-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Colonial Restarts Operations, Israel & Hamas Escalate Fighting

EXECUTIVE SUMMARY

- BOE'S HALDANE: BRITAIN'S TENNIS BALL BOUNCE WILL PUT US ON TOP OF WORLD (Daily Mail)

- ISRAEL STEPS UP GAZA OFFENSIVE, KILLS SENIOR HAMAS FIGURES (AP)

- COLONIAL PIPELINE RESTARTS OPERATIONS

- BIDEN LIFTS U.S. SHIP MANDATE TO EASE GASOLINE SHORTAGES (BBG)

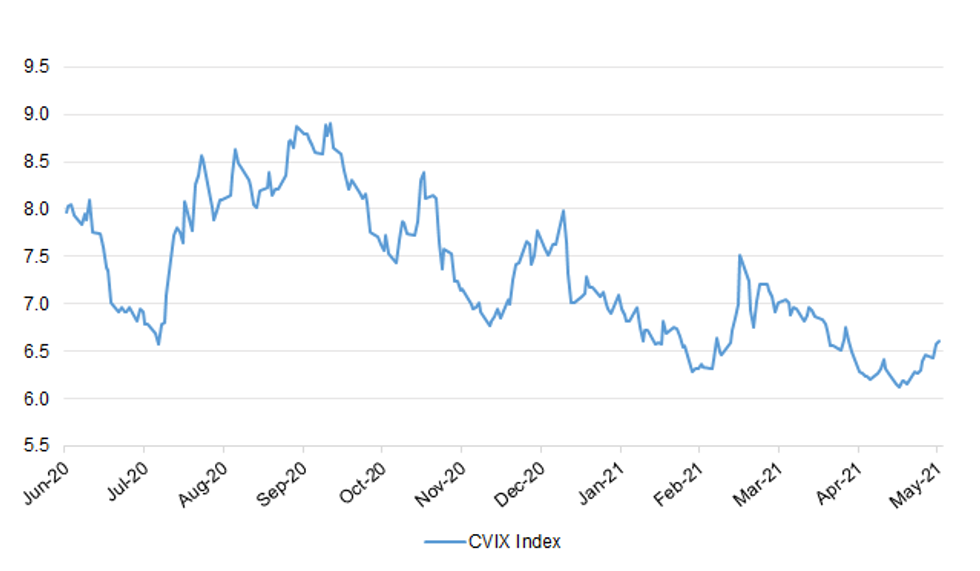

Fig. 1: CVIX Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BOE: Britain's economy will bounce back from Covid-19 like a 'tennis ball', putting the country at the top of the G7 growth league, a Bank of England boss says today. Chief economist Andy Haldane says the UK's recovery will be so strong that as many new jobs could be created as lost this year, meaning 'little or no' further rise in dole queues. He foresees that the UK's performance may surpass other nations in the G7, made up of the world's leading economies including the US, France and Germany. 'Spring has sprung for the UK economy,' Mr Haldane declares in an article for the Daily Mail today. But he warns that the boom will turn to bust if inflation is allowed to run riot. A year from now, it is 'realistic' to expect economic activity to be 'comfortably above pre-Covid levels', for unemployment to be falling and for UK growth to be in 'double-digits'. The housing market is 'going gangbusters', helped by the extension of the stamp duty exemption in the Budget, he adds. (Daily Mail)

BOE: MNI BRIEF: BOE Haskel: Very Aware Of Supply Constraints

- Bank of England Monetary Policy Committee member Jonathan Haskel downplayed the likely record breaking growth in the Covid recovery Wednesday, saying that it is a temporary effect. "If there is a lot of scarring then it is possible when demand comes back again that it might run into ...supply constraints," he said - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

HOUSING: U.K. house prices marched higher again in April as rising demand and a dearth of properties for sale added fuel to a booming market. In a report published Thursday, the Royal Institution of Chartered Surveyors said a lack of new listings was now the biggest concern as demand for property increased in every region of the country. That's stoking prices in a market already buoyed by a temporary tax cut and lockdown-inspired searches for extra space. Real-estate agents expect prices to keep rising over the next year." Housing supply, or more pertinently, the shortfall in supply relative to demand is the key theme coming through loud and clear," said Simon Rubinsohn, chief economist at RICS. On average, agents now have just 40 properties for sale on their books. (BBG)

