-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: U.S. Fiscal Impasse Continues, Chinese PPI Surges

EXECUTIVE SUMMARY

- SENATE PASSES BIPARTISAN BILL TO COMBAT CHINA'S GROWING ECON INFLUENCE (CNN)

- CAPITO-BIDEN INFRASTRUCTURE TALKS BREAK DOWN, BIDEN PURSUES OTHER AVENUES

- U.S. AND EU TO END FOR GOOD TRUMP'S $18 BILLION TARIFF FIGHT (BBG)

- WHITE HOUSE SEES SUPPLY CHAIN BOTTLENECKS RESOLVING IN COMING WEEKS (RTRS)

- CHINA VOWS TO KEEP CONSUMER GOODS PRICES STABLE AFTER PPI SURGES (BBG)

- SUNAK COULD ACCEPT FOUR-WEEK DELAY TO ENDING COVID RESTRICTIONS IN ENGLAND (GUARDIAN)

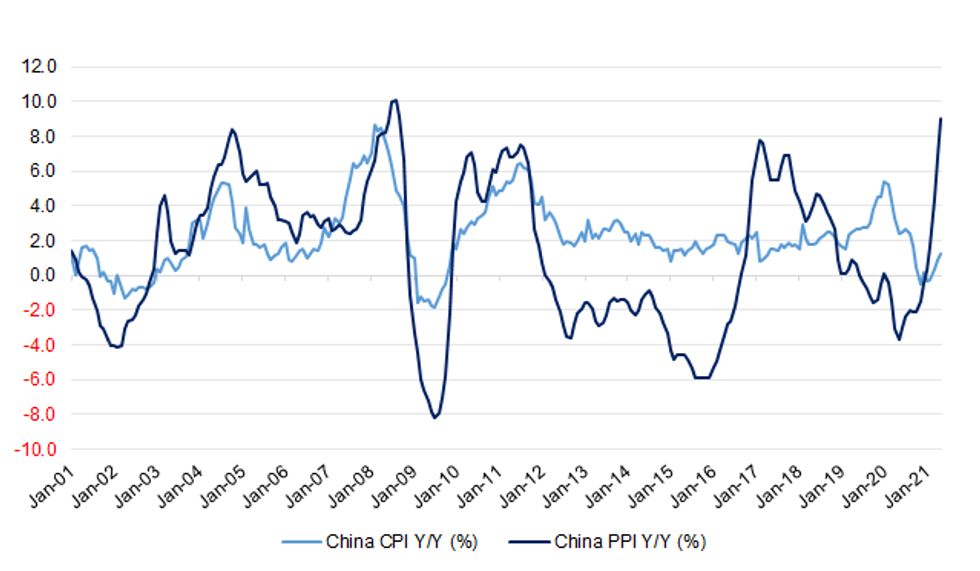

Fig. 1: China CPI Y/Y Vs. China PPI Y/Y (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Rishi Sunak is willing to accept a delay of up to four weeks to the final stage of England's reopening roadmap, the Guardian understands, as the government considers extending restrictions beyond 21 June. Ministers will continue to scrutinise data on cases and hospitalisations over the coming days, with a final decision set to be announced by the prime minister on Monday. From 21 June nightclubs are due to reopen, with the cap on wedding numbers, large-scale events and indoor mixing lifted and guidance on working from home and mask-wearing dropped. A delay in all these changes would infuriate many Conservative backbenchers. On Tuesday the former Tory minister Steve Baker pressed for the date dubbed "freedom day" to go ahead, calling it the "last chance" to save industries such as hospitality, which is calling for the 2-metre distancing rule to be scrapped. (Guardian)

BREXIT: The UK's Brexit minister Lord Frost has urged the EU to show "common sense" during talks over post-Brexit rules in Northern Ireland. The Tory peer will meet his EU counterpart Maros Sefcovic in London on Wednesday to discuss ways to reduce disruption at the Irish Sea border. Some delayed border checks are due to start next month, but both sides are calling on each other to compromise. Mr Sefcovic has warned against "quick fixes" to border issues. The UK and EU officials have been locked in talks over simplifying the Northern Ireland Protocol, part of the UK's 2019 Brexit withdrawal deal. This created a trade border between Northern Ireland and Great Britain, in order to prevent goods checks along the Irish land border. (BBC)

BREXIT: The row between the UK and the EU over checks on sausages and other chilled foods sent from Britain to Northern Ireland has deepened, with the Brexit minister telling Brussels that trade war threats will not wash with voters. As a major meeting on Wednesday approached, Lord Frost said: "Further threats of legal action and trade retaliation from the EU won't make life any easier for the shopper in Strabane who can't buy their favourite product. Nor will it benefit the small business in Ballymena struggling to source produce from their supplier in Birmingham." (Guardian)

BREXIT: Prime Minister Boris Johnson's top Brexit adviser, David Frost, will attend this week's Group of Seven summit, according to multiple officials familiar with the plan, in a sign the British delegation is preparing for tough talks over the situation in Northern Ireland. The British team is due to hold discussions with U.S. President Joe Biden and European Union leaders on the sidelines of the summit in Cornwall, England. One of the people said that Frost's presence suggests that the meetings could feature detailed conversations about how to handle the Northern Ireland protocol of the Brexit accords. Frost was the U.K.'s chief Brexit negotiator and is now a cabinet minister, advising Johnson on Europe and trade. Johnson's office declined to comment. (BBG)

