-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: U.S. Fiscal Tussle & Chinese Commodity Crackdown Headline

EXECUTIVE SUMMARY

- GOP BALKS ON SPENDING PLAN AS BIDEN AIDE RULES OUT INACTION (BBG)

- UK MINISTERS SAY LOCKDOWN EASING LIKELY TO GO AHEAD ON JUNE 21 (FT)

- PBOC SEEN TIGHTENING IF CPI RISES OVER 3%; CONTROL CREDIT (MNI)

- PBOC SAYS IT WILL MAINTAIN 'BASICALLY STABLE' EXCHANGE RATE (BBG)

- CHINESE REGULATORS WARN METAL FIRMS TO MAINTAIN GOOD MARKET ORDER (RTRS)

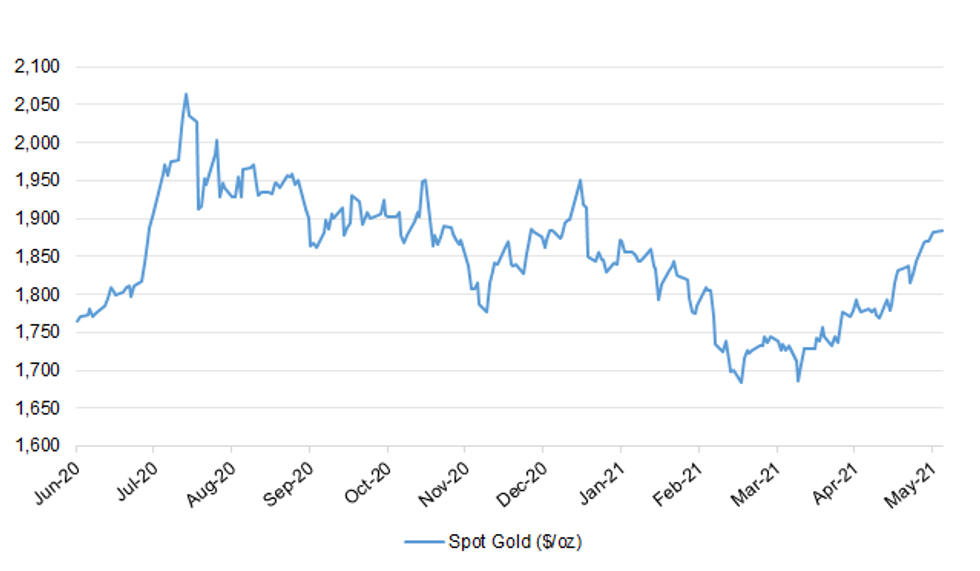

Fig. 1: Spot Gold ($/oz)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Boris Johnson has said he intends to tell people by the end of the month if the final COVID-19 restrictions can be lifted on 21 June. Doubt had been cast on the last step on the roadmap out of the lockdown by the rising number of cases of the Indian coronavirus variant. However, speaking on Friday, the prime minister said he had not seen any signs that he would have to "deviate" from plans to scrap all COVID-19 curbs in England by next month, suggesting there was no need for so-called vaccine passports to be used to gain entry to pubs. (Sky)

CORONAVIRUS: Senior UK ministers say they are increasingly confident that the June 21 easing of all lockdown restrictions in England will go ahead as planned after research suggested Covid-19 vaccines were effective against new strains. Data from Public Health England suggested that two doses of either the BioNTech/Pfizer or Oxford/AstraZeneca vaccines offered good protection against symptomatic infection by the B.1.617.2 variant that was first identified in India. The latest data show a minimal reduction in efficacy against B.1.617.2 for both vaccines compared with the dominant B.1.1.7 variant, first identified in Kent. (FT)

CORONAVIRUS: London Heathrow airport will devote a terminal to arrivals from countries with high levels of Covid-19 infection amid concern that having them share a building with other passengers risks spreading the virus. A dedicated facility for flights from so-called red list nations will open in Heathrow's Terminal 3 from June 1, the airport said in a statement Friday. The hub had been in protracted talks over government funding for the plan, which it said will be very challenging logistically. (BBG)

CORONAVIRUS: Germany will impose fresh restrictions on travelers from the U.K. starting on Sunday due to the rapid spread in Britain of the coronavirus strain first identified in India. Travelers from the U.K. will have to spend two weeks in quarantine upon arrival in Germany even if they test negative for the virus, according to the foreign ministry. In addition, transport companies will only be allowed to bring German citizens back into the country. Germany now classifies Britain as a "virus variant area," the country's highest risk category, following a recommendation from the Robert Koch Institute, according to the foreign ministry. (BBG)

CORONAVIRUS: Glasgow is remaining under level three Covid restrictions for at least a further week amid concern over rising number of cases. But Moray has now been downgraded from level three to level two - with all of Scotland's other areas remaining in their current levels. (BBC)

CORONAVIRUS/POLITICS: Dominic Cummings last night accused Boris Johnson of having pursued a secret policy of herd immunity to combat the coronavirus that would have led to "catastrophe". He also claimed that all three lockdowns could have been avoided if someone "competent" had been in charge. In a broadside at the prime minister before he gives evidence to MPs this week, the former Downing Street aide said the "shocking truth" was that herd immunity was the government's plan until less than a fortnight before the first lockdown. It was abandoned only when ministers were warned that it would lead to "hundreds of thousands choking to death" on hospital wards. (Sunday Times)

