-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: UK COVID Caution Remains Evident Despite Reopening

EXECUTIVE SUMMARY

- FED'S BULLARD MINDFUL OF INFLATION EXPECTATIONS (MNI)

- KAPLAN: INFLATION TO MODERATE NEXT YEAR BUT THERE'S UNCERTAINTY (BBG)

- LIKELIHOOD OF UK'S FULL LOCKDOWN RESTRICTIONS BEING LIFTED ON JUN 21 'CLOSE TO NIL' (ITV)

- CHINA VOWS TO BOOST DOMESTIC IRON ORE EXPLORATION TO MEET DEMAND (BBG)

- BIDEN TO SEND COVID VACCINES ABROAD (BBG)

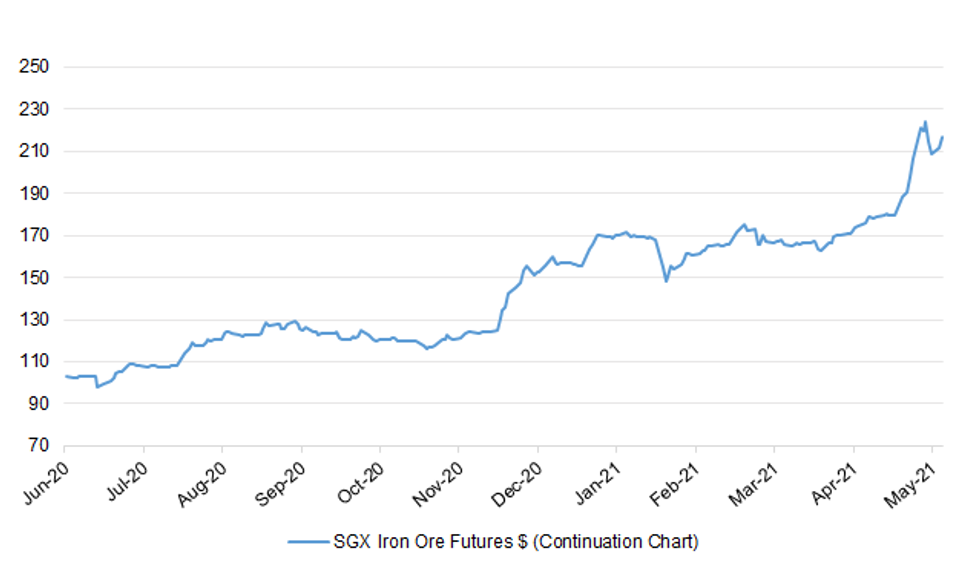

Fig. 1: SGX Iron Ore Futures $ (Continuation Chart)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Authorities have identified 2,323 cases of the Indian strain of coronavirus in the U.K., Health Secretary Matt Hancock said, as the highly transmissible new variant spreads. Speaking in Parliament on Monday, Hancock said 86 different local authority areas had now identified at least five people with the new strain. Cases have doubled in the past week in Bolton, Blackburn and Darwen in northwestern England and the Indian variant is now the dominant strain of the virus, Hancock said. He urged the public to get vaccinated, saying most people with the India strain in Bolton hospital hadn't received a shot. Early evidence shows vaccines still work against this new variant, he added. (BBG)

CORONAVIRUS: The prospect of the final easing of lockdown restrictions in England going ahead precisely as planned on 21 June are close to nil, according to ministers and officials. "It is clear some social distancing will have to be retained, not everything we've set out for 21 June is likely to happen," said a government adviser. "But it is also possible some of the easing we've done today will have to be reversed." Neither he nor a minister would be drawn on precisely which parts of the planned unlocking may have to be delayed, or which aspects of unlocking that's already happened would need rolling back. (ITV)

CORONAVIRUS: Ministers are considering contingency plans for local lockdowns or a delay to reopening after June 21 in response to concern about the spread of the Indian variant of coronavirus, The Times has been told. Officials have drawn up plans modelled on the Tier 4 restrictions introduced last year. Under the measures, people would be advised to stay at home and non-essential shops and hospitality would be closed if the new strain was not brought under control. Businesses in areas subject to the restrictions would receive grants of up to £18,000. The scheme would be administered by local authorities, with payments adjusted according to the length of restrictions. Another scenario anticipates a delay to the June 21 date for easing lockdown restrictions. In this case grants would be made available for the worst-affected sectors, such as nightclubs, and for "mass events" including festivals. (The Times)

