-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Israel Strikes From Land And Air

EXECUTIVE SUMMARY

- FED'S WALLER: MONTHS OF 4% INFLATION WOULD CONCERN (MNI)

- FED'S BULLARD SEES INFLATION "MEANINGFULLY" ABOVE 2% (MNI)

- BOE'S BAILEY: LOOKING AT SUPPLY SIDE DISRUPTION (MNI)

- ISRAELI TANKS, ARTILLERY JOIN JETS IN OFFENSIVE AGAINST HAMAS (BBG)

- WHITE HOUSE PUSHING CEASEFIRE BUT RECOGNISES SIDES NOT THERE YET (Times of Israel)

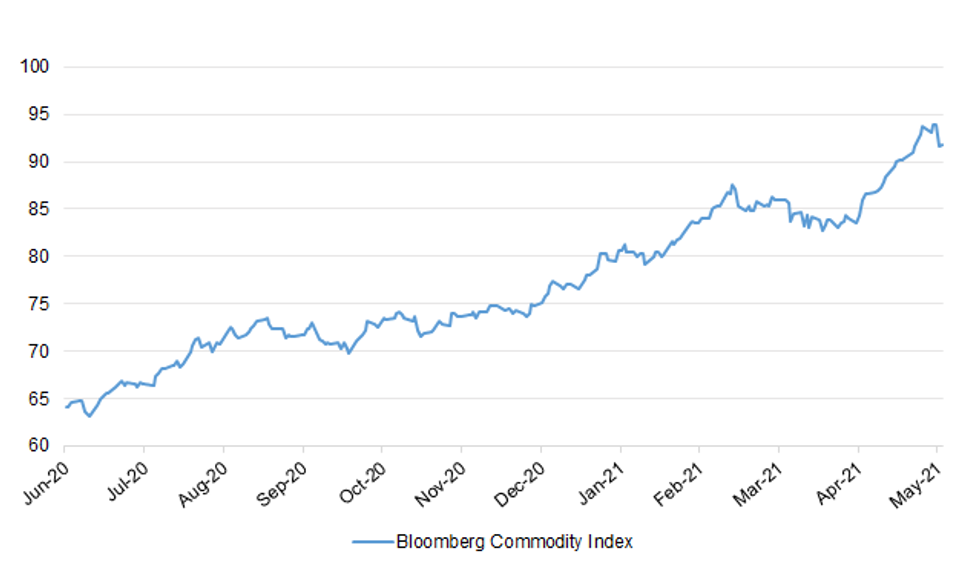

Fig. 1: Bloomberg Commodity Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BOE: MNI BRIEF: BOE's Bailey Says Looking At Supply Side Disruption

- Bank of England Governor Andrew Bailey said that there is evidence of supply side disruptions and that the BOE was watching closely for signs of these feeding through into higher inflation - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

CORONAVIRUS: UK prime minister Boris Johnson on Thursday said health officials are "anxious" about the Covid-19 variant first identified in India and refused to rule out the possibility of localised lockdowns to stem its spread. "We want to make sure we take all the prudential, cautious steps now that we could take," Johnson said, speaking at a primary school in Ferryhill, County Durham. "There are a range of things we could do, we're ruling nothing out," he said, adding that he has not seen any evidence to delay the staged lifting of England's lockdown. But he added: "There may be things that we have to do locally and we will not hesitate to do them if that is the advice we get." (FT)

CORONAVIRUS: Bolton care homes have been asked not to follow England's roadmap out of lockdown next week but to continue to restrict visitors, with the local authority citing concern over a possible "severe outbreak" of the Covid variant first detected in India. Some schools in the Greater Manchester borough have also told pupils and staff to keep wearing masks for now, despite face coverings no longer being a requirement from Monday. The moves came as public health officials, plus local MPs and the mayor of Greater Manchester, Andy Burnham, asked the government to allow Bolton to offer vaccinations to all people over 16 in an attempt to curb infections. On Thursday night multiple sources suggested the government was poised to approve the move. (Guardian)

