-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: Antipodean Central Bank Matters Steal The Limelight

- The RBA delivers some hawkish tweaks, although unchanged overarching view on inflation & wage growth limit follow through.

- 2 notable sell-side names roll their RBNZ OCR hike calls forward to Nov '21.

- OPEC+ impasse & USD weakness sees crude push higher in Asia.

BOND SUMMARY: RBA Tweaks Bond Buys, Hawkish Changes At The Margin

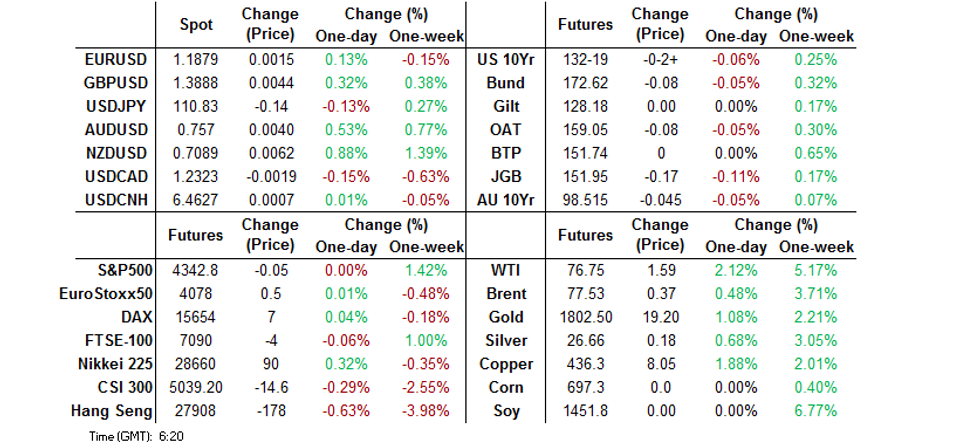

The latest move higher in crude oil and building of the Asia-based US$ issuance slate applied some modest pressure to U.S. Tsys during overnight trade. 2s print at unchanged levels in cash trade, while 30s are ~2.5bp cheaper on the day, with bear steepening in play. T-Notes are still holding to a tight 0-03+ range, with the contract last -0-02+ at 132-19, representing worst levels of the session. Volume isn't impressive, with ~50K T-Notes trading hands thus far, as liquidity picks back up after the Independence Day weekend. The ISM services survey print headlines the local docket during NY hours.

- The broader JGB space saw a brief bid kick in after the well-received round of 30-Year JGB supply. The low price comfortably topped broader expectations (which stood at 100.35 per the BBG dealer poll), while the cover ratio ticked higher and the tail narrowed. Futures unwound a chunk of their overnight/morning weakness to last print -17 vs. settlement, just off worst levels of the day, while super-long JGBs held on to their post auction bid, printing a little richer on the day. This came after some modest weakness during the Tokyo morning, in addition to signs of some paying flows in the super-long end of the swap curve ahead of supply. Looking ahead to the BoJ's incentivisation scheme surrounding the fight against climate change, BBG have highlighted that "BoJ officials want to avoid getting bogged down in trying to differentiate between green projects, according to people familiar with the matter." Local wage data provided a modest disappointment vs. broader expectations, accompanied with revisions lower for the previous month. Elsewhere, domestic household spending data topped exp. at the margin. Looking to tomorrow, the local docket will be headlined by the latest round of BoJ Rinban operations.

