-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Sino-U.S. Trade Calls Resume In Candid, Constructive Manner

EXECUTIVE SUMMARY

- US-CHINA TOP NEGOTIATORS HOLD 'CANDID AND CONSTRUCTIVE' TALKS (SCMP)

- BIDEN'S ASIA CZAR SAYS ERA OF ENGAGEMENT WITH XI'S CHINA IS OVER (BBG)

- JUSTICE DEPARTMENT IS SAID TO OPEN PROBE INTO ARCHEGOS BLOWUP (BBG)

- YUAN EXCHANGE RATE SHOULD BE DECIDED BY MARKET (SEC. TIMES)

- VICTORIA TO ENTER LOCKDOWN AS COVID CASES FROM MELBOURNE GROW (ABC)

- BOK HOLDS RATES; LIFTS GDP, CPI FORECASTS (MNI)

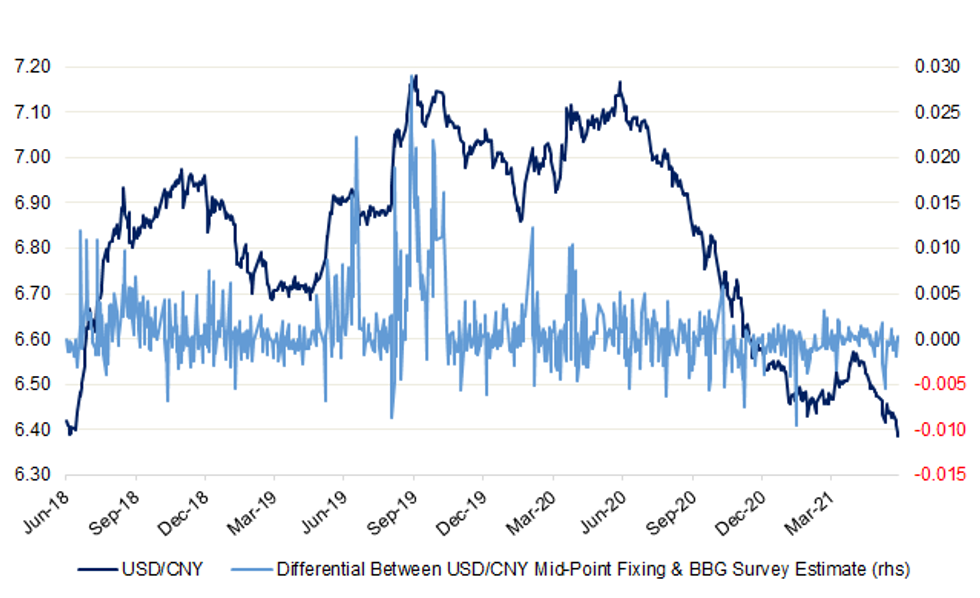

Fig. 1: USD/CNY Vs. Differential Between USD/CNY Mid-Point Fixing & BBG Survey Estimate

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: The next seven days will be "crucial" in assessing the impact of rising coronavirus case numbers on hospitals, NHS leaders have said as the daily tally passed 3,000 for the first time in a month. Cases jumped 18 per cent in a week, while admissions to hospital rose 11 per cent compared with the previous seven days. Deaths remained level with nine reported within 28 days of a positive test. Typically, an increasing number of cases has been followed by rises in hospitalisations and deaths, but officials hope that the vaccination programme will break that link. (The Times)

CORONAVIRUS: Matt Hancock is due to face MPs a day after his handling of the pandemic was fiercely attacked by the prime minister's former senior aide. Dominic Cummings described the health secretary as "completely incapable of doing the job" and said he "should have been fired" for lying. He criticised Mr Hancock over PPE shortages and "stupid" testing targets. A spokesman for Mr Hancock said: "We absolutely reject Mr Cummings' claims about the health secretary." "The health secretary will continue to work closely with the prime minister to deliver the vaccine rollout, tackle the risks posed by variants and support the NHS and social care sector to recover from this pandemic," he added. Mr Hancock later said he had not seen the evidence session in full, adding: "Instead I've been dealing with getting the vaccination rollout going, especially to over-30s, and saving lives." (BBC)