EUROPE

ECB: European Central Bank Governing Council member Yannis Stournaras says there's no reason yet to worry about inflation in Europe. "In Europe our models show that we are not to worry about inflation, or not to worry as perhaps in the U.S." Markets are pointing to some increase in inflation and there are supply constraints and pent up demand from the pandemic, but old forces including technology that keep inflation restrained are still present, Stournaras says. (BBG)

FRANCE: In an announcement Wednesday, Paris Mayor Anne Hidalgo set an audacious new benchmark in her ongoing campaign to reduce car use across the French capital: a ban on most vehicle traffic crossing the city center in 2022. The plan would stop through traffic from a large zone covering Paris' core, to cut pollution and noise and free up more space for trees, cycle lanes and pedestrian areas. A public consultation for the plan launched this week. (BBG)

IRELAND: Discussions on Troubles legacy issues and the Northern Ireland protocol are expected to dominate a summit meeting on Friday between Taoiseach Micheál Martin and British prime minister Boris Johnson. Mr Martin will travel to Chequers, the prime minister's country residence, for a lunchtime meeting, Government Buildings confirmed on Thursday night. (Irish Times)

PORTUGAL: Tens of thousands of Britons hoping for a holiday in Portugal this month had their plans plunged into chaos last night as the country looked set to ban holidaymakers until at least May 30. (Times)

UKRAINE: A Ukrainian court imposed house arrest on Kremlin-friendly politician Viktor Medvedchuk as prosecutors suspect him of treason. A judge in capital Kyiv rejected prosecutors' petition for Medvedchuk's pre-trial detention or releasing him on a 300 million-hryvnia ($10.9 million) bail, according to a hearing broadcast online. Prosecutors suspect Medvedchuk of sharing information about a secret Ukrainian military unit with Russia. (BBG)

U.S.

FED: MNI BRIEF: Waller Says Months of 4% Inflation Would Concern

- Federal Reserve Governor Christopher Waller said Thursday months of 4% inflation would be a concern and potentially cause him tore-evaluate the central bank's easy policies - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

- St. Louis Fed President said Thursday U.S. inflation will rise "meaningfully above 2% over the forecast horizon," adding that the labor market may be much tighter than data suggest - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: Senate Republicans will give President Biden a revised infrastructure offer next week after a sit-down at the White House on Thursday. Biden met with a group of 10 Republicans, led by Sen. Shelley Moore Capito (W.Va.), where they discussed two of the biggest sticking points: what qualifies as infrastructure and how to pay for it. "He asked that we would come back with another offer, with more granularity to it and more details, and so we agreed to do that," Capito said. Republicans are planning to give Biden their revised counteroffer early next week, and didn't rule out meeting again with Biden. (Hill)

FISCAL: Some Senate Democrats are open to paying for a compromise infrastructure package by imposing user fees, including increasing the gas tax and raising money from electric car drivers through a vehicle-miles-traveled charge. Why it matters: By inching toward the Republican position on pay-fors, some Democrats are bucking President Biden's push to offset his proposed $2.3 trillion plan by focusing only on raising taxes on corporations and the wealthy. (Axios)

POLITICS: Senate Democrats are ramping up their work on reining in President Biden's war powers, after years of watching the fights stall out on Capitol Hill. Senate Foreign Relations Committee Chairman Bob Menendez (D-N.J.) told The Hill on Thursday that he will hold a vote on legislation from Sens. Tim Kaine (D-Va.) and Todd Young (R-Ind.) that would repeal the 1991 and 2002 authorizations for the use of military force (AUMFs), both of which deal with Iraq. (Hill)

CORONAVIRUS: In a major step toward returning to pre-pandemic life, the Centers for Disease Control and Prevention eased mask-wearing guidance for fully vaccinated people on Thursday, allowing them to stop wearing masks outdoors in crowds and in most indoor settings. The new guidance still calls for wearing masks in crowded indoor settings like buses, planes, hospitals, prisons and homeless shelters but it will help clear the way for reopening workplaces, schools, and other venues — even removing the need for social distancing for those who are fully vaccinated. (AP)

