-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI EUROPEAN MARKETS ANALYSIS: USD A Touch Lower, Tsys See Narrow Ranges

- Yellen attempts to clarify Tuesday's comments.

- Strong NZ labour market seen, while the RBNZ notes that it can do more re: house prices.

- USD a touch lower overnight, U.S. Tsys tight with cash markets closed in Asia on the back of the Japanese holiday.

BOND SUMMARY: Limited Trade In Asia, With Japan & China Still Out

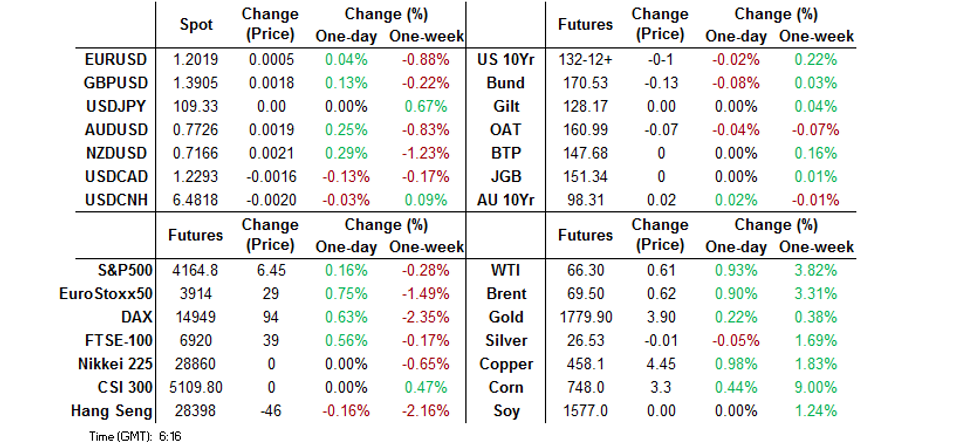

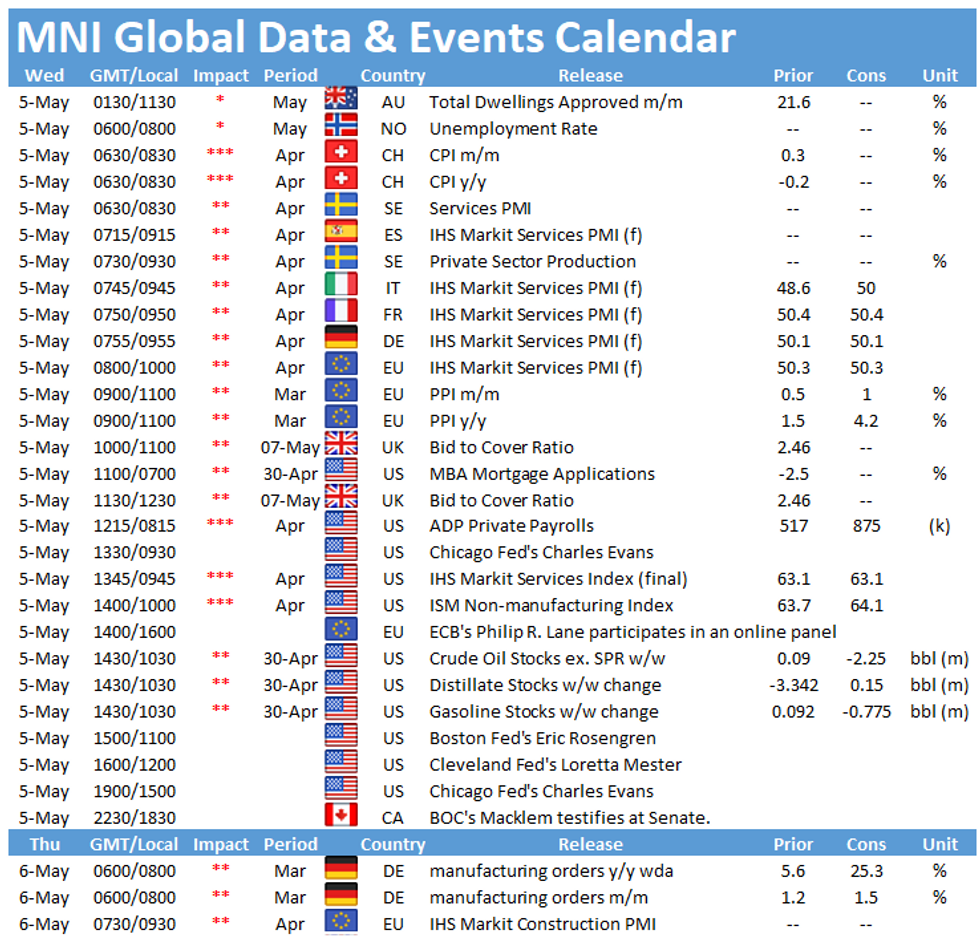

T-Notes were happy to operate within the confines a 0-03+ range in Asia-Pac hours, last printing -0-01 at 132-12+, well within the boundaries of yesterday's range, with ~45K lots changing hands. E-minis have nudged higher, while EuroStoxx 50 futures are now ~0.9% above Tuesday's settlement levels. Cash Tsy markets are closed until London hours owing to the previously flagged Japanese holiday (with Japanese & Chinese markets set to return from their respective elongated weekends on Thursday). There has been little in the way of notable headline flow, with Minneapolis Fed President Kashkari (dove, non-voter in '21) sticking to his cautious script. As a reminder U.S. Tsy Sec. (and ex-FOMC Chair) Yellen stole the headlines on Tuesday. Comments late in the day underlined the idea that she does not foresee an "inflation problem," but noted that if one were to appear then the Fed would address the matter. She also flagged transitory price pressures over the next "6 months or so." Yellen was keen to stress her strong belief in Fed independence and highlighted that she is not predicting/recommending a rate hike from the Fed. She also reiterated the idea that she expects full employment in '22. This came in the wake of her comments made earlier in NY hours re: the potential need for the Fed to hike rates if the economy overheats. We would suggest that those initial comments didn't provide anything new, having featured in Yellen's commentary in recent months e.g. the Fed has the tools to deal with inflation if it becomes an issue. The quarterly refunding announcement from the Tsy, ISM services survey and monthly ADP employment reading headline locally on Wednesday. Elsewhere, Fedspeak from Mester, Evans & Rosengren is scheduled.

- A solid round of ACGB Nov '31 supply was seen in Australia, with the weighted average yield printing 0.52bp through prevailing mids at the time of supply (per Yieldbroker pricing), XM rallied after the auction. Futures continue to observe relatively narrow ranges and are back from best levels, with YM -0.5 and XM +2.0 on the day at typing. A strong round of building approvals data did little for the space. A reminder that an address from RBA Deputy Governor Debelle (titled "Monetary Policy during Covid") will headline the local docket on Thursday.