BREXIT: Britain has a trade deal with oil-rich Gulf states in its sights, international trade secretary Liz Truss has said, as ministers close in on a £5bn investment tie-up with Abu Dhabi. Officials are working on an approach to the six members of the Gulf Cooperation Council (GCC), including Saudi Arabia and the United Arab Emirates after making the oil-pumping bloc a "definite target" for a trade deal, Ms Truss told the Daily Telegraph. She also called on G7 trade ministers last night to rally behind a push to overhaul the under-fire World Trade Organisation at a meeting on Thursday, warning the trade referee faces a "do or die moment". (Telegraph)

EUROPE

ECB: The European Central Bank has almost completed a report on digital currency for Governing Council and has agreed on several cornerstones, Handelsblatt reports, citing central bank sources. Governing Council expected to decide on project at ECB's July meeting. Digital currency expected to be named "digital euro"; ECB wants to secure trademark on the name. Digital euro expected to be stored in conventional accounts under ECB control. There will likely be maximum amount people can have in their digital wallets; one limit under discussion is EU3,000. Digital euro probably won't be based on blockchain. (BBG)

FRANCE: The French government will present lawmakers next week with a bill containing emergency stimulus measures worth 15 billion euros ($18.29 billion) in a bid to help revive the coronavirus-hit economy, Finance Minister Bruno Le Maire told Les Echos. The measures, which come on top of emergency aid close to 100 billion euros last year, will include tax rebates for hotels, restaurants and bars, as well as various support mechanisms, such as compensation for lost working hours, Le Maire said. The European Commission forecasts economic growth of 5.7% in France this year while the government targets growth of 5%. (RTRS)

ITALY: All the signs are pointing to Italian Prime Minister Mario Draghi naming Dario Scannapieco as the next head of state-backed lender Cassa Depositi e Prestiti SpA, placing a long-time ally into one of the most high-profile posts in the country. That is the view of many people familiar with the situation who asked not to be named discussing the issue. (BBG)

U.S.

FED: MNI: Fed's Quarles Sees Upside Risks to Inflation

- A strong U.S. economic recovery means inflation risks are tilted to the upside even though a recent spike is likely temporary, Federal Reserve Vice Chair For Supervision Randal Quarles said Wednesday. "My optimistic outlook for growth and employment places me among those who see the risks to inflation over the medium term as weighted to the upside, relative to my baseline forecast," Quarles said in prepared remarks to a Brookings Institution conference. "I expect rapid growth to continue for some time before slowing to a still robust pace next year" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: White House officials and other Democrats close to the bipartisan infrastructure talks are willing to let the negotiations stretch past their Memorial Day deadline — but not too far. Senate Republicans are slated to bring forward their latest proposal on Thursday, a plan that is unlikely to approach $1 trillion in new spending — making it far less palatable to the White House. There also are deepening doubts about an agreement on how to pay for the infrastructure spending package. Democrats are resistant to tapping leftover Covid-relief money, which the White House argues isn't sufficient to cover the plan, anyway. White House aides and Democrats say they're giving Republicans ample time to put forward their offers on "hard" infrastructure — money to build roads, repair aging bridges and expand broadband. Barring breakthroughs on a long list of sticking points, Biden advisers and Democrats are preparing to wind down talks within a week or possibly two, three people familiar with the discussions told POLITICO. At that point, they will start shifting their focus to what it will take to pass a bill on a party-line vote. (POLITICO)

MARKETS: The Department of Justice is investigating the market-rattling meltdown of Bill Hwang's Archegos Capital Management in March, a debacle that left big banks in Europe, Asia and the U.S. nursing more than $10 billion in losses. Federal prosecutors in Manhattan sent requests for information to at least some of the banks that dealt with the firm, according to people with knowledge of the matter, who asked not to be identified discussing the confidential probe. It's unclear what potential violations or entities authorities are examining. A spokesperson for prosecutors declined to comment, a spokesperson for Archegos didn't immediately respond to a request for comment. (BBG)

OTHER

GLOBAL TRADE: Tesla is set to take the unusual step of paying in advance for chips to secure its supply of the crucial materials and is also exploring buying a plant as part of efforts to overcome the global shortage, according to people familiar with the matter. The US electric-car maker is discussing the proposals to secure chip supply with industry operators in Taiwan, South Korea and the US, said the people, who work at semiconductor industry suppliers, chipmakers and consultancies. They said Tesla's interest in an outright purchase of a plant was at a much more preliminary stage. Given the prohibitive costs that would be involved, they said such an acquisition would be difficult. Tesla needs the newest generation mass-production chips, which are made mainly in Taiwan and South Korea. (FT)