FUEL: The largest fuel pipeline in the U.S. restarted its entire system after a cyberattack nearly a week ago, but said it will take several days for the supply chain to return to normal. Colonial Pipeline Co. has started delivering products like gasoline, diesel and jet fuel to all of the markets it serves, the pipeline operator said in a statement on Thursday, but some areas may experience service interruptions during the restart process. The system, which transports products from Gulf Coast refineries as far north as New York, is running at less than half of capacity, according to people familiar with the matter. Earlier, it emerged that the operating company paid almost $5 million in untraceable cryptocurrency to Eastern European hackers last week to help get gasoline and jet fuel flowing again along the Eastern Seaboard. Fuel shortages from Florida to Virginia continue and Colonial said its system is about 5.5 days behind its current schedule. (BBG)

CYBERSECURITY: The dark web page belonging to the ransomware group accused of attacking Colonial Pipeline Co. attack has gone down. The FBI and cybersecurity experts identified DarkSide as the group behind the Colonial attack that forced the company to shut down operations, triggering fuel shortages in parts of the U.S. Some evidence has linked DarkSide's operations to Russia and other Eastern European countries. It's not clear if the site is down because of a technical snafu, which aren't uncommon on the dark web, or some action by law enforcement or the group itself, which is facing the wrath of the U.S. government. Ransomware is a type of malware that encrypts a victim's data; the groups sometime steal data too. The hackers then ask for a payment to unlock the files or return the stolen data. (BBG)

OTHER

GLOBAL TRADE: U.S. Trade Representative Katherine Tai said on Thursday that expired exclusions from "Section 301" tariffs on Chinese goods will be addressed as part of the Biden administration's review of trade policy, an analysis where "time is of the essence." Tai said in testimony to the House Ways and Means Committee that the Biden administration "will not hesitate to call out China's unfair trade practices that harm American workers, undermine the multilateral system or violate basic human rights." (RTRS)

CORONAVIRUS: COVID-19 vaccine developers are making ever bolder assertions that the world will need yearly booster shots, or new vaccines to tackle concerning coronavirus variants, but some scientists question when, or whether, such shots will be needed. In interviews with Reuters, more than a dozen influential infectious disease and vaccine development experts said there is growing evidence that a first round of global vaccinations may offer enduring protection against the coronavirus and its most worrisome variants discovered to date. (RTRS)

ISRAEL: Israeli air and ground troops launched a blistering assault on the Hamas-run Gaza Strip, sweeping aside international appeals for de-escalation after four days of aerial bombardments failed to quell the heaviest militant rocket fire yet on Israel from the Palestinian enclave. Prime Minister Benjamin Netanyahu has been warning that an extended campaign was in the offing. The decision to escalate early Friday with heavy aircraft, tank and artillery fire came at a uniquely sensitive time, as Israel grappled with the worst outbreak in years of violence between Arabs and Jews inside its borders. Trouble loomed on another front after three rockets launched from Lebanon crashed into the Mediterranean off Israel's northern coast late Wednesday, raising the specter of a second battleground with Iran-backed Lebanese Hezbollah militants. "I said that we will exact a very heavy price from Hamas," Netanyahu wrote on Facebook, referring to the militant group. "We are doing so and will continue to do so with great force. The last word hasn't been said and this campaign will continue as long as necessary." (BBG)

ISRAEL: While the Biden administration has been pushing for de-escalation in the Gaza-Israel violence, it recognizes that a ceasefire in the next couple of days is unlikely, a source familiar with the matter tells The Times of Israel. US Secretary of State Antony Blinken spoke yesterday with Palestinian Authority President Mahmoud Abbas, but there is a recognition on the secretary's part that Ramallah's influence is limited at this point, given that the rocket fire is coming from political rival Hamas in Gaza, the source says. The Biden administration has been in touch with Qatar hoping the Gulf kingdom that provides significant humanitarian aid to Gaza would be able to pressure the terror group into agreeing to a ceasefire, the source adds. (Times of Israel)