POLITICS: The Conservative majority would rise to 100 under proposed changes to constituency boundaries, according to the pollster managing the party's response. MPs were said yesterday to be "neurotic" about planned changes that are more wide-ranging than expected, affecting at least 90 per cent of seats in England. Ben Wallace, the defence secretary, is the highest-profile MP whose seat could vanish, though allies insist that he would win a rejigged seat in Lancashire. (The Times)

EUROPE

GERMANY: Germany's launch of a digital vaccine certificate could be imminent, with Handelsblatt reporting that IBM will probably activate the technical infrastructure on Wednesday. The German newspaper cited a letter from the head of digital at the Federal Ministry of Health. Digital certificates will be available for citizens at "many" regular pharmacies starting June 14, according to a separate release by the ABDA Federal Union of German Associations of Pharmacists on Tuesday. (BBG)

FRANCE: French President Emmanuel Macron gains 7 points of popularity, with 50% of people saying they have a positive opinion of him, according to an IFOP-Fiducial poll conducted by phone for Paris Match magazine and Sud Radio. Macron gains 6 points among senior people and 18 points among members of right-wing party Les Republicains. Macron's former Prime Minister Edouard Philippe remains the most popular politician tested, with 64% of positive opinions. Far-right leader Marine Le Pen only has 34% of positive opinions. (BBG)

BANKING: Several EU states are fighting a last-ditch battle to thin down the bloc's most significant change in banking regulation for a decade, as Brussels prepares to set out long-awaited legislation. The proposed rules will introduce a new capital minimum, or floor, making it harder for banks to use their own internal calculations to decide the size of their capital base. The European Commission is expected to propose the rules — part of the international Basel III banking reforms — in September or October. But capitals led by Paris, Berlin, Copenhagen and Luxembourg are trying to persuade the commission to moderate the minimum level imposed, according to those involved in the discussions. The way in which the international standards have been drawn up threatens to penalise EU banks, they argue.

U.S.

FED: MNI INTERVIEW: Fed Leery of Money Fund Rescue, Reinhart Says

- The Federal Reserve is likely to abstain from raising rates paid on reverse repos or excess reserves despite potential financial stability risks as money-market funds drown in surfeit liquidity, former Fed Board division of monetary affairs chief Vincent Reinhart told MNI. "If there's a problem in bill rates because of the lack of issuance by the under secretary of the Treasury, pay downs, and running off the Treasury General Account, then take it up with Treasury," he said - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: President Joe Biden ended talks with Republican Senator Shelley Moore Capito on an infrastructure plan on Tuesday without a deal, after failing to reach agreement on the scope of spending or how to pay for it. The talks concluded after a brief phone call between the president and the West Virginia senator. Biden will instead turn his attention to a bipartisan group of senators working on their own infrastructure plan, White House Press Secretary Jen Psaki said in a statement. (BBG)

FISCAL: Republican Senator John Barrasso said bipartisan talks with the White House have hit "a significant roadblock" and the administration is seeking "massive tax increases" to pay for it. Republicans have made a number of offers and it's time for the. White House to work with us, Barrasso, who is a part of infrastructure talks, told reporters Tuesday. (BBG)

FISCAL: Biden shifted gears quickly. He spoke Tuesday afternoon with Sen. Bill Cassidy (R-La.), who has been part of a bipartisan effort that met Tuesday evening, as well as Sens. Joe Manchin III (D-W.Va.) and Kyrsten Sinema (D-Ariz.). Sen. Mitt Romney (R-Utah) said the bipartisan group of Senators made "good progress" during Tuesday's meeting, which lasted nearly three hours. He declined to cite specific figures on spending agreements, but he said the group focused on new spending over a five-year period. "We went through line by line and we've got pretty good agreement on most of those and went to the pay fors as well and they're a little less solid," he said. Romney said he expected the group to put forward a public proposal in the coming weeks. The new bipartisan talks are expected to focus on a package that would be narrower than what Biden originally proposed, but one of the biggest hurdles will be how to finance it, which is what Romney was referring to when he said "pay fors." Biden has proposed raising corporate taxes, but Republicans have tried to explore other mechanisms. An administration official, who, like others, spoke on the condition of anonymity to discuss private conversations, said the talks with Capito, the GOP's top negotiator, fell apart after the president could not get her group to increase their overall spending on the plan, among other things. (Washington Post)

FISCAL: A CNN reporter tweeted the following on Tuesday: "Schumer indicates Dems planning to go reconciliation on infrastructure. I asked him if he had confidence in Sinema-Portman talks. He noted they are "pursuing" reconciliation along with bipartisans talks. "That's not going to be the only answer," he said of bipartisan effort." (MNI)

CORONAVIRUS: U.S. health officials are scrambling to get more Americans vaccinated to keep the Delta variant, first identified in India, from proliferating across the United States. The variant has become the dominant strain in the U.K., accounting for an estimated 60% of new cases. It's now more prevalent than the Alpha strain, formerly called the B.1.1.7 strain, which was first identified in the U.K., and transmission is peaking in people between the ages of 12 and 20, White House chief medical advisor Dr. Anthony Fauci said at a press briefing Tuesday. (CNBC)

CORONAVIRUS: The U.S. Centers for Disease Control and Prevention (CDC) has eased travel recommendations for more than 110 countries and territories, including Japan just ahead of the Olympics. The CDC's new ratings, first reported by Reuters and posted on a CDC website on Monday, include 61 nations that were lowered from its highest "Level 4" rating that discouraged all travel to recommending travel for fully vaccinated individuals, the agency confirmed on Tuesday. An additional 50 countries and territories have been lowered to "Level 2" or "Level 1," a CDC spokeswoman said. Countries ranked lowest for COVID-19 risks now include Singapore, Israel, South Korea, Iceland, Belize and Albania. (RTRS)

