-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Hang Seng & JPY Struggle

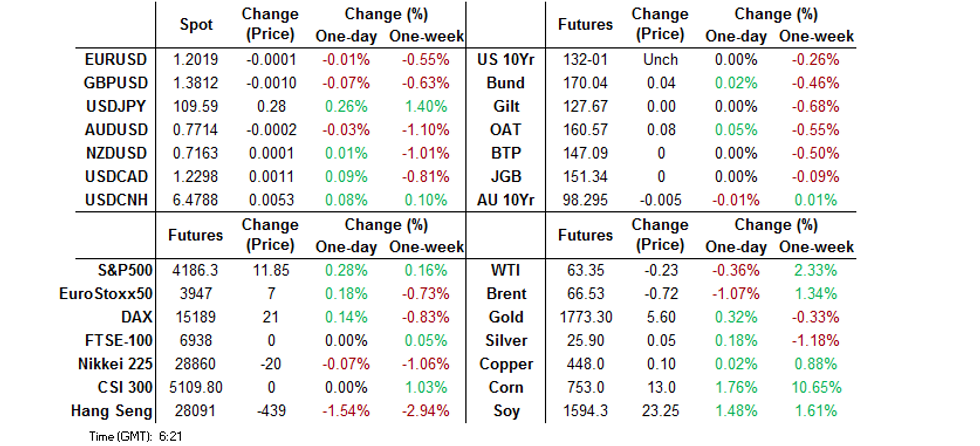

- JPY lags in G10 FX with e-minis advancing, although Asia-PAc equities were a little more defensive, with the HAng Seng the underperformenr there.

- Holidays in Japan, China & the UK thinned broader activity in the Asia-PAc timezone.

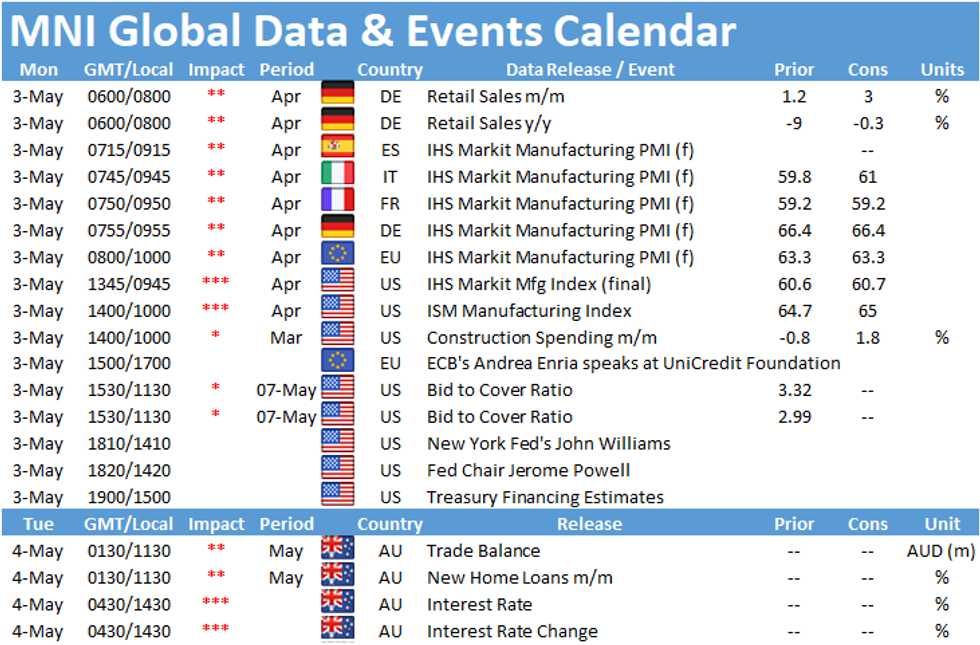

- The latest ISM m'fing survey headlines on Monday.

