-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Familiar Risks Continue To Headline In Asia

EXECUTIVE SUMMARY

- CDC TENTATIVELY SETS J&J MEETING (BBG)

- CHINA LODGES PREDICTED STELLAR Y/Y ECON GROWTH, THOUGH DATA MIXED VS. EXP.

- HUARONG SECURITIES SAID TO WIRE FUNDS FOR LOCAL BOND DUE SUNDAY (NNG)

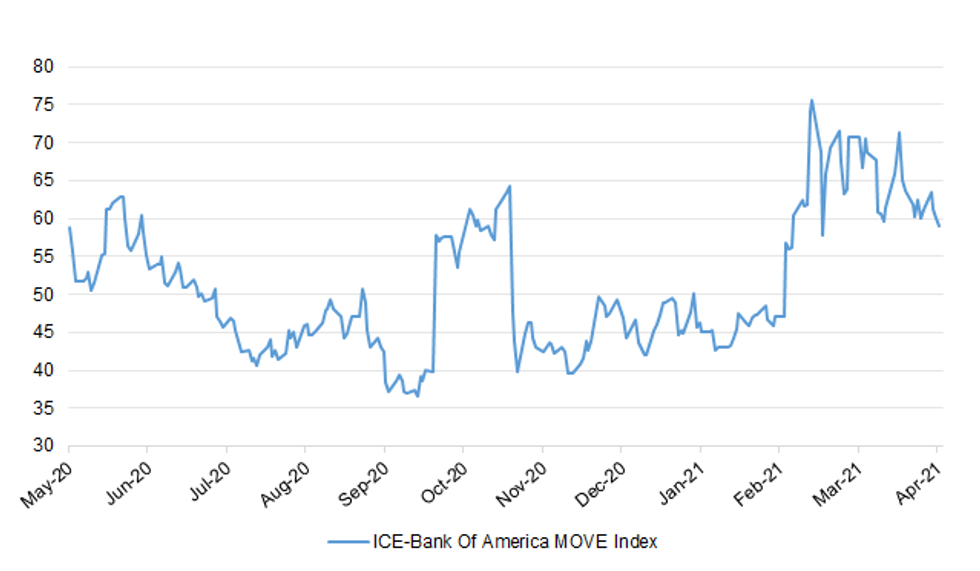

Fig. 1: ICE-Bank Of America MOVE Index

Source: MNI - Markets News/Bloomberg

Source: MNI - Markets News/Bloomberg

UK

CORONAVIRUS: Surge testing has been expanded to four London boroughs amid growing concern that the test and trace programme cannot contain a coronavirus variant that has shown increasing signs of vaccine resistance. A total of 56 cases of the variant first identified in South Africa were found in the week to April 14, according to data released on Thursday, taking the total confirmed cases since it was first detected in December to 600. The largest "surge testing" operation since the start of the pandemic was launched in the boroughs of Wandsworth and Lambeth on Tuesday, then extended to postcodes in Southwark and Barnet, as public health officials urgently try to halt the spread of the strain, named 501Y.V2. (FT)

CORONAVIRUS: A coronavirus variant with potentially worrying mutations that was first detected in India has been found in the UK. In total, 77 cases of the variant, known as B.1.617, have been recorded in the UK up to 14 April, according to the latest update from Public Health England (PHE), released on Thursday. Of these, 73 were recorded in England and four in Scotland. It was the first time PHE had reported the variant in the UK. (Guardian)

RATINGS: Potential sovereign rating reviews of note scheduled for Friday include:

- Moody's on the UK (current rating: Aa3; Outlook Stable)

EUROPE

ECB: The European Central Bank will slow its emergency bond- buying by July and signal at the end of this year that the program will come to a halt in March 2022, according to a Bloomberg survey of economists. More than 60% of respondents predict the ECB will stick to its current timeline for net purchases, and almost as many expect it to give three months' notice before stopping the program. Economists don't expect any policy changes at next week's meeting. (BBG)

FISCAL: MNI BRIEF: German Court To Complicate, Not Derail EU Fund

- The German Constitutional Court could potentially "complicate" but not derail ratification of legislation to allow the European Union's EUR750 billion Recovery and Resilience Fund to raise money, with member states set to conclude the process on time by the end of June, an EU source said - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

GERMANY: Some 72% of CDU/CSU supporters favor Bavarian Premier Markus Soeder as chancellor candidate for Angela Merkel's conservative bloc, broadcaster ARD reports, citing a new poll it commissioned. That compares with a 17% backing among the bloc's supporters for Armin Laschet, his rival for the candidacy ahead of the Sept. election. The CDU/CSU led the polls with 28% support, ahead of the Green Party with 21%; the Social Democrats came in third at 15%; the Free Democrats and the AfD got 11% each. (BBG)

