-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: Likely QE Tweaks From The Fed Flagged

- NY Fed's Logan flags likelihood of uptick in 20-Year Tsy purchases and downtick in TIPS purchases.

- Chinese PPI surges.

- Fedspeak reiterates existing message.

BOND SUMMARY: Little Changed, Fed Purchase Tweaks & ACGB Syndication Headline

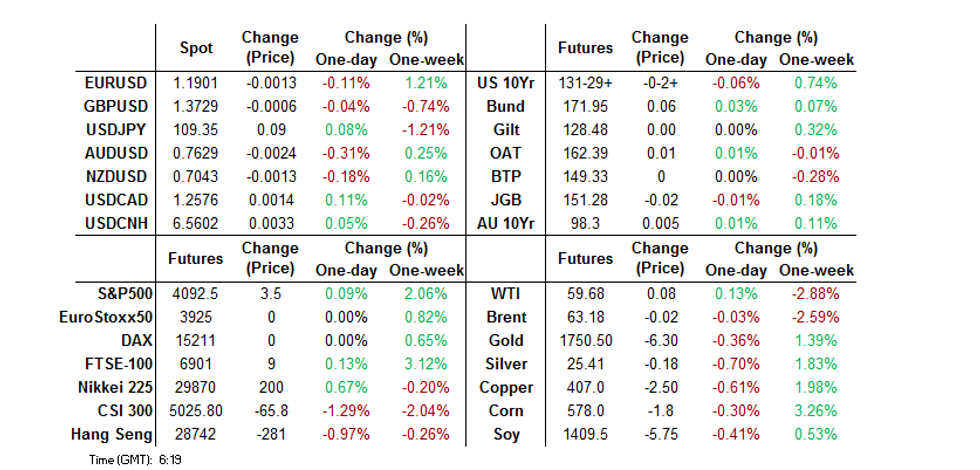

A pocket of TYM1 futures buying resulted in an uptick from lows in early Asia dealing, before some light pressure for Aussie bonds resulted in some (very modest) pressure for Tsys. T-Notes last -0-00+ at 131-31+, holding to a narrow 0-04 range. Cash Tsys sit little changed to 1.5bp cheaper across the curve. A reminder that late NY trade saw some outperformance for 20s on the back of comments made by NY Fed's Logan, as she pointed to the likelihood of an uptick in 20-Year Tsy purchases from the Fed, as well as a downtick in TIPS purchases given the recent issuance trends (indeed 20s have showed some resilience in Asia-Pac hours, and print at unchanged levels, richening by ~6.5bp on the 10-/20-/30-Year fly since Logan spoke). Asia-Pac flow was headlined by a 5.0K block buyer of the TYM1 132.00 calls. Logan also noted that the Fed will offset downward pressure on money market rates by focusing policy adjustments on its overnight reverse repo facility including possibly expanding counterparty eligibility in coming months. PPI data and Fedspeak from Harker headline locally on Friday. Fedspeak over the last 24 hours or so has reaffirmed the Fed's stance and desire for actual not expected economic outcomes, with an underscoring of its focus on underlying not transitory inflation also evident.

- There was very little to report for JGBs on Friday, with the cash market lacking a clear sense of direction, the major benchmarks generally trade within 0.5bp of unchanged at typing. Futures +1. There was a steady trickle of pricing of JPY corporate supply today, with the pipeline also building. Elsewhere, the Japanese government is set to formally introduce stricter COVID-19 measures in Tokyo, Kyoto and Okinawa, as flagged on Thursday. PPI & preliminary machine tool orders data headline locally on Monday.

- {AU} AUSSIE BONDS: YM last printing at unchanged levels in Sydney, while XM has given back its overnight gains in the wake of the AOFM announcement re: the syndication of the new ACGB Nov '32, also dealing at unchanged levels at typing after a brief foray into negative territory. As a reminder, some had suggested that the syndication may be delayed until FY21/22, given the government's better than expected fiscal standing, while others had suggested that April provided the best issuance window for the syndication in the remainder of the current FY. Elsewhere, the pricing witnessed at the latest round of ACGB Nov '25 supply was particularly firm, with the weighted average yield printing a little over 1.1bp through prevailing mids at the time of supply (supportive factors were outlined in our auction preview), although the cover ratio wasn't quite as aggressive as what was seen at the previous auction of the line (even when auction size is adjusted for). The RBA's Financial Stability Review & questions re: the local COVID vaccination drive had little, if any, impact on the space. Syndication dynamics are set to dominate next week, with nothing of any real note (at least on the local front) scheduled for Monday.

FOREX: Caution Prevails In Lacklustre Asia-Pac Trade

A degree of caution crept into G10 FX space, with most currency pairs happy to hold tight ranges amid little in the way of fresh catalysts crossing the wires. The DXY moved away from its monthly low of 92.00, but remains poised for a weekly loss after crossing below its 200-DMA a couple of days back.

- USD/JPY wavered around neutral levels, ahead of today's expiry of $1.55bn of options with strikes at Y109.15 & $1.1bn of USD puts with strikes at Y109.25-50.