GLOBAL TRADE: Germany and France have complained that the EU is not tough enough on Big Tech and called on regulators to make it harder for the likes of Google and Facebook to pursue killer acquisitions. A paper signed by Bruno Le Maire, France's finance minister; Peter Altmaier, Germany's minister for economic affairs; and Mona Keijzer, the Dutch economic affairs minister, said the EU's flagship proposals for future technology regulation, the Digital Markets Act, lacked "ambition". The paper, which has yet to be published, but which has been seen by the Financial Times, called for the EU to strengthen and "speed up" merger scrutiny, particularly when it comes "to strategies of platform companies consisting in systematically buying up nascent companies in order to stifle competition". (FT)

U.S./CHINA: Top trade negotiators from China and the United States held their first telephone call since Joe Biden entered the White House, and stressed the importance of improving their bilateral trade ties. A brief statement on Thursday by China's Ministry of Commerce said Vice-Premier Liu He and US Trade Representative (USTR) Katherine Tai had a "candid and constructive" exchange. "The two sides conducted candid, pragmatic and constructive exchanges in an attitude of equality and mutual respect. The two sides believe that the development of bilateral trade is very important, and they exchanged views on issues of mutual concern and agreed to continue to communicate," the statement said. (SCMP)

U.S./CHINA: The U.S. is entering a period of intense competition with China as the government running the world's second-biggest economy becomes ever more tightly controlled by President Xi Jinping, the White House's top official for Asia said Wednesday. "The period that was broadly described as engagement has come to an end," Kurt Campbell, the U.S. coordinator for Indo-Pacific affairs on the National Security Council, said at an event hosted by Stanford University. U.S. policy toward China will now operate under a "new set of strategic parameters," Campbell said, adding that "the dominant paradigm is going to be competition." Chinese policies under Xi are in large part responsible for the shift in U.S. policy, Campbell said, citing military clashes on China's border with India, an "economic campaign" against Australia and the rise of China's "wolf warrior" diplomacy. Beijing's behavior was emblematic of a shift toward "harsh power or hard power" which "signals that China is determined to play a more assertive role," he said. (BBG)

U.S./CHINA/CORONAVIRUS: President Joe Biden announced Wednesday that he has ordered a closer intelligence review of what he said were two equally plausible scenarios of the origins of the Covid-19 pandemic. Biden revealed that earlier this year he tasked the intelligence community with preparing "a report on their most up-to-date analysis of the origins of Covid-19, including whether it emerged from human contact with an infected animal or from a laboratory accident." "As of today, the U.S. Intelligence Community has 'coalesced around two likely scenarios' but has not reached a definitive conclusion on this question," Biden said in a statement. (CNBC)

U.S./CHINA/CORONAVIRUS: Senate passes a bill that would require the Biden administration to declassify intelligence related to any potential links between the Wuhan Institute of Virology and the origins of the Covid pandemic. Legislation, sponsored by Republican Senators Josh Hawley and Mike Braun, passed by unanimous consent. (BBG)

U.S./CHINA/CORONAVIRUS: China supports "overall examinations" of all early Covid cases that were discovered around the world, according to a statement on the foreign ministry's website. The probe must be complete, transparent and based on facts and should include "some secret bases and biological labs," the statement says without elaborating. (BBG)

EU/CHINA: China and Europe shouldn't let false information block the truth nor let "political virus" damage unity, Chinese Foreign Minister Wang Yi said at the Munich Security Conference on Wednesday, the Xinhua News Agency reported. China will stick to its chosen political system and development as a reliable partner to the world's nations, and it is not an adversary in systems, Wang said according to Xinhua. Wang responded to questions including those on the now-suspended investment treaty with the EU and Xinjiang issues, Xinhua said. (MNI)

GEOPOLITICS: The United States is looking to convene an in-person fall summit of leaders of the Quad countries - Australia, India and Japan - with a focus on infrastructure in the face of the challenge from China, President Joe Biden's Indo-Pacific policy coordinator said on Wednesday. (RTRS)