CORONAVIRUS: The Biden administration is forming expert working groups with Canada, Mexico, the European Union and the United Kingdom to determine how best to safely restart travel after 15 months of pandemic restrictions, a White House official said on Tuesday. Another U.S. official said the administration will not move quickly to lift orders that bar people from much of the world from entering the United States because of the time it will take for the groups to do their work. The White House informed airlines and others in the travel industry about the groups, the official said. (RTRS)

OTHER

GLOBAL TRADE: European Union leaders and President Joe Biden will commit to ending outstanding trade battles when they meet next week and promise to remove tariffs related to a steel and aluminum conflict before the end of the year. That is according to a draft of the conclusions seen by Bloomberg News ahead of an EU-U.S. summit in Brussels on June 15. It spells out that the allies will agree to resolve disagreements, including a nearly two-decade old aircraft dispute next month that came to a head under the Trump administration and contributed to more than $18 billion in U.S. and EU exports subject to painful levies. (BBG)

GLOBAL TRADE: The White House fully expects bottlenecks in the global supply chain and rising prices for some products to be temporary and resolve themselves in coming weeks, the deputy director of the National Economic Council said on Tuesday. Sameera Fazili told a White House briefing that price increases and other issues were largely a product of a quicker-than-expected recovery in the U.S. economy that had spurred unexpectedly higher demand for certain goods. She said the private sector would also have a role to play in addressing longer-term structural vulnerabilities in U.S. supply chains. (RTRS)

GLOBAL TRADE: Ford says there's a 'risk' chip shortage will 'spill into 2022.' (BBG)

GLOBAL TRADE: A Covid-19 outbreak in southern China is curbing activity at some of the country's biggest ports, stoking fears that further disruption in international trade risk pushing up the price of its exports. More than 100 new cases have been reported since late May in Guangdong province, one of China's most important manufacturing hubs, leading to strict counter measures from the government. Processing at the Yantian container terminal in Shenzhen, which suspended exports for almost a week last month after workers tested positive, has plummeted. There has also been a sharp decline in the number of ships berthing as authorities enforce coronavirus prevention measures. The slowdown at the terminal, which has worsened congestion at the nearby Chinese ports of Nansha and Shekou, highlights the vulnerability of global shipping to outbreaks in the country, where new infections have remained low compared with other big economies over the past year. (FT)

GLOBAL TRADE: Rishi Sunak, the UK chancellor, is pushing to win a carve-out for the City of London in the G7's push for a new global tax system to cover the world's "largest and most profitable multinational enterprises". Sunak said the weekend's "historic agreement" by G7 finance ministers would force "the largest multinational tech giants to pay their fair share of tax in the UK". But one official close to the talks said the UK was among those countries pushing "for an exemption on financial services", reflecting Sunak's fears that global banks with head offices in London could be affected. (FT)

U.S./CHINA: The Senate passed rare bipartisan legislation on Tuesday aimed at countering China's growing influence by investing more than $200 billion in American technology, science and research. The final vote was 68-32. Independent Sen. Bernie Sanders of Vermont was the only member of the Democratic caucus to vote against the bill. Nineteen Senate Republicans joined Democrats voting for passage. Passage is a victory for Majority Leader Chuck Schumer, a New York Democrat who co-wrote and strongly backed the measure, and for President Joe Biden, who made reaching across the aisle a central promise of his governing strategy, although he has faced criticism for moving unilaterally on his largest agenda items to this point. (CNN)

U.S./CHINA: China has only itself to blame for a global backlash against its policies, the White House's top official for Asia said. "Over the last year or two the country that has done the most to create problems for China is not the United States but China," Kurt Campbell, the U.S. coordinator for Indo-Pacific affairs on the National Security Council said Tuesday at an event hosted by the Center for a New American Security. Campbell said the Chinese foreign policy establishment understands that the country's policies, which include militarizing artificial islands and outcroppings in the South China Sea and a more assertive approach to global diplomacy, have helped to cause a global backlash against Beijing. "But is that getting through to the most inner-circle in the Chinese leadership? I think that's a question we can't answer," Campbell said. (BBG)

U.S./CHINA: The Editor in Chief of the Global Times tweeted the following on Tuesday: "You think the US can strike China like it does to small countries? Why the US imported more Chinese goods in the first five months of this year? Why sell your agricultural products to China? It seems you haven't learned from Trump's trade war." (MNI)

U.S./CHINA/TAIWAN: Secretary of State Antony Blinken told a Senate panel Tuesday that while attention focuses on "large weapons systems," the U.S. "should focus on helping Taiwan strengthen its asymmetric capabilities like reserve force reform." Campbell said the situation in Myanmar was "deeply concerning" and "continuing to get worse." He said that the U.S. is working with allies to tell the government that its actions have been counterproductive. It is "undeniable that violence is spiraling," he said. (BBG)

GEOPOLITICS: Closer Russia-U.S. relations won't affect China's ties with either the U.S. or Russia, Li Yonghui, a senior researcher at the Chinese Academy of Social Sciences, wrote in an article published by the Global Times commenting on the upcoming Biden-Putin summit. The U.S. believes that China and Russia will be united more closely if it doesn't try to pull Russia to its side, although it cannot bluntly ask Russia to unite against China during the summit, Li said. Russia also knows that its relations with China are crucial and won't just follow Washington's steps, Li wrote. The summit is more symbolic and the most likely substantive outcome will be in the area of arms control, Li wrote. (MNI)

