-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Relief Rally For Chinese Equities Help Sooth Worry

EXECUTIVE SUMMARY

- FED SIGNALS TAPER CLOSER IF JOB GAINS BUILD (MNI)

- SENATE VOTES TO ADVANCE BIPARTISAN INFRASTRUCTURE BILL (CNBC)

- SANDERS SAYS HE HAS 50 VOTES NEEDED TO PASS A BROAD BUDGET PLAN (BBG)

- CHINA WILL STILL ALLOW IPOS IN THE UNITED STATES, SECURITIES REGULATOR TELLS BROKERAGES (CNBC)

- CHINA'S SOLID ECONOMY GURANTEES CAPITAL MKT DEVELOPMENT (XINHUA)

- EFFICACY OF PFIZER/BIONTECH COVID VACCINE SLIPS TO 84% AFTER SIX MONTHS, DATA SHOW (STAT)

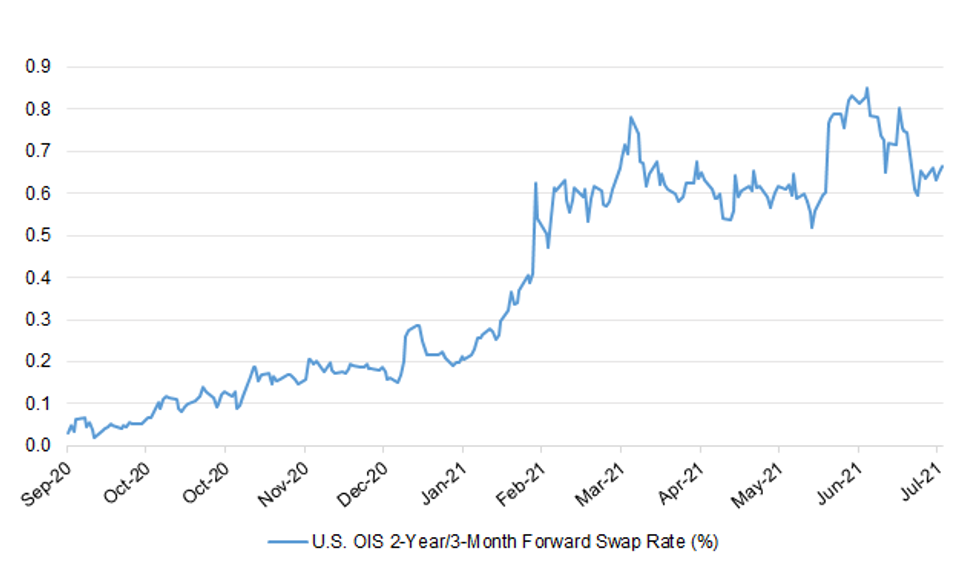

Fig. 1: U.S. OIS 2-Year/3-Month Forward Swap Rate (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Downing Street has no plans to run a nationwide campaign to get people back to work in offices as they did last year, meaning working from home could become the norm for many. (Telegraph)

CORONAVIRUS: Ministers approved plans to reopen the border to foreign travellers yesterday in defiance of official warnings that the move posed a "clear public health risk". From Monday, millions of fully vaccinated passengers from the US and EU — which includes countries on the amber list — will be able to enter England, Scotland and Wales without spending up to ten days in quarantine. The change is widely expected to be expanded to other countries in the coming months. However, senior officials warned the cabinet that allowing fully vaccinated Europeans to enter freely could raise the risk of lower quality vaccines undermining Britain's immunity against the coronavirus. Ministers on the Covid-19 operations (Covid-O) committee were told the move posed a "clear public health risk". Sajid Javid, the health secretary, is understood to have been told of the risk posed by Europeans who had been given jabs not approved for use in Britain, such as the Chinese Sinopharm vaccine used in Hungary. There are also concerns that paper vaccine certificates issued in the United States could be falsified. (The Times)

CORONAVIRUS: Britain expects the US to drop its UK travel ban after ministers reopened the border to Americans, the Transport Secretary said on Wednesday night. (Telegraph)