ISRAEL: Yamina leader Naftali Bennett has said in a closed-door meeting between members of his party and Likud representatives on Thursday that a "government of change," composed of the parties that seek to replace Prime Minister Benjamin Netanyahu, is off the table. He said that given the state of emergency in mixed Arab-Jewish cities, the planned makeup of the government led by Yesh Atid leader Yair Lapid and Bennett won't be able to manage the situation because it has become necessary to deploy military troops and conduct arrests. He said that doing so would be impossible with Mansour Abbas and his United Arab List party. Bennett said he now prefers a large unity government. (Haaretz)

ISRAEL: U.S. Ambassador to the United Nations Linda Thomas-Greenfield tweeted the following on Thursday: "The UN Security Council will meet to discuss the situation in Israel and Gaza on Sunday. The U.S. will continue to actively engage in diplomacy at the highest levels to try to de-escalate tensions." (MNI)

JAPAN: The Japanese government plans to add three more prefectures to its state of emergency as coronavirus cases continue to surge nationwide. Six prefectures, including Tokyo and Osaka, are under a state of emergency until the end of this month. Now, the government plans to add three more prefectures -- Hokkaido, Okayama and Hiroshima -- to the state of emergency, starting Sunday. Those prefectures are experiencing surges and their medical systems are strained. Intensive measures, which don't fall under a state of emergency, are currently in place in eight prefectures, including those that neighbor the capital. Hokkaido is one of those prefectures, but it will be upgraded to the state of emergency on Sunday. And the government will add three other prefectures, including Gunma, Ishikawa and Kumamoto, to the intensive measures list from Sunday. (NHK)

SOUTH KOREA: Prime Minister Kim Boo-kyum said Friday that he will work toward pursuing national unity in the face of the ongoing COVID-19 crisis, as he began his official term as the administration's third prime minister. "I will become a prime minister who thoroughly aims for national unity," Kim said while arriving at the government complex in Seoul on his first day as prime minister. [Meanwhile,] President Moon Jae-in appointed the new ministers of science and land Friday despite controversies over their alleged ethical lapses. The president approved the appointment of Lim Hye-sook to lead the Ministry of Science and ICT and Noh Hyeong-ouk to head the Ministry of Land, Infrastructure and Transport, according to Cheong Wa Dae spokesperson Park Kyung-mee.(Yonhap)

SINGAPORE: Singapore is returning to lockdown-like conditions it last imposed a year ago, banning dining-in and limiting gatherings to two people, as a rising number of untraceable infections pressures one of the most successful places in the world at Covid containment. For four weeks from May 16 to June 13, gathering sizes as well as household visitors will be cut to a maximum of two people from five people now, working from home will be the default, and food places can only do takeaways and deliveries, the health ministry said in a statement on Friday. "A pattern of local unlinked community cases has emerged and is persisting," the statement said. "We need to act decisively to contain these risks as any one leak could result in an uncontrolled resurgence of cases." (BBG)

HONG KONG/SINGAPORE: A quarantine-free travel agreement between Hong Kong and Singapore due to start on May 26 may not go ahead due to a rise in coronavirus cases in Singapore. Edward Yau, Hong Kong's Secretary for Commerce and Economic Development, said Friday there's a "high chance" the so-called travel bubble might not go ahead as scheduled. Both cities will review the situation in the coming days, he said. Singapore is trying to combat a growing virus outbreak, which has included a cluster at the city's iconic Changi Airport. Dozens of cases have been linked to the airport, prompting the closure of two terminals and the Jewel complex. (BBG)

TAIWAN: Taiwan Premier Su Tseng-chang said on Friday that there is no need to raise the island's COVID-19 alert level for the time being and that compared with last year it has more experience and resources to fight the pandemic. (RTRS)