CORONAVIRUS: Scientists in Germany claim to have cracked the cause of the rare blood clots linked to the Oxford/AstraZeneca and Johnson & Johnson coronavirus vaccines and believe the jabs could be tweaked to stop the reaction happening altogether. Rolf Marschalek, a professor at Goethe university in Frankfurt who has been leading studies into the rare condition since March, said his research showed the problem sat with the adenovirus vectors that both vaccines use to deliver the genetic instructions for the spike protein of the Sars-Cov-2 virus into the body. The delivery mechanism means the vaccines send the DNA gene sequences of the spike protein into the cell nucleus rather than the cytosol fluid found inside the cell where the virus normally produces proteins, Marschalek and other scientists said in a preprint paper released on Wednesday. (FT)

JAPAN: Japan to extend employment subsidy program to end-July. (Nikkei)

JAPAN: Former Japanese Prime Minister Shinzo Abe has weighed in on who should lead the country and the ruling Liberal Democratic Party that he controlled for more than eight years, but polling suggests his views are out of step with the public's preferences. In an interview with the conservative Hanada monthly magazine released Wednesday, Abe named Foreign Minister Toshimitsu Motegi, Chief Cabinet Secretary Katsunobu Kato, party policy research chief Hakubun Shimomura and former Foreign Minister Fumio Kishida as potential candidates. Abe stepped down as prime minister last year after a record-long tenure, citing health problems. Asked whether he himself might consider another run for leadership, he demurred. "There's plenty of talent, so I'm not considering it at all," he said. (Nikkei)

AUSTRALIA: The Victorian government has announced a seven-day lockdown today in a bid to curb the state's growing coronavirus outbreak. The state's outbreak has now reached 26 cases, with 11 new cases recorded overnight. One of the cases is now in intensive care in hospital and on a ventilator. Health Minister Martin Foley said the person in ICU was "an elderly person" who was among the earlier cases in the outbreak. (ABC)

AUSTRALIA: China's move to close the espionage trial of Australian writer Yang Hengjun is "deeply regrettable," Canberra's ambassador said outside a courthouse in Beijing, a sign of the simmering tensions between the nations. "The reason given was because of the pandemic situation but the Foreign Ministry has also told us that it was because this is a national security case," diplomat Graham Fletcher said Thursday morning at Beijing No. 2 Intermediate People's Court. "This is deeply regrettable and concerning." Fletcher added that "regardless of what happens today, we will continue to advocate strongly on behalf of Dr. Yang, his interests and his rights." (BBG)

RBNZ: The Reserve Bank Of New Zealand's (RBNZ) governor said on Thursday that monetary policy conditions could start normalizing by about this time next year if the economic outlook unfolds as anticipated. "In our projections, conditional to the economic outlook continuing to unfold as anticipated, about this time next year if not further on we see ourselves in a positive position of being able to start to normalize monetary conditions towards somewhat neutral position," Governor Adrian Orr said at a parliamentary select committee meeting. Even so, Orr said the bank will be patient and wait to see if the economy unfolds as expected. (RTRS)

RBNZ: Reserve Bank of New Zealand Governor Adrian Orr comments on projections showing rates may rise next year, in interview with Radio New Zealand. "What we're signaling is that we are more confident around a central projection." That projection is a scenario where "we are able to take our monetary conditions, interest rates, higher back to somewhere more neutral." "Having said that, given the uncertainties to both the upside to our forecasts and downside, we remain willing to shift the OCR up or down. We just see our central projection of keeping it where it is and with a bias to having to increase it sometime late next year." "The reason we removed the sentence around we remain willing to cut the OCR was largely because we thought we could say it once, we didn't need to keep saying it. The projections suggest we don't need to at this pointm but we would be willing to if needed."

