-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASI OPEN: Fed Bostic Still Confident of Waning Inflation

MNI ASIA MARKETS ANALYSIS: Tsy Curves Twist Flatter

PIPELINE: $2.2B Nigeria 2Pt Kicks Off December Issuance

MNI EUROPEAN OPEN: Asia Lacks Real Impetus After Powell Plays Straight Bat

EXECUTIVE SUMMARY

- FED CHAIR POWELL: NO PREEMPTIVE HIKE AMID FLEETING INFLATION (MNI)

- CHINA SAYS ITS MILITARY READY TO RESPOND TO ALL PROVOCATION (BBG)

- CHINA SHOULD BE ALERT TO YUAN DEPRECIATION RISKS (CSJ)

- NDRC: CHINA TO CHECK LOCAL FIRMS' TRADING IN COMMODITIES MARKETS (BBG)

- ENGLAND SET TO DROP FACEMASKS AND SOCIAL DISTANCING ON JULY 19 (TIMES)

- U.K., EU CLOSE TO TRUCE IN BREXIT TRADE DISPUTE, OFFICIALS SAY (BBG)

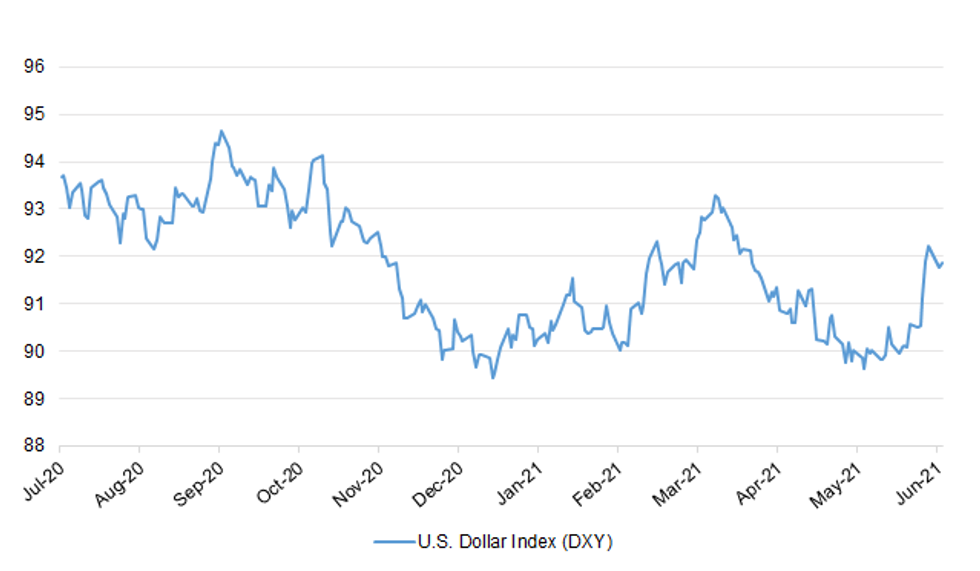

Fig. 1: U.S. Dollar Index (DXY)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: England is on track to lift all remaining lockdown restrictions including social distancing, facemasks and work-from-home guidance on July 19. Ministers have been encouraged by the "very, very" low number of deaths from coronavirus and the slowdown in infections, which has boosted confidence that a sizeable summer wave can be avoided. The government is expected to confirm on Monday that July 5 is too early to lift restrictions, despite the positive data, because ministers want to ensure that more people have received their second jabs. The prime minister is increasingly optimistic, though, that all remaining restrictions can be eased on July 19. As long as current trends continue the one metre-plus social distancing rule and the "rule of six" on indoor gatherings will be lifted, along with the limit on mass gatherings outdoors. Nightclubs are expected to reopen. (The Times)

BREXIT: British and European officials are increasingly optimistic they will avert a post-Brexit trade war, believing the two sides will strike a truce in the dispute over checks on goods moving into Northern Ireland. The British government has asked the European Union to extend the grace period before a ban comes into force on the sale of chilled meats and fresh sausages into Northern Ireland from the rest of the U.K. (BBG)

BREXIT: British citizens living in the EU after Brexit are being denied work and healthcare, Priti Patel has warned. In an exclusive article for The Telegraph, published below, the Home Secretary urges EU nations to treat UK citizens as fairly as Britain was treating their citizens. It coincides with the fifth anniversary of the Brexit referendum vote, as Boris Johnson marked the moment by declaring the recovery from the pandemic offered the chance to "seize the true potential of our regained sovereignty to unite and level up our whole United Kingdom". The warning comes amid government concerns that Britons have been stopped at borders and faced hurdles to being granted residency in some EU states, which has led to complaints in joint committees on citizens rights after Brexit, according to the Home Office. (Telegraph)