CORONAVIRUS/POLITICS: The U.K. government pushed back on claims from the former chief aide of Prime Minister Boris Johnson that officials pursued a herd-immunity strategy in the early days of the pandemic. Dominic Cummings unleashed a series of tweets on Saturday criticizing the U.K.'s response. (BBG)

ECONOMY: Business and government should put the bitter divisions of Brexit behind them and focus on building a fairer, greener economy, according to the Confederation for British Industry. That could drive an extra £700bn of economic growth by 2030, the CBI says. The employers' organisation is launching what it says is a "landmark" economic plan for the next decade. And its proposals would lead to "prizes for everyone", not just for some firms, the CBI's director general believes. "For the last five years business and government have been at odds. Brexit was very divisive," Tony Danker told the BBC. "But after the events of the last five years, we find ourselves in total alignment about what needs to be done. We need to level up, we need a greener economy and, my God, we should not waste this opportunity." (BBC)

ECONOMY/FISCAL: Pub and restaurant bosses are pushing ministers to introduce a "coronavirus recovery visa" to persuade foreign workers to return, as they resort to increasingly desperate measures to attract staff. Hospitality chiefs want a version of the visa used in Australia to plug worker shortages and keep food chains and hotels open. The mass reopening of the sector has exposed a dearth of immigrant workers, many of whom returned home at the start of the pandemic. (Sunday Times)

BREXIT: Canada is seeking to secure sweeping access to the British market for its farmers in trade talks, after UK concessions to Australia threatened to open the floodgates for food imports. Ottawa believes it can secure an ambitious deal on agriculture in negotiations later this year and hopes to take inspiration from the generous agreement set to be sealed with Australia, The Sunday Telegraph can reveal. (Telegraph)

BREXIT: Top City of London executives have raised concerns about the environmental impact of encouraging trade with distant countries after the UK moved closer to striking a tariff-free deal with Australia. Members of the FT's City Network, a forum of more than 50 senior executives, backed the UK's push to open up its borders to trade from around the world, as well as bring in new sources of overseas finance such as sovereign wealth funds. (FT)

MARKETS: Britain's top banking regulator is pressing ahead with an international push for answers on how banks' exposure to Archegos Capital Management got so massive, leading to more than $10 billion in losses. The Prudential Regulation Authority has started a probe, asking firms including Credit Suisse Group AG, UBS Group AG and Nomura Holdings Inc. to hand over information related to their lending to Archegos by next month, according to people familiar with the matter. (BBG)

EUROPE

ECB: ECB President Lagarde tweeted the following on Friday: "We believe that the current inflation increase is temporary. Bearing that in mind, we should see through the period of higher inflation. The fundamentals are certainly not there to let us assume that inflation will stay at current levels. The focus at our next monetary policy meeting in June will be on ensuring that financing conditions remain favourable for people and companies. We must continue to provide this support well into the recovery – it's far too early to look beyond that right now." (MNI)

ECB: ECB Vice President Luis de Guindos says at concluding press conference for meeting of EU finance ministers in Lisbon that recent economic data has been much more positive than 3 months ago, and the recovery is ongoing. ECB's June policy decision will be data dependent, but "we have to maintain very accommodative monetary policy conditions." On broader economic aid: "What we are asking for and monitoring is that the withdrawal of support measures has to be gradual." (BBG)

ECB: ECB Executive Board member Frank Elderson tweeted the following on Sunday: "In my interview for the Supervision Newsletter I discuss credit risk, climate-related risks, and diversity on banks' boards. These are important topics for a safe and sound banking sector and financial stability. Our findings so far don't reflect the full impact of the pandemic, but they do show measurable increases in credit risk. Of the banks we examined, 40% need to address significant gaps to meet our expectations on credit risk management. Climate risks pose real challenges and have material financial implications. Through our guide on climate-related risks and a new climate stress test, we are actively contributing to banks adequately addressing this vital issue. We want to place more weight on boards that are sufficiently diverse in terms of professional background and gender. More diverse and therefore stronger boards mean stronger governance in banks, which will ultimately translate into a safer and sounder European banking system." (MNI)

GERMANY: Germany's health minister, Jens Spahn, has promised a wide-ranging easing of pandemic restrictions during the summer if the country's seven-day incidence rate falls below 20. "Last summer the rate was below 20. We should aim for that again," Spahn told the Sunday edition of Bild. According to the Robert Koch Institute, Germany has a seven-seven-day incidence rate of 64.5. That means that there are 64.5 new infections per 100,000 individuals over a period of seven days. (BBG)

GERMANY: Support in Germany for the two main electoral rivals, Chancellor Angela Merkel's bloc and the Greens party, each fell 1 percentage point in a weekly poll. The two remain neck-in-neck four months before the country's federal election. Support for Merkel's Christian Democratic Union and its Bavarian ally, the Christian Social Union, fell to 24%, while the Greens dipped to 23% in an INSA poll for Bild am Sonntag published Sunday. The Social Democrats, Merkel's junior coalition partner since 2013, rose 1 point to 17%. The opposition Free Democrats gained 2 points to 13%, a level the party last reached in national polls in 2009. (BBG)

ITALY: Italy may consider making Covid-19 vaccinations mandatory in the future, the country's head of civil protection, Fabrizio Curcio, said in an interview with La Stampa daily on Saturday. "It is an option that needs to be thoroughly assessed, given the need of annual booster shots." (BBG)