CORONAVIRUS: The U.S. and the European Union are set to back a renewed push into investigating the origins of Covid-19 after conflicting assessments about where the outbreak started, according to a document seen by Bloomberg News. In a draft statement the countries hope to adopt at a summit later this month, they "call for progress on a transparent, evidence-based, and expert-led WHO- convened phase 2 study on the origins of COVID-19, that is free from interference." The U.S. is among several countries that have called on China to be more transparent with its data and allow greater access, amid ongoing questions over whether the outbreak was caused by a laboratory accident, was transmitted from wildlife or caused by something else. (BBG)

RBA: The Reserve Bank of Australia says there are good prospects for economic growth in Australia that will eventually see an increase in wages and inflation. Even so, RBA assistant governor Christopher Kent believes it will be a gradual process, with inflation unlikely to be sustainably be within the two to three per cent target band until at least 2024. He was not concerned by the recent rise in market interest rates. "Households and business borrowers continue to benefit from record low interest rates on most loans, their balance sheets are in good shape and the economy is benefiting from supportive fiscal policy," he told an online conference on Wednesday. (AAP)

RBA: The Reserve Bank of Australia is likely to stick with its current yield target bond and scale back its quantitative easing as it takes "tactical" decisions at next month's meeting, former board member John Edwards said. "It's something they've got to do at some point and things have gone far more favorably than their earlier forecasts," said Edwards, now a senior fellow at the Lowy Institute. "My sense is they may take this opportunity to dismantle some of the elements of their structure" on longer-dated bond purchases. (BBG)

AUSTRALIA: Millions of Victorians will finally be let out of lockdown on Friday, but crippling restrictions will remain in place despite just one new Covid-19 case. The single infection was traced to existing cases and had already been in precautionary quarantine, meaning they are unlikely to have infected others. Despite the low infection rates, Melburnians will still be banned from having guests at their home, and even those in the regions will only be permitted to have two people over. Acting Premier James Merlino on Wednesday said metropolitan Melbourne will move to 'most of the same settings' currently in place across regional Victoria, with masks still be mandatory indoors and people encouraged to work from home. Those living in the city will now be allowed to leave home for whatever reason they want, with shops, restaurants and cafes permitted to open with strict capacity limits. The existing 10km limit will be increased to 25km, meaning the only reasons to go further than 25km will be for work, education, caregiving or getting a vaccination. The 25km travel limit for Melburnians is likely to reek havoc on regional businesses who rely on a major influx from the city over the upcoming long weekend. (Daily Mail)

AUSTRALIA: The ABS note that "payroll jobs rose by 0.3% in the fortnight to 22 May 2021, following a 0.1% fall in the previous fortnight. Fortnightly growth in payroll jobs held by men had generally been below that of women since the end of January 2021, through to early May. However, payroll jobs growth for men was higher in the most recent fortnight, increasing by 0.4% compared with 0.2% for women. Payroll jobs held by women continued to show stronger growth since the start of the pandemic. At 22 May 2021 they were 2.0% above mid-March 2020, compared with 0.4% above for men. This stronger recovery for payroll jobs held by women aligns with what we have seen in female employment in Labour Force statistics, with both measures also showing much larger losses for women early in the COVID period. Most payroll jobs (86%) are held by 20-59 year olds. Within this group, changes in payroll jobs across the most recent fortnight ranged from an increase of 0.6% for 40-49 year olds to a 0.2% decrease for 20-29 year olds. At 22 May 2021, payroll jobs continued to be above pre-pandemic levels in all age groups. Changes in payroll jobs continued to vary across the states and territories, with the latest figures covering the period before the recent lockdown in Victoria. Payroll jobs rose in almost every state and territory in the fortnight to 22 May 2021, with the largest increases seen in Queensland and the Northern Territory (up 0.6% and 0.5%). Payroll jobs in Tasmania fell by 0.3%." (MNI)

NEW ZEALAND: New Zealand Finance Minister Grant Robertson speaks to parliament's finance and expenditure select committee in Wellington about May budget. Says on track to meet vaccination goal, which is that everyone aged 16 and over who wants to will be vaccinated by the end of the year. Treasury Secretary Caralee McLiesh tells committee that level of service exports is currently about 50% of pre-pandemic level, largely due to drop in tourism and international students. Treasury assumes service exports will gradually rise to about 75% across budget forecast period. Robertson says too early to forecast additional revenue from G-7's proposed global corporate tax rate. (BBG)

SOUTH KOREA: South Korea's ruling Democratic Party said on Wednesday (June 9) it was trying to regain public trust by asking 12 lawmakers to leave the party over a property scandal that has alienated voters. The insider land trading scandal, alongside skyrocketing home prices and deepening inequality, has contributed to President Moon Jae-in's approval ratings plunging to record lows and his party's abject defeat in key mayoral elections in April. Offering a public apology last week, Prime Minister Kim Boo-kyum said 20 people had been arrested and 529 referred to prosecutors, including 90 members of the parliament and high-level and local government officials, as part of an intra-agency investigation. (RTRS)

SOUTH KOREA: South Korea will allow group trips as early as in July for people who complete vaccination after discussing travel bubble with countries whose Covid-19 situation is controlled, Prime Minister Kim Boo-kyum says in meeting. Koreans who are fully vaccinated and test negative at airport will be allowed to travel overseas without having to quarantine upon arrival and return. (BBG)

CANADA: Business groups are calling on the Canadian and U.S. governments to relax border restrictions for vaccinated travelers this month, increasing pressure on Justin Trudeau to act swiftly. Chambers of commerce on both sides of the border, along with other groups, want travelers who've been fully inoculated against Covid-19 to be able to cross the border without having to show a negative test or undergo a quarantine, a letter released Tuesday said. The business groups say the changes should take effect on June 22, the day after the renewal deadline for a pact that restricts travel between the two countries. The letter was reported first by Bloomberg News. (BBG)