CORONAVIRUS: British holidaymakers are on Wednesday set to be given the green light by the EU to use "vaccine passports" to enter Europe. (Telegraph)

BOE: MNI BRIEF: BOE Vlieghe: Supply Rise Entails Heavy Stimulus

- Bank of England Monetary Policy Committee member Gertjan Vlieghe rejected the idea that the looming fast rebound in growth entails that little stimulus is now needed, telling a King's College Business School event that as much of the decline in supply due to the Covid shock is temporary, this means that "over the coming quarters the economy needs to grow very fast in order to keep up with that (upcoming) increase in the supply capacity" and this entails that "the economy needs a lot of stimulus" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: Britain risks mirroring Italy's economic woes unless it develops a strategy for tackling the five seismic changes that will shape a decisive decade for the country, a report has warned. A joint project by the Resolution Foundation thinktank and the London School of Economics said the UK was neither used to nor prepared for the challenges posed by the aftermath of Covid-19, Brexit, the net zero transition, automation and a changing population. (Guardian)

BREXIT: The British government is locked in a "ferocious" internal battle over whether to sign off a trade deal with Australia after a split between the department of agriculture and the department of international trade over the terms of the agreement. Two people with knowledge of internal discussions said ministers were divided over whether to grant tariff-free access to Australian farmers, which would risk a backlash from the UK farming industry — and potentially spark domestic political fallout. Clinching a deal with Australia — the first big post-Brexit trade deal that is not a 'rollover' of existing agreements the UK enjoyed as a EU member — would be a symbolic moment for Brexiters arguing for the benefits of free trade. The government announced in April that it was in a "sprint" to finalise the deal by June ahead of the G7 summit in Cornwall, which Australia's prime minister Scott Morrison has been invited to attend as a guest. (FT)

BREXIT: The U.K. government is recruiting an external adviser to identify new opportunities created by Britain's split from the European Union, as Prime Minister Boris Johnson seeks to prove the value of Brexit. "We have high hopes of outside input into this process," David Frost, the minister in charge of the U.K. post-Brexit relationship with the EU, said to a committee of MPs on Monday. "We're all fully behind making things happen." Nearly five years on from the divisive Brexit referendum, Johnson's government is still struggling to demonstrate the benefits Britain has gained from being outside the EU. A task force set up to assess how Britain can re-shape its economy led by former Conservative Party leader Iain Duncan Smith has yet to publicly make any suggestions. (BBG)

PROPERTY: The coronavirus pandemic has shown that Britain's planning system is "not fit for purpose" and more affordable homes must be built to "transform the quality of life" for young people, the Housing Secretary has said. (Telegraph)

RATINGS: Sustained emigration from the UK (Aa3 stable) would lead to labour shortages in some sectors, weaken growth potential and intensify fiscal challenges, Moody's Investors Service said in a report published today. Recent data suggests the UK's foreign-born population fell steeply in 2020, with London in particular seeing the largest outflows. In the short term, net emigration, alongside sizeable government support measures, will help to keep unemployment in check, as the economy recovers from the pandemic shock and the jobs-rich services sector slowly returns to normal. (Moody's)

EUROPE

CORONAVIRUS: Johnson & Johnson has cut by half expected deliveries of COVID-19 vaccines to the European Union this week, an EU official told Reuters on Monday, compounding supply problems the company has faced since it began shipping doses to the bloc in April. Under its contract with the EU, J&J has committed to shipping 55 million doses of its one-shot vaccine in the second quarter. But midway through the quarter, it had delivered less than 5 million doses, less than 10% of its target. In addition to these initial delays, the drugmaker "is cutting deliveries this week by half," one EU official involved in talks with vaccine makers said, adding that it is not clear how many doses will be delivered next week. The official did not say how many doses were expected this week. (RTRS)