BOND SUMMARY: Marching To The Beat Of The Equity Drum

T-Notes have traded either side of unchanged but haven't threatened to close the opening gap lower from Friday's late NY highs. As a reminder, cash Tsys are closed until NY hours owing to the observance of Japanese & UK holidays, which limited broader activity, with just over 50K T-Notes changing hands as of typing. The early dip, facilitated by a bid in e-minis, was perhaps countered by the move lower in the Hang Seng/e-minis pulling back from best levels. It is worth noting that the weekend saw U.S. Tsy Secretary Yellen again play down the inflationary impulse stemming from President Biden's fiscal support schemes, once again highlighting the idea that the Fed has the capability and tools to deal with those sort of issues if they develop. Elsewhere, Iran sent out positive overtures re: the U.S. lifting sanctions, although the U.S. was quick to note that a deal is yet to be struck. The m'fing ISM survey headlines the local U.S. docket on Monday. Elsewhere, Fed Chair Powell will speak, although the topic of "Community Development" may limit the scope for discussion surrounding the nuances of monetary policy.

- Sydney trade was relatively narrow, leaving YM +0.5 & XM -1.0 at typing, with the curve holding steeper vs. settlement throughout Sydney trade, perhaps aided by the presence of the RBA purchasing ACGBs maturing in '25 to '28. On the semi front, SAFA is considering tapping its 2.75% May '30 select line bond. There was nothing in the way of notable market reaction observed in the wake of the latest round of local m'fing PMI, ANZ job ads & CoreLogic house price data (as you would expect), although the broader headline measures presented by those metrics continue to present an encouraging domestic story. In terms of this week's domestic docket, focus will fall on the RBA decision (Tuesday) and release of the SoMP (Friday), which will be supplemented by an address from RBA Deputy Governor Debelle (Thursday) covering the topic of "Monetary Policy during Covid."

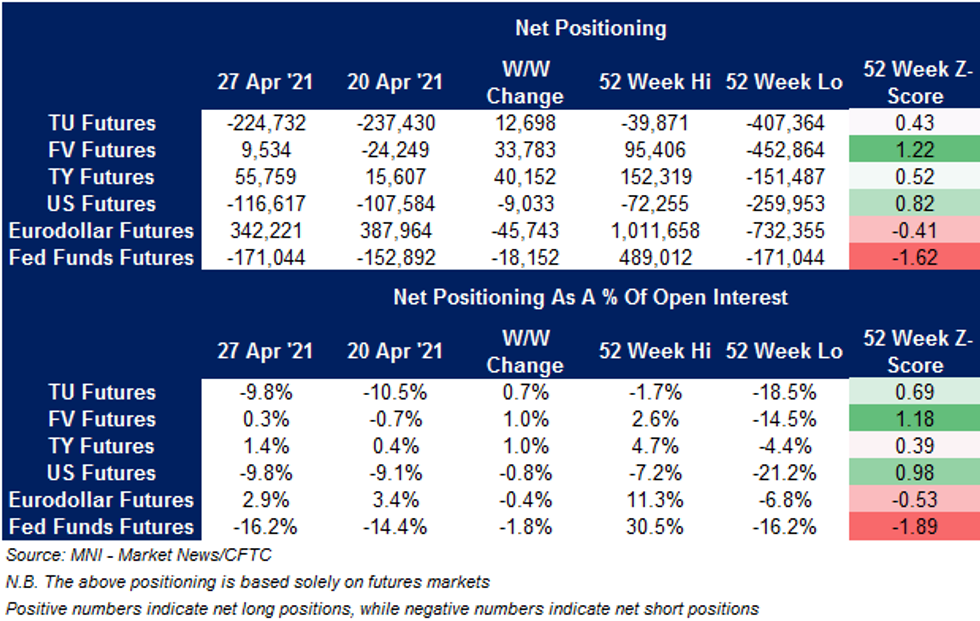

US TSY FUTURES: STIR Positions Provide The Highlight In The Weekly CFTC Report

The latest weekly CFTC CoT report saw non-commercial TU net shorts trimmed, while non-commercial FV net positioning flipped back into long territory and non-commercial TY net length extended. Non-commercial positioning in US futures was the exception among the major Tsy futures contracts, with the net short position there extending. Positioning remained shy of the recent respective extremes across all 4 contracts.

- Non-commercial net length in Eurodollar futures pulled back to the lowest level witnessed since July '20, as the recent run in reduction of net length extended.

- Non-commercial net shorts in Fed Funds futures continued to extend, edging closer to the extremes that were last witnessed in '19.

