources, which had been suspended due to the coronavirus pandemic and as a new bridge linking the two countries is set to open. (Nikkei)

CANADA: Canada is suspending the use of the Oxford-AstraZeneca vaccine for people under the age of 55 following concerns it may be linked to rare blood clots. The National Advisory Committee on Immunization recommended a pause on AstraZeneca COVID-19 vaccinations for people under 55 for safety reasons and the Canadian provinces, which administer health in the country, announced the suspensions Monday. (AP)

CANADA: A new briefing note from a panel of science experts advising the Ontario government on COVID-19 shows a province at a tipping point. (CBC)

TURKEY: Turkish President Recep Tayyip Erdogan appointed a Morgan Stanley executive to the central bank's interest-rate setting committee, as the shake-up at the monetary authority deepens. Mustafa Duman, formerly an executive director at Morgan Stanley in Turkey, was named a deputy governor Saturday, according to a decree published in the Official Gazette. (BBG)

TURKEY: Turkish President Tayyip Erdogan called on Turks to convert their foreign exchange and gold holdings through financial institutions as a "win-win" strategy for the country and themselves, after an overhaul of the central bank sent the lira down nearly 12% in a week. Erdogan's replacement of former governor Naci Agbal with Sahap Kavcioglu, who supports the president's view that high interest rates lead to high inflation, led to market turmoil amid concerns Turkey may return to unorthodox economic policies, including imposing capital controls to protect its currency. (RTRS)

TURKEY: Turkish President Tayyip Erdogan announced tighter measures against the coronavirus on Monday, citing the rising number of high-risk cities across the country. Erdogan said a full weekend lockdown was to be in place during the holy Islamic month of Ramadan, and restaurants would only serve food for delivery and take-outs. A curfew from 9 pm until 5 am across the country will continue, Erdogan said. (RTRS)

BRAZIL: President Jair Bolsonaro announced sweeping cabinet changes amid growing pressure from the pandemic that's ravaging Brazil. Bolsonaro, an idiosyncratic rightist who swept into office just over two years ago in a Trumpian triumph, had to accept members of the centrist establishment he once disdained while seeking to hold onto his military and ideological bases. The resignations and firings on Monday spanned a half a dozen top posts, including minister of defense, foreign affairs and justice. The new secretary of the government is from that establishment while his new minister of justice comes from his right-wing base. (BBG)

SOUTH AFRICA: South Africa's ruling party ordered members who've been charged with crimes to step down within a month or face suspension. The announcement signals that African National Congress Secretary-General Ace Magashule, a key opponent of President Cyril Ramaphosa's economic reforms, will have to leave his post next month. Magashule has been charged with money laundering, fraud and corruption. "All members who have been charged with corruption or other serious crimes must step aside within 30 days, failing which they should be suspended," Ramaphosa said in an online briefing on Monday after a four-day meeting of the party's top leaders. (BBG)

SOUTH AFRICA: Pfizer Inc. is demanding that South Africa's health and finance ministers personally sign a Covid-19 vaccine-supply agreement so that it is indemnified from any claims made against it in the country regarding the shot. The demand is contained in a March 24 letter from South Africa's Health Minister Zweli Mkhize to his finance counterpart Tito Mboweni, seen by Bloomberg and confirmed by the National Treasury. Pfizer was not satisfied by assurances that the signature of the country's health director general was sufficient to guarantee the indemnity, Mkhize said. (BBG)

IRAN: If President Joe Biden is serious about rejoining the Iran nuclear deal, then the next few weeks could prove make-or-break as the politics in both Washington and Tehran appear poised to intensify. For now, however, Biden's team is struggling just to get the Iranians to the table. Biden administration officials, mindful of the increasingly unfavorable calendar, plan to put forth a new proposal to jump-start the talks as soon as this week, two people familiar with the situation told POLITICO. (POLITICO)