ITALY/BTPS: Italy to sell up to EUR3.5bn short term bonds on May 26. (BBG)

SNB: The Swiss National Bank can expand its balance sheet further if needed, President Thomas Jordan told Neue Zuercher Zeitung in an interview. "A big balance sheet is per se no problem. We can expand the balance sheet further, if monetary policy so requires," he told the newspaper in an interview published on Saturday. The SNB's holdings of foreign exchange have ballooned to more than 900 billion francs ($1.1 trillion) due to its long-running campaign to weaken the franc via interventions. That practice not only drew scrutiny from the U.S. Treasury -- the central bank's huge pile of assets also exposes it to big swings in prices. The franc is still highly valued, Jordan told the paper. Still, "we only intervene as needed." (BBG)

RATINGS: Sovereign rating reviews of note from Friday include:

- Fitch affirmed Switzerland at AAA; Outlook Stable

- DBRS Morningstar confirmed Latvia at A (low), Trend changed to Positive from Stable

- DBRS Morningstar confirmed Lithuania at A, Trend changed to Positive from Stable

U.S.

FED: Factors pushing U.S. inflation higher are likely to ebb at the start of 2022, said Federal Reserve Bank of San Francisco President Mary Daly. "There's just going to be a sequence of these temporary factors that are going to persist probably through the end of the year," Daly said Friday in an interview with Bloomberg News. "They will start to roll off at the beginning of next year. How many of them will roll off or whether other bottlenecks will emerge as we start to get the economy back into shape and get back into recovery is hard to say." (BBG)

FED: Richmond Fed President Barkin: "I'm not ready at this point to completely pivot. I do want to see a lot more job creation before I'm willing to push on this too hard," on scaling back monetary stimulus. "We're on the backside of this crisis," regarding pandemic economic effects. (BBG)

FED: MNI BRIEF: Fed's Bostic 'Always' Wanted to Discuss QE Taper

- Atlanta Fed President Raphael Bostic said Friday he has "always been in that space" when asked if he was one of the Fed policymakers who is already discussing when to taper bond buys - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: The Federal Reserve's efforts to create jobs will naturally benefit Wall Street even if it's not the priority, Atlanta Federal Reserve Bank president Raphael Bostic told Dion Rabouin in an "Axios on HBO" interview. "For us to succeed in the jobs side, there's also going to be success on the wealth side. You can't get one without the other." Bostic told "Axios on HBO" that he focuses on "getting as many people a job as possible." "If you don't have a job, there's no way you're going to get to assets. I want our institutions and our policies to work in a way that many more people get jobs than have historically because then they can actually start to build those assets." "I don't do what Wall Street wants. I do what's best for the economy. If Wall Street has an investment in the economy and the economy grows and they do better, so be it." (Axios)

FED: MNI BRIEF: Fed's Kaplan Says 'Vigilant' to Inflation Risks

- Dallas Fed President Robert Kaplan said Friday the Fed is cognizant of the risk that its new policy of waiting longer to tighten monetary policy could force it to move more aggressively in the future. "People should have a lot of confidence that we are very vigilant," Kaplan said during a Dallas Fed conference - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: MNI BRIEF: Fed's Harker Wants QE Taper Talk Sooner Not Later

- Philadelphia Fed President Patrick Harker said Friday a discussion to begin slowing the central bank's asset purchase program should begin sooner rather than later, with discussions including an MBS taper. "I am of the camp that sooner rather than later we should start talking about tapering, and clearly part of that conversation will be the MBS taper," Harker said - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: A Dallas Fed survey meant to track U.S. employment trends pointed to potentially weak job growth in May, a sign that bottlenecks in the labor market may be continuing. The online survey conducted the week of May 9 through 15 showed the estimated employment rate among adults dipped to 71.1% from 71.8% in the April survey, with unemployment rising and a drop in the share of adults either working or looking for work. The statistics in the "Real Time Population Survey" are not meant to duplicate exactly the monthly survey of households conducted by the Bureau of Labor Statistics to estimate the U.S. unemployment rate. (RTRS)

FED: The Democratic chairman of the Senate Banking Committee sees economist Lisa Cook, an advocate for remedying racial and gender income inequality, as his top choice to fill the remaining vacancy on the Federal Reserve's governing board, people familiar with the matter told CNBC. If nominated and confirmed, Cook would be the Fed board's first Black woman. (CNBC)

FED: A Republican senator sent letters to three regional Federal Reserve bank leaders on Sunday seeking information about their recent work on racial economic equality, which he said he views as politicized activity that stands at odds with the central bank's mandate. Sen. Pat Toomey (R., Pa.) wrote to the leaders of the Atlanta, Boston and Minneapolis Federal Reserve banks. The latest letters follow one sent in March to the San Francisco Fed on its climate change and social focus, which he also deemed at odds with the central bank's mission. (Dow Jones)

FISCAL: President Joe Biden "will not let inaction be the final answer" on his infrastructure spending plan, and will change course if it becomes clear a bipartisan outcome is impossible, said a top White House adviser. Senate Republicans on Friday panned a trimmed-down $1.7 trillion infrastructure proposal from the White House, saying the revised offer suggested the two sides were even further apart than the GOP lawmakers had thought. Sunday brought no change in tone. Speaking on CNN's "State of the Union," Biden aide Cedric Richmond said the president showed good faith by coming down $550 billion from his original proposal. "The real question is whether the Republicans will meet the effort the president is showing," Richmond said. (BBG)

