-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Rocket Fire Intensifies

EXECUTIVE SUMMARY

- FED OFFICIALS SEE BRIGHT ECONOMIC OUTLOOK - AND A NEED FOR AID (BBG)

- EXCHANGE OF FIRE BETWEEN ISRAEL DEFENCE FORCES AND HAMAS ESCALATES

- COLONIAL FACES DEADLINE TO DECIDE ON HACKED PIPELINE RESTART (BBG)

- WHITE HOUSE FACES RISING PRESSURE AS GASOLINE SHORTAGES GROW (BBG)

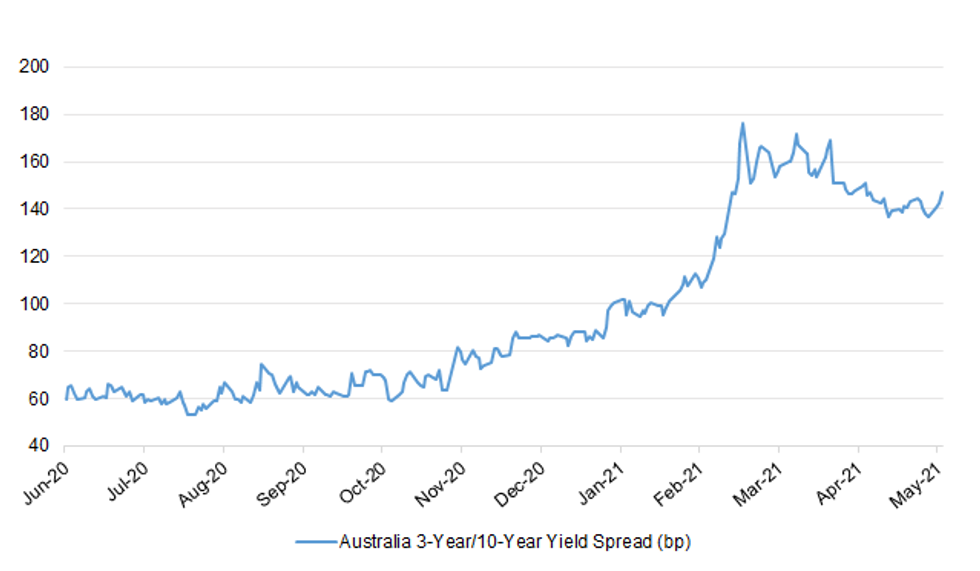

Fig. 1: Australia 3-Year/10-Year Yield Spread (bp)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

ECONOMY: Britain's booming economic recovery will remove any need for further tax rises this parliament as Rishi Sunak is given a £20 billion growth windfall, according to an analysis of the Bank of England's upgraded forecasts. With the government facing a series of uncosted spending pressures on welfare, health and other departments, the chancellor is likely to use the headroom in full to meet the Tory pledge to "end austerity" and avoid having to impose a wealth tax. Andrew Goodwin, chief UK economist at Oxford Economics, which carried out the analysis, said: "The prospect of better growth has given him more flexibility. Tax hikes should be off the table, certainly new tax hikes." (Times)

POLITICS: More than 2 million UK voters could lack the necessary ID to take part in future elections, according to a government analysis of its flagship bill on voting rights, spurring warnings that "decades of democratic progress" risk going into reverse. The plan for mandatory photo ID at elections – a central element of Tuesday's Queen's speech – risks disproportionately hitting older, disabled and homeless voters who are less likely to have such documents, critics said. US civil rights groups have warned it amounts to Republican-style voter suppression. (Guardian)

BREXIT: The Brexit deal for Northern Ireland will not be "sustainable for long" if it continues in its current form, the UK government minister responsible for EU-UK trade relations has warned following a two-day visit to the region. Lord David Frost warned that the Northern Ireland protocol, which requires all goods travelling from Great Britain into Northern Ireland to conform to complex EU customs rules, was still presenting "significant challenges" for businesses and urged the EU to take a "common sense" approach to its implementation. "Businesses have gone to extraordinary efforts to make the current requirements work, but it is hard to see that the way the protocol is currently operating can be sustainable for long," he said in a statement released after the visit. (FT)

CORONAVIRUS: Pfizer has asked the UK regulator to approve its vaccine for use in young teenagers as US watchdogs signalled their approval for the step. The pharmaceutical giant has formally asked the Medicines and Healthcare products Regulatory Agency (MHRA) for permission to use the jab in 12 to 15-year-olds – one of the age groups most responsible for spreading the virus. Given the organisation's fast-track review process, it is likely the vaccine would be approved well before the end of July, the point at which the Government aims to have offered a jab to all adults. (Telegraph)

