-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Yellen Wants The Fiscal Taps To Keep Running

EXECUTIVE SUMMARY

- U.S. TSY SEC YELLEN SAYS HIGHER INTEREST RATES WOULD BE 'PLUS' FOR U.S., FED (BBG)

- U.S. TSY SEC YELLEN TELLS G7 TO KEEP SPENDING, SAYS INFLATION WILL PASS (RTRS)

- ECB'S VISCO: WE MUST BE CAREFUL ABOUT INFLATION RISKS (BBG)

- MERKEL'S HEIR BOLSTERS BID FOR CHANCELLORSHIP WITH STATE VICTORY (BBG)

- TECH GIANTS AND TAX HAVENS TARGETED BY HISTORIC G7 DEAL (RTRS)

- EU & UK JOSTLE FOR POSITION AHEAD OF WEDNESDAY GATHERING

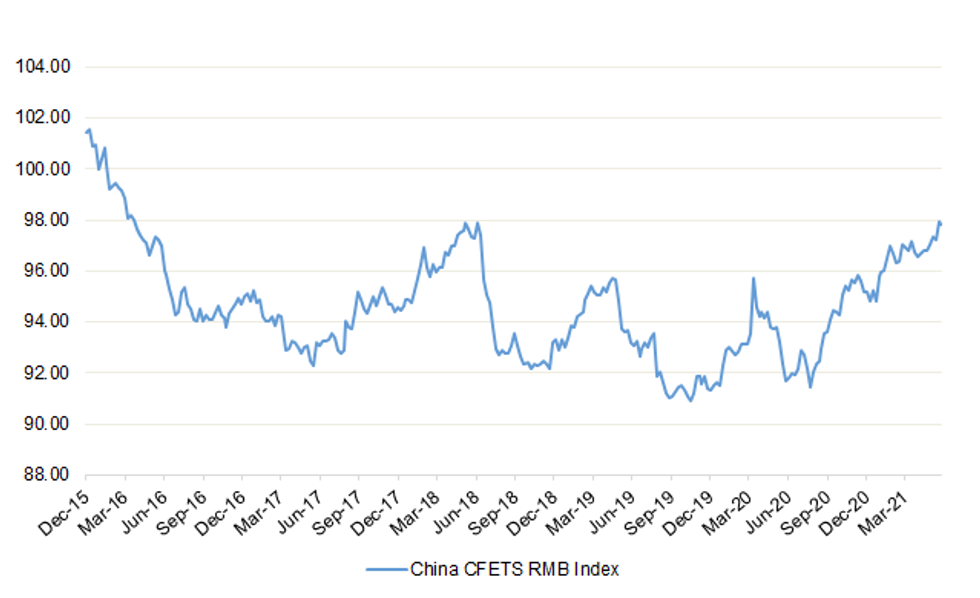

Fig. 1: China CFETS RMB Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: The government is "absolutely open" to delaying the final lifting of England's Covid lockdown on 21 June if necessary, the health secretary has said. Matt Hancock insisted 21 June was a "not before" date to end restrictions and No 10 "would look at the data". He said the Delta variant first seen in India was about 40% more transmissible than the Alpha (Kent) strain. But he added that hospitalisations were "broadly flat" which meant Covid vaccines were working. Speaking to the BBC's Andrew Marr show, the health secretary said the increased transmissibility of the Delta variant made the decision on lifting lockdown "more challenging". (BBC)

CORONAVIRUS: Boris Johnson has been warned not to "move the goalposts" over freedom day on June 21 after MPs became concerned that the criteria for unlocking have changed. (Telegraph)

CORONAVIRUS: Civil servants are drawing up contingency plans to delay the June 21 easing of England's lockdown restrictions, as the UK reported another large rise in coronavirus cases on Friday. Pressure from scientists on prime minister Boris Johnson to leave some Covid-19 measures in place for England intensified with further evidence that the more contagious Delta variant originally detected in India was displacing the previously dominant Alpha (Kent) variant and pushing up infections fast. (FT)

CORONAVIRUS: Advice to wear facemasks in enclosed public spaces will remain after June 21, senior government sources said yesterday as polling showed people back a cautious approach to reopening. A YouGov survey for The Times found that the public narrowly support allowing groups of more than six people to meet indoors but there is a resistance to a further relaxation of the rules. Nearly three quarters of all voters believe it should remain mandatory for people to wear face coverings in shops and public transport while 55 per cent support limits on sporting and entertainment venues. (The Times)

CORONAVIRUS: Britain's vaccine rollout is to be accelerated in a bid to secure a route out of lockdown, with over-40s set to get their second jab within eight weeks of the first rather than 12. The Telegraph also understands that over-25s will be offered their first doses from next week, with millions called forward as the Government attempts to beat Covid variants. On Friday, ministers said they were doing "everything we possibly can" to expedite the jabs rollout ahead of a decision about whether Covid restrictions can be lifted on June 21. The Government has already announced the acceleration of second jabs for over-50s, with the gap between doses cut from 12 weeks to eight. The same change is now set to be made for those in their 40s after a formal recommendation is made by the Joint Committee on Vaccination and Immunisation (JCVI). (Telegraph)

CORONAVIRUS: School leaders are calling for pupils to be vaccinated as a matter of priority after UK regulators approved a jab for 12- to 15-year-olds and data showed outbreaks of the Delta variant in schools throughout England. The Medicines and Healthcare Products Regulatory Authority (MHRA) on Friday gave its approval for the use of the Pfizer/BioNTech vaccine in children aged 12 to 15, paving the way for its use among all but the youngest secondary school pupils. (Guardian)

CORONAVIRUS: The UK is drawing up plans to offer coronavirus vaccines to children over the age of 12 later this summer, the health secretary Matt Hancock signalled on Sunday. The UK health secretary's comments came after the approval for 12 to 15-year-olds of the BioNTech/Pfizer vaccine from the Medicines and Healthcare Products Regulatory agency on Friday. Hancock said he would take advice from the UK's Joint Committee on Vaccination and Immunisation (JCVI) on how and when to roll out the inoculation of the over 12s. (FT)

CORONAVIRUS: British holidaymakers nearly got to Malta without having to quarantine and could have finished their holidays in Portugal until a "heated" meeting all but killed trips abroad this summer. Ministers ignored scientific advice that Malta could go on the green list and rejected plans to put Portugal on a watchlist after a row between Grant Shapps and Matt Hancock, government sources say. The unexpected decision left thousands of people scrambling to get back from Portugal before 4am on Tuesday, after which they must spend ten days in self-isolation at home. (Sunday Times)