FISCAL: The White House and congressional Democrats have argued for weeks that the lack of child care services poses a major obstacle to the economic recovery, pressing for a massive and immediate investment to get parents back to work. But a new economic analysis led by a prominent White House ally concludes that school and daycare closures are not driving low employment levels — blunting a key Biden administration argument in favor of its American Families Plan and undercutting the view of some Democrats that investing in child care is crucial for the country to climb out of the coronavirus recession. "School closures and lack of child care are not holding back the recovery," said Jason Furman, a Harvard professor who chaired the Council of Economic Advisers in the Obama administration and co-authored the analysis. "And conversely, we shouldn't expect a short-term economic bump from reopening schools and making child care more available." (POLITICO)

FISCAL: A Senate committee released a bipartisan draft Saturday of a $303.5 billion highway, road and bridge bill — the type of traditional transportation package that Congress is likely to pass in some form in the coming year, despite Republicans' rejection of President Joe Biden's latest big infrastructure proposal. (POLITICO)

CORONAVIRUS: Covid cases in the U.S. have dropped to their lowest level since June as the nation prepares for Memorial Day weekend, the unofficial start of the summer travel season. The seven-day average of new infections is about 26,000 as of Sunday, according to data compiled by Johns Hopkins University. That is the lowest number since June of last year. (CNBC)

CORONAVIRUS: Federal Health officials are ramping up their surveillance of the highly transmissible Covid-19 variant first identified in India as experts warn that under-vaccinated areas in the U.S. could become hot spots for the mutation. (BBG)

CORONAVIRUS: California outlined its plans for full reopening, saying it will lift physical distancing and capacity limits on June 15, as well as drop quarantine requirements for people traveling into the state. The state has already said it will conform to CDC guidelines and lift mask mandates for those who are vaccinated on June 15. The state said it is recommending that large outdoor sporting events and concerts with more than 10,000 attendees and indoors events of more than 5,000 should require proof of a vaccine or a negative coronavirus test. "We feel like we are tracking well," said California Health Secretary Mark Ghaly said during a call with reporters, citing high vaccination rates and plummeting hospitalizations. (BBG)

CORONAVIRUS: The Centers for Disease Control is investigating a small number of young adults and adolescents who may have experienced heart problems following a COVID-19 vaccine, though the agency stressed that it is unclear the vaccine is responsible. There have been "relatively few" reports of myocarditis and "most cases appear to be mild," but the COVID-19 Vaccine Safety Technical Work Group said it felt the potential issue should be communicated to providers. The CDC noted that mRNA vaccines, which are made by Moderna and Pfizer-BioNTech, are potentially causing the problem. (Fox)

OTHER

GLOBAL TRADE: The White House on Friday stressed that its effort to institute a global minimum corporate tax is a top priority for President Joe Biden and represents more than merely a talking point for the globe's economists. Daleep Singh, who serves as both a deputy national security advisor and as a deputy National Economic Council director, told CNBC that the effort to persuade allies to adopt a minimum tax is motivated by both economic and national security factors. (CNBC)

GLOBAL TRADE: The Organization for Economic Cooperation and Development is proceeding with a U.S. proposal to set an international rule on what companies are subject to a digital services tax, the intergovernmental organization told about 140 countries and regions participating in the negotiations. (Nikkei)

GLOBAL TRADE: Growth in orders for 5G smartphone components will decline 10% to 30% this quarter from 1Q as end-demand is weaker than expected, Taipei-based Economic Daily News reports, citing unidentified people. (BBG)

GEOPOLITICS: China's top diplomat, Yang Jiechi, will visit Russia for the 16th strategic and security consultation between the two countries starting Monday, the Chinese Ministry of Foreign Affairs said on Sunday. Yang, director of the Communist Party's central committee for foreign affairs who sits on the 25-member Politburo, will also visit Slovenia and Croatia, ministry spokesperson Zhao Lijian said in a statement posted on its website. The trip will end May 27. (BBG)

GEOPOLITICS: US and European leaders called for an immediate international response after Belarus forced a Ryanair flight bound for Lithuania to land in Minsk and arrested one of its passengers, a top opposition activist. State media said online activist Roman Protasevich, resident in Lithuania, was detained in the Belarusian capital on Sunday, after Ryanair flight FR4978 from Athens to Vilnius was unexpectedly diverted to Minsk shortly before it was due to leave Belarusian airspace. President Alexander Lukashenko of Belarus personally gave an "irrevocable command to turn the plane around and land it", according to a post on a semi-official presidential channel on messaging app Telegram The news sparked furious responses from world leaders. US secretary of state Antony Blinken said: "The US strongly condemns the forced diversion of a flight between two EU member states and the subsequent removal and arrest of journalist Raman Pratasevich in Minsk. (FT)

CORONAVIRUS: G20 countries have pledged to step up the production and distribution of coronavirus vaccines to poorer countries as leaders of the most industrialised countries met virtually for the Global Health Summit in Rome. (Euronews)