BOC: MNI: BOC Sees CAD Rise Partly Fundamental, Inflation Temporary

- BOC Governor Tiff Macklem said Thursday the Canadian dollar's recent strength is tied to higher commodity prices though major further gains could become a headwind, and said so far he's confident the run-up of inflation will peak around 3% and fade out - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

BRAZIL: Brazil's economy czar has a candid assessment of his three-year relationship with Jair Bolsonaro: both men trust each other and continue to push for key reforms, although the president's support for his minister's pro-market agenda has been waning. Paulo Guedes told Bloomberg News on Thursday that key proposals to overhaul the country's tax system and curb public-sector costs will be approved this year, as well as bills allowing more privatizations to move forward. Challenges abound, however, as a congressional probe into the government's handling of the pandemic consumes lawmakers' energy. Guedes, 71, estimated that the real is bound to strengthen as privatizations, investment and structural reforms turn Brazil's cyclical rebound into a sustained recovery. "As reforms make progress, everybody will see that the currency is mispriced, that it will strengthen," he said. "The currency had an overshooting and is now finding its equilibrium -- if it's going to be 5 per dollar, 4.8 per dollar or 3 per dollar... I have my hunch, but I won't say." (BBG)

BRAZIL: Brazil's Fiocruz biomedical institute said on Thursday it would interrupt production of the AstraZeneca vaccine for certain days next week due to a lack of ingredients, until new supplies arrive on May 22. (RTRS)

CHINA

PBOC: China is likely to keep its monetary policies steady to support the real economy, refrain from excess stimulus and stabilize the macro leverage, reported PBOC-owned Financial News citing Dong Ximiao, the chief analyst with Merchants Union Consumer Finance, who commented on the central bank's Q1 monetary report. Financial regulators should step up policy supports to small and medium-sized banks including helping to replenish bank capital and recruiting qualified investors to dissolve risks, Dong was cited as saying. (MNI)

INFLATION: China should seek to boost commodity supplies to keep prices stable as recent price spikes have been driven by global supply shortages, said China Securities Journal said in its commentary. The central bank has so far refrained from tightening and played down expectations for higher inflation, the newspaper said. Policies could be tightened if rising commodity prices affect consumer products, it said. (MNI)

BONDS: China's domestic bond market has sold CNY161 billion green bonds this year to date, 69% more than a year ago, as companies raise capital to help reduce emissions and pursue greener energy and development, the Economic Information Daily reported citing its analysis based on Wind data. Traditional companies including state-owned power generators and coal producers are offering bonds tied to specific sustainable projects, which have generated interests from investors, the newspaper said. (MNI)

COMMODITIES: MNI: China Seen Using Reserves, Export Limits To Damp Prices

- China may release state reserves or limit exports of commodities to tame prices and ensure domestic supplies but could hold off on monetary action unless there is evidence that higher upstream costs are feeding through to a wide range of consumer goods, policy advisors and market analysts told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

CORONAVIRUS: Chinese biotech firm Kintor Pharmaceutical Limited saw its stock price jump by more than 20% the day after it announced on April 25 that it had "completed the first patient enrollment and dosing" in a late-stage U.S. clinical trial of its experimental COVID-19 treatment. But the company had not dosed any patients as of early May, according to the doctor Kintor identified as its principal clinical trial investigator in documents it posted on a U.S. trials website. The doctor - California-based gastroenterologist Zeid Kayali - also told Reuters he was "not in charge" of the trial, contradicting what the company had said in the documents describing the study. Kayali declined further comment, referring questions to Kintor. (RTRS)

