-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Sino-Aussie Tensions Evolve Again

EXECUTIVE SUMMARY

- CLARIDA: THE FED IS 'A LONG WAY FROM OUR GOALS' AND TIGHTENING POLICY (CNBC)

- FED'S ROSENGREN: SUBSTANTIAL PROGRESS MAY COME IN 2H (MNI)

- U.S. SENATE PANEL TO TAKE UP TECHNOLOGY RESEARCH SPENDING BILL (RTRS SOURCES)

- CHINA TO SUSPEND ECONOMIC DIALOGUE WITH AUSTRALIA (MNI)

- RBNZ'S BASCAND: RATES NEED TO STAY LOW FOR QUITE A LONG TIME (BBG)

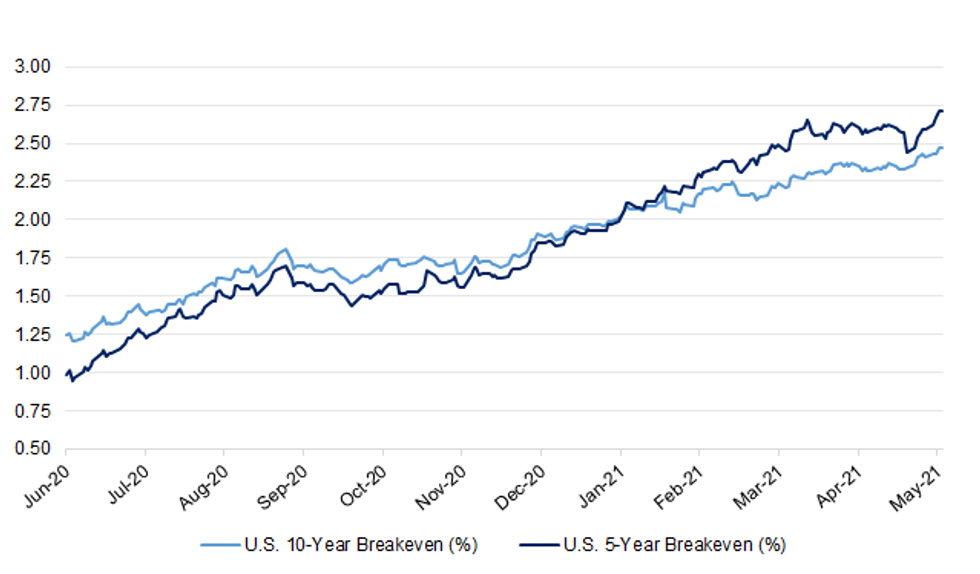

Fig. 1: U.S. 10-Year vs. 5-Year Breakevens (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: The U.K. is set to lift the ban on international leisure travel from mid-May but only a handful of countries are likely to be approved as holiday destinations, as ministers seek to keep control over the pandemic. Prime Minister Boris Johnson's officials are studying the latest data on infection rates in other countries with a view to adding those with low levels of Covid-19 to a new "green list" of approved destinations for foreign travel. The details are expected to be announced on Friday, and to take effect from May 17, according to officials. Initially only a small number of nations and territories are likely to be approved but the list will be revised every three weeks to take account of the changing pandemic situation. (BBG)

BREXIT: MNI: EU-UK Edge Closer To Post-Brexit Northern Ireland Deal

- There should be a clearer picture by early next month of the likelihood of a deal to resolve problems that have dogged the first months of operation of the Northern Ireland Protocol, EU officials said, pointing to increasing willingness by the UK to consider a temporary agreement to facilitate cross-border movements of agricultural products. "By the end of the month or beginning of June we should have a clearer sense of how big the points of commonality are and how big points of divergence are," one official in Brussels said - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

BREXIT: The U.K. and the European Union have resolved a dispute over the status of the bloc's top diplomat in London, bringing an end to a row that soured already troubled relations between the two sides after Brexit. The U.K. appears to have backed down and will now give full diplomatic status to the EU's delegation and giving its chief envoy, Joao Vale de Almeida, the position of ambassador. Prime Minister Boris Johnson's government had previously refused to grant the status given to envoys from foreign states. U.K. Foreign Secretary Dominic Raab and the EU High Representative Josep Borrell met to finalize the arrangement in the margins of the Group of Seven foreign ministers' meeting in London, they said in a joint statement. (BBG)

BREXIT: The UK is sending two Royal Navy patrol vessels to monitor a protest in waters around Jersey's main port amid a fishing rights row with France. PM Boris Johnson said "any blockade would be completely unjustified" as over 100 French fishing boats prepared to sail to the island on Thursday. It follows a threat by France to cut off Jersey's electricity over new post-Brexit rules for French fishing boats. No 10 said sending the Navy vessels was a "precautionary measure". (BBC)

