-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN OPEN: A Helping Of Geopolitics & U.S. Fiscal Headlines To Start The Week

EXECUTIVE SUMMARY

- SENATE DEMOCRATS SETTLING ON 25% CORPORATE TAX RATE (AXIOS)

- BIDEN TO MEET LAWMAKER GROUP TO DISCUSS JOBS PLAN MONDAY

- JAPAN VOWS TO SUPPORT US IN OPPOSING 'COERCION' FROM CHINA (FT)

- GEOPOLITICAL TENSIONS SURROUNDING RUSSIA REMAIN EVIDENT

- SIGNS OF THAW ON IRAN NUCLEAR DEAL EMERGE IN VIENNA TALKS (BBG)

- GLOBAL COVID INFECTIONS HIT WEEKLY RECORD (BBG)

Fig. 1: U.S. Dollar Index (DXY)

Source: MNI - Markets News/Bloomberg

Source: MNI - Markets News/Bloomberg

UK

CORONAVIRUS: The USA, Gibraltar, Israel and Iceland will be among only eight countries on the Government's "green" list for safe travel from May 17, according to modelling for the industry. (Telegraph)

CORONAVIRUS: Downing Street has insisted lateral flow tests are "accurate" after leaked emails warned that they may only pick up two per cent of Covid cases. A Number 10 spokesman said the rapid turnaround technology was proving "incredibly useful" at picking up asymptomatic infections despite scepticism among many scientists. (Telegraph)

CORONAVIRUS: Health officials say they are still assessing whether a variant of Covid-19 first discovered in India is more transmissible and vaccine evasive than other forms of the virus after the discovery of 77 cases in the UK. Susan Hopkins, a senior medical adviser at Public Health England, said on Sunday that scientists did not have enough data to clarify whether it should be classed as a "variant of concern" — the most serious classification. At the moment the B.1.617 variant, which has been linked with a surge in cases in India in recent weeks, has been classified by Britain as a "variant under investigation". (FT)

CORONAVIRUS: A U.K. minister said it's too soon to say if hospitality venues in England can reopen indoors as planned next month. The comments from Environment Secretary George Eustice on Sunday signal concerns that the road map out of lockdown could be knocked off course by mutations in the virus seen in India and Brazil. The next stage of the plan to unlock more of the economy is on May 17, when hotels, cinema and museums are allowed to reopen, and other hospitality venues including pubs and restaurants -- which were allowed to open outdoors earlier this month -- can serve customers inside. (BBG)

CORONAVIRUS: Face masks will not be used at a series of large-scale pilot events in the coming weeks as ministers plan for the return of mass gatherings without Covid rules. Trials that involve suspending combinations of restrictions including face coverings and social distancing will take place at up to 15 pilots before the end of May. (Telegraph)

ECONOMY: The U.K. economy is building momentum, with real-time indicators suggesting consumers have started to splurge some of the cash they've saved now that the government has loosened lockdown rules. Restaurant bookings and job postings surged to the highest since the start of the coronavirus pandemic, while road traffic and the number of people traveling to workplaces grew in recent weeks, data from Bloomberg Economics and government statistics show. Shops and bars were allowed to reopen on April 12, and most restrictions are set to lapse by June 21. With more almost two thirds of adults in the U.K. immunized against the coronavirus, Prime Minister Boris Johnson is starting to relax advice on contaning the virus. Bank of England Governor Andrew Bailey anticipates a strong recovery as households unleash some of the 150 billion pounds ($207 billion) of savings accumulated over the past year. (BBG)

BREXIT: The EU's Brexit chief has said he is convinced solutions can be found to "minimise" the disruption of Brexit on Northern Ireland, calling for a "good faith" approach to applying new trading rules in a way that can reduce tensions. Maros Sefcovic, the EU commission vice-president in charge of Brexit, told the FT he believed discussions with the UK could yield approaches that protect the EU market from illicit entry of goods and reduce problems for people and businesses in Northern Ireland — although he also stressed there needed "to be an effort from both sides". (FT)

POLITICS: Boris Johnson could lose the "red wall" general election seats he won from Labour if he does not address the "shameful" lobbying crisis engulfing Whitehall, a senior Tory MP has warned. Sir Bernard Jenkin described the current row over lobbying as "corrosive" of public trust. It comes amid criticism that David Cameron contacted ministers on behalf of collapsed finance firm Greensill. A review has been launched of contacts between top officials and ministers. (BBC)

EUROPE

CORONAVIRUS: The European Union will try to coordinate a common policy for travelers from countries dealing with coronavirus variants such as Brazil and India, France's Foreign Affairs Minister Jean-Yves Le Drian said on Sunday. (BBG)

GERMANY: Bavarian State Premier Markus Soeder flew into Berlin on Sunday night with support piling up for his bid to lead Chancellor Angela Merkel's conservative bloc into September's election. Just over a week after formally declaring his candidacy, Soeder has been trying to persuade members of Merkel's Christian Democratic Union that his ability to connect with voters makes him a better bet to hold on to the chancellery than the party leader they elected barely three months ago. If the CDU does decide to go with Soeder, who heads its Bavarian sister party, it will mark a shocking departure for the alliance that has dominated German politics since World War II and could presage more dramatic shifts in the way the country is run. As Soeder looks to force his opponent, Armin Laschet, to capitulate on Monday, the Green party is also due to announce its candidate for chancellor. With their support increasing, the Greens' pick is likely to play a significant role in the next administration. (BBG)

FRANCE: French President Emmanuel Macron says he foresees at least some tourists returning to Paris this summer if they have gotten vaccinated or have proof of testing negative for the coronavirus as France moves to progressively lift infection-control restrictions. "We are building a certificate to facilitate travel after these restrictions between the different European countries with testing and vaccination," Macron said in an interview that aired Sunday on the CBS News show "Face the Nation." Macron spoke as the French government is preparing to impose tough, new entry restrictions on travelers from four countries — Argentina, Chile, South Africa and Brazil — in hopes of keeping out especially contagious virus variants. The number of countries on the list could grow, France's foreign minister said Saturday. (AP)

