-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Biden Admin Eyes Productive Lame Duck

MNI US MARKETS ANALYSIS - Tsys Firmer Ahead of Early Close

MNI EUROPEAN MARKETS ANALYSIS: Curtailed Month-End Eyed

- Top level Sino-U.S. trade negotiators held a "candid, constructive" phone call, but there was little in the way of detail apparent.

- Equities tick lower in Asia, USD/CNY registered an incremental new multi-year low.

- Eyes on month-end matters given the curtailed trading calendar for May owing to U.S. & UK holidays on Monday.

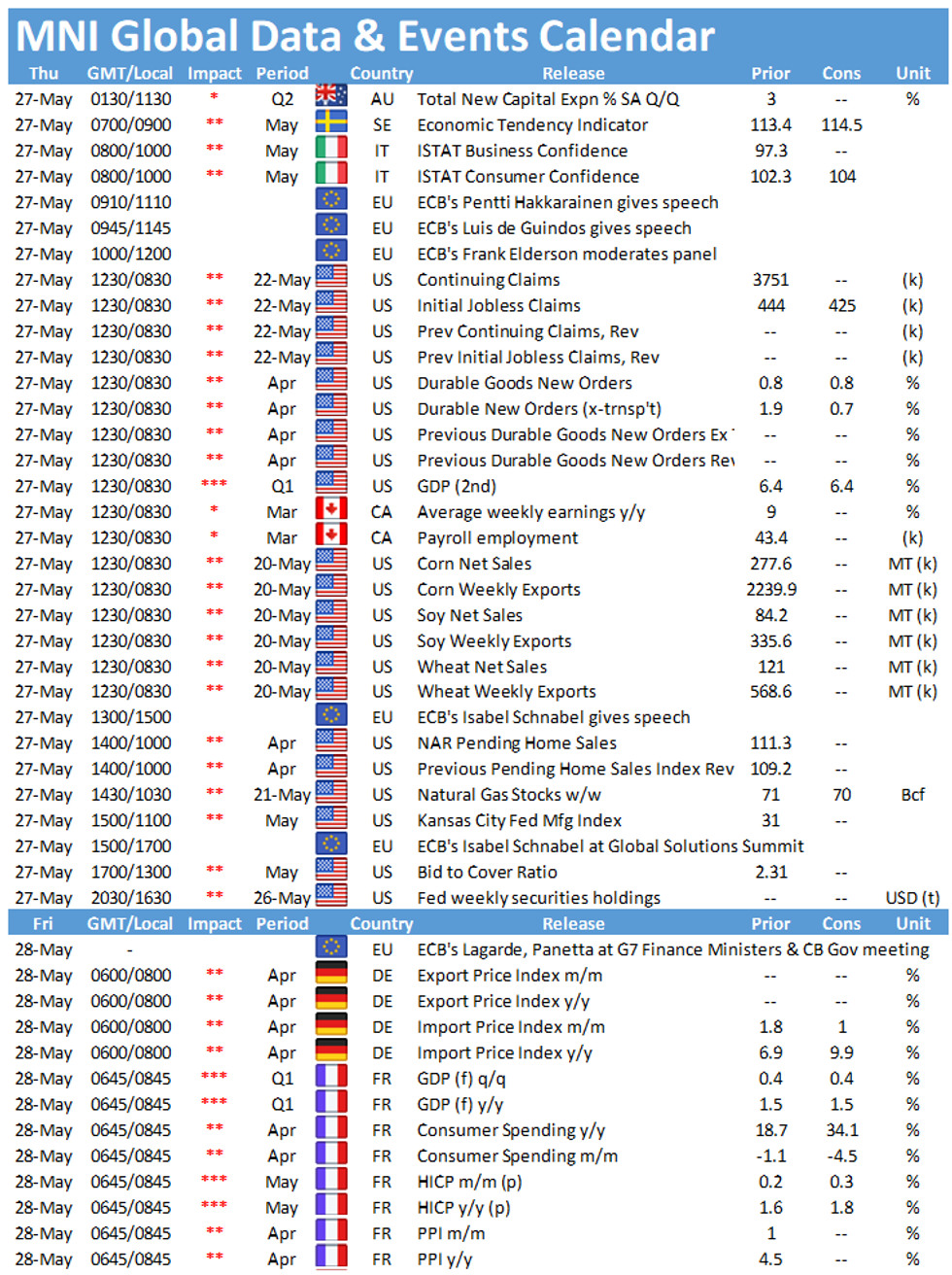

BOND SUMMARY: Core FI Narrow In Asia

T-Notes meandered along in a narrow 0-02 range overnight, last -0-02 at 132-27, with cash Tsys trading unchanged to ~0.5bp cheaper across the curve. There has been a lack of meaningful macro headlines. Details surrounding the high-level Sino-U.S. phone call (involving the senior trade negotiators on both sides) were sparse, although the dialogue was deemed constructive and candid, as both parties expressed the importance of their bilateral relationship, although differences clearly remain. Flow was headlined by a 5K block seller of the FVN1 124.00 calls at 0-13+. Durable goods, weekly initial claims, the second Q1 GDP estimate, pending home sales and the Kansas City Fed m'fing index headline the local economic docket on Thursday. Elsewhere, 7-Year Tsy supply is due.

- There was nothing in the way of reaction seen in futures in the wake of the latest round of JGB supply, with super-long paper firming a touch in cash trade. The high yield witnessed at the 40-Year JGB auction came in 0.5bp below broader expectations (per the BBG dealer poll), with the cover ratio holding steady as the percentage of the paper allotted at the high yield moderated. We highlighted the outright attractiveness of the line ahead of supply, although there was a lack of relative value appeal. Futures last +5, after edging away from late overnight session levels at the Tokyo re-open, as local participants reacted to the modest cheapening that was seen in U.S. Tsys in the latter rounds of NY dealing. The major cash benchmarks run little changed to ~1.0bp richer on the day at typing. The latest round of weekly international security flow data revealed a solid round of net buying of Japanese bonds on the part of foreign investors for the second consecutive week. Elsewhere, the Nikkei reported that Japan will extend its employment subsidy program to the end of July. Friday's local economic docket will be headlined by the monthly labour market report and Tokyo CPI readings. We will also see the latest round of BoJ Rinban operations covering 3- to 10-Year JGBs.