STOCKS: AstraZeneca Plc shareholders only narrowly approved increases to its chief executive officer's pay, even as they overwhelmingly backed the pharmaceutical giant's biggest takeover in decades. About 40% voted against increasing CEO Pascal Soriot's pay potential by about 2 million pounds ($2.8 million) at the annual meeting Tuesday, after objections from some investors in recent weeks. Support for the $39 billion takeover of rare-disease specialist Alexion Pharmaceuticals Inc. was broader, with more than 99% in favor, clearing the way for the companies to close the transaction in the third quarter. (BBG)

EUROPE

ECB: The euro-area economy may expand by more than the 4% currently projected by the European Central Bank this year as savings are unleashed and consumption rebounds, according to Governing Council member Klaas Knot. The Dutch policy maker argued that service-sector activity is reviving in line with the experiences of other countries that were faster at rolling out vaccinations, and that the bloc will likely follow a similar path now that it is catching up. "We can take comfort that the euro area in the coming months will take the exact same trajectory, services will also pick up, we expect more than 4% growth over the full year," he said at an event late on Tuesday. "I would argue that there is still significant upside risk actually, and that has to do with pent-up demand." (BBG)

EU: In a shock pledge amid a stuttering presidential bid, former Brexit negotiator Michel Barnier has told French TV he wants to suspend immigration to France for 3-5 years and toughen checks on the EU's external borders. "There are links between [immigration flows] and terrorist networks which try to infiltrate them," he told RTL-LCI-Le Figaro on Sunday, adding that he didn't think all immigrants "including those who are trying to cross the Mediterranean to find a better life, are major terrorists or delinquents." Barnier, a conservative former finance minister, said immigration was a threat to the stability of French society. "There is a risk of an explosion, particularly on the topic of immigration," he said. "We need to introduce a moratorium on immigration. We need to take time to evaluate, check and if necessary, change our immigration policies." (Politico)

EU/CHINA: The European Union wants a more balanced relationship with China that includes reciprocity in areas like market access and rules on state aid, according to a senior Italian official. "The EU is undergoing a reflection on its relationship with China," Vincenzo Amendola, undersecretary for European affairs in Prime Minister Mario Draghi's cabinet, said in an interview with Bloomberg Television Tuesday. "I think it's a positive move, not like in the past when it was all based on exports and trade." Draghi has been at the forefront of a recent hardening of the EU's stance toward China, in close alignment with President Joe Biden's U.S. administration. (BBG)

FRANCE: Negotiations on access for French fishermen to waters around Jersey will continue after the British island postponed new licensing rules and France lifted a ban on vessels from the Channel Islands landing catches at its ports. The U.K. and French navies were last week drawn into the increasingly bitter dispute over post-Brexit fishing rights, after dozens of French boats mounted a protest near the main harbor in Jersey, the largest of the Channel Islands off the northwest coast of France. "Jersey just proposed to postpone the new technical restrictions until the end of July, so that we can start negotiations in the coming hours," France's maritime minister, Annick Girardin, told lawmakers on Tuesday. (BBG)

FRANCE: President Emmanuel Macron's promise to enshrine the fight against climate change in the French constitution via a referendum appeared moribund on Tuesday after the upper house watered down the ambitious wording of a government-sponsored bill. The initiative to state in the constitution that France "guarantees environmental protection and biological diversity, and combats climate change" originated in a citizen's body set up by Macron last year. Seeking the upper hand in what could be a key issue in next year's presidential election, the French leader promised a referendum on the bill if it gained approval in both houses of parliament. The National Assembly, where Macron has a majority, overwhelmingly voted in favour of the revision in March. But when the bill then went to the Senate, the body -- majority-ruled by the right-wing Republicans -- removed a key provision from the draft law before backing a new version in a vote late Monday. (France24)

FRANCE: The far-right looked set to win control of the regional authority encompassing Provence and the French Riviera in elections in June, according to one poll which, if proven correct, would show momentum is building behind Marine Le Pen. Le Pen's party, led by former conservative minister Thierry Mariani would come top in all alliance scenarios, according to the Ipsos Sopra Steria poll for France Television, with between 37% and 39% of the votes in the first round on June 20. In the second round of voting on June 27, Mariani would also come first. The scenario in which all parties rallied behind the best-placed one to defeat the far-right, a strategy known as the 'Republican front", was not tested, however. (RTRS)

SPAIN: Spain plans to waive its PCR testing requirement for British visitors from May 20, if the UK's Covid-19 infection rate allows. "[British holidaymakers] could come from May 20 onwards without a PCR if the incidence rates are below the range currently under review, which is around 50 [cases per 100,000 people]", Spain's tourism minister Maria Reyes Maroto told reporters after a weekly cabinet meeting on Tuesday. (Telegraph)