BREXIT: "We ultimately need to re-establish a minimum level of trust that allows us to find solutions," Joao Vale de Almeida, the EU ambassador to Britain, told Times Radio before talks between EU and British officials that are expected to resume on Wednesday. He added: "I remain confident that we can get there." The envoy said no viable alternative to the Northern Ireland protocol, a measure designed to prevent a "hard" border between the EU and Britain on the island of Ireland, had been proposed. He called on Britain to honour its agreements. David Frost, Britain's minister in charge of EU ties, said EU negotiators needed to adopt a "new playbook" for talks. In comments published by the Financial Times, Frost said the EU needed to show more pragmatism and less "legal purism". "We continue to work for negotiated solutions which achieve this. But time is starting to run out. We need to see progress soon. I hope we can this week," Frost said. Britain had made huge compromises to make the agreement work, he added. (RTRS)

BREXIT: Brussels misses dealing with Michael Gove, EU sources said as they accused David Frost of stoking up Unionist anger at the Northern Ireland Protocol. But one EU diplomat told The Telegraph: "Gove's professional, less emotional approach was the more logical one from where we sit." Mr Gove is said to have built up a constructive relationship with his opposite number at the European Commission Maros Sefcovic. The Chancellor of the Duchy of Lancaster even nicknamed "Big Maros" the "sausage king" after striking a deal to keep British bangers coming into Northern Ireland after Brexit. (Telegraph)

BREXIT: European leaders are drawing up plans to impose trade sanctions on Britain, accusing Boris Johnson of "taking them for fools" over the Northern Ireland protocol. Amid growing anger in Brussels, senior EU diplomats claimed that Lord Frost, the Brexit minister, had "completely failed to engage" with the commission on implementing the controversial agreement that came into force in January. The first meeting of the UK/EU partnership council next week will discuss issues relating to the protocol. One EU diplomatic source accused the UK of attempting to dismantle the agreement and warned that Brussels was prepared to take unilateral action. (The Times)

BREXIT: The U.K. is playing a "very dangerous game" by inflaming tensions in Northern Ireland over Brexit, the Irish Independent cites Ireland's EU Commissioner Mairead McGuinness as saying in an interview. The Northern Irish protocol of the Brexit agreement is being "battered by the U.K., who agreed to it," newspaper cites McGuinness as saying. (BBG)

BREXIT: President Biden will warn Boris Johnson not to renege on the Northern Ireland Brexit deal when they meet for the first time at the G7 summit this week. He will use a bilateral meeting with the prime minister before the gathering of world leaders in Cornwall to explicitly express America's support for the Northern Ireland protocol. Biden is expected to tell Johnson that the United States sees the deal, agreed by the prime minister in 2019, as an integral part of maintaining long-term peace in Northern Ireland and in particular the Good Friday agreement of which America is a guarantor. He will also warn that the prospects of the US trade deal with the UK will be damaged if the situation remains unresolved. (The Times)

BREXIT: The UK could threaten to pull out of the EU's €100bn flagship research programme after Brussels was accused on Friday of holding up access in the latest act of "political" vengeance, The Telegraph can disclose. In what looks set to become the next major political dispute between the two sides, senior Government sources have claimed that the EU is "purposely going slow" on formalising the UK's participation in Horizon Europe. Ministers are similarly frustrated at the progress of the UK's association to Euratom Research and Training, the nuclear research programme linked to Horizon, and Copernicus, the earth monitoring satellite project. (Telegraph)

ECONOMY: Easing lockdown restrictions has lifted consumer confidence to its highest level since before the EU referendum, a survey suggests. Household sentiment hit a score of 113.6 points last month, according to a gauge of the Centre for Economics and Business Research and YouGov. This was the highest reading since April 2016. The neutral mark is 100. The findings suggest that households are sanguine in the face of growing fears that the emergence of new variants could derail the government's plan for reopening the economy. (The Times)

ECONOMY: Labour shortages are spilling into the retail sector following a hiring crisis in hospitality that has upended the day-to-day running of pubs, bars and restaurants. Shop workers have been hard to find this year with one in three retail leaders struggling to fill roles, new data has shown. Fashion firms are among the companies hit the hardest, followed by smaller retailers, which employ up to 1,000 staff. (Telegraph)

ECONOMY: Britain's pubs continued to pull fewer pints in the first week that venues opened indoors than before the pandemic after Covid restrictions led to a 20% slump in trade compared with pre-pandemic levels. Pub owners have warned that despite welcoming customers back indoors from 17 May, and a boom in table bookings for restaurants and bars, turnover in the first week of reopening was 20% lower than in the same week in 2019 because of government restrictions and physical-distancing measures. The British Beer & Pub Association (BBPA), which carried out the survey of publicans representing 7,000 pubs across the country, said the government's rules to limit the spread of the coronavirus had continued to make the businesses "unviable". (Guardian)

BOE: Britain is enjoying a strong economic bounce-back as COVID restrictions lift, though pubs and restaurants are recovering faster than town-centre retail, Bank of England Deputy Governor Jon Cunliffe said on Friday. "What we're seeing is a strong bounce back of activity," Cunliffe told BBC Radio Suffolk after speaking to businesses in that region of eastern England. "People have accumulated a lot of savings, they're going out and they're spending, particularly in those areas we couldn't go out in the last year or so," he added. (RTRS)

FISCAL: For hundreds of years the new financial year has begun on April 6 but now the Government's tax adviser wants to move it. It will consider a change in the start of the tax year for individuals either to April 1, so that it coincides with the beginning of a month and a quarter, or to Jan 1. The Office of Tax Simplification said the Government itself used April 1 as the start of its financial year, as did major countries such as America, France and Germany. It said its review would "focus" on a change to April 1 but it would also consider the costs and benefits of a change to Jan 1. (Telegraph)

POLITICS: Tory rebels have urged the Government to re-introduce its 0.7 per cent foreign aid pledge next year or face defeat in the Commons. (Telegraph)

POLITICS/POLICY: Job creation and wage growth should be at the heart of the government's efforts to level up the economy, according to a report by the Living Wage Foundation. The campaign group said that the government should avoid skewing its investment towards infrastructure projects, such as roads and bridges, if they do not improve job prospects for residents. In a survey of more than 2,000 adults, the foundation said that residents of former "red wall" towns who voted Conservative in the last general election were more likely to prioritise jobs and pay when asked what would improve their living standards. (The Times)

POLICY: The U.K.'s top financiers have been invited to meet Prime Minister Boris Johnson and Chancellor of the Exchequer Rishi Sunak to discuss the country's post-pandemic recovery. Executives from companies including Standard Chartered Plc, HSBC Holdings Plc and London Stock Exchange Group Plc are expected to attend a virtual meeting Monday, according to people familiar with the matter, who asked not to be named discussing private matters. (BBG)

