-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: U.S. Fiscal Matters Still Dominating The Headlines

EXECUTIVE SUMMARY

- FED'S BULLARD: 75% VACCINATIONS WOULD ALLOW FOR TAPER DEBATE (BBG)

- BIDEN: PREPARED TO NEGOTIATE SCOPE OF INFRA PLAN & HOW TO PAY FOR IT (CNBC)

- OFFICIAL: BIDEN'S GAS TAX COMMENTS EXPLAIN WHY DOESN'T FAVOUR HIKING (RTRS)

- YELLEN PLANS TO SPARE CHINA FROM CURRENCY MANIPULATOR LABEL (BBG)

- CHINESE TRADE SURPLUS NARROWER THAN EXP. AS EXPORTS MISS AND IMPORTS BEAT

- STUDY: UK COVID VARIANT ISN'T LINKED TO MORE SEVERE DISEASE OR DEATH

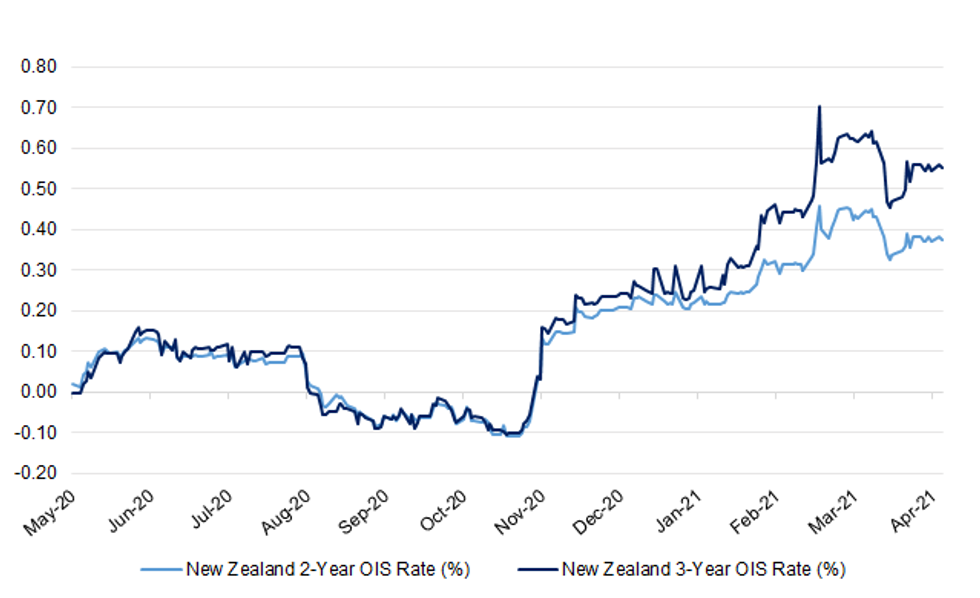

Fig. 1: New Zealand 2- & 3-Year OIS Rates (%)

Source: MNI - Markets News/Bloomberg

Source: MNI - Markets News/Bloomberg

UK

CORONAVIRUS: The target of offering a first COVID vaccine dose to the nine most vulnerable groups by 15 April has been reached, the government has said. Ministers had vowed to offer a COVID-19 jab to all over-50s, the clinically vulnerable and health and social care workers - about 32 million people - by Thursday. The target - for the whole of the UK - was reached three days early and means adults under 50 will start to be invited for their first jab "in the coming days", Number 10 said. (Sky)

CORONAVIRUS: London Mayor Sadiq Khan urged people who live, work or study in two city boroughs to be tested following an outbreak of new cases linked to the South African variant. Anyone over the age of 11 should book a test as soon as possible, whether they're symptomatic or not, so infected people can be identified and the spread of the virus limited, Khan said in a post on Twitter. There have been 44 new cases and 30 probable cases identified in Wandsworth and Lambeth, Khan said. (BBG)

ECONOMY: Many consumers remained apprehensive about indulging in retail therapy as thousands of shops finally reopened on Monday after months of hibernation. Visits to high streets, retail parks and shopping centres were still down 16.2pc compared with pre-pandemic levels despite customer queues outside chains including JD Sports, Primark and Zara. High street footfall was down by almost a quarter in the afternoon, according to data from Springboard, but retail parks, which have larger stores, fared better with a 1.7pc increase in visitors from 2019. Nevertheless, compared to the previous Monday, footfall jumped 146pc suggesting considerable pent-up demand. (Telegraph)

POLITICS: The government has announced a review covering David Cameron's efforts to lobby ministers on behalf of finance firm Greensill Capital. The former prime minister has been criticised for contacting ministers via text on behalf of the company, which collapsed in March. Downing Street said the probe would be led by lawyer Nigel Boardman on behalf of the Cabinet Office. Labour says the government's response is "inadequate". Mr Cameron has said he has not broken any codes of conduct or lobbying rules. (BBC)

EUROPE

ECB: A premature withdrawal of stimulus measures aimed at helping Europe's economy through the COVID-19 pandemic could be costly, European Central Bank Governing Council member Mario Centeno warned on Monday. "Support measures must be maintained for as long as necessary," Centeno told an economic conference, calling for a cautious approach, adapted to the evolution of the economic and financial situation which is still heavily influenced by the pandemic. "Premature withdrawal of measures could lead to significant costs," he said. (RTRS)

GERMANY: Officials close to Angela Merkel are worried that her conservative bloc risks losing the German chancellery in September's election because of the increasingly damaging battle to follow her at the top of the ticket. (BBG)