PORTUGAL: Portugal will continue to gradually ease confinement measures as planned, with secondary schools and more shops allowed to reopen. All stores, shopping malls and theaters can open in most of the country from Monday, Prime Minister Antonio Costa said at a press conference in Lisbon on Thursday. In four municipalities that have had a high number of new coronavirus cases some restrictions will be tightened, he said. Controls on the land border with Spain will remain in place during the next two weeks. (BBG)

RATINGS: Potential sovereign rating reviews of note scheduled for Friday include:

- DBRS Morningstar on France (current rating: AA (high); Stable Trend)

U.S.

FED: MNI BRIEF: Daly: Fed is Far Away From Both Mandate Goals

- San Francisco Federal Reserve President Mary Daly said Thursday the Fed is far away from both its mandate goals on employment and inflation, in response to a question about her definition of making substantial further progress that could lead to a scaling back of stimulus like asset purchases. The millions of Americans still on the sidelines of the job market "is pretty far away from substantial further progress," she said during an online question-and-answer session with the Money Marketeers. Inflation only going above 2% temporarily means "we are far away from that target as well," she said. "We need to see that we are well on our way to being able to achieve those goals before we say it's time to start thinking about any kind of withdrawal of accommodation," Daly said. "We have the tools to pull inflation back," she said. "Our constraints are in getting inflation back up and eliminating the employment shortfalls" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: MNI POLICY: Fed's Mester Sees Unemployment at 4.5% By Year End

- Cleveland Fed President Loretta Mester said Thursday she expects the unemployment rate to fall to 4.5% or lower by December but warned it will take time to achieve a "sustainable, broad-based recovery." "I anticipate we're going to see labor market conditions improve a lot by the end of the year" barring a surge in variants that are impervious to Covid vaccines, she told reporters on a call. But "what I'm looking for is a move to something that's a sustainable, broad-based recovery. Right now I still say we have an uneven recovery at the individual level," with higher income jobs basically back to pre-pandemic levels but lower income jobs far behind, she said - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: The U.S. should consider "a wide range of possibilities" to make up for the impact of slavery and systemic racism on the financial health of Black families, with reparations one of the options, Atlanta Fed president Raphael Bostic said on Thursday. "Issues around African Americans and wealth building and the state's role in preventing that from happening are long recognized," Bostic said as part of a forum organized by The Atlantic magazine. "It is important we consider a wide range of possibilities and approaches to try and make amends for that. Reparations is one of them." (RTRS)

FED: MNI BRIEF: Fed's Logan: Negative Repo Trades Appear Technical

- Modest volumes of repo that have been trading below zero appear technical in nature and the Fed's overnight reverse repo facility has provided an effective floor on rates, New York Fed's market chief Lorie Logan said Thursday. Recent negative trades below zero in interdealer markets, as captured in the SOFR first percentile, appear to be technical in nature, driven in part by the value that dealers place on the ability to centrally clear the transactions and net their balance sheet exposures, Logan said in prepared remarks for a speech at a SIFMA webinar, suggesting patience. "However, we will continue to monitor money markets closely and make adjustments to ON RRP operations as needed," she added, also repeating previous comments - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: MNI BRIEF: Fed's Logan: Minor QE Tweaks Likely Announced May 13

- The Federal Reserve's plan for "minor technical adjustments" recalibrating bond purchases to better match outstanding U.S. debt could be announced May 13, New York Fed's markets chief Lorie Logan said Thursday. "We'll continue to update these at regular intervals going forward," said Logan in a question-and-answer session at a SIFMA webinar - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: U.S. President Joe Biden said on Thursday "things are moving" after data showed U.S. retail sales rose by the most in 10 months in March as Americans received additional pandemic relief checks from the government. "We still have a long way to go," Biden told reporters at the Oval Office. "But America is coming back." (RTRS)

FISCAL: President Joe Biden's $2.3 trillion infrastructure package could be passed by Congress in smaller pieces, White House press secretary Jen Psaki said on Thursday, citing agreement on a number of components of the president's proposal. "We're ... quite open to what path this takes," Psaki told reporters. "We're not going to predetermine whether it all has to happen in one big package. There are different components that could move forward, certainly, on their own." Psaki said Biden's goal remained to see progress on the proposals by the Memorial Day holiday at the end of May, and would like to see the package passed by Congress this summer. (RTRS)

