-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: 1 Million Jobs?

- RBA tweaks borrowing cost for bonds covered by 3-Year yield target scheme as shorts get squeezed.

- DXY & U.S. Tsys tight ahead of U.S. NFP print, with gains of 1 million jobs seen.

- UK Tories set to take Hartlepool in by-election, local election counting continues.

BOND SUMMARY: Swings In Aussie 3s

A generally muted overnight session for core global FI markets left T-Notes in a narrow 0-02+ range, last -0-01+ at 132-20, with benchmark yields little changed across the curve, in what was a typical pre-NFP session for the Asia-Pac region. T-Notes operate on light volume of ~46K at typing. The major cash benchmarks generally trade little changed to a touch richer on the day. The aforementioned NFP release headlines the local docket on Friday, with Fedspeak from Barkin also due. It is interesting to note that benchmark Tsy yields have been biased lower this week, even with expectations for a ~+1mn print in the headline NFP reading.

- JGB futures held to a narrow range, last +2, with the local COVID issues and stronger than expected local wage data having no real impact on the space. There may have been some incremental support from a solid liquidity enhancement auction for off-the-run JGBs with 1- to 5-Years until maturity (firmer cover and stronger pricing through prevailing yields at the time of supply), with the major benchmarks generally trading unchanged to a touch firmer across the cash curve. BoJ Rinban ops covering 1- to 5-Year JGBs headline locally on Monday.

- YM unchanged with XM +1.0 in Sydney. There were no surprises provided in the release of the RBA's latest SoMP given the guidance already seen earlier this week. The A$800mn auction of ACGB Nov '24 went well, with the cover ratio moving higher vs. the prev round of supply for the line, while the weighted average yield printed 0.74bp through prevailing mids at the time of supply (per Yieldbroker pricing). There were some interesting swings in ACGB Apr '24 (the bond targeted by the RBA under its 3-Year yield targeting mechanism), which forms part of the YMM1 basket. The line traded as low as 0.055% in yield terms (comfortably through the Bank's 0.10% target) before backing off to trade at 0.09% at typing. Shorts in the line were squeezed in the early goings as they seemingly looked to secure bonds for settlement of existing positions. The retracement came as the RBA noted that it "is currently accepting requests to borrow the Apr '23 and Apr '24 bonds via its own facility only. The indicative fee to borrow these bonds is currently 25 bps, subject to change." Back in March the RBA lifted the cost of borrowing of these lines to 100bp, as it looked to limit short selling that was testing the implementation of its 3-Year yield targeting mechanism. The weekly RBA issuance slate was vanilla. The latest NAB business survey, March retail sales data & Q1 retail sales volume data all hit on Monday. Monday will also bring A$1.0bn of ACGB 1.00% 21 December 2030 supply.

FOREX: Commodity FX Lose Ground, Redback Firms On Chinese Trade Data

Commodity FX faltered in quiet Asia-Pac trade even as BBG Commodity Index extended gains to fresh multi-year highs, with little in the way of notable headline flow crossing the wires. JPY struggled for momentum despite aversion to high-betas, as Japanese gov't confirmed they will seek the extension & expansion of Covid-19 state of emergency.

- USD/CNH knee-jerked to a session low as a surge in exports underpinned the much wider than expected Chinese trade surplus. This allowed the pair to extend its earlier losses and print worst levels since late Feb. The PBOC set its central USD/CNY mid-point at CNY6.4678, 27 pips above sell-side estimates, but the redback was unfazed.

- Sterling outperformed in G10 FX space as polling stations closed after the "Super Thursday" elections. Labour MP McMahon effectively conceded defeat in Hartlepool by-election, where a "red wall" stronghold looked set to turn blue.

- U.S. NFP report provides takes centre stage today, with German industrial output, Canadian unemployment & comments from Fed's Barkin, ECB's Lagarde, Riksbank's Floden and BoE's Broadbent & Haldane also due.

FOREX OPTIONS: Expiries for May07 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1895-10(E1.2bln), $1.2025-40(E2.3bln), $1.2100(E749mln)

- USD/JPY: Y106.60($500mln), Y109.00-10($988mln)

- GBP/USD: $1.3900(Gbp842mln)

- EUR/GBP: Gbp0.8650-60(E625mln)

- AUD/USD: $0.7800(A$1.1bln)

- USD/CAD: C$1.2400-20($938mln)

ASIA FX: Won Leads The Way Higher

The greenback continued its move lower, robust appetite for risk supported a bid in most Asia EM FX.