GERMANY: Germany's plan to compensate companies for closing their coal plants by 2038 could lead to billions of euros in overpayment, according to a report from climate and energy research organization Ember. The formula used by the government contains "problematic" assumptions related to power and carbon prices, fixed costs, and the length of compensation, it said. Ember estimates that its alternative proposals would cost as little as 343 million euros ($417 million), versus 4.35 billion euros currently planned. (BBG)

ITALY: Italy is set to to phase out a national curfew, currently set at 10 p.m., seeking to remove it on June 21, bowing to calls to reopen the country following a steady decrease in the number of cases. At a Monday meeting, the government of Mario Draghi agreed to delay the curfew for low-risk areas to 11 p.m., and to allow indoor dining from June 1, according to an official who asked not to be named. (BBG)

U.S.

FED: MNI INTERVIEW: Fed's Bullard Mindful of Inflation Expectations

- St. Louis Fed President James Bullard told MNI in an interview Monday that rising inflation expectations are so far consistent with a shift in the Federal Reserve's goal of making up for past undershoots of its 2% inflation target, and market-based measures bear watching for signs of any worrisome spike - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: Federal Reserve Bank of Dallas President Robert Kaplan says supply and demand imbalances and base effects will contribute to elevated inflation this year, but he expects price pressures to ease in 2022. "Our base case is that next year you'll see some moderation but I think there's a lot of uncertainty around this." Says central bank's massive monthly bond purchases "has an effect on creating excesses in financial markets, in housing markets and in the economy." "I think it'd be healthy sooner rather than later to discuss some of these side effects, unintended consequences and begin having discussions about adjusting these asset purchases as we make progress in the recovery." (BBG)

FED: The economic fallout from the coronavirus pandemic was concentrated among minorities, women and workers who hadn't finished high school, according to a new survey from the Federal Reserve. Three-fourths of U.S. adults reported doing at least OK financially in November 2020, a share that was unchanged from previous years, the Fed said Monday. But that finding masked significant divergences in economic well-being between workers who retained their jobs and those who were laid off, households with more education and those with less, and those who have children versus those without. (WSJ)

ECONOMY: We take inflation very seriously. Our Secretary of Treasury, obviously, the Federal Reserve is in — responsible for monitoring it. But there are a number of factors, as the economy turns back on, including — there are areas like the cost of airline tickets where, you know, if you look back at pre-pandemic, they dropped by about 20 percent. They are up about 10 percent since then. Right? So, there are — there are prices where the baseline was actually lower than it was prior to the pandemic, and that's one of the things we're seeing in the data. But it has not changed our view and the view of economists, I would say, around the country that there's more that needs to be done to put 8.5 million Americans back to work; to ensure that we are getting working families, working mothers the assistance they need; and to ensure we're competitive over the long term. So, it has not changed our overarching objectives and approach and our proposals. (White House)

FISCAL: Treasury Secretary Janet Yellen is heading into the belly of the beast tomorrow and asking the business community to support President Biden's $2.3 trillion infrastructure plan during a speech to the U.S. Chamber of Commerce, Axios' Hans Nichols has learned. By trying to persuade a skeptical and targeted audience, Yellen is signaling the president's commitment to raising corporate taxes to pay for his plan. Republican senators, critical to a potential bipartisan deal, oppose any corporate tax increase. (Axios)

FISCAL: U.S. Republicans are expected to unveil a new infrastructure proposal as early as Tuesday as optimism grows about a possible bipartisan deal that would cover a fraction of President Joe Biden's $2.3 trillion infrastructure plan. Senator Shelley Moore Capito, who is leading the Republican infrastructure drive, told reporters on Monday that she expected Republicans to unveil a new counter-proposal to Biden's sweeping plan sometime early this week. Her comments followed a day of discussions between Senate Republicans and White House staff, on the eve of a meeting with top administration officials slated for Tuesday afternoon. Capito and other Republicans including Senate Commerce Committee Chairman Roger Wicker announced an initial $568 billion infrastructure plan, which Democrats criticized as inadequate. Capito and Wicker were among a group of Senate Republicans who met with Biden last Thursday. Asked whether Senate Republicans would unveil a new infrastructure proposal on Tuesday, Capito replied: "We hope so. Well, it'll be early this week." (RTRS)

