-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: Chinese PPI Surges, Has Little Market Impact

- Chinese PPI hits levels not seen since the GFC, triggering talk of price control mechanisms among policymakers.

- Markets tight with a lack of overt progress on U.S. infrastructure matters evident.

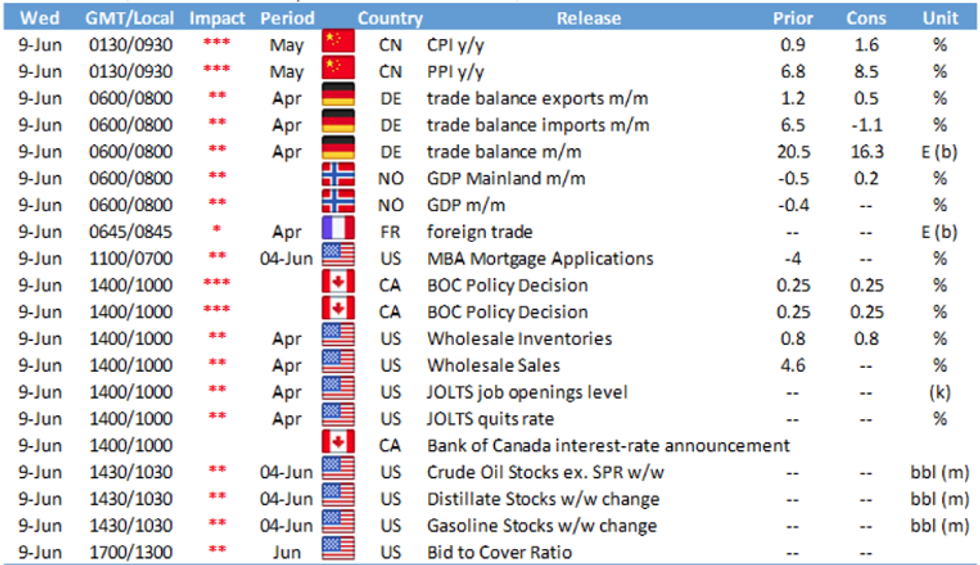

- Wednesday's docket will be headlined by the latest Bank of Canada monetary policy decision and accompanying statement, although this is largely expected to be a placeholder for a live July meeting.

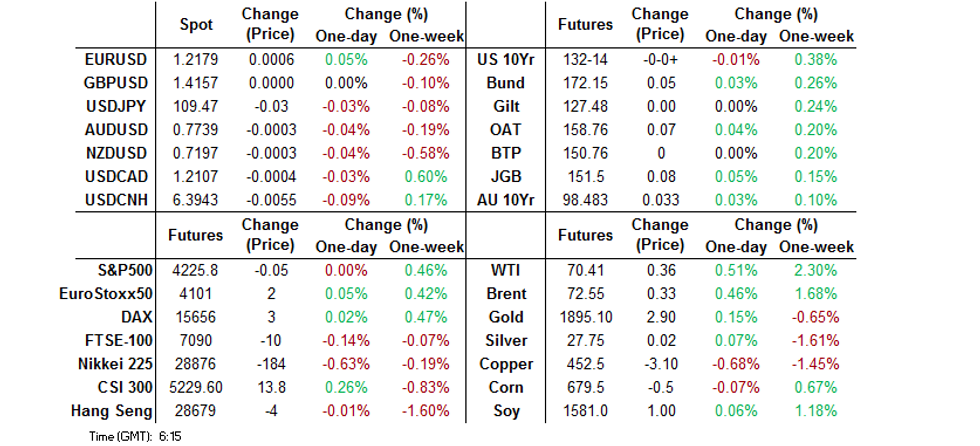

BOND SUMMARY: Biased Higher In Asia

A (familiar) tight Asia-Pac session for T-Notes, sticking to a 0-02+ range last -0-01+ at 132-13. The cash Tsy curve has seen some modest twist flattening, with 30s richening by 1.0bp. U.S. fiscal matters (and the lack of movement there) continue to garner the most attention in terms of discussions, while the U.S. Senate passed bipartisan legislation aimed at countering China's swelling global influence through investing more than $200bn in American tech & research, as expected. 905 lots of WNU1 were lifted on block, which headlined on the flow side. 10-Year Tsy supply dominates the domestic U.S. docket on Wednesday.

- JGB futures ticked higher as we moved through Tokyo trade, last +7, just shy of best levels. The long end leads the bid in the cash JGB space given the overnight lead from U.S. Tsys, as 20s and 30s richened by ~1.5bp, with spill over from yesterday's 30-Year JGB auction also touted. There was nothing of note on the local news front, while the latest round of BoJ Rinban operations revealed flat to higher offer to cover ratios across the 1- to 10-Year buckets when compared with the prior respective operations. PPI data and a liquidity enhancement auction for off-the-run 5- to 15.5-Year JGBs headline locally on Thursday.

- Aussie bond futures firmed a little during early Sydney dealing, adding to overnight gains, YM +1.1 & XM +3.4 at typing, with roll activity headlining (the YM & XM rolls both traded to the left). Some trans-Tasman impetus in the form of a firmer NZGB space may have provided some early support. Still, the space is off richest levels given the softer cover ratio and modest pricing of the weighted average yield through pre-auction levels (0.13bp per Yieldbroker) in the latest round of ACGB Nov '31 supply. The latest address from RBA Assistant Governor Kent didn't provide much in the way of market changing information. Elsewhere, we learnt that Melbourne's COVID restrictions would be loosened a little in the coming days. Finally, the latest round of Westpac consumer confidence saw another fall, with the survey collator noting that "May can be mainly attributed to a combination of a statistical correction following a very strong surge in April to an eleven-year high, and some disappointment around the Budget given high expectations leading into the announcement. The latest fall in June is almost certainly due to concerns around the two-week lockdown in Melbourne. The survey was conducted during the first week of the lockdown." There is little in the way of tier 1 data evident on the local docket on Thursday.