POLITICS: The Conservatives are increasingly confident they will pull off a "hat-trick" of election victories in Hartlepool, Teesside and the West Midlands as voters go to the polls today. Tory MPs and activists are bullish about their chances of winning all three races after maintaining a healthy national poll lead buoyed by the success of the vaccination rollout. They believe they are on course to win the by-election in Hartlepool, a constituency which has elected Labour MPs since its creation, and retain the West Midlands and Tees Valley mayoralties, both of which were won by narrow margins under Theresa May in 2017. Polling this week suggested the Conservatives are on track for victory in all three areas. (The Times)

POLITICS: The Conservatives are still enjoying a vaccine bounce and retain a significant lead over Labour as voters head to the polls, a survey has suggested. Research by YouGov for The Times in the run-up to the "Super Thursday" elections today found the Conservatives had a ten-point lead over Labour, down just one point from last week. Nearly nine in ten voters believed the government had handled the Covid-19 vaccine programme well, and 51 per cent of those who thought it was a success credited Boris Johnson. (The Times)

EUROPE

GERMANY: Chancellor Angela Merkel's government can continue to impose nighttime curfews after Germany's highest court rejected emergency bids to suspend the controversial lockdown law. The legality of the contentious measure is still being decided, and the outcome is open, the Federal Constitutional Court in Karlsruhe said Wednesday in an emailed statement. At least 315 suits have been filed to contest the law. "There is yet no ruling on whether nighttime curfews are in line with the constitution," the court said. "Such a ruling can't be made in emergencyproceedings. The issue will now be scrutinized in the main case." (BBG)

U.S.

FED: Federal Reserve Vice Chairman Richard Clarida told CNBC on Wednesday that he thinks the central bank should keep its ultra-loose policy in place even as the U.S. economy storms back from its pandemic-era tumble. In a "Closing Bell" interview, Clarida said he expects the economy to grow close to 7% for the full year, which would be the fastest pace since 1984. He added that the jobs picture continues to improve, but still needs to progress considerably before the Fed will feel comfortable pulling back on all of the help it has provided since Covid-19 ended the longest expansion in U.S. history. "We're still a long way from our goals, and in our new framework, we want to see actual progress and not just forecast progress," Clarida said. (CNBC)

FED: MNI BRIEF: Rosengren Says Substantial Progress May Come in 2H

- Boston Fed President Eric Rosengren said Wednesday the "substantial further progress" benchmark for looking at reduced bond purchases could be met in the second half of the year. "We need to have a substantial improvement for us to begin tapering. It is quite possible that we'll see those conditions as we get to the latter half of the year," he said in a question-and-answer session at a Boston College event when asked about how the Fed will communicate slowing purchases. When QE taper talk begins the central bank will have to think about at "what speed we taper the Treasuries versus the mortgage-backed securities," he said. "The mortgage market probably doesn't need as much support now, and in fact one of my financial stability concerns would be if the housing market gets too overheated" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: Federal Reserve Bank of Boston President Eric Rosengren says "we need a little more time" to determine the progress being made in the U.S. labor force and economy. Rosengren says it's premature to talk about tapering the Fed's bond-buying purchases as a result. "We have a long way to go," he says pointing to low labor-force participation rate. (BBG)

FED: MNI: Evans Challenges Inflation Hawks to Define Credible Danger

- Chicago Fed President Charles Evans on Wednesday challenged critics of the Fed's plans to maintain near-zero interest rates to show more detailed scenarios proving inflation will get out of hand as the economy rebounds. "I wish people would fill in the dots" when they make this argument, he told reporters after a speech. Some critics appear to be talking about scenarios from decades long past when there were fears price gains could surge beyond 10%, he said - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: MNI INTERVIEW: Chicago Fed Adviser Fears Fiscal Dominance

- The Federal Reserve will likely face strong political opposition to raising interest rates in the face of a record budget deficit, raising the risk of future inflation due to central bank inaction or at least a delayed reaction, Chicago Fed Advisor Martin Eichenbaum told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: MNI: Fed's Mester: Labor Participation May Not Recover Fully

- The U.S. labor force participation rate may not recover to pre-pandemic levels due to a wave of retirements in the past year, Cleveland Fed President Loretta Mester told reporters Wednesday, adding the job recovery still falls short of the "substantial further progress" benchmark for tapering asset purchases. "Some conditions will be back where they were in February (2020) but there's reason to believe the labor market participation rate won't necessarily get back to the February level. A lot of people retired, and we'd like to see some people do better than the February level" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: San Francisco Fed President Mary Daly tweeted the following on Wednesday: "Why do we have bottle necks? Newly vaccinated people are spending, so we have a "freedom-induced demand spurt." Producers have to catch up. So ride through the temporary pops in inflation—the economy's in transition." (MNI)

