-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY345.9 Bln via OMO Friday

MNI: PBOC Sets Yuan Parity Higher At 7.1942 Fri; -1.48% Y/Y

MNI BRIEF: Japan Oct Core CPI Rises 2.3%, Services Rise

MNI EUROPEAN MARKETS ANALYSIS: Calmer Asia Session After Thursday's Tsy Swings

- China date predictably firm in Y/Y terms, but a little more mixed vs. estimates.

- FVM1 call blocks dominate Tsy trade in Asia after Thursday's late NY pullback from best levels.

- Headline flow was limited overnight, with familiar risks at the fore.

BOND SUMMARY: Block Flow In Tsys Headlines After Thursday's Tsy Swings

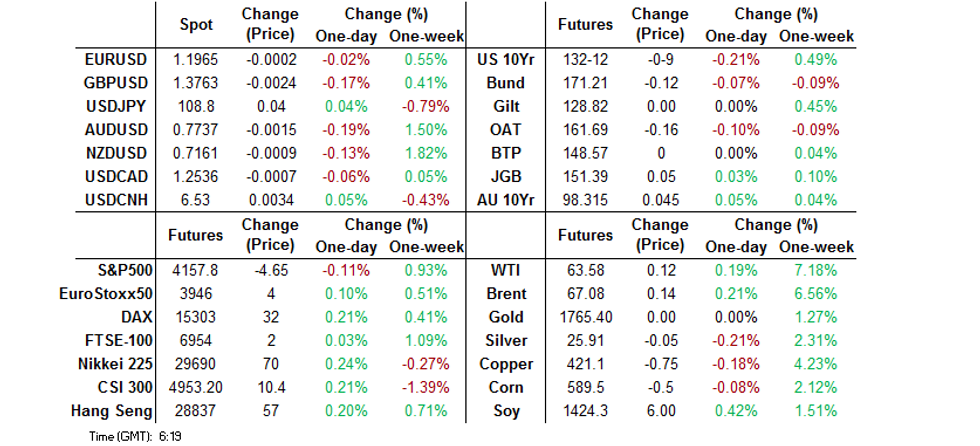

The U.S. Tsy space was much calmer than what was witnessed during Thursday's NY session. T-Notes registered an incremental fresh session low as Chinese equity indices pared their initial post-Chinese data dip (Chinese data was predictably strong in Y/Y terms, although a little more mixed vs. exp.), which came after a pullback from best levels in late NY hours. Some pockets of TYM1 buying then showed their hand helping the contract off lows, before a tick back to worst levels. TY -0-09 at 132-12 at typing, 0-01+ off lows, holding to a 0-05+ range overnight, with cash Tsys unchanged to 0.5 bp cheaper across the curve. Block flow was headlined by 20K of FVM1 124.25 call selling and what looked like 15K of FVM1 123.75 call selling (this may have represented a seller of the relevant 3x4 call strip). Elsewhere, there was what seemed to be a 2,275 block sale of UXYM1. Housing starts, building permits & UoM sentiment headline the local economic data docket on Friday, with comments from Dallas Fed President Kaplan also due.

- JGB futures moved away from their overnight levels during the Tokyo session, in sympathy with the late NY pullback in U.S. Tsys, with the contract last 3 ticks above yesterday's settlement levels. Cash JGBs have seen some light twist steepening of the curve as a result, with marginal cheapening of 30s and 40s on the day, unwinding the early (modest) bid. There has been little in the way of notable domestic news flow, with BoJ Governor Kuroda failing to offer anything new in his latest parliamentary address. BoJ Rinban operations headline the local docket on Monday, with 20-Year JGB supply probably providing the focal point of next week's local docket.

- It was a very narrow Sydney session for Aussie bond futures, with no follow through from the slew of Chinese economic data, while the AOFM weekly issuance schedule was the definition of vanilla (as expected). YM +0.5, XM +4.5 at typing, after the space tracked U.S. Tsys overnight. Prelim. retail sales data headlines the local economic docket next week, elsewhere, the minutes of the RBA's most recent monetary policy meeting will be combed over.