MEXICO: Mexico's government does not plan tax increases in an upcoming fiscal reform, but will consider closing loopholes, improving taxing efficiency and expanding the taxable base, Deputy Finance Minister Gabriel Yorio said on Tuesday. "In 2021, we find ourselves in a situation where Mexico has no need to increase tax rates. So I don't think that will be included in any initiative that the government sends to the new Congress," Yorio told Reuters in an interview. (RTRS)

MEXICO: Mexico and U.S. will hold a high level, ministerial meeting on security by the end of summer, Foreign Minister Marcelo Ebrard said in remarks after a visit by U.S. Vice President Kamala Harris. (BBG)

BRAZIL: Brazil's government will need at least 11 billion reais ($2.2 billion) in extra cash to extend emergency cash transfers to the poor for two or three months until the COVID-19 outbreak is under control, Economy Minister Paulo Guedes said on Tuesday. The monthly cost of the program is around 9 billion reais, so a two-month extension would cost 18 billion reais, Guedes said, adding that the government already has an unspent 7 billion left over from the previous package that was revived in April. President Jair Bolsonaro is deciding whether the aid will be extended for two or three months, Guedes said. This will depend on how the pandemic evolves, but even three months should not cause ripples in financial markets, Guedes said. "I wouldn't expect any noise from the market ... if you spend 11 or 12 billion more. That's reasonable (in view of the pandemic)," Guedes said. (RTRS)

BRAZIL: Provisional measure on Eletrobras's privatization may be voted on this Thursday or until the beginning of next week in the Senate, rapporteur Marcos Rogerio said to journalists in Brasilia. (BBG)

SOUTH AFRICA: Eskom will impose stage 2 loadshedding from 10am local on Wednesday until 10pm Sunday due to continued delays in returning generation units to service at some power stations. Constraints exacerbated by high winter demand over the past few days due to colder temperatures. (BBG)

IRAN: U.S. Secretary of State Antony Blinken on Tuesday said he anticipates that even if Iran and the United States return to compliance with the nuclear deal, hundreds of U.S. sanctions on Tehran would remain in place. "I would anticipate that even in the event of a return to compliance with the JCPOA, hundreds of sanctions will remain in place, including sanctions imposed by the Trump administration. If they are not inconsistent with the JCPOA, they will remain unless and until Iran's behavior changes," Blinken told a Senate committee. (RTRS)

IRAN: The United States told Iran on Tuesday that it must let the U.N. atomic agency continue to monitor its activities, as laid out in an agreement that has been extended until June 24, or put wider talks on reviving the Iran nuclear deal at risk. The International Atomic Energy Agency and Iran reached a three-month agreement in February cushioning the blow of Tehran's decision to reduce its cooperation with the agency by ending extra monitoring measures introduced by the 2015 deal. (RTRS)

OIL: U.S. crude oil production is expected to fall by 230,000 barrels per day (bpd) in 2021 to 11.08 million bpd, the U.S. Energy Information Administration (EIA) said on Tuesday, a smaller decline than its forecast last month for a drop of 290,000 bpd. (RTRS)

CHINA

INFLATION: China's economic planning agency vows to increase supply of key consumer goods to stabilize prices, according to a statement on NDRC website on a national video meeting Tuesday. Corn, wheat, edible oil, pork and vegetables are top items in China's consumer price control list. China will also control commodities market and strengthen supervision. (BBG)

INFLATION: China will increase state pork reserves in order to ensure supply and stabilize prices, the nation's economic planning agency says in a statement. The number of hogs available for slaughtering is expected to resume...Number of hogs slaughtered is expected to resume to a "normal level" in the second half year. China will add temporary pork reserves on top of the current conventional one, in order to focus on reserves when prices or output slump. (BBG)

INFLATION: China is considering imposing a cap on the price of thermal coal as it struggles to contain stubbornly high energy costs ahead of peak demand over the summer. One idea under discussion is to cap the price at which miners sell coal, according to people familiar with the plan, who declined to be named because the matter isn't public. Yulin, a major production base in northwestern Shaanxi province, is already testing a price cap, one of the people said. Another idea is to enforce a limit of 900 ($141) or 930 yuan a ton on the benchmark price at the port of Qinhuangdao, which would influence other markets nationwide, the people said. Under this scenario, power plants would be advised by the authorities that they can't buy coal above that level. The second plan is currently being tested at the port by some state-owned generators, one of the people said. (BBG)

LOCAL GOV'T BONDS: China's local governments may issue about CNY800 billion special bonds in June, with the pace of issuance in H1 slower than previous years, as local governments face more stringent review over the intended investment projects, the China Securities Journal reported citing analysts. Local governments are facing less pressure to stabilize growth as the annual GDP target is set at over 6%, and their rising balance of fiscal deposits indicates funds raised under last year's fiscal stimulus countering the pandemic remain unused, the newspaper said citing Li Yong, chief analyst at Soochow Securities. The peak issuance will come in around June to September, playing a role in supporting continued economic growth in H2, the newspaper said citing Wu Qiying, analyst at GF Securities. (MNI)

FISCAL: China should introduce policies to hedge against the possible impact of a global minimum corporate tax rate of 15% agreed by G7 countries if enacted, as it may reshape the global industrial and supply chain, said the 21st Century Business Herald in a commentary. Developing countries rely on cutting taxes to attract foreign investment, and multinational companies may be less willing to spread out their production capacities globally once the global minimum tax is introduced, the newspaper said. (MNI)