BREXIT: MNI INTERVIEW: NI Grace Periods Seen Extended As EU Talks Drag

- Grace periods for implementing checks on goods going from Britain to Northern Ireland will inevitably be extended as negotiations over the post-Brexit protocol governing trade with the province drag on beyond September with no guarantee of success, the chair of a House of Lords EU Affairs sub-committee on the protocol told MNI. Lord Jay warned that the danger cannot be discounted that the UK could eventually activate Article 16, which gives both sides the power to take unilateral action should the protocol give rise to serious economic or societal difficulties. This would make an eventual deal still harder to achieve, and would be "a big mistake, he added in an interview - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: The UK plans to use the Commonwealth Games in Birmingham next year to boost investment and trade with members of the organisation made up mostly of its former imperial possessions. It will launch on Thursday a £24m business and tourism programme to attract more visitors, trade, events and investment into both the West Midlands city and country as a whole, focusing on the 53 other members of the Commonwealth, a group of nations with common goals of democracy and development. The UK government believes it can attract more than £650m of extra overseas investment, and create £7m of additional exports by 2027. It also expects to draw an additional 39,000 visitors to the region as a result of the campaign, who it is estimated will spend £12m, and create 1,000 new jobs. (FT)

ECONOMY: UK car production is still much lower than it needs to be due to shortages of staff and semiconductors, the industry is warning. The Society of Motor Manufacturers and Traders (SMMT) said just 69,097 cars were produced in June, the lowest since 1957, with the exception of last year. The trade body is calling for urgent assistance to exempt staff pinged by the NHS Covid app. SMMT said the industry was "desperately trying to get back to full capacity". The picture "didn't look particularly pretty", the SMMT's chief executive Mike Hawes said, even though production numbers were up on June 2020, just after the first coronavirus lockdown ended. (BBC)

EUROPE

ITALY: Italy will get 1 million extra doses of Pfizer covid-19 vaccine which will allow the country to complete its vaccination campaign by the end of September, according to a government official. Doses due in the second half of August, as negotiated by Prime Minister Mario Draghi with EU Commission head Ursula von der Leyen. (BBG)

U.S.

FED: MNI STATE OF PLAY: Fed Signals Taper Closer If Job Gains Build

- The Federal Reserve is one step closer to winding down its USD120 billion of monthly asset purchases and is waiting for continued job market improvement before pulling the trigger. The U.S. economy is on track to grow at the fastest rate in decades and the Delta variant may only slow momentum for a few months as people have learned to live with Covid, Fed Chair Jay Powell told reporters Wednesday. Inflation is already running well above the Fed's 2% target, but that gain may be fleeting with the drag of eight million people still out of work. "We're some way away from having substantial further progress toward the maximum employment goal," he said when asked about tapering after a two-day FOMC meet. "I would want to see some strong jobs numbers" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: The Senate voted Wednesday to advance a bipartisan infrastructure plan, a critical step toward Democrats passing their sweeping economic agenda. Senators voted 67-32 to push the bill forward; 17 Republicans and all 50 Democrats voted yes. The vote opens the process to debate and amend the proposal, which would put $550 billion into transportation, broadband and utilities. While senators who backed the procedural motion could oppose a final package, Wednesday's vote bodes well for its chances of passage. (CNBC)

FISCAL: Senate Budget Committee Chairman Bernie Sanders said he has the votes to pass a broad budget resolution next week, a key step in enacting President Joe Biden's economic agenda. The Vermont independent's comments mean all 50 senators who caucus with Democrats are onboard with passing a resolution that could lead to follow-on legislation totaling $3.5 trillion to address priorities such as climate change, the tax code, health care, and immigration. (BBG)

FISCAL: The IRS is sending an additional 1.5 million taxpayers refunds averaging $1,686 on 2020 unemployment insurance (UI) taxes, the agency said Wednesday. Unemployment insurance benefits typically count as taxable income. However, the American Rescue Plan (ARP), signed into law by President Joe Biden in March, excluded UI benefits of up to $10,200 from taxable income for 2020. (CNBC)

FISCAL: House Speaker Nancy Pelosi suggested on Wednesday that people who believe President Joe Biden can forgive student debt on his own are misinformed. "The president can't do it," Pelosi said, at a press briefing. "That's not even a discussion." Pelosi said any student debt forgiveness would have to be carried out by Congress. Other people in her party have said otherwise. (CNBC)

CORONAVIRUS: Labor Secretary Marty Walsh said that the U.S. will likely be living with the Covid-19 delta variant for at least a few months, and encouraged people to get vaccinated to be able to get back to work. "The reality of the current situation," Walsh said on Bloomberg Radio, "is that we still are living with the coronavirus." "In the period essentially the next couple months now -- maybe even longer than that -- we're going to be living with the variant." "The numbers are heading in the wrong direction," he said, The new Centers for Disease Control and Prevention mask guidance and workplace vaccination requirements aren't likely hindering people's desire to return to work. "I think a lot of people will come back to work," Walsh said. "My fear is that people that aren't vaccinated are currently working." (BBG)

