-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: RBA Holds, Notes Declining Inflation Risk

MNI: PBOC Net Injects CNY90.3 Bln via OMO Tuesday

MNI EUROPEAN MARKETS ANALYSIS: Activity Crimped By U.S. Independence Day

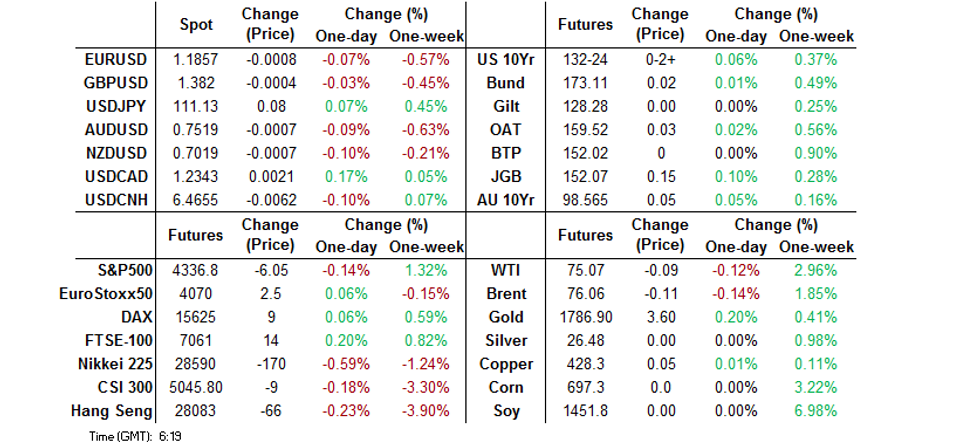

- USD marginally higher in a limited Asia-Pac session, with broader activity suppressed by the observance of the U.S. Independence Day holiday.

- Chinese Caixin Services PMI data provides a notable miss.

- Services PMIs (most of which are final readings) and central bank speak headline the broader economic docket on Monday, in addition to the latest chapter in the ongoing OPEC+ saga.

BOND SUMMARY: Volume Hampered By Independence Day Holiday

T-Notes stuck to a 0-03 range overnight, with the contract last +0-02+ at 132-24 on ~31K lots, with cash markets set to remain closed on Monday owing to the observance of the U.S. Independence Day holiday (CME trading hours will also be adjusted). The space has looked through the much softer than expected Chinese Caixin Services PMI print, which slowed to a near-neutral 50.3. The text of the release noted that "the recent resurgence of Covid-19 in the Pearl River Delta had a certain impact on the services sector." A positive, albeit negative factor on the headline reading, was that "the gauge for input prices remained in expansionary territory for the 12th month in June, but fell to the lowest point in 9 months."

- JGB futures gave back a portion of their overnight gains during Tokyo dealing before pushing higher again, last reading 16 above settlement levels, just shy of their overnight peak. Cash JGBs saw the major benchmarks out to 20s trade little changed to ~1.5bp richer, while longer dated paper (30s & 40s) saw very modest cheapening (around 0.5bp worth) ahead of tomorrow's 30-Year JGB supply. In terms of weekend news flow, PM Suga's ruling coalition gained seats in the Tokyo assembly vote, although it fell short of gaining a majority. There has been a lack of meaningful news flow evident since the Tokyo open, with BoJ Governor Kuroda offering little new in his latest address, while the BoJ's latest Sakura report saw the Bank leave its overall economic assessment of 5 regions as they were, while the bank upgraded 2 regions and downgraded 2 regions. The aforementioned round of 30-Year JGB supply headlines the local docket on Tuesday. Local wage and household spending data will also cross on Tuesday.

- Aussie bond futures continue to hover around overnight closing levels with a lack of notable catalysts evident early this week, while the proximity to tomorrow's RBA decision will be limiting broader market activity/conviction. As a reminder, the local COVID picture in Sydney seemingly improved over the weekend, although today's figures represented a step back from that positive development. YM +1.5, XM +5.0 at typing. Cash ACGBs have bull flattened, playing catch up to the overnight session moves in futures. The aforementioned RBA monetary policy decision and subsequent address from RBA Governor Lowe headline the local docket on Tuesday (expect our full preview of the meeting to hit during the London morning).

FOREX: GBP Gains On Looming End To UK Covid Rules, NOK & CAD Slip On Weaker Oil

The DXY crept higher as a new week got underway, with U.S. markets closed in observance of the Independence Day. China drew attention in Asia-Pac hours, as its Caixin Services PMI undershot forecasts, while Beijing broadened its cybersecurity probe into tech companies. Elsewhere, BBG sources said that China's Xi will hold talks with Germany's Merkel & France's Macron this week.

