-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: RBA Sticks With Taper Plan, RBNZ Unveils Net MacroPru Move

- Fresh, double-barreled Chinese regulatory worry weighs on broader sentiment in Asia-Pac hours.

- Plenty to digest down under as the RBA goes against consensus and maintains its tapering plans, while the RBNZ unveils its next round of macropru measures.

- Fed Governor Waller flags the potential for a taper announcement as soon as September.

BOND SUMMARY: 2-Way Flow On China Reg. Worry & RBA Sticking With Taper Plans

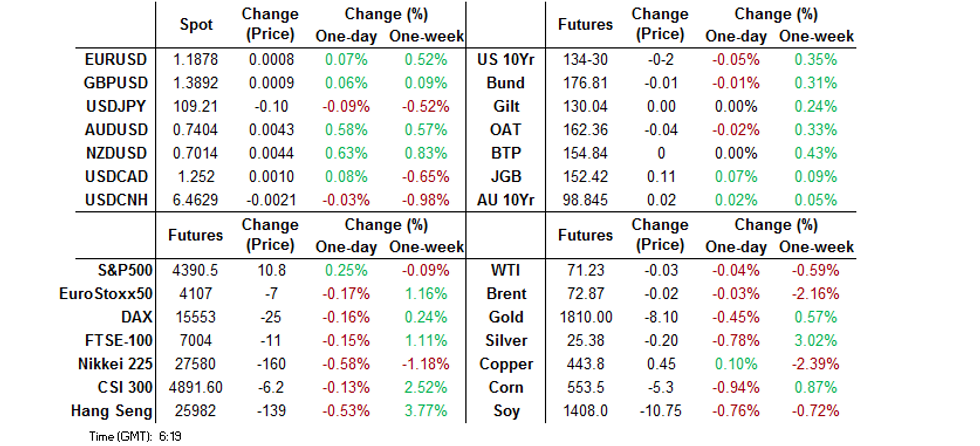

T-Notes squeezed to Asia-Pac session highs as China outlined a crackdown on auto chip sellers surrounding pricing matters, which came after worry surrounding a clampdown on the internet gaming sector in the wake of comments made by state-run media outlets earlier in the day (although the story on that matter was later removed). Dynamics in the Aussie bond space then pulled Tsys away from best levels. T-Notes -0-02 at 134-30 as a result, with cash Tsys little changed to 0.5bp cheaper across the curve. A 1,250 lot block buy of TYU1 (~$103K DV01 equivalent) headlined on the flow side.

- JGB futures stuck to a narrow range, last +10 on the day, with the major cash benchmarks running 0.5-1.5bp richer as 30s outperform. 0.01% in yield terms continues to cap the 10-Year JGB rally. There was no reaction in futures or cash 10s as the latest 10-Year JGB auction provided a mediocre result. The tail widened a touch from the previous round of 10-Year supply but was still relatively narrow. Elsewhere, the cover ratio ticked lower but remained just above the 6-auction average (3.271x). The low price witnessed at the auction provided a marginal miss vs. broader expectations (100.87 per the BBG dealer poll). We highlighted some outright valuation headwinds ahead of supply, although some of the relative value that we touched on may have helped the auction pass without any real problems.

- Aussie bond futures have moved away from best levels of the day in the wake of the RBA decision, with the central Bank not to reneging on its tapering plans. Market consensus looked for the tapering decision to be reversed. The Bank noted short-term uncertainty, while underlining the flexibility of its bond buying and its central scenario re: interest rates, while its medium-term economic projections look in line with wider exp. It also underscored the recent strength witnessed in the labour market and pointed to underlying CPI printing around 2.25% come the end of '23. Expect more colour on the decision in our full review. YM -0.5 with XM +2.5 at typing, with both trading off respective reaction lows.

FOREX: Antipodean FX Get Fillip From Hawkish Central Banks

The RBNZ released a statement outlining their intention to step up efforts to reign the roaring housing market by tightening mortgage lending standards. The statement added that the MPC "needs to think about when and how we would return interest rates to more normal levels, which are neither unnecessarily giving the economy a push forward nor holding it back," while the "next opportunity to publicly address this issue is the 18 August Monetary Policy Statement". The Reserve Bank's intensified crackdown on property prices and hawkish rhetoric provided a boost to OCR hike bets, with the OIS strip currently pricing an ~84% chance of a 25bp hike at the August meeting, up from ~65% yesterday. Hawkish RBNZ repricing pushed NZD to the top of the G10 scoreboard in early Asia-Pac trade.

- AUD caught up with its Antipodean cousin, when the RBA defied market consensus and chose to stick with its tapering plan, despite the ongoing resurgence of Covid-19 in Australia. AUD/NZD clawed back its earlier losses in a single bounce following RBA decision announcement, while NZD extended gains vs. other major currencies as spillover from across the Tasman gave it a shot in the arm.