METALS: China's steel industry will reduce carbon emissions by 30% from the peak in 2030, or 420 million tons a year, as a part of the country's stated overall plan to reach peak carbon emissions by 2030 and net-zero by 2060, the Economic Information Daily said. China accounts for more than 60% of the global emissions by steelmaking, the newspaper said citing Li Xinchuang, an official at Metallurgical Industry Planning and Research Institute. China plans to restructure the steel industry and reduce the production of small and medium-sized rebars, it said citing researcher Yin Ruiyu at the China National Engineering Research Institute. (MNI)

CHINA

CHINA RATES: Index provider FTSE Russell confirmed on Monday that Chinese sovereign bonds will be included in its flagship bond index, starting later this year. Chinese government bonds (CGBs) will be included in the FTSE World Government Bond Index (WGBI) from the end of October and will be phased in over 36 months, FTSE Russell said in a statement. Chinese government bonds were previously included in index suites from JPMorgan and Bloomberg Barclays, but FTSE WGBI inclusion is expected to have a larger effect due to the size of passive flows tracking it. (RTRS)

PBOC: MNI BRIEF: PBOC Urges More Credit Support For SME Bonds

- BEIJING (MNI) - China should provide more credit support for bonds issued by small and medium companies to boost their attractiveness, streamline the issuing process, and help develop the high-yield bond market to step up direct financing for such firms, a research paper published by the People's Bank of China said on Tuesday. Outstanding bonds by SMEs accounted for just 1.3% of all bonds by 2019, according to the paper. Beijing has prioritised support for SMEs, which have borne the brunt of the covid slowdown - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: China may generate over CNY60 trillion through cloud-based computing, big data, blockchain and other digital industries through 2025 under its five-year development plan, reaching about 10% of total GDP, the Economic Information Daily said citing Yu Xiaohui, President of the China information and Communication Research Institute. China should better integrate the digital economy with the real economy, promote digitization of manufacturing and facilitate businesses' transformation, the Daily reported citing Sun Ke, an official at China Academy of Information and Communications Technology. (MNI)

OVERNIGHT DATA

JAPAN FEB UNEMPLOYMENT 2.9%; MEDIAN 3.0%; JAN 2.9%

JAPAN FEB JOB-TO-APPLICANT RATIO 1.09; MEDIAN 1.09; JAN 1.10

JAPAN FEB RETAIL SALES -1.5% Y/Y; MEDIAN -2.8%; JAN -2.4%

JAPAN FEB RETAIL SALES +3.1% M/M; MEDIAN +0.8%; JAN -1.7%

JAPAN FEB DEPT STORE, SUPERMARKET SALES -4.7% Y/Y; MEDIAN -4.2%; JAN -7.2%

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 112.3; PREV. 110.4

Consumer confidence recovered with a gain of 1.7%as the weather improved along the east coast, after heavy rainfall and floods wreaked havoc. Confidence rose sharply in Queensland, with a gain of 10.5% in Brisbane and 6.7% in the rest of the state. Sentiment in Queensland may be tested by the emergence of a COVID-19cluster in Brisbane. NSW was more subdued, with confidence down 0.3% -reflecting perhaps the ongoing impact of the flooding and the sad news that two lives were lost. The rise in overall confidence to almost its long-run average is encouraging and points to the end of JobKeeper being successfully navigated overall, if not without some difficult individual circumstances. (ANZ)

NEW ZEALAND FEB BUILDING PERMITS -18.2% M/M; JAN +1.5%

UK MAR LLOYDS BUSINESS BAROMETER 15; FEB 2

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Tuesday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2043% at 09:23 am local time from the close of 2.1815% on Monday.

- The CFETS-NEX money-market sentiment index closed at 35 on Monday vs 40 on last Friday. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.5641 TUES VS 6.5416

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher for a fifth day at 6.5641 on Tuesday, compared with the 6.5416 set on Monday.