- USD/CNH ground lower after the PBOC set its central USD/CNY mid-point at CNY6.4695, 7 pips shy of sell-side estimate. The yuan looked through a considerable miss in Caixin Services PMI, which deteriorated to a near-neutral 50.3 in Jun from 55.1 recorded in May, while also shrugging off Beijing's actions vs. tech firms.

- GBP caught a bid and topped the G10 pile as PM Johnson looked set to confirm that the gov't will lift most of the remaining Covid-19 rules in two weeks and shift emphasis to personal responsibility.

- NOK & CAD underperformed amid a downtick in crude oil prices, as Saudi Arabia & the UAE signalled that their disagreement on output remains unresolved ahead of today's OPEC+ summit.

- Focus turns to a number of services PMI readings as well as comments from ECB Vice Pres de Guindos.

FOREX OPTIONS: Expiries for Jul05 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1840-50(E1.9bln), $1.1900(E780mln)

- USD/JPY: Y110.25-28($600mln), Y111.00($829mln)

- AUD/USD: $0.7500-05(A$605mln)

- NZD/USD: $0.7025-45(N$506mln)

ASIA FX: Mostly Stronger

Mixed moves with thin liquidity as the US remains closed for a market holiday. A mediocre jobs report that has assuaged fears of near-term Fed tapering boosted risk appetite.

- CNH: Offshore yuan is stronger, shaking off earlier weakness. China June Caixin services PMI prints 50.3 in June from 55.1 in May, the figure denotes the lowest since April 2020. Composite PMI dragged down to 50.6 from 53.8.

- SGD: Singapore dollar is flat. PMI slipped to 50.1 in June from 54.4 in May – just staying in positive territory and the lowest since November 2020.

- KRW: The won is stronger, USD/KRW playing catch up from Friday. Coronavirus case numbers jumped in the past few days, hitting a six-month high on Friday and staying above 700 since.

- TWD: Taiwan dollar is stronger today, USD/TWD dropping as the rate plays catch up with the downward move in the greenback on Friday and retreating from the 28.00 handle.

- MYR: Ringgit is stronger. On Saturday, FinMin Zafrul & Defence Min Ismail Sabri confirmed that the criteria for moving to consecutive stages of the reopening plan will now be applied at state level. Health experts called for caution, as restrictions are eased in Kelantan, Terengganu, Pahang, Perak and Perlis.

- IDR: Rupiah is stronger, Indonesia ramped up efforts to contain the spread of Covid-19 after a record 555 positive cases died on a single day. The gov't tightened border controls and ordered that all production of industrial oxygen production is converted to pharmaceutical oxygen.

- PHP: Peso is weaker, the Philippine Coast Guard said it dispersed five Chinese vessels from the West Philippine Sea, amid simmering tensions over the disputed waters.

- THB: Baht is flat having given back earlier strength. Thailand CPI rose 1.25% Y/Y, above estimates of 1.12%, core CPI also slightly above estimates.

ASIA RATES: India Proposes Changes To Auctions; China Drains Liquidity

- INDIA: Friday's auctions struggled, primary dealers were left to take INR 105bn out of the INR 110bn sale, the RBI did sell a total of INR 345bn against a target of INR 320bn, selling more than targeted of the 6.64% 2035 bond. India's central bank is said to have written to primary dealers proposing a new framework for defining acceptable bids at auction. The RBI wants to define any bids that have a spread of more than two basis points from secondary market yields as outliers, this would allow the RBI to cap bond yields by not accepting outlier bids.

- SOUTH KOREA: Futures higher in South Korea but off best levels seen at opening. A mediocre US NFP number on Friday assuaged fears of tapering in the near term which has helped support bonds. The MOF sold 3-year bonds, the auction was in line with recent averages. Coronavirus case numbers jumped in the past few days, hitting a six-month high on Friday and staying above 700 since. There were 711 cases in the past 24 hours.

- CHINA: The PBOC drained CNY 20bn from the financial system today, a total of CNY 60bn has now been drained in the past three sessions; repo rates rose but have stayed within normal ranges. Futures are lower as repo rates edge higher. China June Caixin services PMI prints 50.3 in June from 55.1 in May, the figure denotes the lowest since April 2020. Composite PMI dragged down to 50.6 from 53.8.

- INDONESIA: Yields lower with some bull steepening seen. Indonesia ramped up efforts to contain the spread of Covid-19 after a record 555 positive cases died on a single day. The gov't tightened border controls and ordered that all production of industrial oxygen production is converted to pharmaceutical oxygen. The gov't has also intensified efforts to waive Covid-related IP rights at the WTO, which would allow countries like Indonesia to manufacture mRNA Covid-19 vaccines. Meanwhile, the emergency measures in Java & Bali have fully taken effect, but the authorities still expect daily cases to keep rising for the "critical period" of two weeks.