NETHERLANDS: The Dutch government has told a consortium of companies including BP Plc and Exxon MobilCorp. that it will spend as much as 2.1 billion euros ($2.6 billion) in the coming years to put some of their carbon emissions underground. The project at the Port of Rotterdam could sequester about 2.5 million metric tons of carbon dioxide annually by storing it in depleted gas fields in the seabed. The four companies involved—BP, Exxon, Air Liquide SA, and AirProducts and Chemicals Inc.—will receive state backing for the plan, according to Sjaak Poppe, a spokesman for theport. (BBG)

GREECE: Greece is moving ahead with its program to recover from the economic fallout of the pandemic even before initial funding arrives from the European Union, Finance Minster Christos Staikouras said. "We are among the first countries to submit our program and we've already started to implement some of the reforms and investments," Staikouras said in an interview in Athens. The government of Prime Minister Kyriakos Mitsotakis is ready to start labor market reforms, while projects such as providing tablets and laptops to students are already up and running. Rather than waiting for the initial disbursement of EU funds expected by the end of the summer, Greece is "covering initial costs with our own resources," Staikouras said. (BBG)

UKRAINE: Ukrainian prosecutors are seeking the arrest of Viktor Medvedchuk, a close friend of Russia's president Vladimir Putin and leader of Ukraine's main pro-Russia party, on suspicion of offences including "treason" and "looting of national resources" in Crimea. The development, announced by prosecutor-general Iryna Venediktova at a press conference and on Facebook on Tuesday, is likely to stoke further tensions between Kyiv and Moscow. It comes after the pro-western administration of Ukraine's president Volodymyr Zelensky sanctioned Medvedchuk earlier this year and shut three television channels linked to the multi-millionaire politician for allegedly spreading Russian disinformation. (FT)

U.S.

FED: The U.S. economy is on the road to recovery but still faces risks and it's premature to discuss reducing monetary policy support, according to a chorus of Federal Reserve officials. "The outlook is bright, but risks remain, and we are far from our goals," Governor Lael Brainard told a virtual event Tuesday hosted by the Society for Advancing Business Editing and Writing. "It will be important to remain patiently focused on achieving the maximum-employment and inflation outcomes in our guidance." Separate remarks from Cleveland Fed President Loretta Mester, San Francisco's Mary Daly, Philadelphia's Patrick Harker, Atlanta's Raphael Bostic and James Bullard of St. Louis voiced similar views. That common message pushes back against critics who say the Fed's near-zero interest rates and asset purchases of $120 billion a month are recklessly fanning financial market excess and future inflation. (BBG)

CORONAVIRUS: The Cleveland Clinic on Tuesday released a study showing that 99.75% of patients hospitalized with COVID-19 between Jan. 1 and April 13 were not fully vaccinated, according to data provided to Axios. Why it matters: Real-world evidence continues to show coronavirus vaccines are effective at keeping people from dying and out of hospitals. The Pfizer-BioNTech and Moderna vaccines have been found to be 95% and 94% effective, respectively, at preventing symptomatic infections. (Axios)

CORONAVIRUS: President Biden on Tuesday said his administration would soon offer a more "aggressive effort" to model the freedoms that people have once they are vaccinated, as a way to encourage more people to get shots. "We're just getting there now to the degree that I think you're going to see a more aggressive effort on our part to lay out that once vaccinated, it's not only you can hug your grandchildren. You can do a lot more," Biden said. (Hill)

CORONAVIRUS: The Biden administration has reached agreements with ride-sharing companies Uber and Lyft to offer free rides to coronavirus vaccination sites through July 4, the White House announced Tuesday. (Axios)

POLITICS: Senate Majority Leader Charles Schumer (D-N.Y.) offered fiery criticism of Republicans on Tuesday for efforts around the country to tighten voter laws amid unproven claims made by former President Trump that the 2020 election was stolen. Schumer, speaking at a Senate Rules Committee meeting on a sweeping elections overhaul bill, accused Republicans of trying to act upon the "big lie that the election was stolen" to "placate" and "please" Trump. "Unfortunately, the big lie is spreading like a cancer among Republicans. It's enveloping and consuming the Republican Party, in both houses of Congress," Schumer said. (Hill)

POLITICS: U.S. Representative Liz Cheney, speaking on the House floor on Tuesday, a day before her expected ouster from a Republican leadership post, chastised her party colleagues for not standing up to former President Donald Trump and his false claim that the November election was stolen. Cheney, the No. 3 Republican in the House of Representatives, was one of 10 Republicans in the House who voted to impeach Trump in January after he delivered a fiery Jan. 6 speech to supporters, many of whom then stormed the U.S. Capitol in a bid to block certification of his election loss to Democrat Joe Biden. "Remaining silent and ignoring the lie emboldens the liar. I will not participate in that," Cheney said Tuesday night. (RTRS)