BOK: MNI STATE OF PLAY: BOK Holds Rates; Lifts GDP, CPI Forecasts

- The Bank of Korea held the base rate at the historical low of 0.5% citing uncertainties around covid and modest price pressures from demand even as it raised its growth and inflation forecasts for the year. While the domestic recovery is expected to strengthen and inflation would remain high for some time, the board will maintain its accommodative stance as "there are underlying uncertainties surrounding the path of COVID-19 and inflationary pressures on the demand side are forecast to be modest," the bank said in its statement following the decision. The bank now forecasts GDP growth for the year at 4%, above the February forecast of 3%. It expects consumer price inflation in the high 1% range, exceeding the February forecast of 1.3%. "Core inflation is forecast to run at the lower 1% range," the bank said - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

CANADA: MNI INTERVIEW: Canada Revamps CPI After "Unprecedented" Shifts

- An overhaul of Canada's CPI basket in July will reflect unprecedented shifts in spending patterns during the Covid-19 pandemic, though it remains unclear how much of the pickup in inflation recorded in preliminary data will feed through to the final calculations, the assistant director of Statistics Canada's consumer prices branch told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

CANADA: Alberta, the province that produces most of Canada's oil, expects to lift almost all Covid-19 restrictions by July as vaccinations pick up and infections decline. Outdoor dining will be permitted in restaurants starting next week and hair salons will be allowed to book appointments, Premier Jason Kenney said in a press conference. By the middle of June, gyms will be allowed to reopen and restaurants will be able to serve people indoors. Two weeks after 70% of the population receives a first dose of vaccine, almost all restrictions will be lifted. The province expects to hit that milestone around the end of June. (BBG)

BOC: The Bank of Canada is thinking in more concrete terms about how its digital currency might look and work but it does not currently see a strong case for issuing one, a deputy governor said on Wednesday. The central bank is well into the development process on a cash-like digital currency that it could release to the public, should the need arise. A number of other central banks are doing similar work. (RTRS)

BRAZIL: Brazil's Treasury plans to offer more bonds linked to price indexes and to the benchmark interest rate in order to satisfy growing demand from investors who forecast inflation to accelerate and borrowing costs to go up in Latin America's largest economy. Inflation linkers will comprise as much as 30% of public debt this year while floating-rate bonds may reach as much as 37% of the stock, according to the Treasury's revised annual financing plan published on Wednesday. The portion of fixed-rate paper, on the other hand, may fall to as low as 31%. (BBG)

SOUTH AFRICA: South Africa's review of the Sinovac and Sputnik coronavirus vaccines is nearing completion, the South African Health Products Regulatory Authority said. China's Sinovac Biotech Co. may be able to supply South Africa with as many as 5 million doses of its Covid-19 vaccine, Johannesburg-based newspaper Business Day reported in March. In April, Health Minister Zweli Mkhize directed officials to buy 10 million doses of Russia's Sputnik V and China's Sinopharm shots. No applications have been received yet for the Sinopharm inoculation, officials said. (BBG)

IRAN: Last week's round of indirect nuclear talks between the U.S. and Iran in Vienna was the first in which progress was made on both negotiating tracks, sanctions relief and nuclear measures, U.S. officials say. (Axios)

COMMODITIES: China should continue to ensure commodity supply, curb excessive speculation, and show "zero tolerance" toward hoarding and manipulating the futures market as it seeks to cool the surging commodity prices, the official English-language newspaper China Daily said in a commentary. The rapid gain in prices of China's key upstream raw materials this year largely resulted from speculation, in addition to the faster-recovering demand outpacing supply, the newspaper said. A market supervision and law enforcement team should be set up to strengthen the controls over the functioning of the futures and spot markets, the daily said. (MNI)

COPPER: BHP Group Ltd said on Wednesday it would take contingency measures regarding operations in Chile after a labor union at its Escondida and Spence copper mines rejected the global mining firm's contract offer and called for a strike. The union, representing 205 workers who run BHP's Integrated Operations Center, which remotely manages pits and cathode and concentrator plants from Santiago, has called on members to walk off the job from Thursday. The Escondida and Spence mines have given notice "they will adopt contingency measures within the framework established by law," BHP said in a statement, adding that workers who were not part of the union and contractors would keep working. The impact of the strike on BHP's operations in Chile was not immediately clear, as the negotiations between the remote operations union and the firm are the first of their kind. Escondida is the world's largest copper mine and Chile is the world's top producer of the red metal. (RTRS)

OIL: The Biden administration defended a proposed ConocoPhillips oil development in Alaska on Wednesday, backing the project pushed by Alaskan Sen. Lisa Murkowski, the centrist lawmaker the administration has wooed as a potential swing vote. The decision by the Interior Department to defend in court the Trump administration's October 2020 decision and allow the Willow project in the National Petroleum Reserve-Alaska to proceed comes despite Interior Secretary Deb Haaland's opposition to the project last year when she was a member of Congress. (POLITICO)