FISCAL: A CNN reporter tweeted the following on Monday: "GOP senators plan to meet with senior administration officials tomorrow afternoon on new GOP offer on infrastructure, though senators are signaling it's not clear if they will have that plan together by their meeting tomorrow. WH and GOP staff have been talking through the day." (MNI)

CORONAVIRUS: President Joe Biden warned Monday that coronavirus case numbers could rise once again in U.S. states with low Covid-19 vaccination rates. For the first time since the pandemic began over a year ago, Covid-19 cases are down in all 50 states, Biden announced during a White House press conference on the nation's progress fighting the virus. That progress could still be reversed, he said, especially in states where a low percentage of people have been vaccinated. (CNBC)

CORONAVIRUS: New York will lift its mask mandate on Wednesday in accordance with national guidance from the Centers for Disease Control and Prevention as Covid vaccinations approach 50% of the state's residents and cases and hospitalizations ebb. (BBG)

CORONAVIRUS: New Jersey Governor Phil Murphy said all school districts must return to in-person learning by September. The governor on Monday said his executive order allowing districts to provide remote instruction will expire at the end of the current school year. Full-time remote learning will no longer be an option, he said. Murphy also lifted the state's travel advisory that required visitors to quarantine, and he ended the outdoor mask mandate in public places. The requirement for masks in indoor public places remains in place, Murphy said. (BBG)

CORONAVIRUS: California will keep its mask mandate in place until it fully reopens its economy on June 15 in an effort to persuade more residents to get vaccinated, breaking from other states that are dropping their requirements on the federal government's advice. (BBG)

EQUITIES: Saudi Arabia's sovereign wealth fund has increased its U.S. stock holdings to $15.4 billion in the first quarter from nearly $12.8 billion at the end of 2020, according to a U.S. regulatory filing on Monday. (RTRS)

OTHER

EU/CHINA: Premier Li Keqiang urged the EU to sign the bilateral investment agreement as soon as possible in a call with Italian Prime Minister Mario Draghi on Monday, the official China Daily reported. The agreement, the negotiations of which concluded last year, was delayed by the EU following sanctions imposed by each other over human rights issues in China's Muslim Xinjiang Uygur region. Li calls the two countries "comprehensive strategic partners" and hopes Italy will help promote a healthy and stable development of China-EU ties, the daily said. (MNI)

GLOBAL TRADE: The Japanese government will introduce new regulations for 14 critical infrastructure sectors to bolster cyber defenses, learning from the recent Colonial Pipeline hack that shut down a major energy artery in America's East Coast. (Nikkei)

GLOBAL TRADE: Japan's Ministry of Economy, Trade and Industry will set up a working group with 14 automakers in Japan to discuss ways to address chipshortages, Nikkei reports, without attribution. (BBG)

CORONAVIRUS: The global pandemic isn't over yet despite high Covid vaccination rates in some countries, the head of the World Health Organization warned on Monday, days after the CDC told fully vaccinated Americans they can go without masks in most places. "There is a huge disconnect growing where in some countries with the highest vaccination rates, there appears to be a mindset that the pandemic is over, while others are experiencing huge waves of infections," WHO Director-General Tedros Adhanom Ghebreyesus said during a news conference from the agency's Geneva headquarters. (CNBC)

CORONAVIRUS: President Joe Biden plans to send an additional 20 million doses of U.S. coronavirus vaccines abroad by the end of June -- including, for the first time, shots authorized for domestic use, where supply is beginning to outstrip demand. (BBG)

JAPAN: Japan's health ministry plans to approve use of Moderna's Covid vaccine on May 21, public broadcaster NHK reports, without attribution. (BBG)

JAPAN: Japan isn't heading toward a big contraction in the second quarter and economic activity will broaden out as vaccinations proceed, says Economy Minister Yasutoshi Nishimura. (BBG)