ECONOMY: MNI INTERVIEW: US Services Prices Hit 13-Yr High

- Surging prices for U.S. services driven by high demand aren't likely to slow in the near future as the supply of materials and labor remains insufficient, ISM survey chair Anthony Nieves told MNI Wednesday. "The question is whether or not we're seeing strong inflation," he said. "We just have such strong demand that it's affecting the pricing and we just don't have the output necessary" to accommodate it - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: President Biden said Wednesday that he is open to compromise on his proposal to raise the corporate tax rate, but said he would not back an infrastructure bill that is not paid for because of concerns about the deficit. Biden was asked following remarks at the White House on Wednesday if he was open to an increase of the corporate tax rate to 25 percent instead of his proposed 28 percent. "I'm willing to compromise but I'm not willing to not pay for what we're talking about," Biden told reporters. "I'm not willing to deficit spend. They already have us $2 trillion in the whole." (The Hill)

FISCAL: More than 186,000 restaurants flooded the federal government with applications for money in the first two days of a program set up to ameliorate the impact of the coronavirus pandemic, the White House said Wednesday. President Joe Biden touted the high interest in the Restaurant Revitalization Fund, launched on Monday as part of the $1.9 trillion COVID-19 relief package he signed into law nearly two months ago, as an industry group warned the fund's popularity could cause it to quickly exhaust its $28.6 billion in funding. (ABC)

CORONAVIRUS: The Great White Way finally has an official reopening date — Sept. 14. New York Gov. Andrew Cuomo said Wednesday that Broadway theaters would reopen just after Labor Day at full capacity. Tickets are expected to go on sale starting Thursday. (CNBC)

CORONAVIRUS: The Centers for Disease Control and Prevention (CDC) released the final guidance on Wednesday for cruise lines to apply to run test trips with volunteer passengers, signifying a step closer toward normalcy for the industry. The simulated cruises would be designed to test the cruise lines' COVID-19 precautions before ships would be permitted to return with paying travelers to U.S. waters for the first time since shutting down in March 2020. The CDC suggests that cruise lines submit the necessary information and request the agency's approval for any test cruises at least 30 days ahead of the departure. (The Hill)

MARKETS: Gary Gensler, new chair of the Securities and Exchange Commission, has expressed concern about the prominent role Citadel Securities and other big trading firms are playing in US equity markets, warning that "healthy competition" could be at risk. In testimony released ahead of his appearance before the House financial services committee on Thursday, Gensler said he had directed his staff to look into whether policies were needed to deal with the small number of market makers that are taking a growing share of retail trading volume. "One firm, Citadel Securities, has publicly stated that it executes about 47 per cent of all retail volume. In January, two firms executed more volume than all but one exchange, Nasdaq," Gensler said. (FT)

OTHER

U.S./CHINA: A U.S. legislative proposal to allocate about $110 billion for basic and advanced technology research and science in the face of rising competitive pressure from China will be debated by the Senate Commerce Committee on May 12, sources said on Wednesday. (RTRS)

GEOPOLITICS: Top diplomats from the Group of Seven nations singled out China in a number of ways that will irritate the government in Beijing, from alleged human-rights abuses to its actions on Taiwan and incursions in cyber space. In a final statement first obtained by Bloomberg, the language used to reproach the Asian nation echoed past communiques but it was the laundry list of concerns that will get under China's skin, along with the chiding. "We encourage China, as a major power and economy with advanced technological capability, to participate constructively in the rules-based international system," the statement said as it singled out in detail the treatment of Uyghur Muslims and pointedly supported Taiwan's "meaningful participation in World Health Organisation forums." (BBG)

GLOBAL TRADE: Ministers are exploring the creation of a national stockpile of so-called rare earth metals amid rising fears that Britain's efforts to adopt electric cars are at risk from a Chinese stranglehold on supplies. It is understood that officials at the Department for Business are discussing options to protect the UK's access to vital materials including lithium and cobalt, which are essential for batteries and part of a global commodity prices boom as expectation rise for massive demand. Whitehall sources said Britain could build a national stockpile to avoid shortages, support attempts to create domestic sources such as potential lithium mines in Cornwall, or use its diplomatic network to secure supplies from abroad in partnership with private businesses. (Telegraph)