BOE: The Bank of England should scrap the final £50 billion of quantitative easing at this week's policy meeting, The Times' panel of economic experts has said. All nine members of this paper's shadow monetary policy committee said they would reduce the £895 billion target stock of QE amid signs of rising inflation and robust growth. Four members said the Bank should also look to raise interest rates before the end of the year. The unanimous call for action marks a sharp shift on the panel, which includes former Bank deputy governors, rate-setters and senior independent economists. Six weeks ago, they urged the Bank to slow the rate of QE, which it did, from £4.4 billion to £3.4 billion a week. Since then, Andy Haldane, the Bank's chief economist, has voted to limit QE to £845 billion and has warned that the UK faces its "most dangerous moment" for inflation since 1992. (The Times)

ECONOMY: British employers are their most confident about the economy in almost five years, helped by the lifting of coronavirus restrictions, a survey showed on Wednesday, but the lack of staff to fill jobs is a growing problem. The Recruitment & Employment Confederation's measure of business confidence surged by 21 percentage points to a net reading of +11. That was the highest level since July 2016, shortly after Britain voted to leave the European Union, and the first time the index was in positive territory since 2018. "This surge in employers' confidence in the UK economy is remarkable," Neil Carberry, REC chief executive, said. (RTRS)

FISCAL: UK companies struggling with coronavirus-related debts have been thrown a lifeline by the government which will not pursue them for unpaid taxes in order to avoid a wave of insolvencies this summer. Restructuring experts have warned that many companies will struggle to stay afloat from next month when emergency Covid-19 business support measures begin to be wound down. Business groups have raised concerns with ministers that this would be exacerbated if HM Revenue & Customs were to take an aggressive approach to collecting overdue taxes that are needed to help restore strained public finances. (FT)

POLITICS: Keir Starmer is expected to announce several new appointments to his top team when he resets his leadership after the Batley and Spen byelection next month, with several longtime allies including Jenny Chapman moving aside. Lady Chapman, who was an early backer of Starmer's leadership bid, will be shifted from her role as his political director to be a frontbench spokesperson on Brexit in the House of Lords, Labour sources confirmed on Tuesday. The change is expected to be part of what one Starmer ally called a "substantial" shift in his backroom operation, set to be announced next month, as he tries to overcome criticism that he has failed to put across a clear message to voters. (Guardian)

SCOTLAND: Nicola Sturgeon will not be allowed to hold a second Scottish independence referendum before the next general election, the government has said. Michael Gove, who as chancellor of the Duchy of Lancaster is overseeing Boris Johnson's attempts to keep Scotland in the Union, said that it would be "at best reckless, at worst folly" to hold a second referendum while the United Kingdom was recovering from the pandemic. (The Times)

EUROPE

ITALY: The European Union's executive Commission on Tuesday formally approved 191.5 billion euros ($228.5 billion) in pandemic recovery funds for Italy, the 27-nation bloc's third-biggest economy. Premier Mario Draghi said the funds will make Italy "more just, more competitive and more sustainable in its growth." He spoke at a joint press conference in Rome with visiting Commission President Ursula von der Leyen. The hardest hit country in the EU both economically and in terms of pandemic deaths, Italy is getting the largest chunk of the EU recovery funds, consisting of 68.9 billion euros in grants and 122.6 billion in loans. The Commission's approval is an important step toward the distribution of funds for Italy's vast reform and investment plan. Von der Leyen said the first funds could be released in four weeks, after the European Council approves the plan. More than one-third of Italy's total funding is earmarked for projects supporting climate goals and one-quarter for digital investments. (AP)

ITALY/BTPS: Italy has intensified discussions with hedge funds participating in its syndicated bond sales, the head of the country's debt management office, Davide Iacovoni, said on Tuesday. Issuers, including the European Union, France and Spain have been capping the orders they will consider from hedge funds in syndicated bond sales. Bankers and debt officials say such funds often inflate their orders to secure better allocations than the small amounts they receive. "The way we manage that, so far we have not changed our rules and guidelines that we communicate to investors, however we have intensified pretty significantly the relation with several investors, especially in the hedge fund community... direclty through our primary dealers," Iacovoni said, speaking at a Euromoney conference on debt markets. (RTRS)

ITALY/BTPS: Italy plans to sell up to 2.75 billion euros ($3.3 billion) of 0 percent bonds due Nov 29, 2022 in an auction on Jun 25. Italy plans to sell up to 1 billion euros ($1.2 billion) of 0.15 percent inflation-linked bonds due May 15, 2051 in an auction on Jun 25. (BBG)

BONDS: Spain and Portugal will likely be able to reduce their government borrowing targets for 2021 in the second half of this year, debt management officials from both countries said on Tuesday. Spain's debt office head Pablo de Ramon-Laca Clausen said Spain would probably be in a position by the summer to reduce the issuance target for the rest of 2021. The country expects to issue its debut green bond during the fourth quarter, Ramon-Laca Clausen added. Portugal also expects to scale down the country's funding plan at the margin for the rest of the year as tax receipts for the country have been higher than expected, debt management office head Cristina Casalinho said. The officials were speaking at a Euromoney conference on debt markets. Speaking at the same event, Italy's debt management chief Davide Iacovoni said that his office was closely following the inflation-linked bond market, with there being potential for new bonds to be issued. (RTRS)

U.S.