POLITICS: Show Recall Vote Against California Gov. Newsom Failing To Gain Steam

- The latest Berkeley/IGS poll on the expected recall election against California Governor Gavin Newsom shows the initiative failing to gain traction, while potential Republican challengers are also struggling to break through into state-wide consciousness - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: Speaker Nancy Pelosi supports House Democrats who are pushing for funding in the upcoming infrastructure package to allow the U.S. Postal Service to buy an all-electric fleet, according to a spokesperson. (BBG)

FUEL: Colonial Pipeline Co. told federal officials it will know by late Wednesday whether it's safe to restart gasoline and diesel shipments that have been on hold since criminal hackers targeted the company last week. Beyond that deadline, vouchsafed to U.S. Energy Secretary Jennifer Granholm by Colonial Chief Executive Officer Joe Blount, details about when the biggest North American fuel pipeline will recover have been scant. It's been more than 24 hours since Colonial issued a statement pledging to be back online by the weekend, and the growing frustration among political leaders is palpable as gas stations across the East and South run dry. (BBG)

FUEL: The Biden administration moved Tuesday to ease gasoline shortages caused by a ransomware attack on the nation's largest pipeline network, as concerns grew that spiking fuel prices and supply disruptions could hinder travel while the nation emerges from the coronavirus pandemic. The Environmental Protection Agency waived gasoline volatility requirements across 12 states and Washington, D.C., to help bring more fuel to areas normally well supplied by the Colonial Pipeline. The Department of Transportation also announced initial steps that could permit foreign tankers to transport gasoline and diesel to East Coast ports, despite 101-year-old Jones Act mandates to use American vessels. The actions are among several options President Joe Biden has to blunt the potential political fallout from fuel shortages and rising prices just as he's trying to jump start the economy after the worst pandemic in a century. "We're going to move in lightning speed," Homeland Security Secretary Alejandro Mayorkas said at a White House briefing. (BBG)

FUEL: Florida Gov. Ron DeSantis declared a state of emergency Tuesday amid concerns of gas shortages and price hikes after a cyberattack on a critical U.S. fuel pipeline. The executive order signed by DeSantis activates the Florida National Guard, as need, and directs state emergency management officials to work with federal and local officials. The declaration comes as people in several states, particularly northwest Florida, reported waiting in long lines to fill up their cars. (NBC)

GAS: The US Energy Information Administration May 11 lowered its forecasts for natural gas production for the remainder of 2021, even as it expected growing LNG exports and domestic consumption would help push Henry Hub spot prices higher. In its May Short-Term Energy Outlook and an accompanying report on the summer electricity sector, the agency also cast higher natural gas prices as dampening use of the fuel in the power sector. EIA lowered by 810 MMcf/d to 97.51 Bcf/d its natural gas marketed production estimate for the US in the second quarter and trimmed the Q3 production forecast by 990 MMcf/d to 98.13 Bcf/d. Dry gas production was expected to be relatively flat in May, ahead of a rise starting in mid-2021, reflecting sustained higher forecast prices for natural gas and crude oil, compared with 2020, the report said. (Platt's)

OTHER

ISRAEL: A 13-storey residential block in the Gaza Strip collapsed on Tuesday night after being hit by an Israeli air strike, witnesses said, and three people were wounded in a retaliatory rocket attack from Gaza on Tel Aviv. Video footage showed three plumes of thick, black smoke rising from the Gaza tower, its upper storeys still intact as they fell. The building houses an office used by the political leadership of the enclave's Islamist rulers, Hamas. (RTRS)

ISRAEL: The Israeli military has continued its bombardment of the besieged Gaza Strip early on Wednesday, targeting several areas after rockets were fired from the enclave. It is the most intense airstrikes in Gaza since the bombardment in 2014. Health authorities in Gaza said at least 35 Palestinians – including 10 children – were killed in Israeli air strikes on the Strip since late on Monday, after Hamas launched rockets from the coastal territory towards Israel. (Al Jazeera)

ISRAEL: The Hamas militant group targeted Tel Aviv with dozens of rockets on Tuesday evening after Israel stepped up the intensity of its air strikes on the Gaza Strip. Flights were rerouted as the skies over central Tel Aviv were lit up with Israel's Iron Dome defences tracking dozens of rockets simultaneously. One hit a reportedly empty bus in Holon to the south of Tel Aviv. At least six people received medical attention and more casualties are expected. "Hamas will receive blows here that it did not expect," Netanyahu said on Tuesday evening. Hamas responded with a vow to attack Tel Aviv, saying that it had launched 130 rockets at a time in a probable attempt to overwhelm the Israeli air defences. Benny Gantz, defence minister, who has ordered 5,000 reserve troops back to duty, said earlier that Israel's air campaign would continue until "its operational goals are met". (FT)