FISCAL: A reporter with The Hill tweeted the following on Thursday: "Sen. Joe Manchin declines to endorse $800 billion target for infrastructure package. He says he could support $4 trillion package if it's needed and paid for. "We're going to do whatever it takes. If it takes $4 trillion, I'd do $4 trillion but we have to pay for it," he said." (MNI)

FISCAL: A group of moderate Senate Republicans is drafting a scaled-back infrastructure proposal, an opening salvo as they seek to strike a deal with President Biden on a package more narrowly targeted in scope. The GOP lawmakers are poised to offer a bill somewhere around $650 billion, nearly one-third the size of Biden's American Jobs Plan, according to a source familiar with the matter. The senators are expected to introduce the counteroffer "sometime during May recess." (FOX)

FISCAL: A group of House members on Thursday applied more pressure to repeal the state and local tax deduction cap, as the policy emerges as a possible stumbling block in efforts to pass President Joe Biden's infrastructure plan. Lawmakers from both parties announced the SALT caucus, which aims to scrap the $10,000 limit on state and local deductions set as part of the 2017 Republican tax law. The roughly 30 House members in the group largely represent the high-tax states of New York, New Jersey and California. (CNBC)

CORONAVIRUS: A hold on the use of Johnson & Johnson's Covid-19 vaccine in the U.S. could stretch out for several weeks, according to the head of an advisory panel that is expected to make a recommendation about whether shots should resume. The Centers for Disease Control and Prevention's Advisory Committee on Immunization Practices is weighing the scientific evidence after reports that six people who received the vaccine subsequently suffered rare blood clots in the brain. Earlier this week, U.S. regulators ordered a temporary halt in use of the shot. After deciding not to vote on a recommendation on Wednesday, the advisory panel is tentatively scheduled to reconvene on Thursday or Friday of next week, chairman Jose Romero said in a telephone interview. (BBG)

CORONAVIRUS: Anthony Fauci, the top U.S. infectious disease doctor, hopes U.S. regulators will make a quick decision to lift a pause on the Johnson & Johnson (JNJ.N) vaccine and get that vaccine "back on track," he said in an interview with Reuters on Thursday. His comments come a day after a panel of advisers to the U.S. Centers for Disease Control and Prevention (CDC) delayed a vote on whether to resume the J&J shots for at least a week, until it had more data on the risk. (RTRS)

CORONAVIRUS: The U.S. has found 5,800 "breakthrough" cases of Covid-19, in which a fully vaccinated person was infected, the Centers for Disease Control and Prevention said. The nation has fully vaccinated more than 75 million people. Breakthrough infections occurred among all ages but more than 40% were 60 years and older. A third of the cases were asymptomatic, and almost two thirds were female. Seven percent were hospitalized and 1% died. (BBG)

CORONAVIRUS: New York state hospitalizations for Covid-19 dropped below 4,000 for the first time since Dec. 1. The seven-day average rate of positive test results dropped to 3.05%, the lowest since Nov. 25, Governor Andrew Cuomo said Thursday in a statement. New York City's average positivity is 3.33% with Staten Island reporting the highest rate among the five boroughs, at 4.29%. The state reported 6,884 new positive cases, in line with its seven-day average. At that pace, New York should top 2 million cases in the next week. (BBG)

CORONAVIRUS: The Colorado Department of Public Health and Environment appealed to residents to test for Covid-19 as a fourth wave of the disease sweeps the state. "As we've seen vaccine rates go up, in some areas we've started to see testing numbers go down," Scott Bookman, state incident commander, said during an online briefing Thursday. "Testing can help to slow the spread of this virus." Colorado has allowed cities and counties to ease local health restrictions and Denver lifted its outdoor mask mandate Wednesday. (BBG)

CORONAVIRUS: Governor Chris Sununu said New Hampshire's mask mandate will end on Saturday, citing declining fatalities and hospitalizations. He said that localities and private businesses could continue to require masks. "New Hampshire residents know how to keep ourselves and our neighbors safe without a state mandate," the Republican governor tweeted on Friday. (BBG)

POLITICS: Joe Biden begins his presidency having achieved out of the gate what his predecessor could only do once during his four years: a positive approval rating. The CNBC All-America Economic Survey finds that 47% of the public approves of Biden's handling of the presidency, with 41% disapproving. A substantial 12% say they are not sure. Former President Donald Trump managed to get above the breakeven level just once in the survey, in March 2020. (CNBC)

EQUITIES: House Republicans are gearing up to take aim at the legal shield that protects tech platforms from liability for the content users post. On Thursday, Republican staff for the House Energy and Commerce Committee sent a memo suggesting several concepts for reforming Section 230 of the Communications Decency Act, a 1996 law that protects tech platforms from liability for users' posts and for their own moderation practices. (CNBC)