POLICY: Boris Johnson's government told companies to publish their carbon reduction plans and commit to phasing out greenhouse gas emissions altogether by 2050, or lose out on large U.K. state contracts. (BBG)

SCOTLAND: Courtiers are drawing up plans for the Duke and Duchess of Cambridge to spend more time in Scotland to bolster the Union, amid fears in the royal household that politicians are "losing Scotland". Palace aides want William and Kate to build on the success of a recent visit north of the border by becoming a visible symbol of the bonds between England and Scotland. Officials do not think the issue should be left to politicians because the Union is based on a united monarchy as well as a political deal. (Sunday Times)

EUROPE

ECB: Exiting the current accommodative monetary policy isn't simple, Bank of Italy Governor Ignazio Visco said on Sunday. "It would however have been much worse if the central bank hadn't undertaken an accommodative policy. "In the past I saw many risks related to deflation" but now "it's clear that we need to be very careful about inflation, as we have been careful about deflation. I am sure we will be successful in keeping inflation in check if it comes." "When you divide governors between hawks and doves, you always look at risk of inflation versus stability. I believe that one who is very careful about the risk of deflation is a 'hawk' as much as someone who is very careful about the risk of inflation." (BBG)

CORONAVIRUS: Just a few months ago, Britain was the envy of continental Europeans. A rapid vaccination push opened a path to reopen the U.K. economy, from shops to restaurants to international travel. The European Union, by contrast, looked stuck in inoculation bureaucracy and endless Covid-19 lockdowns. Now the tables are turning, with the government of Prime Minister Boris Johnson on the defensive following a sudden policy U-turn on travel that caught many U.K. vacationers off guard. On the other side of the channel, holiday bookings from Germany to France to Spain are gathering pace, in line with a vaccination drive covering a growing part of the population and depressing infections. (BBG)

CORONAVIRUS: France will allow vaccinated travelers from the European Union to enter without showing negative Covid-19 tests starting June 9, a move designed to ease travel before the traditional summer holiday season. The looser rules unveiled Friday for one of the world's top destinations will organize countries into three categories, with visitors from so-called "green" nations accepted with proof of vaccination. These include all EU members as well as seven others ranging from Australia and Japan to Singapore and South Korea. (BBG)

GERMANY: Armin Laschet boosted his chances of succeeding Angela Merkel as German chancellor by securing a decisive victory in the country's poorest state. In the final electoral contest before the national vote in September, the 60- year-old party leader showed he can successfully guide the Christian Democrats in a tight campaign. The outcome will help ease doubts about his suitability to lead Germany's conservatives. The CDU halted its slide in recent elections on Sunday, winning 37% of the ballots in Saxony-Anhalt to improve on its last result, according to projections from public broadcaster ARD. The far-right Alternative for Germany, which was pushing for the lead in recent polls, slumped to a distant second in the former communist region with 22%. (BBG)

GERMANY: Chancellor Angela Merkel's governing party bloc gained for a second week in a poll ahead of Germany's election in September, while the Green party retreated. Support for Merkel's Christian Democratic-led bloc rose 1 percentage point to 26% in the weekly Insa poll for the Bild am Sonntag newspaper. The Greens slipped for a third consecutive week to 21%, compared with a near-record 24% in early May when Insa had the party tied with Merkel's CDU-CSU bloc. (BBG)

FRANCE: President Emmanuel Macron's government isn't abandoning its controversial plan to reform the French pension system, hammering home the argument that it's key to attracting foreign investors. "We'll keep working on the pension reform," France's Delegate Minister for Foreign Trade Franck Riester told Bloomberg News. "It shows we are committed to keep improving the business environment in France." Macron came to power in 2017 with a pledge to boost growth and employment by cutting bureaucracy and encouraging foreign investment. But the pandemic derailed his plans and forced him to halt some of his reforms -- including the one that triggered the strongest opposition on the streets, the overhaul of the pension system. (BBG)

ITALY: Italy may get the first part of a more than 200 billion-euro ($243 billion) European Union pandemic recovery-fund package as soon as next month, Il Messaggero cited Public Administration Minister Renato Brunetta as saying. The country stands to receive 25 billion euros "between July and August," the newspaper quoted him as saying in an interview. Measures approved recently by the Italian government on governance, administrative simplification and human-capital recruitment will provide the "pillars of the recovery plan," he said. (BBG)

ITALY/BTPS: Italy announces it will sell the following on Jun 9: EUR7.5bn of new 12-Month Jun 14, 2022 BOT. Note that the Ministry of Economy and Finance could have offered 3 month BOT at this auction as well, but declined to do so, "due to the lack of specific funding needs". (MNI)

AUSTRIA: It would be "unimaginable" for Austrian Chancellor Sebastian Kurz to stay in office if convicted of perjury, the country's vice chancellor and leader of the Greens, Werner Kogler, said in remarks broadcast on Saturday.Kogler's comments suggest the coalition between his party and Kurz's conservatives could collapse if Kurz, whom prosecutors have placed under investigation over his testimony to a parliamentary commission, were charged and then convicted. (RTRS)

SWEDEN: Sweden's centrist government came under threat on Friday after the Left Party vowed to bring it down over the prospective abolition of rent controls on new residential housing. The Left Party threat came after the government received a report into the reform of Sweden's highly regulated and much debated rent market, proposing that tenants and landlords negotiate rent between them and that rents subsequently follow the consumer prices index. (RTRS)

NORWAY: The Covid-19 pandemic is over in Norway, according to one of the doctors leading the response against coronavirus in the rich Scandinavian country. Preben Aavitsland, chief physician in the infection control division at the Norwegian Institute of Public Health, tweeted on Sunday a graph showing Norway with its lowest level of hospital admissions since the end of last summer and wrote: "That is the pandemic over with." He added to newspaper VG: "Here in Norway, the pandemic is so to say over. We can start to prepare ourselves for corona taking very little space in our everyday lives." (FT)

NORWAY: Norway's opposition Center Party named its leader Trygve Slagsvold Vedum as a prime ministerial candidate for the upcoming elections, a change from long-standing practice of backing the candidate of its political ally, the Labour Party. (BBG)

RATINGS: Sovereign rating reviews of note from Friday include:

- Fitch affirmed Italy at BBB-; Outlook Stable

- Fitch affirmed Malta at A+; Outlook Stable

- Fitch affirmed Sweden at AAA; Outlook Stable

- DBRS Morningstar confirmed Germany at AAA, Stable Trend

U.S.