ISRAEL: The IDF says it has killed two senior Hamas leaders in a targeted strike on a building they were in. "In a combined operation between the IDF and the Shin Bet security service about two hours ago we eliminated key operatives from Hamas's military intelligence system," the IDF says in a statement. (Times of Israel)

INDIA: Prime Minister Narendra Modi will not be travelling to UK to attend the G7 summit. The decision has been taken in view of the prevailing pandemic situation in the country. The ministry of external affairs (MEA) on Tuesday evening appreciated UK PM Boris Johnson's invitation to PM Modi, while also making known that the PM will not travel to UK "in person." (Times of India)

INDIA:India is calling on China to help stop surging prices and increase cargo flights to get urgently needed supplies to the pandemic-ravaged country. Indian companies have sourced oxygen concentrators and other medical supplies from their Chinese counterparts but have been hit with prices at more than double the usual rate, while cargo flights between the two countries have yet to return to previous levels. (SCMP)

TAIWAN: Taiwanese Foreign Minister Joseph Wu "smears" China, Taiwan Affairs Office spokeswoman Zhu Fenglian says in response to question over whether he would be put on a watchlist of independence supporters. China will take any necessary to punish separatists like Wu, Zhu says. Zhu also avoided a question on whether KMT representatives will be invited to events celebrating the Communist Party's 100th anniversary later this year. (BBG)

TAIWAN: Taiwan may elevate alert level on Covid-19 further today after banning large gatherings Tuesday, Taipei-based Liberty Times reports, citing health minister Chen Shih-chung. Government may ban indoor gatherings of over 5 people and outdoor gatherings of over 10 people, and may request non-essential businesses to close their doors (BBG)

IRAN: "Fluctuations" at Iran's Natanz plant pushed the purity to which it enriched uranium to 63%, higher than the announced 60% that complicated talks to revive its nuclear deal with world powers, a report by the U.N. nuclear watchdog said on Tuesday. Iran made the shift to 60%, a big step towards nuclear weapons-grade from the 20% previously achieved, last month in response to an explosion and power cut at Natanz that Tehran has blamed on Israel and appears to have damaged its enrichment output at a larger, underground facility there. (RTRS)

RUSSIA: Russia has proposed discussing arms control and security issues at a possible meeting between Russian President Vladimir Putin and U.S. President Joe Biden, Foreign Minister Sergei Lavrov said on Tuesday. Lavrov said Russia was still waiting for answers from Washington on a proposed summit between the two leaders, and that Moscow had proposed that strategic nuclear stability, both offensive and defensive, be high on the agenda. In separate comments, U.S. ambassador on disarmament Robert Wood said preparations for the talks were underway. (RTRS)

CANADA: Prime Minister Justin Trudeau urged provinces today to maintain strict public health measures until COVID-19 case counts are much lower than they are now — so that Canadians can enjoy a "one-dose summer." Speaking to reporters at a COVID-19 briefing, Trudeau said that with the steady supply of vaccines now streaming into the country, there will be enough shots to immunize every eligible Canadian with at least one dose by the end of June. But vaccinations alone will not crush the third wave stretching the country's health care system to its limits, he added. (CBC)

BRAZIL: Brazil's health regulator recommended officials stop giving AstraZeneca Plc's Covid-19 shots topregnant women as authorities investigate the reported death of a woman in Rio de Janeiro who had received thevaccine. (BBG)

MEXICO: President Andres Manuel Lopez Obrador said on Tuesday he supported the Mexican attorney general office's criminal investigation of two leading gubernatorial candidates, after the opposition said the probe was politically motivated. Adrian de la Garza from the Institutional Revolutionary Party (PRI) is being investigated for vote buying and Samuel Garcia from the Citizen Movement party on allegations of suspect campaign financing ahead of June 6 elections, the attorney general's office, known as FGR, said in a statement on Monday. (RTRS)

PERU: There's too much uncertainty to review Peru's sovereign credit rating before the second round of presidential elections scheduled for June 6, said Livia Honsel, director and lead analyst for sovereign ratings in Latin America at S&P Global Ratings. The runoff will be "critical," but regardless of who wins, governability will be challenging as congress is likely to support populist measures. Early pension fund withdrawals could eventually weaken the system, but are not "a short-term risk for the sovereign rating as the long-term significance is not clear." (BBG)

OIL: OPEC on Tuesday stuck to its prediction of a strong recovery in world oil demand in 2021 as growth in China and the United States counters the coronavirus crisis in India, an outlook that bolsters the group's plan to gradually ease output cuts. In a monthly report, the Organization of the Petroleum Exporting Countries said demand will rise by 5.95 million barrels per day (bpd) this year, or 6.6%. The forecast was unchanged from last month. The report's optimism comes even as it warns of "significant uncertainties," mainly around the pandemic, and as concern about India weighs on oil prices. Crude fell after the report was released but is still up 30% this year at near $68 a barrel. "India is currently facing severe COVID-19-related challenges and will therefore face a negative impact on its recovery in the second quarter, but it is expected to continue improving its momentum again in the second half of 2021," OPEC said in its monthly report. (RTRS)