- USD and CAD went offered across the board despite the absence of notable local headline catalysts. Canadian markets were shut Monday in observance of a public holiday.

- Spot USD/CNH was rangebound, with an in-line PBOC fix providing no material impetus.

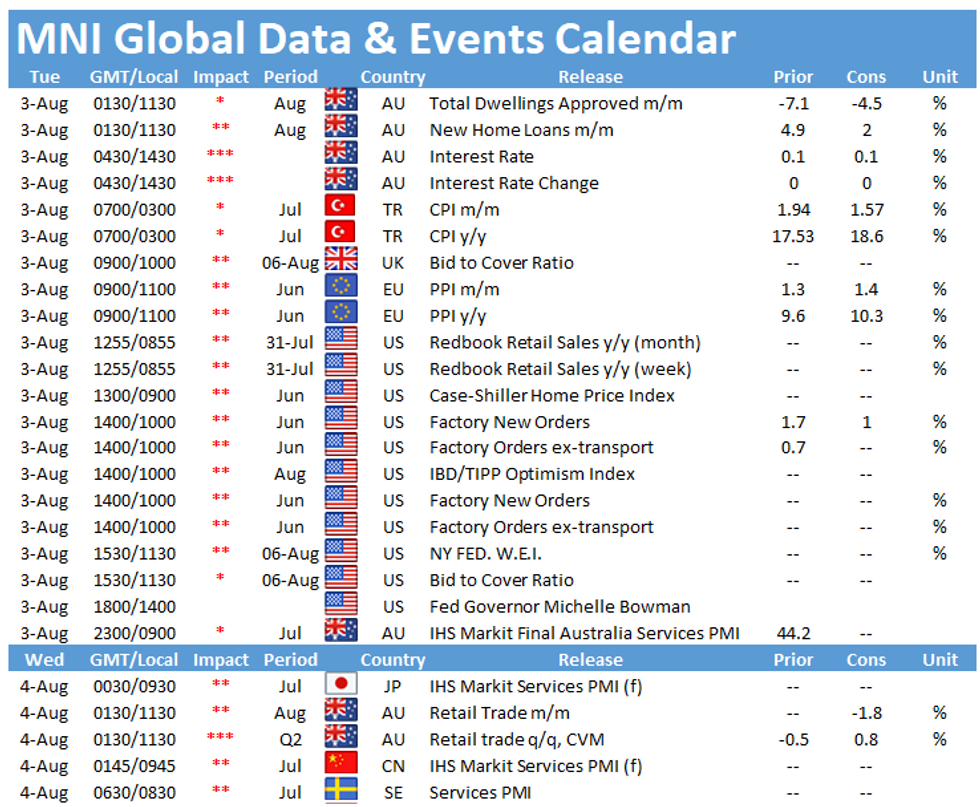

- U.S. factory orders & final durable goods orders headline the global data docket going forward, while Fed's Bowman will speak at a Fed conference.

FOREX OPTIONS: Expiries for Aug03 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1840-55($1.4bln), $1.1880-00(E1.0bln), $1.2000(E868mln)

- USD/JPY: Y110.00($775mln)

- USD/CAD: C$1.2480($1.2bln)

- USD/CNY: Cny6.4780($1bln), Cny6.5000($1.3bln)

ASIA FX: IDR Posts Gains For Fifth Session

Mixed performance for Asia EM currencies again today, the rupiah outperformed its peers and gained for the fifth session.

- CNH: Offshore yuan is slightly weaker, buy holding the majority of last week's gain. Coronavirus concerns are becoming more of an issue; there were 61 cases in the past 24 hours, up from 55 the day before. As a result of the steadily increasing numbers millions of people have been placed under lockdown.

- SGD: Singapore dollar is a few pips stronger, on the coronavirus front case numbers remain elevated, there were 106 new cases yesterday. The current restrictions will be reviewed in early August.

- TWD: Taiwan dollar is stronger, there were 14 new cases on Monday, but Health Minister Chen warned that although the local COVID-19 outbreak has been relatively well controlled there is little possibility of further easing.

- KRW: Won is hovering around neutral levels, CPI earlier was above estimates and higher than the BoK targets for the third month. Markets will look to the BoK minutes later in the session for any clues as to how the fourth wave of coronavirus has affected the outlook and opinions of BoK members.

- MYR: Ringgit is flat. Malaysia declared record highs in both Covid-19 fatalities (219) and patients treated in intensive care units (1,063) on Monday, but there were some positive news as well. The PM announced restrictions will be relaxed in several areas from Aug 4.

- IDR: Rupiah is stronger, outperforming its peers from Asia EM FX space, even as officials decided to extend the multi-tiered lockdown restrictions. Bond inflows are adduced for some of the gain as US yields drop.