- Aussie bonds failed to exhibit a tangible reaction to the official declaration of a fresh COVID-related lockdown in the state of Victoria given the earlier press reports pointing to such a move. YM +0.5, XM +2.0 at typing. On the domestic data front, private capex for Q1 was firmer than expected, with positive revisions for FY21/22 investment expectations (+7.9% from the initial estimate). The strong headline reading was driven by the equipment, plant and machinery component, which bodes well for the GDP release, building on the theme of decent domestic driven partials, although some of the offshore driven/related inputs aren't as encouraging. Sino-Aussie tensions also continue to simmer, after China moved to close the espionage trial of Australian writer Yang Hengjun. A portion of today's AOFM Note supply was conducted at negative yields (not for the first time), with the record levels of excess liquidity sloshing around in the domestic banking sector crimping yields, while U.S. domiciled bidders likely continued to hoover up the paper, which provides a positive yield when swapped back into US$. The release of the weekly AOFM issuance schedule & A$1.0bn of ACGB 4.75% 21 April 2027 supply headline the local docket on Friday.

JAPAN: Weekly Data Reveals Foreigners Scoop Up Japanese Bonds Again

Foreign net purchases of Japanese bonds headlined the weekly international security flow dataset for a second straight week, tipping the 4-week rolling sum of the measure back into positive territory after a mere 2 weeks in negative territory.

- Net international sales of Japanese equities moderated in the most recent week

- Elsewhere, the direction of Japanese net flows surrounding foreign bonds and equities flipped in direction but didn't quite reverse the respective flows seen in the previous week.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | -551.5 | 600.0 | -1455.7 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -89.3 | 190.2 | 10.9 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 1189.1 | 878.4 | 984.0 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | -223.5 | -471.4 | -491.3 |