OTHER

U.S./CHINA: Senate Finance panel to hold hearing on China trade on April 22. (BBG)

U.S./CHINA: China needs to increase its military strength to counter U.S. ambitions for military intervention should it decide to reunify Taiwan by force, the Global Times said in an editorial. China also needs to boost technological development to break the U.S. stranglehold and keep other countries from joining the U.S. anti-China policy, the state-owned newspaper said. China should also stabilize relations with the U.S. and be prepared for a long-term struggle, it said. The U.S. has fixed China as a strategic rival, and such a mindset will last decades, the editorial said. (MNI)

CORONAVIRUS: The United States is preparing for the possibility that a booster shot will be needed between nine to 12 months after people are initially vaccinated against COVID-19, a White House official said on Thursday. While the duration of immunity after vaccination is being studied, booster vaccines could be needed, David Kessler, chief science officer for President Joe Biden's COVID-19 response task force told a congressional committee meeting. "The current thinking is those who are more vulnerable will have to go first," he said. Meanwhile, Pfizer Inc Chief Executive Albert Bourla said people will 'likely' need a third booster dose of COVID-19 vaccines within 12 months and could need annual shots, CNBC reported based on his comments from April 1, which were made public on Thursday. (RTRS)

GEOPOLITICS: President Joe Biden's effort to harness U.S. alliances in Asia to counter China will get a test run during his summit with Japanese Prime Minister Yoshihide Suga on Friday -- his first in-person meeting with a foreign leader since taking office. China's shadow will loom large over almost every topic during Suga's visit, from human rights to Taiwan to supply chain resilience. The two leaders plan to issue statements on the situation in the Taiwan Strait -- a move sure to draw China's attention -- as well as announce a $2 billion initiative on 5G technology, according to a U.S. official who briefed reporters on Thursday. (BBG)

BOJ: Bank of Japan Governor Haruhiko Kuroda said on Friday he hopes to deepen debate with global policymakers on what role monetary policy can play in addressing climate change. "There are many factors we need to take into account, such as how this will affect distribution of resources," Kuroda told parliament, when asked by a lawmaker how the BOJ can help address climate change through monetary tools. "We hope to deepen debate in international meetings. I'm not saying we won't think about possibilities at all." Kuroda said that any decision the BOJ makes on climate change must be in line with its mandate of maintaining price and financial system stability. (RTRS)

BOJ: MNI POLICY: BOJ Sees No Need To Cut JGB Buys Now

- The Bank of Japan sees no need to further reduce the scale of its JGB purchases at present, despite some market players seeing the bank scale back buys, MNI understands - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

JAPAN: The Japanese government plans to reimpose restrictions on areas around Tokyo to control the latest surge in the coronavirus, Economy Minister Yasutoshi Nishimura told an advisory panel Friday. (BBG)

AUSTRALIA: Senior economists are warning Australia's disrupted COVID-19 vaccination rollout is likely to take at least six months longer than some comparable countries and cost the economy tens of billions of dollars in lost output. The Morrison government's recommendation that people aged under 50 should not have the AstraZeneca vaccine is likely to slow the rate at which key sectors of the economy recover from the pandemic-induced recession. (The Age)

SOUTH KOREA: South Korean President Moon Jae-in's support rate dropped to a record-low of 30% vs. 32% in the previous survey, amid the land speculation scandal by government officials, Gallup Korea survey showed. Disapproval rating was at a record high 62% vs. 58%. Of those who disapproved, 31% cited property market policies and 9% cited shortfall to tackle economic issues, while 7% cited unfairness. Among those who approved, 34% cited Moon's coronavirus outbreak response. (BBG)

CANADA: Ontario's COVID-19 situation is "dire," one of the province's top doctors said Thursday as the government considered new restrictions to deal with an alarming rise in cases. Hours after the province set a new record for daily infections — logging 4,736 cases — Barbara Yaffe, Ontario's associate medical officer of health, said she had never seen things so bad. (London Free Press)

TURKEY: Turkey and Greece's top diplomats bickered publicly on Thursday evening after a round of talks that had been aimed at reducing tensions over the neighbours' territorial disputes and the divided island of Cyprus. Greece's foreign minister, Nikos Dendias, travelled to Turkey for the first time since warships from both nations were caught up in a dangerous confrontation in the eastern Mediterranean Sea last year over drilling for hydrocarbons in contested waters, provoking threats of sanctions from the EU. Turkey is a candidate for EU membership but its poor relationship with member states Greece and Cyprus and an erosion in human rights at home have stalled its bid. In a televised joint statement, Dendias said Athens supported Turkey's EU entry because it was in Greece's interests to have its neighbour as an ally in the bloc — but Turkey first had to "de-escalate and avoid statements that could dynamite our relations". Territorial "breaches have increased recently and such infringements are an obstacle to creating an environment of trust", he said. "If Turkey continues violating our sovereign rights, then sanctions, measures that are on the table, will be put back on the agenda." His assertions visibly angered Ankara's foreign minister Mevlut Cavusoglu, who accused Dendias of going off-script from a "positive" message they had agreed upon during the closed-door talks and making "extremely unacceptable accusations" to appeal to Greek public opinion once he was in front of the cameras. (FT)