FOREX: Antipodeans On Softer Footing, But Still Poised For Weekly Gains

Demand for the Antipodean currencies petered out in today's Asia-Pac session, but AUD & NZD are still poised for solid weekly gains, as they fared better than any other G10 currency this week. The Antipodeans lost ground alongside the redback ahead of the release of China's GDP & activity indicators. These came in slightly weaker than expected, triggering another round of light CNH, AUD & NZD sales.

- The PBOC continued its run of stronger than expected fixes for the yuan, the USD/CNY mid-point fixed 11 pips below sell side estimates. This month's fixings seem to indicate the PBOC's willingness to allow the yuan to strengthen.

- The DXY crept higher as the greenback outperformed in the G10 basket. USD may have drawn some support from decent demand for USD/JPY into the Tokyo fix.

- Other than that, there was little in the way of general direction to overnight price action, with CAD & CHF holding up well, while NOK & GBP went offered.

- EZ trade balance & final CPI, U.S. housing starts, building permits & final U. of Mich. Sentiment as well as comments from Fed's Kaplan & BoE's Cunliffe take focus today.

FOREX OPTIONS: Expiries for Apr16 NY cut 1000ET (Source DTCC)

- USD/JPY: Y108.00($545mln), Y108.95-00($837mln)

- GBP/USD: $1.3650-55(Gbp679mln)

- AUD/USD: $0.7550(A$519mln)

- USD/CAD: C$1.2480-85($1.1bln), C$1.2550-60($506mln)

ASIA FX: Mixed As China Data Misses Estimates

Despite a lack of notable headline flow the greenback rose during the session, breaking out of yesterday's range, which combined with misses in Chinese data put pressure on most Asia EM FX and taking USD/crosses off lows.

- CNH: Offshore yuan is weaker, losing ground after data. GDP and industrial production both missed estimates.

- SGD: Singapore dollar has retreated from its highest level since March 3, market looked through a strong set of export data from Singapore, electronics exports rose 24.4%, while non-oil exports rose 12.1% Y/Y.

- TWD: Taiwan dollar is slightly stronger, holding yesterday's gains after TMSC announced big spending plans and improved guidance.

- KRW: The won is flat, recovering after earlier losing ground. Some of the weakness was attributed to Samsung paying KRW 13tn in dividends, the majority of which are expected to be repatriated.

- MYR: Ringgit is weaker, losing the most ground in a week. Several gov't off'ls threatened to close Ramadan bazaars if their operation leads to the spread of Covid-19 infections. Science Min Khairy said that the National Security Council should review its decision to allow the bazaars to open.

- IDR: Rupiah is stronger, but is on track for its ninth consecutive weekly decline. Bank Indonesia will publish Feb offshore borrowings data and Mar survey of bank financing demand and offer today.

- PHP: Peso is stronger, the presidential spokesman informed that Diokno wants to speak with Indian PM Modi about potential supply of Covid-19 vaccines, but the meeting is yet to be scheduled. The government also said it would expand its vaccination programme.

- THB: Baht is stronger as it returns to market after a holiday, Dep PM Anutin suggested that the gov't considers a nationwide ban on sales of alcoholic beverages in restaurants, closure of pubs and entertainment venues, early restaurant closures and suspension of in-person teaching. At the same time, Anutin noted that "we have seen no point in imposing a [full, nationwide] lockdown for the time being."

ASIA RATES: China Data Supports Bid Tone

Misses in the Chinese data changed the complexion of the session and helped keep bonds supported, while surges in US Treasuries yesterday saw local markets play catch up.

- INDIA: Bonds sold off sharply yesterday, and remain under pressure today, though a global bid tone is helping support the short end. the RBI conducted its first GSAP purchases yesterday but bond yields rose after the operation. The disappointing results cast doubts on the efficacy of the programme at a time when a dramatic uptick in coronavirus cases threatens to shutdown large parts of the economy. The RBI will auction INR 260bn of bonds today, demand at the auction could struggle, meaning primary dealers could be left to rescue the sale again.

- SOUTH KOREA: South Korean bonds are higher after selling off post BoK yesterday. The number of COVID-19 cases remains elevated, while a smooth 50-year auction also helped support demand. The MOF sold slightly more than advertised with a solid jump in bid/cover ratio.

