-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: RBA Holds, Notes Declining Inflation Risk

MNI: PBOC Net Injects CNY90.3 Bln via OMO Tuesday

MNI EUROPEAN MARKETS ANALYSIS: Bonds Heavy Into Long U.S. Weekend

- Core FI struggled in Asia after Thursday's pressure.

- USD generally firmer vs. G10 FX but mostly weaker vs. Asia FX.

- U.S. PCE data headlines on Friday ahead of the elongated U.S. weekend.

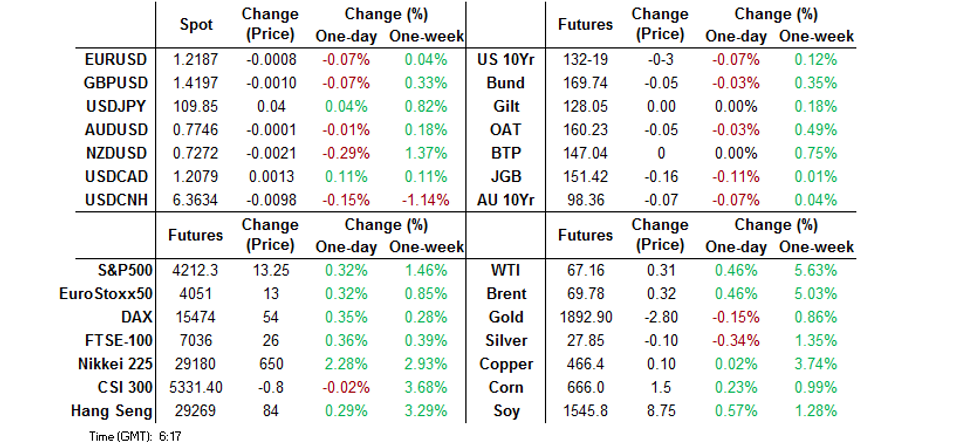

BOND SUMMARY: Core FI Biased Lower In Asia

The U.S. Tsy space has cheapened a little overnight, TYU1 last deals -0-03 at 131-22 (Sticking to a 0-03+ range), with cash Tsys bear steepening a little, as 30s cheapen by just over 1.0bp. There hasn't been much in the way of regional willingness to push back against Thursday's cheapening during Asia dealing, with the proximity to the elongated Memorial Day weekend and today's U.S. PCE reading perhaps keeping some sidelined, even with estimates pointing to an above average round of month-end extensions for the space. April's PCE suite provides the focal point of Friday's local docket. The PCE reading will be supplemented by the release of the latest Chicago PMI survey, final UoM sentiment reading and inventories data. A reminder that Friday will bring an early close for the cash Tsy market ahead of Monday's Memorial Day holiday (which itself will see a shortened session for Tsy futures and no cash trade).

- The Aussie bond space continues to hold weaker on the day, with 3-Year EFPs pushing out to levels not witnessed since the Mar '20 vol. YM -2.5, XM -7.5, with the impetus from U.S. hours spilling over into the local session. While there has been little in the way of overt headline triggers, it is worth flagging the widening in the ACGB Apr '24/Nov '24 yield spread, which has now unwound 2/3rds of the recent 6-7bp of tightening over just 2 sessions, as markets swing back to pricing a lower chance of the RBA extending its yield targeting mechanism out to cover ACGB Nov '24 in July. Red Bill contracts print 2 to 5 ticks softer at typing. There has also been some focus on local mortgage rate dynamics, after local press flagged that NAB cut two of its variable investment home loans by 30bp this morning. Sino-Aussie tensions remain evident, with recent headlines noting Australia's request re: the formation of a panel at the WTO re: Chinese barley duties. The pricing side of the latest round of ACGB Apr '27 supply was firm enough, with the weighted average yield printing 0.94bp through prevailing mids at the time of supply (per Yieldbroker pricing), although the cover ratio wasn't anywhere near as firm, printing just above 2.00x. Participants were perhaps a little wary in the wake of the recent richening and may have one eye on the RBA's July's decision, which may have kept overall bidding subdued (also resulting in a slightly wider high to average yield differential this time out). Finally, the AOFM released its weekly issuance slate, which is a little light on duration. Next week's local docket will be headlined by the latest RBA decision (Tuesday) & the Q1 GDP reading (Wednesday).