BRAZIL: Brazil's government expects to chalk up budget shortfalls in each of the next three years of more than 100 billion reais ($18 bln), which would mark 11 consecutive years of budget deficits, according to Economy Ministry proposals sent to Congress on Thursday. The ministry's goal is for a primary deficit next year of 170.5 billion reais ($30.4 billion), less than the 179 billion reais deficit goal established in December and lower than the 2021 target of 247.1 billion reais. (RTRS)

BRAZIL: A majority of Brazil's Supreme Court confirmed on Thursday a decision to annul criminal convictions against former President Luiz Inacio Lula da Silva, teeing up a presidential run against current President Jair Bolsonaro in 2022. The decision, which was widely expected, came after Supreme Court Justice Edson Fachin determined in early March that the lower federal court where Lula was tried lacked jurisdiction, a ruling that was quickly appealed by Brazil's top prosecutor. Lula, 75, governed Latin America's biggest country and largest economy between 2003 and 2011, overseeing a commodities boom that turbocharged economic growth. (RTRS)

BRAZIL: Food prices have already risen and should post a much higher increase when Brazil eases its restriction measures, President Jair Bolsonaro said in his weekly live on social media. "We have an almost perfect storm ahead," said Bolsonaro. (BBG)

RUSSIA: President Joe Biden on Thursday addressed the sweeping sanctions his administration imposed on Russia, a move that seeks to address a litany of malign behaviors and is expected to peeve Moscow. "If Russia continues to interfere with our democracy, I'm prepared to take further actions to respond. It is my responsibility as president of the United States to do so," Biden said from the White House. "I was clear with President Putin that we could have gone further, but I chose not to do so, I chose to be proportionate," Biden said of the measures, adding that he did not want to "kick off a cycle of escalation and conflict with Russia." Biden also said that he proposed in a phone call with Putin that the two meet in person this summer in Europe to discuss a range of pressing issues. (CNBC)

RUSSIA: An official with the United States Department of Justice said the government is examining "dozens" of Russian companies for potential supply chain vulnerabilities. Assistant Attorney General John Demers told reporters on Thursday the process is expected to take months and could lead to some Russian companies being referred to the Department of Commerce for further action. (RTRS)

RUSSIA: There is a 'low to medium risk' of a Russian invasion of Ukraine in the next few weeks, a US military chief warned today as Vladimir Putin continues sending troops, artillery and tanks to the border. The head of US forces in Europe, General Tod Wolters, was giving evidence to the Senate Armed Services Committee in Washington when he was asked about the risk of invasion in that timeframe. The general insisted the chances were 'low to medium,' adding that it would depend on a number of factors but, based on the current trajectory and disposition of Russian forces, that likelihood would start to wane. (Daily Mail)

RUSSIA: Ukraine's Ministry of Foreign Affairs said on Thursday that Russia announced it would be closing part of the Black Sea near the Kerch Strait for foreign warships until October, under the pretense of conducting military exercises. A spokesperson said Russia's actions violate international law and reiterated that Ukraine "has the right to regulate shipping in these waters of the Black Sea." (POLITICO)

IRAN: The U.S. needs to explicitly state what sanctions it's willing to lift to unblock talks to revive the stricken 2015 nuclear accord, Iran's lead negotiator said on Thursday, with diplomacy struggling to bridge deep differences after three rounds of meetings in a little over a week. Iran in response would state the steps it's prepared to take to scale back its nuclear activity, Deputy Foreign Minister Abbas Araghchi said on the sidelines of the latest round of negotiations with world powers in Vienna. "They have to lift" the sanctions on us, Araghchi told state-run Press TV. "Without the list, I don't think we can make any progress." Russia said talks would resume on Friday. (BBG)

CHINA

PBOC: The interest rates for MLF or loan prime rates will remain at current levels as the economic recovery is uneven, reported the Shanghai Securities News citing Yan Se, the chief economist with Founder Securities after the PBOC yesterday renewed maturing MLF but without issuing an additional amount. The restraint, unexpected by the market, was mainly due to sufficient liquidity, said Wang Qing, the chief analyst with Golden Credit Rating. Tightening is also unlikely as CPI won't exceed 3%, a ceiling tolerated by policy makers, in the near future, Wang told the newspaper. (MNI)