FRANCE: The French economy is slowing only slightly in April due to the tightening of Covid-19 restrictions, easing concerns that school closures would cause a deeper contraction. The Bank of France said activity will decline to 7% below pre-crisis levels in April after President Emmanuel Macron imposed stricter travel restrictions and ordered schools and nurseries to close. The hit to activity in March was 4%, better than previously estimated thanks improvements in services, industry and construction, according to the institution's monthly survey. (BBG)

ITALY: Italy's government is preparing a new stimulus package worth around 40 billion euros ($47.60 billion) to support its coronavirus-battered economy, a source close to the matter said on Monday. The extra borrowing will probably push this year's budget deficit above 10% of gross domestic product (GDP), up from 9.5% in 2020 when the economy shrank by 8.9% as a result of the coronavirus curbs, a government source told Reuters last week. (RTRS)

ITALY: The government of Prime Minister Mario Draghi is in discussions to set up vaccine production hubs in Italy using state funding, according to the director-general of the nation's drug regulator. Nicola Magrini, head of the Italian Medicines Agency, or AIFA, told Bloomberg in an interview the government is considering financing the project with about 200 million euros. The Covid-19 vaccine will be one of those approved by the European Medicines Agency, he said, declining to say which one. (BBG)

IRELAND: Ireland recommended the AstraZeneca vaccine be given to people age 60 and older only, becoming the latest country to restrict its use amid blood clot concerns. People under 60 who have already received a first dose should have the interval before the second shot extended to 16 weeks from 12 weeks "to allow further assessment of the benefits and risks as more evidence becomes available," the state's vaccine advisory group said Monday night. While the vaccine is "highly effective," authorities recommended the restriction because the reported clotting events carry "a very high risk of death or severe outcome," the group said. (BBG)

EQUITIES: Credit Suisse has cut bonuses for its staff by hundreds of millions of dollars after the Swiss lender lost $4.7bn from the collapse of family office Archegos Capital, according to people familiar with the situation. Switzerland's second-biggest lender by assets was the worst hit of several global banks by the collapse of Archegos, which was run by former hedge fund manager Bill Hwang. The family office was a client of Credit Suisse's prime brokerage division, the business of lending cash and securities to hedge funds and processing their trades. The $4.7bn of losses Credit Suisse has revealed so far are the equivalent of 18 months of average net profits for the bank and come shortly after another crisis involving its funds linked to collapsed supply-chain finance company Greensill Capital. The Archegos and Greensill debacles have led to several internal and external probes, a swath of executives being ousted and questions raised over Credit Suisse's risk management systems. Credit Suisse last week said the Archegos writedown would push the bank to a $960m loss in the first three months of the year, even after it had enjoyed its strongest underlying quarter for a decade, significantly outperforming analysts' expectations. People briefed on the bank's performance said its underlying pre-tax income for the quarter was expected to be just over $3.7bn, with about $600m achieved through reductions to bonus pool accruals and other one-off booked items. (FT)

U.S.

FED: MNI POLICY: Market Reform Needed Amid Strong Rebound-Rosengren

- The U.S. economy appears poised for a strong rebound, but a "hot" economy could pose financial stability challenges and policy makers would be well-served to consider options that would avoid the market ructions last March when Covid hit, Boston Federal Reserve President Eric Rosengren said Monday The U.S. economy should experience a significant rebound this year, said Rosengren, who is expecting it will take two years to reach pre-pandemic levels, adding there are some continuing concerns with coronavirus variants - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: Federal Reserve Bank of Boston President Eric Rosengren said policy makers should be "pretty humble" about their level of confidence on inflation and said there are risks to both overshooting or undershooting the 2% target. "In the post war period we don't have a pandemic experience with a new monetary policy framework with very aggressive fiscal policy all happening at the same time," he told Bloomberg News in an interview Monday. "We have to be pretty humble about how confident we are about what the inflation outcomes are going to be." The Fed has signaled it will hold interest rates near zero through 2023 and maintain asset purchases of $120 billion a month until it's made "substantial further progress" on its goals for employment and inflation, which has run consistently under its 2% target since 2012. (BBG)

FED: Federal Reserve Bank of Boston leader Eric Rosengren on Monday said monetary policy is in the right place for the challenges now facing the economy and that it will be some time before the Federal Reserve will need to contemplate a change on that front. "Being too precise about exactly when lift off is going to be, I don't think we have that foresight to be quite honest," Mr. Rosengren said in a Wall Street Journal interview following a virtual speech earlier in the day. When it comes to when the economy has recovered enough for the Fed to contemplate raising rates, "I think we're two years away from when that likely is going to become a much more important question," Mr. Rosengren said. "We still have a lot of labor market slack, the [labor force] participation rate is still quite low relative to prior to the pandemic, and the unemployment rate is still at 6%. So we need to get rid of the slack, have a sustained inflation rate, before we need to worry about raising rates," he said. (WSJ)

FED: Federal Reserve Bank of St. Louis President James Bullard said that getting three-quarters of Americans vaccinated would be a signal that the Covid-19 crisis was ending, a necessary condition for the central bank to consider tapering its bond-buying program. "It's too early to talk about changing monetary policy," Bullard said in an interview with Bloomberg Television's Kathleen Hays Monday. "We want to stay with our very easy monetary policy while we are still in the pandemic tunnel. If we get to the end of the tunnel, it will be time to start assessing where we want to go next." (BBG)