- JGB futures print -14 vs. yesterday's settlement, a little above session lows, with the belly of the curve leading the way lower in cash trade. There has been little in the way of meaningful news flow, with onshore investors playing catch up to overnight movements in the broader core global FI space. Local data was broadly in line with expectations, with nothing in the way of notable movement in the latest round of Tokyo CPI & labour market data. A quick look at the latest round of BoJ Rinban operations saw purchase sizes remain unchanged across the buckets in play, with steady to lower offer to cover ratios across the 3- to 5- and 5- to 10-Year buckets. Recent headline flow from BoJ Governor Kuroda provided no surprises, as he shrugged off any concerns re: global monetary policy divergence, stressing the need for ultra-loose policy settings in Japan. Elsewhere, Kuroda said that the Bank would consider the extension of its COVID support schemes after press reports suggested that the facilities may be extended through the end of the calendar year. Elsewhere, corporate supply saw SoftBank price Y100bn of paper across 5-, 7- & 10-Year tranches.

FOREX: Greenback Gains Into Month-End, Yuan Remains Buoyant

The greenback firmed during the final Asia-Pac session of the week, as musings surrounding U.S. Pres Biden's budget proposal took focus. Usual chatter about the impact of month-end flows also did the rounds, with the U.S. about to observe a long weekend. Headline flow in the Asia-Pac timezone failed to provide much in the way of notable catalysts.

- The yuan caught a bid, ignoring a softer than expected PBOC fix, which came in at CNY6.3858 (21 pips above sell-side estimate). BBG tracker of broader yuan strength against a basket of currencies extended gains to a new three-year high.

- NZD went offered across the board, losing its post-RBNZ shine and snapping a four-day winning streak. A hawkish surprise provided by the Reserve Bank on Wednesday has allowed the kiwi to become the best G10 performer this week.