- CHINA: The China data dump was overall slightly weaker than expected, which saw bond futures erase losses. GDP was a slight miss at 18.3% against expectations of 18.5%, industrial production also below estimates by 2ppts at 24.5%, while fixed asset investments missed by 0.4ppts at 25.6%. One bright spot was retail sales at 33.9%. These figures are strong on an objective basis, but benefit from a low base effect, and the misses against estimates indicate the recovery is progressing slightly more slowly than expected.

- INDONESIA: Yields lower for a third day in Indonesia. Bank Indonesia will publish Feb offshore borrowings data and Mar survey of bank financing demand and offer today. Elsewhere, the Finance Ministry holds a discussion on state assets.

EQUITIES: Mixed Despite Positive Lead From US

A mixed day to end the week with moves muted in both directions despite a positive lead from US stocks where yet another all time high was hit. Markets in China dipped after the data dump saw GDP and industrial production miss estimates, though retail sales did beat. Japanese markets oscillated between minor losses and gains, failing to find decisive direction. US futures are in negative territory, retreating from record highs as sentiment was hit on China data.

GOLD: Bulls In Charge?

Thursday's fall in U.S. real yields allowed bulls to capitalise, pushing spot through technical resistance. Gold has edged back from Thursday's peak, with U.S. real yields off of lows, but the technical picture is now more positive. Spot last deals little changed, just shy of $1,765/oz, with bulls now looking to force a test of resistance at $1,775.9 oz (the Feb 26 high).

OIL: Crude Futures Tread Water

Crude futures have hugged a narrow range in Asia-Pac trade on Friday; with Brent & WTI last printing ~$0.10 above their respective settlement levels. WTI is on track for gains of around 7% this week, its best week since early March.

- A number of positive signals on demand this from week from the IEA and OPEC have helped oil gather momentum and break out of recent ranges. Data from China earlier was slightly below estimates but still showed an economy progressing at a decent clip and should also be supportive of demand going forward. Earlier in the session CNPC said China's oil demand is expected to rise 1% this year.

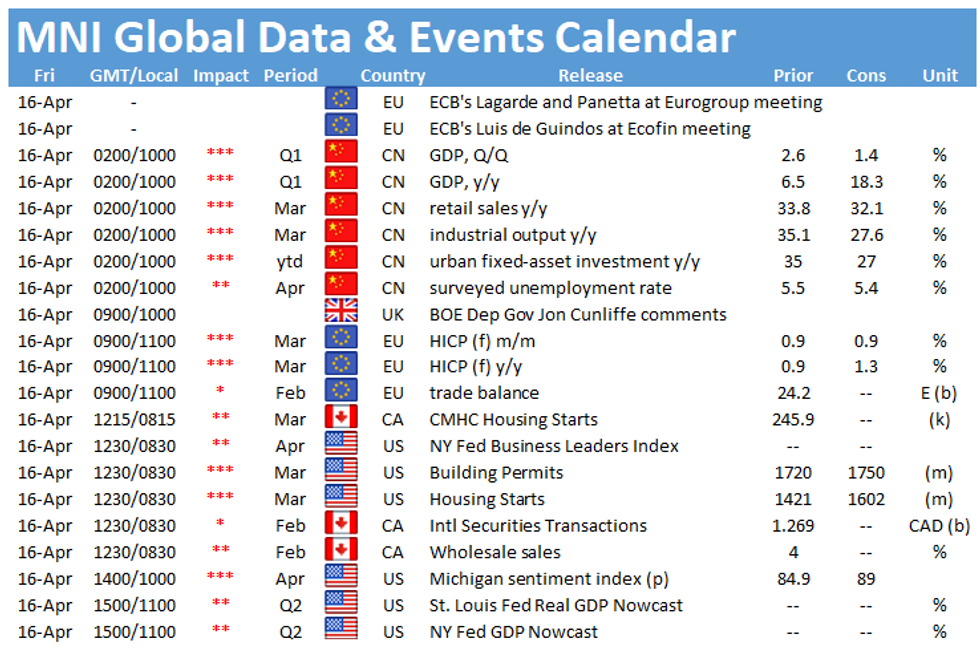

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.