FISCAL/FED: Treasury Secretary Janet Yellen said President Joe Biden should push forward with his $4 trillion spending plans even if they trigger inflation that persists into next year and higher interest rates. "If we ended up with a slightly higher interest rate environment it would actually be a plus for society's point of view and the Fed's point of view," Yellen said Sunday in an interview with Bloomberg News during her return from the Group of Seven finance ministers' meeting in London. (BBG)

FISCAL: President Joe Biden rejected a new Republican infrastructure counteroffer on Friday, but will continue talks with Republicans next week as the White House considers whether it should abandon hopes for a bipartisan deal. During a conversation with the president Friday, Sen. Shelley Moore Capito, R-W.V., proposed adding about $50 billion in spending to the GOP's framework, White House press secretary Jen Psaki said in a statement. Republicans last put forward a $928 billion plan. Biden most recently proposed a $1.7 trillion package. (CNBC)

FISCAL: The Democrat-led U.S. House of Representatives will start the mark-up of an infrastructure bill on Wednesday, with or without Republican support, U.S. Energy Secretary Jennifer Granholm told CNN on Sunday morning. (RTRS)

FISCAL: Sen. Joe Manchin (D-W.Va.) is "confident" the White House and Senate Republicans will reach a compromise on the infrastructure package in the coming days, he told Fox News Sunday. (FT)

CORONAVIRUS: Most of the Covid restrictions in California will be lifted by June 15, though there are no plans to lift the state of emergency immediately, Governor Gavin Newsom said. (BBG)

CORONAVIRUS: Governor Phil Murphy signed legislation to end New Jersey's 15-month public health emergency, affirming the lifting of most major restrictions that included indoor masking, social distancing and crowd limits. It's "a clear and decisive step on the path toward normalcy," Murphy said in a statement. Businesses, including retail shops, still may require patrons to follow masking and other virus-safety protocols, and precautions remain in places including public transportation, hospitals and schools. The law also stipulates that the governor will continue to oversee the pandemic response, including vaccination. It delayed until Jan. 1 the removal of renters and property homeowners subject to eviction or foreclosure proceedings. (BBG)

CORONAVIRUS: Almost one-third of adolescents hospitalized with Covid-19 in the U.S. ended up in intensive care units in the first quarter, and 5% needed machines to help them breathe, the Centers for Disease Control and Prevention said in a report. CDC Director Rochelle Walensky said she's "deeply concerned" by Friday's data and encouraged adolescents to continue to wear masks until they're fully vaccinated. (BBG)

POLITICS: Sen. Joe Manchin (D-W.V.) wrote in a Charleston Gazette-Mail op-ed Sunday that he will not support congressional Democrats' expansive election and anti-corruption bill, suggesting the measure is partisan. Manchin's opposition to H.R. 1, known as the For the People Act, puts the bill in tenuous footing in the evenly split Senate. The West Virginia senator said any elections-related legislation should be the result of both parties coming together. (Axios)

POLITICS: House progressives are getting fed up with efforts to accommodate Republican senators — and Joe Manchin. Look for them to start demanding swift action — and threatening payback. The White House is under growing pressure to accede to the left's demand to bust the filibuster. That rule effectively requires the support of 10 Republicans for most measures in this 50-50 Senate, rather than the simple majority that most Democrats want. (Axios)

EQUITIES: Wall Street's top brokers are quietly tightening their rules for who can bet against retail traders' most-popular meme stocks. Goldman Sachs Group Inc., Bank of America Corp., Citigroup Inc. and Jefferies Financial Group Inc. are among firms that have adjusted their risk controls at prime-brokerage operations, according to people familiar with the moves. The banks are trying to protect themselves against fallout from extreme surges and dips that have characterized trading in companies including AMC Entertainment Holdings Inc., MicroVision Inc. and GameStop Corp. (BBG)

EQUITIES: TD Ameritrade put in place trading limitations on AMC Entertainment Holdings' shares, the retail brokerage's website showed on Friday. Trading in the stock will be limited to clients with own capital on hand and not borrowed funds, TD Ameritrade said, adding there might be some additional requirements on trading options that expire on June 11. (RTRS)

OTHER

MACRO: U.S. Treasury Secretary Janet Yellen urged other rich nations on Saturday to keep up spending to support their economies even as the COVID-19 pandemic wanes, and said U.S. inflation this year would be elevated but transitory. (RTRS)

G7/GLOBAL TRADE: The United States, Britain and other large, rich nations reached a landmark deal on Saturday to squeeze more money out of multinational companies such as Amazon and Google and reduce their incentive to shift profits to low-tax offshore havens. Hundreds of billions of dollars could flow into the coffers of governments left cash-strapped by the COVID-19 pandemic after the Group of Seven (G7) advanced economies agreed to back a minimum global corporate tax rate of at least 15%. (RTRS)

GLOBAL TRADE: Ireland will make the case for the role of legitimate tax competition, Irish Finance Minister Paschal Donohoe said after the Group of Seven advanced economies agreed on a minimum global corporate tax rate of at least 15%. "Today is an important sign post," Donohoe said. "It does have consequences for the future of corporate tax policy across the world, but in the process that is to come, I'll be making the case for the role of legitimate tax competition," he told reporters in London, adding that he will be engaging "constructively" with the Organization for Economic Cooperation and Development and U.S. Treasury Secretary Janet Yellen. (BBG)

GLOBAL TRADE: White House national economic director Brian Deese said on Friday the administration will discuss its review on supply chain problems next week. Deese told reporters at the daily White House briefing the White House review will address short-term bottlenecks seen this year including housing, construction materials, transportation and logistics. He said the administration has identified concrete solutions on semiconductor supply chains. (RTRS)

GLOBAL TRADE: Two more Taiwan tech suppliers have been hit by COVID-19 clusters, in a further threat to supply chain continuity amid the global semiconductor shortage. After King Yuan Electronics Co suspended all domestic production on Friday, chip packaging and testing supplier Greatek Electronics and networking gear provider Accton Technology have also reported clusters among employees. (Nikkei)

GLOBAL TRADE: The global chip shortage disrupting the car industry and threatening the supply of consumer technology products will last for at least another year, one of the world's largest electronics contract manufacturers has warned. The forecast from Flex, the world's third-biggest such manufacturer, is one of the gloomiest yet for a crisis that is forcing car and consumer electronics groups to re-examine their global supply chains. A rapid rebound in vehicle sales combined with a lockdown-driven boom in games consoles, laptops and televisions has left the world's chipmakers overwhelmed by the sharp increase in demand. (FT)

U.S./CHINA: The trade relationship between the two largest economies in the world has "significant imbalance" and the Biden administration is committed to leveling it, according to the U.S. trade representative. "There are parts of this trade relationship that are unhealthy and have over time been damaging in some very important ways to the U.S. economy," Trade Representative Katherine Tai told reporters Saturday in response to a question about whether the U.S. would continue with a trade deal signed with China in January 2020 and the tariffs on Chinese goods. (BBG)