CORONAVIRUS: The chief executive of AstraZeneca has insisted its Covid-19 vaccine has a future, as he revealed the UK had priority access to the jab and hit out at the "armchair generals" behind "traumatic" attacks on the company. In his first interview following a string of setbacks, including the emergence of rare fatal side-effects, Pascal Soriot defended the Oxford/AstraZeneca vaccine and offered new evidence that it could play an important role in the ongoing battle against the disease. Soriot told the Financial Times that the jab was only slightly less effective against the variant first found in India than the strain identified in Kent and said that in animal studies a new booster had performed well against other variants. AstraZeneca is in talks with governments, including the UK, about new contracts for booster doses, he said. (FT)

CORONAVIRUS: Three researchers from China's Wuhan Institute of Virology became sick enough in November 2019 that they sought hospital care, according to a previously undisclosed U.S. intelligence report that could add weight to growing calls for a fuller probe of whether the Covid-19 virus may have escaped from the laboratory. The details of the reporting go beyond a State Department fact sheet, issued during the final days of the Trump administration, which said that several researchers at the lab, a center for the study of coronaviruses and other pathogens, became sick in autumn 2019 "with symptoms consistent with both Covid-19 and common seasonal illness." The disclosure of the number of researchers, the timing of their illnesses and their hospital visits come on the eve of a meeting of the World Health Organization's decision-making body, which is expected to discuss the next phase of an investigation into Covid-19's origins. (WSJ)

JAPAN: The Japanese government expects to finish delivering coronavirus vaccines for senior citizens to all municipalities by July 4, the Yomiuri newspaper reported. (BBG)

JAPAN: The Japanese government is planning to extend a coronavirus state of emergency in 9 prefectures including Tokyo and Osaka that's scheduled to expire on May 31, the Yomiuri newspaper reports, citing several unidentified officials. The government is considering an option to extend the period in all 9 prefectures to June 20 when the emergency in Okinawa is due; another option being discussed is to end on June 13. The govt plans to officially decide on the extension this week. (BBG)

AUSTRALIA: Australia's government is promising enough Pfizer Inc. vaccines to have all Australians vaccinated by the end of 2021, the Sun-Herald newspaper reported. Two million Pfizer doses are expected to be available in Australia each week from the beginning of October, which would mean all who are keen can get their two shots by the end of the year, the paper said, citing the Australian Medical Association. (BBG)

RBNZ: While Shadow Board members still considered current monetary settings as appropriate for the upcoming May meeting, attention turns to a tightening in monetary policy over the coming year. In the near term, members pointed to some uncertainty over how sustainable the recovery will be particularly in light of continued border restrictions. Hence members saw a cautious approach as justified for the upcoming meeting. Beyond that, members saw a tightening in monetary policy as appropriate given the strengthening New Zealand economic outlook and higher inflation pressures. Some members pointed to the slowing in bond purchases by the Reserve Bank under its Large-Scale Asset Purchase programme (LSAP) that was already underway, and considered an increase in the Official Cash Rate after the LSAP programme was wound down as appropriate for the coming year. The continued strength in house prices was highlighted by some members as remaining an area of concern for the New Zealand economy. (NZIER)

SOUTH KOREA: South Korea's finance ministry is not considering drawing up an extra budget, ministry says in emailed statement. Asia Business Daily earlier reported the ministry has internally started reviewing 2nd extra budget plan. (BBG)

NORTH KOREA: President Joe Biden on Friday rejected his predecessor's approach to North Korea and said his goal as president was to achieve a "total denuclearization" of the Korean Peninsula. Speaking at a joint press conference with South Korean President Moon Jae-in, Biden used the example of former President Donald Trump's high-profile meetings with North Korean leader Kim Jong-Un to illustrate what he, Biden, would never do. (CNBC)

CANADA: Prime Minister Justin Trudeau's government began to sketch out necessary conditions to ease travel restrictions at the Canada-U.S. border. The world's longest international border has been closed to non-essential traffic for more than a year. "We recognize that in the coming weeks, when the number of vaccinated people grows and if we continue to see a reduction in Covid cases and hospitalizations, that we may be in a position to progressively loosen these measures," Intergovernmental Affairs Minister Dominic Leblanc told reporters. (BBG)

TURKEY: Former Turkish interior minister Mehmet Agar and 17 others are to face a retrial after being acquitted in 2019 in relation to unsolved murders dating back to the 1990s, Turkish media reported on Sunday. According to the T24 portal, the court of appeals in Ankara handed down the decision in April. One of the victims was Savas Buldan, the husband of Pervin Buldan, current leader of the pro-Kurdish opposition part, the HDP. Unsolved murders have also come up in a new video published by fugitive mafia boss Sedat Peker on Sunday. Peker has been at the centre of attention for weeks with YouTube videos in which he has accused the current interior minister, Suleyman Soylu, of links to organized crime. (DPA)

BRAZIL: Brazil's government on Friday issued a brighter fiscal outlook for this year, with the growing economy set to deliver higher revenues and lower spending than previously expected, narrowing the budget deficit to 2.2% of gross domestic product. Economy Ministry officials said an improving fiscal position is a key condition for a sustainable economic recovery, and repeated their view that government debt close to 90% of GDP makes fiscal consolidation an imperative rather than a choice. In its bimonthly spending and revenue report, the Economy Ministry lowered its forecast for this year's budget deficit excluding interest payments to 187.7 billion reais ($35 billion), or 2.2% of GDP. That was down from a previous forecast of a 286 billion reais deficit, and largely down to an anticipated increase in tax revenues. (RTRS)