EXCHANGE NEWS: CME Group to Permanently Close Most Open Outcry Trading Pits

CME Group, the world's leading and most diverse derivatives marketplace, today announced that it will not reopen its physical trading pits that were closed last March due to the outbreak of the COVID-19 pandemic. The Eurodollar options pit, which was reopened last August, will remain open, allowing these contracts to continue to trade in both open outcry and electronic venues. CME Group also announced that, subject to regulatory review, it will delist its full-size, floor-based S&P 500 futures and options contracts following the expiration of the September 2021 contracts on September 17, 2021. Open interest that remains after the delisting will be migrated into the E-mini S&P 500 futures and options contracts that are available electronically on CME Globex. All individual trading positions will be converted into the corresponding E-mini S&P 500 contracts with the matching expiration date and strike price for options at the current 1:5 ratio. (PR NewsWire)

FOREX: NZD Gains On Upbeat Jobs Report, Risk-On Flows Underpin Commodity FX

Robust Q1 jobs data released out of New Zealand provided some early support to the kiwi, as the unemployment rate unexpectedly nudged lower, amid above-forecast employment growth & uptick in participation. Initial enthusiasm waned but NZD remained buoyant as the risk switch across the broader G10 FX space was flicked to on.

- AUD gained alongside its cousin from across the Tasman, as the Antipodeans led commodity-tied FX higher. Firmer crude oil prices underpinned high-betas in the Asia-Pac session.

- The DXY unwound some of yesterday's gains as participants moved on after U.S. Tsy Sec Yellen's comments re: potential for higher interest rates, while e-minis crept higher.

- Liquidity in the region was limited by market holidays in mainland China, Japan & South Korea.

- A number of Services PMIs from across the globe, U.S. ADP employment report take focus on the data front. Fed's Evans, Rosengren & Mester, BoC's Macklem and ECB's Lane will provide central bank speak.

FOREX OPTIONS: Expiries for May05 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2025-30(E561mln), $1.2040-55(E1.4bln), $1.2120(E650mln)

- AUD/USD: $0.7750(A$959mln)

- USD/CAD: C$1.2300($1.1bln)

ASIA FX: Mixed Amid Local Data

Liquidity remains thin with Japan, mainland China and South Korea out for market holidays, the greenback lost some ground after US Tsy Sec Yellen confirmed rate hikes were not on the horizon soon.