CHINA

YUAN: China has been resolute in the market-based reform of the yuan and the People's Bank of China has largely ceased regular interventions, so the future rise and fall of the yuan should be determined by the market, said the Securities Times in a front-page commentary. Blindly pursuing currency stability isn't in the long-term development interest of an open economy, as China has vowed to increase monetary policy independence, promote capital free flow and an internationalized yuan, the newspaper said. The yuan surged past 6.4 against the U.S. dollar this week, the first time since June 2018, with some analysts predicting as high as 6.2 in offshore trading. (MNI)

OVERNIGHT DATA

CHINA APR INDUSTRIAL PROFITS +57.0% Y/Y; MAR +92.3%

AUSTRALIA Q1 PRIVATE CAPITAL EXPENDITURE +6.3% Q/Q; MEDIAN +2.0%; Q4 +4.2%

SOUTH KOREA APR RETAIL SALES +13.7% Y/Y; MAR +18.5%

SOUTH KOREA APR DISCOUNT STORE SALES -2.8% Y/Y; MAR +2.1%

SOUTH KOREA APR DEPARTMENT STORE SALES +34.5% Y/Y; MAR +77.6%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS THURS; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Thursday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.2482% at 09:24 am local time from the close of 2.2603% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 47 on Wednesday vs 38 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4030 THURS VS 6.4099

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower for a second day at 6.4099 on Thursday, compared with the 6.4099 set on Wednesday, marking the strongest fixing since Jun 14, 2018.

MARKETS

SNAPSHOT: Sino-U.S. Trade Calls Resume In Candid, Constructive Manner

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 120.1 points at 28522.78

- ASX 200 up 25.775 points at 7117.4

- Shanghai Comp. up 6.454 points at 3599.811

- JGB 10-Yr future up 5 ticks at 151.57, yield up 0.1bp at 0.075%

- Aussie 10-Yr future up 2.5 ticks at 98.415, yield down 2.5bp at 1.646%

- U.S. 10-Yr future -0-01 at 132-28, yield up 0.34bp at 1.579%

- WTI crude down $0.36 at $65.85, Gold up $2.78 at $1899.36

- USD/JPY down 6 pips at Y109.09

- US-CHINA TOP NEGOTIATORS HOLD 'CANDID AND CONSTRUCTIVE' TALKS (SCMP)

- BIDEN'S ASIA CZAR SAYS ERA OF ENGAGEMENT WITH XI'S CHINA IS OVER (BBG)

- JUSTICE DEPARTMENT IS SAID TO OPEN PROBE INTO ARCHEGOS BLOWUP (BBG)

- YUAN EXCHANGE RATE SHOULD BE DECIDED BY MARKET (SEC. TIMES)

- VICTORIA TO ENTER LOCKDOWN AS COVID CASES FROM MELBOURNE GROW (ABC)

- BOK HOLDS RATES; LIFTS GDP, CPI FORECASTS (MNI)

BOND SUMMARY: Core FI Narrow In Asia

T-Notes meandered along in a narrow 0-02 range overnight, last -0-02 at 132-27, with cash Tsys trading unchanged to ~0.5bp cheaper across the curve. There has been a lack of meaningful macro headlines. Details surrounding the high-level Sino-U.S. phone call (involving the senior trade negotiators on both sides) were sparse, although the dialogue was deemed constructive and candid, as both parties expressed the importance of their bilateral relationship. Flow was headlined by a 5K block seller of the FVN1 124.00 calls at 0-13+,

- There was nothing in the way of reaction seen in futures in the wake of the latest round of JGB supply, with super-long paper firming a touch in cash trade. The high yield witnessed at the 40-Year JGB auction came in 0.5bp below broader expectations (per the BBG dealer poll), with the cover ratio holding steady as the percentage of the paper allotted at the high yield moderated. Futures last +4, after edging away from late overnight session levels at the Tokyo re-open, as local participants reacted to the modest cheapening that was seen in U.S. Tsys in the latter rounds of NY dealing. The major cash benchmarks run little changed to ~1.0bp richer on the day at typing.