CORONAVIRUS: Some of the most vaccine-resistant parts of the U.S. are now leading the country in the number of people getting a first dose of vaccine, a Bloomberg analysis shows, as surging infections and rising hospitalizations push formerly reluctant Americans to protect themselves. The increase in vaccinations is concentrated in the Southern and Central parts of the U.S., with the highest daily rate of shots happening in places like Louisiana, Arkansas and Missouri — states that have had some of the lowest rates of vaccination in the eight months since vaccines became available. Those places, along with hot spots including California and Florida, are also where a new wave of Covid cases is hitting hardest, driven by the highly contagious delta variant, and where local health officials have been pulling out all the stops to try to catch up on vaccinations. (BBG)

CORONAVIRUS: Texas logged more than 10,000 in daily new virus cases for the first time in almost six months as the latest wave of the pandemic intensifies across the second-most populous U.S. state. The caseload surged by 10,086 in the past 24 hours, a 55% increase from Tuesday's addition and the highest since Feb. 9, state health department figures showed. Hospitalizations, meanwhile, have more than doubled this month to 5,292, the data showed. Intensive-care unit occupancy by virus patients has pushed above 10% in three of the state's 22 trauma service areas, and one of those regions has zero ICU capacity left. (BBG)

CORONAVIRUS: President Biden is expected to announce Thursday that his administration will require federal employees to get vaccinated or be regularly tested for Covid-19, according to a person familiar with the discussions. The move would represent the latest effort by the administration to address the highly transmissible Delta variant of the coronavirus. The person familiar with the situation said no decision has been finalized, and the policy is still under review. The person said the administration is also strongly considering more stringent masking protocols for unvaccinated federal workers. Such policies could affect millions of workers, depending on which categories of employees were included. (WSJ)

CORONAVIRUS: New York state is working with unions to mandate employees be vaccinated or get tested, Governor Andrew Cuomo said. Officials aim to have that done by Labor Day, he said, and urged local governments do the same. All patient-facing health-care workers in New York state hospitals must get vaccinated, and there will be no testing option, he said. (BBG)

CORONAVIRUS: California is recommending mask use in all public indoor settings, regardless of vaccination status, following the Centers for Disease Control and Prevention's revised guidance. More than 90% of the state's population is in areas with substantial or high transmission, the Department of Health said. Los Angeles County, the nation's most populous, has made masks a requirement. (BBG)

CORONAVIRUS: Governor Phil Murphy urged New Jerseyans to mask indoors when Covid-19 transmission risk is increased but stopped short of issuing a mask mandate. The decision comes after the U.S. Centers for Disease Control and Prevention reversed its indoor mask policy on Tuesday for vaccinated people in a bid to stem a surge of cases linked to the contagious delta variant. (BBG)

CORONAVIRUS: Apple Inc. plans to restore a mask requirement at most of its U.S. retail stores on Thursday for both customers and staff, even those who are vaccinated, in a response to a resurgence in Covid cases. The company informed retail staff of the move Wednesday in a memo obtained by Bloomberg News. Apple already started requiring masks for employees at select stores earlier this month, and it pushed back a return-to-office deadline for corporate employees. It also began requiring masks for customers in a few counties based on local guidelines. (BBG)

CORONAVIRUS: Alphabet Inc.'s Google postponed its date for bringing employees back to its offices by a month, and will require returning workers to be vaccinated, Chief Executive Officer Sundar Pichai wrote on Wednesday. The internet search giant will now ask most of its staff to return to campuses starting Oct. 18. (BBG)

EQUITIES: Facebook shares fell as much as 5% in extended trading on Wednesday after the social media company called for revenue growth to slow in the quarters ahead, even as second-quarter results came in ahead of estimates. (CNBC)

OTHER

GLOBAL TRADE: Biden will make the determination on whether to direct funds to only U.S.-headquartered companies after the administration's internal policy discussions are completed, Raimondo said in an interview Wednesday with Bloomberg editors and reporters in Washington. (BBG)

GLOBAL TRADE: Shortage ratio of empty containers at major Chinese ports fell by 12.2 percentage points to 1.4% in June from early 2021, Sun Wenjian, spokesman for the Ministry of Transport, says at a briefing. (BBG)

U.S./CHINA: China will continue to allow Chinese companies to go public in the U.S. as long as they meet listing requirements, China's securities regulator told brokerages late Wednesday, according to a source familiar with the matter. A series of regulatory actions in the last few weeks has heightened investor concerns that Beijing is trying to block foreign capital flows into Chinese assets. The cross-border stock listings can also occur using the variable interest entity structure, the source said, citing the regulator. It refers to a legal structure which allows international investors to access shares of Chinese companies in the U.S. (CNBC)

U.S./CHINA: U.S. destroyer conducted Taiwan Strait transit on July 28. (BBG)