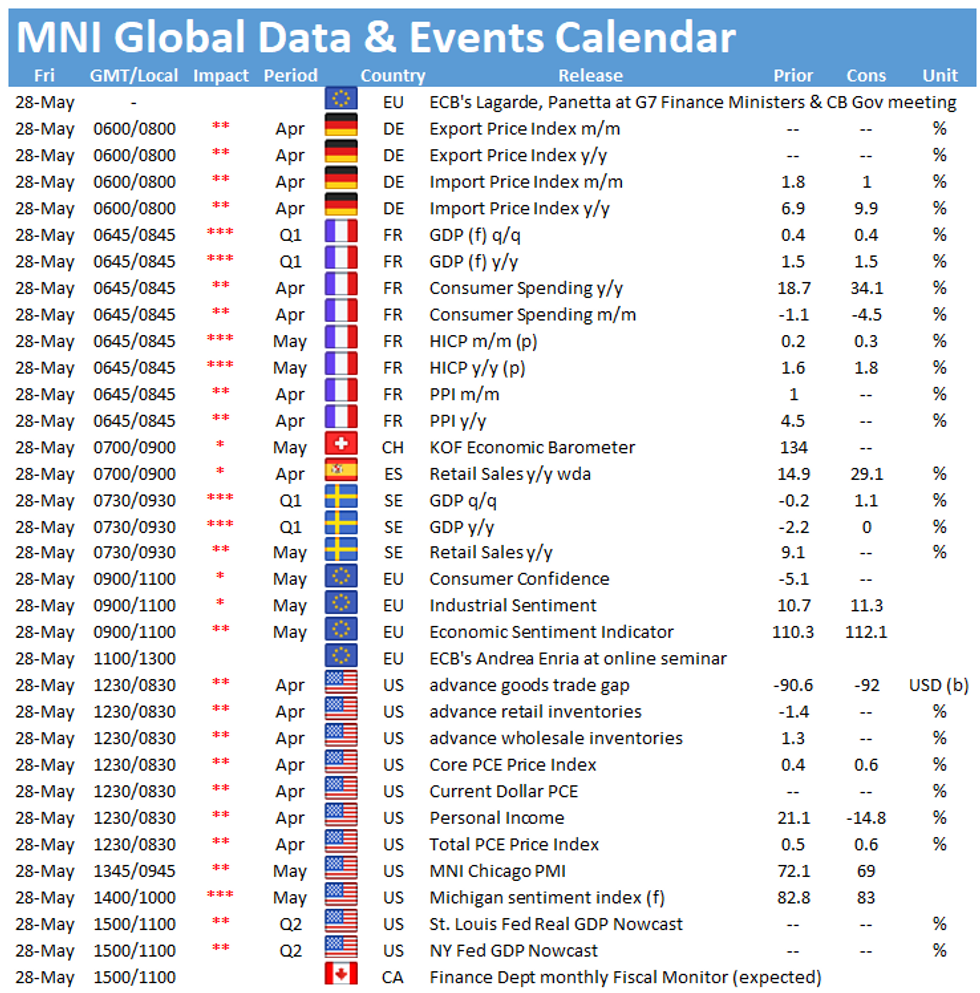

- U.S. PCE takes centre stage today, on top of Chicago PMI survey, final UoM sentiment & inventories data. Elsewhere, GDP data from France & Sweden are also due. ECB's Villeroy speaks at an ACPR meeting.

FOREX OPTIONS: Expiries for May28 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1985-1.2000(E1.0bln), $1.2100-15(E552mln), $1.2185-1.2200(E1.8bln-EUR puts), $1.2210-20(E1.2bln-EUR puts), $1.2250-65(E1.2bln-EUR puts), $1.2275(E722mln-EUR puts), $1.2300(E672mln-EUR puts)

- USD/JPY: Y108.50-60($895mln-USD puts), Y110.00($2.0bln-USD puts), Y110.50($976mln)

- GBP/USD: $1.4200(Gbp817mln-GBP puts)

- EUR/JPY: Y132.80-00(E723mln)

- EUR/CHF: Chf1.1000(E960mln-EUR puts)

- AUD/USD: $0.7750(A$553mln)

- USD/CAD: C$1.2000($640mln-USD puts), C$1.2050($C420mln), $1.2100($1.3bln), C$1.2150($612mln-USD puts)

- USD/MXN: Mxn19.75($1.3bln-USD puts), Mxn20.25($689mln)

ASIA FX: Ending The Week On A High Note

Most Asia EM FX higher amid positive risk sentiment.

- CNH: Offshore yuan is stronger, reversing earlier weakness. The PBOC fixed USD/CNH above sell-side estimates, indicating a preference for a weaker yuan, but the move reversed, data showed Chinese companies industrial profits rose 240% Y/Y in the first four months of 2021.

- SGD: Singapore dollar gained, on the coronavirus front Singapore reported 15 cases in the past 24 hours. Testing has surged in Singapore, to the point where results are being delayed as labs work at maximum capacity.

- TWD: Taiwan dollar is higher, on track for a fourth day of declines. The pair is at the lowest since May 10 where it bottomed out at 27.7415, which denotes the lowest since the pair dropped past 28.00. There were reports yesterday that the DPP wants to double planned stimulus.

- KRW: Won is higher, President Moon said Thursday that South Korea needs to maintain expansionary fiscal policy for the time being despite a hike in national debts attributable to the response to COVID-19.

- MYR: Ringgit gained, the Finance Ministry listed uncertainty over the prolonged Covid-19 outbreak, vaccine supply disruptions and commodity price shocks as key downside risks to Malaysia's economic recovery. The Ministry has estimated that the recent tightening of Covid-19 curbs will have an impact of less than 1% on domestic GDP growth.