CHINA

PBOC: The PBOC may maintain policy rates for open market operations for the rest of this year, judging by the Q1 monetary policy report released on Tuesday, which said the effects of rising U.S. Treasury yields and fast increases of commodity prices are both under control, CITIC Securities said in a research note. The central bank is likely to continue relying on daily OMOs to moderate daily repo rates as a benchmark, CITIC said. (MNI)

TAXES: China may not introduce a property tax soon given its economy is recovering and in transformation, the Shanghai Securities News reported citing Zhang Yiqun, a member of the Society of Public Finance of China affiliated with the Ministry of Finance. Macro policies need to be consistent and stable to solidify the post-pandemic growth, so the environment is "immature" for such a tax, Zhang said in an apparent attempt to ease concerns after property tax was raised by the ministry in recent reports. China will nonetheless increase controls over the property markets in core urban centers, Zhang was reported saying. (MNI)

DATA: China's PPI is likely to further gain 7% y/y in May following a 6.8% y/y increase in April, the fastest pace in more than three years, before slowing in Q4, the 21st Century Business Herald said citing Wu Chaoming, the chief economist with Chasing Securities. The current rising prices of commodities may not lead to higher CPI given competition among producers and moderate demand from consumers, while the strong yuan also helps tame prices of imported material, Wu was cited saying. April's CPI and PPI likely won't prompt changes in central bank policies, the newspaper said citing analysts. (MNI)

CORONAVIRUS: Sinovac Biotech Ltd.'s vaccine is wiping out Covid-19 among health workers in Indonesia, an encouraging sign for the dozens of developing countries reliant on the controversial Chinese shot, which performed far worse than western vaccines in clinical trials. Indonesia tracked 25,374 health workers in capital city Jakarta for 28 days after they received their second dose and found that the vaccine protected 100% of them from death and 96% from hospitalization as soon as seven days after, said Health Minister Budi Gunadi Sadikin in an interview on Tuesday. The workers were tracked until late February. Sadikin also said that 94% of the workers had been protected against infection -- an extraordinary result that goes beyond what was measured in the shot's numerous clinical trials -- though it's unclear if the workers were uniformly screened to detect asymptomatic carriers. (BBG)

OVERNIGHT DATA

SOUTH KOREA APR UNEMPLOYMENT 3.7%; MEDIAN 3.9%; MAR 3.9%

SOUTH KOREA APR BANK LENDING TO HOUSEHOLD TOTAL KRW1,025.7TN; MAR KRW1,009.6TN

CHINA MARKETS

PBOC NET INJECTS CNY10BN VIA OMOS WEDS

The People's Bank of China (PBOC) conducted CNY10 billion via 7-dayreverse repos with the rate unchanged at 2.2% on Wednesday. This resulted in a net injection of CNY10 billion given no maturity of reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2000% at 09:24 am local time from the close of 2.0020% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 37 on Tuesday vs 39 on Monday. A lower index indicates a weaker expectation for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.4258 WEDS VS 6.4254

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4258 on Wednesday, compared with the 6.4254 set on Tuesday.

MARKETS

SNAPSHOT: Rocket Fire Intensifies

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 613.24 points at 27995.35

- ASX 200 down 77.867 points at 7019.1

- Shanghai Comp. down 0.425 points at 3441.42

- JGB 10-Yr future down 5 ticks at 151.42, yield up 0.2bp at 0.080%

- Aussie 10-Yr future down 5.5 ticks at 98.275, yield up 5.3bp at 1.775%

- U.S. 10-Yr future -0-01 at 132-13+, yield up 0.18bp at 1.624%

- WTI crude up $0.07 at $65.33, Gold down $8.28 at $1829.14

- USD/JPY up 25 pips at Y108.87

- FED OFFICIALS SEE BRIGHT ECONOMIC OUTLOOK - AND A NEED FOR AID (BBG)

- EXCHANGE OF FIRE BETWEEN ISRAEL DEFENCE FORCES AND HAMAS ESCALATES

- COLONIAL FACES DEADLINE TO DECIDE ON HACKED PIPELINE RESTART (BBG)

- WHITE HOUSE FACES RISING PRESSURE AS GASOLINE SHORTAGES GROW (BBG)

BOND SUMMARY: Aussie Yield Curve Bear Steepens On Federal Budget, T-Notes Edge Lower In Quiet Asia-Pac Trade