FED: MNI BRIEF: No Preemptive Hike Amid Fleeting Inflation-Powell

- Federal Reserve Chair Jerome Powell told Congress Tuesday he will be patient before pulling back from near-zero interest rates as the economy reopens with solid job growth and more regular production that slows down price gains. "We will not raise rates preemptively" because employment appears too high, Powell said in testimony to the House select subcommittee on the coronavirus. Policy makers still have work to do on on having a more inclusive recovery even as "job creation will be moving up well over the rest of the year" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: MNI: Daly Sees Fall Taper Clarity, Hike Talk Not Yet on Table

- San Francisco Federal Reserve President Mary Daly said Tuesday that while there should be more certainty in the fall on the economic rebound and policy makers are right to open talks now on preparing to taper QE, it's premature to look at raising policy interest rates. The backdrop means looking to the fall to get some clarity as to the future of the economy, Daly told reporters after a speech. She expects good economic momentum as working families send children back to school, vaccines continue to roll out, and enriched unemployment benefits expire - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: MNI: Fed's Mester: Expects Clarity on Labor Progress In Sept

- Further progress is needed in the U.S. labor market recovery before winding down asset purchases, Federal Reserve Bank of Cleveland President Loretta Mester told reporters Tuesday, adding she expects more clarity by September. "We've made a lot of good progress. I'd like to see some further progress, especially on participation. I think we'll get more clarity in September," when schools reopen, more people get vaccinated and enhanced unemployment benefits expire, she said - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: Congressional testimony from Federal Reserve Board Chairman Jerome Powell on Tuesday shows that President Joe Biden's economic plan is working, a White House official said. (RTRS)

ECONOMY: National Economic Council director Brian Deese will label the coronavirus pandemic a "wake-up call" to bring manufacturing jobs back to America in a speech Wednesday unveiling the Biden administration's industrial policy, Axios has learned. President Biden's campaign was predicated on providing well-paying jobs for millions of Americans who've seen the country's industrial heartland hollowed out by automation and competition for lower-cost labor from other countries. (Axios)

FISCAL: President Joe Biden's administration on Tuesday continued to sound somewhat upbeat on achieving a bipartisan deal on infrastructure spending, as some of its top officials met with lawmakers on Capitol Hill. "The president is encouraged by the ongoing talks and discussions that are continuing with Democrats and Republicans," White House press secretary Jen Psaki told reporters, adding that senior administration officials had been meeting with a bipartisan group of senators. Later, she said the meeting was "productive." "While progress was made, more work remains to be done. We expect our team to meet again with the bipartisan group later today or tomorrow, as schedules permit," Psaki said in a statement. (MarketWatch)

FISCAL: A CNN reporter tweeted the following on Tuesday: "After hours of meetings, bipartisan group of senators and admin officials are still struggling to finalize deal on how to pay for infrastructure package." (MNI)

FISCAL: House Speaker Nancy Pelosi and Senate Majority Leader Chuck Schumer will confer Wednesday with White House officials on next steps for President Joe Biden s nearly $4 trillion infrastructure plans as talks with Republicans see-saw in search of a potential deal. (Independent)

CORONAVIRUS: The White House acknowledged that the U.S. will likely fall short of President Joe Biden's goal of getting 70% of U.S. adults a first Covid-19 shot by the July 4 holiday. Jeffrey Zients, the head of the White House Covid-19 response team, said the administration had hit its 70 percent vaccination target among Americans ages 30 and older, and is poised to reach that threshold for those 27 and older by Independence Day. It will take a few extra weeks to hit the 70% mark for everyone 18 and older, Zients said. (BBG)

CORONAVIRUS: White House chief medical advisor Dr. Anthony Fauci said Tuesday the highly contagious delta variant is the "greatest threat" to the nation's attempt to eliminate Covid-19. Delta, first identified in India, now makes up about 20% of all new cases in the United States, up from 10% about two weeks ago, Fauci said during a White House news conference on the pandemic. He said delta appears to be "following the same pattern" as alpha, the variant first found in the U.K., with infections doubling in the U.S. about every two weeks. "Similar to the situation in the U.K., the delta variant is currently the greatest threat in the U.S. to our attempt to eliminate Covid-19," he said. (CNBC)

CORONAVIRUS: Morgan Stanley employees and clients who have not received their Covid-19 vaccine will be barred from entering the bank's New York offices, according to an internal memo seen by the Financial Times. "Starting July 12 all employees, contingent workforce, clients and visitors will be required to attest to being fully vaccinated to access Morgan Stanley buildings in New York City and Westchester," said the memo, signed by chief human resources officer Mandell Crawley. After that date, those who do not attest to being fully inoculated would lose building access, Crawley wrote, adding that the "overwhelming majority of staff" had already reported getting their jabs. (FT)