- IDR: Rupiah bucked the trend and weakened, there was limited local news flow, markets focusing on yesterday's announcements of PPKM movement restrictions in a bid to stem the spread of coronavirus. Bank Indonesia said Thursday that money supply grew 11.5% Y/Y in April on the back of seasonal impact of Ramadan and Eid holidays.

- PHP: Peso is stronger, S&P affirmed the Philippines' sovereign credit rating at BBB+, with outlook left at stable. The agency said that the Philippines is expected to undergo "healthy" economic recovery, which will result in reductions of fiscal deficits over the next 2-3 years.

- THB: Baht is higher, Bangkok has launched registration for Covid-19 vaccinations Thursday, with the mass rollout of jabs due to start next month.

ASIA RATES: Yields Higher Throughout Asia AM

Yields higher and futures lower throughout Asia EM.

- INDIA: Yields higher in early trade. Participants look ahead to today's INR 260bn auction, the sale could struggle on fears that India could have to increase borrowing again this year due to the pandemic. The Finance Minister Sitharaman is expected to speak today after a meeting with the goods and services tax panel, markets will hope there are some hints as to borrowing requirements. The meeting is scheduled at 0630BST/1100IST with no scheduled time for comments.

- SOUTH KOREA: Futures lower, dropping at the open and moving in a narrow range. President Moon said Thursday that South Korea needs to maintain expansionary fiscal policy for the time being despite a hike in national debts attributable to the response to COVID-19. He emphasized that the role of state budget spending is important amid the crisis, speaking at the outset of an annual meeting on fiscal strategy.

- CHINA: The PBOC matched maturities with injections, the overnight and 7-day repo rate rose, the latter at 2.2746% is higher than the PBOC's 2.20% rate, both rates still below this week's high. Futures are lower, 10-year down around 16 ticks. The US Senate advanced legislation aimed at countering increasing Chinese competitiveness. The bill cleared the first set of procedural hurdles as Senate Majority Leader Schumer and Republicans struck a deal to make some additions. The legislation would increase domestic funding in critical industries such as semiconductors, and expand research initiatives, there is still some way to go before the bill is passed.

- INDONESIA: Yields higher across the curve, markets focusing on yesterday's announcements of PPKM movement restrictions in a bid to stem the spread of coronavirus. The measures will be in place for two weeks starting from June 1. Yesterday's new case number was the highest since May 7.

EQUITIES: China Lags Regional Gains

Positive risk sentiment in Asia has seen most major markets in the green, Japan leading the way higher with gains around 2% as the yen weakens on a trade weighted basis, even as Japan extends its State of Emergency in Tokyo and other areas through to June 20, just five weeks before the Olympics is due to start. In Taiwan the Taiex is up around 1.5%, boosted by foreign inflows which resumed yesterday after four days of outflows. The ASX 200 is up over 1%, buoyed by miners after metals prices rose as China said it could reduce output in a pollution crackdown. Markets in mainland China are struggling though, just about keeping their head above water. The yuan weakened today as the PBOC set the fix higher than sell-side estimates, indicating a preference for a weaker yuan, there is speculation that this is a signal the bank sees the currencies recent appreciation as too fast. In the US futures are higher, building on yesterday's gains after a rally inspired by US President Biden's spending plans.

GOLD: Taking A Breather

Bullion struggled for air above $1,900/oz on Thursday, with steady to higher U.S. real yields keeping a lid on prices. Spot has coiled in Asia & last trades just shy of $1,895/oz, with nothing changing from a technical perspective.

OIL: Crude Futures On Track For Weekly & Monthly Gain

Oil is higher again on Friday, on track for a sixth straight day of gains and upside of almost 6% this week and over 7.5% on the month, the fifth gain in the last six months. WTI & Brent sit ~$0.30 higher on the day at typing. The benchmarks are slightly below yesterday's highs which denoted the highest in two years. Markets look ahead to the OPEC_ meeting next week, and the outcome of negotiations between Iran and world powers which could result in an increase in Iranian supply.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.