Australian yield curve bear steepened, digesting overnight impetus from U.S. Tsys & the 2021/22 Federal Budget delivered by Treasurer Frydenberg yesterday evening. The government made bold spending promises and forecast a wider than expected budget deficit of A$106.6bn., noting that 2021/22 debt issuance would total A$130bn (that is slightly more than expected) and revising issuance plan for the remainder of this year to A$210bn (of which $198 billion has been completed). That said, cash ACGB yields trade off steeps, last 0.5-5.9bp higher across the curve, with 10s underperforming. YM sits -1.0, with XM -6.0 as we type; futures contracts have been rangebound. Bills last seen unch. to -1 tick through the reds. Worth noting that the RBA offered to buy A$1.0bn of semis today, while across the Tasman, NZGBs took a hit on the back of weak pricing seen at the latest round of RBNZ LSAP ops.

- T-Notes were biased lower but Tuesday's low of 132-12+ provided firm support. The contract last sits -0-01+ at 132-13, as e-minis slipped in a fairly quiet Asia-Pac session. The escalation of violence in Gaza may have weighed on risk appetite amid the absence of other catalysts, as IDF & Hamas continued to trade fire. Cash Tsy yields are broadly higher, albeit very marginally. Eurodollar futures last trade +0.5 to -0.5 tick through the reds. April CPI report, 10-Year auction & Fedspeak take focus in the U.S. today.

- JGBs saw little in the way of domestic drivers. Futures eased off ahead of the lunch break and last trade at 151.34, 13 ticks below Tuesday's settlement. Cash JGB yields were marginally mixed, with 4s underperforming. Focus in Japan moves to Thursday's 30-Year debt supply.

AUSSIE BONDS: AOFM Provides Guidance On Planned Debt Issuance

The AOFM writes the following in an emailed note:

- Issuance of Treasury Bonds in 2021-22 will be around $130 billion.

- Issuance of Treasury Indexed Bonds by tender in 2021-22 will be around $2-2.5 billion.

- The AOFM will remain active in the Treasury Notes market with regular issuance for cash management purposes.

- Issuance of Treasury Bonds for 2020-21 has been revised to around $210 billion (of which $198 billion has been completed). Issuance of Treasury Indexed Bonds for 2020-21 will be around $2.5 billion (of which $2.05 billion has been completed).

- More detailed guidance on issuance plans for 2021-22 will be provided on 2 July 2021.

- Details of each week's transactions will be announced at midday on the preceding Friday.

EQUITIES: Tech Rout Continues

Equity markets in Asia mostly in the red as the global tech rout continues; the Taiex is the worst performer, down over 5% at its nadir which equates to over 10% from its April highs. South Korea also sustaining heavy losses despite strong labour market data. Japanese markets also in the red for the second day, having wiped out all of last week's gains. The Hang Seng and bourses in mainland China have managed to just about keep their head above water. In the US futures are negative with the Nasdaq leading the way lower, markets await the US CPI report as well as a speech from US President Biden.

OIL: Crude Futures Tread Water

After building on Tuesday's gains earlier in the session oil has since retreated and trades around neutral levels; WTI is up $0.01 from settlement at $65.29/bbl while Brent is flat at $68.55/bbl. Earlier Colonial Pipeline said it was making progress on returning system to services and that it was prioritizing markets with supply constraints. The company said it should know later today if it is safe to restart the network. US Energy Sec Granholm said it could take days to fully restore shipments. After market on Tuesday API data showed headline crude stocks fell 2.53m bbls, distillate stocks fell 900k bbls and stocks at Cushing fell 1.2m bbls. Gasoline stocks rose 5.6m bbls. Elsewhere, markets continue to digest the EIA forecast for lower output though 2022, while OPEC raised demand forecasts. The IEA will release its monthly report today, while participants will also watch for US DOE stockpile data.

GOLD: Falling

Bullion declined in Asia, undermining its recovery after bouncing during the US session on Tuesday. The yellow metal last trades at $1828.71, down $8.71 having hit session lows at $1826. The decline in gold has come despite general risk aversion, the greenback has risen with markets now focusing on the US CPI report as well as a speech from US President Biden after fairly upbeat assessments of the economy from several Fed speakers yesterday.

FOREX: USD Gains Ahead Of CPI Report, AUD Softens After Budget Speech

The greenback garnered some strength in Asia-Pac hours, as U.S. equity index futures edged lower while participants prepared for the upcoming U.S. CPI report. The DXY extended its recovery from a multi-week low printed on Tuesday. Most G10 crosses respected tight ranges as news and data flow was relatively subdued, albeit continued exchange of fire in Gaza may have reduced appetite for riskier currencies.