FED: MNI EXCLUSIVE: Fed's Lack of QE Exit Plan a Looming Challenge

- The Federal Reserve is worried an eventual move to pare back its hefty bond-buying program could disrupt financial markets that are priced for perfection, fueling tighter conditions that hamper the recovery, former staffers tell MNI. "No one at the Fed is really sure how, or if, QE works," Rick Roberts, a former long-time staffer at the Federal Reserve banks of New York and Kansas City, told MNI. "I remain very concerned with the implications of our ongoing asset purchases and eventual taper" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: President Joe Biden said Monday that he is ready to bargain with lawmakers about changes to his more than $2 trillion infrastructure plan. "I'm prepared to negotiate as to the extent of my infrastructure project as well as how we pay for it. ... I think everyone acknowledges we need a significant increase in infrastructure. It's going to get down to what we call infrastructure," the president said ahead of an Oval Office meeting with House and Senate members from both parties. (CNBC)

FISCAL: Top Biden officials have meetings planned with more than a dozen congressional committees this week as they try to pass a multi-trillion-dollar infrastructure package on an accelerated timeline, senior White House sources tell Axios. Democrats are anxious to pass their massive tax-and-spend package before the August recess. If negotiations stretch beyond the summer break, the chances increase they drag into 2022, and it's hard to get members to take tough votes during election years. (Axios)

FISCAL: U.S. President Joe Biden raised the prospect of a gas tax hike during a meeting with lawmakers to point out it would not raise a lot of money and explain why he did not favor it as a way to pay for his infrastructure proposal, a White House official said on Monday after media reports. A reporter for ABC News had said earlier on Monday on Twitter that Democratic U.S. Representative Donald Payne had said Biden expressed an openness to raising the tax during the meeting. The Biden administration is proposing several measures, including a substantial overhaul of the U.S. corporate taxation system, to pay for the president's $2.3 trillion infrastructure and job creation package, which includes large investments in clean energy and electric vehicle technology. (RTRS)

FISCAL: Senator Roger Wicker (R-MS) joined Fox Business' "Kudlow" on Monday following his Oval Office meeting with President Biden and says he and his Republican colleagues made "good points" but noted there remains "a lot of space between" the two parties. (FOX)

FISCAL: The U.S. government posted a March budget deficit of $660 billion, a record high for the month, as direct payments to Americans under President Joe Biden's stimulus package were distributed, the Treasury Department said on Monday. The deficit for the first six months of the 2021 fiscal year ballooned to a record $1.706 trillion, compared to a $743 billion deficit for the comparable year-earlier period. The first six months of fiscal 2020 largely did not include emergency pandemic spending to counter the coronavirus-related lockdowns that started in March 2020. (RTRS)

CORONAVIRUS: The Biden administration on Monday put Michigan's Democratic governor on notice that her plea for more vaccine to be sent to the state isn't going to happen, despite a surging Covid-19 outbreak there. Shutdowns are needed to control the spike in cases, not more vaccine, said Rochelle Walensky, the head of the U.S. Centers for Disease Control and Prevention in a Monday news briefing. Meanwhile, White House Press Secretary Jen Psaki said in a separate briefing that the administration is "not in a place, nor will we be, where we take supply from one state to give them to another." Michigan Governor Gretchen Whitmer has urged the federal government to increase the amount of vaccine sent to Michigan, which has the highest rate of new infections in the U.S. (BBG)

SOCIETY: Minneapolis Mayor Jacob Frey declared a state of emergency in the city on Monday after the fatal police shooting of Daunte Wright. (Insider)

MARKETS: U.S. regulators are throwing another wrench into Wall Street's SPAC machine by cracking down on how accounting rules apply to a key element of blank-check companies. The Securities and Exchange Commission is setting forth new guidance that warrants, which are issued to early investors in the deals, might not be considered equity instruments and may instead be liabilities for accounting purposes. The move, reported earlier by Bloomberg News, threatens to disrupt filings for new special-purpose acquisition companies until the issue is resolved. (BBG)

OTHER

U.S./CHINA/TAIWAN: The risk of a full-scale war in the Taiwan Straits due to minor incidents is increasing as the situation deteriorates, the Communist Party-run Global Times said in a commentary. The newspaper was writing in response to a warning by U.S. Secretary of State Antony Blinken that China should not try to change the status quo by force. The People's Liberation Army is prepared to send warplanes to fly across the island of Taiwan to declare sovereignty in case of further hostile behavior by the authorities of Taiwan's Democratic Progressive Party, said the tabloid owned by People's Daily. If the Taiwan military dares to fire the first shot at the PLA under any circumstance, that shot will be the beginning of reunification, it said. (MNI)

GLOBAL TRADE: President Joe Biden told companies vying with each other for a sharply constrained global supply of semiconductors that he has bipartisan support for government funding to address a shortage that has idled automakers worldwide. During a White House meeting with more than a dozen chief executive officers on Monday, Biden read from a letter from 23 senators and 42 House members backing his proposal for $50 billion for semiconductor manufacturing and research. (BBG)