CORONAVIRUS: The efficacy of the Covid-19 vaccine developed by Pfizer and BioNTech fell from 96% to 84% over six months, according to data released Wednesday, a decline that could fuel Pfizer's case that a third dose will eventually be required. The data, released in a preprint that has not been reviewed by outside scientists, suggest the vaccine was 91% effective overall at preventing Covid-19 over the course of six months. In the ongoing study, which enrolled more than 44,000 volunteers, the vaccine's efficacy in preventing any Covid-19 infection that causes even minor symptoms appeared to decline by an average of 6% every two months after administration. It peaked at more than 96% within two months of vaccination and slipped to 84% after six months. (STAT News)

CORONAVIRUS: Dyadic International Inc., a U.S. biotechnology company, has joined the race to produce Covid-19 vaccines in Africa, the least-vaccinated continent. The Jupiter, Florida-based company on Tuesday announced a technology transfer and licensing deal with South Africa's Rubic Consortium, a newly formed group that includes, Mathews Phosa, a former treasurer-general of the country's ruling African National Congress. In October or November Dyadic may begin an early-stage trial for the company's coronavirus vaccine candidate after applying to the local health regulator for approval, said Shabir Madhi, a vaccinologist at Johannesburg's University of the Witwatersrand, which is partnering Rubic. Dyadic's technology may later be used to develop other vaccines and treatments, he said. (BBG)

JAPAN: Japan's health ministry is considering using AstraZeneca's Covid vaccine on middle-aged adults, amending earlier plans of administering it to those aged 60 and above, to accelerate its inoculation effort, Nikkei reports, without attribution. Inoculation of the middle-age group has become key focus as their age group represents the biggest share of serious Covid cases in Tokyo. The ministry will hold a panel meeting "soon" to make an official decision. (BBG)

BOJ: MNI INSIGHT: Covid-19 Vaccine Rollout Pace Erodes BOJ Outlook

- Uncertainty over the pace of the Covid-19 vaccine rollout in Japan has eroded the upside chances of a rebound in private consumption, almost two thirds of GDP, as the Bank of Japan weighs the path of recovery for next year, MNI understands. The bank does see an uptrend in private consumption headed into the fiscal year starting April 2022 through pent-up demand for services. Both exports and capital spending are likely to remain firm, so the key is how private consumption recovers - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

AUSTRALIA: Sydney's delta-outbreak cases reached a new peak even as the city nears the end of its fifth week under strict stay-at-home orders, triggering authorities to implement further restrictions and penalties to enforce compliance. New South Wales, Australia's biggest state economy, recorded 239 new cases Thursday -- the highest tally since this outbreak started in Sydney in mid-June. At least 70 cases were active in the community while infectious, concerning health officials that the delta variant may further spread in the city. Mask-wearing in public will be mandated for the city's worst-hit areas, with penalties increased from a A$200 ($147) fine to A$500, New South Wales state Premier Gladys Berejiklian told reporters on Thursday. Stricter travel restrictions will be implemented, and thousands of additional police officers are being tasked with ensuring compliance. (BBG)

SOUTH KOREA: South Korea's top economic policymaker said Thursday the government plans to spend more than 5 trillion won (US$4.3 billion) in supporting chips, bio-health and next-generation vehicle sectors next year. Finance Minister Hong Nam-ki said the country will spare no effort to nurture the three "big" industries. This year, the government plans to offer financial support worth some 4.2 trillion won to the sectors. The country has designated semiconductors, batteries and vaccines as three key national strategic technologies in a bid to provide targeted support to the sectors. (Yonhap)

MEXICO: The top executive at Petroleos Mexicanos slammed the decision by Moody's Investors Service to cut the state oil producer's credit rating further into junk, calling the move "shameful." Pemex, as the company is known, "completely disagrees" with the downgrade and believes Moody's acted unprofessionally, Octavio Romero, the driller's chief executive officer, said Wednesday on its second-quarter earnings call. On Tuesday, the rating agency cited high liquidity needs and increasing business risk in announcing its decision. "It seems to us that it's an action taken by the credit rating agency that lacks professionalism, ethics -- in short, it's something shameful," Romero said. In a press conference after the downgrade, Moody's analyst Nymia Almeida said in response to a question about Romero's comments that the agency applies the same standard to other, similar companies. (BBG)

BRAZIL: Brazil health regulator received request for temporary use of Pfizer's medicine for Covid-19 treatment Xeljanz, according to a note. (BBG)

BRAZIL: Brazil Regulator known as Anvisa approved good practices for a new manufacturing plant that can participate in the production of Pfizer's vaccine delivered to Brazil, according to a statement. (BBG)

