-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: JPY Outperforms In Asia

- A lack of tier 1 macro headline flow was evident in Asia, although a defensive feel left the JPY at the top of the G10 FX pile, with some regional worry re: COVID evident.

- The publication & press conference surrounding the findings of the ECB's strategy review headline the broader docket on Thursday, with central bank decisions from Poland & Malaysia also due.

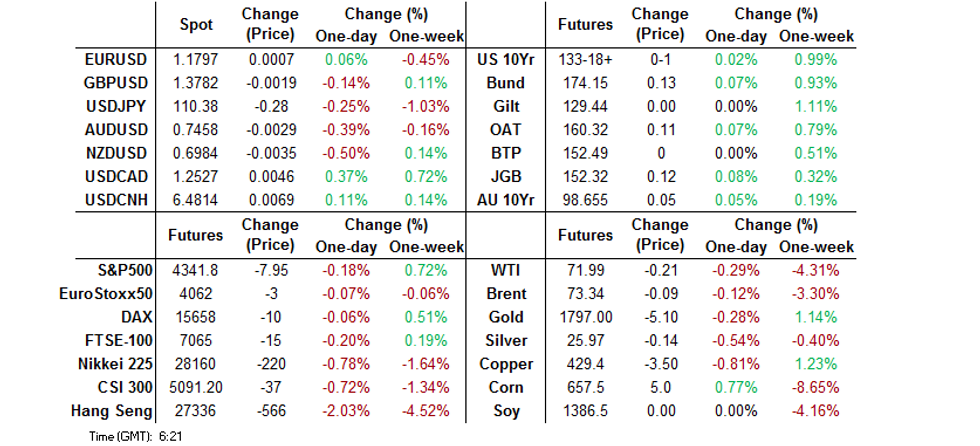

BOND SUMMARY: JGBs Surge At Tokyo Open, U.S. Tsys Flat In Asia

Another muted round of Asia-Pac trade for U.S. Tsys saw T-Notes stick to a 0-04+ range, last +0-01 at 133-18+ with cash Tsys exhibiting some very light twist flattening, operating within -/+1.0bp of Wednesday's closing levels at typing. Flow was headlined by a 5.0K block seller of FVU1 (~$255K DV01 equivalent), which helped pressure the belly of the curve. There was a lack of meaningful macro headline flow overnight. Weekly jobless claims data headlines the local docket on Thursday, although some attention will be on the publication of the ECB's heavily anticipated strategy review and the subsequent press conference surrounding the matter. The Treasury will also issue its mid-month supply announcement, for auctions next week.

- JGB futures surged higher at the Tokyo re-open, with some pointing to CTA accounts as drivers of the move. The move has pared a little, as the contract last prints 11 ticks above yesterday's settlement levels, 13 ticks shy of session highs. 5s provide the firmest point of the curve, trading ~2.0bp richer on the day. Japan's COVID policy chief (and Economy Minister) Nishimura outlined an extension of COVID related limits/states of emergency (most notably in Tokyo & Okinawa), which gave a fundamental reason to buy JGBs on the day, although the headlines weren't a surprise given the recent speculation/rhetoric re: the matter. The latest round of 5-Year JGB supply wasn't the firmest, with a lack of outright and relative value appeal likely crimping demand a little. The low price was lower than broader expectations (which stood at 100.60 per the BBG dealer poll), while the cover ratio softened and tail width held steady. There is nothing in the way of notable local events scheduled for Friday.

- Aussie bond futures ticked higher as local participants reacted to Wednesday's move in U.S. Tsys, leaving YM +4.0 and XM +5.0 at typing. Longer dated ACGBs sit ~5.5bp richer on the day in cash trade. Comments on the "labour market and monetary policy" from RBA Governor Lowe offered little in the way of meaningful new information, as he affirmed the Bank's sanguine view on inflation & wages. The Q&A session that followed the address wasn't eventful The presence of the latest round of scheduled RBA ACGB purchases covering the '28 to '32 zone of the curve would have provided some underlying support. The release of the AOFM's weekly issuance slate headlines the local docket on Friday.