CORONAVIRUS: People infected with the more contagious coronavirus variant first identified in the United Kingdom did not experience more severe symptoms and were not at higher risk of death, according to a new study published Monday. Scientists are struggling to pin down the nature of the U.K. variant, which has become the dominant strain across Europe and, as of last week, in the United States. Chief among the questions: Is the variant more deadly? The study, published in The Lancet Infectious Diseases, looked at data from last fall in the U.K., shortly after the variant was first detected. It soon spread rapidly, eventually becoming the dominant strain circulating in the country. The new findings add to scientists' ever-evolving understanding of the U.K. variant, known as B.1.1.7, at a crucial time in the pandemic, as it and other variants are circulating widely in other countries. Researchers looked at Covid-19 patients who were admitted to University College London Hospital and North Middlesex University Hospital from Nov. 9 to Dec. 20. The scientists sequenced virus samples from 341 patients, finding that 58 percent were positive for the U.K. variant and that 42 percent had been infected with a different strain. (NBC)

BOJ: Bank of Japan Governor Haruhiko Kuroda preached on Tuesday the benefits of a weak yen currency, saying it helped manufacturers by inflating the value of profits earned overseas. Many Japanese manufacturers now produce goods they sell overseas locally, which means a weak yen may not boost export volumes as much as it had in the past, Kuroda said. "But there's quite a lot of positives for Japan from a weak yen," as companies earn huge profits overseas and would see their yen-denominated value rise from a lower yen, he told parliament. Kuroda added that it was desirable for currency rates to move at levels considered an equilibrium, saying it was "not as if the weaker the yen the better, or the stronger the better". Japanese policymakers have traditionally been sensitive to unwelcome yen spikes that hurt the export-reliant economy. (RTRS)

BOJ: The Bank of Japan is highly unlikely to deepen its negative interest rate without a fresh economic crisis on a massive scale, according to former board member Makoto Sakurai, whose term ended last month. "The BOJ didn't lower rates" even at the height of the pandemic shock last year in March, Sakurai said in his first interview since leaving the central bank two weeks ago. "The kind of historic crisis needed to trigger a cut very rarely takes place." (BBG)

AUSTRALIA: Johnson & Johnson's one-dose vaccine will not be part of Australia's vaccine rollout, at least for now, after the federal government confirmed it would not purchase any doses from the company. The vaccine is being widely used in the United States and has the advantage of only requiring one dose, unlike the Pfizer, AstraZeneca and Moderna alternatives which all require two doses. (ABC)

AUSTRALIA: Payroll jobs rose by 0.8% in the month to 27 March 2021, rising 0.1% in the last fortnight, according to figures released by the Australian Bureau of Statistics (ABS) today. The pace of growth in payroll jobs across March was similar to what we saw in early March 2020, in the weeks before the major COVID-19 restrictions came into effect. Payroll jobs held by women continued to show stronger recovery than those held by men. In the early weeks of restrictions, women were more impacted by payroll job losses than men. While the recovery in payroll jobs worked by both men and women was similar across much of 2020, the recovery in payroll jobs held by women surpassed that of men by late October. By 27 March 2021 payroll jobs held by women were 0.8% above mid-March 2020, compared to 1.0% below for men. Payroll jobs in the Accommodation and food services industry continue to be the most impacted by 27 March 2021, remaining 9.5% below mid-March 2020. More than three quarters (76%) of payroll jobs in this industry are currently held by people aged under 40. Within this age group, payroll jobs recovery was weakest for people aged 20-29, with less than three quarters (72%) of payroll jobs lost at mid-April 2020 regained by 27 March 2021. (ABS)

NEW ZEALAND: The latest NZIER Quarterly Survey of Business Opinion (QSBO) shows a modest improvement in business confidence in the first quarter of 2021, while demand held steady. A net 11 percent of businesses expect a worsening in general economic conditions over the coming months, on a seasonally adjusted basis. This is a modest improvement from the 16 percent of businesses which were pessimistic about the economic outlook in the previous quarter. Meanwhile, firms' own trading activity was unchanged from the previous quarter. This measure suggests annual GDP growth will track around 2 percent in the March 2021 quarter. The retail sector has become the most downbeat of the sectors surveyed, with a net 38 percent expecting a deterioration in the economic outlook. Although retailers report some softening in demand, the significant development has been the surge in costs in the retail sector. This is likely to reflect the effects of COVID-related supply chain disruptions, which are driving up shipping and freight costs and affecting retailers' ability to restock shelves. The building sector has also become more downbeat, despite a still solid pipeline of construction. Supply chain disruptions also look to be affecting activity, along with an acute shortage of skilled labour. Building construction firms report difficulty in finding skilled labour at levels last seen in mid-2017. (NZIER)

RBNZ: The Reserve Bank has established a new standalone Enforcement Department to promote confidence in compliance across regulated sectors, central bank says in emailed statement. (BBG)

SOUTH KOREA: President Moon Jae-in stressed the importance Tuesday of stepping up policy efforts to address the problem of young adults struggling to get decent jobs and housing. During a weekly Cabinet meeting, he made a relatively lengthy remark on the socio-economic issue related to increased difficulties facing those in their 20s and 30s, who are called Millenials and Generation Z. They demonstrated their voting power in last week's Seoul and Busan mayoral by-elections, in which Moon's liberal Democratic Party (DP) suffered crushing defeats. (Yonhap)

SOUTH KOREA: U.S. and South Korea are discussing a possible summit between Presidents Joe Biden and Moon Jae-in in Washington DC in May, Chosun Ilbo newspaper reports, citing an unidentified South Korean government official. U.S. proposes holding a U.S.-South Korea-Japan trilateral summit immediately after the U.S.-South Korea summit. (BBG)

CANADA: Ontario schools will stay closed indefinitely to in-person learning as COVID-19 cases continue to surge in the province. Premier Doug Ford made the announcement on Monday alongside Education Minister Stephen Lecce at Queen's Park following a cabinet meeting earlier in the day. (CTV)