RUSSIA: Real disposable incomes in Russia grew in annual terms in the second quarter for the first time since early 2020, while unemployment has almost returned to pre-pandemic levels, data showed on Wednesday. Recovery in incomes is a sensitive issue for Russian authorities, particularly ahead of September parliamentary elections, amid the social discontent with high inflation and restrictions related to the COVID-19 pandemic. (RTRS)

SOUTH AFRICA: About 54% of South Africans say they are unlikely to get a Covid-19 vaccine and almost half say they believe prayer provides more protection than the shots against contracting the disease, a survey showed. The Afrobarometer survey of 1,600 South Africans highlights a hurdle for the government's drive to inoculate two thirds of its 60 million people in a bid to curb infections in the country, which is Africa's worst hit by the disease, according to official statistics. (BBG)

IRAN: With the new Iranian government about to take office, U.S. officials are stressing that Iran won't win more concessions by attempting to renegotiate the understandings reached in Vienna. The U.S. hoped an agreement on returning to the 2015 nuclear deal would be reached before hardliner Ebrahim Raisi took office. But after six rounds of talks, the negotiations were suspended by the Iranians until the new government can form its own negotiating team. (Axios)

IRAN: The State Department on Wednesday said it was monitoring reports of internet outages and slowdowns in Iran amid ongoing anti-government protests spurred by a water shortage in the country. State spokesman Ned Price said in a statement issued by his office that the U.S. supports the "right" of the Iranian people "to voice their frustrations and hold their government accountable." "The Iranian people are now putting a spotlight not only on their unmet needs but also their unfulfilled aspirations for respect for human rights — rights to which individuals the world over are entitled," Price explained. (The Times)

EQUITIES: Samsung Electronics Co. offset relative weakness in smartphone shipments by capitalizing on another quarter of roaring demand for its memory chips. Samsung, the world's largest smartphone and memory-chip maker, is considered an industry bellwether because it is both a major electronics maker and components supplier to the world's biggest tech firms, including Apple Inc. and Sony Group Corp. The South Korea-based company posted second-quarter net profit of 9.63 trillion won, or the equivalent of $8.37 billion. That represented a 35% increase from 7.14 trillion won a year earlier. (WSJ)

CHINA

POLICY: China's upcoming midyear Politburo meeting on the economy may decide against further loosening in H2 to leave policy space for next year, the 21st Century Business Herald reported citing researcher Zhang Jiqiang with Huatai Securities. The critical meeting, usually held at the end of July, decides on the theme for H2 economic measures, the newspaper said. The conference is likely to call for continued curbs on housing, promote carbon neutrality policies and discuss inflation, the newspaper said. Given that this year's growth pressure may be relatively lower than the uncertainties next year, policymakers may be reluctant to give another RRR cut and also delay fiscal boost till next year, the newspaper said. (MNI)

ECONOMY: China's economy remains positive and the foundation of its capital markets is solid, Xinhua News Agency said in an editorial in an apparent effort to calm the routed domestic stock and other financial markets. In addition to a strong economy, the market has reasonable liquidity and the PBOC has expressed continued normal monetary policy space and further support to the real economy, the official news agency said. China continues to support businesses choosing where to list and to speed up the opening of its capital markets, Xinhua said. Addressing the newly toughened rules over fintech and curbs over investments in the after-school tutoring industry, which shook up some investors, Xinhua said the rules were meant to promote healthier social development and prevent excess capital putting pressure on the public education systems and the students. The authorities will further reform the capital market to respond to China's economic demand, Xinhua said. (MNI)

YUAN: Yuan-denominated assets will remain highly attractive and the share of Chinese currency assets in global asset allocation will continue to rise, China Securities Journal, one of China's three most widely circulated financial dailies, says in an editorial Thursday. The fundamental of China's economy continues to improve and the profitability of listed companies is expected to improve substantially. Yuan assets are more cost-effective and have more allocation value compared to other assets. China's stock and bond markets continues to be optimized to facilitate foreign investment. The attractiveness of yuan assets will steadily increase, as China further opens up, advances its technological innovation and upgrades consumption

YUAN: China is speeding up the trial use of its digital currency with the PBOC recently included China Merchant Bank as a digital currency operator, joining most of the country's big banks, telecoms as well as Ant Financial and Tencent Financial participating in the promotion of the digital currency's operations, the Economic Information Daily said. Provincial capitals including Hainan, Changsha and Xi'an were also joining other cities disclosing their report cards on the adoptions of the new currency in their areas, it said. However, the digital currency remains little understood by consumers and merchants, and so far the uses are limited to the issuances of low-amount red packets, the newspaper said. (MNI)