- AUD brought up the rear in the G10 basket as the gov't released guidance advising against inoculating under 50s with the AstraZeneca product & NSW temporarily suspended vaccinations with the jab. Elsewhere, the RBA's FSR flagged that regulators are closely monitoring house-price growth.

- The PBOC set its central USD/CNY mid-point at CNY6.5409, 14 pips below sell side estimates. The redback looked through China's above-forecast CPI & PPI prints. USD/CNH oscillated around neutral levels, sticking to yesterday's range. Implied USD/CNH volatilities fell across the curve, with 1-month tenor seen at its lowest levels since Jul 2020.

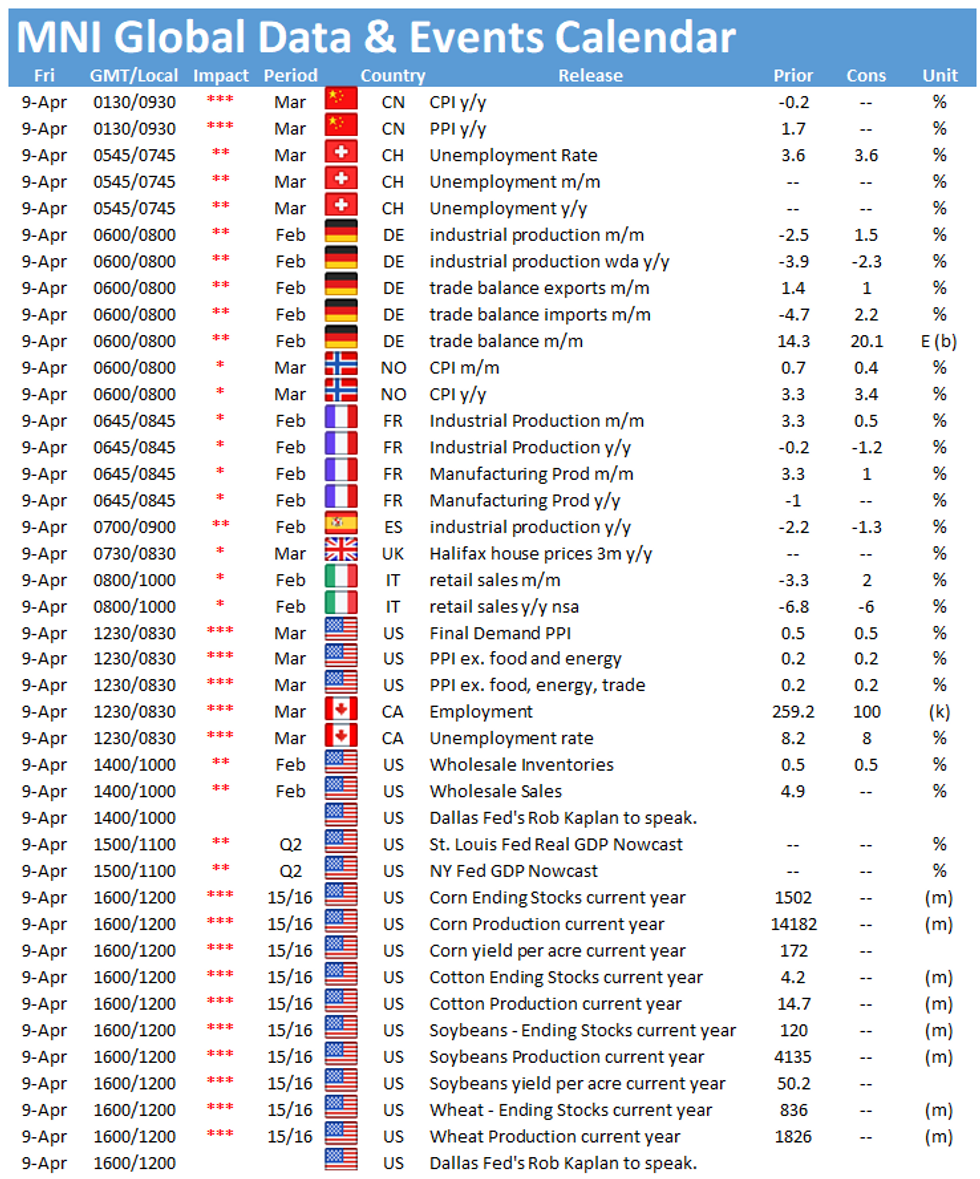

- German industrial output, Canadian unemployment, Norwegian CPI and central bank speak from Riksbank's Ingves & Breman, ECB's de Guindos & Fed's Kaplan take focus today.