CANADA: Doctors in the Canadian province of Ontario may soon have to decide who can and cannot receive treatment in intensive care as the number of coronavirus infections sets records and patients are packed into hospitals still stretched from a December wave. Canada's most populous province is canceling elective surgeries, admitting adults to a major children's hospital and preparing field hospitals after the number of COVID-19 patients in ICUs jumped 31% to 612 in the week leading up to Sunday, according to data from the Ontario Hospital Association. (RTRS)

CANADA: Air Canada said it reached a deal with the Canadian government for loans and equity worth nearly C$5.9 billion ($4.7 billion), a package that will see the airline restore many routes it canceled because of the pandemic. The state, which sold off its ownership of the airline in the 1980s, will once again take a stake, buying C$500 million of shares at a discount. Prime Minsiter Justin Trudeau's government will also receive warrants as part of a financing agreement that makes Air Canada eligible for five new credit facilities totaling C$5.38 billion, according to a statement. (BBG)

TURKEY: A panel of scientists advising Turkey's government on tackling the coronavirus pandemic will recommend a series of tougher measures to combat a "third peak" of the disease, Health Minister Fahrettin Koca said on Monday. Koca did not provide details on the new measures but said a period of limitations on mobility and close contact was necessary to stem the spread of the virus, adding that more contagious variants were now dominant in Turkey. (RTRS)

TURKEY/RUSSIA: Russia will restrict flights to and from Turkey from April 15 to June 1 due to a rise in COVID-19 cases in Turkey, Russian Deputy Prime Minister Tatiana Golikova said on Monday, amid growing political tensions between the two countries. (RTRS)

MEXICO: Mexican Deputy Finance Minister Gabriel Yorio said that it's difficult to see the central bank transferring any of its foreign reserves surplus to the government due to the strong appreciation of the currency last year. The central bank may have little left to transfer, he said in comments to reporters. Yorio added that issuing more catastrophe bonds is an interesting proposal for the government, and it will be examined. (BBG)

MEXICO: The rise in Mexican banks' bad loans is manageable, central bank Governor Alejandro Diaz de Leon said, but he didn't rule out potential problems arising if the recovery is delayed. (BBG)

MEXICO: A close ally of Mexican President Andres Manuel Lopez Obrador has threatened members of the country's electoral body over his disqualified governorship candidacy, a sign of growing political tensions less than two months before key midterm elections. Felix Salgado Macedonio, whose candidacy for governor of the state of Guerrero was disqualified last month by electoral authority INE after missing a campaign finance deadline, said he will go after the seven members of the body if he isn't reinstated. (BBG)

BRAZIL: Brazil's economic team is mulling proposing a new constitutional amendment that could free up more money for Covid spending, said two people with knowledge of the matter. The new amendment would allow government to finance job preservation program, as well as aid to small and medium companies, bypassing the country's spending cap, the people said, asking not to be named because discussions are private. It would also allow President Jair Bolsonaro to sign the current budget without any vetoes, which lawmakers have increasingly pressured him to do, the people said. (BBG)

BRAZIL: In the current economic scenario, Brazil needs to send message of austerity, fiscal seriousness, Central Bank President Roberto Campos Neto says in a virtual event. Says it's difficult to imagine that Brazil or other emerging countries will have the same capacity as developed countries to formulate policies to sustain the crisis today. (BBG)

BRAZIL: Brazil's government sold about 11.47 billion reais in perpetual bonds from mining company Vale SA whose yields had become the talk of local financial circles. Brazil's Treasury and development bank BNDES, which before the sale owned about 55% of the notes' outstanding amount, sold all 214.33 million bonds at the price of 53.50 reais a piece, said people familiar to the matter, asking not to be identified because the results are not public yet. (BBG)

IRAN: The White House on Monday denied having played any role in a power outage at an Iranian nuclear site and declined to comment on whether Israeli sabotage was to blame or whether the incident might impair efforts to revive the 2015 Iran nuclear deal. "The U.S. was not involved in any manner," White House press secretary Jen Psaki said in response to questions. "We have nothing to add on speculation about the causes or the impacts." (RTRS)

MIDDLE EAST: Top national security officials from the U.S. and Israel will convene virtually on Tuesday for a second round of strategic talks on Iran. (Axios)

FOREX: Treasury Secretary Janet Yellen will decline to name China as a currency manipulator in her first semiannual foreign-exchange report, according to people familiar with the matter, a move that allows the U.S. to sidestep a fresh clash with Beijing. The report, which is not yet finalized, is due on Thursday, although it is unclear when the department will release it. During the Trump era, the Treasury Department was accused of politicizing the report after it abruptly designated China a manipulator in mid-2019 outside its usual release schedule, only to lift the label five months later to win concessions in a trade deal. A Treasury spokeswoman declined to comment. (BBG)

OIL: U.S. oil output from seven major shale formations is expected to rise for a third straight month, climbing by about 13,000 barrels per day (bpd) in May to 7.61 million bpd, the U.S. Energy Information Administration said on Monday. The biggest increase is set to come from the Permian, the top-producing basin in the country, where output is expected to rise by 52,000 bpd to about 4.47 million bpd, the highest since April 2020, the EIA said in a monthly forecast. (RTRS)