- CNH: Offshore yuan is stronger, adding to gains after trade data showed a wider than expected trade surplus with soaring exports and import growth broadly in line with expectations.

- SGD: Singapore dollar has strengthened, despite an increase in coronavirus infections Singapore is keen to push ahead with plans to open its aviation industry according to Transport Minister Ong Ye Kung. "We hope we can achieve this mutual opening with Hong Kong".

- TWD: Taiwan dollar is higher after dropping yesterday. Yet another Taiwan central banker has joined the chorus touting the futility of intervention in TWD touting the success of Taiwanese companies and foreign inflows.

- KRW: Won has gained and is the best performer today, Vice Finance Minister Lee gave an upbeat assessment of the economic recovery late yesterday, predicting the recovery will be faster than expected.

- MYR: Ringgit is stronger, Finance Ministry said that the gov't will inject MYR440mn into the State Reserve Fund to help regional gov't's in dealing with the consequences of the Covid-19 outbreak.

- IDR: Rupiah has strengthened. The Jakarta Post circulated the results of the 2021 Edelman Trust Barometer, which showed that 89% of Indonesians are concerned about losing their jobs, which is more than the 65% worried about potentially contracting coronavirus.

- PHP: Peso is stronger, Philippine trade deficit narrowed to $2.413bn in March from the revised $2.711 recorded in February, while both imports and exports considerably topped expectations.

- THB: Baht has gained, tourism Min Phiphat addressed concerns about the reopening of Phuket to foreign visitors. The off'l said that the number of Covid-19 cases in the resort island must fall to zero before allowing the entry of tourists, which is scheduled for Jul 1.

ASIA RATES: India Sees Some Auction Set-Up

Repo rates drop sharply in China despite a lack of additional PBOC liquidity, Indian auctions in focus after RBI measures earlier this week and operation twist success.

- INDIA: Yields a touch higher early on with the curve bear steepening. The RBI will today auction a total INR 320bn of securities from four lines, yields have fallen in recent days after RBI Governor Das outlined a raft of new measures to support the economy and the bond market. The RBI will also conduct INR 2tn 14-day reverse repo today. Yields fell yesterday as the RBI conducted INR 100bn operation twist, under the operation the bank filled its whole allocation with 5.85% 2030 bonds and did not buy any of the 2026 or 2028 bonds.

- SOUTH KOREA: Yields and futures move in the same direction, lower. Futures drop after an upbeat assessment of the economy from Vice Finance Minister Lee who said he saw growth above previous estimates, while the MOF conversion offer helps suppress cash yields.

- CHINA: The PBOC matched maturities with injections today after draining CNY 40bn yesterday. The last time the PBOC injected liquidity into the system was Feb. 25. The overnight repo rate fell 27bps to 1.7888%, the seven-day repo rate fell 1.9746%. Futures are higher again for the third session (including a gap for the Labor Day break) but came off best levels after strong trade data; the trade surplus widened on soaring exports. Elsewhere, Huarong has said it has transferred the funds needed to fulfil five offshore bond coupons due today. Corporate bond spreads have widened though as yields in government securities decline.

- INDONESIA: Yields mostly lower across the curve. The Jakarta Post circulated the results of the 2021 Edelman Trust Barometer, which showed that 89% of Indonesians are concerned about losing their jobs, which is more than the 65% worried about potentially contracting coronavirus. Elsewhere a Fitch report asserted that the pace of the recovery will be capped by the persistence of the virus in Indonesia.

EQUITIES: In The Green

A positive day for Asia-Pac equity indices, supported by a positive lead from the US and further gains across the commodity complex. All major bourses are in the green at the time of writing, Taiwan leads the way higher ahead of what is expected to be positive trade data today, while markets in South Korea also saw strong gains after an upbeat economic assessment from the Vice FinMin. China added to gains after trade data showed a wider than expected trade surplus with soaring exports and import growth broadly in line with expectations. In the US futures are higher, markets await the April payrolls report which will be dissected for clues as to the Fed's timetable for tapering.