BREXIT: France aims to delay access to the European single market for U.K. financial firms until it considers that the British government is honoring its post-Brexit commitments on fishing rights, according to people familiar with the matter. French officials are looking to stall a regulatory cooperation agreement on finance as part of a broader effort to bring pressure to bear on the U.K., the people said, asking not to be named discussing private conversations. The non-binding Memorandum of Understanding would be a first step on future cooperation and pave the way to granting market access to U.K. firms further down the track. (BBG)

NORTHERN IRELAND: The Brexit minister, Lord Frost, and the Northern Ireland secretary, Brandon Lewis, met representatives of loyalist paramilitaries on Monday during a visit to Northern Ireland, it has emerged. The Loyalist Communities Council (LCC), a body which includes representatives of the UVF, UDA and Red Hand Commando paramilitary groups, confirmed a "small delegation" of its members met the ministers on Monday to discuss continuing concerns over checks on goods coming into the region from Great Britain caused by Brexit. "The delegation emphasised the need for significant change to the Northern Ireland protocol to bring it back into consistency with the Belfast agreement and to remove the clear change in the status of Northern Ireland that has occurred due to the imposition of the protocol," it said. (Guardian)

EUROPE

ECB: keep credit flowing to fragile economies, according to people familiar with the matter. Lenders on the continent have been pressing officials to be allowed to keep excluding deposits held at central banks when calculating their leverage ratio. The exemption, set to expire June 27, effectively makes banks looks stronger and allows them to do more business with existing financial reserves. (BBG)

EU: "The current fiscal rules were inadequate, and they are even more inadequate for an economy exiting a pandemic," Italian Premier Mario Draghi tells lawmakers during parliamentary question time in Rome. "In the next few years we'll have to concentrate mainly on relaunching economic growth, which is also the best way to ensure the sustainability of public accounts." (BBG)

EU: Ending the block on exports from countries like the U.S. and the U.K. would be "easier" than waiving vaccine patents, Italian Prime Minister Mario Draghi says in parliamentary hearing in Rome on Wednesday. (BBG)

GERMANY: Cabinet ministers and Chancellor Angela Merkel on Wednesday agreed on a plan that includes making the country climate-neutral five years earlier than previously planned. The legislation is the German government's response to an unprecedented April Constitutional Court ruling that demanded that the country share the burden of emissions reduction between older and younger generations. (Deutsche Welle)

FRANCE: French President Emmanuel Macron's LREM party came under pressure after dropping its support for a candidate because she appeared on a local election campaign poster wearing a headscarf. LREM chief Stanislas Guerini said earlier this week that Sara Zemmahi, the candidate running on a ticket in a southern French district, no longer had the support of the party as its values are not compatible with the "ostentatious wearing of religious symbols." That sparked a debate over the legality of the move and the values of Macron's movement. "With party leadership I fix a political line," Guerini said on RTL radio on Tuesday. "The law is not to be questioned, but the law also says political movements decide on the support they give to candidates." (BBG)

FRANCE: France's parliament on Wednesday backed President Emmanuel Macron's plan to introduce a Covid "health pass", after deputies pushed back against the move arguing it was discriminatory for those not yet vaccinated. Macron wants the pass to help speed up the lifting of coronavirus restrictions as his Covid vaccination programme gathers pace. It will be used to travel outside France for people showing proof of coronavirus vaccination, a recent negative test or recovery from a Covid-19 infection. (France24)

UKRAINE: The European Union says Russia is trying to gradually absorb parts of eastern Ukraine, according to a document the bloc shared this week with member states. In the paper, seen by Bloomberg, the EU says steps by the Kremlin such as organizing illegitimate elections and issuing passports to locals are "aimed at de facto integration of Ukraine's non-governmental-controlled areas into Russia." The EU's foreign-affairs arm, the EEAS, will prepare a report on the matter, according to the paper. Russia has repeatedly denied plans to take over the territories, saying it's committed to a now-stalled 2015 peace deal under which they'd receive substantial autonomy within Ukraine. (BBG)

U.S.