PROPERTY: Chinese regulators have instructed major creditors of China Evergrande Group to conduct a fresh round of stress tests on their exposure to the world's most indebted developer, according to people familiar with the matter. Authorities led by the Financial Stability and Development Committee, China's top financial regulator, recently told lenders including Industrial & Commercial Bank of China Ltd. to assess the potential hit to their capital and liquidity should Evergrande run into trouble, the people said, asking not to be identified discussing a private matter. It's unclear whether the results will lead to any official action. While it's not the first time regulators have required banks to report their Evergrande exposure, the directive suggests concerns about the company's financial health have become serious enough to once again reach the upper levels of China's government. (BBG)

OVERNIGHT DATA

CHINA MAY CPI +1.3% Y/Y; MEDIAN +1.6%; APR +0.9%

CHINA MAY PPI +9.0% Y/Y; MEDIAN +8.5%; APR +6.8%

JAPAN MAY MONEY STOCK M2 +7.9% Y/Y; MEDIAN +8.4%; APR +9.2%

JAPAN MAY MONEY STOCK M3 +6.9% Y/Y; MEDIAN +7.0%; APR +7.8%

AUSTRALIA JUN WESTPAC CONSUMER CONFIDENCE 107.2; MAY 113.1

AUSTRALIA JUN WESTPAC CONSUMER CONFIDENCE -5.2% M/M; MAY -4.8%

The Index has now fallen by 9.7% over the last two months. We think the initial 4.8% fall in May can be mainly attributed to a combination of a statistical correction following a very strong surge in April to an eleven-year high, and some disappointment around the Budget given high expectations leading into the announcement. The latest fall in June is almost certainly due to concerns around the two-week lockdown in Melbourne. The survey was conducted during the first week of the lockdown. The Index is now back at the level we saw back in January when the country was impacted by significant lockdowns in parts of Sydney and Queensland. The fall in the Index between the surveys in early January and December – when the country had been comfortably reopening with memories of lockdowns fading – was 4.5%, comparable to the fall we are now experiencing. Of course, just as we saw in January, the falls this month are not uniform across the nation. In January, the state most affected by the lockdown, NSW, suffered the biggest hit (–5.3%). In today's survey we have seen a fall of 7.5% in Victoria, 4% in Queensland, 9% in Western Australia, and 10.9% in South Australia. While the fall in Victoria is to be expected, the significant declines elsewhere may be pointing to considerable insecurity in the small states with respect to their vulnerability to further outbreaks as well, in some cases, to their particular reliance on Victoria for tourism. In contrast, the Index in NSW fell by a meagre 1.1% highlighting the confidence the state has in its capacity to contain the virus. Sentiment in NSW is now 15.4% above Victoria; 11% above Queensland; 19.3% above Western Australia; 14.4% above South Australia and 29.6% above Tasmania. That resilience in NSW, our largest state, will be very important for supporting national sentiment and, in turn, sustaining the economic recovery. (Westpac)

NEW ZEALAND Q1 M'FING ACTIVITY +2.1% Q/Q; Q4 -0.2%

NEW ZEALAND Q1 M'FING ACTIVITY VOLUME +0.4% Q/Q; Q4 +0.4%

NEW ZEALAND JUN, P ANZ BUSINESS CONFIDENCE -0.4; MAY 1.8

NEW ZEALAND JUN, P ANZ ACTIVITY OUTLOOK 29.1; MAY 27.1

The preliminary ANZ Business Outlook data for June saw business confidence fall 2 points to -0.4%, while the own activity outlook lifted 2 points to +29.1%. Activity indicators were mixed. Investment intentions jumped 6 points, consistent with the 4-point lift in capacity utilisation. Profit expectations eked out a 2-point gain while export intentions also rose. However, headline business confidence and employment intentions eased. Cost and inflation pressures continue to intensify. Expected costs rose another 5pointsto a net 85.6% expecting higher costs ahead. A net 62.8% of respondents intend to raise their prices, up 6 points, another record in data that goes back to 1992. For context on just how spectacular that record is, the previous high before this year was 47.4% in 2000. Inflation expectations continue to lift – at 2.33%, they are close to the 2% RBNZ CPI target midpoint, but they're still rising. We'll wait for the full month's data to report sectoral results, but it's worth noting that the retail sector's inflation expectations and pricing intentions outstrip everyone else's by quite some margin, and retail prices weigh heavily on the consumer price index. Shipping disruptions, rising global commodity prices, the higher minimum wage, labour shortages due to both the closed border and uneven sector growth are creating a perfect storm for the supply side of the economy at the same time as demand is holding up much more than firms (or economists!) had anticipated. Headline inflation is set to jump over the next six months as a result, but it's best to focus on wage growth and inflation expectations for clues regarding when the Reserve Bank might conclude they can no longer look through inflation pressure and simply wait for temporary pressures to subside, necessitating a higher OCR. (ANZ)