POLITICS: Senate Republicans blocked a sprawling Democratic voting rights and government ethics bill Tuesday, as federal efforts to respond to a rash of restrictive ballot laws passed by GOP-held state legislatures hit a wall. The For the People Act aims to set up automatic voter registration, expand early voting, ensure more transparency in political donations and limit partisan drawing of congressional districts, among other provisions. Democrats pushed for the reforms before the 2020 election, but called them more necessary to protect the democratic process after former President Donald Trump's false claims of electoral fraud sparked an attack on the Capitol and restrictive state voting measures. (CNBC)

OTHER

GLOBAL TRADE: Chip-starved industries from automakers to consumer electronics will need to wait a bit longer for components, as delays in filling orders continue to get worse. Chip lead times, the gap between ordering a semiconductor and taking delivery, increased by seven days to 18 weeks in May from the previous month, an indication that chipmakers' struggles to keep up with demand are worsening, according to research by Susquehanna Financial Group. That gap, already the longest wait time since the firm began tracking the data in 2017, is now more than four weeks longer than the previous peak in 2018. (BBG)

GLOBAL TRADE: U.S. President Joe Biden believes steps are needed to safeguard privacy, bolster innovation and deal with other problems created by big technology platforms, the White House said on Tuesday, signaling his support for legislation concerning Big Tech. Biden is encouraged by bipartisan work underway in Congress to tackle these issues, the official said, a day before the U.S. House Judiciary Committee votes on a package of antitrust bills, some of which target the market power of large tech firms. (RTRS)

U.S./CHINA/TAIWAN: Chinese military followed and monitored USS Curtis Wilbur destroyer as it sailed through the Taiwan Strait Tuesday, Zhang Chunhui, spokesperson of the Eastern Theater Command of China's People's Liberation Army said in a statement. U.S. behavior is a deliberate sabotage of the regional security and a serious threat to peace and stability in the Taiwan Strait. Chinese military keeps high alert and will resolutely safeguard national sovereignty and territorial integrity. (BBG)

U.S./CHINA/TAIWAN: A U.S. warship has again sailed through the sensitive waterway that separates Taiwan from China, a week after the Chinese-claimed island reported the largest incursion to date of Chinese air force jets in Taiwan's air defense zone. (RTRS)

CORONAVIRUS: The Biden administration has shipped only about 20 percent of the 20 million Covid-19 vaccine doses it has pledged to donate directly to other countries by the end of June, according to two U.S. officials with direct knowledge of the matter. The slow pace means the White House may not meet its original late-June target for those doses, the sources said. The shipments so far include one million doses sent to South Korea on June 4. (POLITICO)

CORONAVIRUS: AstraZeneca Plc's COVID-19 vaccine is effective against Delta and Kappa variants, which were first identified in India, the company said on Tuesday, citing a study. The study by the Oxford University investigated the ability of monoclonal antibodies in blood from recovered people and from those vaccinated to neutralize the Delta and Kappa variants, the statement said. (RTRS)

BOJ: MNI BRIEF: BOJ April Minutes Show Concern on Business Debt

- The Bank of Japan board agreed that the central bank needs to pay attention to whether businesses will pay their debts and if the amount of credit will return to a normal level, according to the minutes of the April 26-27 policy meeting released Wednesday showed - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

AUSTRALIA: NSW Premier Berejiklian has announced a raft of new restrictions following today's COVID-19 numbers, including banning people who live or work in seven COVID-affected local government areas from travelling outside metropolitan Sydney. Effective immediately with compliance from 4pm, Ms Berejiklian said the restrictions also include a return to no more than five visitors to households, seating-only in hospitality venues, no dancing or singing except for wedding dance floors (restricted to 20). The local government areas include the City of Sydney, Woollahra, Bayside, Canada Bay, Inner West, Randwick and Waverley Council." (Sydney Morning Herald)

RBA: The Reserve Bank of Australia's monetary policy support is enabling "any structural adjustments" that might be needed in the economy during the post-pandemic recovery, Assistant Governor Luci Ellis said. "It is far easier for a firm to change business models when demand is robust, and far easier for a worker to switch industries or careers when there are plenty of jobs available," Ellis said in the text of a speech Wednesday. "To the extent that the post-pandemic world is indeed different from the pre-pandemic one, a robust recovery and expansion can smooth the transition." (BBG)

NEW ZEALAND: New Zealand moved to contain a possible Covid-19 outbreak in the capital city Wellington, limiting the size of gatherings and imposing social distancing after a tourist tested positive for the virus upon their return to Australia. The Wellington region will move to alert level 2 at 6 p.m. local time Wednesday, one step below a lockdown, Covid Response Minister Chris Hipkins announced at a press conference. Businesses and schools can remain open but gatherings are limited to 100 and physical distancing must be observed, making queues at supermarkets likely. (BBG)

SOUTH KOREA: Another extra budget under review to support the pandemic-hit people may reach some 30 trillion won (US$26.5 billion), the country's chief economic policymaker said Wednesday. The government is planning to create this year's second extra budget with excess tax revenue as it seeks to underpin an economic recovery and minimize the fallout of the pandemic. Finance Minister Hong Nam-ki told a parliamentary meeting that another extra budget would be below some 32 trillion won, which is roughly equal to the excess tax revenue estimated for this year. (Yonhap)