OVERNIGHT DATA

JAPAN APR MONEY STOCK M2 +9.2% Y/Y; MEDIAN +9.4%; MAR +9.4%

JAPAN APR MONEY STOCK M3 +7.8% Y/Y; MEDIAN +7.9%; MAR +7.9%

NEW ZEALAND APR BUSINESSNZ MANUFACTURING PMI 58.4; MAR 63.6

New Zealand's manufacturing sector continued in expansion mode during April, according to the latest BNZ - BusinessNZ Performance of Manufacturing Index (PMI). The seasonally adjusted PMI for April was 58.4 (a PMI reading above 50.0 indicates that manufacturing is generally expanding; below 50.0 that it is declining). While this was 5.2 points down from March, it was still the second highest result since July 2020 when New Zealand came out of lockdown. BusinessNZ's executive director for manufacturing Catherine Beard said that the April result was another positive outcome for the sector. Despite the lower level of expansion in comparison with March, it would have been surprising if the April result had shown even higher expansion levels. "The two major sub-index values of Production (64.5) and New Orders (60.9) continued to be the main drivers of the April result, with the latter coming off its historic level of expansion. Both Employment (52.7) and Finished Stocks (55.2) remained at similar levels to March, while Deliveries of Raw Materials (52.4) decreased 10.6 points". "Given the lower level of expansion for the current month, the proportion of those outlining positive comments decreased from 58% in March to 53.2% in April. Comments continued to outline demand side influences, with increased enquiries and orders". BNZ Senior Economist, Craig Ebert stated that "firms' commentary to April's PMI noted improving conditions internationally, in addition to many global PMIs clearly pointing to economic activity expanding strongly in significant portions of the world right now". (BNZ)

SOUTH KOREA APR EXPORT PRICE INDEX +10.6% Y/Y; MAR +5.9%

SOUTH KOREA APR EXPORT PRICE INDEX +2.2% M/M; MAR +3.6%

SOUTH KOREA APR IMPORT PRICE INDEX +15.0% Y/Y; MAR +9.0%

SOUTH KOREA APR IMPORT PRICE INDEX -0.5% M/M; MAR +3.5%

CHINA MARKETS

PBOC NET INJECTS CNY10BNVIA OMOS FRI; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) conducted CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Friday, leaving liquidity unchanged given CNY10 billion reverse repos are due to mature today, according to Wind Information.

PBOC SETS YUAN CENTRAL PARITY AT 6.4525 FRI VS 6.4612

People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4525 on Friday, compared with the 6.4612 set on Thursday.

MARKETS

SNAPSHOT: Israel Strikes From Land And Air

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 608.79 points at 28056.62

- ASX 200 up 53.381 points at 7036.1

- Shanghai Comp. up 41.633 points at 3471.169

- JGB 10-Yr future up 12 ticks at 151.37, yield down 1.4bp at 0.080%

- Aussie 10-Yr future up 2.5 ticks at 98.265, yield down 2.1bp at 1.791%

- U.S. 10-Yr future +0-03 at 132-09, yield down 0.52bp at 1.652%

- WTI crude down $0.2 at $63.62, Gold down $3.61 at $1823.11

- USD/JPY up 8 pips at Y109.56

- FED'S WALLER: MONTHS OF 4% INFLATION WOULD CONCERN (MNI)

- FED'S BULLARD SEES INFLATION "MEANINGFULLY" ABOVE 2% (MNI)

- BOE'S BAILEY: LOOKING AT SUPPLY SIDE DISRUPTION (MNI)

- ISRAELI TANKS, ARTILLERY JOIN JETS IN OFFENSIVE AGAINST HAMAS (BBG)

- WHITE HOUSE PUSHING CEASEFIRE BUT RECOGNISES SIDES NOT THERE YET (Times of Israel)

BOND SUMMARY: Reinvestment Flows Support ACGBs, JGBs Gain Despite Firmer Equities

Limited news and data flow translated kept T-Notes rangebound overnight. The contract inched higher at some point, but was capped by Thursday's high of 132-10. It last changes hands +0-02+ at 132-08+, just above the mid-point of the Asia-Pac session's range. Cash curve flattened at the margin, with yields last seen +0.2bp to -1.2bp, even as e-minis remain elevated. Eurodollar futures trade unch. to +1.0 tick through the reds. Going forward, focus in the U.S. turns to retail sales, industrial output, U. of Mich. Survey & comments form Fed's Kaplan.