FOREX OPTIONS: Expiries for Apr09 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1700(E904mln), $1.1780(E789mln), $1.1800-05(E1.0bln), $1.1850(E1.2bln-EUR puts), $1.1885-00(E954mln), $1.2000(E583mln)

- USD/JPY: Y109.15($1.55bln), Y109.25-50($1.1bln-USD puts), Y109.75($632mln-USD puts), Y110.45-55($765mln), Y111.00($605mln)

- AUD/USD: $0.7600-20(A$975mln-AUD puts)

- AUD/JPY: Y83.25(A$450mln-AUD puts)

- NZD/USD: $0.6948-50(N$1.35bln-NZD puts), $0.7050(N$521mln-NZD puts)

- USD/CAD: C$1.2540-50($705mln), C$1.2600 ($1.36bln-USD puts), C$1.2635-50($734mln)

- USD/CNY: Cny6.40($800mln), Cny6.4450-65($759mln)

ASIA FX: Rupiah Is Worst Performer As Rout Continues

Mixed performance to end the week, narrow ranges seen as the greenback holds most of its declines from Thursday.

- CNH: Offshore yuan is weaker having given back gains made post inflation data. The PBOC sets its USD/CNY midpoint at 6.5409, 14 pips below sell side estimates, the third consecutive session where the bank has fixed the yuan stronger than expected, and the tenth time in the past thirteen sessions, reversing the pre-LNY trend for a fix above sell side estimates.

- SGD: Singapore dollar is stronger, on track for the biggest weekly gain since mid-Feb. Late yesterday, FinMin Heng stepped aside as the designated successor to PM Lee, a shock move that could delay the transition of power.

- TWD: Taiwan dollar is stronger, data yesterday showed robust inflation figures, markets look ahead to trade balance data after market today.

- KRW: The won is slightly weaker, giving back initial gains on coronavirus fears. Acknowledging the severity of the coronavirus situation in the country officials have said it is possible that new case numbers could double in the next 1-2 weeks, and that a situation worse than the third wave is possible. Officials also said that raising the social distancing level is possible if needed.

- MYR: Ringgit is slightly stronger but has declined through the session after opening higher, data showed industrial production rose 1.5% against expectations of a 1.8% rise.

- IDR: Rupiah is lower, having seen a narrow trading range, since mid-Feb IDR has fallen around 4.6%.

- THB: Baht has strengthened but is off best levels, Thai central bank warned the economy may grow less than forecast this year and said inflation could miss forecasts.

- PHP: Philippines markets closed for a holiday.

ASIA RATES: Yields Mostly Lower, China Bucks Trend

Yields mostly lower as markets track yesterday's moves in UST's, China bucks the trend despite upbeat inflation data.

- INDIA: Bonds are supported today after the announcement of purchase programme details, but upside could be limited due to upcoming supply today. The RBI announced it will purchase INR 250bn across five of the most liquid lines on April 15. Meanwhile, markets await INR 320bn worth of auctions later in the session.

- CHINA: The PBOC matched maturities with injections again today, the twenty fourth straight session of matching maturities, while the bank hasn't injected funds since February 25. The overnight repo rate is higher, last up 4bps at 1.7906% after opening just below 1.90%, the 7-day repo rate is 5bps higher at 2.00%, but still below the PBOC's 2.20% rate. Futures initially dipped after inflation data, but have since recovered, in the cash space yields are higher with the curve steepening. Inflation data was higher than consensus, CPI rose 0.4% compared to estimates of 0.3%, while PPI saw robust gains of 4.4% against estimates of 3.6%, the highest since July 2018. Commodity prices are cited as the main driver for PPI.

- INDONESIA: Yields lower across the curve, declining for the seventh straight session. Indonesia will sell IDR 30tn of bonds at auction on April 13.

- SOUTH KOREA: Bonds higher in South Korea on pandemic fears. Acknowledging the severity of the coronavirus situation in the country officials have said it is possible that new case numbers could double in the next 1-2 weeks, and that a situation worse than the third wave is possible. Officials also said that raising the social distancing level is possible if needed.

EQUITIES: Mixed

Another mixed picture for equity markets to end the week. Markets in mainland China lost ground after robust inflation figures prompted speculation the PBOC could be forced into tightening monetary policy sooner than expected. Japanese indices were in positive territory but off highs as the government is set to impose virus restrictions in Tokyo, Kyoto and Okinawa. Markets in South Korea struggled as officials said the country may be on the brink of a fourth wave of coronavirus and extended social distancing measures for three weeks, with the potential for extra measures. US futures are higher, building on another record close yesterday after reassurances from a number of Fed speakers including FOMC Chairman Powell.

GOLD: Bulls Look To Clear Next Hurdle

Unchanged U.S. real yields and a softer DXY have combined over the last 24 hours, allowing bullion to nudge higher over that horizon, although gold has held to a confined range during Asia-Pac hours, last dealing little changed, just below $1,755/oz. Yesterday's high and the 50-Day EMA provide the immediate points of resistance.

OIL: Treading Water In Asia

Crude futures are little changed as we move into European hours. The benchmarks are on track for a weekly decline, tracking losses of 2.9%. Crude is treading water, buffeted by the competing influences of additional lockdowns in Europe and a weaker greenback. Yesterday Saudi Arabia's energy minister Prince Abdulaziz bin Salman said he was confident in the OPEC+ decision to gradually increase output over the next three months, adding that output decisions can be adjusted if needed.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.