NORTH KOREA: The United States remains committed to engaging with North Korea, a State Department spokesman said Tuesday, despite a negative statement from the sister of the North Korean leader that the U.S. may be in for a great disappointment. Ned Price also reiterated U.S. hopes that North Korea would respond positively. "We remain prepared to engage in principled negotiations with the DPRK to deal with the challenge of its nuclear program," the spokesman said in a telephonic press briefing, referring to North Korea by its official name, the Democratic People's Republic of Korea. (Yonhap)

CANADA: Prime Minister Justin Trudeau says Canadians can soon expect more updates about the easing of travel restrictions should vaccinations continue to increase and COVID-19 case counts remain low. His comments come a day after the federal government announced that effective July 5 at 11:59 p.m. EDT, fully immunized Canadians can return to the country after travel without having to self-isolate for 14 days, take a test on day eight, or have to stay in a designated quarantine hotel upon arrival. "We are looking at continuing our plan for gradual and safe reopening, hopefully with more announcements in the coming weeks about next and further steps," said Trudeau speaking to reporters on Tuesday. (CTV)

TURKEY: Turkish central bank governor pledged to take necessary steps to protect the lira's value in a meeting with senior bankers. according to a person with direct knowledge of the matter. Governor Sahap Kavcioglu told senior members of the Banks' Association of Turkey on Tuesday that the Turkish central bank is in talks with four counterparts for new swap deals, the person said, speaking on condition of anonymity. The governor said the central bank may tweak the required reserves rule after consultations with banks in order to boost the credibility of the lira, the person said. The central bank declined to comment on what was discussed at the meeting. (BBG)

TURKEY: Turkey is in talks to secure currency swap agreements with four countries and is close to a deal with two of them, Central Bank Governor Sahap Kavcioglu said at a meeting with bank managers on Tuesday, according to participants. Earlier this month, President Tayyip Erdogan said Turkey had agreed with China to increase an existing currency swap facility to $6 billion from $2.4 billion. Kavcigolu did not specify which countries Turkey was in talks with. Kavcioglu told managers of banks in the Turkish Banks Association (TBB) that the central bank would maintain its tight monetary stance and take the policy steps needed to protect the ailing lira currency, the participants said. (RTRS)

MEXICO: Growth of just above 1% for Mexico's construction sector is "very bad news," a Bank of Mexico board member said on Tuesday, suggesting it should have grown by double digit figures as the economy rebounds from its pandemic-induced recession last year. The construction sector grew by 1.2% in April from a year earlier, and contracted by 1.8% in the month versus March, data from the INEGI national statistics agency showed earlier in the day. "In principle, most of the indicators should show high annual rates, in the two digits, as of April given the arithmetic effects of the comparative base," central bank board member Jonathan Heath said on Twitter. (RTRS)

RUSSIA: Russia is hoping that pragmatism will prevail in Washington's approach to future talks on strategic stability, Russia's Deputy Foreign Minister Sergey Ryabkov said on Tuesday speaking at the international nuclear policy videoconference of the Carnegie Foundation. "Our hope is that the pragmatic approach will prevail, like in the situation with the extension of the Treaty on the Measures for the Further Reduction and Limitation of Strategic Offensive Arms (New START), and the US will look for solutions together with Russia. For it to happen, the talks should be based on reciprocity. We are not going to move down a one-way traffic street. There cannot be any unilateral concessions on our side, in this sensitive area," he said. (TASS)

IRAN: The U.S. has seized three dozen Iranian websites, according to the Justice Department, in a move likely to inflame tensions ahead of nuclear talks in Vienna expected to resume next month. A message appeared on several Iranian state-run news websites claiming they had been "Seized by the United States Government" in a joint law enforcement action between the FBI and the Commerce Department's Bureau of Industry and Security. (BBG)

MIDDLE EAST: Saudi air defences destroyed on Tuesday an explosive-laden drone launched by Yemen's Iran-aligned Houthi movement towards the southern Saudi city of Khamis Mushait, Saudi state TV reported. It cited a statement by the Saudi-led coalition that is fighting the Houthis in Yemen. (RTRS)

COMMODITIES: China's national economic planning agency and the market regulator sent "many" joint work teams to some provinces and cities to ensure commodities supply and stabilize prices, NDRC says in a statement, without identifying the regions. The work teams will check enterprises' trading in the commodities futures and spot markets, listen to suggestions from various firms on crackdown on speculations and ensuring market supply. The officials will also seek opinions from experts and market institutions on strengthening supervision of both futures and spot markets, and ensure normal market order. (BBG)

METALS: Ivan Glasenberg, the billionaire boss of Glencore Plc, said China's efforts to cool surging metal prices can't be sustained for long. "The Chinese are trying to push it down, bring it back to lower levels," Glencore's outgoing chief executive officer said Tuesday at the Qatar Economic Forum. "I think that's a short-term game because the underlying fundamentals will keep it at these levels." (BBG)