U.S./CHINA: Secretary of State Antony Blinken told "Axios on HBO" the Biden administration is determined to "get to the bottom" of COVID-19's origins, and said the U.S. will hold China accountable. "The most important reason we have to get to the bottom of this is that's the only way we're going to be able to prevent the next pandemic or at least do a better job in mitigating it," he said during a wide-ranging interview in the State Department's Benjamin Franklin State Dining Room. (Axios)

U.S./CHINA/TAIWAN: The US will donate 750,000 Covid-19 vaccines to Taiwan, signalling its support for the country after Taipei accused Beijing of interfering in its efforts to secure jabs. The announcement by a group of US senators during a high-profile visit to Taipei on Sunday came just days after Japan donated 1.2m jabs as Taiwan grapples with its first large-scale Covid outbreak. The US contribution to Taiwan accounts for more than 10 per cent of the 7m vaccine doses Washington has pledged to give to Asian and Pacific nations. (FT)

JAPAN/CHINA: The China Coast Guard has been making repeated incursions into waters around the Japan-administered Senkaku Islands in the East China Sea, marking a record for the number of consecutive days it has done so. (Nikkei)

GEOPOLITICS: Energy Secretary Jennifer Granholm told CNN's "State of the Union" Sunday that U.S. adversaries have the capability to shut down the power grid, saying they are "trying even as we speak." (Axios)

GEOPOLITICS/DIGITAL CURRENCIES: Financial chiefs from the Group of Seven major economies will discuss rules for digital currencies issued by central banks, hoping to bring China's digital yuan into an international regulatory framework. The G-7 finance ministers, who kicked off a two-day meeting in London on Friday, will sort out potential issues arising from state-issued digital currencies, with the aim of announcing new rules as soon as this fall. China's aggressive push to issue a digital yuan has raised concerns that it could give rise to a new economic zone centering around nations taking part in its Belt and Road infrastructure initiative. Such a framework could undermine the current currency system based on the U.S. dollar. (RTRS)

CORONAVIRUS: Prime Minister Boris Johnson is to urge leaders of other wealthy countries to commit to vaccinating the world against Covid-19 by the end of next year. He will lay out a global target at a summit of the G7 group of advanced economies on Friday. The US, France, Germany, Italy and Japan have all said how many doses they will donate to the global vaccine-sharing programme, Covax. But the UK and Canada are yet to put figures on their planned contributions. (BBC)

CORONAVIRUS: The U.S. government plans to provide more vaccine donations in the months ahead and is counting on the authorization of AstraZeneca Plc doses that are stuck in a safety review, a State Department official said. worldwide is based on maximizing global coverage, addressing surges and heading off others, and responding to requests from abroad, Gayle Smith, the State Department's coordinator for global Covid response and health security, told reporters Friday. (BBG)

JAPAN: Japan will highlight the need for fiscal reform even as it keeps up stimulus to combat the blow from the coronavirus pandemic, a draft of its economic and fiscal blueprint reviewed by Reuters showed. The government will also unveil plans to promote green and digital investment by drawing in private demand, as part of efforts to revitalise the world's third largest economy, according to the draft of this year's blueprint. (RTRS)

JAPAN: Japan's wage growth has slowed to levels last seen in the aftermath of the 2008 financial crisis as companies have taken a hit from the coronavirus pandemic. Major companies have agreed on an average pay hike of 1.82 percent in this year's annual spring wage negotiations, falling below 2 percent for the time since 2013, according to data released by the Japan Business Federation. The final results are due out in July. (Kyodo News)

JAPAN: Japan intends to issue Covid-19 vaccine passports this summer to inoculated residents traveling abroad to boost travel and other economic activities, Nikkei reported. An inter-agency team is discussing a plan to issue a paper certificate this summer for businesspeople and others, followed by a digital version by the end of the year, the newspaper said, without disclosing where it got the information. (BBG)

JAPAN: Big Japanese sponsors of the Tokyo Olympics are calling privately for the games to be postponed for several months so more spectators can attend as businesses fret over the value of their marketing campaigns. (Nikkei)

JAPAN: Japanese voters are split over whether the Tokyo Olympics should be held as planned from July or canceled, according to a nationwide poll conducted by the Yomiuri from June 4 to June 6. Half were for having the games while 48% said they should be canceled; the breakdown was 39% vs. 59% in a survey taken last month. Some 63% said they thought coronavirus prevention measures in place for athletes and staff visiting from abroad were insufficient. (BBG)

JAPAN: Japan has relaxed some restrictions on retailers, even as the government extended a state of emergency for nine prefectures, but department store operators remain downbeat about their business prospects. (Nikkei)

JAPAN: The Japanese government plans to make it easier for foreign finance personnel such as fund managers and investment advisers to obtain permanent residence, Nikkei reports, without attribution. Plans to give to give an extra 10 points to certain finance industry workers, making it easier to obtain "highly skilled" status under its points system; such workers are able to apply for permanent residence after 1-3 years depending on their score. (BBG)

BOJ: MNI: BOJ Sees Weaker Near-Term Economy; Recovery View Intact

- Bank of Japan officials see the near-term economy as weaker than their view in April due to weaker private consumption caused by the extended state of emergency and supply-side restrictions caused by semiconductor shortages, MNI understands. But bank officials see no need to change the baseline recovery scenario as they expect the economy to recover in or after the third quarter, thanks to the vaccine rollout and recovering global demand - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

AUSTRALIA: One in five Australians aged 16 and over have received their first Covid-19 vaccine dose, Prime Minister Scott Morrison said in a Facebook post on Saturday. (BBG)

AUSTRALIA/RATINGS: S&P affirmed Australia At AAA; Outlook changed to Stable from Negative

SOUTH KOREA: South Korea may collect around 32 trillion won (US$28.6 billion) in excess tax revenue this year, potentially securing ammunition to finance another round of an extra budget under review, government sources said Sunday. Finance Minister Hong Nam-ki said Friday the government is considering creating this year's second extra budget with a larger-than-expected tax revenue in a bid to underpin an economic recovery and support vulnerable groups hit hard by the pandemic. The country is estimated to collect 315 trillion won in tax revenue this year, up 32 trillion won from its earlier forecast of 283 trillion won, according to government and parliamentary sources. (Yonhap)

NORTH KOREA: North Korean leader Kim Jong Un made his first public appearance in about a month, with state media showing him at a Party meeting that discussed ways to improve the country's deteriorating economy. Kim, wearing his signature black Mao suit, said it was time to take "additional state measures for solving pending problems urgent for the economic work and people's living," according to official Korean Central News Agency Saturday. A plenary meeting of the Central Committee of the Party will be held in early June, KCNA said. (BBG)