CORONAVIRUS: The U.S. will back a proposal to waive intellectual- property protections for Covid-19 vaccines, joining an effort to increase global supply and access to the life-saving shots as the gap between rich and poor nations widens. "We are for the waiver at the WTO, we are for what the proponents of the waiver are trying to accomplish, which is better access, more manufacturing capability, more shots in arms," U.S. Trade Representative Katherine Tai said in an interview on Wednesday. The Biden administration will now actively take part in negotiations for the text of the waiver at the World Trade Organization and encourage other countries to back it, Tai said. She acknowledged the talks will take time and "will not be easy," given the complexity of the issue and the fact that the Geneva-based WTO is a member-driven organization that can only make decisions based on consensus. (BBG)

CORONAVIRUS: A booster shot of Moderna's Covid-19 vaccine generated a promising immune response against the B.1.351 and P.1 variants first identified in South Africa and Brazil, respectively, the company announced Wednesday, citing early data from an ongoing clinical trial. In the trial, Moderna is testing a 50-microgram dose of its vaccine in previously vaccinated individuals. It found the booster dose increased neutralizing antibody responses against the original virus as well as B.1.351 and P.1, two variants that have since spread to other countries, including the U.S. (CNBC)

CORONAVIRUS: Novavax said initial primary analysis of Phase 2B results for its vaccine showed efficacy against a South African variant of the coronavirus. Among healthy adults without HIV, the Novavax vaccine showed efficacy of 60% in the initial analysis and 55% in the subsequent complete analysis, the company said. Novavax may have lost the race on vaccinating millions of Americans but a successful trial can still help developing nations like India and Brazil where shots are in high demand. (BBG)

BOJ: MNI BRIEF: BOJ Minutes: New Policy Framework Future Guideline

- A Bank of Japan board member believes that the bank's new policy framework continues to be the basic guideline for monetary easing for a few years to come, according to the policy minutes from the BOJ Board meeting held between March 18-19 and released today - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

JAPAN: Tokyo will ask the Japanese government to extend a virus emergency, Jiji Press reported, a request likely to be approved by Prime Minister Yoshihide Suga as he seeks to stem infections ahead of the capital hosting the Olympics from July. The official decision to make the request will come later Thursday, the news agency said, citing sources close to the matter. The length of the extension and details of the rules to be applied are to be discussed, Jiji said. (BBG)

AUSTRALIA: Residents across the Greater Sydney region will be subject to snap new COVID-19 restrictions after two new cases of community transmission were discovered. From midday today - and enforceable by authorities from 5pm - the restrictions will apply for residents of Greater Sydney including Wollongong, Central Coast and the Blue Mountains. The restrictions will be in place until 12:01am Monday, May 10. (9 News)

AUSTRALIA: SEEK new job ads rose 11.9% m/m in April, further extending the record high levels of advertising that were seen last month. Compared to pre-pandemic levels, job ads are now 38.8% above February 2020 levels. The strong growth in SEEK job ads indicates an ongoing labour market tightening even after the JobKeeper wage subsidy ended last month. The strong demand for labour coupled with decreased candidate availability suggests an ongoing tightening in the labour market is occurring. In part, this likely reflects some dislocation in labour supply and labour shortages as a result of interstate and international border restrictions. (NAB)

AUSTRALIA/CHINA: MNI BRIEF: China To Suspend Economic Dialogue With Australia

- China will indefinitely suspend all activity under the China-Australia Strategic Economic Dialogue following Canberra's increasingly hawkish tone, the National Development and Reform Commission said in a statement on its website. Some Australian officials have launched a series of measures to disrupt normal exchange and cooperation between China and Australia out of Cold War mind set and ideological discrimination, the NDRC said. Ties between the two countries have deteriorated with Canberra cancelling a pact between Victoria state and China's Belt and Road Initiative in April. More recently, Australian Prime Minister Scott Morrison said he would act if national security concerns were raised about the lease of Darwin port by Chinese company Landbridge - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

RBNZ: Reserve Bank of New Zealand Deputy Governor Geoff Bascand speaks in interview with Radio New Zealand. Asked about outlook for interest rates: "I really can't comment on where they're going now, other than that we've said we think they need to remain low for quite a long time. We need to keep supporting this economy. It's doing better, but it's doing better partly because we're still supporting it and we need to keep supporting it for some time to get back to our inflation and our employment goals. That's still the big picture." On inflation concerns: "We said in our last statement that we did see that there'd be some higher inflation in the short term this year. There are some supply constraints, it's difficult with getting goods into New Zealand at times, and oil price have risen. So we knew there'd be a bit of a spike in inflation. The question we've always got is how long does that persist and we've said basically we think it's more of a temporary factor than a long-term factor. But we'll continually assess that as we understand how things are changing. "