CHINA

YUAN: The market should be prepared for a depreciating yuan in the near term as the Federal Reserve's hawkish turn raises the prospect of a higher U.S. dollar index, the China Securities Journal reported citing analysts. The PBOC may take various measures if the yuan is judged to be moving too quickly in either way, the newspaper said citing Zhang Ming, deputy director of the Institute of Finance & Banking at the Chinese Academy of Social Sciences. Both onshore and offshore yuan has weakened more than 1,000 points to around 6.47 after peaking in the end of May, the newspaper said. (MNI)

PBOC: China's local governments are expected to scale up sales of special-purpose bonds in Q3 and the PBOC may increase liquidity injection to ease pressure on liquidity, the China Securities Journal reported citing Zhou Yue, the chief analyst at Zhongtai Securities. The issuances of local government special bonds have been slower than last year as authorities strengthened supervision and strictly reviewed projects to control risks, the newspaper said citing Zhao Wei, chief economist of Kaiyuan Securities. In total CNY1.17 trillion of special bonds have been sold in the first five months, accounting for about 16% of the annual issuance quota, compared to the pace of more than 40% in the same periods of the past two years, said the newspaper. (MNI)

PROPERTY: Those who speculate in China's property market should stop as soon as possible as the authorities have enhanced measures to stabilize the market, the 21st Century Business Herald said in an editorial. Some banks in several cities have halted mortgage lending to pre-owed homes as the government wants to prevent an overheated housing market driven by fast-rising residential debt from last year through Q1, it said. A complete freeze in lending to pre-owned homes is unlikely as authorities may not want to spark a panic or spur higher demand for new homes, the newspaper said. Some developers are playing "cat and mouse" games by finding complicated ways to funnel overseas capital into the mainland, even as the authorities have enforced controls over the markets, the newspaper said. (MNI)

OVERNIGHT DATA

JAPAN JUN, P JIBUN BANK M'FING PMI 51.5; MAY 53.0

JAPAN JUN, P JIBUN BANK SERVICES PMI 47.2; MAY 46.5

JAPAN JUN, P JIBUN BANK COMPOSITE PMI 47.8; MAY 48.8

Activity at Japanese private sector businesses remained in contraction territory at the end of the second quarter of 2021, as flash PMI data signalled a quicker deterioration in business activity. New orders also reduced for the second successive month, and at the fastest pace since February. Panel members commonly associated disruption to operating conditions to ongoing COVID-19 restrictions, coupled with severe supply chain pressures, notably for manufacturers. That said, one bright note was private sector firms in Japan continued to expand employment levels despite subdued demand conditions. Job creation occurred for the fifth time in as many months as manufacturing firms noted the fastest pace of job creation since January 2020. Despite the ongoing pandemic-related restrictions on the Japanese economy, private sector businesses were optimistic that business conditions would improve in the year ahead, and to a greater extent than that seen in May. Positive sentiment stemmed from expectations that the accelerating vaccination programme would contribute to an easing of restrictions and trigger a broad-based recovery in demand in both domestic and international markets. (IHS Markit)

JAPAN APR, F LEADING INDEX 103.8; FLASH 103.0

JAPAN APR, F COINCIDENT INDEX 95.3; FLASH 95.5

AUSTRALIA MAY, P TRADE BALANCE +A$13.316BN; APR +A$8.028BN

AUSTRALIA MAY, P EXPORTS +11% M/M; APR +3%

AUSTRALIA MAY, P IMPORTS +1% M/M; APR -3%

AUSTRALIA JUN, P MARKIT M'FING PMI 58.4; MAY 60.4

AUSTRALIA JUN, P MARKIT SERVICES PMI 56.0; MAY 58.0

AUSTRALIA JUN, P MARKIT COMPOSITE PMI 56.1; MAY 58.0

Australia's private sector growth momentum further eased in June but remained at a strong level to indicate continued improvement in economic conditions during the recovery from the COVID-19 pandemic. Renewed movement restrictions in the Victorian state and supply constraints stood out as two key reasons weighing on the growth momentum for Australia in the June flash PMI data, which is worth scrutinising. Meanwhile private sector firms were also slightly less optimistic with regards to output in the next 12 months amid the uncertain virus and supply situation. (IHS Markit)

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS WEDS; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Wednesday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.2460% at 09:30 am local time from the close of 2.3580% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 40 on Tuesday vs 51 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4621 WEDS VS 6.4613

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher for a seventh day at 6.4621 on Wednesday, compared with the 6.4613 set on Tuesday.