NEW ZEALAND MAY ANZ TRUCKOMETER HEAVY -4.8% M/M; APR +5.9%

This month we discovered an error with the usual Easter adjustment in April not feeding through correctly, and have fixed that, causing an upward revision to that month's data. Apologies for the inconvenience. We've also taken the opportunity to 'spread the load' – we've reduced the maximum weight on any single road from 25% to 15%, with the aim of making the indexes more robust to the variable traffic patterns that are affecting the data at the moment. However, there's still plenty of volatility, with the seasonally adjusted traffic data rising very strongly over recent months, due to summer traffic not falling away as quickly as usual – both trucks and cars. Some of this no doubt represents high economic activity, but it's also true that there is plenty of disruption in transport both globally and domestically at present, with goods having to make their way to their destinations by unusual means. This is affecting truck movements, particularly around ports. There's plenty of volatility in the car traffic too, especially around Auckland with its recent snap lockdowns, which will also have affected not only the real-time data but also the seasonal adjustment process. The traffic data is unlikely to be an accurate barometer for GDP until the noise settles down. The New Zealand economy is under pressure, facing supply issues around inputs to production and logistical headaches. But firms and people are getting on with it, as the strong traffic flows attest. (ANZ)

SOUTH KOREA Q1, F GDP +1.9% Y/Y; MEDIAN +1.8%; FLASH +1.8%

SOUTH KOREA Q1, F GDP +1.7% Q/Q; MEDIAN +1.6%; FLASH +1.6%

SOUTH KOREA MAY UNEMPLOYMENT 3.8%; MEDIAN 3.6%; APR 3.7%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS WEDS; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Wednesday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2698% at 09:25 am local time from the close of 2.2684% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 37 on Tuesday, flat from the close of Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3956 WEDS VS 6.3909

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.3956 on Wednesday, compared with the 6.3909 set on Tuesday.

MARKETS

SNAPSHOT: U.S. Fiscal Impasse Continues, Chinese PPI Surges

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 102.31 points at 28861.99

- ASX 200 down 16.09 points at 7276.7

- Shanghai Comp. up 14.419 points at 3594.525

- JGB 10-Yr future up 6 ticks at 151.68, yield down 0.8bp at 0.070%

- Aussie 10-Yr future up 3.3 ticks at 98.483, yield down 3.7bp at 1.575%

- U.S. 10-Yr future -0-01 at 132-13+, yield down 0.68bp at 1.526%

- WTI crude up $0.39 at $70.44, Gold up $0.97 at $1893.86

- USD/JPY down 2 pips at Y109.48

- SENATE PASSES BIPARTISAN BILL TO COMBAT CHINA'S GROWING ECON INFLUENCE (CNN)

- CAPITO-BIDEN INFRASTRUCTURE TALKS BREAK DOWN, BIDEN PURSUES OTHER AVENUES

- U.S. AND EU TO END FOR GOOD TRUMP'S $18 BILLION TARIFF FIGHT (BBG)

- WHITE HOUSE SEES SUPPLY CHAIN BOTTLENECKS RESOLVING IN COMING WEEKS (RTRS)

- CHINA VOWS TO KEEP CONSUMER GOODS PRICES STABLE AFTER PPI SURGES (BBG)

- SUNAK COULD ACCEPT FOUR-WEEK DELAY TO ENDING COVID RESTRICTIONS IN ENGLAND (GUARDIAN)

BOND SUMMARY: Biased Higher In Asia

A (familiar) tight Asia-Pac session for T-Notes, sticking to a 0-02+ range last -0-01 at 132-13+. The cash Tsy curve has seen some modest twist flattening, with 30s richening by 1.0bp. U.S. fiscal matters (and the lack of movement there) continue to garner the most attention in terms of discussions, while the U.S. Senate passed bipartisan legislation aimed at countering China's swelling global influence through investing more than $200bn in American tech & research, as expected. 905 lots of WNU1 were lifted, which headlined on the flow side.

- JGB futures stuck to a narrow range, last +6, with the long end leading the bid in the cash JGB space given the overnight lead from U.S. Tsys, as 20s and 30s richened by 1.5-2.0bp. There was nothing of note on the local news front, while the latest round of BoJ Rinban operations revealed flat to higher offer to cover ratios across the 1- to 10-Year buckets when compared with the prior respective operations.

- Aussie bond futures firmed a little during early Sydney dealing, adding to overnight gains, YM +1.1 & XM +3.2 at typing, with roll activity headlining thus far (the YM & XM rolls both traded to the left). Some trans-Tasman impetus in the form of a firmer NZGB space may have provided some early support. Still, the space is off richest levels given the softer cover ratio and modest pricing of the weighted average yield through pre auction levels (0.13bp per Yieldbroker) in the latest round of ACGB Nov '31 supply. The latest address from RBA Assistant Governor Kent didn't provide much in the way of market changing information. Elsewhere, we learnt that Melbourne's COVID restrictions would be loosened a little in the coming days.

JGBS AUCTION: Japanese MOF sells Y2.7762tn 6-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y2.7762tn 6-Month Bills:

- Average Yield -0.1016% (prev. -0.1090%)

- Average Price 100.051 (prev. 100.055)

- High Yield: -0.0996% (prev. -0.1070%)

- Low Price 100.050 (prev. 100.054)

- % Allotted At High Yield: 92.3390% (prev. 41.9996%)

- Bid/Cover: 4.098x (prev. 4.740x)

BOJ: Rinban Conducted

The BoJ offers to buy a total of Y1.435tn of JGBs from the market, sizes unchanged from the previous operations:

- Y475bn worth of JGBs with 1-3 Years until maturity

- Y450bn worth of JGBs with 3-5 Years until maturity

- Y450bn worth of JGBs with 5-10 Years until maturity

- Y60bn of JGBis

AUSSIE BONDS: The AOFM sells A$1.0bn of the 1.00% 21 Nov '31 Bond, issue #TB163:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 1.00% 21 November 2031 Bond, issue #TB163:- Average Yield: 1.5713% (prev. 1.7453%)

- High Yield: 1.5725% (prev. 1.7475%)

- Bid/Cover: 2.6700x (prev. 3.3542x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 73.1% (prev. 35.3%)

- bidders 44 (prev. 42), successful 17 (prev. 15), allocated in full 6 (prev. 8)

- N.B. We have published the auction results later than usual owing to a delay with the AOFM email system.