ASIA: Foreign ministers from China and the Association of Southeast Asian Nations will meet this week and discuss issues including cooperation to stem the coronavirus pandemic. The meeting on June 7 will be in Chongqing in southwest China as part of the 30th anniversary of Asean-China Dialogue Relations, Malaysia's Ministry of Foreign Affairs said in a statement on Saturday. Besides an exchange of views and finding collaborative ways to deal with Covid-19, ministers will also discuss "regional and international matters of common concern," it said. (BBG)

ASIA: Asia-Pacific ministers responsible for trade in the region said they would work to expedite the distribution and flow of inoculations and other essential medical supplies between economies. Officials from the Asia-Pacific Economic Cooperation, which includes the U.S., China and Japan, said they would "consider removing unnecessary barriers to trade in services, particularly those services that expedite and facilitate the flow of essential goods," according to a weekend statement. (BBG)

ASIA/RATINGS: Population aging in China (A1 stable) and other emerging markets in Asia will hurt economic growth, competitiveness and fiscal revenue, unless productivity gains accelerate, according to a new report by Moody's Investors Service. And although China's new policy allowing couples to have up to three children could support fertility, it is unlikely to dramatically change the national birthrate, meaning that aging will remain a credit-negative constraint. "The historically fast GDP growth of many of Asia's emerging economies in recent years has reflected rapid gains in labor supply and investment. But as workforces shrink over the next decade, it will become more difficult for these economies to sustain their previous rates of expansion," says Martin Petch, a Moody's Vice President and Senior Credit Officer. "Additionally, contending with an aging population at a relatively early stage in their economic development will increase the challenge for emerging market governments in addressing this issue," adds Petch. (Moody's)

MEXICO: Mexican President Andres Manuel Lopez Obrador's party took the lead in midterm elections for the lower house of Congress on Sunday, according to an exit poll, but the survey suggested his ruling coalition won't retain a two-thirds majority needed to pass constitutional reforms. The provisional tally showed the president's Morena party took home 40% of the vote, according to the exit poll by El Financiero newspaper, while its allies the Green Party and Worker's Party won 4% and 3%, respectively. Opposition parties followed Morena, with 21% for the PRI and 20% for the PAN, the survey showed. Morena and its allies need to keep, or come close to retaining, their current two-thirds majority in the lower house for Lopez Obrador to pass sweeping changes to the country's energy sector. (BBG)

MEXICO: Mexico City is reopening schools, convention centers and concert halls this month as Covid-19 cases and deaths reached their lowest levels in over a year. Soccer stadiums and movie theaters will be able to fill half their seats and gyms will hold classes, in a gradual return over the course of this month. Surrounding the capital, Mexico state, the nation's most populous, has also reduced its Covid restrictions to the lowest level, or "code green." (BBG)

RUSSIA: President Vladimir Putin said Russia doesn't want to stop using the dollar as he accused the U.S. of exploiting the currency's dominance for sanctions and warned the policy may rebound on Washington. Russia has to adopt other payment methods because the U.S. "uses its national currency for various kinds of sanctions," Putin said late Friday in St. Petersburg at a videoconference with representatives of international media organizations. "We don't do this deliberately, we are forced to do it." Settlements in national currencies with other countries in areas such as defense sales and reductions in foreign-exchange reserves held in dollars eventually will damage the U.S. as the greenback's dominance declines, Putin said. "Why do U.S. political authorities do this? They're sawing the branch on which they sit," he said. (BBG)

RUSSIA: Russia has warned that it is prepared to continue with its export curbs on key food products after recent price rises prompted the Kremlin to cap the domestic cost of staple goods such as sugar and flour, the country's economy minister said. Maxim Reshetnikov, minister of economic development, told the Financial Times that Russia, one of the world's biggest grain exporters, was considering how to best support its food exports while protecting domestic consumers from rising prices. (FT)

RUSSIA/RATINGS: Sovereign rating reviews of note from Friday include:

- Moody's affirmed Russia at Baa3: Outlook Stable

SOUTH AFRICA: South Africa may have to pay 680 million rand ($51 million) to access 5 million doses of Sputnik V from Russia, just months after the health regulator turned down a donation of 15 million doses on fears about how people with HIV/Aids would react to the vaccine, City Press reported. (BBG)

IRON ORE: Leading Vietnamese steelmaker Hoa Phat Group has purchased the entire interest in an Australian iron ore mine to secure a stable supply of raw materials in a competitive market. (Nikkei)

OIL: Igor Sechin, the head of Russian oil major Rosneft, said on Saturday the world was facing an acute shortage of oil due to underinvestments amid a drive for alternative energy. He also told an online session of St Petersburg's economic forum that a court order to deepen carbon cuts for Shell was a new form of risk for oil majors. (RTRS)

OIL: OPEC+ appears in control of crude prices as U.S. production is lagging pre-pandemic levels, according to a senior executive at the world's biggest independent oil trader, Vitol Group. The decline in U.S. drilling and output leaves little competition to efforts by the producers' group to manage markets, Mike Muller, Vitol's head of Asia, said during an online conference on Sunday. Brent crude closed above $70 a barrel last week for the first time in two years, as buyers demand more oil than producers are pumping. U.S. oil producers are still employing only half the rigs they used before the coronavirus struck. Meanwhile OPEC+, as the group led by Saudi Arabia and Russia is known, is easing barrels back on to the market as demand recovers. (BBG)

CHINA

YUAN: China should launch yuan futures trading right away to help regulators to prevent attacks on its currency and improve risk prevention amid the further opening of the financial market, wrote Guan Tao, chief economist at BOC International and a former forex regulatory official at a blog post on Yicai.com. The introduction of yuan futures is also a viable measure for small and medium exporters to avoid profit losses amid yuan appreciation and reduce forward contract hedging costs, said Guan. This can greatly expand the scope of participants with different risk appetites in the yuan FX market, said Guan, noting that this round of yuan's surge was pushed by the market's self-fulfilling expectation of yuan appreciation. (MNI)

PBOC: The PBOC aims to require mandatory disclosures of climate-rated information, forcing major domestic commercial banks and listed companies to disclose carbon information and activities, said PBOC Governor Yi Gang at a conference hosted by the Bank for International Settlements, the 21st Century Business Herald reported. China has begun to conduct climate stress tests on the financial system to identify institutions most vulnerable to climate change, said Yi. The PBOC is trying to evaluate the green and brown assets of commercial banks, and will set the deadline for the green transformation of banks, said Yi. (MNI)

CORONAVIRUS: At least 70% of China's "target population" is expected to be vaccinated against Covid-19 by year-end, Xinhua reported, citing Zeng Yixin, vice head of the National Health Commission. Recent local Covid infections suggest that China still faces a severe situation in pandemic control. A worker at Shenzhen Yantian Port was confirmed to be infected. The outbreak at the key port risks adding delays in shipping goods from one of the busiest ports in the world. (BBG)