FED: MNI INTERVIEW: Supply Drives Record Price Expectation-Fed Econ

- Supply disruptions have propelled firms' short-run inflation expectations to a record high 2.8% this month and may start feeding longer run views, Atlanta Fed policy adviser Brent Meyer told MNI on Wednesday - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: Senate Minority Leader Mitch McConnell (R-Ky.) sounded an optimistic note on Wednesday about the chances of getting a deal with President Biden on infrastructure. McConnell's positive rhetoric comes after he and the other three top congressional leaders met with Biden and Vice President Harris, the first time the president has met with the top four leaders in the Oval Office. (Hill)

FISCAL: The top Republicans in the House and Senate told reporters after meeting with President Biden at the White House that "there is a bipartisan desire to get an outcome" on an infrastructure package, but stressed that revisiting the 2017 tax cuts is a "red line." Why it matters: Wednesday marked the first time that Biden has hosted Senate Minority Leader Mitch McConnell (R-Ky.) and House Minority Leader Kevin McCarthy (R-Calif.) at the White House. (Axios)

POLITICS: In an extraordinary bow to former President Trump, House Republicans voted Wednesday to purge GOP Conference Chairwoman Liz Cheney from her leadership post, punishing the conservative Wyoming Republican for daring to refute Trump's lie that the 2020 election was stolen. (Hill)

FUEL: Secretary of Homeland Security Alejandro N. Mayorkas approved a temporary and targeted Jones Act waiver request to an individual company, according to a statement. Waiver will help "provide for the transport of oil products between the Gulf Coast and East Coast ports to ease oil supply constraints as a result of the interruptions in the operations of the Colonial Pipeline." Decision was made after "careful consideration and consultation with interagency partners across the federal government." Departments of Transportation, Energy, and Defense were consulted in order to assess the justification for the waiver request. (BBG)

FUEL: The nation's largest fuel pipeline restarted operations Wednesday, days after it was forced to shut down by a gang of hackers. Colonial initiated the restart of pipeline operations late Wednesday, saying in a statement that "all lines, including those lateral lines that have been running manually, will return to normal operations." But it will take several days for deliveries to return to normal, the company said. (AP)

FUEL: Panic over the shutdown of a vital fuel pipeline in the United States has driven Americans to search for gas for their vehicles, causing several thousand gas stations across the nation to run out of fuel. Hundreds of others are limiting sales. State officials in the Southeast have made efforts to stabilize the flow of gas, but consumers have become gripped by a fear that there could be a gas shortage. Many have turned to social media to vent, posting videos and pictures of long lines and empty pumps at filling stations. Some have begun comparing President Biden to President Jimmy Carter, who was the nation's leader when gas lines rattled the country after the Iranian revolution and other Middle East troubles. (NYT)

OTHER

U.S./CHINA: The Pentagon has failed to give Congress a legally required report on Chinese companies with military ties, as US President Joe Biden nears a decision on whether Americans can invest in such groups. Congress required the US Department of Defense in January to produce a report by April 15. But the Pentagon told lawmakers it has missed the deadline, according to two people familiar with the report. The delay comes as the Biden administration decides whether to keep an executive order signed by Donald Trump, the former president, that banned Americans from investing in Chinese companies named in a previous Pentagon blacklist. (FT)

WHO: The COVID-19 pandemic was a "preventable disaster" that exposed weak links "at every point" of the preparedness process, according to a World Health Organization-commissioned report published Wednesday. Why it matters: The report by the Independent Panel for Pandemic Preparedness and Response criticized governments worldwide for being unprepared for the pandemic despite the prevalence of past "global health threats," such as Ebola, Zika, and SARS outbreaks. (Axios)

CORONAVIRUS: United Nations Secretary-General Antonio Guterres called on Wednesday for the need to double the capacity of COVID-19 vaccine production and for fairer redistribution of the shots in the developing world, which faces new waves of the coronavirus. Many countries are experiencing shortages of the vaccine, especially India, worsening a dire second wave of infections that has left hospitals and morgues overflowing while families scramble for increasingly scarce medicines and oxygen. At the same time, the European Union has reserved a surplus of the vaccines. (RTRS)