FRANCE: France confirmed Friday that some cultural venues and outdoor dining will start reopening in mid-May. The country is currently under national lockdown as hospital intensive care unit capacity hovers at 117%. (BBG)

FRANCE: French President Emmanuel Macron said U.S. citizens will be able to travel to the country again in the summer. France is working on a "special pass" to allow Americans who are vaccinated to enter the country, in addition to an ongoing EU initiative to create certificate for European citizens to travel, he said on CBS's "Face the Nation." (BBG)

ITALY: Italy will meet an April 30 deadline for submitting a final version of its recovery plan to the European Commission, the Ansa newswire reported Sunday, citing sources at Prime Minister Mario Draghi's office. Reuters reported earlier that Italy may not meet the deadline because Brussels is unhappy with features of the drafts presented, citing two unidentified people close to the matter. The objections included a lack of detail on how the plan will be managed once it receives EU approval and the substance of some of the reforms outlined, including of the justice system, according to Reuters. Draghi will present the plan to Italy's parliament on April 26 and 27, Ansa said. (BBG)

ITALY: Italy's former interior minister Matteo Salvini will face trial for his role in blocking a ship carrying rescued migrants from docking in Sicily in 2019, a judge in Palermo ruled Saturday. (BBG)

RATINGS: Sovereign rating reviews of note from after hours on Friday included:

- DBRS Morningstar confirmed France at AA (high), Stable Trend

- DBRS Morningstar confirmed Norway at AAA, Stable Trend

EQUITIES: Credit Suisse Group AG was sued by a small pension fund that alleges the bank misled investors and let "high-risk clients" including Greensill Capital and Archegos Capital Management take on too much leverage, in one of the first lawsuits since the twin debacle. (BBG)

U.S.

FED: Dallas Federal Reserve Bank President Robert Kaplan reiterated Friday his view that the U.S. central bank should reduce its support for the economy at the "earliest opportunity," once the pandemic is mostly over and as the economy gains steam. "I don't want to get in the mode of being reactive, and so reactive that we wind up being late," Kaplan told the Texas A&M Bitcoin Conference. "We've got to balance the side effects of what we are doing - one is inflation, but also excesses and balances in the financial markets." (RTRS)

FED: Fewer than 200,000 businesses in the United States may have failed during the first year of the COVID-19 pandemic, a lighter toll than initially feared and one that may have had relatively little impact on unemployment, according to Federal Reserve research. The figure contrasts with the early forecasts that the pandemic would leave America's"Main Street" desolate as well as with polls that continue to show large percentages of U.S. small business owners are worried about their survival. Perhaps 600,000 businesses, most of them small firms, fail in any given year, and U.S. central bank researchers estimated that from March 2020 through February of this year the figure has been perhaps a quarter to a third higher. (RTRS)

FISCAL: Biden to meet lawmaker group to discuss jobs plan Monday. Biden to meet with lawmakers on jobs plan at 13:15 ET. (BBG)

FISCAL: The universe of Democratic senators concerned about raising the corporate tax rate to 28% is broader than Sen. Joe Manchin, and the rate will likely land at 25%, parties close to the discussion tell Axios. (Axios)

FISCAL: A senior Republican senator said he and his colleagues could support an infrastructure bill of around $800 billion, underscoring GOP interest in a bipartisan fix for the nation's aging roads and patchy broadband service. The comments by Sen. John Cornyn (R., Texas) on Sunday signal that Senate Republicans are seeking a compromise on infrastructure, ahead of President Biden's meeting with lawmakers on Monday to push his own $2.3 trillion plan. (WSJ)

CORONAVIRUS: Half of Americans 18 years or older have received at least one dose of a Covid-19 vaccine, the Centers for Disease Control and Prevention reported Sunday. About 32% of adults have been full vaccinated. (BBG)

CORONAVIRUS: U.S. health authorities came close to simply warning about a blood-clotting risk from Johnson & Johnson's Covid-19 vaccine, but decided to recommend pausing use out of concern doctors would improperly treat the condition, people familiar with the matter said. (WSJ)

CORONAVIRUS: NIAID director Anthony Fauci said he expects a decision on resuming the Johnson & Johnson vaccine by Friday after a CDC panel meets to discuss the issue, he told NBC's Meet the Press. (Axios)

CORONAVIRUS: The White House is launching a targeted media blitz Monday to promote President Biden's new deadline for states to make all U.S. residents 16 and older eligible for the COVID-19 vaccine, an administration official tells Axios. (Axios)

CORONAVIRUS: New York City Mayor Bill de Blasio is sticking to his call to start bringing city workers back to the office on May 3, refuting claims by some employees that it's too soon. "It's definitely time to come back," de Blasio said Friday after a city employee asserted on WNYC radio that many people don't feel comfortable returning to the office. Other workers have objected on social media, and union officials have questioned whether work sites have made appropriate health and safety changes. (BBG)

CORONAVIRUS: Michigan Gov. Gretchen Whitmer (D) told "Meet the Press" that she isn't instituting a new lockdown due to a combination of factors, including the state's strong mitigation measures and pushback from Republicans. (Axios)

CORONAVIRUS: Michigan Governor Gretchen Whitmer said cases may be slowing in her state, which has been hit hard by the virus variant first detected in the U.K. and has the most per-capita Covid infections in the U.S. While Michigan is starting to see "the beginning of what could be a slowdown," she expressed concern about getting people vaccinated. "We are going to see, I think, a moment where supply outweighs demand," Whitmer said on NBC's "Meet the Press." (BBG)