BRAZIL: Brazil's infrastructure minister has predicted a boom in development of the nation's highways, railways and airports on the back of $50bn in investment in concession projects by the end of next year. "Brazil will become an immense construction site," Tarcísio Gomes de Freitas told the Financial Times. "With the planned concessions, by the end of 2022, $50bn will have been contracted in investments for the modernisation of airports, ports, highways and railways. In other words, the equivalent of more than 30 years of the public budget for infrastructure," he said. (FT)

RUSSIA: For the second time in a week, Secretary of State Antony Blinken said on Sunday the United States is looking to have a more "stable" and "predictable" relationship with Russia. (Axios)

SOUTH AFRICA/RATINGS: Sovereign rating reviews of note from Friday include:

- Fitch affirmed South Africa at BB-; Outlook Negative

- S&P affirmed South Africa at BB-; Outlook Stable

IRAN: A three-month monitoring deal between Tehran and the United Nations nuclear watchdog expired on Saturday, Iran's parliament speaker told the country's state TV on Sunday, adding that access to images of nuclear sites would cease. "From May 22 and with the end of the three-month agreement, the agency will have no access to data collected by cameras inside the nuclear facilities agreed under the agreement," state TV quoted Mohammad Baqer Qalibaf as saying. Iran's state TV also quoted an unnamed official saying that the agreement between the agency and Tehran could be extended "conditionally" for a month. (RTRS)

IRAN: Iran will continue the talks with world powers over how to revive the 2015 nuclear deal even as hardline lawmakers call on the government to end international inspections of its atomic activities. "U.S. has clearly expressed readiness to lift sanctions under the nuclear deal," President Hassan Rouhani said, according to a statement on his official website. "We will continue talks until a final agreement." He didn't say whether an interim nuclear inspections deal with the International Atomic Energy Agency, which expired on Saturday, will be extended. (BBG)

IRAN: U.S. Secretary of State Antony Blinken on Sunday said the United States has not seen yet whether Iran will move to comply with its nuclear commitments in order to have sanctions removed even as ongoing talks have shown progress. (RTRS)

ISRAEL: The U.N. Security Council on Saturday called for a "full adherence" to the cease-fire in Gaza and urged immediate humanitarian aid for Palestinian civilians in its first statement on the 11-day war between Israel and Hamas. The cease-fire, which took affect at 2 a.m. Friday local time, has held so far despite clashes in Jerusalem outside Al Aqsa mosque between Israeli police and Palestinians just hours after the truce officially began. (CNBC)

METALS: China's market regulators warned industrial metal companies to maintain "normal market order" during talks on the significant gains in metals prices this year, the National Development and Reform Commission (NDRC) said on Monday. The NDRC, China's top economic planner, along with the industry ministry, the state-owned assets regulator, the State Administration of Market Regulation, and the China Securities Regulatory Commission held the talks on Sunday with major domestic commodity companies and urged them not to drive up prices, according to the statement. The talks follow a statement from China's cabinet on Wednesday that the government would manage "unreasonable" price increases for copper, coal, steel, and iron ore. Those commodities, of which China is the world's biggest user, have surged this year on rising demand as lockdowns to curb the COVID-19 pandemic have eased and government stimulus has boosted consumer spending globally. "This round of price increases is the result of multiple factors, including international transmission but also have many aspects reflecting over-speculation," the NDRC said, adding that normal production and sales in the industry are disrupted. (RTRS)

OIL: US District Judge James Boasberg of the District of Columbia said the Standing Rock Sioux-led plaintiffs did not prove the necessary irreparable harm to close the 570,000 b/d pipeline, although he argued the Army Corps could have acted without the higher legal burden. A court-ordered environmental review that could put the pipeline in proper legal standing is not expected to be finalized until March 2022. The DAPL case was closely watched by industry and environmental observers alike because it could potentially set a standard for attempting to close existing pipelines and other fossil fuel infrastructure. In the end, Boasberg ruled the plaintiffs did not clear the "daunting hurdle" required by law. (Platts)

OIL: Japan and Australia have disputed the findings of the International Energy Agency's report on reaching net zero emissions by 2050, indicating they will continue fossil fuel investment despite the watchdog's advice. The push back from member countries — traditionally big fossil fuel consumers — and global energy producers, highlights the controversy surrounding the IEA's recommendations which include halting fossil fuel exploration and spending on new projects. (FT)

CHINA

PBOC: MNI: PBOC Seen Tightening If CPI Rises Over 3%; Control Credit

- The People's Bank of China is likely to keep liquidity stable unless the consumer price index rises over 3% year-on-year while continuing to restrict further credit expansion in the hot property market, policy advisors told MNI, an approach aimed at supporting growth and curbing major risk - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

YUAN: China's central bank said it will maintain the exchange rate of the yuan at "basically stable" levels after recent comments by its officials who suggested the currency be allowed to appreciate and authorities should eventually let up on controlling it. The future trend of the exchange rate will be decided by supply and demand, as well as changes in international financial markets, Liu Guoqiang, vice governor at the People's Bank of China, said in a Q&A segment posted on the bank's website. The yuan will be kept at reasonable and balanced levels, he said. The existing floating exchange rate regime is a suitable arrangement for China for now and "a period of time in the future," Liu said, without elaborating. His comments came after a PBOC official said the country should let the yuan appreciate to offset rising costs of commodity imports. China is hurt by a rally in global commodity prices, according to central bank researcher Lyu Jinzhong, in an article published Friday in PBOC magazine China Finance. (BBG)