FOREX: Risk Appetite Recovers, Holidays Limit Activity

Participants abandoned safe havens in holiday-thinned Asia-Pac trade as e-minis inched higher, suggesting that Friday's Wall Street rout may have run its course. The yen led losses in G10 FX space, with USD/JPY extending its rally to a three-week high.

- Antipodean currencies outperformed, with NZD taking the lead, drawing support from positive risk sentiment & firmer iron ore prices. NOK also traded on a firmer footing, even as crude oil futures gave away their initial upticks.

- USD/CNH caught a light bid, extending its move away from recent two-month lows. There was no PBOC fix, with the next one coming up when onshore Chinese markets re-open on Thurday.

- Market closures in China, Japan, UK & Australia's Queensland/Northern Territory limit liquidity today. Global economic docket features a suite of M'fing PMI readings & comments from Fed Chair Powell.

FOREX OPTIONS: Expiries for May03 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1900-05(E881mln), $1.1950(E653mln), $1.2045-50(E765mln)

- USD/JPY: Y108.50($580mln), Y108.80($600mln)

- GBP/USD: $1.3700(Gbp1.3bln), $1.4300(Gbp1.1bln)

- AUD/USD: $0.7790-00(A$824mln)

ASIA FX: Narrower Trade Surplus Dents KRW, Most Regional PMIs Remain Robust

Market closures in mainland China, Japan, Thailand, and Vietnam sucked liquidity from Asia EM space as this week's trading went underway. Manufacturing PMI surveys from across the region & local Covid-19 developments took focus in holiday-thinned trade.

- CNH was biased lower vs. the greenback amid tight liquidity conditions, with USD/CNH moving further away from two-month lows printed last week. There was no PBOC fix today, with the next one coming up Thursday, when onshore Chinese markets re-open.

- KRW sold off after South Korea's trade surplus shrank to $388mn in Apr from $4.132bn recorded in Mar, in a considerable miss of the $3.105bn consensus forecast, on the back of a beat in imports growth. Expansion in the local m'fing sector moderated, but remained robust. South Korea's 13-month ban on short-selling stocks has expired today.

- INR as the surge of new Covid cases continued to cripple India. PM Modi suffered a major setback in India's latest state elections, as voters signalled their frustration with the gov't's handling of the pandemic.

- IDR and MYR declined broadly, even as crude palm oil futures surged in Kuala Lumpur. The ringgit was undermined by concerns over the local Covid-19 situation, which prompted PM Muhyiddin to scrap his planned visit to Singapore for talks on gradual re-opening of bilateral travel. Indonesia's CPI marginally missed forecasts, while M'fing PMIs in both countries remained in expansion.

- PHP was rangebound, even as the Philippines was the only country in the region whose Markit M'fing PMI slipped into contraction in Apr. The disappointing data came on the heels of stricter lockdown restrictions implemented in the capital region.

- Little to write home for SGD & TWD, with both posting marginal losses vs. USD. Taiwan's M'fing PMI printed at the strongest level in more than a decade.

EQUITIES: Hang Seng Struggles Again

The Hang Seng has provided the most notable move in the Asia-Pac region, shedding ~1.5% on Monday, adding to Friday's losses which were linked to a Chinese clampdown on the fintech space, with broader trade thinned by holidays in both Japan & China (both will return on Thursday). Elsewhere, the remaining major indices in the region were little changed to lower on the day. U.S. equity index futures were a little more resilient, unwinding some of their Friday losses, with U.S. Tsy secretary Yellen once again trying to play down any fears re: inflation surrounding the U.S. fiscal impulse.

GOLD: As You Were

Holiday-thinned trade made for a tight range in Asia-Pac hours, with spot bullion last dealing a handful of dollars higher, just above $1,770/oz, comfortably within the confines of the well-documented technical parameters that we flagged at the backend of last week.

OIL: A Few Cents Lower

WTI & Brent sit ~$0.30 lower on the day, with the talks surrounding Iranian sanctions initially showing some promise over the weekend, although the U.S. was quick to enforce the notion that no deal had been made re: the rollback of sanctions on the Middle Eastern state. There was little else to go off, with a lack of fresh developments on the broader COVID front.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.