ISRAEL: Israel on Wednesday pressed ahead with a fierce military offensive in the Gaza Strip, killing as many as 10 senior Hamas military figures and toppling a pair of high-rise towers housing Hamas facilities in airstrikes. The Islamic militant group showed no signs of backing down and fired hundreds of rockets at Israeli cities. In just three days, this latest round of fighting between the bitter enemies has already begun to resemble — and even exceed — a devastating 50-day war in 2014. Gaza militants continued to bombard Israel with nonstop rocket fire throughout the day and into early Thursday. The attacks brought life to a standstill in southern communities near Gaza, but also reached as far north as the Tel Aviv area, about 70 kilometers (45 miles) to the north, for a second straight day. Gaza's Health Ministry said the death toll rose to 69 Palestinians, including 16 children and six women. Islamic Jihad confirmed the deaths of seven militants, while Hamas acknowledged that a top commander and several other members were killed. The Israeli military claims the number of militants killed so far is much higher than Hamas has acknowledged. More raids conducted early Thursday were aimed at several "strategically significant" facilities for Hamas, including a bank and a compound for a naval squad, the military said. While United Nations and Egyptian officials have said that cease-fire efforts are underway, there were no signs of progress. Israeli television's Channel 12 reported late Wednesday that Prime Minister Benjamin Netanyahu's Security Cabinet authorized a widening of the offensive. (AP)

ISRAEL: [IDF spokesman] Zilberman says plans for a possible ground invasion of the Gaza Strip will be presented to the IDF General Staff for approval later today. These plans, which are being assembled by the Gaza Division and Southern Command, can then be given to Israel's political leadership for consideration. The IDF in recent days has deployed additional ground troops to the border — from the Paratroopers Brigade, Golani Infantry Brigade and 7th Armored Brigade — ahead of a potential incursion, but no decision to go forward with such a campaign has been made yet. (Times of Israel)

ISRAEL: Israel's military was facing questions on Wednesday as to whether its Iron Dome missile defence system needed an upgrade, after five Israeli civilians were killed by rocket strikes. The system, which Israeli officials say has a 90 per cent interception rate, has already avoided heavy loss of life in Tel Aviv, Ashkelon and other cities which became a focal point for Hamas as it sought to overwhelm air defences. But on Wednesday, Israeli analysts said that for some time intelligence sources had been warning that Hamas had significantly improved its weaponry, to the extent that it could "pierce the Iron Dome shield." (Telegraph)

BOJ: MNI BRIEF: BOJ Sees Risk To Banks From Mixed Services Showing

- Bank of Japan officials are paying close attention to the varying impact of the virus-related emergency on in-person services and the uneven consequences for vulnerable regional banks although they do not see any signs of growing risk to the financial system for now, MNI understands - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

- Bank of Japan Governor Haruhiko Kuroda said on Thursday thatthe BOJ continues to manage monetary policy in a flexible manner while payingattention to financial imbalance and other risks and that now isn't the timefor the bank to discuss when to exit from its easy policy - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

BOC: MNI INTERVIEW: BOC May Hold QE Bonds and Claim No Loss-CD Howe

- The Bank of Canada will likely hold bonds purchased via quantitative easing just as the Fed did after the 2008 recession, meaning no losses will be claimed under the indemnity deal struck with the government lastyear, former BOC analyst and associate research director at C.D. Howe Institute Jeremy Kronick told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

BRAZIL: Former President Luiz Inacio Lula da Silva is set to defeat the country's current leader Jair Bolsonaro by a wide margin in next year's presidential runoff, according to a survey by Datafolha. Lula would capture 41% of votes in the first round of the election, compared to Bolsonaro's 23%, the poll released Wednesday said. (BBG)