YUAN: The People's Bank of China is likely to refrain from setting exchange rate targets for the yuan while allowing it to gain against the U.S. dollar in the medium to long term, Yicai.com reported citing analysts. Over the weekend, PBOC Deputy Governor Liu Guoqiang said the yuan's two-way fluctuation has become the norm and its future trading will be decided by supply and demand as well as the international financial markets. The yuan's recent appreciation was mainly due to the weakening dollar index, while fundamentals like China's economic recovery and balance of payments have not significantly changed, the newspaper said citing Guan Tao, the chief economist of Bank of China International and a former forex official. The yuan has continued to strengthen since April and traded around 6.4-6.5 against the dollar. Last week, the central parity rate nearly reached the high of 6.4235 on June 19, 2018. (MNI)

BONDS: Last week, a report by foreign media on China Huarong Asset Management Co. Ltd. caused further declines in its bonds. This has likely exposed some overseas investors' shallow understanding of a situation in China that financial reform is complex, and that such reform and a proper liquidity of Huarong's offshore debts can co-exist for a long time to come. Meanwhile, some investors with certain knowledge or understanding of Huarong's restructuring issues have "spotted" trading opportunities. (Caixin)

OVERNIGHT DATA

NEW ZEALAND Q1 RETAIL SALES EX INFLATION +2.5% Q/Q; MEDIAN -1.8%; Q4 -2.6%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS MON; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Monday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2000% at 09:25 am local time from the close of 2.1098% on Friday.

- The CFETS-NEX money-market sentiment index closed at 36 on Friday vs 38 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4408 MON VS 6.4300

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4408 on Monday, compared with the 6.4300 set on Friday.

MARKETS

SNAPSHOT: U.S. Fiscal Tussle & Chinese Commodity Crackdown Headline

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 80.22 points at 28398.05

- ASX 200 up 15.143 points at 7045.4

- Shanghai Comp. up 5.483 points at 3492.04

- JGB 10-Yr future up 3 ticks at 151.44, yield down 0.3bp at 0.080%

- Aussie 10-Yr future up 2.0 ticks at 98.345, yield down 1.7bp at 1.717%

- U.S. 10-Yr future +0-01+ at 132-15+, yield down 0bp at 1.622%

- WTI crude up $0.33 at $63.91, Gold up $2.88 at $1884.14

- USD/JPY down 12 pips at Y108.83

- GOP BALKS ON SPENDING PLAN AS BIDEN AIDE RULES OUT INACTION (BBG)

- UK MINISTERS SAY LOCKDOWN EASING LIKELY TO GO AHEAD ON JUNE 21 (FT)

- PBOC SEEN TIGHTENING IF CPI RISES OVER 3%; CONTROL CREDIT (MNI)

- PBOC SAYS IT WILL MAINTAIN 'BASICALLY STABLE' EXCHANGE RATE (BBG)

- CHINESE REGULATORS WARN METAL FIRMS TO MAINTAIN GOOD MARKET ORDER (RTRS)

BOND SUMMARY: Core FI Generally A Touch Firmer In Asia

A non-committal start to the week for U.S. Tsys, with T-Notes last +0-02 at 132-16, sticking to a 0-02+ range thus far on volume of ~55K. Futures activity was supported by the quarterly rolling process, although volume was still sub-par overnight. Participants have looked through the latest round of headlines pointing to greater regulatory oversight for commodities markets in China, with authorities flagging excessive speculation as a key driver in the recent run up in domestic commodity prices, vowing a zero tolerance policy re: monopolies operating in the space (the benchmark Chinese metal futures trade ~4-7% lower on the day at typing as a result). Yields are little changed across the cash Tsy curve. The latest Chicago Fed national activity index reading & Fedspeak from Brainard, Bostic, Mester & George are set to headline during NY hours on Monday.

- JGB futures stuck to a narrow range, briefly extending on the gains lodged in the final overnight session of last week, with little to go off outside of the previously flagged potential for an extension of the state of emergency in play across various regions of Japan (which would likely bring the expiry of the restrictions in play across most regions in line with the expiry of the restrictions in the Hokkaido region). JGB futures last print 4 ticks above Tokyo settlement levels, with the major cash benchmarks little changed to 1.0bp richer across the JGB curve. Elsewhere, the BoJ conducted its scheduled round of 1- to 5-Year JGB purchases, leaving the purchase sizes unchanged, with no movement in the offer to cover ratios observed vs. prev. ops covering the buckets in play.

- Aussie bond futures have ticked higher in early trading this week, with YM taking out the recent highs, last +2.0, a touch shy of best levels (after bulls forced the highest levels since liquidity moved into the M1 contract, testing the March highs on a continuation chart in the process), with short positioning (flagged back on Friday) potentially aiding the move. XM also trades +2.0, as both contracts build on their respective gains lodged back on Friday. We should highlight that the ACGB Apr '24/Nov '24 yield spread has narrowed to the tightest levels seen since the backend of April (last ~18.0bp), reflecting a higher probability that the RBA's 3-Year yield targeting mechanism will be rolled over to ACGB Nov '24 in July. Still, the spread only operates around the mid-point of the range witnessed since mid-March. On the supply front, we have seen SAFA launch a tap of its May '32 line, for up to A$500mn, while NBN is taking IOIs on 7-Year issuance.