CHINA

INFLATION: China faces structural inflation risks given that rising commodity prices fueled gains in the PPI in March by 1.6% m/m and 4.4% y/y, the China Business News reported. Corporate profits may be cut by the widening gap between the CPI and PPI, costs for downstream industrial companies will gain and SMEs will be hurt, the newspaper said citing Zheng Houcheng, Director of the Yingda Securities Research Institute. However, monetary policy is not likely to tighten soon given weak consumption and investment, CBN said. (MNI)

FISCAL: China waives import tax through 2030 for qualified display companies buying raw materials and parts that can't be produced domestically, according to a statement released by the Ministry of Finance. Qualified display firms can pay the value-added tax related to equipment imports in installments. Qualified display firms can pay in installment the value-added tax related to import of new equipment. (BBG)

INFRASTRUCTURE: China's investment in new IT infrastructure, such as 5G, data centers, and cloud computing, will reach CNY1.78 trillion in 2021 and CNY10.53 trillion over the next 5 years, reported the Economic Daily citing data from the China Academy of Information and Communications Technology. The government may finance this investment through loans backed by user rights and government procurement contracts which guarantee future incomes, while companies should tap into REITs and asset-backed securities, the Daily said citing Fan Meng, an advisor with the China Center for Information Industry Development. China's top three telecom carriers plan to invest CNY184.7 billion in 5G this year, up 2.44% from 2020, the Daily said. (MNI)

OVERNIGHT DATA

CHINA MAR TRADE BALANCE +$13.08BN; MEDIAN +$52.00BN; FEB +$37.88BN

CHINA MAR TRADE BALANCE +CNY87.98BN; MEDIAN +CNY327.80BN; FEB +CNY247.28BN

CHINA MAR EXPORTS +30.6% Y/Y; MEDIAN +38.0%; FEB +154.9%

CHINA MAR EXPORTS CNY +20.7% Y/Y; MEDIAN +28.6%; FEB +139.5%

CHINA MAR IMPORTS +38.1% Y/Y; MEDIAN +24.4%; FEB +17.3%

CHINA MAR IMPORTS CNY +27.7% Y/Y; MEDIAN +17.6%; FEB +10.2%

MNI DATA IMPACT: China Foreign Trade Growth Up Through Q1

- China's foreign trade continued to recover in March, boosting growth across the first quarter as exporters ramped up production to meet strong demand from western economies and recovering domestic demand boosted imports, data from the General Administration of Customs showed on Tuesday - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

JAPAN MAR MONEY STOCK M2 +9.5% Y/Y; MEDIAN +9.7%; FEB +9.6%

JAPAN MAR MONEY STOCK M3 +8.0% Y/Y; MEDIAN +8.1%; FEB +8.0%

AUSTRALIA MAR NAB BUSINESS CONFIDENCE 15; FEB 18

AUSTRALIA MAR NAB BUSINESS CONDITIONS 25; FEB 17

Business conditions rose to a record high in March, driven by strong increases in all sub-components - which are all now also all at record highs. The strength in conditions is evident across all states and industries. Forward orders – which also rose to record levels – points to ongoing strength in activity with the pipeline of work rising further. While business confidence edged lower in the month, it remains at a high level, suggesting that firms themselves are optimistic that the strength in activity will continue. Alongside the strength in activity, capacity utilisation rose further in the month and is now well above average. Encouragingly, capacity utilisation is at or above pre-COVID levels in all industries except for rec & personal services – which unsurprisingly is still impacted by pandemic related restrictions. Taken together, the strength in conditions alongside high levels of capacity utilisation, point to an economy that is continuing to grow at a relatively healthy rate as we transition through the wind-up of the JobKeeper program and beyond. (NAB)

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 114.1; PREV. 107.7

The receding of the Brisbane lockdown and announcement of the Trans-Tasman travel bubble has seen confidence jump sharply, to above its long-run average and the highest level since late 2019. The jump has occurred despite the delay in the COVID-19 vaccine rollout. In an article last week we argued that while the direct economic impact of the Trans-Tasman travel bubble might be a small negative, it was likely to be more than offset by the impact on sentiment as the restoration of normality comes at least somewhat closer. These data confirm this expectation. (ANZ)

NEW ZEALAND MAR CARD SPENDING TOTAL +2.0% M/M; FEB -3.2%

NEW ZEALAND MAR CARD SPENDING RETAIL +0.9% M/M; FEB -2.5%

SOUTH KOREA FEB MONEY SUPPLY L +1.0% M/M; JAN +1.1%

SOUTH KOREA FEB MONEY SUPPLY M2 +1.3% M/M; JAN +1.3%

UK MAR BRC SALES LIKE-FOR-LIKE +20.3% Y/Y; MEDIAN +12.0%; FEB +9.5%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS TUES; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Tuesday. This leaves liquidity unchanged given the maturity of CNY10 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2000% at 09:25 am local time from the close of 1.9879% on Monday.

- The CFETS-NEX money-market sentiment index closed at 35 on Monday vs 43 on Friday. A higher index indicates increased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.5454 TUES VS 6.5578

People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.5454 on Tuesday, compared with the 6.5578 set on Monday.