NEW ZEALAND: Real GDP is expected to grow 4% in 2021, driven by domestic demand, IMF says following consultations with New Zealand authorities. The pandemic and border closure will continue to depress migration and tourism flows. Unemployment rate expected to peak at about 5.1%, while wage growth should remain modest. Inflation is expected to durably reach the 2% midpoint of the Reserve Bank of New Zealand's target range only from 2024. 2021 growth follows 2.9% contraction in 2019, IMF says; projects GDP growth slowing to 3.2% in 2022. (BBG)

CANADA: Canada is considering allowing patients to receive two different types of Covid-19 vaccines as the country deals with shortages of shots from AstraZeneca Plc and Moderna Inc. Federal health officials are closely watching a U.K.-based trial in which participants received two kinds of shots. Results are expected in the next month or so, Supriya Sharma, chief medical adviser at Health Canada, said Wednesday at a news conference. Vaccine mixing "would most likely be an mRNA vaccine like a Pfizer or a Moderna, combined with an AstraZeneca which is a viral vector vaccine," Sharma said. Canada has fully vaccinated just 2.6% of its population, the second-lowest rate among Group of Seven countries, according to the Bloomberg Vaccine Tracker. It's grappling with limited supplies of all but the Pfizer Inc.-BioNTech SE vaccine. (BBG)

CANADA: Prime Minister Justin Trudeau's fiscal road map could reduce Canada's future spending capacity by leaving debt at elevated levels for decades, according to the nation's budget watchdog. In a report published Wednesday, the Parliamentary Budget Officer warned that the government's plan would see Canada's ratio of debt-to-gross domestic product remain higher that it was before the pandemic through 2055. "This suggests that the government has decided to effectively stabilize the federal debt ratio at a higher level, potentially exhausting its fiscal room over the medium- and long-term," the PBO said. (BBG)

BRAZIL: Brazil's central bank lifted its benchmark interest rate by 75 basis points and promised another hike of the same magnitude in June as it moves to bring inflation forecasts back down to target. The bank on Wednesday unanimously voted to raise the Selic to 3.5%, in line with estimates from all 39 economists in a Bloomberg survey and also the guidance given by policy makers at their prior meeting in March. (BBG)

SOUTH AFRICA: Eskom Holdings SOC Ltd., South Africa's state power utility, doesn't want to buy electricity from the company that won most of a government emergency-power tender because it's concerned about the cost and length of the contract, according to two people familiar with the situation. Meeting the terms of Karpowership's 20-year deal would add pressure to Eskom's already stretched finances and heighten its exposure to fossil fuels, said the people, requesting anonymity as the utility is yet to comment publicly. The company has a debt burden of 464 billion rand ($32 billion) and is struggling to meet payments even with the help of state bailouts. Karpowership of Turkey's contract is to supply South Africa with 1,220 megawatts of electricity from gas-burning power plants stationed on boats moored offshore. The move is intended to provide a safety net during Eskom's frequent power-plant outages, which trigger blackouts across the country. (BBG)

MIDDLE EAST: Iraq has hosted more than one round of talks between regional foes Iran and Saudi Arabia, Iraqi President Barham Salih said on Wednesday. Salih made his remarks during an interview broadcast live online with the Beirut Institute think tank. He gave no more details. Diplomats hope the opening of direct channels between Iran and Saudi Arabia will signal a calming of tensions across the Middle East after years of hostilities that have brought the region close to a full-scale conflict. (RTRS)

CHINA

ECONOMY: The explosive rebound in travel and spending during the May 1-5 holiday strengthened China's confidence and ability to deal with rising challenges at home and abroad, the Global Times said in an editorial. The number of holiday travelers doubled from last year to 265 million and was close to the number in 2019, the year before the pandemic, and holiday spending increased from 2019, even as much of the world still stumbled through the pandemic, the newspaper said. However, China's growth may slow in H2, and the U.S.-led efforts to contain China create risks and uncertainties, it said. (MNI)

PBOC: The PBOC will vigorously promote the establishment of pilot zones for green finance reform, focusing on strengthening resource allocation, risk management and market pricing to increase financial support for low-carbon development, Xinhua News Agency reported citing Deputy Governor Liu Guiping. These pilot zones should create conditions for the calculations and disclosures of climate-related information such as carbon emissions, and reduce the dependence of economic development on high-carbon industries by upgrading investment structure, Xinhua said citing Liu. (MNI)