EQUITIES: China's securities regulator convened a virtual meeting with executives of major investment banks on Wednesday night, attempting to ease market fears about Beijing's crackdown on the private education industry. The hastily arranged call, which included attendees from several major international banks, was led by China Securities Regulatory Commission Vice Chairman Fang Xinghai, people familiar with the matter said, asking not to be named discussing private information. Some bankers left with the message that the education policies were targeted and not intended to hurt companies in other industries, the people said. It's the latest sign that Chinese authorities have become uncomfortable with a selloff that sent the nation's key stock indexes to the brink of a bear market on Wednesday morning. (BBG)

OVERNIGHT DATA

AUSTRALIA Q2 EXPORT PRICE INDEX +13.2% Q/Q; MEDIAN +9.9%; Q1 +11.2%

AUSTRALIA Q2 IMPORT PRICE INDEX +1.9% Q/Q; MEDIAN +1.0%; Q1 +0.2%

NEW ZEALAND JUL ANZ BUSINESS CONFIDENCE -3.8; JUN -0.6

NEW ZEALAND JUL ANZ ACTIVITY OUTLOOK 26.3; JUN 31.6

In July, headline business confidence eased 3 points, while firms' own activity fell 6 points to +26%. Other activity indicators generally eased a little. Costs continue to rise, pricing intentions remain extremely high, and inflation expectations continue to lift. The latter hit 3.33% in the late-month sample, suggesting further increases may be in store. (ANZ)

CHINA MARKETS

PBOC NET INJECTS CNY20BN VIA OMOS THURS

The People's Bank of China (PBOC) conducted CNY30 billion via 7-day reverse repos with the rate unchanged at 2.2% on Thursday. The operation net injected net CNY20 billion into the market as there is CNY10billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep end-month liquidity stable, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.2275% at 09:34 am local time from the close of 2.3911% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 36 on Thursday vs 41 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4942 THURS VS 6.4929

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4942 on Thursday, compared with the 6.4929 set on Wednesday.

MARKETS

SNAPSHOT: Relief Rally For Chinese Equities Help Sooth Worry

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 194.76 points at 27776.13

- ASX 200 up 28.111 points at 7406.5

- Shanghai Comp. up 34.967 points at 3396.557

- JGB 10-Yr future down 3 ticks at 152.32, yield unch. at 0.020%

- Aussie 10-Yr future down 0.5 tick at 98.845, yield up 0.2bp at 1.154%

- U.S. 10-Yr future +0-05 at 134-13+, yield up 0.83bp at 1.239%

- WTI crude up $0.27 at $72.66, Gold up $8.64 at $1815.84

- USD/JPY down 13 pips at Y109.78

- FED SIGNALS TAPER CLOSER IF JOB GAINS BUILD (MNI)

- SENATE VOTES TO ADVANCE BIPARTISAN INFRASTRUCTURE BILL (CNBC)

- SANDERS SAYS HE HAS 50 VOTES NEEDED TO PASS A BROAD BUDGET PLAN (BBG)

- CHINA WILL STILL ALLOW IPOS IN THE UNITED STATES, SECURITIES REGULATOR TELLS BROKERAGES (CNBC)

- CHINA'S SOLID ECONOMY GURANTEES CAPITAL MKT DEVELOPMENT (XINHUA)

- EFFICACY OF PFIZER/BIONTECH COVID VACCINE SLIPS TO 84% AFTER SIX MONTHS, DATA SHOW (STAT)

BOND SUMMARY: Core FI Off Best Levels As Chinese Equities See A Relief Bid

A bid for Chinese equities amid suggestions that China will not ban domestic companies from listing equities in the U.S. (per CNBC sources) allowed core FI to move away from best levels of the day during Asia-Pac hours, although ranges were contained.

- T-Notes last +0-05 at 134-13+, operating within a 0-03+ range on volume of ~68K. Cash Tsys are little changed to 1.0bp cheaper across the curve, with a very modest bear steepening bias evident after the light bull flattening that was evident during Fed Chair Powell's Wednesday press conference. 8.0K of screen selling of TUU1 provided the highlight on the flow side. The early NY evening saw the Senate advance the bipartisan infrastructure agreement to the debate/amendment stage, with Democratic Senator Sanders noting that he has the 50 votes required to force the measures through.

- JGB futures continued to coil in Tokyo trade, last printing 2 ticks below yesterday's settlement levels. Cash JGBs were little changed to ~1.0bp richer, with some light outperformance for 30s and 40s evident. Much of the local focus continues to fall on the domestic COVID situation (Chiba is set to request the implementation of a state of emergency today). There was little to extract from the latest 2-Year JGB auction, which saw the low price meet broader dealer expectations (as per the BBG dealer poll), with the cover ratio marginally softer than the prev. auction as the tail moved a little wider. Still, there were no problems with digestion of the supply.