CORONAVIRUS: China authorized the emergency use of Sinovac Biotech Ltd.'s coronavirus vaccine for children, becoming the first major country to grant approval for those as young as three. The move comes amid reports that young people with the disease could be as infectious as adults. Singapore, Hong Kong and some U.S. states have so far authorized the use of Covid-19 vaccines for children aged 12 and above. It's not yet confirmed when this age group will receive their first doses of the vaccine in China. Phase I and Phase II research, involving several hundred participants, showed that the Sinovac vaccine is as safe and effective for children as it is for adults, the company's Chief Executive Officer Yin Weidong told state broadcaster China Central Television on Friday. (BBG)

CORONAVIRUS: A worker at Shenzhen Yantian Port was confirmed to be infected of Covid-19, a development that risks adding delays in shipping goods from one of the busiest ports in the world. (BBG)

CORONAVIRUS: Authorities in the southern Chinese industrial hub of Guangzhou on Saturday imposed more restrictions on business and social activity, seeking to curb the spread of COVID-19 cases. The city's Nansha, Huadu and Conghua districts have ordered all residents and any individuals who have travelled through their areas to be tested for the coronavirus. Nansha authorities also ordered restaurants to stop offering dine-in services as of Saturday and also called on gyms, pools and other public venues to temporarily cease operations. About a dozen subway stops throughout the city were also closed. The outbreak of new cases since late May has seen Guangzhou authorities impose lockdowns in certain neighborhoods. The airport in the city of Shenzhen has ordered residents of Guangzhou or nearby Foshan to show a negative virus test result before they can depart. (RTRS)

CONNECT SCHEMES: The opening of the southbound link of China's Bond Connect scheme, which will give mainland investors a new channel to buy bonds in Hong Kong, may be expected as the country steadily pushes forward the two-way opening of its financial market, the China Securities Journal reported. The PBOC and FX regulator will have a series of new measures centered on the high-level opening of capital accounts to balance cross-border capital flows, the newspaper cited Guan Tao, chief economist of BOC International as saying. The newspaper reported last December that the PBOC is discussing a framework of the southbound link with the Hong Kong Monetary Authority. (MNI)

OVERNIGHT DATA

CHINA MAY TRADE BALANCE +$45.53BN; MEDIAN +$50.75BN; APR +$42.86BN

CHINA MAY EXPORTS +27.9% Y/Y; MEDIAN +32.1%; APR +32.3%

CHINA MAY IMPORTS +51.1% Y/Y; MEDIAN +53.5%; APR +43.1%

CHINA MAY TRADE BALANCE +CNY296.00BN; MEDIAN +CNY276.00BN; APR +CNY276.50BN

CHINA MAY EXPORTS CNY +18.1% Y/Y; MEDIAN +19.5%; APR +22.2%

CHINA MAY IMPORTS CNY +39.5% Y/Y; MEDIAN +44.2%; APR +32.2%

JAPAN APR, P LEADING INDEX 103.0; MEDIAN 102.9; MAR 102.4

JAPAN APR, P COINCIDENT INDEX 95.5; MEDIAN 95.6; MAR 92.9

AUSTRALIA MAY ANZ JOB ADVERTISEMENTS +7.9% M/M; APR +4.9%

ANZ Australian Job Ads rose 7.9% m/m in May to be up 38.8% on the pre-pandemic level. This points to continued rapid tightening in the labour market. ANZ Job Ads hit 12 straight months of gains in May, and is now consistent with an unemployment rate of around 5%. In May, we upgraded our labour market forecasts, and now expect an unemployment rate of 4.8% by the end of this year and 4.4% by end-2022. We think solid employment growth will drive this rapid improvement, notwithstanding near-term volatility post-JobKeeper. The Victorian lockdown is unlikely to derail the state's labour market recovery. Even if we see some employment losses in June, as long as restrictions start easing from 11 June as currently planned, workers should be reinstated or find new jobs quite quickly, given the underlying strength in the labour market. (ANZ)

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS MON; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Monday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2161% at 09:25 am local time from the close of 2.1741% on Friday.

- The CFETS-NEX money-market sentiment index closed at 43 on Friday vs 48 on Thursday.

MARKETS

SNAPSHOT: Yellen Wants The Fiscal Taps To Keep Running

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 101.91 points at 29043.43

- ASX 200 down 7.551 points at 7287.8

- Shanghai Comp. down 7.668 points at 3584.177

- JGB 10-Yr future up 13 ticks at 151.56, yield down 1bp at 0.077%

- Aussie 10-Yr future up 6.0 ticks at 98.435, yield down 6.2bp at 1.625%

- U.S. 10-Yr future -0-03 at 132-03+, yield up 1.7bp at 1.570%

- WTI crude down $0.29 at $69.34, Gold down $5.36 at $1886.23

- USD/JPY down 4 pips at Y109.48

- U.S. TSY SEC YELLEN SAYS HIGHER INTEREST RATES WOULD BE 'PLUS' FOR U.S., FED (BBG)

- U.S. TSY SEC YELLEN TELLS G7 TO KEEP SPENDING, SAYS INFLATION WILL PASS (RTRS)

- ECB'S VISCO: WE MUST BE CAREFUL ABOUT INFLATION RISKS (BBG)

- MERKEL'S HEIR BOLSTERS BID FOR CHANCELLORSHIP WITH STATE VICTORY (BBG)

- TECH GIANTS AND TAX HAVENS TARGETED BY HISTORIC G7 DEAL (RTRS)

- EU & UK JOSTLE FOR POSITION AHEAD OF WEDNESDAY GATHERING

BOND SUMMARY: U.S. Tsys Off Post-NFP Highs

T-Notes print -0-03+ at 132-03, hovering just above session lows as Tsys trade a touch softer across the board after a peculiar pop through Friday's highs for longer dated Tsy futures around the re-open was quickly reversed. Cash Tsys run 0.5 to 2.0bp cheaper across the curve, with light bear flattening in play. Weekend focus fell on the G7's agreement re: the broader implementation of a minimum corporate tax structure, as they look to fight tax evasion, notably within the big tech space, while a BBG interview with U.S. Tsy Secretary Yellen is also garnering attention. Yellen noted that U.S. President Biden should push on with his $4tn spending schemes, even if they may result in inflation spill over into '22 and higher interest rate settings from the Fed. Elsewhere on the U.S. fiscal front, the weekend saw U.S. Energy Secretary Granholm tell CNN that the U.S. House will start the mark-up of an infrastructure bill on Wednesday, with or without Republican support.