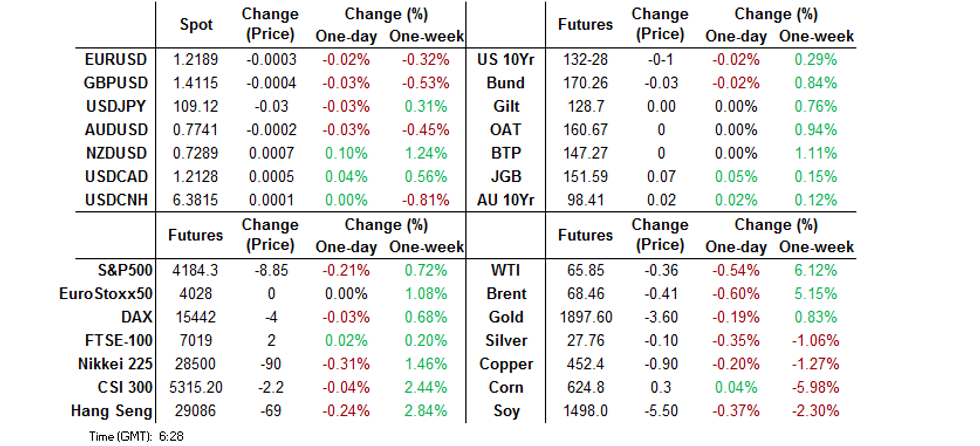

FOREX: NZD Remains Firm In Quiet Asia-Pac Trade

It was a mixed and rather limited session for G10 FX. The kiwi outperformed at the margin, building on gains inspired by the RBNZ's latest Monetary Policy Statement. AUD/NZD faltered past Wednesday's low, as the Aussie struggled unlike its peer from across the Tasman.

- The PBOC set the central USD/CNY mid-point at CNY6.4030, just 2 pips above sell-side estimates. BBG doppelganger of the CFETS RMB Index climbed to a three-year high, as did onshore and offshore redback, with China Securities Journal noting that the exchange rate should be decided by the market.

- JPY and CHF as e-minis slipped, while NOK was dented by softer crude oil prices.

- Focus moves to U.S. jobless claims, durable goods orders, pending home sales, the second Q1 GDP est. as well as Italian sentiment gauges & Swedish trade balance. Comments are due from ECB's de Guindos, de Cos, Weidmann & Schnabel, BoE's Vlieghe & Riksbank's Skingsley.

FOREX OPTIONS: Expiries for May27 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2100(E501mln), $1.2200-02(E600mln)

- USD/JPY: Y108.95-109.05($533mln)

- EUR/CHF: Chf1.1000(E440mln-EUR puts)

- EUR/NOK: Nok9.9550(E700mln-EUR puts)

- AUD/USD: $0.7770-80(A$654mln-AUD puts)

- NZD/USD: $0.7250-60(N$594mln-NZD puts)

- USD/CAD: C$1.2100-10($977m-USD puts), C$1.2125($797mln), C$1.2155($442mln-USD puts), C$1.2195-1.2205($1.4bln)

EQUITIES: China Reverses Early Losses On US Trade Talks

A mixed session for indices in the Asia-Pac region. Markets in mainland China are just keeping their head above water, reversing early losses after the US and China reported holding preliminary trade talks. Markets in South Korea have also managed to eke out some gains, the BoK kept rates on hold and upgraded forecasts as well as issuing a positive assessment of the economy. Markets in Japan are lower, the Japanese government cut its assessment of the economy Wednesday, following an extension and expansion of the Covid-19 state of emergency. In the US future are lower, the Nasdaq is the laggard after outperforming yesterday. Fed's Quarles spoke late on and said that the FOMC could discuss tapering in the coming months if the economic recovery continues.

GOLD: Bulls Fail To Hold $1,900/oz

The uptick in the DXY & weighted U.S. real yields over the last 24 hours or so combined to push bullion back below $1,900/oz, with spot last dealing little changed, around the $1,895/oz mark. There has been no real movement in terms of meaningful technical support & resistance levels.

OIL: Crude Futures On Track To End Four-Day Rally

Oil is lower in Asia-Pac trade, on track to end a 4-day rally that saw WTI gain over 6.5%, with WTI & Brent both sitting $0.40 lower on the day at typing. Some of the downtick is being attributed to a stronger greenback, USD holding yesterday's gains. Competing forces of positive demand cues from the US and potential additional supply from Iran are expected to influence price action in the near term, markets look ahead to next week's OPEC+ meeting where the group will likely sign off on supply increases.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.