JAPAN: Nothing Standout In Weekly Securities Flow Data

The most notable net flow observed in the latest round of weekly international security flow data out of Japan was the reversion to foreign net purchases of Japanese bonds (with net purchases now witnessed in 4 of the last 5 weeks). Elsewhere, Japanese net sales of foreign bonds were trimmed, while Japanese investors flipped to net selling of foreign equities after 1 week of very modest net purchases. Finally, foreign investors registered a 4th straight week of net sales of Japanese equities.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | -190.9 | -1003.4 | 199.8 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -202.1 | 32.7 | -269.7 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 907.3 | -303.2 | 2204.9 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | -310.1 | -146.7 | -684.2 |

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

FOREX: Yen Leads Gains As Risk Appetite Remains Subdued

Lingering concern about the spread of the Delta variant across Asia amplified existing risk-off sentiment, boosting demand for safe haven currencies. The yen garnered strength over the Tokyo fix and established itself atop the G10 pile, as defensive mood prevailed. In a Japan's panel of experts recommended a state of emergency for Tokyo, which would cover the entire duration of the Olympics. The decision came on the heels of a number of press reports suggesting as much.

- The weakness displayed by crude oil sapped some strength from commodity-tied FX space. The Antipodeans led high-betas lower, amid chatter that AUD was sold ahead of RBA Gov Lowe's speech. The Governor's comments did not provide much in the way of fresh insights.

- NZD/USD dipped through the $0.7000 mark and printed a new weekly low of $0.6981, while AUD/NZD moved away from a two-month low of NZ$1.0661, as the kiwi underperformed.

- The greenback remained solid in the wake of Wednesday's release of Fed minutes. The DXY edged higher, albeit yesterday's three-month high remained intact.

- The main data highlights today include U.S. weekly jobless claims and German trade balance. The ECB will release the minutes from their Jun MonPol meeting, while policymaker de Cos is set to speak.

FOREX OPTIONS: Expiries for Jul08 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1685-00(E1.3bln), $1.1800(E514mln), $1.1930-50(E1.9bln)

- USD/JPY: Y110.75-85($849mln), Y111.25($570mln), Y112.00-10($774mln)

- AUD/USD: $0.7515-30(A$1.3bln), $0.7600-05(A$901mln)

- USD/CNY: Cny6.5100($635mln)

ASIA FX: Negative Risk Environment

Asia EM currencies weaken in a negative risk environment with coronavirus concerns weighing.

- CNH: Offshore yuan is weaker, there is continued speculation around a possible RRR cut, the CSJ suggested the cut is likely to be targeted at SME's and could come at the end of Q3 if upward pressure on CPI eases.

- SGD: Singapore dollar is weaker, markets still disappointed by the statement from health authorities yesterday that they will tie removal of further restrictions with vaccination progress which is expected to be mid-July when over 50% of the population have been inoculated.

- KRW: The won is lower, USD/KRW stopping just short of 2021 highs. New coronavirus cases hit a record 1275, there were some reports from Yonhap that South Korea is considering raising social distancing rules in South Korea, as reported previously, while adding that health authorities expect virus cases to continue rising for one-week.

- TWD: Taiwan dollar is weaker, USD/TWD reclaiming the 28.00 handle. There is still concern over coronavirus numbers but the CDC suggested keeping the soft lockdown with some easing.

- MYR: Ringgit fell, Bank Negara Malaysia will deliver their monetary policy decision today and almost all analysts expect them to leave the Overnight Policy Rate unchanged. Elsewhere political shenanigans drag on, early this morning, UMNO withdrew its support for PM Muhyiddin and demanded his immediate resignation

- IDR: Rupiah declined, Indonesia broadened its Covid-19 restrictions to dozens of localities across the country on Wednesday, at a time when its healthcare system operates beyond capacity. The number of fatalities from Covid-19 exceeded 1,000 on Wednesday, for the first time on record. Elsewhere consumer confidence printed 107.4 in June from 104.4 in May.