MARKETS

SNAPSHOT: U.S. Fiscal Matters Still Dominating The Headlines

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 259.64 points at 29799.08

- ASX 200 down 1.455 points at 6972.5

- Shanghai Comp. down 0.273 points at 3412.675

- JGB 10-Yr future up 1 tick at 151.23, yield down 0.3bp at 0.105%

- Aussie 10-Yr future down 3.5 ticks at 98.230, yield up 2.9bp at 1.802%

- US 10-Yr future -0-04+ at 131-15+, yield up 2.49bp at 1.691%

- WTI crude up $0.32 at $60.01, Gold down $3.41 at $1729.12

- USD/JPY up 33 pips at Y109.71

- FED'S BULLARD: 75% VACCINATIONS WOULD ALLOW FOR TAPER DEBATE (BBG)

- BIDEN: PREPARED TO NEGOTIATE SCOPE OF INFRA PLAN & HOW TO PAY FOR IT (CNBC)

- OFFICIAL: BIDEN'S GAS TAX COMMENTS EXPLAIN WHY DOESN'T FAVOUR HIKING (RTRS)

- YELLEN PLANS TO SPARE CHINA FROM CURRENCY MANIPULATOR LABEL (BBG)

- CHINESE TRADE SURPLUS NARROWER THAN EXP. AS EXPORTS MISS AND IMPORTS BEAT

- STUDY: UK COVID VARIANT ISN'T LINKED TO MORE SEVERE DISEASE OR DEATH

BOND SUMMARY: Aussie Supply Weighs On U.S. Tsys & ACGBs

Asia-Pac headline flow was sparse at best. Still, T-Notes have edged to fresh session lows ahead of European hours, and last print -0-05 at 131-15 on the back of a couple of 2.5K clips worth of TYM1 selling (on screen). The cash curve has bear steepened, longer dated Tsys are running ~2.5bp cheaper on the day, with some light pressure evident from spill over surrounding Australian bond supply matters and news that Tencent will price a $4bn round of US$ issuance as soon as today. Most participants are looking ahead to today's local risk events (U.S. CPI, 30-Year Tsy supply and the announcement re: the Fed's latest Tsy purchase schedule). We should flag that Chinese trade data for the month of March provided a much narrower than expected headline trade surplus, with mixed internals as exports rose at a slower than expected Y/Y rate while imports surged, as the Y/Y rise in that metric topped exp.

- JGB futures clung to a narrow range, last dealing unchanged, cash JGBs are running unchanged to a touch richer on the day, with the long end of the curve drawing some light support from a firm enough round of supply (in the form of a liquidity enhancement auction for off-the-run 15.5- to 39-Year JGBs). On the corporate supply front, reports suggested that Softbank is planning to sell 5-, 7- & 10-Year JPY paper.

- ACGB Nov '32 syndication-related hedging resulted in above average activity for XM, and pressure on the Aussie bond space. YM -2.5, XM -4.0 at typing. this was the dominating factor with nothing in the way of tangible input from the latest round of ABS payroll data and the NAB business survey.

JGBS AUCTION: Japanese MOF sells Y497.8bn of 15.5-39 Year JGBs in liquidity enhancement auction:

The Japanese Ministry of Finance (MOF) sells Y497.8bn of 15.5-39 Year JGBs in a liquidity enhancement auction:- Average Spread: -0.008% (prev. +0.002%)

- High Spread: -0.007% (prev. +0.003%)

- % Allotted At High Spread: 46.6121% (prev. 60.4151%)

- Bid/Cover: 3.104x (prev. 3.105x)

AUSSIE BONDS: The AOFM sells A$150mn of the 0.75% 21 Nov '27 I/L Bond, issue #CAIN414:

The Australian Office of Financial Management (AOFM) sells A$150mn of the 0.75% 21 November 2027 I/L Bond, issue #CAIN414:- Average Yield: -0.8600% (prev. -0.7882%)

- High Yield: -0.8550% (prev. -0.7850%)

- Bid/Cover: 6.6533x (prev. 5.1667x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 24.3% (prev. 85.7%)

- bidders 42 (prev. 40), successful 8 (prev. 12), allocated in full 4 (prev. 8)

EQUITIES: Higher After Rout On Monday

A positive day for equity markets in the Asia-Pac timezone on Tuesday, recovering from a rout on Monday. Bourses in South Korea and Hong Kong lead the way higher, the latter boosted by reports that US President Biden saw the chip shortage as a top priority and was taking steps for a summit with South Korean president Moon. The Hang Seng is higher on reports that Hong Kong has made progress on a 'travel bubble' with Singapore, while pre-tested visitors from China are soon to be allowed to enter without quarantine. Markets in mainland China were supported by another set of robust trade figures. US futures are higher, there were reports late on Monday that Nvidia was taking aim at Intel after unveiling its first server microprocessors but this has failed to dampen the Nasdaq. Markets await inflation figures from the US later today.

OIL: Crude Futures Eke Out Small Gains

Crude futures made some small gains in Asia-Pac trade, WTI is up $0.30 from settlement levels at $60.00/bbl, Brent is up $0.34 at $63.62/bbl. There was little impetus to move oil markets, with participants now looking ahead to inventory data, US API data is due later on Tuesday. Median estimates on Bloomberg are for a 2.4m bbl drop, which if confirmed would be the third consecutive weekly decline in headline crude stocks. There could be some headwinds in terms of higher production; output at the Permian Basin is expected to rise to 4.466m bpd in May according to EIA data, a level not seen since the start of the pandemic.

GOLD: The Lines Are Drawn

Little to report for bullion, with spot hemmed into the recently established ranges as participants await any decisive signals from the DXY/U.S. Tsys. Spot last deals little changed around the $1,735/oz mark, with no changes to report on the technical front.