NEW ZEALAND: Travel will soon be back on the cards for government ministers and officials involved in negotiating trade deals. Prime Minister Jacinda Ardern will lead a "trade and promotional" delegation to Australia in early July. In June, Trade Minister Damien O'Connor will travel to London and Brussels to progress negotiations for New Zealand's free trade agreements with the United Kingdom and European Union. This will be the first ministerial trip since COVID-19 hit. Ardern, in a speech delivered at a BusinessNZ lunch on Thursday, also said she intended to "actively pursue an enhanced trade relationship with the US over the coming term". She mentioned the change of administration in the US, and a "deepening relationship with President Joe Biden across a range of issues". (interest.co.nz)

NEW ZEALAND: Two people in New Zealand have identified themselves as casual contacts of the recently-announced Melbourne Covid-19 community case, the Ministry of Health says. Both cases have contacted Healthline and have been provided with advice. Testing has been arranged, the ministry said on Thursday. (Stuff)

BOK: South Korea's central bank should continue to keep monetary policy loose as the economy's recovery still isn't solid, a state-funded think tank said after raising its growth and inflation outlook for this year. An improving global economy and rising oil prices will temporarily add upward pressure on headline inflation, but the country's core price gauge, which better reflects domestic demand, remains below the Bank of Korea's 2% target "by a large margin," the Korea Development Institute said in its semi-annual economic outlook on Thursday. (BBG)

TAIWAN: The regulator will continue monitoring virus impact on economy and Taiwan stocks, and will adopt measures when needed to deal with "irrational" declines in the stock market, according to statement from Financial Supervisory Commission Wednesday. (BBG)

BITCOIN: Tesla Inc.'s Chief Executive Officer Elon Musk said the electric-vehicle manufacturer is suspending purchases using Bitcoin, triggering a slide in the digital currency. In a post on Twitter Wednesday, Musk cited concerns about "rapidly increasing use of fossil fuels for Bitcoin mining and transactions," while signaling that Tesla might accept other cryptocurrencies if they are much less energy intensive. He also said the company won't be selling any of the Bitcoin it holds. (BBG)

CHINA

POLITICS: Beijing is considering whether to replace Vice Premier Liu He as its top economic envoy with Washington, according to officials with knowledge of the matter, a decision that Biden administration officials say will indicate the depth of China's interest in economic cooperation. Under this scenario, these officials said, Mr. Liu, who has spent decades working on economic reform, would be succeeded by Hu Chunhua, a younger vice premier who made his mark overseeing the restive Tibet region and running the trade-reliant coastal province of Guangdong but who has little experience in U.S.-China relations. The deliberation is part of a wider personnel shuffle as China recalibrates its approach to the new U.S. administration. A trade truce reached by both sides early last year has led Beijing to shift its economic focus from tariffs to pressing for the relaxation of sanctions against Chinese companies, especially telecommunications giant Huawei Technologies Co. (BBG)

CREDIT: China's slower expansion in money supply and total social financing last month shown in data released on Wednesday was mainly because last year's numbers as the basis of comparison were unusually high in response to the pandemic, and the two-year average money and credit growths matched the pace of nominal GDP, the central bank's newspaper Financial News reported citing monetary policy advisor Wang Yiming. M2 rose 8.1% y/y in April, down from 9.4% in March, while TSF gained 11.7% y/y, down from 12.4%. Two-year average M2 and TSF growths were 9.6% and 11.9% accordingly, on par with data seen in pre-pandemic years, while medium and long-term loans increased by CNY660.5 billion, up CNY105.8 billion from last year, suggesting higher expectations for corporate investments in the coming months, Wang said. (MNI)

CHINA/AUSTRALIA: China needs a counter plan to diversify imports from Australia given Canberra's escalating confrontation with its biggest trade partner, including plans to spend 270 billion Australian dollars over the next decade to upgrade defense, which may lead the country to surge deficits and "economic carnage," the Global Times said. The government-owned tabloid cited a media report that China ordered two importers not to buy Australian liquified natural gas next year. Without endorsing the report's authenticity, the newspaper said China may nonetheless seek diversification of its LNG imports. (MNI)