- Aussie bonds felt some modest pressure in the wake of the RBA release, YM -6.5, XM -4.5, while the belly leads the way lower as the RBA managed to tick more hawkish boxes than it skipped. The RBA's move to trim the weekly government bond purchases to A$4bn at the expiration of the current purchase plan in early September vs. the existing A$5bn, alongside a first review date of the new scheme at the Bank's November meeting will be adding some weight to the ACGB space. Note that the accompanying documentation points to no change in the 80/20 ACGB/semi bond weights in the new purchase scheme. The fact that the RBA seems to be relatively sanguine re: the economic impact of the recent COVID lockdowns is likely to add some incremental pressure as well. Elsewhere, there was a slight tweak to the Bank's broader guidance. The concluding paragraph of the statement now reads: "The Board remains committed to maintaining highly supportive monetary conditions to support a return to full employment in Australia and inflation consistent with the target. It will not increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range. The Bank's central scenario for the economy is that this condition will not be met before 2024. Meeting it will require the labour market to be tight enough to generate wages growth that is materially higher than it is currently." This removes the reference to "at the earliest" surrounding the 2024 part of the passage, which is indicative of a lest a marginal downtick in RBA conviction surrounding the guidance. Still the Bank remains cautious re: inflation and wage growth, as it was pre-COVID, which is preventing an outright hawkish read through (although that presents no surprise). In the section of the address covering lending surrounding the housing market the Bank highlighted an uptick in investment lending. It is worth remembering that Trans-Tasman impetus was in play ahead of today's decision, with 2 of NZ's big 4 (ASB & BNZ) now looking for the RBNZ to hike the OCR in November '21, applying some fresh pressure to YM during the first half of Sydney trade. Focus now moves to RBA Governor Lowe's post-decision address, scheduled for 16:00 Sydney, 07:00 London.

FOREX: NZD Rallies On Hawkish RBNZ Repricing

The repricing of future OCR path pushed the kiwi higher, as an upbeat NZIER Quarterly Survey of Business Opinion helped build RBNZ rate hike bets. The survey revealed a sharp improvement in business confidence and demand, combined with intensifying inflation pressures. The kiwi's rally accelerated after ASB and BNZ both revised their RBNZ calls and said that they now expect the tightening cycle to begin in November this year.

- NZD/USD surged past its 200-DMA, which limited gains in early Asia-Pac trade. AUD/NZD plunged to its lowest point in more than a month, albeit a BBG trader source flagged demand from short-term accounts looking to buy AUD on dips ahead of the RBA's policy announcement. A degree of spillover from kiwi strength provided further support to the Aussie.

- The greenback went offered across the board before U.S. markets reopen after the Independence Day. USD/JPY extended losses, but struggled to make any substantial headway beyond yesterday's low. Worth flagging that $2.2bn of USD/JPY options with strikes at Y111.00 expire at today's NY cut.

- GBP remained buoyant after PM Johnson confirmed that the UK was poised to ditch most Covid-19 rules on Jul 19.