CORONAVIRUS: The Chicago Teachers Union approved a plan to reopen the city's high schools on Monday. High schools have been closed since last year, and it took long negotiations to reopen grade schools earlier this year. (BBG)

CORONAVIRUS: Oregon Governor Kate Brown said she wouldn't reimpose tougher restrictions despite a worsening outbreak in the state. "Oregonians at this point know how to take personal responsibility" by wearing masks and socially distancing, the Democratic governor said at a media briefing. She also said that the "dynamic has shifted" as more of the state is vaccinated. (BBG)

OTHER

U.S./CHINA: The United States has made previous attempts to reemerge as a dominant player in a rare earths supply chain that is responsible for some of the most important materials involved in electric vehicle production, battery making, renewable energy systems and technology manufacturing. Under the Biden administration, the effort is receiving renewed focus, with massive investments planned in climate change technology and a hard line being taken on geopolitical rivalries and the national security threat posed by China. (CNBC)

U.S./CHINA: The U.S. said China continues to focus its policies on exports, and called on its biggest economic rival to implement forceful measures to boost domestic demand. "China's recovery has been highly imbalanced" since the hit from the coronavirus pandemic, the U.S. Treasury Department said in its semiannual foreign-exchange report. "Stringent containment measures enabled China to quickly resume manufacturing while domestic consumption lagged." (BBG)

U.S./CHINA: The U.S. and China are committed to cooperating to tackle climate change, they said in a joint statement after meetings between senior envoys last week that were held amid rising geopolitical tensions between the two countries. The two nations will work together and with other parties to support implementation of the Paris Agreement and to promote a successful U.N. climate change conference in Glasgow later this year, they said. (BBG)

GEOPOLITICS: Japanese prime minister Yoshihide Suga said the US and Japan would oppose coercion or force in the South and East China Seas, in unusually blunt remarks about China after his summit with Joe Biden. Speaking alongside the US president at the White House on Friday, Suga said the two leaders had held serious discussions about China and the "severe security environment" in the Indo-Pacific region. "We agreed to oppose any attempts to change the status quo by force or coercion in the East and South China Seas and intimidation of others in the region," Suga said. (FT)

GEOPOLITICS: Japanese Prime Minister Yoshihide Suga has further strained relations with China by displaying an alliance with the U.S. to contain China in his meeting with President Joseph Biden last week, the official China Daily said in an editorial. Japan had already soured relations through its decision to discharge the nuclear wastewater from the Fukushima nuclear plant into the Pacific, it said. However, Suga's words were weaker than expected given his likely intention to strike a balance with Japan's economic ties with China, the Daily said. (MNI)

GEOPOLITICS: Foreign spies operating in Britain face being prosecuted and deported under new laws to protect the nation from hostile states such as China and Russia. Boris Johnson will use the Queen's Speech on May 11 to announce a bill to counter hostile states, including a requirement for all individuals working on behalf of foreign governments in Britain to register their presence. Failure to do so would be a criminal offence. (The Times)

CORONAVIRUS: More people around the world were diagnosed with the coronavirus during the past seven days than any other week since the virus emerged, topping 5.2 million globally, according to data from Johns Hopkins University. The worst outbreaks are gaining speed in many countries that are ill-equipped to cope. The data also showed a 12% increase in cases from a week earlier, throwing doubt on hopes that the end of the pandemic is in sight. (BBG)

CORONAVIRUS: More than 3 million lives have been lost as a result of the novel coronavirus that emerged in 2019, with the latest 1 million recorded deaths coming even faster than the first two. The relentless pace of death from the global Covid-19 pandemic is continuing unabated despite global vaccination efforts, and is now being increasingly borne by the poorest places in the world. The real death toll from Covid-19 is likely far higher than 3 million, due to under and patchy reporting around the world. (BBG)

CORONAVIRUS: Rare blood clots and high platelet counts after taking AstraZeneca's vaccine led to death in about 40% of 39 identified cases, according to an editorial in the New England Journal of Medicine. Most of the reports were women younger than age 50, the editorial said. The authors called for more study of whether certain population groups would be more suitable for certain Covid vaccines. (BBG)

CORONAVIRUS: Johnson & Johnson said Friday there wasn't enough evidence to establish that the company's Covid-19 vaccine causes the rare blood-clotting condition that prompted U.S. health officials this week to recommend a pause in its use. The New England Journal of Medicine published online a letter from three J&J employees involved in vaccine development and epidemiology saying, "At this time, evidence is insufficient to establish a causal relationship between these events" and J&J's vaccine. (WSJ)

CORONAVIRUS: The death of a 48-year-old woman in New South Wales was "likely linked" to the AstraZeneca vaccine, though the case was "complicated" by underlying conditions, Australian health officials said Saturday. (BBG)

HONG KONG: Hong Kong's government is considering whether to further tighten hotel quarantine measures and flight restrictions after a man who returned from Dubai and completed 21 days of quarantine tested positive for Covid-19, Health Secretary Sophia Chan said on Sunday according to broadcaster RTHK. (BBG)

HONG KONG: Hong Kong health officials quarantined more than 80 residents of a building in a densely populated neighborhood after a Covid-19 case detected there initially tested positive for a highly transmissible mutant strain. Health authorities locked down the Parkes Building in the Jordan area of the Kowloon district to conduct mandatory testing, according to a government statement late Friday. The preliminary test result from the confirmed case involved the N501Y mutant strain of the coronavirus, which is highly transmissible, the Department of Health said in a statement. The building is "relatively old" and houses some sub-divided units, it said. (BBG)