GOLD: Support Still Evident In Asia

The DXY saw a small extension through yesterday's lows in Asia, which, when coupled with a steady U.S. yield environment, allowed bulls to add a handful of dollars to yesterday's gains. Spot last deals at ~$1,820/oz after yesterday's convincing break through $1,800/oz. Bulls now target the Feb 12 high at $1,830.8/oz, with today's U.S. NFP print providing the headline risk event ahead of the weekend.

OIL: Crude Futures On Track For Consecutive Weekly Gain

Crude futures are higher in Asia, WTI & Brent print a little over $0.40 better off. The move higher today has been supported by a slight pullback in the greenback and improved risk appetite. For the week the benchmarks are up over 2%, the second straight weekly gain.

- If the move higher can continue WTI looks to the March 15 high at $66.15 which has been probed but not convincingly broken. A clear break would pave the way for a test of the key hurdle for bulls at $67.29, Mar 8 high.

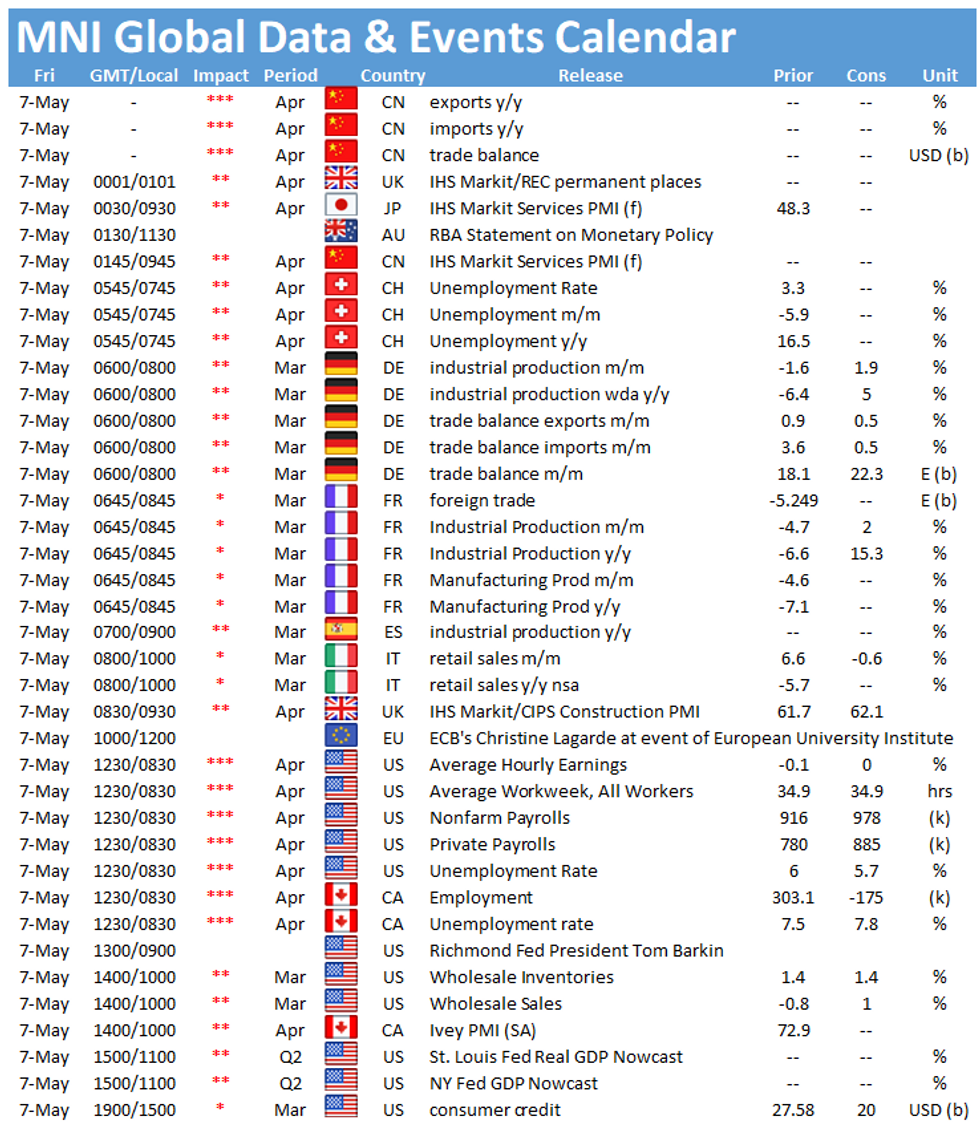

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.