- PHP: Peso dropped for the seventh consecutive session, USD/PHP is at its highest for a year. A clearance of the nearby PHP50.000 figure would allow bulls to set their sights on Jun 23, 2020 high of PHP50.245.

- THB: Baht is weaker, consumer confidence dropped to 43.1 in June from 44.7. Elsewhere Thailand's Covid-19 task force said Wednesday that they will consider locking down hotspots in Bangkok and neighbouring provinces, once proposals are submitted by experts. Officials refused to rule out a scenario in which the number of new infections would rise by 10,000 per day next week.

ASIA RATES: Bonds Supported On Coronavirus Concerns & OMO Prospects

- INDIA: Yields lower in early trade. Bonds are expected to be supported today ahead of the RBI's latest GSAP operation later in the session. The RBI will purchase INR 200bn from 8.24% 2027, 7.17% 2028, 7.59% 2029, 7.88% 2030 and 7.57% 2033 lines. Elsewhere RBI Governor Das gave an interview to the Business Standard and said the Central Bank is very watchful of the inflation scenario and that should moderate in Q3 if the fiscal year. Das noted growth was the main challenge now, and that higher inflation was transitory.

- SOUTH KOREA: Bonds in South Korea pressured higher again as risk assets take a hit after the health ministry announced a record high number of COVID-19 cases, with cases staying above 1200 for two consecutive days for the first time since December. Some reports from Yonhap that South Korea is considering raising social distancing rules in South Korea, as reported previously, while adding that health authorities expect virus cases to continue rising for one-week.

- CHINA: Repo rates drop, futures higher. The market is still latching on to reports from yesterday that the RRR could be cut after reports from the State Council meeting. There is growing speculation that the cut will be targeted rather than a cut to the broader RRR, a story just run in the China Securities Journal posited that the cut is more likely to be for SME. The piece asserts that the cut could come at the end of Q3 if upward pressure on CPI eases.

- INDONESIA: Yields higher across the curve. Indonesia broadened its Covid-19 restrictions to dozens of localities across the country on Wednesday, at a time when its healthcare system operates beyond capacity. The number of fatalities from Covid-19 exceeded 1,000 on Wednesday, for the first time on record. Elsewhere consumer confidence printed 107.4 in June from 104.4 in May and FinMin Indrawati told BBG that the budget deficit will remain elevated next year, owing to the current resurgence of Covid-19. She estimated that the deficit will reach 4.7%-4.8% of GDP in 2022, which is close to the upper end of the gov't's projection (4.50%-4.85%).

EQUTIES: Lose Ground

A negative day for equity markets in the Asia-Pac region. Tech heavy indices such as the Hang Seng and KOSPI are bearing the brunt of the selling after the Nasdaq struggled to make the same gains as its peers yesterday, while markets in South Korea are also pressured by record coronavirus cases. In mainland China indices are lower, Didi Global are still in the headlines after falling for a third consecutive day yesterday. Regulators are said to be considering rule changes that would allow them to block a Chinese company from listing overseas even if the unit to which the shares belong is incorporated. Markets in Japan are negative, but losses are subdued compared to peers, markets resilient despite a potential state of emergency for Tokyo looming. Futures in the US are lower, retracing gains made in the second half of the session yesterday.

GOLD: Glued to $1,800/oz

Gold lacked any real conviction on Wednesday; with the latest uptick in the broader USD competing with a fairly flat U.S. real yield profile. This leaves spot hovering around the $1,800/oz mark, with no change to the technical overlay.

OIL: Back From Overnight Lows

Crude oil futures have moved off of worst levels, leaving WTI -$0.10 and Brent little changed on the day. Markets appear to be speculating that extended discord among OPEC+ members could dent curb compliance, providing a short spell of increased supply in the near-term. Stockpile data from API yesterday showed headline crude stocks fell 7.893m bbls, the DoE Crude Oil Inventories were delayed a day due to Monday's July 4th public holiday and will be released later today. Markets expect a draw of around 4.5mln bbls. Still, sources of geopolitical tension in the Middle East seem to be limiting the downside, at least for now.