JAPAN: Chief Cabinet Secretary Katsunobu Kato stated at a regular meeting on the morning of 19th that the governor of Osaka Prefecture, Hirofumi Yoshimura, should request the government to declare an emergency in response to the spread of the new corona virus. , Governor Yuriko Koike of Tokyo is also considering the request, and the government has indicated that it will promptly consider issuing it if requested. (RTRS)

JAPAN: Pfizer will increase supplies of the Covid-19 vaccine for Japan by the end of September, Japan's vaccine czar Taro Kono said in a Fuji TV program on Sunday. Prime Minister Yoshihide Suga and Pfizer Chief Executive Officer Albert Bourla discussed increasing the supply on a recent phone call, the Ministry of Foreign Affairs said in a statement. (BBG)

JAPAN: Japan is considering an exception that would allow dentists to administer Covid vaccines in places where enough doctors and nurses aren't available, according to the Yomiuri newspaper. Meanwhile, Tokyo Governor Yuriko Koike said Sunday evening that had she instructed officials to consider a state of emergency as an option to contain the virus, public broadcaster NHK reported. "The number of confirmed virus cases is on a rising trend and it should be considered with a sense of speed," Koike said. (BBG)

AUSTRALIA: Concerns in Australia about Covid-19 spreading in quarantine are mounting as three new cases among a family of returned travelers were discovered to have been transmitted in a Sydney hotel. The infections, initially recorded as contracted overseas, are now believed to have been picked up from a family of four in an adjoining room in a city quarantine hotel, New South Wales Health said in a statement Sunday. Investigations into how the transmission occurred are under way, it said. "All guests staying on the same floor of the hotel have been retested and returned negative results," and staff who worked nearby are self-isolating and getting tests, New South Wales Health said. The incident adds to debate over possible shortcomings within the hotel quarantine system, given the rise of more-infectious strains of the virus. The new cases also fuel speculation that ventilation systems may be contributing to dispersion. (BBG)

AUSTRALIA: Australian federal and state leaders will discuss ways to speed up the coronavirus vaccination rollout and shift to alternatives to the AstraZeneca Inc. inoculation in their upcoming meeting, Prime Minister Scott Morrison said Sunday. Current vaccine supplies are sufficient to cover initial stages of the program currently under way, which target frontline workers and the elderly, Morrison said. (BBG)

AUSTRALIA: Australia's most populous state is planning a major overhaul of its Covid-19 innoculation program, including a possible increase in the volume of Pfizer Inc.'s doses and distribution of new alternative vaccines, the Sydney Morning Herald reported. The strategy in New South Wales is under review ahead of Monday's national cabinet meeting, which is also likely to address the future of the rollout of AstraZeneca Plc's shots for people over 50 years of age, the paper said. (BBG)

RBNZ: MNI INTERVIEW: NZ Needs Less QE Than Thought-Ex RBNZ Economist

- New Zealand does not need as much fiscal or monetary stimulus as previously thought, former Reserve Bank of New Zealand chief economist Sharon Zollner told MNI, adding that lower-than-expected government borrowing and economic recovery mean the RBNZ is unlikely to reach the NZD100 billion cap on its bond buying program by the target of June 2022. "The QE program is fading into the background as the government issues few bonds and the economy recovers," Zollner, chief economist at the ANZ bank in NZ after leaving the RBNZ in 2006, said in an interview on Friday - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

SOUTH KOREA: South Korean President Moon Jae-in may name new finance minister next month to replace Hong Nam-ki, after Kim Boo-kyum officially takes office as prime minister, JoongAng Ilbo newspaper says, without citing anyone. Koo Yun-cheol, minister of government policy coordination, may replace Hong. Moon may also replace agricultural minister and chairman of Financial Services Commission. (BBG)

CANADA: In a Hail Mary attempt to control a third wave of Covid-19, Ontario unveiled its strictest measures yet to restrict the movement of people, setting up checkpoints with neighboring Quebec and Manitoba for the first time in Canada's outbreak. The government of Premier Doug Ford said it will extend an emergency stay-at-home order to six weeks from four. Essential stores such as supermarkets and pharmacies will operate at 25% of capacity. "My friends, we're losing the battle between the variants and vaccines," Ford said at a news conference Friday afternoon. (BBG)

CANADA: Ontario's government walked back some of its new policing powers one day after they were announced, now only allowing police to stop vehicles or people if they are suspected of participating in an organized public event or social gathering. Doug Ford's government initially said on Friday that police could stop people at random and ask why they are not at home and where they live as part of a strengthened stay-at-home order to help stem a rising number of COVID-19 cases. (CBC)

CANADA: The Canadian province of Ontario will begin offering AstraZeneca's COVID-19 vaccine on Tuesday to people turning 40 or older this year, according to a government source. (RTRS)

CANADA: Canadian Prime Minister Justin Trudeau said Sunday he'll deploy additional health-care workers and equipment to help Ontario, the country's most populous province, which is struggling to contain a sharp rise in Covid-19 cases. The move follows Ontario Premier Doug Ford's decision on Friday to impose some of North America's toughest restrictions to get a handle on the region's third wave of the pandemic that threatens to overwhelm its health-care system. (BBG)

CANADA: MNI PREVIEW: Canada Budget May Extend Unanchored Deficits

- Canada's longest ever spell without a budget ends Monday with Finance Minister Chrystia Freeland likely maintaining record deficits absent a strong "fiscal anchor" and arguing the economy still needs unbridled assistance. The deficit for the fiscal year that began April 1 could come in at CAD160 billion on expanded pandemic and social spending programs, according to RBC economists, larger than Freeland's Nov. 30 estimate of CAD121 billion. The previous year's shortfall will be in line with the government's estimate of CAD382 billion according to RBC. That would be 17.5% of GDP, seven times the cash record of CAD56 billion set in 2009-10 and approaching the record 22.5% of GDP set in World War II - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

