-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Tsys Firm, DXY Flat

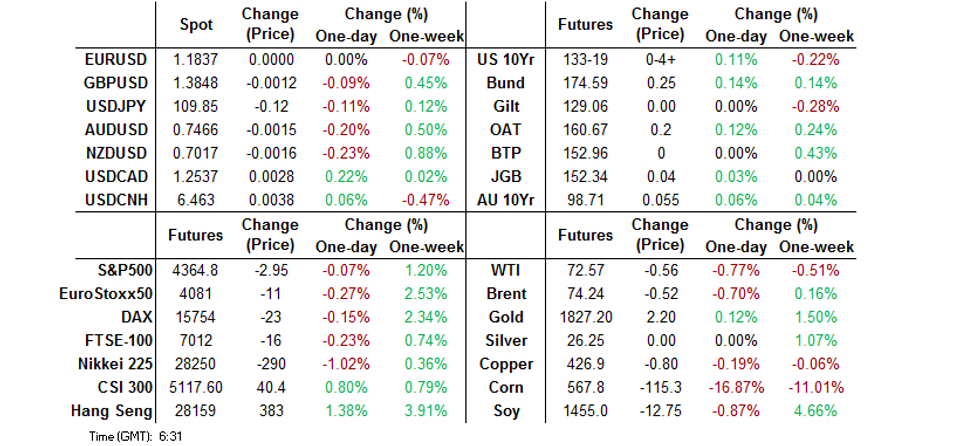

- U.S. Tsy curve flattens further in Asia after Wednesday's rally, while the DXY sits little changed.

- Chinese economic data was roughly in line to better than exp. in broader terms, while the headline Australian labour market figures provided a positive surprise.

- Fed Chair Powell's second day of testimony headlines the broader docket on Thursday.

BOND SUMMARY: Core FI Generally Bid In Asia

U.S. Tsys showed little in the way of reaction to the Chinese data dump, with the quarterly GDP and monthly economic activity readings generally in line to a touch firmer vs. broader exp. T-Notes struggled to extend through the July 12 high overnight (133-20+), with the contract topping out at 133-21, last printing +0-05 on the day at 133-19+. The cash Tsy curve has seen some modest bull flattening, extending the move seen on Wednesday, with 2s little changed on the day, while the longer end of the cash Tsy curve runs as much as ~2.0bp richer. Weekly jobless claims and some of the regional Fed activity indices are due to be released during NY hours. Elsewhere, Fed Chair Powell will testify on the Hill for a second day, while Chicago Fed President Evans ('21 voter) will speak on the economy.

- JGB futures managed to add to their overnight gains at the Tokyo reopen, before pulling back to last print +4. Cash JGB trade has seen some outperformance for the 20- to 40-Year zone of the curve, which has richened by ~1.5-2.0bp given the overnight dynamic in U.S. Tsys, while the remaining benchmarks have richened by ~0.5bp. 10-Year JGB yields registered a new multi-month low of 0.01%. Broader headline flow has been a little light, with the latest liquidity enhancement auction covering off-the-run 1- to 5-Year JGBs having no real impact on the broader market. The latest BoJ decision headlines the local docket on Friday.

- Aussie bonds showed little in the way of net movement in the wake of the better than expected local labour market report (headline jobs and unemployment were better than exp., although underutilisation & underemployment ticked away from multi-year lows on the back of the lockdown in Victoria), with YM +3.0 & XM +5.5 at typing after a blip lower on the data. A reminder that the RBA's most recent SoMP did not look for a drop to 5.0% unemployment until Q421. Still, it will be wage growth and realised inflation that drives the medium-term evolution of the RBA's cash rate (at least based on Bank's current guidance), and the unemployment rate may not travel on a constant one-way trajectory given the local COVID situation. The release of the AOFM's weekly issuance schedule and A$700mn of ACGB 0.25% 21 November 2025 supply headline locally on Friday.