- Aussie bonds failed to exhibit a tangible reaction to the official declaration of a fresh COVID-related lockdown in the state of Victoria given the earlier press reports pointing to such a move. YM unch., XM +1.5 at typing. On the domestic data front, private capex for Q1 was firmer than expected, with positive revisions for FY21/22 investment expectations (+7.9% from the initial estimate). The strong headline reading was driven by the equipment, plant and machinery component, which bodes well for the GDP release, building on the theme of decent domestic driven partials, although some of the offshore driven inputs aren't as encouraging.

JGBS AUCTION: Japanese MOF sells Y599.3bn 40-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y599.3bn 40-Year JGBs:- High Yield: 0.710% (prev. 0.675%)

- Low Price 99.65 (prev. 94.01)

- % Allotted At High Yield: 68.2525% (prev. 100.0000%)

- Bid/Cover: 2.802x (prev. 2.800x)

JAPAN: Weekly Data Reveals Foreigners Scoop Up Japanese Bonds Again

Foreign net purchases of Japanese bonds headlined the weekly international security flow dataset for a second straight week, tipping the 4-week rolling sum of the measure back into positive territory after a mere 2 weeks in negative territory.

- Net international sales of Japanese equities moderated in the most recent week

- Elsewhere, the direction of Japanese net flows surrounding foreign bonds and equities flipped in direction but didn't quite reverse the respective flows seen in the previous week.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | -551.5 | 600.0 | -1455.7 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -89.3 | 190.2 | 10.9 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 1189.1 | 878.4 | 984.0 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | -223.5 | -471.4 | -491.3 |

EQUITIES: China Reverses Early Losses On US Trade Talks

A mixed session for indices in the Asia-Pac region. Markets in mainland China are just keeping their head above water, reversing early losses after the US and China reported holding preliminary trade talks. Markets in South Korea have also managed to eke out some gains, the BoK kept rates on hold and upgraded forecasts as well as issuing a positive assessment of the economy. Markets in Japan are lower, the Japanese government cut its assessment of the economy Wednesday, following an extension and expansion of the Covid-19 state of emergency. In the US future are lower, the Nasdaq is the laggard after outperforming yesterday. Fed's Quarles spoke late on and said that the FOMC could discuss tapering in the coming months if the economic recovery continues.

OIL: Crude Futures On Track To End Four-Day Rally

Oil is lower in Asia-Pac trade, on track to end a 4-day rally that saw WTI gain over 6.5%. WTI is down $0.40 from settlement levels at $65.81/bbl, while Brent is down $0.46 at $68.41/bbl. Some of the downtick is being attributed to a stronger greenback, USD holding yesterday's gains. Competing forces of positive demand cues from the US and potential additional supply from Iran are expected to influence price action in the near term, markets look ahead to next week's OPEC+ meeting where the group will likely sign off on supply increases.

GOLD: Bulls Fail To Hold $1,900/oz

The uptick in the DXY & weighted U.S. real yields over the last 24 hours or so combined to push bullion back below $1,900/oz, with spot last dealing little changed, around the $1,895/oz mark. There has been no real movement in terms of meaningful technical support & resistance levels.

FOREX: NZD Remains Firm In Quiet Asia-Pac Trade

It was a mixed and rather limited session for G10 FX. The kiwi outperformed at the margin, building on gains inspired by the RBNZ's latest Monetary Policy Statement. AUD/NZD faltered past Wednesday's low, as the Aussie struggled unlike its peer from across the Tasman.

- The PBOC set the central USD/CNY mid-point at CNY6.4030, just 2 pips above sell-side estimates. BBG doppelganger of the CFETS RMB Index climbed to a three-year high, as did onshore and offshore redback, with China Securities Journal noting that the exchange rate should be decided by the market.

- JPY and CHF as e-minis slipped, while NOK was dented by softer crude oil prices.