- JGB futures jumped at the re-open and remained afloat thereafter, even as local equity benchmarks registered healthy gains. The contract trades at 151.36, 11 ticks above last settlement & hitting session highs. Cash JGB yields sit lower, curve runs a tad flatter with 40s outperforming. The BoJ offered to buy 1-10 Year JGBs, leaving purchase sizes unch. across all baskets. Breakdown data revealed downticks in offer/cover ratios in today's Rinban ops. Japan's Covid-19 response czar said that the island of Hokkaido as well as Hiroshima and Okayama prefectures will be added to the declaration of Covid-19 emergency through the end of the month. PM Suga holds a presser on the matter at 8pm JST.

- ACGB space likely drew some support from reinvestment flows, ahead of Saturday's redemption of A$26bn in ACGB May '21. Cash ACGB curve bull flattened, albeit 10-year yield rose the most and last sits at 1.784%. YM trades +0.5, with XM +2.5 at typing, after sticking to tight ranges in Sydney trade. Bills last seen -1 to +1 tick through the reds. The AOFM auctioned A$1.0bn of ACGB 21 Apr '26 and bid/cover ratio fell to 3.96x from 5.92x, although the previous auction of the bond was held in Jun 2020. The space looked through the issuance slate for next week.

JGBS AUCTION: Japanese MOF sells Y5.3078tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y5.3078tn 3-Month Bills:- Average Yield -0.0998% (prev. -0.1043%)

- Average Price 100.0249 (prev. 100.0263)

- High Yield: -0.0982% (prev. -0.1011%)

- Low Price 100.0245 (prev. 100.0255)

- % Allotted At High Yield: 76.6471% (prev. 56.7777%)

- Bid/Cover: 3.990x (prev. 3.332x)

BOJ: 1-10 Year Rinban Conducted

The BoJ offers to buy a total of Y1.375tn of JGBs from the market, sizes unchanged from the previous operations:

- Y475bn worth of JGBs with 1-3 Years until maturity

- Y450bn worth of JGBs with 3-5 Years until maturity

- Y450bn worth of JGBs with 5-10 Years until maturity

AUSSIE BONDS: The AOFM sells A$1.0bn of the 4.25% 21 Apr '26 Bond, issue #TB142:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 4.25% 21 April 2026 Bond, issue #TB142:

- Average Yield: 0.7149% (prev. 0.4790%)

- High Yield: 0.7175% (prev. 0.4800%)

- Bid/Cover: 3.9550x (prev. 5.9200x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 45.2% (prev. 47.6%)

- bidders 43 (prev. 31), successful 14 (prev. 10), allocated in full 8 (prev. 3)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance schedule:

- On Wednesday 19 May it plans to sell A$1.0bn of the 1.50% 21 June 2031Bond.

- On Thursday 20 May it plans to sell A$1.0bn of the 27 August 2021 Note & A$1.0bn of the 22 October 2021 Note.

- On Friday 21 May it plans to sell A$800mn of the 0.50% 21 September 2026 Bond.

EQUITIES: Recovering After Sell Off

Most markets in the Asia time zone, recovering after heavy selling earlier this week as US stocks provided a positive lead. Gains are robust across bourses, but China leads the way higher with gains of over 2% on the CSI 300. Markets in Japan are seeing robust gains, up around 1.8% despite reports of a state of emergency in Hokkaido and Hiroshima. After plunging a total of 9.5% in the first four trading sessions of this week the Taiex is up 1.5%. The ASX 200 has also seen gains of around 1% despite further heavy losses in iron ore. Futures in the US are higher, the Nasdaq leading the way with gains of around 0.7%.