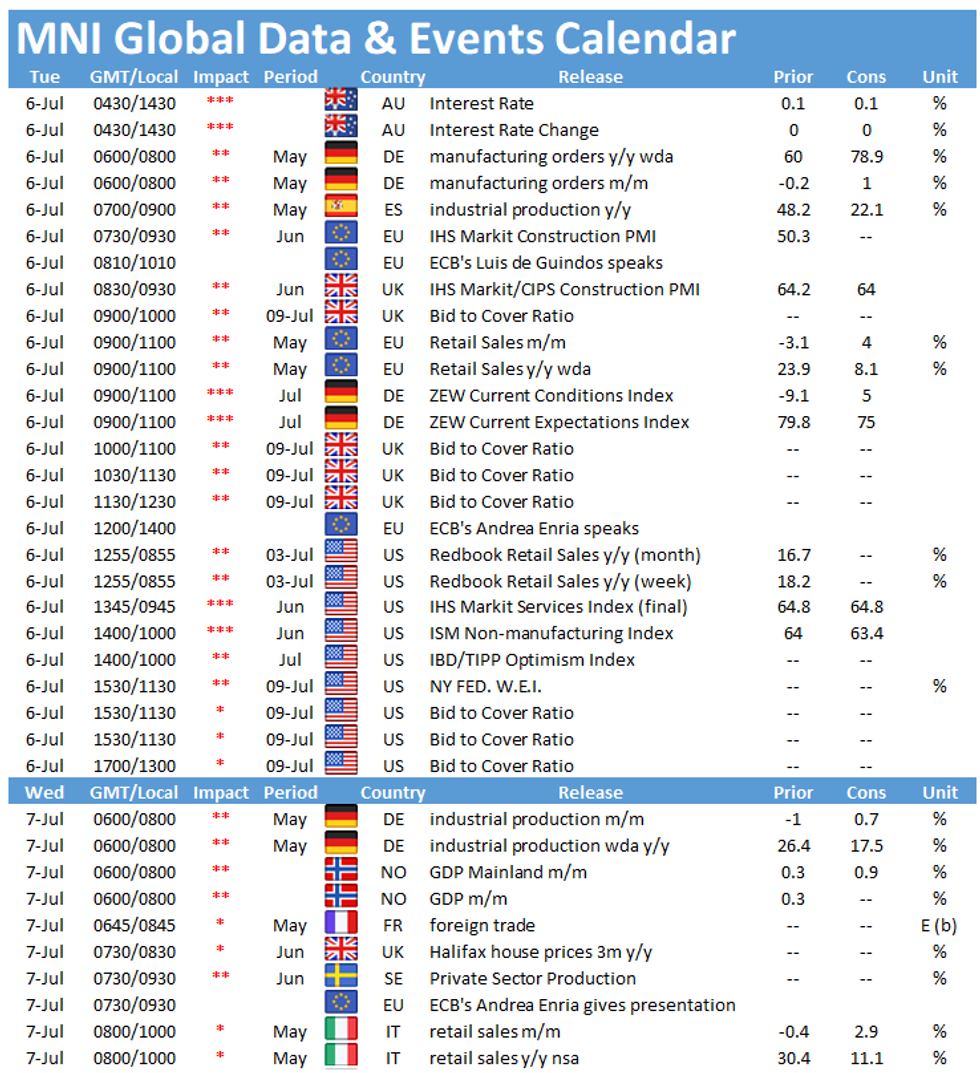

- The RBA's latest monetary policy decision, German ZEW survey & factory orders, U.S. ISM Services, EZ retail sales and ECB speak from de Guindos, de Cos & Visco take focus from here.

FOREX OPTIONS: Expiries for Jul06 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1865-80(E1.6bln), $1.1900-10(E1.6bln)

- USD/JPY: Y109.60-70($1.6bln), Y111.00($2.2bln), Y111.20($615mln)

- USD/CNY: Cny6.45($1.7bln-USD puts)

ASIA FX: Disparate Performance

The greenback went offered across the board before U.S. markets reopen after the Independence Day.

- CNH: Offshore yuan slightly weaker in a quiet session. The PBOC fixed USD/CNY at 6.4613, in-line with sell side estimates. Markets await inflation data later in the week.

- SGD: Singapore dollar is stronger, on the coronavirus there were six new cases in the past 24 hours. Co-chair of the COVID-19 multi-ministry task force Wong said on Monday that Singapore expects to open up further from July 12.

- KRW: Won is flat, there were 746 new coronavirus cases in the past 24 hours, above 700 for the fourth day with authorities expressing concern over the delta variant and potentially delaying relaxing of restrictions next week.

- TWD: Taiwan dollar is weaker, on the geopolitical front trade representatives from Taiwan and Australia met via video conference and made progress on relations.

- MYR: Ringgit is stronger, Penang became the sixth state allowed to move to phase 2 of the National Recovery Plan after meeting the three criteria set by the central gov't. Restrictions in the state will be eased from Wednesday.

- IDR: Rupiah is slightly stronger, FinMin Indrawati warned that Indonesia's GDP growth could slow to +4.0% Y/Y in Q3 (prev. forecast was +6.5%) as the authorities struggle to contain a surge in Covid-19 infections.

- PHP: Peso is weaker, Philippine consumer-price inflation eased more than expected to +4.1% Y/Y in June from +4.5% recorded in March, April & May. Core CPI rose 3.0% Y/Y vs. 3.3% prior, while consumer prices in the NCR area grew 3.2% Y/Y after a 3.6% increase seen previously.