LENDING/REGULATION: China's regional authorities are trying to prevent financial risks by scrutinizing lenders including those serving small companies, with Beijing, Shanghai and Jiangsu provinces releasing new rules to combat unlicensed financial activities, the Economic Information Daily reported. Authorities are concerned that the central government's increasing pressure over fintech giants may cause the risks to spread to other lenders, the daily said citing analysts. Local authorities should clarify the legal status of microfinance companies, the newspaper said citing Dong Ximiao, the chief researcher at Merchants Union Consumer Finance Co Ltd. (MNI)

OVERNIGHT DATA

NEW ZEALAND MAR BUILDING PERMITS +17.9% M/M; FEB -19.3%

NEW ZEALAND MAY, P ANZ BUSINESS CONFIDENCE 7.0; APR -2.0

NEW ZEALAND MAY, P ANZ ACTIVITY OUTLOOK 32.3; APR 22.2

The preliminary ANZ Business Outlook data for May saw business confidence jump 9 points to +7%, while the own activity outlook rose 10 points to +32.3%. Details were also strong. Export, investment and employment intentions, capacity utilisation, and profit expectations all rose between 4 and 10 points. Cost and inflation pressures continue to intensify and broaden. Expected costs rose another 4 points to a net 80% of firms expecting higher costs ahead. A net 58% of respondents intend to raise their prices, a 2 point lift to a fresh record high, in data that goes back to 1992. Inflation expectations rose 0.2% pts to 2.2%, a smidgen above the 2% RBNZ CPI target midpoint. Despite high costs, profit expectations jumped 10 points, with a net 9.6% of firms expecting higher profitability ahead, the highest since October 2017.The strains in the economy are starting to show, as the economy tries to grow faster than it physically can, given shortages of both goods and labour. The degree of reported disruption caused by inward freight issues jumped for both construction and services, while for outward freight, reported disruption jumped economy-wide. Temporary it may be; immaterial it is not. Any ECON 101 student or business person can tell you that strong demand and hampered supply is a sure-fire recipe for inflation. The RBNZ can ignore it only as long as inflation expectations remain well-anchored. So far so good; but it's a lagging, not leading, indicator. (ANZ)

SOUTH KOREA APR FOREIGN RESERVES $452.31BN; MAR $446.13BN

CHINA MARKETS

PBOC NET DRAINS CNY40BN VIA OMOS THURSDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Thursday. This resulted in a net drain of CNY40 billion given the maturity of CNY50 billion reverse repos on the same day, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.1325% at 09:32 am local time from the close of 2.3465% on April 30, the last working day before the May 1-5 holiday.

- The CFETS-NEX money-market sentiment index closed at 38 on April 30 vs the previous 39. A higher index indicates increased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.4895 THURS VS 6.4672

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4895 on Thursday, compared with the 6.4672 set before May Day holiday.

MARKETS

SNAPSHOT: Sino-Aussie Tensions Evolve Again

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 501.97 points at 29319.47

- ASX 200 down 46.015 points at 7049.8

- Shanghai Comp. down 7.735 points at 3439.121

- JGB 10-Yr future up 4 ticks at 151.38, yield down 0.7bp at 0.090%

- Aussie 10-Yr future up 4.0 ticks at 98.350, yield down 4.4bp at 1.696%

- U.S. 10-Yr future +0-00+ at 132-18, yield up 1.24bp at 1.578%

- WTI crude up $0.06 at $65.69, Gold up $1.84 at $1788.78

- USD/JPY up 17 pips at Y109.38

- CLARIDA: THE FED IS 'A LONG WAY FROM OUR GOALS' AND TIGHTENING POLICY (CNBC)

- FED'S ROSENGREN: SUBSTANTIAL PROGRESS MAY COME IN 2H (MNI)

- U.S. SENATE PANEL TO TAKE UP TECHNOLOGY RESEARCH SPENDING BILL (RTRS SOURCES)

- CHINA TO SUSPEND ECONOMIC DIALOGUE WITH AUSTRALIA (MNI)

- RBNZ'S BASCAND: RATES NEED TO STAY LOW FOR QUITE A LONG TIME (BBG)

BOND SUMMARY: A Mixed Bag In Asia

Commentary from Boston Fed President Rosengren failed to add much in the way of tangible new information during Asia-Pac hours, with T-Notes sticking to the confines of a 0-03+ range, last unchanged at 132-17+. Regional participants were happy to sell cash Tsys at the re-open (in what was the first round of cash trade during Asia-Pac hours for the week), with the longer end of the curve running ~1.5bp cheaper on the day, albeit back from softest levels of the day. Activity was headlined by a 20K screen lift of the TYM1 130.00 puts.