OIL: Crude Futures Headed For Weekly Loss

Oil is modestly lower in Asia on Friday, but is still within yesterday's range after plunging on Thursday and seeing a small bounce into the close. WTI is own $0.18 from settlement levels at $63.64/bbl, while Brent is down $0.25 at $66.80. The benchmarks are on track for a weekly decline of almost 2%, which would be the worst week since early April. The fall this week comes despite a positive assessment of demand from the IEA with markets focusing on elevated inflation globally and the possibility of policy tightening, while also considering a surge in coronavirus cases in many countries including India where new cases are still at over 300k per day. As reported yesterday the Colonial Pipeline is back online but it is expected to take a few days for supply to return to normal, the Biden administration allowed a foreign tanker to transport gasoline to a Valero Energy refinery to allow it to keep operating. Other waivers are being considered.

GOLD: Retracing Some Of Yesterday's Gain

Gold has pulled ack after rising on Thursday, but is still holding on to a chunk of yesterday's gains. The yellow metal last trades at $1822.63/oz, down $4.09, but still above lows around $1810 yesterday. Gold declined earlier in the week as the greenback firmed following above expectations CPI report, since then Fed speakers have posited that price pressures are expected to be transitory, Fed's Bullard said yesterday that it's a judgement call on whether inflation is transitory, a departure from previous Fed comments.

FOREX: Yen Under Light Pressure In Pre-Weekend Trade

Markets cruised towards the weekend, with lacklustre headline and data flow providing little in the way of meaningful catalysts. The yen lagged the G10 pack as e-minis and regional equity benchmarks ground higher. USD/JPY clawed back most of Thursday's losses as a result.

- The likes of GBP, CAD & AUD struggled for any impetus, while CHF & the Scandies fared relatively well in a largely directionless trade. Tight ranges were respected.

- The PBOC set the central USD/CNY mid-point at CNY6.4525, 7 pips above sell-side estimates. A third marginally weaker than expected fixing in a row suggests that China's central bank is satisfied with the redback's trajectory, after Monday & Tuesday saw considerably wider fix-vs-estimate spreads.

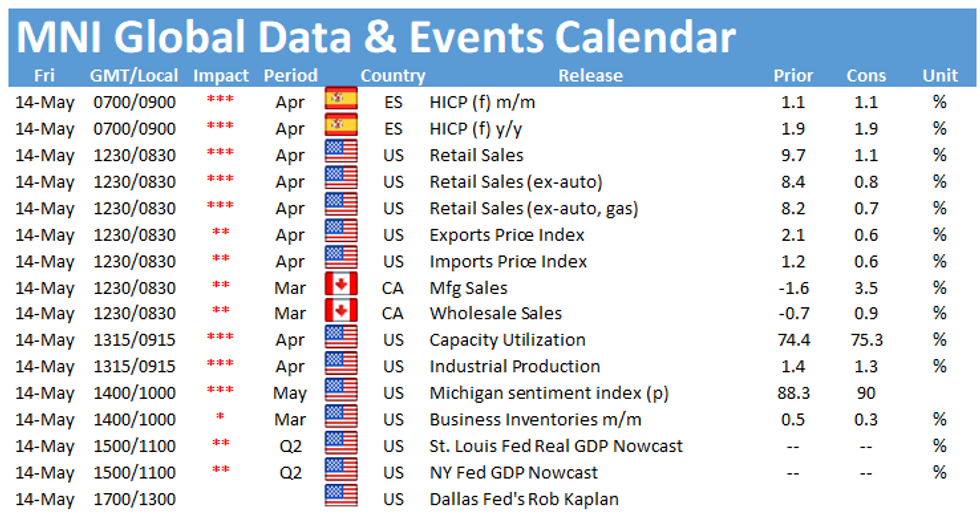

- Today's data docket is rather U.S.-centric, with retail sales, industrial output & U. of Mich. Sentiment due. Central bank speaker slate features Fed's Kaplan, while the ECB will release the account of its latest MonPol meeting.

FOREX OPTIONS: Expiries for May14 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2000(E715mln)

- USD/JPY: Y109.45-50($975mln), Y110.00($680mln)

- GBP/USD: $1.3990-05(Gbp539mln)

- AUD/USD: $0.7750(A$981mln)

- USD/CAD: C$1.2125-40($555mln), C$1.2280-85(C$575mln)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.