EQUITIES: China & Japan Slip Despite Broadly Positive Risk Tone

A mixed day for equity markets in the Asia-Pac region with volumes thinned by the US holiday. Markets in Japan are lower, data showed services PMI rose to 48.0 in Jun, composite PMI printed 48.9 while over the weekend the Chairman of the LDP's Election Strategy Committee Yamaguchi conceded that Japan's ruling coalition failed to secure an outright majority in the Tokyo Metropolitan Assembly. Markets in China are slightly lower, China June Caixin services PMI printed 50.3 in June from 55.1 in May, the figure denotes the lowest since April 2020. Other markets in the region are higher, boosted by Friday's US jobs report which saw US equities hit record highs for the seventh day in a row.

GOLD: $1,800/oz Remains Untouched

Gold has hugged a tight range during Monday's Asia-Pac session, last dealing little changed around $1,785/oz, with activity hampered by the U.S. market holiday. The softer U.S real yield-weaker USD environment that prevailed in the wake of Friday's NFP print pushed bullion higher during the final session of last week, although spot failed to break above $1,800/oz, with key resistance levels untested. The minutes from the FOMC's June meeting (due for release on Wednesday) represent the next notable macro release for gold market participants.

OIL: OPEC+ Remains At An Impasse

WTI & Brent print ~$0.10 below their respective settlement levels ahead of European hours. Markets look ahead to the next round of talks between OPEC+ members with the group at an impasse. Saudi Arabia and the UAE remain at odds over output with both sides taking to the airwaves over the weekend to air grievances. Saudi Arabia claims there is support within the group for extending the declaration of cooperation beyond April 2022 and increasing output, and that the UAE is alone in its dissent. The UAE is firm in its commitment to only a short-term increase and better terms for itself beyond 2022. The group is scheduled to meet again at 1400BST today.

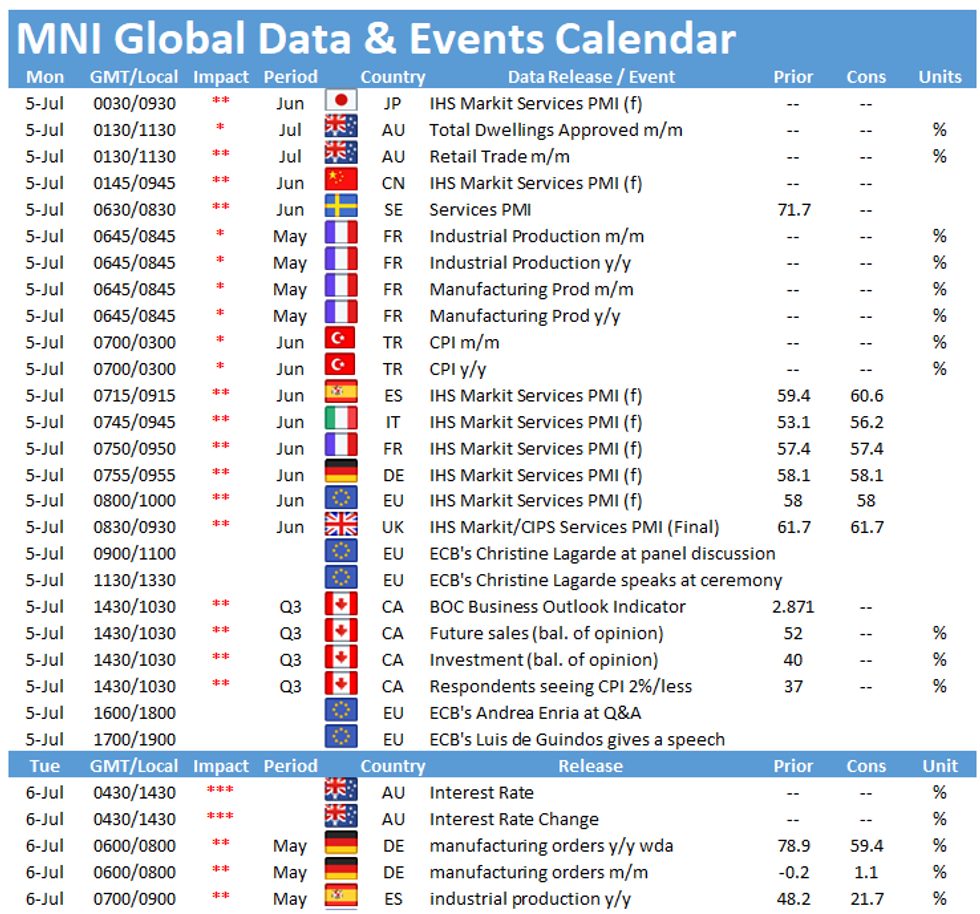

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.