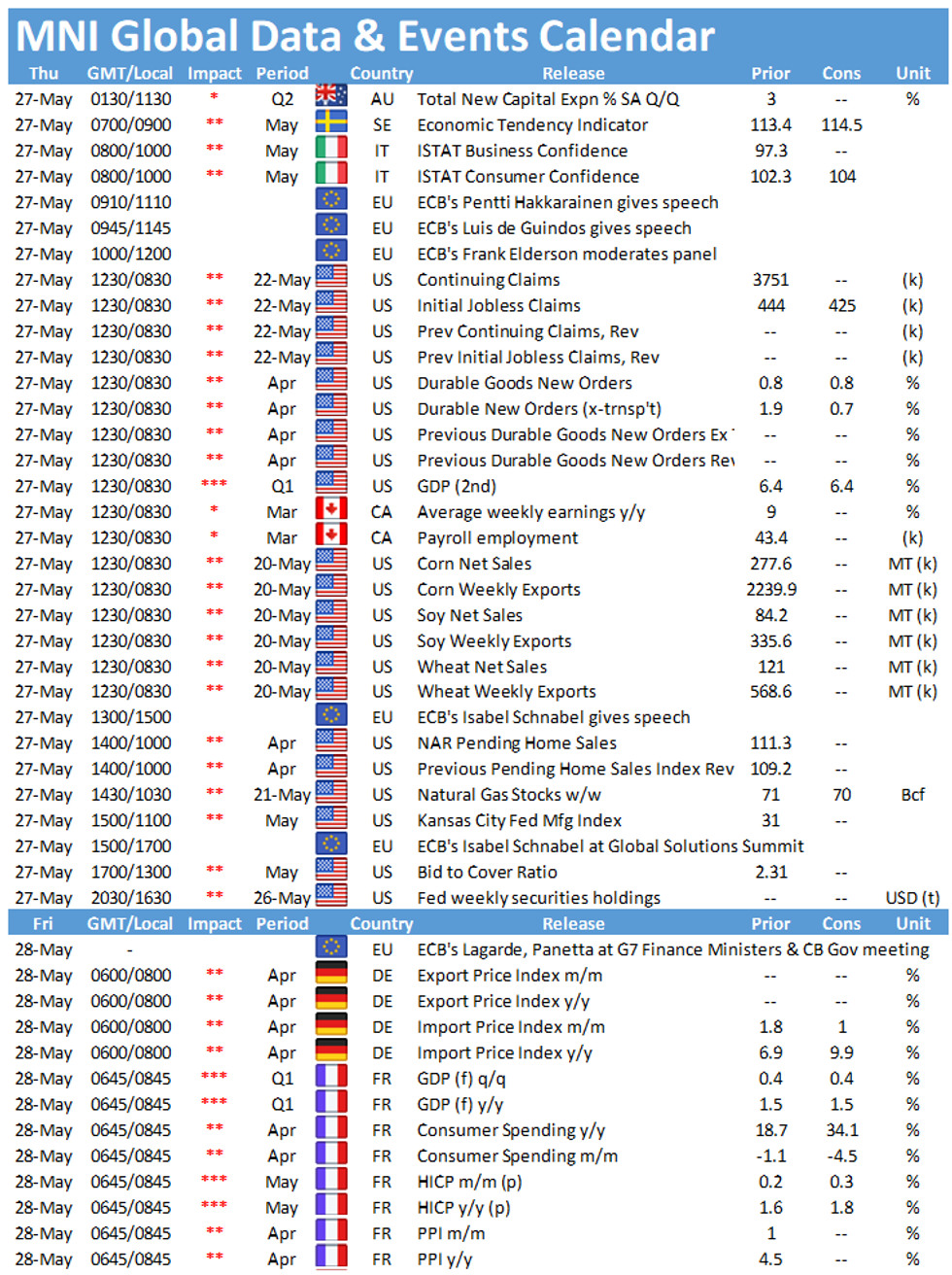

- Focus moves to U.S. jobless claims, durable goods orders, pending home sales, the second Q1 GDP est. as well as Italian sentiment gauges & Swedish trade balance. Comments are due from ECB's de Guindos, de Cos, Weidmann & Schnabel, BoE's Vlieghe & Riksbank's Skingsley.

FOREX OPTIONS: Expiries for May27 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2100(E501mln), $1.2200-02(E600mln)

- USD/JPY: Y108.95-109.05($533mln)

- EUR/CHF: Chf1.1000(E440mln-EUR puts)

- EUR/NOK: Nok9.9550(E700mln-EUR puts)

- AUD/USD: $0.7770-80(A$654mln-AUD puts)

- NZD/USD: $0.7250-60(N$594mln-NZD puts)

- USD/CAD: C$1.2100-10($977m-USD puts), C$1.2125($797mln), C$1.2155($442mln-USD puts), C$1.2195-1.2205($1.4bln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.