INFLATION: China has improved the efficiency of using raw materials to the extent that the ongoing commodity rally won't significantly affect consumer prices, the 21st Century Business Herald reported citing Liu Yuanchun, vice president of the Renmin University of China. While the commodity rally isn't over, prices will not surge significantly as demand is not as strong as expected given the slow pace of global recovery. Given the level of demand, supply will catch up, said Liu, who according to the Herald is a well-known advisor to the government. (MNI)

HOUSEHOLD DEBT: The risks posed to China's financial system stability by rapid growth in household leverage should ease in the medium term as the authorities continue to tighten regulation of household lending, advancing their efforts to improve underwriting standards (particularly for online lending) and risk controls. We believe that tighter regulation, as part of broader efforts to reduce financial-system risks, will result in slower growth of household lending in the period to 2025. This should help to stabilise China's system leverage, although lending to households is still likely to rise as a share of GDP.China's household debt continued to rise rapidly last year, despite the Covid-19 pandemic. (Fitch)

CREDIT: China Huarong Asset Management Co.'s onshore securities unit has wired funds to repay a local bond maturing Sunday, according to people familiar with the matter. Huarong Securities Co. transferred the money to China Securities Depository and Clearing Corp. for its 5.8% yuan bond that matures April 18, the people said, asking not to be identified because they aren't authorized to speak publicly. The note has 2.5 billion yuan ($383 million) outstanding, Bloomberg-compiled data show. Bondholders are typically paid Monday when local bonds mature on a weekend. Investors are keeping a close eye on bond payments by China Huarong and its units for clues on whether the embattled bad-debt manager will meet its obligations as it pursues a wide-ranging overhaul. (BBG)

OVERNIGHT DATA

CHINA Q1 GDP +18.3% Y/Y; MEDIAN +18.5%; Q4 +6.5%

CHINA Q1 GDP YTD +18.3% Y/Y; MEDIAN +18.5%; Q4 +2.3%

CHINA Q1 GDP +0.6% Q/Q; MEDIAN +1.4%; Q4 +3.2%

MNI DATA IMPACT: China Q1 GDP Grows Record 18.3% On Low Base

- The Chinese economy grew a record 18.3% y/y in Q1 mainly due to the low base in the same period last year, which bore the brunt of the initial impact from the Covid-19 outbreak, data released by the National Bureau of Statistics on Friday showed. The figure is in line with the median forecast of 18.0% - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

CHINA MAR INDUSTRIAL OUTPUT +14.1% Y/Y; MEDIAN +18.0%

CHINA MAR INDUSTRIAL OUTPUT YTD +24.5% Y/Y; MEDIAN +26.5%; FEB +35.1%

CHINA MAR RETAIL SALES +34.2% Y/Y; MEDIAN +28.0%

CHINA MAR RETAIL SALES YTD +33.9% Y/Y; MEDIAN +31.7%; FEB +33.8%

CHINA MAR FIXED ASSETS EX RURAL YTD +25.6% Y/Y; MEDIAN +26.0%; FEB +35.0%

CHINA MAR PROPERTY INVESTMENT YTD +25.6% Y/Y; MEDIAN +30.0%; FEB +38.3%

CJOMA MAR UNEMPLOYMENT RATE 5.3%; MEDIAN 5.4%; FEB 5.5%

CHINA MAR NEW HOME PRICES +0.41% M/M; FEB +0.36%

NEW ZEALAND MAR BUSINESSNZ M'FING PMI 63.6; FEB 54.2

New Zealand's manufacturing sector saw a strong boost in new orders and production during March, according to the latest BNZ - BusinessNZ Performance of Manufacturing Index (PMI). The seasonally adjusted PMI for March was 63.6 (a PMI reading above 50.0 indicates that manufacturing is generally expanding; below 50.0 that it is declining). This was up 9.4 points from February, and the highest monthly result since the survey began in 2002. BusinessNZ's executive director for manufacturing Catherine Beard said that the March result was obviously a shot in the arm for the sector, although any single monthly movement needs to be treated with caution in the context of the current economic environment. "The two major sub-index values of Production (66.8) and New Orders (72.5) were the main drivers of the March result, with the latter experiencing its first post 70-point value. This does indicate a swift shift in demand over a relatively short time, which may indicate a move towards previously shelved projects and business ventures that have now been given the green light". "Given the strong March result, the proportion of those outlining positive comments increased significantly from 46% in February to almost 58% in March. Unsurprisingly, comments were centred towards increased demand, both domestically and offshore". BNZ Senior Economist, Doug Steel noted that "more demand is one thing, but meeting it is another. Firms have faced many supply-side challenges. In this regard, it is interesting to see PMI deliveries of raw materials lifted strongly, to 62.8, this month. That coincides with other data showing imports leapt more than 17% above year earlier levels in March following prior weakness". (BNZ)