- JGBs benefitted from the richening in play in U.S. Tsys since Friday's Tokyo close as participants returned from their elongated weekend. The presence of the latest round of BoJ Rinban operations (covering 5- to 25-Year paper) and seemingly impending extension of the state of emergency in Tokyo (and perhaps some of the other areas under their own such declarations) added to the bid. Still, the uptick in local equities seemed to cap the rally, with futures now only 5 ticks higher on the day.

- Aussie bonds stuck to a narrow range, failing to really kick on in early trade, even with short, snap COVID restrictions coming into play in the greater Sydney area (on the back of a couple of COVID cases being found in the last 48 hours). Later in the day we saw headlines note that China's NDRC has halted activities under the China-Australia economic dialogue indefinitely. Still, some local participants and some experts in the field have equated the impact of the cessation of the discussions to 0, with the AUD unwinding some of its knee-jerk move lower, and ACGBs limited in their reaction to the news. YM +0.5 & XM +4.0 on the day at typing.

JGBS AUCTION: Japanese MOF sells Y2.7721tn 6-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y2.7721tn 6-Month Bills:- Average Yield -0.1090% (prev. -0.1102%)

- Average Price 100.055 (prev. 100.055)

- High Yield: -0.1050% (prev. -0.1082%)

- Low Price 100.053 (prev. 100.054)

- % Allotted At High Yield: 31.1050% (prev. 34.8783%)

- Bid/Cover: 3.458x (prev. 5.314x)

BOJ: 5-25 Year Rinban Conducted

The BoJ offers to buy a total of Y650bn of JGB's from the market, sizes unchanged from the previous operations:

- Y450bn worth of JGBs with 5-10 Years until maturity

- Y200bn worth of JGBs with 10-25 Years until maturity

EQUITIES: Risk Appetite Wanes After China-Australia Trade Announcement

Another mixed day for equity markets in the Asia-Pac region as Japan, mainland China and South Korea return from holidays. Markets in mainland China are lower, the move accelerating after China's National Development and Reform Commission announced an indefinite half of all activities under the China-Australia economic dialogue. Bourses in Japan are the outperformer with gains of over 2%, there were reports that Japan considered relaxing emergency restrictions on departments stores, though Tokyo could seek an extension of the virus emergency. In the US futures are lower, dropping into negative territory after the reports of Sino-Aussie trade tensions alongside a safe haven bid in the greenback.

OIL: Crude Futures Recover Early Losses

Oil recovered early losses to see minor positive territory in the Asia-Pac time zone; WTI is up $0.11 from settlement levels at $65.73/bbl, while Brent is up $0.18 at $69.14/bbl.

- Data from the DoE showed US oil stockpiles declined 8.0m bbls, denoting the largest weekly drop since 22 January. The fall in US oil stockpiles was mostly driven by US oil exports rising to record highs. The decline was steeper than the API's estimate of a 7.7m bbl decrease. The downstream figures were less bullish which weighed on oil, gasoline stockpiles rose 700k bbls. Elsewhere the demand picture is positive, pent up travel demand due to the pandemic is estimated to increase jet fuel use by 30% this summer according to the US governments, and elsewhere refineries run rates rose to almost 87% in the latest week, the highest since March 2020 as fuel production ramps up ahead of the summer driving season.

GOLD: Range Respected

Wednesday's combination of lower U.S. real yields and a flat DXY ultimately supported gold, although there was some chop evident intraday. Still, spot remains within the confines of the recent range, last trading little changed just shy of $1,790/oz.

FOREX: Risk Retreats After Sino-Australian Tension Resurfaces

Headlines noting that China's NDRC has halted activities under the China-Australia economic dialogue indefinitely caught many off guard, with one local AUD participant/strategist in Australia signalling that it is "fair to say most of us have forgotten about such a thing." The news delivered a blow to the Antipodeans, sending them to the bottom of G10 pile. Liquidity picked up as trading activity in China, Japan and South Korea resumed after holidays.

- U.S. dollar picked up a bid as the Sino-Australian headlines crossed. The greenback jumped to the top of G10 scoreboard, albeit the DXY failed to break above yesterday's high. The upswing in the dollar index coincided with a downtick in e-mini futures.

- The first post-holiday PBOC fix was closely watched and offshore yuan strengthened as the central USD/CNY mid-point was set 18 pips shy of sell-side estimates. USD/CNH moved away from session lows but still sits ~60 pips lower on the day.

- The BoE & Norges Bank will announce their MonPol decisions today. Speeches are awaited from Fed's Williams, Kaplan & Mester, ECB's Lagarde, de Guindos & Schnabel, RBA's Debelle & Norges Bank's Olsen. Data docket features U.S. initial jobless claims, EZ retail sales, German factory orders & Norwegian industrial output.

