-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: ECB Expected To Cut Rates Later

MNI EUROPEAN OPEN: A$ & Local Yields Surge Following Jobs Data

MNI EUROPEAN MARKETS ANALYSIS: E-Minis Lower In Wake OF Amazon Earnings

- Disappointing revenue and guidance from Amazon weighed on e-minis with the NASDAQ 100 contract underperforming, as you would expect in those circumstances.

- Chinese and Hong Kong equities print lower going into the final few hours of the week.

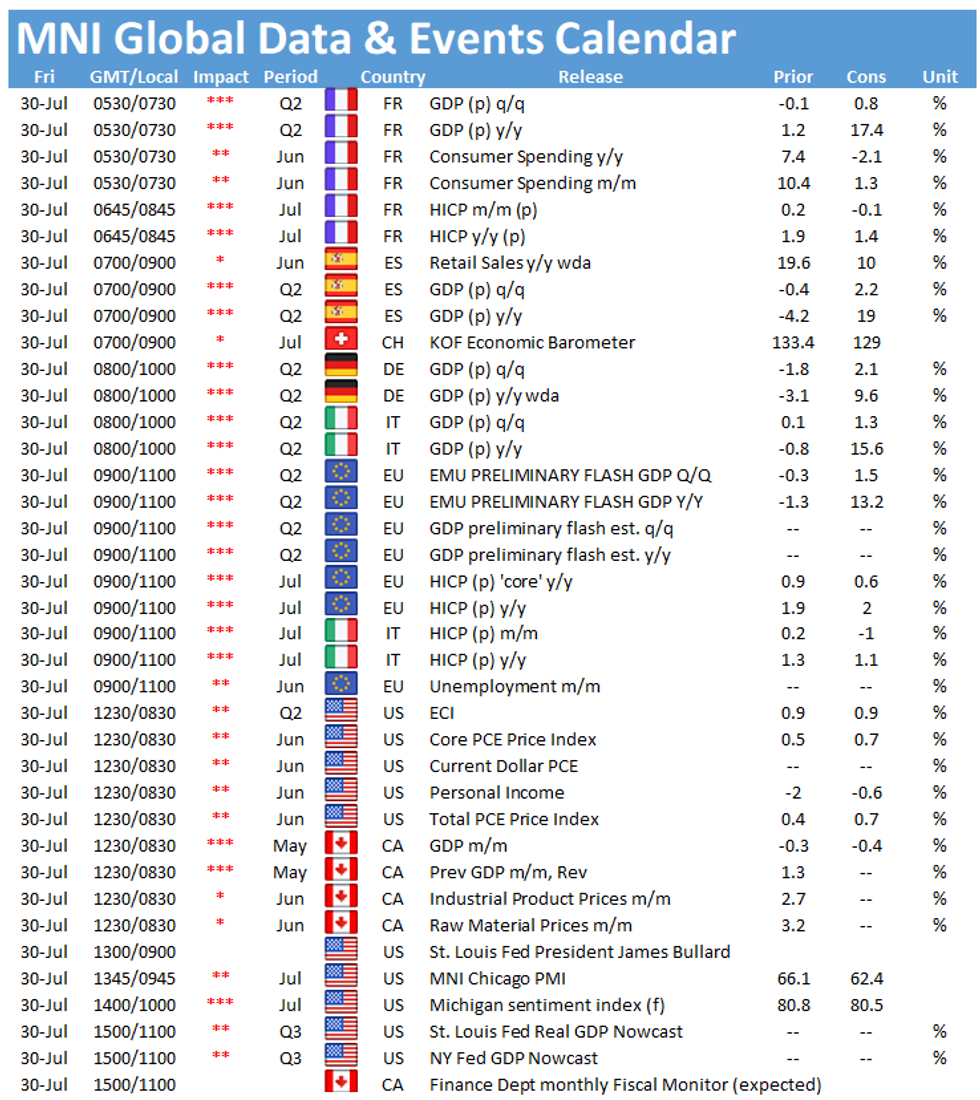

- Flash Eurozone GDP, the latest MNI Chicago PMI reading and an address from St. Louis Fed President Bullard ('22 voter) headline on Friday.