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS FRI; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Friday. This leaves liquidity unchanged given the maturity of CNY10 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2136% at 09:25 am local time from the close of 2.0331% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 50 on Thursday vs 40 on Wednesday. A higher index indicates increased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.5288 FRI VS 6.5297

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower for a fourth day at 6.5288 on Friday, compared with the 6.5297 set on Thursday.

MARKETS

SNAPSHOT: Familiar Risks Continue To Headline In Asia

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 29.78 points at 29671.02

- ASX 200 up 0.678 points at 7058

- Shanghai Comp. up 15.756 points at 3414.744

- JGB 10-Yr future up 3 ticks at 151.36, yield unch. at 0.090%

- Aussie 10-Yr future up 4.5 ticks at 98.315, yield down 4.1bp at 1.727%

- US 10-Yr future -0-09 at 132-12, yield up 0.36bp at 1.580%

- WTI crude up $0.08 at $63.56, Gold up $0.50 at $1764.48

- USD/JPY up 8 pips at Y108.84

- CDC TENTATIVELY SETS J&J MEETING (BBG)

- CHINA LODGES PREDICTED STELLAR Y/Y ECON GROWTH, THOUGH DATA MIXED VS. EXP.

- HUARONG SECURITIES SAID TO WIRE FUNDS FOR LOCAL BOND DUE SUNDAY (BBG)

BOND SUMMARY: Block Flow In Tsys Headlines After Thursday's Tsy Swings

The U.S. Tsy space was much calmer than what was witnessed during Thursday's NY session. T-Notes registered an incremental fresh session low as Chinese equity indices pared their initial post-Chinese data dip (Chinese data was predictably strong in Y/Y terms, although a little more mixed vs. exp.), which came after a pullback from best levels in late NY hours. Some pockets of TYM1 buying then showed their hand helping the contract off lows, before a tick back to worst levels. TY -0-09 at 132-12 at typing, 0-01+ off lows, holding to a 0-05+ range overnight, with cash Tsys unchanged to 0.5 bp cheaper across the curve. Block flow was headlined by 20K of FVM1 124.25 call selling and what looked like 15K of FVM1 123.75 call selling (this may have represented a seller of the relevant 3x4 call strip). Elsewhere, there was what seemed to be a 2,275 block sale of UXYM1.

- JGB futures moved away from their overnight levels during the Tokyo session, in sympathy with the late NY pullback in U.S. Tsys, with the contract last 2 ticks above yesterday's settlement levels. Cash JGBs have seen some light twist steepening as a result, with marginal cheapening of 30s and 40s on the day. There has been little in the way of notable domestic news flow, with BoJ Governor Kuroda failing to offer anything new in his latest parliamentary address.

- It was a very narrow Sydney session for Aussie bond futures, with no follow through impact from the slew of Chinese economic data, while the AOFM weekly issuance schedule was the definition of vanilla (as expected). YM +0.5, XM +4.0 at typing.

JGBS AUCTION: Japanese MOF sells Y5.2982tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y5.2982tn 3-Month Bills:- Average Yield -0.0990% (prev. -0.0945%)

- Average Price 100.0266 (prev. 100.0254)

- High Yield: -0.0968% (prev. -0.0930%)

- Low Price 100.0260 (prev. 100.0250)

- % Allotted At High Yield: 23.4893% (prev. 77.2783%)

- Bid/Cover: 4.133x (prev. 3.825x)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance schedule:

- On Wednesday 21 April it plans to sell A$1.2bn of the 2.50% 21 May 2030 Bond.

- On Thursday 22 April it plans to sell A$500mn of the 22 June 2021 Note & A$500mn of the 27 August 2021 Note.

- On Friday 23 April it plans to sell A$800mn of the 3.25% 21 April 2025 Bond.

EQUITIES: Mixed Despite Positive Lead From US

A mixed day to end the week with moves muted in both directions despite a positive lead from US stocks where yet another all time high was hit. Markets in China dipped after the data dump saw GDP and industrial production miss estimates, though retail sales did beat. Japanese markets oscillated between minor losses and gains, failing to find decisive direction. US futures are in negative territory, retreating from record highs as sentiment was hit on China data.