FOREX OPTIONS: Expiries for May06 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800-15(E525mln), $1.1850-65(E703mln), $1.1875-85(E573mln), $1.1900-05(E511mln), $1.2000-20(E1.8bln), $1.2025-35(E630mln), $1.2050-55(E737mln), $1.2100-20(E1.3bln)

- USD/JPY: Y107.00-15($1.2bln), Y107.80-00($676mln), Y108.80-00($1.0bln), Y109.60-80($1.2bln)

- GBP/USD: $1.4000(Gbp711mln)

- AUD/USD: $0.7700-20(A$705mln), $0.8000(A$1.0bln-AUD puts)

- NZD/USD: $0.7000(N$577mln)

- USD/CAD: Cny6.45($1.4bln-USD puts)

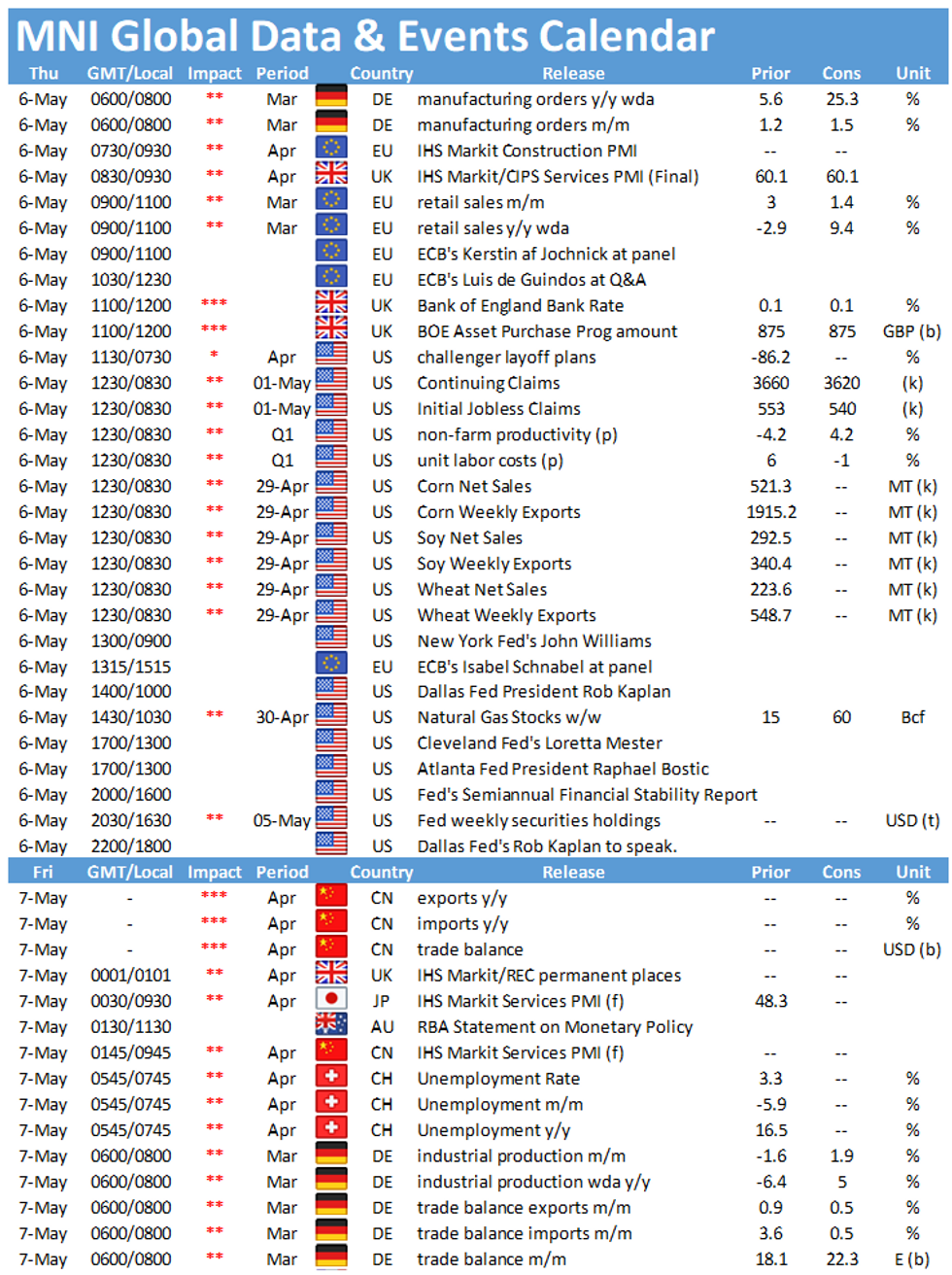

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.