- The record daily number of new COVID cases in NSW (239), coupled with tighter mobility restrictions in 8 Sydney virus hotspots provided some incremental support for Aussie bond futures, before the aforementioned downtick from best levels. YM & XM are unchanged at typing. Appetite for a notable push higher seems to be lacking at present, as the market awaits fresh cues.

JGBS AUCTION: Japanese MOF sells Y2.4275tn 2-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.4275tn 2-Year JGBs:

- Average Yield -0.126% (prev. -0.116%)

- Average Price 100.263 (prev. 100.243)

- High Yield: -0.122% (prev. -0.114%)

- Low Price 100.255 (prev. 100.240)

- % Allotted At High Yield: 3.3441% (prev. 94.4616%)

- Bid/Cover: 4.185x (prev. 4.291x)

JAPAN: Japanese Flows Surrounding Foreign Bonds Dominate Weekly Data

The latest round of weekly Japanese international security flow data (covering a 2-week period in the wake of the Japanese holidays that were observed at the back end of last week) was dominated by Japanese flows surrounding foreign bonds.

- The week ending 16 June saw a net Y782.7bn purchase of foreign bonds, bringing an end to 3 straight weeks of net selling by Japanese investors. This was followed up by Y1.087tn worth of net sales of foreign bonds in the week ending July 23, resulting in a net Y304.7bn of sales of foreign bonds on the part of Japanese investors over the 2-week period.

- Net flows under the remaining categories were much more limited in size.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | -1087.4 | 782.7 | -1714.1 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | 133.5 | -128.9 | -274.7 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | -223.2 | 362.3 | 3592.7 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | -58.5 | -17.5 | -532.7 |

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

EQUITIES: Chinese Indices Lead The Way Higher

Risk sentiment rebounded in the Asia-Pac region despite a slight negative lead from the US. Chinese assets found favour again which was key to direction in the region, the PBOC injected liquidity for the first time since June, the CSRC held meeting with banks to assuage fears and there were reports that China will continue to allow Chinese companies to IPO in the US. These factors culminated in gains of around 1.5% for markets in mainland China, though indices are off opening highs. Gains were broad based; markets in Japan are higher by around 0.4%, moves more muted due to elevated coronavirus cases. South Korean bourses saw gains of around 0.4% helped by a robust earnings report from Samsung. US futures are mixed; e-mini Nasdaq leads the way lower with losses of around 0.3% and set to extend losses from yesterday, after market Facebook dropped after warnings of a slowdown in revenue growth. S&P futures are marginally lower while Dow futures are just keeping their head above water.

OIL: Crude Futures Build On Gains After Supportive Inventory Data

Crude futures are higher in Asia-Pac trade supported by positive risk sentiment in the region with Chinese equity markets rebounding after a recent selloff. WTI is up $0.30 from settlement at $72.69/bbl, Brent is up $0.35 at $75.09/bbl.

- Oil benchmarks rose yesterday with WTI and Brent crude both closing in positive territory. Oil received further support from the weekly DoE inventories report, with the headline crude stockpile seeing a draw of 4mln barrels over the week, close to double market expectations.

- From a technical perspective after taking out the July 26 high at $72.43 bulls will target the 76.4% retracement of the Jul 6 - 20 downleg at $73.46. Brent bulls seek a break of the 76.4% retracement of the Jul 6 - 20 downleg at $75.39.

GOLD: Drawing Support From A Confluence Of Factors

The post-FOMC push lower in U.S. real yields and the DXY, in addition to some respite for Chinese equities and suggestions that China will not ban domestic companies from listing in the U.S. have combined to support bullion over the last 12 hours or so. Spot last deals the best part of $10/oz higher at $1,817/oz. Initial resistance is still some way off, located at the July 15 high/bull trigger ($1,834.1/oz).

FOREX: AUD Dented By NSW Covid Situation, China's Reported Nod For U.S. IPOs Triggers Risk-On Flows

AUD went offered as NSW reported 239 new Covid-19 infections, a record daily increase in its caseload, while officials announced tighter mobility restrictions in 8 Sydney virus hotspots. Major AUD crosses ground lower but generally held tight ranges.

- USD/CNH ignored an in-line PBOC fix but then took a hit as CNBC reported that China will continue to allow domestic firms to go public in the U.S. The spot faltered past yesterday's low.

- The aforementioned CNBC report reduced demand for safe haven currencies. The DXY fell to a fresh two-week low, extending its post-FOMC losses, while USD/JPY posted a marginal uptick.