MARKETS

SNAPSHOT: U.S. Fiscal Chatter Dominates, Familiar Risks Eyed Elsewhere

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 9.79 points at 29392.19

- ASX 200 down 57.095 points at 6742.4

- Shanghai Comp. up 20.148 points at 3455.444

- JGB 10-Yr future down 20 ticks at 151.27, yield up 0.6bp at 0.081%

- Aussie 10-Yr future down 9.5 ticks at 98.185, yield up 9.6bp at 1.785%

- U.S. 10-Yr future -0-07 at 131-04+, yield up 3.38bp at 1.742%

- WTI crude up $0.08 at $61.64, Gold down $4.52 at $1707.63

- USD/JPY up 16 pips at Y109.97

- ARCHEGOS BREAKS SILENCE, SAYING 'ALL PLANS ARE BEING DISCUSSED' (BBG)

- WALL STREET BANKS SUMMONED BY REGULATORS AFTER HWANG'S BLOWUP (BBG)

- TURKEY NAMES MORGAN STANLEY BANKER CENTRAL BANK DEPUTY GOV (BBG)

- FTSE RUSSELL CONFIRMS CHINESE BONDS TO JOIN WGBI, INCLUSION PERIOD EXTENDED

- FOCUS ON POTENTIAL UPSIZING OF BIDEN'S FISCAL/INFRASTRUCTURE SUPPORT LINGERS

- U.S. 10-YEAR YIELDS BACK NEAR RECENT HIGHS, USD/JPY TESTING Y110.00

BOND SUMMARY: U.S. Fiscal Impulse Pressures Bonds

Tsys worked their way lower in Asia-Pac hours, with focus on the potential for an upsizing of U.S. fiscal & infrastructure support spilling over from the latter part of the NY session. This took 10-Year yields to within touching distance of the recent cycle highs, last printing at ~1.744%. The March 18 high resides at 1.7526%. A break would allow bond bears to switch focus to the nearby 50% retracement of the move from the '18 high to the '20 low, located at 1.7866%. On the flow side a 3.0K block seller FVM1 provided the highlight, as 5s printed above 0.900% in yield terms for the first time since Mar '20. T-Notes last -0-07+ at 131-04. 7+-Year Tsys sit ~3.5bp cheaper on the day.

- JGB futures extended lower during the Tokyo afternoon, playing catch up to the aforementioned round of U.S. Tsy weakness, to last print -20 on the day. The 4- to 5-Year zone of the cash curve has richened a little on the day, while the remainder of the curve sits up to 1.0bp cheaper. Better than expected local monthly retail sales data had little in the way of tangible impact on the space, with the same holding true for the virtually in line with expectations labour market report. The low price at the latest 2-Year JGB auction came in below broader dealer expectations (100.260 per the BBG dealer poll), with the cover ratio sliding and tail widening. Looks like the proximity to FY end may mean that Japanese investors chose to keep at least some of their powder dry, which could stem from the allure of the yield of some foreign core global bonds in FX-hedged terms. We also saw the Philippines price Y55bn of 3-Year Samurai paper.

- Aussie bonds were dragged lower by U.S. Tsys, YM -4.5, XM -10.0 at typing. The local labour market continued to reveal positive news. Alongside the latest round of payrolls data, the ABS noted that "after a seasonal peak and fall across the summer months, payroll jobs at mid-March 2021 were slightly above the levels of a year earlier. By mid-March 2021, most state and territory payroll jobs had either reached or passed levels of a year ago. Tasmania and Victoria were the exceptions." Elsewhere, Volkswagen Financial Services launched a 3- & 5-Year A$ senior unsecured benchmark transaction, which is set to price today.

JGBS AUCTION: Japanese MOF sells Y2.4539tn 2-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.4539tn 2-Year JGBs:

- Average Yield -0.126% (prev. -0.099%)

- Average Price 100.263 (prev. 100.399)

- High Yield: -0.119% (prev. -0.097%)

- Low Price 100.250 (prev. 100.395)

- % Allotted At High Yield: 21.9279% (prev. 26.5444%)

- Bid/Cover: 3.624x (prev. 4.275x)

EQUITIES: Mixed Picture

A mixed session for Asia-Pac equities, investors still contemplating worries about a hedge fund default and who could be impacted next, while a fresh wave of concerns about inflation have seen bond yields move higher.