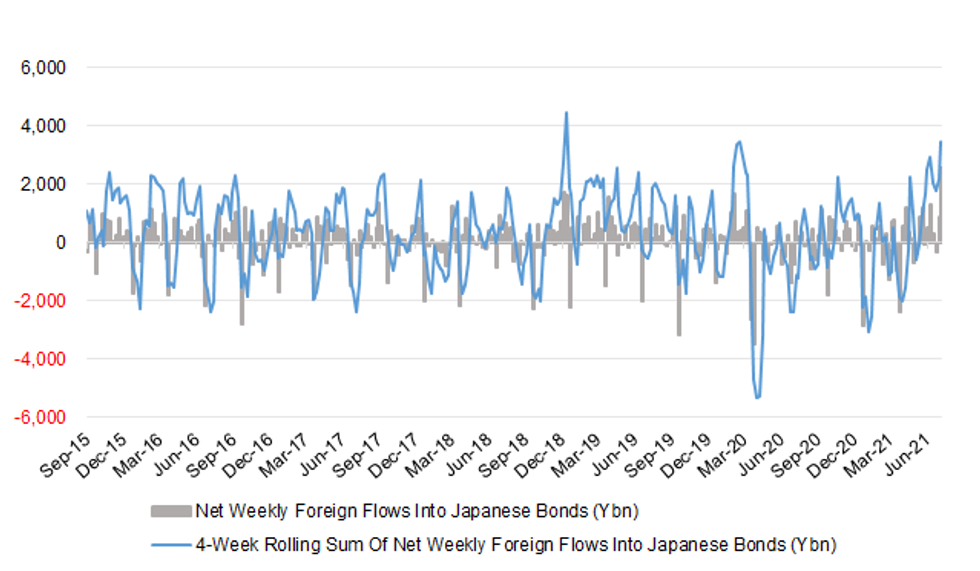

JAPAN: Foreigners Lodge Record Net Weekly Purchases Of Japanese Bonds

Bond flows dominated the latest round of weekly international security flow data:

- Foreign investors recorded the largest round of net weekly purchases of Japanese paper on record (a touch shy of Y2.6tn), in week which saw 10-Year JGB yields press to multi-month lows (0.02%), which have since been (marginally) extended on. The 4-week rolling sum of the measure moved to the highest level (largest amount of net buying) witnessed since early '20.

- Japanese investors sold foreign bonds for a 3rd straight week (~Y1.2tn).

- There were small net sales lodged in both of the equity flow metrics.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | -1217.8 | -191.4 | -1429.1 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -77.2 | -202.1 | -452.4 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 2567.8 | 887.1 | 3442.7 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | -10.5 | -310.0 | -658.9 |

Fig. 1: Net Weekly Foreign Flows Into Japanese Bonds (Ybn)

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

FOREX: Weaker Oil, Heavier Yuan Weigh On G10 High-Betas

Offshore yuan went offered in Asia, with Chinese data front and centre today. Annual GDP growth slowed markedly in Q2, but only marginally undershot expectations, while the deterioration in most monthly activity indicators was less acute than projected. USD/CNH showed little reaction to the data after rising in the lead-up to the release. The PBOC set its central USD/CNY mid-point 14 pips above sell-side estimate, which may have lent some support to the pair.

- Weaker crude oil prices applied pressure to high-beta FX, with the Antipodeans pacing losses. Lingering angst surrounding the Covid-19 outbreak in NSW undermined the Aussie, even as local jobs report was stronger than forecast, with headline unemployment rate unexpectedly easing to 4.9% in June from 5.1% in May.

- Safe haven currencies outperformed, with JPY defying any potential impact of Gotobi Day flows and climbing to the top of the G10 scoreboard. USD/JPY extended losses past its 50-DMA.

- Focus turns to U.S. industrial output, Empire M'fing Survey and weekly jobless claims, UK labour market report and comments from Fed's Evans and BoE's Saunders, in addition to the second part of Fed Chair Powell's congressional testimony.

ASIA FX: Won Leads Gains After BoK

A mixed day for Asia EM currencies, most opened higher following a decline in the greenback overnight, some managing to retain strength even in the face of a USD bounce.

- CNH: Offshore yuan is weaker, USD/CNH reversing some of yesterday's decline. The PBOC rolled over CNY 100bn of MLF funds unexpectedly, while data showed GDP missed estimates slightly and retail sales, industrial production and fixed asset investment were above consensus.

- SGD: Singapore dollar weakened slightly but is still well above yesterday's low. Markets continue to digest GDP from yesterday, consensus among analysts though is that this dip is temporary and that Singapore is in a much stronger position than many of its regional neighbours.

- TWD: Taiwan dollar is stronger, USD/TWD back below 28.00. Markets await TSMC earnings later with another bumper report expected.

- KRW: The won is stronger, gaining further after a surprisingly hawkish press conference from BoK Gov Lee. He noted there was one hawkish dissenter to the unchanged decision today and that next meeting would be the time to discuss removing accommodation.

- MYR: Ringgit is stronger, Dep PM Ismail Sabri struck an optimistic note on reopening the country, as he suggested that a faster rate of vaccinations should allow more states to move into Phase Two of the National Recovery Plan. The whole country is expected to move into Phase Two in early August.

- IDR: Rupiah is weaker, several countries shut their borders to travellers arriving from Indonesia, which has become the main hot spot of Covid-19 in Asia. Indonesia's daily number of cases surpassed that of India and reached a new record high of 54,517 on Wednesday.