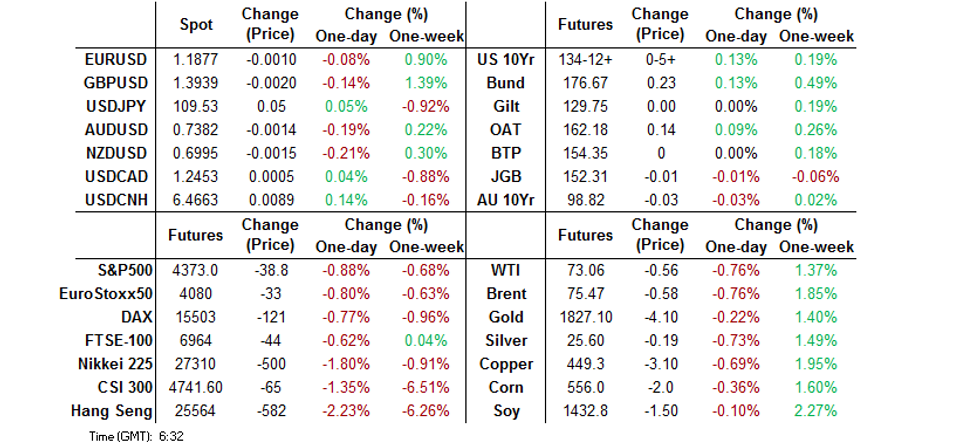

BOND SUMMARY: U.S. Tsys Outperform On Tech-Led E-Mini Weakness

Some weakness in the e-mini space, led by the NASDAQ in the wake of Amazon earnings & guidance, has provided some support for Tsys overnight. A downtick for some of the large Chinese tech equity names also helped the bid. T-Notes last print +0-05 at 134-12, which represents bests levels of the day, on volume of ~120K. The cash Tsy space has bull flattened, with the short-end of the curve ~0.5bp richer on the day, while 5+-Year paper prints ~2.0bp richer, unwinding some of yesterday's bear flattening. 2x 6.0K screen lifts of TYU1 (each equating to $490 DV01 equivalent) headlined on the flow side. Friday's U.S. docket is headlined by PCE data and the latest MNI Chicago PMI reading. Elsewhere, St. Louis Fed President Bullard ('22 voter) will speak on the economy.

- JGB futures gave back their overnight session outperformance, given the cheapening witnessed in U.S. Tsys on Thursday and lack of surprises surrounding the previously flagged COVID state of emergency speculation and subsequent announcements from policymakers. Still, the broader defensive feel evident during Asia-Pac trade likely limited the weakness, with futures -5 at typing. The major cash JGB benchmarks are virtually unchanged across the curve.

- It was a relatively sedate session for Aussie bonds, which struggled to find a bid even with the uptick witnessed in the U.S. Tsy space. YM -1.5, XM -3.5, while cash ACGB trade has seen some steepening, leaving long end paper ~4.0bp cheaper on the day. The A$700mn tap of ACGB 2.75% 21 Nov '27 was smoothly digested, with the weighted average yield printing 0.41bp through prevailing mids at the time of supply (per Yieldbroker), while the cover ratio comfortably topped 5.00x. The previous tap of the line was conducted way back in '18, at a much smaller size and under a different market regime, so any comparisons would be misleading. The pricing through mids may not have been quite as aggressive as some anticipated, but the rarity in terms of taps of the line, market outlook re: the RBA, liquidity dynamic, international appeal and potential demand from dealers identified via AOFM liaison (all of which were flagged ahead of the auction) provided smooth passage despite the recent richening in both outright terms & in the form of belly outperformance. The weekly AOFM issuance slate offered no surprises. Meanwhile, the NSW daily COVID case count ticked back below 200, pulling back from the record high printed earlier this week. Private sector credit data was firmer than expected.

FOREX: USD Gains On Lingering Virus Worry, PBOC Signals Discomfort W/Yuan Strength

The greenback outperformed its G10 peers in muted Asia-Pac trade, albeit by very narrow margins. The DXY advanced off a one-month low, after the 50-DMA crossed above the 100-DMA. Familiar themes continued to weigh on broader sentiment, with several deteriorating Covid-19 outbreaks across Asia stealing the limelight.

- USD/JPY eased off in early trade alongside U.S. e-minis, but erased losses ahead of the Tokyo fix. The fact that it was a Gotobi day in Japan may have helped fuel recovery. The yen paid little attention to domestic economic data, which were generally better than expected.

- USD/CNH crept higher as the PBOC set their central USD/CNY mid-point at CNY6.4602, 24 pips above sell-side estimate. Today's fixing represented the biggest positive miss since June 17, which some interpreted as a sign that China's central bank would prefer to see a weaker yuan. That said, USD/CNH failed to cling onto its post-fix gains and erased them later on.

- European flash GDP prints will hit the wires before flash Eurozone CPI. Canada will also provide an update on its GDP, while the U.S. docket is headlined by core PCE, MNI Chicago PMI & final U. of Mich Sentiment. Fed's Bullard is set to speak today.

FOREX OPTIONS: Expiries for Jul30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1650(E1.2bln), $1.1700(E1.2bln), $1.1850-52(E1.6bln), $1.1865-75(E954mln), $1.1900-20(E1.3bln)

- USD/JPY: Y109.00($527mln), Y110.25-40($615mln)

- USD/CAD: C$1.2400($580mln), C$1.2450($615mln), C$1.2500($630mln)

- USD/CNY: Cny6.4650($585mln)

ASIA FX: Won Gives Back Gains & Turns Negative

Mixed performance for Asia FX with local dynamics in play, some currencies gain despite risk off sentiment while others give back early gains.

- CNH: Offshore yuan is essentially unchanged, USD/CNH crept higher as the PBOC set their central USD/CNY mid-point at CNY6.4602, 24 pips above sell-side estimate. Today's fixing represented the biggest positive miss since June 17.

- SGD: Singapore dollar is flat, paring earlier weakness. Data showed she Singapore Q2 jobless rate fell to 2.7% from 2.9% previously, while banks loans rose 3.5% in June compared to a 1.2% rise in May.