- German unemployment & flash CPI will take focus in European hours, with U.S. docket headlined by advance Q2 GDP & weekly jobless claims.

FOREX OPTIONS: Expiries for Jul29 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1795-00(E1.3bln), $1.1850-70(E3.0bln), $1.1895-00(E750mln)

- USD/JPY: Y110.00-10($593mln), Y110.90($705mln)

- GBP/USD: $1.3750-55(Gbp539mln)

- AUD/USD: $0.7385-00(A$835mln), $0.7500(A$556mln)

- USD/CAD: C$1.2315-30($1.0bln), C$1.2445-55($540mln)

- USD/CNY: Cny6.4000($1.2bln), Cny6.4500($500mln), Cny6.4615($1.3bln), Cny6.5000($945mln)

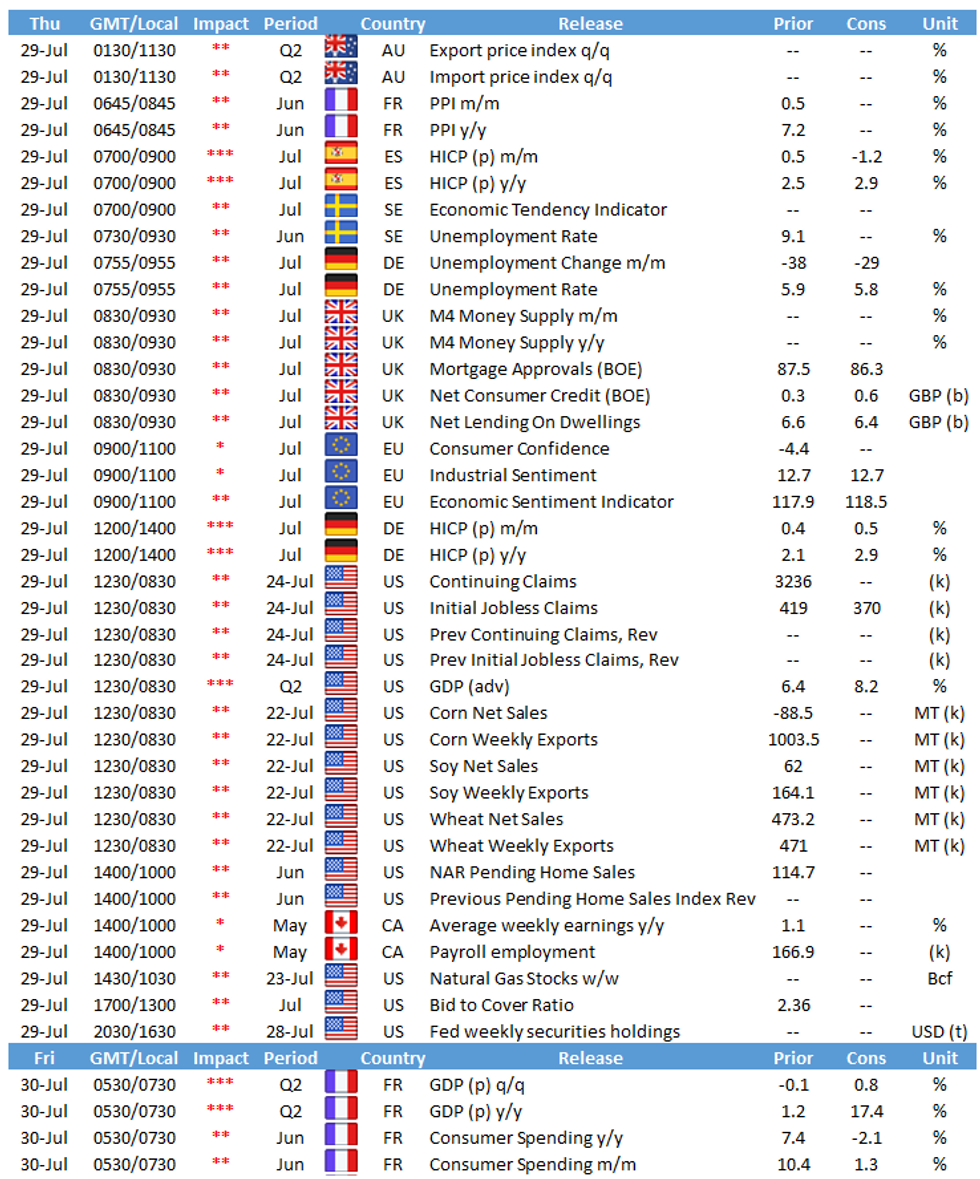

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.