MARKETS

SNAPSHOT: Asia Lacks Real Impetus After Powell Plays Straight Bat

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 10.36 points at 28894.52

- ASX 200 down 30.4 points at 7311.8

- Shanghai Comp. up 16.196 points at 3573.608

- JGB 10-Yr future up 2 ticks at 151.67, yield down 0.1bp at 0.055%

- Aussie 10-Yr future up 2.5 ticks at 98.415, yield down 2.6bp at 1.566%

- U.S. 10-Yr future +0-01 at 132-12+, yield up 0.34bp at 1.467%

- WTI crude up $0.39 at $73.25, Gold up $2.97 at $1781.71

- USD/JPY up 13 pips at Y110.78

- FED CHAIR POWELL: NO PREEMPTIVE HIKE AMID FLEETING INFLATION (MNI)

- CHINA SAYS ITS MILITARY READY TO RESPOND TO ALL PROVOCATION (BBG)

- CHINA SHOULD BE ALERT TO YUAN DEPRECIATION RISKS (CSJ)

- NDRC: CHINA TO CHECK LOCAL FIRMS' TRADING IN COMMODITIES MARKETS (BBG)

- ENGLAND SET TO DROP FACEMASKS AND SOCIAL DISTANCING ON JULY 19 (TIMES)

- U.K., EU CLOSE TO TRUCE IN BREXIT TRADE DISPUTE, OFFICIALS SAY (BBG)

BOND SUMMARY: Narrow Ranges In Play, Some Idiosyncracies Eyed

T-Notes stuck to a tight 0-03 range during Asia-Pac hours, lacking any follow through above yesterday's best levels despite a brief and shallow look above, likely owing to a lack of tier 1 macro news flow (there was some attention on Sino-U.S. relations surrounding the passage of a U.S. naval ship through the Taiwan strait and subsequent rhetoric re: the matter from China, although this did nothing for broader markets). The contract last deals +0-01 at 132-12+, while cash Tsys observed some light twist steepening, as longer dated Tsys cheapened by ~1.0bp.

- JGB futures stuck to a narrow range, last +1 on the day. The major benchmarks across the cash curve run little changed to ~1.5bp richer, with some modest outperformance for the super-long end of the curve. Local news flow remains light, with a slower rate of expansion witnessed in the latest flash m'fing PMI print, while a deeper rate of contraction was seen in the services reading. The latest round of 1- to 3-Year and 5- to 10-Year BoJ Rinban ops saw a modest uptick in offer/cover ratios. Elsewhere, BoJ Gov. Kuroda met with Japanese PM Suga, although it seemed to be a routine catch up between the two, touching on BoJ policy and the broader global economy.

- Aussie bonds shrugged off the imposition of deeper COVID restrictions in parts of Sydney, with YM & XM both +2.0 at typing. CBA's RBA call (they now look for a Nov '22 hike from the RBA) knocked the space back from best levels of the day during the Sydney morning. A$1.0bn of ACGB May '32 supply was easily absorbed, with the cover ratio nudging higher vs. the previous auction, while the weighted average yield printed .25bp through prevailing mids at the time of supply (per Yieldbroker). Elsewhere, Australia's latest round of monthly prelim trade data had nothing in the way of a notable impact on the space, as expected. Finally, the latest round of rhetoric from RBA's Ellis offered nothing new re: monetary policy.

AUSSIE BONDS: The AOFM sells A$1.0bn of the 1.25% 21 May '32 Bond, issue #TB158:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 1.25% 21 May 2032 Bond, issue #TB158:- Average Yield: 1.6120% (prev. 1.6838%)

- High Yield: 1.6150% (prev. 1.6850%)

- Bid/Cover: 3.8300x (prev. 3.6600x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 34.7% (prev. 54.7%)

- bidders 43 (prev. 36), successful 22 (prev. 13), allocated in full 14 (prev. 6)

EQUITIES: Mostly Positive

A mostly positive day for equity markets in the Asia-Pac region after a positive lead from the US with markets closing near record highs. Bourses in Japan are the laggard, struggling to make decisive headway into positive territory, while markets in Australia also struggled. Markets in mainland China are higher for the second day, while the Hang Seng is also positive after dropping yesterday. Futures in the US are higher again, over Fed Chair Powell reiterated that inflation pressures will be transitory and the Fed will be patient in adjusting policy.

OIL: Crude Futures Higher

Oil is higher in Asia-Pac trade, WTI is up $0.40 from settlement levels a $73.25, Brent is up $0.50 at $75.31. Crude futures finished lower yesterday but have reclaimed lost ground and are now above yesterday's opening levels and approaching the intraday high. Data from API yesterday showed headline crude inventories fell 7.2m bbls last week, markets will look to DOE stockpile data later in the session to confirm the print. Focus remains on delegate comments from OPEC+, which raised the prospect of further reversing of oil supply cuts from August - their next meeting. Russia are said to be in favour of an increase in oil supply, with the country's Deputy PM meeting with oil company heads this week to assess the state of the energy market.

GOLD: Range Intact

Bullion has managed to look through a slight uptick in the DXY during Asia-Pac hours, with U.S. yields little changed after real yields fell on Tuesday. Spot last deals a handful of dollars higher on the day, hovering around the $1,785/oz mark after sticking to a tight range on Tuesday. Gold's technical parameters remain well defined.

FOREX: Kiwi Slips After Covid Case Visits Wellington, Greenback Digests Fedspeak

The kiwi went offered after New Zealand implemented restrictions in Wellington and halted a quarantine-free travel corridor with New South Wales. The decision came after a positive Covid-19 case from Sydney visited New Zealand's capital over the weekend. NZD/USD briefly showed below the round figure of $0.7000.