- TWD: Taiwan dollar is stronger, on the coronavirus front Taiwan-based Apple Daily has reported that Taipei could announce dining-in at eateries will be allowed as soon as today.

- KRW: won is slightly weaker, giving back earlier gains amid negative risk sentiment and shaking off strong data. South Korea June industrial output rose above estimates at 2.2% M/M compare to consensus 1.5%. Y/Y also beat estimates at 11.9% while the June cyclical leading index rose 0.3 points on the month

- MYR: Ringgit is stronger, Malaysia's King stepped in to reprimand the government for misleading lawmakers over the cancellation of emergency ordinances enacted during amidst the outbreak of Covid-19, throwing the parliamentary sitting into disarray.

- IDR: Rupiah is higher, the government said Indonesian central bank will begin to reduce excess liquidity carefully in 2022 and will use other policy tools to support growth.

- PHP: Peso gained, BSP Gov Diokno reiterated that Bangko Sentral is committed to a flexible FX policy, as a market-driven exchange rate can serve as a buffer against external shocks. The National Capital Region will be placed under Enhanced Community Quarantine (ECQ) from August 6 to 20.

- THB: Baht has weakened, Thailand's manufacturing production rose 17.58%, below estimates of 19.15%

ASIA RATES: China Futures Make Contract Highs, Unconcerned By Equity Slump

- INDIA: Yields higher in early trade. Markets will await the results of the INR 320bn auction later today (details in earlier bullets), participants will look to see demand at the auction after primary dealers were left to rescue the 6.10% 2031 sale taking INR 111bn of the INR 140bn on offer. The weakness at auction was surprising given that this is a new 10-year line. The 5.63% 2026 line up for grabs also suffered a weak auction on July and INR 104bn of INR 110bn sold was devolved on primary dealers. The RBI have not as yet announced purchase plans for the next GSAP operation. The previous purchase focused in illiquid issues but the sale today could be boosted by inclusion of more liquid lines.

- SOUTH KOREA: Futures are higher today, moving higher amid a decline in equity indices and a reduced slat of sovereign bond issuance in August. 3-Year and 10-Year contracts are near session highs after initially dipping into negative territory. In the cash space yields are lower across the curve with bull steepening seen. 2-/10-Year spread is 0.5bps wider. The won has given back earlier strength as sentiment in the region turns negative, shaking off strong industrial production data earlier in the session. The South Korean MOF will sell KRW 12.5tn of government bonds in August, down from KRW 17.9tn in July.

- CHINA: The PBOC injected a net CNY 20bn today for the second consecutive day after refraining from injections since the end of June. Despite the injection repo rates are higher, the overnight repo rate is up 53bps at 2.1737%, the 7-day repo rate is below yesterday's high but at 2.287% is still above the PBOC's rate. Futures have jumped higher, the 10-year up 21.5 ticks at making a new contract high at 100.10, the sell off in Chinese equities not spreading to bonds today.

- INDONESIA: Yields mostly higher, Indonesia's Financial Services Authority Chair said that the agency is considering extending debt restructuring relaxation amid the resurgence in Covid-19 infections. The final decision will be made by the end of next month. Elsewhere the government said Indonesian central bank will begin to reduce excess liquidity carefully in 2022 and will use other policy tools to support growth.

EQUITIES: Sentiment Switches To Negative

A negative day for equities in the Asia-Pac region, indices paring yesterday's gains after a negative lead from the US. Markets in mainland China are lower the to the tune of ~1%, it seems that pressure on some of the recent "usual suspects" across China & Hong Kong i.e. China Evergrande, Alibaba, Meituan and Tencent, is adding to the downward impetus for risk appetite. Markets in Japan are lower, there were reports that Japan will extend state of emergency declarations to Osaka, Saitama, Chiba and Kanagawa today. US futures are lower with the NASDAQ 100 e-mini contract leading the way lower, currently down around 1.2%. The decline comes on the back of Amazon's quarterly earnings report where revenue slipped and forecasts disappointed.

GOLD: Key Resistance In Sight

A downtick for the broader USD has supported bullion over the last 24 hours or so, even as our weighted U.S. real yield measure ticked away from all-time lows. Asia-Pac trade has been relatively limited, with spot printing little changed, just shy of $1,830/oz at typing. Initial resistance is located at the nearby July 15 high/bull trigger ($1,834.1/oz). Any sustained break there would allow bulls to switch focus to the 61.8% retracement of the Jun 1-29 decline ($1,853.3/oz).

OIL: Comes Off Highs

Crude futures are slightly lower in Asia-Pac trade amid general risk off sentiment but are holding most of the rally seen over the past two days. WTI & Brent print ~$0.40 lower on the day as a result. The move lower comes as the greenback picks up from Thursday's closing lows, USD weakness after Wednesday's Fed decision helped buoy commodities markets across the board. Despite the softness oil is still on track for the second consecutive week of gains with WTI currently up 1.35% for the week. From a technical perspective support is seen at $69.71 the 50- day EMA, Brent also has support at the 50-day EMA of $73.66.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.