CANADA: Canada's first budget in two years, to be presented to parliament on Monday, proposes a sales tax for online platforms and e-commerce warehouses, a digital services tax for Web giants and a luxury tax on items like yachts, government sources familiar with the document said. It will not include a wealth tax, a levy sought by the opposition New Democrats. Liberal Prime Minister Justin Trudeau's budget will need the support of at least one opposition group to pass. "The government is not moving forward with a wealth tax right now," a government source told Reuters. "We will be taking meaningful steps to close loopholes and tackle tax evasion, and ask those who are doing well right now to pay just a little bit more." The budget will include a sales tax for online platforms and e-commerce warehouses starting from July, and a digital services tax on big Web companies starting from Jan. 1, 2022, both measures originally promised last year. (RTRS)

BRAZIL: Petrobras board member Marcelo Gasparino has tendered his resignation, the state-run oil firm said on Friday, just four days after his election to the post, creating a potential eleventh-hour hurdle for its nearly complete management transition. Gasparino, who represents market investors on the board, had previously said he planned to resign to force a new shareholders' meeting. He said he would wait until after the board appointed a new chief executive, which occurred earlier in the day. In a letter published on his LinkedIn account shortly before being elected to the Petrobras board at an extraordinary shareholders' meeting on Monday, Gasparino criticized the allegedly confusing manner in which the meeting was held. He said it deprived market shareholders of their full voting rights. (RTRS)

RUSSIA: Russia's plan to temporarily restrict movement of foreign warships in part of the Black Sea will not affect the nearby Kerch Strait, the RIA news agency reported on Friday, signalling lower risks for regional trade from Russia-Ukraine tension. (RTRS)

RUSSIA: Russia will ask 10 U.S. diplomats to leave the country in retaliation for Washington's expulsion of 10 Russian diplomats over alleged election interference and other malign actions, Russian Foreign Minister Sergei Lavrov said on Friday. The U.S. government on Thursday also blacklisted Russian companies and barred U.S. banks from buying sovereign bonds from Russia's central bank, national wealth fund and Finance Ministry. Lavrov, speaking at a news conference with his Serbian counterpart, said Moscow was also considering possible "painful" measures aimed at U.S. business in Russia. Moscow would also end the activity in Russia of U.S. funds and NGOs that interfere in the country's internal affairs, he said. (RTRS)

RUSSIA: The Biden administration is evaluating the impact of new sanctions on Russia and is prepared to escalate those penalties if the Kremlin fails to rein in hacking attacks and attempts to interfere with the U.S. political process, according to people familiar with the matter. (BBG)

RUSSIA: Russia and Britain are both sending warships to the Black Sea as tensions between Moscow and Ukraine simmer following dueling diplomat expulsions over the weekend. (POLITICO)

RUSSIA: Russia accused a Ukrainian diplomat on Saturday of trying to obtain classified information and ordered him to leave the country by April 22, prompting a like-for-like response from Ukraine as border tensions Simmer. Russia's FSB security service said Oleksandr Sosoniuk had been detained when he tried to access information from Russian law enforcement databases during a meeting with a Russian citizen. The foreign ministry gave Sosoniuk 72 hours to leave, and Ukraine then did likewise to a Russian diplomat in Kyiv. (RTRS)

RUSSIA: Russia rejected the Czech government's allegations that it was involved in a deadly blast at a munitions site in 2014, signaling possible retaliation for the expulsion of 18 staffers from its embassy in Prague. Czech Prime Minister Andrej Babis's unexpected announcement late on Saturday coincides with growing concern in the U.S. and Europe about Russia's military buildup on the border with Ukraine and treatment of jailed opposition leader Alexei Navalney. Foreign Minister Jan Hamacek likened the explosion, which killed two people at a private munitions warehouse, to the 2018 poisoning of former Russian agent Sergei Skripal in Salisbury, England. Moscow said the accusations are "beyond absurd." (BBG)

RUSSIA: French President Emmanuel Macron called for "clear red lines" in dealing with Russia, objecting to Moscow's troop buildup along the Ukraine border and the worsening health of jailed opposition leader Alexey Navalny. "If we want a better system in terms of arms control, if we want to stabilize a lot of existing crises in the world today, we need an open and frank dialogue with Russia," Macron said on CBS television's "Face the Nation" program, according to excerpts made available in a tweet before the Sunday broadcast of the full interview. (BBG)

RUSSIA: Jailed Russian opposition leader Alexey Navalny's condition has worsened sharply after 2 1/2 weeks of hunger strike, his supporters said on Saturday. "Alexey is dying now. Given his condition, it's a matter of days," Navalny's spokeswoman Kira Yarmysh said on Facebook. (BBG)

RUSSIA: The Biden administration warned the Russian government "that there will be consequences" if jailed Russian opposition leader Alexei Navalny dies, National Security Adviser Jake Sullivan told CNN on Sunday. (Axios)

SOUTH AFRICA: South Africa's health regulator asked the government to lift the pause on administering Johnson & Johnson vaccines provided certain conditions are met. "These conditions include, but are not limited to, strengthened screening and monitoring of participants who are at high risk of a blood clotting disorder," the South African Health Products Regulatory Authority said in a statement. (BBG)

IRAN: The U.S. and Iran edged closer to ending their standoff over the nuclear deal, with Washington describing talks as "constructive" and the Islamic Republic signaling that it was ready to debate the details of how the two sides will practically revive the stricken 2015 accord. Jake Sullivan, United States National Security Advisor, told Fox News on Sunday "the talks in Vienna have been constructive in the sense that there is real effort underway there" and that world powers were focused on restoring the agreement on a "compliance for compliance" basis. (BBG)

IRAN: Iran has started the process of enriching uranium to 60% fissile purity at an above-ground nuclear plant at Natanz, the U.N. nuclear watchdog said on Saturday, confirming earlier statements by Iranian officials. (RTRS)