- The greenback caught a bid, leading gains in G10 FX space. Regional participants assessed yesterday's round of Fedspeak, with Powell & Co. noting that the recent rise in inflation will likely prove transitory and that "we will not raise interest rates pre-emptively".

- USD/JPY showed at levels last seen on Apr 1, but trimmed gains thereafter. The rate operates in close proximity to its Mar 31 cycle high/psychological resistance at Y110.97/111.00.

- The PBOC set its USD/CNY mid-point at CNY6.4621, 13 pips shy of sell-side estimate. USD/CNH crept higher, extending its current winning streak to 9 days in a row.

- U.S. new home sales, Canadian retail sales and a slew of global m'fing PMIs take focus on the data front. Central bank speaker slate includes Fed's Bowman, Bostic & Rosengren as well as ECB's Lagarde & de Guindos.

FOREX OPTIONS: Expiries for Jun23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1885-00(E681mln)

- USD/JPY: Y108.15($760mln), Y109.50-73($1.6bln), Y110.00($691mln), Y110.95-00($655mln)

- GBP/USD: $1.4000(Gbp599mln)

- EUR/GBP: Gbp0.8600(E510mln)

- EUR/JPY: Y131.75(E830mln)

- USD/CHF: Chf0.8900($1.3bln)

- USD/MXN: Mxn19.93($1.1bln)

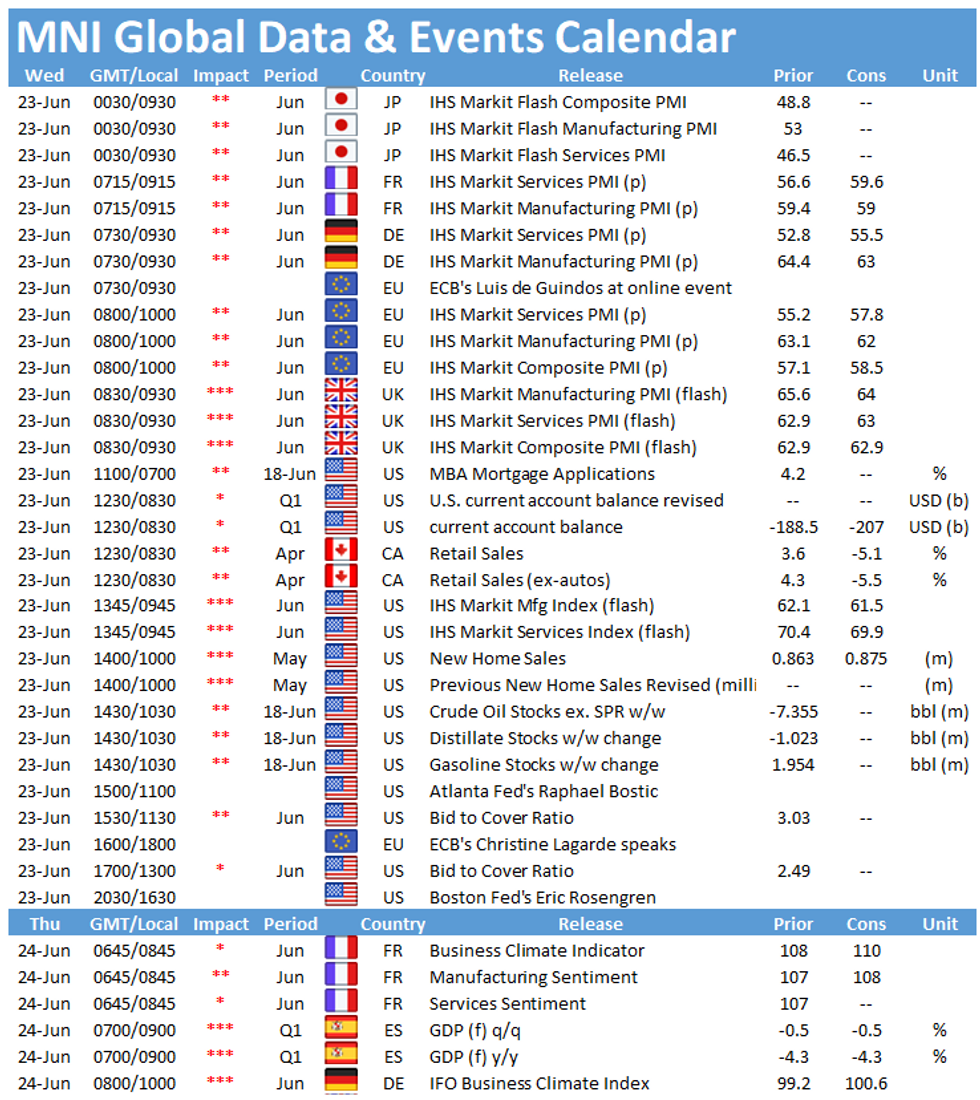

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.