JGBS AUCTION: Japanese MOF sells Y2.7772tn 6-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y2.7772tn 6-Month Bills:- Average Yield -0.1090% (prev. -0.1090%)

- Average Price 100.055 (prev. 100.055)

- High Yield: -0.1070% (prev. -0.1050%)

- Low Price 100.054 (prev. 100.053)

- % Allotted At High Yield: 41.9996% (prev. 31.1050%)

- Bid/Cover: 4.740x (prev. 3.458x)

BOJ: 1-5 Year Rinban Conducted

The BoJ offers to buy a total of Y925bn of JGB's from the market, sizes unchanged from the previous operations:

- Y475bn worth of JGBs with 1-3 Years until maturity

- Y450bn worth of JGBs with 3-5 Years until maturity

EQUITIES: Broadly Positive

A broadly positive day for equities in the Asia-Pac region, most indices are in the green though gains are modest. Bourses in Japan are higher by around 0.4% despite plans to extend Covid-19 state of emergency beyond the end of the month. Mainland China is just in positive territory, struggling to make headway after China once again warned against rising commodity prices and promised to crack down. Markets in South Korea struggled and are in negative territory at the time of writing. In the US futures are higher following a mixed finish for US stocks on Friday.

OIL: Benchmarks Gain

Oil is higher in Asia-Pac trade on Monday, building on Friday's gains. WTI is up $0.50 from settlement levels at $64.08/bbl, while Brent is up $0.52 at $66.96/bbl. There are positive signs that the US is making progress in its battle with coronavirus, data showed in the latest week there were no days where new cases were over 30,000 for the first time in 11 months. The optimism surrounding the recovery is outweighing demand concerns as much of Asia deals with elevated case numbers, and the prospect of additional supply from Japan.

GOLD: Well-Defined Resistance Remains In Play

Bullion has nudged higher during Asia-Pac hours, last +$4/oz at $1,885/oz, within the confines of last week's range. Bulls remain focused on $1,892.7/oz, the 76.4% retracement of the Jan 6 - Mar 8 fall. The USD/inflation/U.S. real yield mix remains at the fore on the fundamental side.

FOREX: AUD Wounded By Collateral Damage From China's Commodity Talk

The Antipodeans cemented their underperformance after China's NDRC warned it will take a "zero tolerance" approach toward violations in spot and futures commodity markets, sending industrial metals tumbling. The statement by Chinese authorities represented another step in Beijing's attempts to reign in the recent rally in commodity prices. Resultant iron ore weakness undermined AUD, while NZD faltered in tandem with its Antipodean cousin, despite a beat in domestic quarterly retail sales print.

- JPY led gains in G10 pack amid sparse news flow and little in the way of notable catalysts from over the weekend. Local press reported that the gov't is planning to extend Covid-19 state of emergency in nine prefectures beyond May 31, possibly through Jun 20, which marks the expiry of emergency declaration in Okinawa.

- The PBOC set the central USD/CNY mid-point at CNY6.4408, just 3 pips above sell-side estimates. USD/CNH lost some altitude, but remained within the confines of Friday's range. Over the weekend, PBOC Vice Gov Liu said that China's central bank will maintain yuan stability, while continuing to enhance the managed floating exchange rate system.

- Global data docket is light today, with comments from Brainard, Mester, George & Bostic as well as BoE's Bailey, Cunliffe, Haldane & Saunders eyed going forward.

FOREX OPTIONS: Expiries for May24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2145-60(E1.0bln-EUR puts), $1.2200(E1.1bln, E1.03bln EUR puts)

- USD/JPY: Y108.45-50($440mln-USD puts), Y108.80-109.00($665mln-USD puts)

- GBP/USD: $1.4150(Gbp298mln-GBP puts)

- AUD/USD: $0.7615-35(A$655mln), $0.7710-25(A$1.4bln-AUD puts), $0.7750(A$556mln-AUD puts)

- USD/CAD: C$1.2150($875mln-USD puts)

- USD/CNY: Cny6.5125($780mln)

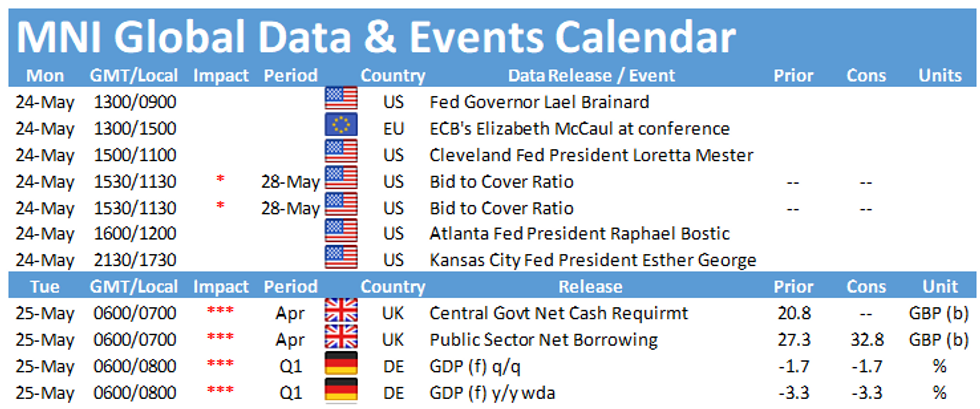

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.