COMMODITIES: Chinese Premier Li Keqiang told his government to better coordinate the commodities markets and track changes in both external and internal conditions to manage excessive price gains and impacts, Xinhua News Agency reported. Li requested monetary policies to be coordinated with other departments to ensure the stability of the economy, Xinhua said. The government also supports issuing at least CNY300 billion special bonds to boost small business lending and requests that the five large state-owned lenders boost microlending by 30%, Xinhua said. (MNI)

OVERNIGHT DATA

JAPAN MAR BOP CURRENT ACCOUNT BALANCE +Y2.6501TN; MEDIAN +Y2.7647TN; FEB +Y2.9169TN

JAPAN MAR BOP CURRENT ACCOUNT BALANCE ADJ +Y1.6965TN; MEDIAN +Y1.8677TN; FEB +1.8441TN

JAPAN MAR TRADE BALANCE BOP BASIS +Y983.1BN; MEDIAN +Y787.7BN; FEB +Y524.2BN

JAPAN APR ECO WATCHERS SURVEY CURRENT 39.1; MEDIAN 47.0; MAR 49.0

JAPAN APR ECO WATCHERS SURVEY OUTLOOK 41.7; MEDIAN 43.5; MAR 49.8

JAPAN APR BANK LENDING INCL-TRUSTS +4.8% Y/Y; MAR +6.2%

JAPAN APR BANK LENDING EX-TRUSTS +4.3% Y/Y; MAR +5.9%

JAPAN APR BANKRUPTCIES -35.80% Y/Y; MAR -14.32%

JAPAN APR TOKYO AVERAGE OFFICE VACANCIES 5.65; MAR 5.42

NEW ZEALAND APR REINZ HOUSE SALES +419.7% Y/Y; MAR +31.2%

NEW ZEALAND APR FOOD PRICE INDEX +1.1% M/M; MAR 0.0%

SOUTH KOREA MAR MONEY SUPLY L +1.5% M/M; FEB +1.0%

SOUTH KOREA MAR MONEY SUPPLY M2 +1.2% M/M; FEB +1.3%

UK APR RICS HOUSE PRICE BALANCE 75%; MEDIAN 62%; MAR 62%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS THURS; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) conducted CNY10 billion via 7-dayreverse repos with the rate unchanged at 2.2% on Thursday., leaving liquidity unchanged given CNY10 billion reverse repos are due to mature today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.1666% at 09:26 am local time from the close of 1.9963% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 35 on Wednesday vs 37 on Tuesday. A lower index indicates a weaker expectation for tightening liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.4612 THURS VS 6.4258

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4612 on Thursday, compared with the 6.4258 set on Wednesday, marking the biggest daily drop since Mar 9, 2021.

MARKETS

SNAPSHOT: Colonial Restarts Operations, Israel & Hamas Escalate Fighting

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 503.68 points at 27643.83

- ASX 200 down 45.073 points at 6999.8

- Shanghai Comp. down 25.607 points at 3437.144

- JGB 10-Yr future down 14 ticks at 151.27, yield up 0.6bp at 0.090%

- Aussie 10-Yr future down 3 ticks at 98.25, yield up 2.7bp at 1.801%

- U.S. 10-Yr future +0-02 at 131-31+, yield down 0.86bp at 1.683%

- WTI crude down $0.66 at $65.42, Gold up $2.32 at $1818.01

- USD/JPY up 3 pips at Y109.7

- BOE'S HALDANE: BRITAIN'S TENNIS BALL BOUNCE WILL PUT US ON TOP OF WORLD (Daily Mail)

- ISRAEL STEPS UP GAZA OFFENSIVE, KILLS SENIOR HAMAS FIGURES (AP)

- COLONIAL PIPELINE RESTARTS OPERATIONS

- BIDEN LIFTS U.S. SHIP MANDATE TO EASE GASOLINE SHORTAGES (BBG)

BOND SUMMARY: T-Notes Edge Away From Wednesday's Low, JGB Curve Steepens After 30-Year Auction

T-Notes edged higher after unsuccessfully retesting Wednesday's low of 131-28. The contract last trades +0-01+ at 131-31, after holding a 0-05 range in Asia-Pac trade. Cash Tsy curve bull flattened, with yields last seen up to 2.0bp lower. Eurodollar futures are unch. to +1.0 tick through the reds. Activity and headline flow were limited by market closures in a number of Asia-Pac economies, including Singapore. The local docket is headlined by PPI, initial jobless claims, 30-Year debt supply & Fedspeak today.