- In Japan the Nikkei 225 lost around 1%, Nomura weighed on the index after saying it was too early to estimate the loss tied to Archegos Capital Management. Australian markets dropped to their lowest in a week after an uptick in COVID-19 cases and a snap lockdown in Greater Brisbane. Hong Kong, China, Taiwan and South Korea all saw gains, supported by the tech sector.

- Futures in the US were earlier in positive territory after US President Biden said 90% of US citizens would be eligible for the COVID-19 vaccine In April, however they have edged down into minor negative territory on concerns of further exposure to Archegos Capital Management positions. The Dow Jones is the exception, futures clinging on to minor gains on hopes for Biden's stimulus plan due to be announced on Wednesday.

OIL: Crude Futures Rise Again

Oil is higher for a second day on Tuesday, WTI is $0.22 higher at $61.78, while Brent is $0.16 higher at $65.14.

- Markets are looking ahead to this week's OPEC+ meeting, the group are expected to maintain output cuts given signs in the last few weeks of the fragility of the oil rally. There are reports that Saudi Arabia has not yet decided its position on oil production quotas.

- Salvagers managed to refloat the Ever Given, the ship that was blocking the Suez Canal, yesterday. Markets now watch for signs of a return to normalcy for the major shipping route, some analysts estimate it could take weeks for the back log to subside.

GOLD: Consolidating After Monday's Downtick

Gold trades $5/oz or so lower on the day, last dealing at $1,707/oz, with the latest uptick in U.S. real yields and selling pressure on the back of the break out of the narrow recent range weighing on bullion since the start of Monday's European trading session. Technically, bears are now targeting the Mar 12 low at $1,699.3/oz.

FOREX: Risk-On Flows Push USD/JPY Toward Y110 Mark

USD/JPY punched through resistance from Y109.85, which capped gains on Jun 5, Mar 26 & Mar 29, as a broader risk-on orientation inspired across-the-board yen sales. USD/JPY found itself within touching distance from the psychological Y110.00 level, which has remained intact for a year.

- The Antipodean currencies outperformed in the G10 basket, as broader sentiment improved after the latest round of U.S. Pres Biden's upbeat comments re: local vaccine rollout. A BBG trader source flagged leveraged buy stops above $0.7018 as a kiwi-supportive factor.

- The PBOC fixed its USD/CNY mid-point at CNY6.5641, 2 pips below sell side estimates. USD/CNH slipped after failing to take out yesterday's high.

- Selling pressure hit TRY as Turkish Pres Erdogan sacked CBRT Dep Gov Cetinkaya and replaced him with Mustafa Duman, a former Morgan Stanley executive.

- U.S. Conf. Board Consumer Confidence, flash German CPI, EZ sentiment gauges as well as speeches from Fed's Williams & Quarles, ECB's Centeno & Riksbank's Ingves take focus today.

FOREX OPTIONS: Expiries for Mar30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1740(E693mln), $1.1800(E503mln), $1.2000(E745mln)

- USD/JPY: Y109.00($700mln), Y109.75($495mln)

- GBP/USD: $1.3910(Gbp530mln)

- EUR/NOK: Nok10.07(E570mln-EUR puts), Nok10.10(E440mln-EUR puts)

- AUD/USD: $0.7640(A$839mln-AUD puts), $0.7700(A$810mln-AUD puts), $0.7960(A$1.1bln)

- AUD/JPY: Y82.60-70(A$598mln-AUD puts), Y84.35(A$453mln-AUD puts)

- USD/CAD: C$1.2475-85($595mln), C$1.2500-15($712mln)