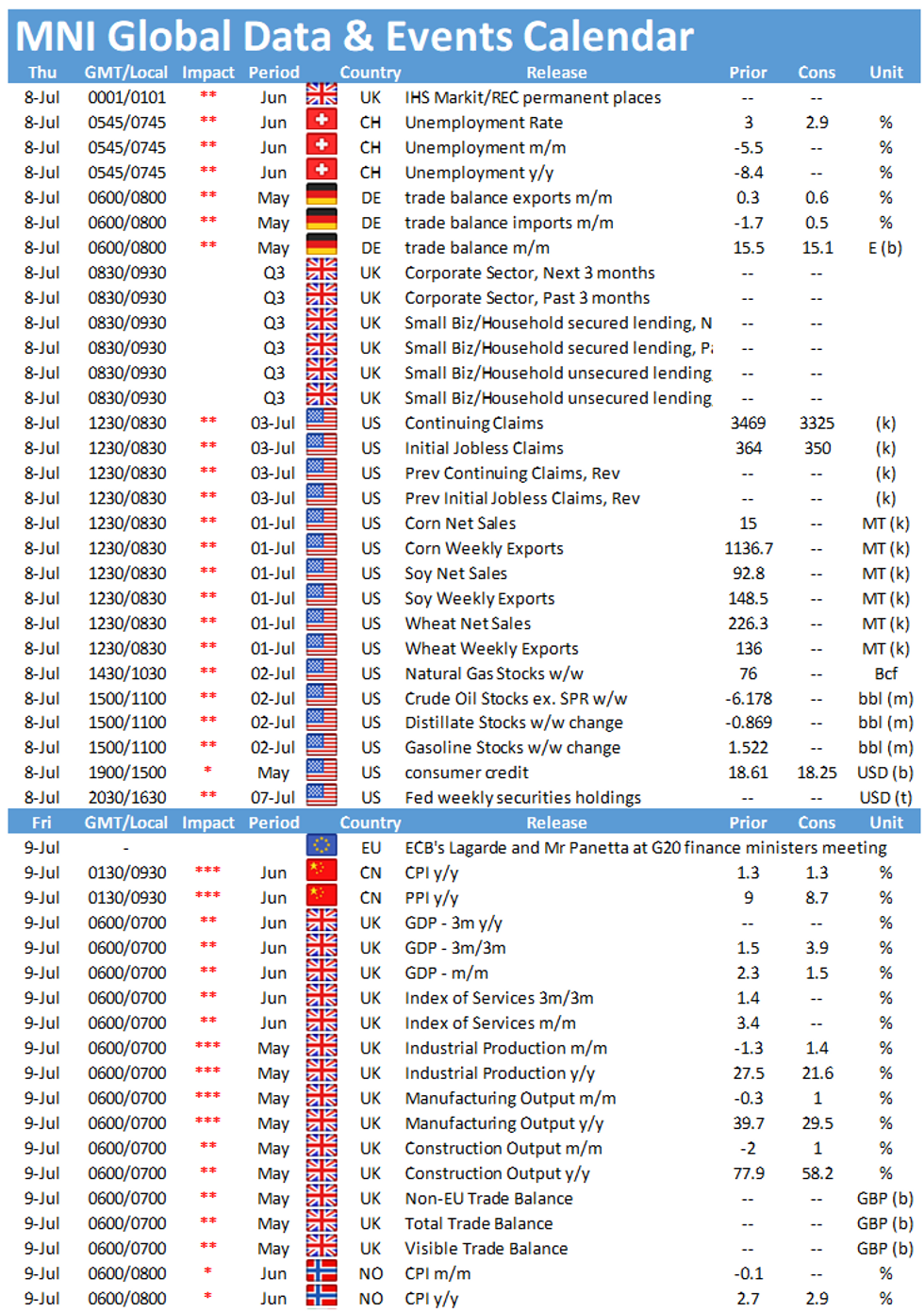

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.