BOJ: MNI: BOJ Vigilant Against Q2 GDP Slowdown After Q1 Dip

- Japan's economic contraction in the first quarter has had little impact on the Bank of Japan's economic outlook, as bank officials are focused on how the economy slows in the second quarter amid the state of emergency and self-imposed restrictions, MNI understands - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

HONG KONG: Hong Kong will start offering on-site Covid-19 vaccinations at major corporations from Tuesday, Chief Executive Carrie Lam says at briefing. (BBG)

BOC: MNI: BOC Investor Poll - Policy Error is Biggest Systemic Risk

- Bank of Canada polling of major investors found that a fiscal or monetary policy error is seen as the biggest risk to the financial system, and a potential inflation surge has become a greater concern than Covid-19, according to a report Monday. The semi-annual Financial System Survey asked respondents to rank each of the three biggest systemic risks and and weighted the answers in an index with scores between one and three. On that basis, a policy error scored 0.85, up from 0.3 in the previous data - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

MEXICO/RATINGS: Fitch affirmed Mexico at BBB-; Outlook Stable.

USMCA: U.S. Trade Representative Katherine Tai discussed a range of trade issues with Canadian Trade Minister Mary Ng on Monday and emphasized the need for Canada to implement new North American trade deal commitments on dairy and e-commerce shipments, her office said in a statement. (RTRS)

USMCA: The United States and Canada urged Mexico to respect foreign investments during trade discussions on Monday, officials said, while Washington also raised issues over Mexican farm produce. The talks came at the start of the first meeting of the United States-Mexico-Canada Agreement (USMCA) Free Trade Commission, which centers on the trade accord that last year replaced the North American Free Trade Agreement (USMCA). (RTRS)

TURKEY: Turkish President Recep Tayyip Erdogan on Monday accused US President Joe Biden of having "bloody hands" because of Washington's support for Israel's bombing campaign on the besieged Gaza Strip. "You are writing history with your bloody hands," Erdogan said in televised remarks directed at Biden. "You forced us to say this. We cannot step back," the Turkish president added. (Middle East Eye)

RUSSIA: Russia's economy is recovering faster than expected and the central bank now thinks output will reach its pre-Covid-19 level before the end of this year. Gross domestic product contracted 1% in the first quarter from a year earlier, according to official data released Monday, less than the 1.2% expected by economists in a Bloomberg survey. (BBG)

ISRAEL: President Biden expressed support for a ceasefire between Israel and Hamas in a call on Thursday evening with Israeli Prime Minister Benjamin Netanyahu, the White House said in a statement. This is the first time since the beginning of the crisis last Monday that Biden or any other U.S. official has publicly backed a ceasefire. It will increase pressure on Israel to seek an end to the conflict, which Netanyahu has insisted will continue until Hamas' ability to attack Israel is further degraded. (Axios)

ISRAEL: Prime Minister Benjamin Netanyahu told President Biden in their call that he wants to complete all the goals of the Gaza operation, WallaNews reporter Barak Ravid tweeted. (BBG)

IRON ORE: China's National Development and Reform Commission encourages companies to increase the sources of iron ore imports and "actively" explore overseas ore resources, NDRC spokesman Jin Xiandong says at a briefing. Regulator will step up market oversight and maintain market stability with targeted measures. NDRC and State Administration for Market Regulation are looking into steel products and iron ore markets. China's PPI may rise further in coming months due to recent commodity price surge; PPI growth is likely to slow down in 2H. (BBG)

OIL: The US Energy Information Administration increased its projection for month-on-month growth in US unconventional oil output for May by more than sevenfold in its latest Drilling Productivity Report. The EIA on May 17 said May crude production will rise by 94,000 b/d from April to 7.707 million b/d, up from its projection of a 13,000 b/d month-on-month gain to 7.6 million b/d it made last month. Total US oil production from April to May will slip by only 3,000 b/d. Higher productivity per rig and a better-than-expected bounceback from the winter freeze that caused widespread well shut-ins in February were behind the upward revision, EIA officials said. (Platts)