EQUITIES: Mixed In Asia

The major regional equity indices traded either side of unchanged during Asia-Pac hours, with little in the way of deviation from unchanged levels seen. U.S. equity index futures were ever so slightly higher after the space recouped the bulk of its early losses on Tuesday. There was little in the way of market moving headline flow, with most of the focus falling on China's surging PPI print.

OIL: Still Ticking Higher

WTI & Brent sit a little over $0.40 above their respective settlement levels, with the former building on its first foray above $70.00 since late '18. The latest weekly API oil inventory estimates delivered a roughly in line with exp. draw in headline crude stocks, larger than expected builds in both gasoline and distillate stocks, as well as a modest drawdown in stocks at the Cushing hub. A reminder that Tuesday saw the EIA alter its U.S. crude oil production estimate for '21 to -230K bpd vs. '20 levels vs. a previous -290K bpd. The weekly DoE crude inventory data headlines on Wednesday.

GOLD: Bulls Still Searching For Sustained Break Above $1,900/oz

Bulls still haven't managed to force their way back through $1,900/oz, at least on a sustainable basis, with Tuesday's showings above the figure limited in nature and short in duration, leaving an unchanged technical picture in place. Spot last deals little changed around the $1,895/oz mark, with Tuesday's retracement from lows in U.S. real yields keeping a lid on prices.

FOREX: Antipodeans Lag G10 Pack, Tight Ranges In Play

The Antipodeans lost ground, even as both BBG Commodity Index and the yuan edged higher. Their respective downswings were shallow, as G10 crosses hugged very tight ranges. Regional sentiment gauges suggested that moods are souring this month, as Australia's Westpac Consumer Confidence and New Zealand's flash ANZ Business Confidence slipped.

- Chinese inflation data provided the main point of note on the Asia-Pac docket. PPI beat expectations on the back of the global commodity boom, which boosted factory-gate inflation to +9.0% Y/Y, the fastest pace since 2008. Strong producer price growth overshadowed a slight miss in CPI, while the yuan extended gains after the release.

- The USD came under a modicum of pressure ahead of the release of U.S. CPI on Thursday. China's PPI was under scrutiny as a potential bellwether of U.S. consumer price growth.

- Looking ahead to the London/NY sessions, the docket will be headlined by the latest Bank of Canada monetary policy decision and accompanying statement, although this is largely expected to be a placeholder for a live July meeting.

FOREX OPTIONS: Expiries for Jun09 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2080-1.2100(E1.25bln-EUR puts), $1.2135(E686mln-EUR puts), $1.2145-55(E1.4bln-EUR puts), $1.2165-75(E1.3bln-EUR puts), $1.2195-1.2200(E1.3bln-EUR puts), $1.2235-40(E514mln-EUR puts), $1.2250(E1.7bln-EUR puts), $1.2265(E532mln-EUR puts), $1.2400(E919mln-EUR puts)

- USD/JPY: Y108.45-55($1.2bln), Y109.00-10($1.46bln-USD puts)

- USD/CHF: Chf0.8975($1.2bln-USD puts)

- EUR/CHF: Chf1.0980(E601mln-EUR puts), Chf1.1040(E1.1bln-EUR puts), Chf1.1100(E595mln-EUR puts)

- AUD/USD: $0.7750(A$779mln-AUD puts), $0.7900-10(A$892mln-AUD puts), $0.8010(A$724mln-AUD puts)

- USD/CNY: Cny6.38($595mln-USD puts), Cny6.40($770mln-USD puts)

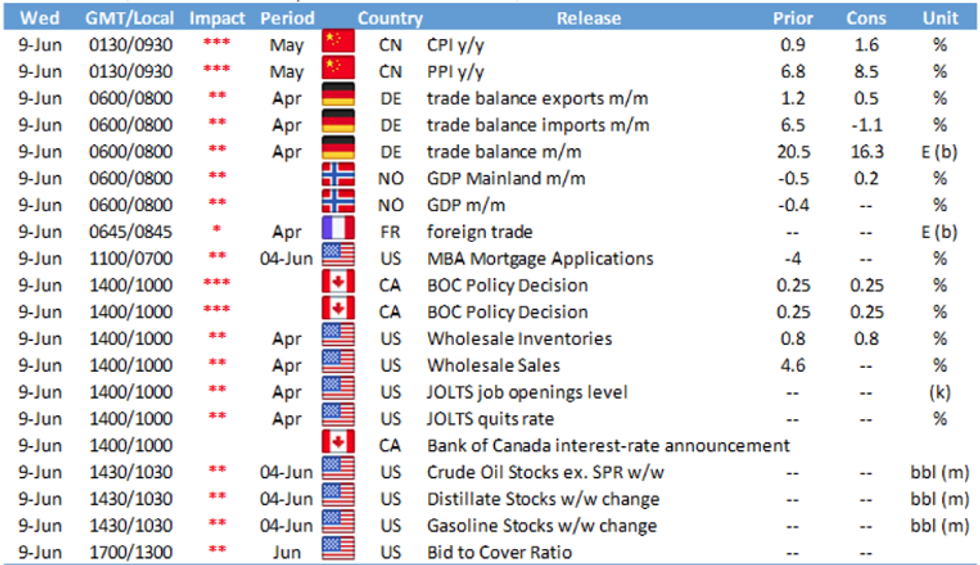

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.