- PHP: Peso gained, clawing back early losses despite Goldman Sachs downgrading growth forecasts due to virus restrictions muting the economic recovery.

- THB: Baht is slightly stronger, several media outlets reported that Thailand considers a temporary ban on exports of locally manufactured AstraZeneca jabs, as the country seeks to accelerate its own inoculation drive. That said, the Bangkok Post reported that Thailand reported that an unspecified proportion of vaccines will be set aside for export.

ASIA RATES: Futures In S.Korea Drop After BoK Retains Hawkish Tilt

- INDIA: Yields lower in early trade. Bonds are expected to be supported by a number of factors today including a drop in crude prices as an OPEC+ deal appears to draw nearer, lower US yields after a more dovish than expected testimony from FOMC chair Powell, and signs of waning inflation domestically. Data yesterday showed wholesale inflation rose 12.07%, below estimates of 12.18% and slowing from the 12.94% print in May. Yesterday the curve bull steepened after state run banks were heavy buyers in the short-end after selling illiquid bonds in the most recent GSAP operation. Markets look ahead to Indian trade balance data today; the trade surplus is expected to have widened to $9.4bn. Also on the docket today is a speech from RBI Governor Das at the financial inclusion summit, scheduled for 1030BST/1500IST.

- SOUTH KOREA: BoK on hold as expected at 0.50%. Futures lower, taking a nosedive during BoK Governor Lee's press conference, while the curve bear flattens. Lee noted that one MPC member called for a 25bps hike, an unexpected hawkish dissent. Lee also said that the need for policy normalization was increasing due to financial imbalances, such as home prices and household debt. Lee did note in his press conference that the BoK could purchase government bonds if needed, he said the Bank could take various market stabilization steps if there's a need to ease volatility in market interest rates.

- CHINA: The PBOC conducted CNY 100bn of 1-Year MLF's at an unchanged 2.95%, equating to a net drain of CNY 300bn. Given that last week's 0.5ppt RRR cut is expected to result in an additional CNY 1tn into the system it was expected the PBOC would allow all of the MLF funds to roll off. There were some reports mentioned earlier that the PBOC had gauged demand for MLF from commercial banks, and at this MLF operation have cited demand from tax payments. There is still some speculation that the PBOC could cut the LPR rates this month given that the RRR cut will lead to lower funding costs for banks and enable them to charge less on loans. Data showed GDP was slightly below estimates and confirmed a slowdown, but other data points including retail sales, industrial production and fixed asset investment were all strong. Futures in China fell after the data, the first decline in three days.

- INDONESIA: Yields lower across the curve. The Indonesian government said today that it estimated virus mobility would decline 2-3 weeks after curbs were imposed and that long term growth trajectory was still intact. Several countries shut their borders to travellers arriving from Indonesia, which has become the main hot spot of Covid-19 in Asia. Indonesia's daily number of cases surpassed that of India and reached a new record high of 54,517 on Wednesday. Data showed the trade balance narrowed as exports rose above estimates.

EQUITIES: China Gains After Partial MLF Rollover

Equity markets are mixed in the Asia-Pac region; in China markets are higher, the PBOC rolled over CNY 100bn of MLF funds, even after the 0.5ppt RRR cut last week. Elsewhere data slowed from last month and while GDP missed estimates retail sales and industrial production were both above consensus. Following the release the NBS said it saw the economy to keep recovering steadily in the second half of the year. In Japan markets are lower, local press reports have pointed to the BoJ adopting a lower GDP outlook for the current FY come the end of its 2-day meeting (which runs across today & tomorrow), which isn't a surprise given the local COVID situation. In South Korea markets are higher, the BoK kept rates on hold as expected and remained upbeat on the economy despite a surge in coronavirus cases. The Bank did note that next month would be time to start discussing removal of monetary accommodation. In the US futures are mixed again, e-mini Dow and e-mini S&P are lower, while e-mini Nasdaq is higher boosted by gains in the tech sector.

GOLD: Bulls In Charge

Wednesday's downtick for U.S. real yields and an unwind of some of Tuesday's broader USD strength supported bullion, leaving spot to deal around the $1,825/oz mark during Asia-Pac hours. With the 50-day EMA & recent intraday highs now cleared, bulls look to some Fibonnaci levels related to June's decline ($1,833.7/oz & $1,853.3/oz) as the next areas of resistance. Further comments from Fed Chair Powell will likely garner most of the attention on Thursday.

OIL: Crude Futures Slip As OPEC+ Deal Seems Closer

Oil is lower in Asia-Pac trade, on track for a second day of declines; WTI & Brent run ~$0.50 below their respective settlement levels into European hours, but are off of session lows.