CHINA

LPR: The PBOC is likely to keep the Loan Prime Rate (LPR) unchanged when it issues monthly guidance on May 20, the Securities Daily reported citing analysts. The central bank on Monday rolled over the maturing medium-term lending facilities (MLF) with the amount and the rate unchanged, indicating it intends to keep policies stable and guide interbank rates around policy rates, the newspaper said. Banks also lack the motivation to increase May LPR quotes given marginal changes in banks' capital costs, the newspaper said citing Wang Qing, chief analyst at Golden Credit Rating. The one-year LPR has been unchanged for the 12th month at 3.85%, with the five-year LPR also unchanged at 4.65%. (MNI)

ECONOMY: China's April data released on Monday showed momentum of recovery has weakened with consumption and service industry lagging, even as industrial output expanded aided by strong exports, the 21st Century Business Herald reported citing analysts. Rising raw material prices have hurt small and medium-sized manufacturers and may ultimately slow wage growth, the newspaper said citing Luo Zhiheng, deputy head of Yuekai Securities Research Institute. Slower construction activities amid rainy weather in parts of the country contributed to weakened service performance, the newspaper said. Investment is expanding due to the resilient real estate and improved manufacturing, the newspaper said. (MNI)

OVERNIGHT DATA

JAPAN Q1, P GDP -1.3% Q/Q; MEDIAN -1.1%; Q4 +2.8%

JAPAN Q1, P GDP ANNUALISED -5.1% Q/Q; MEDIAN -4.5%; Q4 +11.6%

JAPAN Q1, P GDP NOMINAL -1.6% Q/Q; MEDIAN -1.3%; Q4 +2.4%

JAPAN Q1, P GDP DEFLATOR -0.2% Y/Y; MEDIAN -0.1%; Q4 +0.2%

JAPAN Q1, P GDP PRIVATE CONSUMPTION -1.4% Q/Q; MEDIAN -1.9%; Q4 +2.2%

JAPAN Q1, P GDP BUSINESS SPENDING -1.4% Q/Q; MEDIAN +0.8%; Q4 +4.3%

JAPAN Q1, P INVENTORY CONTRIBUTION % GDP +0.3%; MEDIAN +0.2%; Q4 -0.5%

JAPAN Q1, P NET EXPORTS CONTRIBUTION % GDP -0.2%; MEDIAN -0.2%; Q4 +1.0%

JAPAN MAR TERTIARY INDUSTRY INDEX +1.1% M/M; MEDIAN +0.8%; FEB -0.3%

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 112.5; PREV. 111.6

Consumer confidence increased by 0.8%, with sentiment in Sydney jumping 5.4% as no new community cases of COVID-19 were reported. The greater than expected spending promised by the government in the federal budget may have also provided a boost to confidence. Among the detail, 45% of the responders said it is a 'good time to buy a major household item' versus 22% for it being a 'bad time to buy', which are respectively the highest and lowest values since February 2020. (ANZ)

NEW ZEALAND APR NON-RESIDENT BOND HOLDINGS 50.1%; MAR 51.5%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS TUE; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Tuesday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2031% at 09:28 am local time from the close of 2.1857% on Monday.

- The CFETS-NEX money-market sentiment index closed at 44 on Monday vs 45 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4357 TUE VS 6.4307

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4357 on Tuesday, compared with the 6.4307 set on Monday.

MARKETS

SNAPSHOT: UK COVID Caution Remains Evident Despite Reopening

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 603.09 points at 28423.05

- ASX 200 up 48.238 points at 7071.8

- Shanghai Comp. up 2.863 points at 3520.479

- JGB 10-Yr future down 3 ticks at 151.39, yield down 0.5bp at 0.080%

- Aussie 10-Yr future down 4.0 ticks at 98.265, yield up 3.7bp at 1.788%

- U.S. 10-Yr future -0-01+ at 132-09+, yield down 0.34bp at 1.645%

- WTI crude up $0.22 at $66.49, Gold up $0.7 at $1867.56

- USD/JPY down 3 pips at Y109.19

- FED'S BULLARD MINDFUL OF INFLATION EXPECTATIONS (MNI)