- JGB futures have held to a narrow range, +14 ticks vs. settlement at typing, peaking through overnight highs. Bonds in the belly of the JGB curve run 1.0-2.0bp firmer, while the wings lag, with the super long end likely limited by the previously flagged proximity to tomorrow's 30-Year JGB supply. There has been little to note on the domestic front, outside of a RTRS report which flagged the following: "Japan will highlight the need for fiscal reform even as it keeps up stimulus to combat the blow from the coronavirus pandemic, a draft of its economic and fiscal blueprint reviewed by Reuters showed. The government will also unveil plans to promote green and digital investment by drawing in private demand, as part of efforts to revitalise the world's third largest economy, according to the draft of this year's blueprint."

- Aussie bond futures have failed to work their way out of the ranges established early on in Sydney trade, with YM +1.5 and XM +6.0. The latter has struggled to extend meaningfully through the recent highs, but bulls seemingly remain in control there. Headline flow remains light, with a decent pipeline of A$ issuance building (particular focus has fallen on sustainability/social bonds, with onshore and offshore names active there).

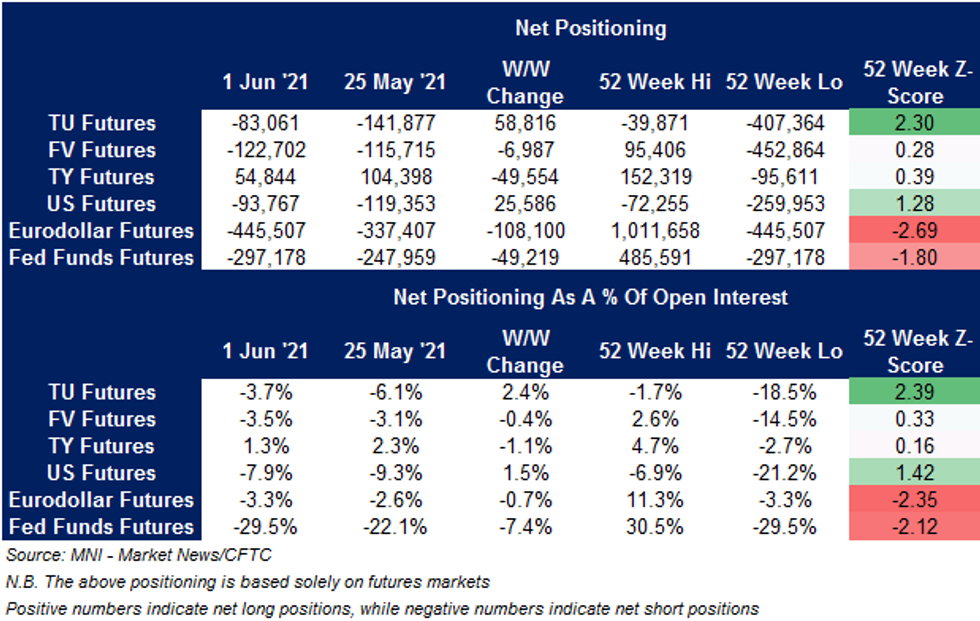

US TSY FUTURES: Eurodollar Net Shorts Continue To Headline CFTC CoT

The latest CFTC CoT report (covering the week ending 1 June), revealed the following non-commercial net positioning moves ahead of Friday's NFP print.

- Net short positioning in Eurodollar futures continues to draw the most attention, with net positioning in the space moving to the deepest net short witnessed since early May '20.

EQUITIES: Nursing Losses

A broadly negative day for equity markets in the Asia-Pac region, most major markets nursing losses but off worst levels. The Taiex was earlier down around 2% but has recovered most of the downside, it was announced that the soft lockdown would be extended to June 28. Some underperformance for HK/mainland Chinese equities, there were weekend reports surrounding continued IPO headwinds in Hong Kong in the wake of the "Chinese tech crackdown," while Sino-U.S. tensions and deeper COVID restrictions for China's Guangzhou also garnered some attention. In the US futures are lower as markets assess the most recent comments from US Tsy Sec Yellen and Friday's NFP report, while looking ahead to inflation data later this week.

OIL: WTI Slips After Briefly Hitting $70/bbl

Oil is lower in Asia-Pac trade on Monday on the back of a stronger USD and some profit taking; WTI retreating slightly after earlier rising above $70/bbl for the first time since October 2018. WTI is down $0.17 from settlement levels at $69.45 while Brent is down $0.24 at $71.65. Crude futures rose around 4% last week, and have risen in five out of the last six weeks.

GOLD: Range Is Now Defined

Very modest upticks in U.S. yields and the broader USD have provided light pressure for gold during Asia-Pac hours, with spot last dealing a handful of dollars lower around $1,886/oz. To recap, our weighted measure of U.S. real yields moved back to Thursday's lows on the back of Friday's softer than expected headline NFP print, with nominal yields lower on the day, while breakevens were little changed. A defensive round of post-data dealing for the broader USD also helped support gold. Still, bulls failed to reclaim the $1,900/oz, with no substantial movement on the technical front seen.

FOREX: Yuan Falters After Softer Then Expected PBOC Fix

The yuan weakened as the PBoC set its central USD/CNY mid-point at CNY6.3963, 32 pips above sell-side estimate. The fixing represented yet another sign that China's central bank is opposed to further yuan appreciation. USD/CNH reclaimed the bulk of its Friday loss, even as it showed little immediate reaction when China's trade surplus proved narrower than forecast.

- Yuan weakness in combination with softer e-minis may have applied a modicum of pressure to the Antipodeans, with regional liquidity sapped by a market holiday in New Zealand. AUD failed to draw any meaningful support from a solid local ANZ job ads print & S&P's decision to upgrade Australia's credit rating outlook.

- Sterling showed some weakness in Asia-Pac hours amid worries over the spread of a highly transmissible variant of coronavirus in the UK as well as continued tensions with the EU over Northern Ireland.

- German factory orders, Norwegian industrial output & comments from BoE's Broadbent take focus from here.

FOREX OPTIONS: Expiries for Jun07 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2050(E677mln-EUR puts), $1.2175-80(E661mln-EUR puts), $1.2210-15(E759mln-EUR puts),$1.2250(E651mln-EUR puts), $1.2290-1.2305(E956mln-EUR puts)

- USD/JPY: Y108.25-35($776mln-USD puts), Y109.00-20($625mln-USD puts), Y109.50-65($1.55bln-USDputs), Y110.00($1.0bln-USD puts), Y110.50($825mln)

- EUR/JPY: Y133.40(E440mln-EUR puts)

- USD/CHF: Chf0.9125($600mln-USD puts)

- AUD/USD: $0.7700(A$543mln-AUD puts)

- USD/CAD: C$1.2000($970mln-USD puts)

- USD/MXN: Mxn19.65($507mln)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.