MIDDLE EAST: The Saudi-led coalition said on Friday it destroyed a Houthi ballistic rocket fired in the direction of the kingdom's southern city of Jazan, state TV reported. (RTRS)

GOLD: China has given domestic and international banks permission to import large amounts of gold into the country, five sources familiar with the matter said, potentially helping to support global gold prices after months of declines. (RTRS)

OIL: The unprecedented oil inventory glut that amassed during the coronavirus pandemic is almost gone, underpinning a price recovery that's rescuing producers but vexing consumers. Barely a fifth of the surplus that flooded into the storage tanks of developed economies when oil demand crashed last year remained as of February, according to the International Energy Agency. Since then, the lingering remnants have been whittled away as supplies hoarded at sea plunge and a key depot in South Africa is depleted. (BBG)

OIL: Militants using explosives attacked two oil wells northwest of Kirkuk in northern Iraq on Saturday but no significant damage resulted and production was not affected, the Iraqi oil ministry said. The attack at the Bay Hassan oilfield "did not cause a fire or damage, affect production or stop oil pumping from the well," the ministry said in a statement. (RTRS)

OIL: A 5.9 magnitude earthquake in southern Iran partially has damaged a critical oil facility and disrupted production, state television reported April 18. The temblor caused a ceiling to collapse at the Goureh pump station and a turbine to go out of service, Houshang Seidali, managing director of Gachsaran Oil and Gas Co., was quoted as saying. The outage has halted some crude production, though he did not provide any details. (Platts)

CHINA

PBOC: China's digital currency is not designed to challenge the U.S. dollar's global dominance, PBOC Deputy Governor Li Bo said at the Boao Forum as reported by the Securities Times. The PBOC will widen the digital currency's domestic use while promoting the Chinese currency's internationalization, said Li. The PBOC needs to improve the regulatory frameworks for the digital currency before an official launch can be decided, Li told the Forum. The PBOC is also probing Bitcoin and other cryptocurrencies to gauge the financial risks, Li said. (MNI)

INFLATION: MNI BRIEF: Overseas Inflation Impact On China Limited: NDRC

- China's CPI will show a moderate gain but still fall within the government's 3% ceiling this year as the transmission of overseas inflation is limited and controllable, said Meng Wei, spokeswoman of the National Development and Reform Commission at a briefing on Monday. Food and services, which account for a high proportion of CPI, are less affected by external factors, said Meng, adding that sufficient supplies of grain and pork will help stabilize their prices. Consumer goods prices are also expected to remain stable given ample supply and market competition, she said. Meng played down the recent rise in commodity prices as temporary and the result of the global economy recovery, abundant liquidity and speculation, and said there is no fundamental change to supply and demand - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FINTECH: Ant Group is exploring options for founder Jack Ma to divest his stake in the financial technology giant and give up control, as meetings with Chinese regulators signaled to the company that the move could help draw a line under Beijing's scrutiny of its business, according to a source familiar with regulators' thinking and two people with close ties to the company. (RTRS)

CREDIT: Huarong Securities has wired funds to China Securities Depository and Clearing Corp. to fully repay a 2.5b yuan bond due April 18, according to a statement from its official Wechat account. All bonds of the company are paid in full on schedule without defaults. (BBG)

CREDIT: China Huarong Asset Management Co.'s dollar bonds jumped after the country's financial regulator said on Friday that the bad-debt manager was operating normally and had ample liquidity. (BBG)

OVERNIGHT DATA

JAPAN MAR TRADE BALANCE +Y663.7BN; MEDIAN +Y493.2BN; FEB +Y215.9BN

JAPAN MAR TRADE BALANCE ADJ +Y297.8BN; MEDIAN +Y212.9BN; FEB -Y11.0BN

JAPAN MAR EXPORTS +16.1% Y/Y; MEDIAN +11.4%; FEB -4.5%

JAPAN MAR IMPORTS +5.7% Y/Y; MEDAN +4.7%; FEB +11.8%

JAPAN FEB, F INDUSTRIAL OUTPUT -2.0% Y/Y; FLASH -2.6%

JAPAN FEB, F INDUSTRIAL OUTPUT -1.3% M/M; FLASH -2.1%

JAPAN FEB CAPACITY UTILISATION -2.8% M/M; JAN +4.7%

JAPAN MAR TOKYO CONDOMINIUMS FOR SALE +44.9% Y/Y; FEB +50.7%

NEW ZEALAND MAR SERVICES PMI 52.4; FEB 49.7

Activity in New Zealand's services sector climbed into expansion during March for the first time in five months, according to the BNZ - BusinessNZ Performance of Services Index (PSI). The PSI for March was 52.4, which was up 2.7 points from February (A PSI reading above 50.0 indicates that the service sector is generally expanding; below 50.0 that it is declining). This was the highest result since July 2020, although still below the long term average of 53.8. BusinessNZ chief executive Kirk Hope said that a lift in the key sub-index of New Orders/Business (56.9) led the way towards expansion in March, followed by Activity/Sales (54.5). The other three sub-indices continue to show either lacklustre expansion or remain in contraction. "Any sustained shift towards the services sector exhibiting ongoing expansion will need to see activity/ sales and new orders remaining near or above their long term average results to continue momentum". BNZ Senior Economist Craig Ebert said that "as decent as New Zealand's PSI was for March, with its 52.4, it was shy of where the global PSI got to for the month, namely 54.7. Of course, it's all relative to recent history, which for many countries abroad has meant a lift out of a hole rather than onto a podium". (BNZ)

UK APR RIGHTMOVE HOUSE PRICES +5.1% Y/Y; MAR +2.7%

UK APR RIGHTMOVE HOUSE PRICES +2.1% M/M; MAR +0.8%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS MON; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Monday. This leaves liquidity unchanged given the maturity of CNY10 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2123% at 09:35 am local time from the close of 2.1676% on Friday.