- KAPLAN: INFLATION TO MODERATE NEXT YEAR BUT THERE'S UNCERTAINTY (BBG)

- LIKELIHOOD OF UK'S FULL LOCKDOWN RESTRICTIONS BEING LIFTED ON JUN 21 'CLOSE TO NIL' (ITV)

- CHINA VOWS TO BOOST DOMESTIC IRON ORE EXPLORATION TO MEET DEMAND (BBG)

- BIDEN TO SEND COVID VACCINES ABROAD (BBG)

BOND SUMMARY: A Rangebound Asia Session For Core FI

News flow was light at best during Asia-Pac hours, with commentary from Dallas Fed President Kaplan ultimately revealing nothing in the way of fresh information. T-Notes last -0-01+ at 132-09+, sticking to the confines of a 0-03 range, with cash Tsy yields virtually unchanged across the curve.

- JGB futures nudged lower during the Tokyo morning as domestic participants reacted to the overnight cheapening in U.S. Tsys & EGBs, while the uptick in local/regional equity markets also added some pressure. The contract managed to recover from worst levels, printing 4 ticks below Monday's settlement levels at typing, while yields sit little changed in the cash space. Japan's Q1, P GDP reading was softer than expected, although markets looked through the release.

- There was no tangible reaction in the Aussie bond space on the back of the release of the RBA's May meeting minutes. This wasn't surprising, with the meeting itself already putting focus on the July decision, when the Bank will decide on whether or not to extend the coverage of its yield targeting scheme to ACGB Nov '24 from ACGB Apr '24. The July meeting will also see the Board consider future bond purchases, with the second A$100bn round of purchases under its government bond purchase program set to be exhausted in September. Elsewhere, Australian Treasury Sec. Kennedy spoke, underlining the country's economic outperformance and fiscal capacity. He also pointed to encouraging signs in the labour market. YM -0.5, XM -4.0, hovering a little above their respective session lows.

EQUITIES: Rebound

Most major markets in Asia in positive territory, led higher by a rebound in the Taiex. The Taiwanese index is up around 4.5% after closing 3% lower yesterday, and after shedding 9% last week. The Taiwan Financial Stabilisation Fund said late yesterday that it would closely monitor stock markets and would enact measures if needed. Markets in Japan, South Korea, Hong Kong and Australia also seeing decent gains, while upside in mainland China is more muted. US futures are higher, the Nasdaq leading the way higher after tech shares sold off yesterday.

OIL: Brent Approaches $70/bbl

Oil is higher in Asia-Pac trade on Tuesday, building on Monday's gains. WTI is up $0.16 from settlement levels at $66.43/bbl, Brent is up $0.14 at $69.90/bbl. Markets are focusing on positive demand cues after the US reported the highest passenger numbers in airports since the pandemic began. Elsewhere Nigeria is seeing slower run rates at three of its main export terminals in May. Flows from Bonny, Forcados and Qua Iboe have all seen rates fall below initial loading programmes.

GOLD: Bulls Still In Control

A softer USD continues to lend support to bullion after spot closed above its 200-DMA for the first time since early February on Monday. Spot last deals little changed, just shy of the $1,870/oz mark, with initial resistance now seen at the Jan 29 high ($1,875.7/oz). A sustained break of that level would switch bullish focus to the 76.4% retracement of the Jan 6 to Mar 8 sell off ($1,892.7/oz).

FOREX: Better Sentiment, Firmer Commodity Markets Support Antipodeans

Risk-on flows allowed the Antipodeans to outperform in G10 FX space, with BBG trader source flagging corporate demand for the kiwi and noting that AUD appreciated after stops were triggered. Stronger than forecast PBOC fix & firmer commodity markets provided further support, as gains in iron ore & crude oil helped push BBG Commodity Index closer to its multi-year high.

- Offshore yuan caught a bid after the PBOC set its USD/CNY mid-point at CNY6.4357, 50 pips lower than yesterday, 12 pips lower than sell-side estimates.

- Sterling extended gains as cable breached its May 11 high of $1.4166, which reportedly triggered buy-stops above that figure. GBP/USD showed at its strongest levels in three months.