- The Antipodeans traded on a softer footing but AUD/USD struggled to penetrate the $0.7800 mark. BBG trader sources flagged the cutting of long positions in AUD initiated before the delivery of Federal Budget, while CBA warned that Australia would "mostly likely" lose its AAA credit rating.

- The PBOC set the central USD/CNY mid-point at CNY6.4258, 9 pips above sell-side estimates, which may have helped USD/CNH grind higher later on.

- Focus turns to U.S. CPI, final German CPI, UK quarterly GDP & monthly economic activity indicators as well as speeches from BoE's Bailey, ECB's Centeno, Riksbank's Breman and Fed's Clarida, Rosengren, Bostic & Harker.

FOREX OPTIONS: Expiries for May12 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2000(E542mln)

- USD/JPY: Y108.25-35($769mln), Y109.95-00($783mln)

- AUD/USD: $0.7900(A$619mln)

- USD/CAD: C$1.2800($610mln)

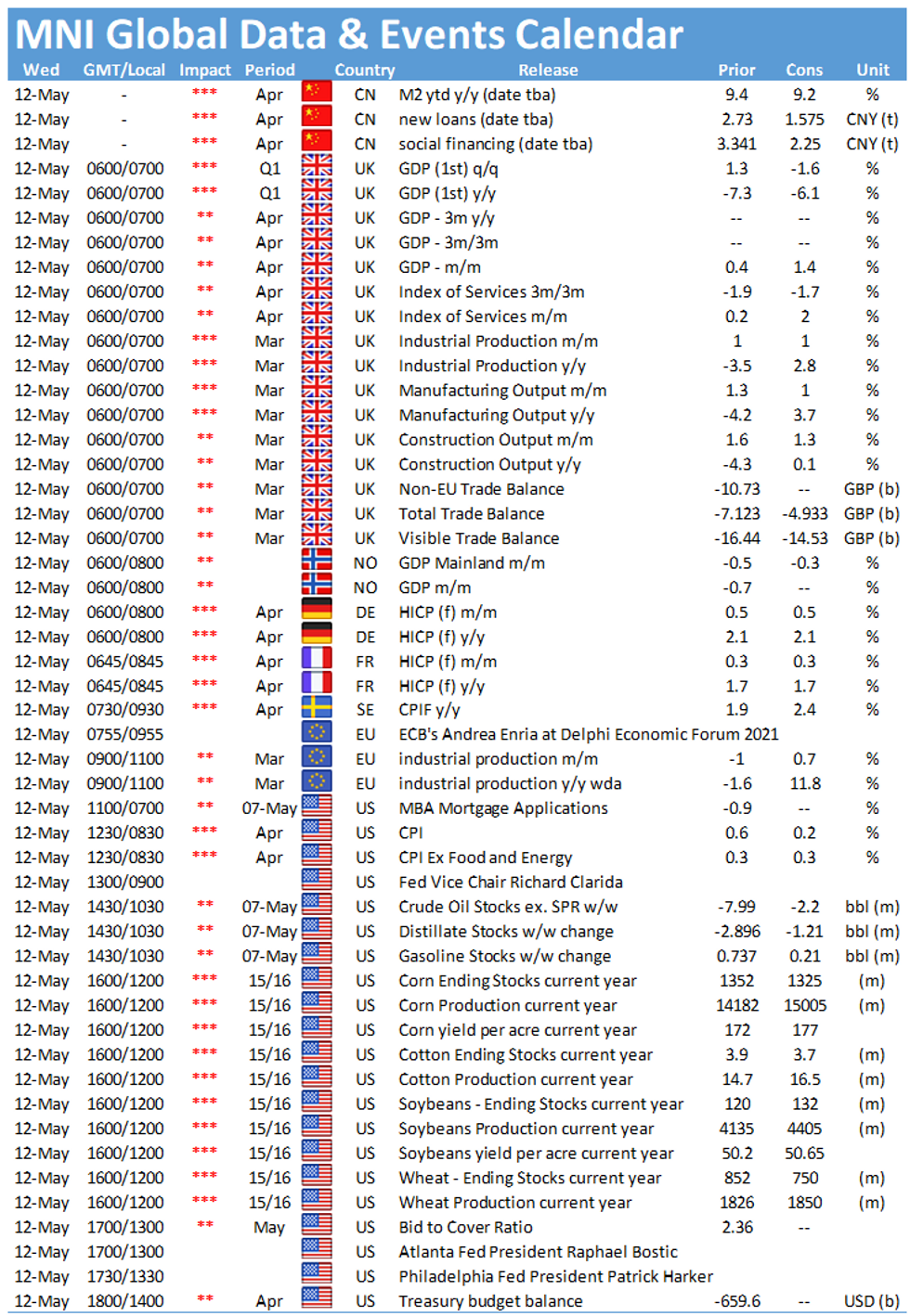

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.