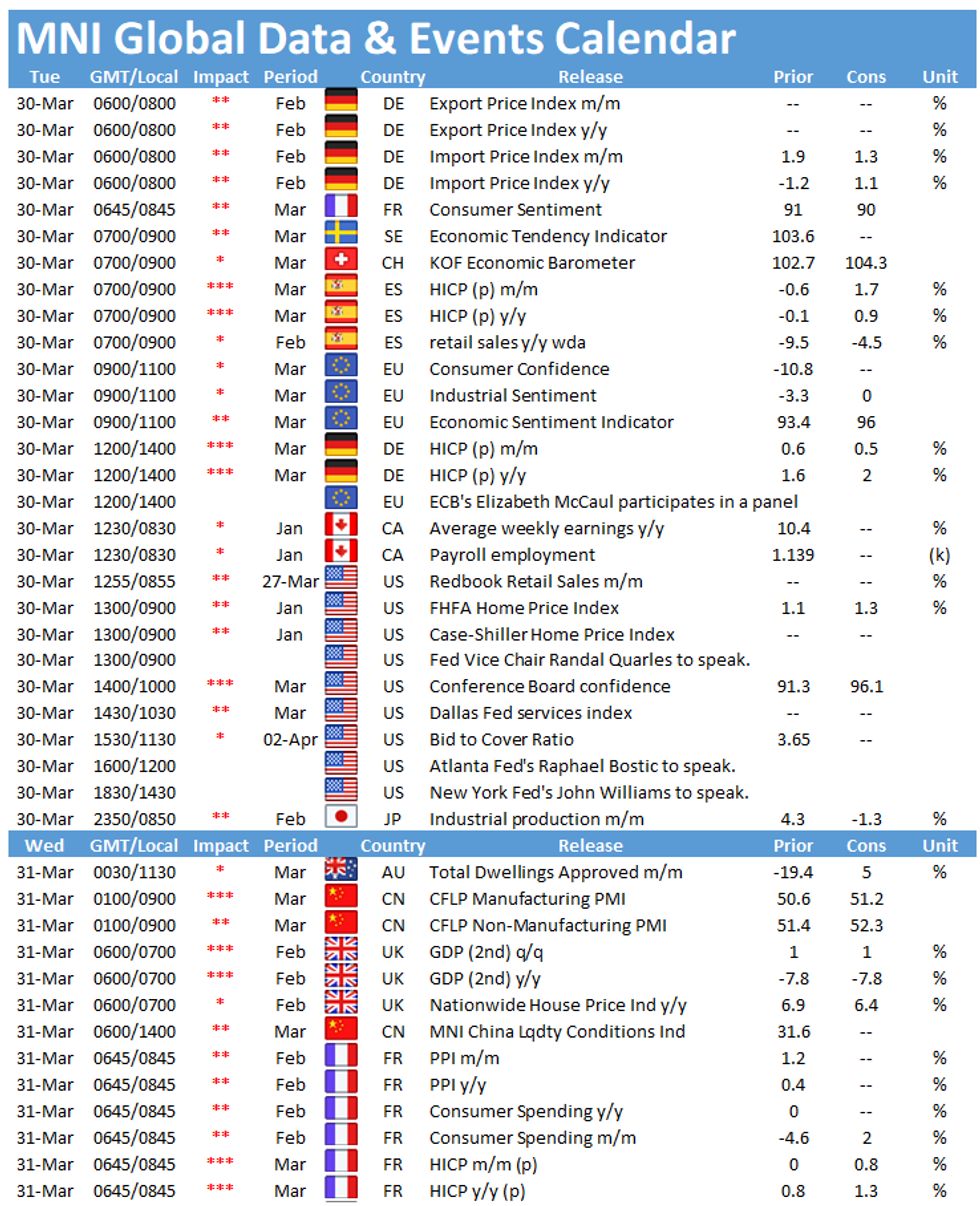

UP TODAY (TIMES GMT/LOCAL)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.