FOREX: Antipodeans Lag G10 Pack, Tight Ranges In Play

The Antipodeans lost ground, even as both BBG Commodity Index and the yuan edged higher. Their respective downswings were shallow, as G10 crosses hugged very tight ranges. Regional sentiment gauges suggested that moods are souring this month, as Australia's Westpac Consumer Confidence and New Zealand's flash ANZ Business Confidence slipped.

- Chinese inflation data provided the main point of note on the Asia-Pac docket. PPI beat expectations on the back of the global commodity boom, which boosted factory-gate inflation to +9.0% Y/Y, the fastest pace since 2008. Strong producer price growth overshadowed a slight miss in CPI, while the yuan extended gains after the release.

- The USD came under a modicum of pressure ahead of the release of U.S. CPI on Thursday. China's PPI was under scrutiny as a potential bellwether of U.S. consumer price growth.

- Looking ahead to the London/NY sessions, the docket will be headlined by the latest Bank of Canada monetary policy decision and accompanying statement, although this is largely expected to be a placeholder for a live July meeting.

FOREX OPTIONS: Expiries for Jun09 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2080-1.2100(E1.25bln-EUR puts), $1.2135(E686mln-EUR puts), $1.2145-55(E1.4bln-EUR puts), $1.2165-75(E1.3bln-EUR puts), $1.2195-1.2200(E1.3bln-EUR puts), $1.2235-40(E514mln-EUR puts), $1.2250(E1.7bln-EUR puts), $1.2265(E532mln-EUR puts), $1.2400(E919mln-EUR puts)

- USD/JPY: Y108.45-55($1.2bln), Y109.00-10($1.46bln-USD puts)

- USD/CHF: Chf0.8975($1.2bln-USD puts)

- EUR/CHF: Chf1.0980(E601mln-EUR puts), Chf1.1040(E1.1bln-EUR puts), Chf1.1100(E595mln-EUR puts)

- AUD/USD: $0.7750(A$779mln-AUD puts), $0.7900-10(A$892mln-AUD puts), $0.8010(A$724mln-AUD puts)

- USD/CNY: Cny6.38($595mln-USD puts), Cny6.40($770mln-USD puts)

ASIA FX: Chinese Inflation Figures Take Focus In Muted Asia Trade

Mixed session for Asian EM currencies, with little in the way of regional news to digest, apart from the closely watched Chinese inflation data.

- CNH: USD/CNH continued to lose altitude as China released its inflation data, which showed that the global commodity boom boosted factory-gate inflation to the fastest pace since 2008. A beat in PPI was coupled with a miss in CPI, as consumer prices rose 1.3% Y/Y. Spot USD/CNH remained within yesterday's range, with the in-line PBOC fix ignored by the redback.

- KRW: The won remained softer, despite trimming its initial losses. South Korea's Q1 GDP was revised higher, despite expectations for no change vs. flash readings. Unemployment unexpectedly ticked higher in May, as higher participation outweighed employment growth.

- MYR: The ringgit remained resilient amid some encouraging signs surrounding the local Covid-19 situation. Malaysia's King invited party leaders for consultations on handling the outbreak of the disease.

- IDR: The rupiah was rangebound. Indonesia's official consumer confidence index rose 2.9% M/M to 104.4 in May.

- PHP: The peso shrugged off the release of wider than expected Philippine trade deficit, underpinned by slower than forecast imports and exports growth.

- THB: The baht outperformed in muted Asia trade, with further talk re: gradual reopening of borders to foreign tourists doing the rounds.

- SGD: USD/SGD slipped, moving away from yesterday's peak, amid thin local headline flow.

- TWD: USD/TWD crept higher, briefly showing at a fresh monthly high, as the Taiwanese dollar struggled.

EQUITIES: Mixed In Asia

The major regional equity indices traded either side of unchanged during Asia-Pac hours, with little in the way of deviation from unchanged levels seen. U.S. equity index futures were ever so slightly higher after the space recouped the bulk of its early losses on Tuesday. There was little in the way of market moving headline flow, with most of the focus falling on China's surging PPI print.

GOLD: Bulls Still Searching For Sustained Break Above $1,900/oz

Bulls still haven't managed to force their way back through $1,900/oz, at least on a sustainable basis, with Tuesday's showings above the figure limited in nature and short in duration, leaving an unchanged technical picture in place. Spot last deals little changed around the $1,895/oz mark, with Tuesday's retracement from lows in U.S. real yields keeping a lid on prices.

OIL: Still Ticking Higher

WTI & Brent sit a little over $0.40 above their respective settlement levels, with the former building on its first foray above $70.00 since late '18. The latest weekly API oil inventory estimates delivered a roughly in line with exp. draw in headline crude stocks, larger than expected builds in both gasoline and distillate stocks, as well as a modest drawdown in stocks at the Cushing hub. A reminder that Tuesday saw the EIA alter its U.S. crude oil production estimate for '21 to -230K bpd vs. '20 levels vs. a previous -290K bpd. The weekly DoE crude inventory data headlines on Wednesday.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.