- JGB futures staged a shallow round trip to session high of 151.31 before the lunch break and last trade at 151.27, 14 ticks shy of Wednesday's settlement as trading resumed in Tokyo. Cash JGB yield curve bear steepened a tad as the super-long end faltered. Low price in the latest 30-Year JGB auction missed estimate from BBG dealer poll (101.25 vs. est. of 101.30). Bid/cover ratio and tail were close to historical averages. In local data, BoP current account surplus shrank slightly more than expected in March, with Eco Watchers Survey coming up later today.

- Cash ACGB space played catch up with yesterday's moves in U.S. Tsys in early trade, but Aussie bond yields are off steeps. They last sit 0.6-2.7bp higher. 10-year yield registered largest gains and trades at 1.793% at typing. YM trades -1.0, while XM ground higher through the session and last sits -2.5. Bills trade unch. to -2 ticks through the reds.

JGBS AUCTION: Japanese MOF sells Y742.2bn 30-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y742.2bn 30-Year JGBs:- Average Yield 0.645% (prev. 0.688%)

- Average Price 101.36 (prev. 100.28)

- High Yield: 0.649% (prev. 0.691%)

- Low Price 101.25 (prev. 100.20)

- % Allotted At High Yield: 67.9449% (prev. 66.6415%)

- Bid/Cover: 3.117x (prev. 3.107x)

EQUITIES: Lower For A Third Day; US Futures Higher

Equity markets in Asia were lower again, in negative territory for the third straight session with several indices erasing gains for the year. Markets in Singapore, India, Indonesia, Malaysia, Philippines and Pakistan are closed for holiday's which kept liquidity thin. Bourses in Japan lead the way lower, weighed down by SoftBank who sustained heavy losses following earnings. In Taiwan the Taiex managed to rebound from earlier losses of over 4% with the selling this week blamed on unwinding of leveraged positions. Futures in the US are higher, rebounding after yesterday's declines, the Nasdaq leads the way higher after declining almost 7% in May.

OIL: Crude Futures Lower

Oil is lower in the Asia-Pac time zone on Thursday; WTI is down around $0.52 from settlement levels at $65.56/bbl while Brent is down $0.52 at $68.80/bbl. The Colonial Pipeline is returning to service, recovering from a cyberattack late last Friday. Fuel shipments resumed late Wednesday, though it could take days for supplies to return to normal after widespread shortages. Markets also assess US DOE inventory data that showed headline crude stocks fell by 426k bbls and hit the lowest levels since February. Elsewhere the IEA yesterday said a crude surplus built up during the pandemic has now been mostly worked off.

GOLD: Modestly Higher

After recording its biggest decline in six weeks yesterday as the greenback gained, the yellow metal is slightly higher in Asia-Pac trade, though a parabolic move has seen bullion give up the majority of its gains heading into European hours. Gold is last up $1.50 at $1817.50/oz compared to session highs of $1823.08/oz. A sell off in stocks also helped support gold, while the greenback held most of yesterday's gains.

FOREX: Greenback Gives Away Some Of Its Wednesday's Gains

The greenback retreated from weekly highs registered yesterday, while the yen also struggled. Regional equity benchmarks faltered after another poor session on Wall Street, but U.S. equity index futures crept higher. Most G10 crosses held narrow ranges, as activity and headline flow was limited by market holidays in Singapore, India, Indonesia, Malaysia & the Philippines.

- USD/JPY blipped higher at Tokyo reopen, briefly showing above yesterday's high. The rate struggled to cling onto those modest gains and eased off, with a contact flagging hearsay re: profit taking by Japanese retail accounts. The rate bottomed out at Y109.48, but recovered thereafter and returned to neutral levels.

- BBG trader source pointed to exporters buying AUD/USD in the wake of yesterday's dip. The Aussie failed to hold these gains and sold off, as iron ore futures went offered. The kiwi diverged from its Antipodean cousin and firmed against most G10 peers.