- The CFETS-NEX money-market sentiment index closed at 41 on Friday vs 50 on Thursday. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.5233 MON VS 6.5288

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower for a fifth day at 6.5233 on Monday, compared with the 6.5288 set on Friday.

MARKETS

SNAPSHOT: A Helping Of Geopolitics & U.S. Fiscal Headlines To Start The Week

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 69.85 points at 29752.8

- ASX 200 up 10.745 points at 7074.2

- Shanghai Comp. up 44.549 points at 3471.167

- JGB 10-Yr future up 7 ticks at 151.43, yield down 0.8bp at 0.085%

- Aussie 10-Yr future up 0.5 tick at 98.310, yield down 0.8bp at 1.727%

- U.S. 10-Yr future +0-01+ at 132-13+, yield down 1.23bp at 1.568%

- WTI crude down $0.15 at $62.98, Gold up $0.60 at $1777.11

- USD/JPY down 13 pips at Y108.67

- SENATE DEMOCRATS SETTLING ON 25% CORPORATE TAX RATE (AXIOS)

- BIDEN TO MEET LAWMAKER GROUP TO DISCUSS JOBS PLAN MONDAY

- JAPAN VOWS TO SUPPORT US IN OPPOSING 'COERCION' FROM CHINA (FT)

- GEOPOLITICAL TENSIONS SURROUNDING RUSSIA REMAIN EVIDENT

- SIGNS OF THAW ON IRAN NUCLEAR DEAL EMERGE IN VIENNA TALKS (BBG)

- GLOBAL COVID INFECTIONS HIT WEEKLY RECORD (BBG)

BOND SUMMARY: Core FI Marginally Firmer To Start The Week

Tsys drew some early support from geopolitical tensions surrounding Russia, while there may have also been some focus on an Axios source piece which noted that "the universe of Democratic senators concerned about raising the corporate tax rate to 28% is broader than Sen. Joe Manchin, and the rate will likely land at 25%," which could pose some hurdles for the broader fiscal impetus in the U.S. T-Notes edged away from highs as e-minis pared their early losses, with the former last trading +0-01+ at 132-13+. The belly outperforms in cash trade with 5- to 10-Year paper richening by ~1.5bp vs. settlement levels as of typing. Asia-Pac flow was headlined by a 20.0K block lift of the TYM1 131.00/130.00 put spread, which saw paper pay 0-11.

- The cash JGB space trades flat to 1.0bp richer at typing, with futures last +6, a handful of ticks shy of best levels. The previously flagged Tokyo state of emergency questions and the broader (modest) risk aversion evident in early trade this week provided initial support for the space, which held even as the Nikkei 225 unwound its early losses. The lunch break saw the Governor of Osaka note that the region will request the implementation of a state of emergency, with Chief Cab. Sec. Kato noting that prompt consideration is required re: the Tokyo & Osaka state of emergency situations. A quick look at the offer/cover ratios witnessed in today's BoJ Rinban operations (note that the 25+ Year operations represented the first round of operations in that bucket since the well-documented tweaks announced at the back end of March) revealed steady cover for 25+ Year ops and an uptick for the 3- to 5-Year ops.

- The broader defensive feel has fed into the Aussie bond space, allowing futures to unwind their overnight losses, while yields sit unchanged to 1.0bp lower across the major benchmarks in the cash ACGB space. YM unch, XM +0.5. at typing. The only real point of note on the local front has been the launch of TCV's new '33 line, the deal is set to price on Tuesday.

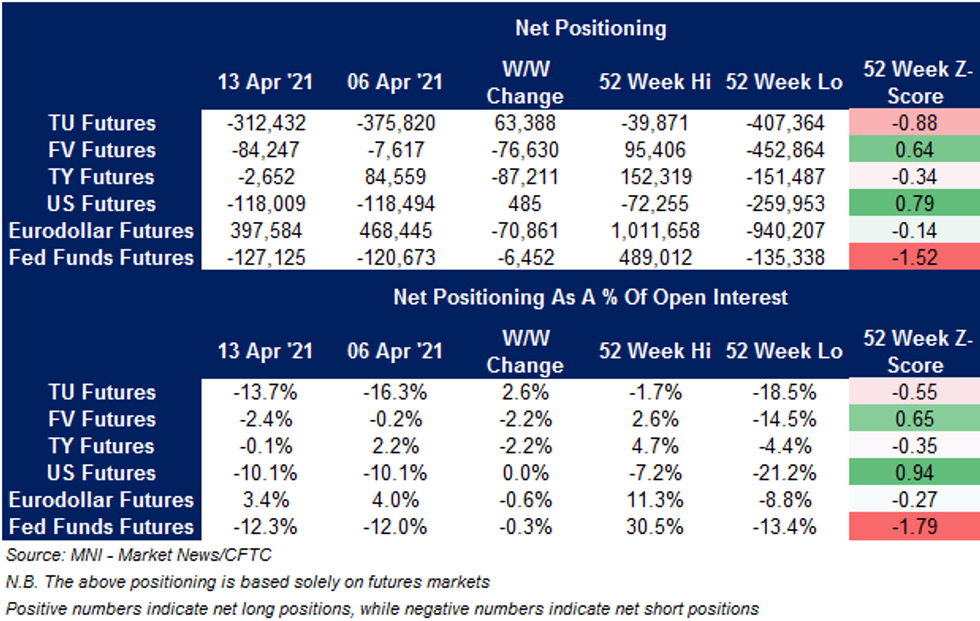

US TSY FUTURES: Mixed Position Adjustments In CFTC CoT

Net positioning swings (per the latest CFTC report) among the major Tsy futures contracts lacked anything in the way of uniform movement, with TU & US seeing reductions in net shorts (although the moves in US were limited), while net FV shorts extended and TY positioning flipped back to net short.