- Crude futures remain under pressure after the UAE and Saudi Arabia appear to have resolved a dispute over a demand by the UAE to raise its production quota that could pave the way for an extension of producer cooperation and enable substantial volumes of oil supply to come back to the market. What happens next will depend upon deliberations at a yet-to-be announced, OPEC+ ministerial meeting expected to take place this week ahead of the Islamic Eid on Jul. 19. The issue of the baseline change will also be discussed during the meeting by all members of the producer group. For reference, that meeting is not guaranteed to result in an agreement as other countries could raise similar requests on the back of the UAE's seeming success.

- Elsewhere, there were reports that the US-Iran nuclear talks will not resume until mid-August, which pushed the prospect of additional supply from Iran further down the road. According to Reuters sources Iran won't resume talks until its new president takes over which isn't expected to be until August.

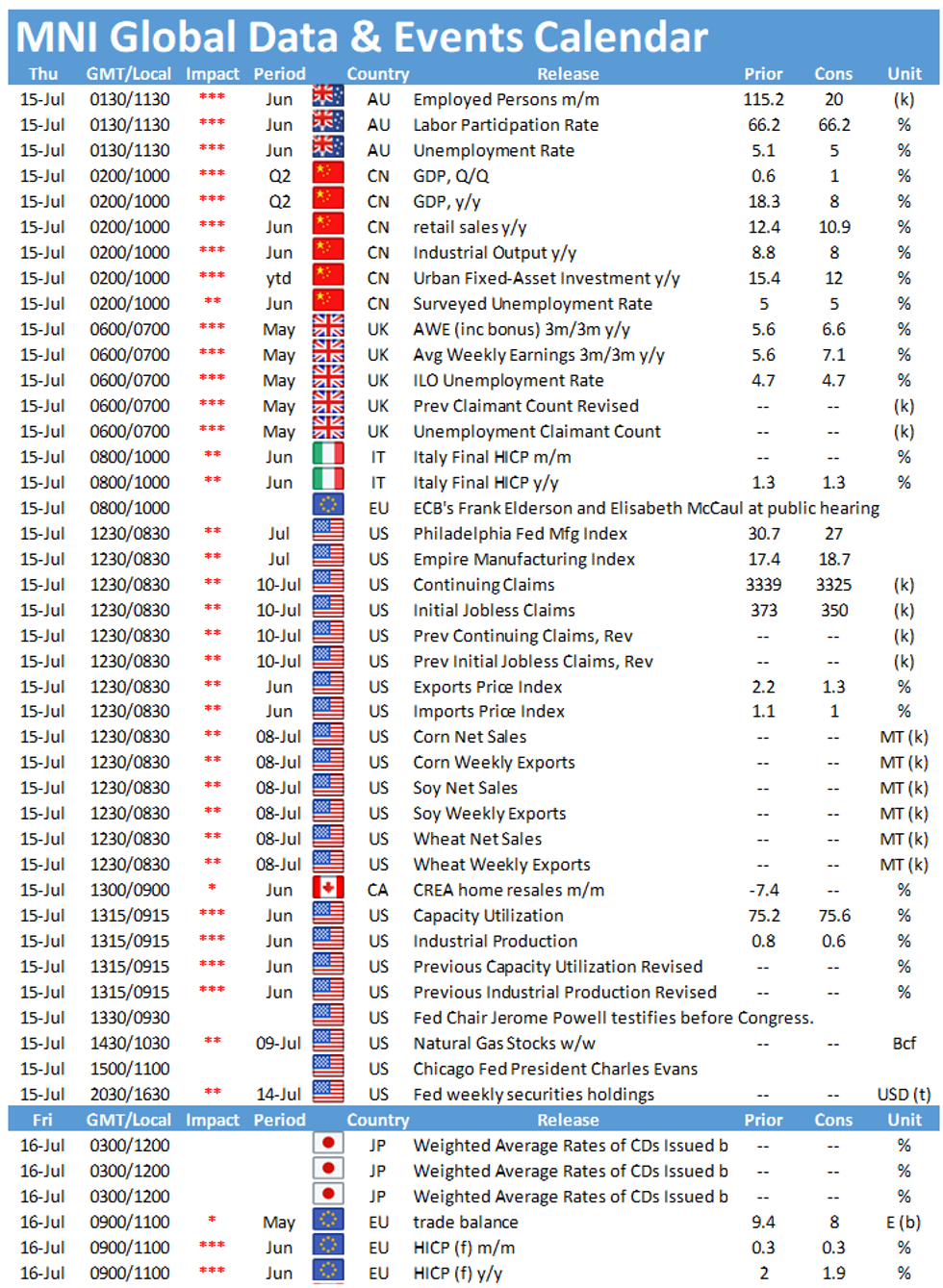

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.