- PHP: Peso gained, Philippine unemployment rate remained at 7.7% in June, amid upticks in participation and underemployment.

- THB: Baht is weaker. Ministers are expected to debate further relief measures today after the recent extension & expansion of lockdown measures. The gov't said Monday that residents of the 16 provinces added to the lockdown.

ASIA RATES: Strong Bids At Auction For Indonesia

- INDIA: Yields lower in early trade. Bonds spent the session treading water on Monday, markets shaking off the weak auction from Friday and choosing to focus instead on rising GST collections and a pickup in PMI figures. Markit India manufacturing PMI rose to 55.3 in July, up from 48.1 in June, helped by lower coronavirus case numbers. Elsewhere there were reports that India's plan to sell two state-controlled lenders could be deferred to next financial year, the government is yet to seek parliament's approval for law changes needed for the sale to go ahead. Markets await services PMI data tomorrow but focus remains on the RBI rate announcement later in the week. Bond traders will also watch today's INR 125bn state debt sale.

- SOUTH KOREA: Futures are higher, jumping after a sharp decline into the close on Monday. Data earlier showed CPI rose above estimates, Core CPI rose 1.7% Y/Y, above the 1.5% estimates while headline CPI rose 2.6% against a 2.4% consensus. Inflation above the Bank of Korea's 2% target for the third month in a row, but this expected to have little effect on short end bonds with the rate hike already priced in. Markets will look to the BoK minutes later in the session for any clues as to how the fourth wave of coronavirus has affected the outlook and opinions of BoK members.

- CHINA: After hitting fresh contract highs yesterday futures are lower today, yields also higher after declines in Monday's session. The 10-Year yield fell to 2.8% on Monday, the lowest in over 12 months, as concerns over coronavirus cases combined with expectations of further easing measures from China. Bonds have gained for seven weeks in a row, the longest since the start of the US-China trade war in 2018. Meanwhile repo rates are slightly higher but within yesterday's ranges. The overnight repo rate is at 1.8167% while the 7-day repo rate is at 1.90%. The PBOC injected CNY 10bn, matching maturities with injections.

- INDONESIA: Yields mostly higher but off session highs after strong bids at the bond sale. There were said to be bids for IDR 107.8tn against a target of IDR 22tn at the sale of 2032, 2036, 2042 and 2051 paper. Elsewhere, Indonesia extended its emergency curbs on mobility through Aug 9, with the strictest rules set to be left in place in major Javanese cities, including Jakarta. Min Luhut Panjaitan who coordinates emergency Covid-19 measures said that "confirmed cases, positivity rate and deaths are still high in areas such as Bali, Malang, Yogyakarta and Solo," but also noted that restrictions would be relaxed gradually by the end of the month.

EQUITIES: Asia Markets Lower

A negative day for equity markets in Asia, equity markets slipping after gains yesterday but a slightly negative lead from the US. The Hang Seng led the way lower with losses of almost 1.5%, before paring back from worst levels. Tencent dragged the index down as markets evaluate implications of Beijing's broad crackdown on Chinese internet giants with some negative press reports also doing the rounds. Markets in mainland China are lower by around 0.5%, coronavirus concerns are becoming more of an issue; there were 61 cases in the past 24 hours, up from 55 the day before. As a result of the steadily increasing numbers millions of people have been placed under lockdown. Markets in South Korea and Taiwan are slightly lower, there are some marginal gains in other emerging market indices. In the US futures are slightly higher, e-mini Dow and e-mini S&P contracts seeing small gains and e-mini Nasdaq flat.

GOLD: Consolidating

Bullion has consolidated around the middle of the recently observed range over the last 24 hours, with the DXY a touch lower and our weighted U.S. real yield monitor a little higher over that horizon. Monday's well-documented taper-related comments from Fed Governor Waller did little to stir bullion, with spot operating well within the confines of the well-defined technical overlay, last dealing at $1,810/oz. Fed Vice Chair Clarida's latest address (Wednesday) and the latest U.S. NFP print (Friday) are set to provide the key inputs for participants during the remainder of the week.

OIL: Holding Losses

WTI & Brent futures are virtually unchanged at typing. Oil benchmarks retreated Monday, with the active WTI and Brent futures contracts off over 3.5% despite relatively sanguine markets elsewhere. WTI futures were mean reverting, with prices gravitating towards the 50-DMA at $70.55/bbl. Macro data may have added some weight, with China's manufacturing PMI and the US ISM manufacturing release below expectations. This, twinned with OPEC's recent supply deal weighed on energy markets on Monday. There could be further headwinds the latest wave of coronavirus infections continues to dominate headlines in Asia, the latest figures from Indonesia showed that gasoline usage fell almost 25% due to lockdown restrictions in July while cases in China are ticking higher. Markets look ahead to earnings from BP and US API inventory data.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.