OIL: Crude Futures Tread Water

Crude futures have hugged a narrow range in Asia-Pac trade on Friday; WTI is down $0.06 from settlement levels at $63.40/bbl, while Brent is down $0.03 at $66.91/bbl. WTI is on track for gains of around 7% this week, its best week since early March.

- A number of positive signals on demand this from week from the IEA and OPEC have helped oil gather momentum and break out of recent ranges. Data from China earlier was slightly below estimates but still showed an economy progressing at a decent clip and should also be supportive of demand going forward. Earlier in the session CNPC said China's oil demand is expected to rise 1% this year.

GOLD: Bulls In Charge?

Thursday's fall in U.S. real yields allowed bulls to capitalise, pushing spot through technical resistance. Gold has edged back from Thursday's peak, with U.S. real yields off of lows, but the technical picture is now more positive. Spot last deals little changed, just shy of $1,765/oz, with bulls now looking to force a test of resistance at $1,775.9 oz (the Feb 26 high).

FOREX: Antipodeans On Softer Footing, But Still Poised For Weekly Gains

Demand for the Antipodean currencies petered out in today's Asia-Pac session, but AUD & NZD are still poised for solid weekly gains, as they fared better than any other G10 currency this week. The Antipodeans lost ground alongside the redback ahead of the release of China's GDP & activity indicators. These came in slightly weaker than expected, triggering another round of light CNH, AUD & NZD sales.

- The PBOC continued its run of stronger than expected fixes for the yuan, the USD/CNY mid-point fixed 11 pips below sell side estimates. This month's fixings seem to indicate the PBOC's willingness to allow the yuan to strengthen.

- The DXY crept higher as the greenback outperformed in the G10 basket. USD may have drawn some support from decent demand for USD/JPY into the Tokyo fix.

- Other than that, there was little in the way of general direction to overnight price action, with CAD & CHF holding up well, while NOK & GBP went offered.

- EZ trade balance & final CPI, U.S. housing starts, building permits & final U. of Mich. Sentiment as well as comments from Fed's Kaplan & BoE's Cunliffe take focus today.

FOREX OPTIONS: Expiries for Apr16 NY cut 1000ET (Source DTCC)

- USD/JPY: Y108.00($545mln), Y108.95-00($837mln)

- GBP/USD: $1.3650-55(Gbp679mln)

- AUD/USD: $0.7550(A$519mln)

- USD/CAD: C$1.2480-85($1.1bln), C$1.2550-60($506mln)

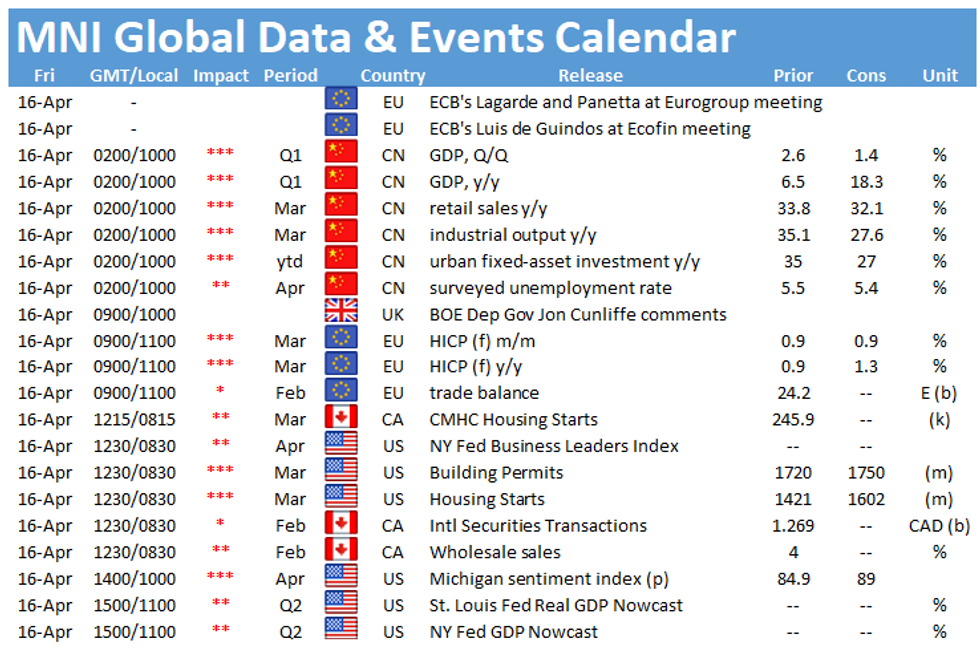

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.