- The bid in most regional equity markets applied some pressure to the USD in Asia-Pac hours. JPY went offered alongside USD amid a broader pick-up in risk appetite.

- UK labour mkt report, flash EZ GDP as well as U.S. housing starts & building permits take focus on the data front today. Central bank speaker slate includes ECB's Lagarde & Villeroy, Fed's Kaplan, BoE's Bailey & Riksbank's Ohlsson.

FOREX OPTIONS: Expiries for May18 NY cut 1000ET (Source DTCC)

- USD/CHF: Chf0.9140($420mln)

- AUD/USD: $0.7750(A$1.0bln)

- NZD/USD: $0.7260-70(N$1.4bln-NZD puts)

- USD/CAD: C$1.1945($887mln), C$1.2410-15($1.3bln)

- USD/MXN: Mxn19.82($600mln), Mxn19.90($595mln)

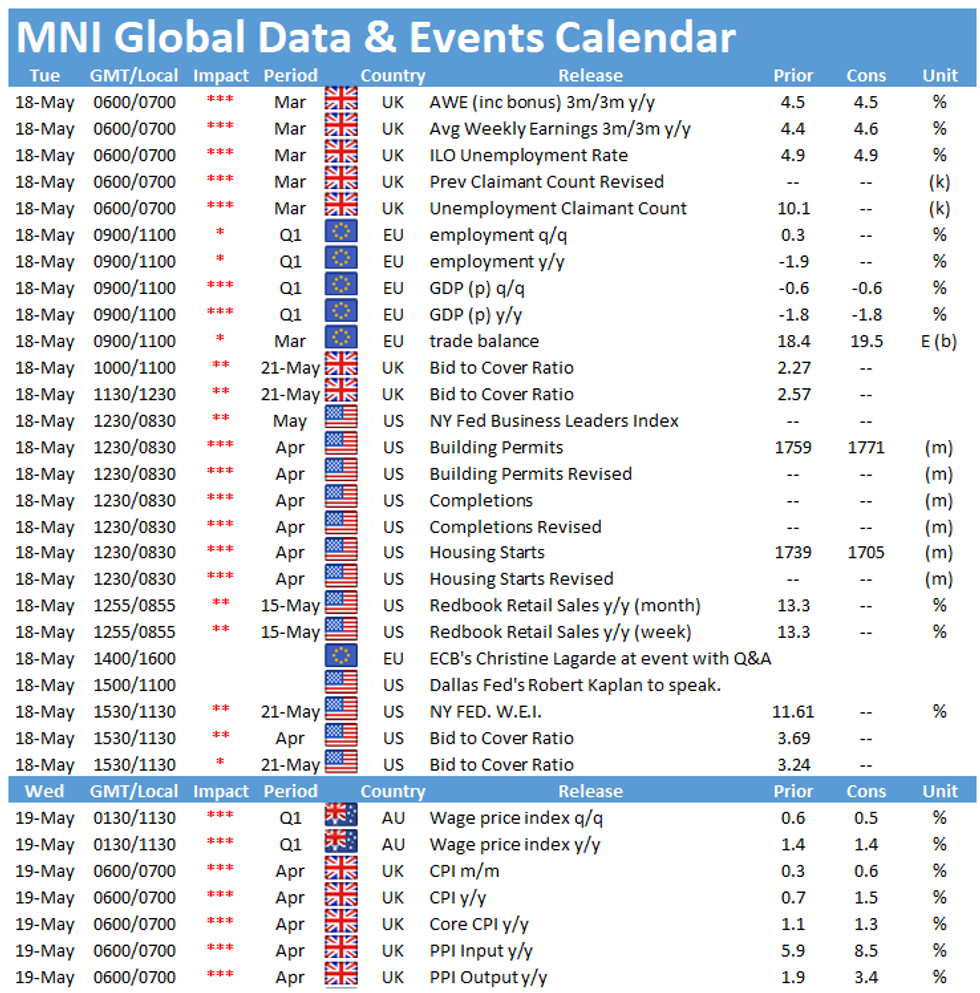

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.