- THB: Baht Is lower, the latest report from the Federation of Thai Industries said the June industry sentiment index was 80.7 and said the pandemic has affected the sector.

ASIA RATES: RBI Initiatives Backfire As Yields Rise

- INDIA: Yields higher across the curve. The RBI announced yesterday it would purchase INR 200bn of bonds through its GSAP 2.0, the issues eligible are less liquid than under the first set of purchases. The Bank also announced Friday's INR 260bn auction would feature a new 10-year bond. The RBI also confirmed yesterday that it will start using the uniform price auction method for auctions.

- SOUTH KOREA: Futures in South Korea are lower along with other bonds in the region. In the cash space yields are lower in the short end. 2-Year supply from the MOF was smoothly taken down. Elsewhere the finance minister has repeated that the government plans to step up efforts to curb the growth of its national debt in a bid to improve fiscal soundness. Last week South Korea launched consultations with ratings agency Fitch, the meetings will run until Thursday.

- CHINA: The PBOC drained CNY 20bn from the financial system again, a total of CNY 80bn from the CNY 100bn injected heading into month-end. Repo rates have crept higher for the second session but are still well below recent highs. Higher repo rates has put pressure on the cash space, yields higher across the curve with some steepening seen. There were reports that foreign investors bought CNY 13.39bn of Chinese government bonds in June, the second month of lower purchases. Local government bonds through saw net purchases of CNY 730m, the biggest purchase on record.

- INDONESIA: Yields mostly lower. During yesterday's media briefing, FinMin Indrawati warned that Indonesia's GDP growth could slow to +4.0% Y/Y in Q3 (prev. forecast was +6.5%) as the authorities struggle to contain a surge in Covid-19 infections. Indrawati estimated that the economy could still grow by close to 5.0% this quarter if the current wave of coronavirus is contained this month. Meanwhile, Indonesia continues its battle against the relentless surge in new Covid-19 cases, exacerbated by severe ICU bed shortages and an oxygen crisis. Some patients seeking emergency treatment have had to be turned away over the recent days, while CNN Indonesia reported that dozens of patients died in one hospital over the weekend, after the facility ran out of oxygen.

EQUITIES: Mixed Ahead Of US Return

Another mixed day in Asia-Pac equity markets; bourses in mainland China are lower, pressured by losses in Didi Global after China's cyberspace regulator said it was reviewing the company on national security grounds and found serious violations. The NZX 50 is also lower, pressured by a hawkish turn from several banks on the RBNZ and subsequent move higher in NZD. Other markets in the region generally higher, though risk sentiment remains uncertain due to elevated COVID-19 numbers and thin volumes as participants await the return of US markets. Ahead of their return US futures are mixed, the e-mini Nasdaq is lower, e-mini S&P flat, while e-mini Dow Jones is higher on the back of gains in oil.

GOLD: Probing $1,800/oz

The softer USD has pushed spot gold through $1,800/oz in Asia-Pac trade, although the 20-day EMA seems to be capping momentum. Above there bulls will look to the June 17 high ($1,825.4/oz). Initial support is seen at the June 29 low ($1,750.8/oz).

OIL: OPEC+ Spat Support Gains

Crude futures continued to extend gains on Tuesday, with Brent +$0.30 or so vs. Monday settlement, while WTI is ~$1.50 above Friday's closing levels. Supported by reports that the prospective OPEC+ deal struck late last week had crumbled, as the UAE refused to budge on the demand for their production baseline to be revised. The preliminary deal could be revisited at a future meeting, but the group failed to set a date for further negotiations, meaning that the cooperative will revert to the pre-existing deal - and no increase in output has been agreed. There is a chance that the next set of talks could come in time to increase output in August, but the public spat has damaged the groups reputation and if no agreement is reached there is a chance members will take it upon themselves increase their own production quotas.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.