- The PBOC set the central USD/CNY mid-point at CNY6.4612, just 3 pips above sell-side estimates. This comes after considerably larger deviations seen earlier this week, suggesting that China's central bank is happy with the impact of earlier fixings. USD/CNH slipped on the back of broader USD sales.

- Coming up today we have U.S. initial jobless claims & PPI data as well as comments from Fed's Bullard, Waller & Barkin, BoE's Bailey & Cunliffe, BoC's Macklem & ECB's Centeno.

FOREX OPTIONS: Expiries for May13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1865(E2.4bln), $1.1900-05(E1.4bln), $1.1950-55(E2.2bln-EUR puts), $1.1964-75(E2.0bln-EUR puts), $1.1995-00(E535mln), $1.2040-50(E538mln), $1.2100(E1.3bln-EUR puts), $1.2115-30(E850mln), $1.2150(E821mln), $1.2170-80(E2.5bln-EUR puts), $1.2235-50(E1.9bln)

- USD/JPY: Y107.00($1.1bln), Y107.20-30($910mln), Y108.30-40($678mln), Y108.90-109.00($1.6bln-USD puts), Y109.15-20($505mln), Y110.40-50($648mln)

- GBP/USD: $1.4200-04(GBP806mln-GBP puts)

- USD/CHF: Chf0.9085-95($1.3bln-USD puts)

- EUR/CHF: Chf1.1040(E1.1bln-EUR puts), Chf1.1150(E1.35bln-EUR puts)

- AUD/USD: $0.7690-00(A$656mln), $0.7760-65(A$1.0bln), $0.7780-95(A$1.7bln)

- USD/CAD: C$1.2090-10($503mln)

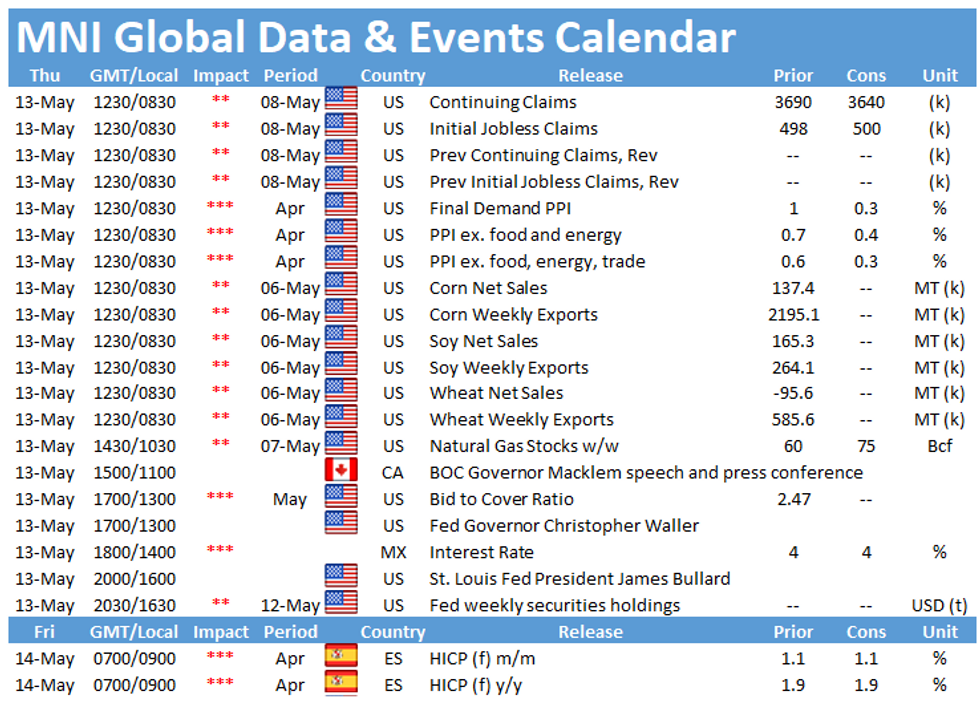

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.