FOREX: Antipodeans Sag In Quiet Asia-Pac Trade, USD Gains Ahead Of Local CPI Report

The Antipodeans traded on a softer footing in the quiet Asia-Pac session, even as a positive showing from core equity markets suggested that yesterday's risk aversion has petered out. BBG trader sources flagged light NZD/USD sales ahead of the upcoming monetary policy decision from the RBNZ, even as March data showed recovery in local card spending.

- AUD briefly edged away from session lows after the latest NAB Business Conditions hit record high, even as headline Confidence Index deteriorated at the margin. Resultant recovery in AUD was rather shallow and short-lived.

- The greenback led gains in G10 FX space, with the DXY clawing back yesterday's losses. USD/JPY gained into the Tokyo fix and remained afloat thanks to demand for the dollar.

- The PBoC set its central USD/CNY mid-point at CNY6.5454, 12 pips below sell-side estimate. China's trade balance unexpectedly shrank in Mar, as a miss in exports was coupled with a beat in imports. The redback showed little reaction to the data.

- U.S. CPI, German ZEW Survey, UK economic activity indicators take focus on the data front, with Fed's Harker, Daly, Barkin, Mester, Bostic & Mester, ECB's Villeroy & Norges Bank's Olsen due to speak.

FOREX OPTIONS: Expiries for Apr13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800-05(E504mln), $1.1885-1.1900(E643mln-EUR puts)

- USD/JPY: Y106.35($1bln), Y109.50($478mln)

- EUR/GBP: Gbp0.8560-70(E646mln-EUR puts)

- AUD/USD: $0.7595-0.7600(A$767mln-AUD puts), $0.7630(A$413mln-AUD puts)

- USD/CNY: Cny6.45($700mln), Cny6.60($730mln)

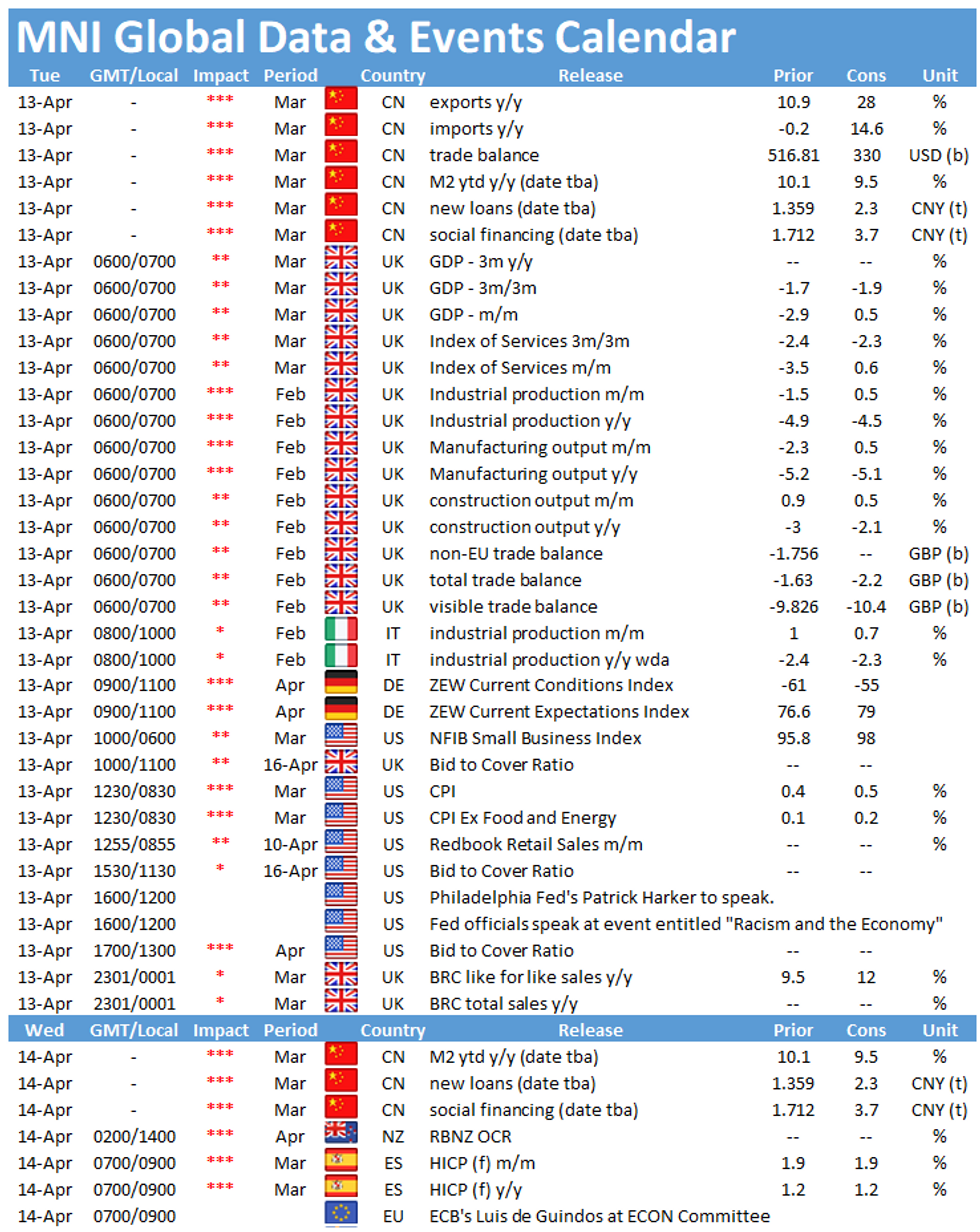

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.