- Eurodollar net longs were trimmed, while net shorts in Fed Funds futures extended.

- We should highlight that the positioning only covers the week to 13 April, so doesn't capture any adjustments to the richening seen in Tsys during the latter part of last week.

JGBS AUCTION: Japanese MOF sells Y2.8607tn 1-Year Bills:

The Japanese Ministry of Finance (MOF) sells Y2.8607tn 1-Year Bills:- Average Yield -0.1268% (prev. -0.1298%)

- Average Price 100.127 (prev. 100.130)

- High Yield: -0.1258% (prev. -0.1288%)

- Low Price 100.126 (prev. 100.129)

- % Allotted At High Yield: 80.1260% (prev. 56.6320%)

- Bid/Cover: 3.717x (prev. 3.435x)

EQUITIES: In The Green

Bourses in the Asia-Pac time zone rose on Monday; markets in Hong Kong and mainland China led the gains, with the CSI 300 up over 2%. Markets got boost after China's financial regulator said the bad-debt manager Huarong was operating normally and had ample liquidity. In South Korea markets hit a record high. In the US futures are mixed, Nasdaq futures are in the green, buoyed by the tech sector rally in China, while S&P500 futures and Dow Jones futures are both lower, but off worst levels

OIL: Crude Futures Softer But off Worst Levels

Oil is softer to start the week, on track for the second straight session of decline; WTI is around $0.18 lower than settlement levels at $62.95/bbl, while Brent is $0.27 lower at $66.50/bbl. Oil dropped sharply at the open as risk aversion took hold in Asia, but gradually recovered from worst levels amid thin news flow. Markets assess progress made in US and Iran nuclear talks, with both sides saying talks were constructive and indicting movement in the right direction. The US still insists that the removal of any sanctions will only come once the US has "clarity and confidence" that the Islamic Republic will reduce its nuclear work, heavily curtail enrichment and atomic activity. Elsewhere, senior officials from Saudi Arabia and Iran are said to have been holding talks to repair relations.

GOLD: Testing Resistance

The broader defensive feel witnessed in Asia-Pac trade has resulted in a firmer DXY and lower U.S. Tsy yields, creating cross currents for bullion, with spot last dealing little changed, just shy of $1,780/oz. Last week's high ($1,783.9/oz) capped gains early on this week and provides initial resistance just ahead of the 38.2% retracement of the Jan 6 to Mar 8 sell off ($1,784.8/oz). A break through the latter would allow bulls to focus on $1,800/oz, with any break there exposing the late Feb highs. ETF holdings of gold continue to trend lower, and now sit ~11% shy of the record level of holdings posted back in October, but remain elevated in historical terms.

FOREX: Geopolitical Angst Inspires Risk-Off Start To The Week

Geopolitical tensions centring on Russia inspired a sense of caution at the start of the week, as the U.S. warned Moscow of "consequences" if Alexey Navalny dies. Risk-off mood dominated Asia-Pac trade, with little in the way of fresh news flow to alter the broader picture. The yen picked up a bid as a result and outperformed in the G10 basket. USD/JPY fell to its lowest levels since Mar 24, while a BBG trader source flagged AUD/JPY sales amid a slide in e-minis.

- The Scandies were the worst G10 performers, with EUR also pressured, as focus remained on Russia. NOK was wounded by slightly softer crude oil prices, although CAD was resilient.

- The PBOC set the central USD/CNY mid-point at CNY6.5233, just shy of sell-side estimate of CNY6.5235. USD/CNY staged a round trip from CNH6.5346.

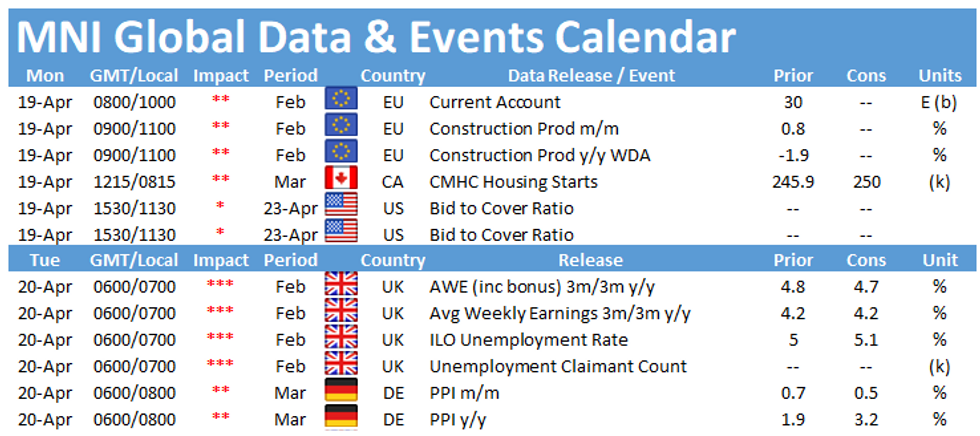

- Today's thin economic docket features Canadian housing starts & comments from Riksbank's Breman.

FOREX OPTIONS: Expiries for Apr19 NY cut 1000ET (Source DTCC)

- USD/JPY: Y108.50($565mln-USD puts), Y108.60-64($1.2bln-USD puts), Y110.00($1.2bln)

- EUR/GBP: Gbp0.8700-10(E519mln-EUR puts)

- AUD/USD: $0.7620-40(A$705mln), $0.7720-30(A$871mln)

- USD/CAD: C$1.2485-90($735mln-USD puts), C$1.2500-10($625mln-USD puts), C$1.2615-25($600mln-USD puts), C$1.2715-25($1.1bln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.