- CNH: Offshore yuan moved as a function of the greenback amid a lack of domestic catalysts. USD/CNH declined through the session, hitting lows just above 6.4790 before recovering slightly.

- SGD: Singapore dollar strengthened, data earlier in the session showed Markit Singapore PMI fall to 51.8 in April from 53.5 in March due to pandemic concerns. Familiar technical levels held, retail sales are due later.

- TWD: Taiwan dollar finishing up broadly neutral, sticking to its recent range of 27.85-27.95. Foreign reserves data is due later, markets will look for confirmation that the central bank has refrained from, or at least reduced, FX intervention.

- IDR: Rupiah has lost some ground but stayed within a range, Indonesia's Q1 GDP headlines the local docket today. Consensus sees the economy shrinking 0.65% Y/Y in Q1 (per BBG), with estimates ranging from -2.00% to +1.90%.

- MYR: Ringgit is stronger, Defence Min Sabri Yaakob announced that the gov't will upgrade the level of restrictions in six Selangor districts to MCO, initially through May 17. Selangor is Malaysia's richest state and one of national economic powerhouses. The official added that hosting open house & interstate travel will remain banned during next week's Hari Raya celebrations.

- PHP: Peso has gained, post CPI figures BSP Gov Diokno commented that inflation is poised to remain elevated this year on the back of supply-side pressures, but will ease towards the target in 2022. He noted that inflation expectations are well anchored and expressed hope that pork import tariff cuts will help mitigate price pressures.

- THB: Baht is lower, data showed CPI above estimates, while Thailand's manufacturing sector has returned into expansion, the latest Markit survey showed. Headline index printed at 50.7 in April, up from March's 48.8 and IHS Markit said that "key indicators for output and new orders signalled renewed growth, driven by the strongest increase in exports for over a year-and-a-half." BoT due later in the session.

ASIA RATES: RBI Gov Das Says India Will Fight Virus Will All Available Tools

Several markets remain closed in the region, including South Korea and China. Coronavirus concerns continue to remain at the forefront in India.

- INDIA: Yields are lower in early trade after rising through the session yesterday. RBI Governor Das delivered a speech and laid out that the economic recovery was strong before the second wave of the virus, and emphasised that India will continue to fight the situation using all instruments available saying actions need to be swift and wide ranging. The Governor has been meeting with bankers and other lenders since last week to discuss the economic situation. Markets also await PMI Services figures. Focus remains on the coronavirus situation, with many experts now saying that things are likely to get worse before they get better.

- INDONESIA: Yields mostly higher across the curve. The finance ministry filled all of its IDR 10tn sukuk target at auction yesterday. GDP was below consensus, falling 0.96% Q/Q against an expected fall of 0.85%. The Y/Y figure fell 0.74%. Private consumption was the biggest drag, dropping 2.23% Y/Y.

EQUITIES: US Futures Rise After Yellen Clarification; Asia Stocks Mixed

Another mixed session for equities in the Asia-Pac timezone after a broadly negative lead from the US with tech shares bearing the brunt of the selling. Markets in Japan, mainland China and South Korea are closed which sapped liquidity from the region. Bourses in Hong Kong were flat, while the ASX 200 gained alongside a rise in oil, the Taiex managed some small gains after heavy selling yesterday. Chip producers are still coming under pressure after US Commerce Secretary Raimondo called for major production increases in the US in order to end reliance on overseas companies. US futures were higher, recovering some of yesterday's selloff while focusing on clarifying remarks from US Tsy Secretary Yellen that rate hikes were not on the cards any time soon, and similar comments from known Fed dove Kashkari.

GOLD: $1,800/oz Proving Tough To Crack

The $1,800/oz mark held firm on Tuesday, with a subsequent uptick in the USD helping bullion away from that psychological level. Spot last deals little changed, hovering around $1,780/oz, in what has been a limited Asia-Pac session. Bulls need to take out the Feb 25 high at $1,805.7/oz to open the next leg higher.

OIL: Bullish Stockpile Data Helps Crude Futures Gain

Oil has made gains in the Asia-Pac session on Wednesday, WTI & Brent sit ~$0.50 better off vs. settlement, but $0.40-.50 off best levels. Data after market from API yesterday showed US stockpiles fell 7.69m bbls, if this was followed up with a decline of the same magnitude at DoE stockpile data later today it would denote the biggest drop since January. Also aiding upside in oil is encouraging demand signals from the US where the vaccination drive is gathering steam amid a new target to vaccinate 70% of US adults with one dosage by July 4, while the UK is track to end lockdown measures in 7 weeks. The situation in India though has not shown signs of peaking and is tempering upside in oil.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.