-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Announces Raft Of Key Nominations

BRIEF: EU-Mercosur Deal In Final Negotiations - EC

MNI EUROPEAN MARKETS ANALYSIS: USD & U.S. Tsy Yields Edge Higher Ahead Of NFPs

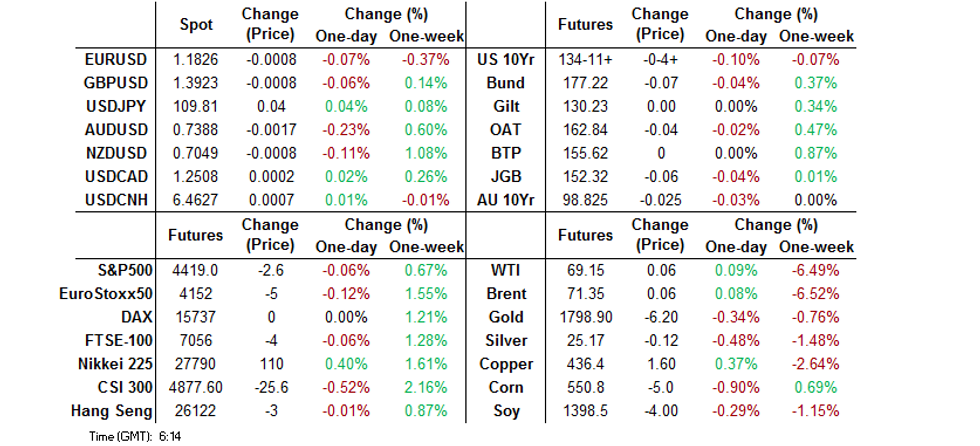

- USD a touch firmer while U.S. Tsy yields nudge higher ahead of NFPs.

- RBA retains glass half full approach.

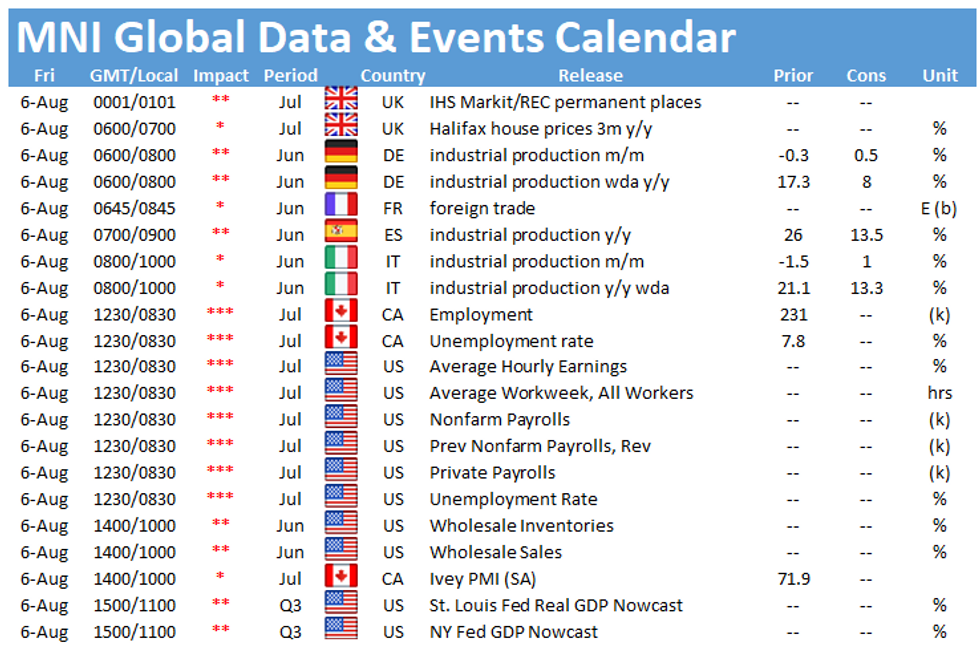

- Friday's broader docket is dominated by the aforementioned U.S. labour market report, with the Canadian equivalent also due to hit.

BOND SUMMARY: Tsys Drift Lower In Pre-NFP Asia Trade

T-Notes have seen some modest pressure overnight, with Thursday's cheapening impetus seemingly spilling over into Asia-Pac dealing given the lack of macro headline flow. This allowed the contract to move through Thursday's trough. Still the contract continues to operate within a fairly narrow 0-05 range, last -0-05 at 134-11, 0-01 off lows. Cash Tsys print ~0.5-1.5bp cheaper on the day, with some modest bear steepening in play. The most notable round of overnight flow has focused on the upside, with the TYU1 134.00/135.00 call spread lifted 10K times (5.0K outright, 5.0K covered). The monthly NFP print headlines the NY docket on Friday.

- JGB futures have played catch up after outperforming overnight, last sitting 8 ticks below yesterday's settlement levels. The cash JGB curve saw some light twist steepening pressure around the belly of the curve, although yields sit within the confines of -/+1.0bp vs. yesterday's closing levels in net terms. The latest round of domestic wage and household spending data provided a notable set of misses vs. exp. A quick reminder that Japan will observe a national & market holiday on Monday, so JGBs will be closed.

- Over in Australia YM is -2.0 & & XM is -2.5 at typing, although the drift lower in U.S. Tsys seems to be the driving factor there, as opposed to developments surrounding the RBA. We had most of the loose details surrounding the RBA's key economic projections on Tuesday, via the statement that accompanied the Bank's latest monetary policy decision. The tone of RBA Governor Lowe's testimony was upbeat (matching the "half full" label on his coffee cup), albeit cognisant of risk, which was reflected in the Bank's '21 projections re: economic growth (only shaving 0.75ppt off of its '21 GDP growth call, despite the recent lockdowns), while the Bank marked its '22 GDP exp. higher, aided by base effects. The Bank's end '21 unemployment rate estimate was left unchanged at 5.0%. Comments surrounding the AUD (effectively happy with AUD weakness, although noting it wasn't a target) & macroprudential matters (no need at present but could be a need in a year or so) generated the most interest when it came to Lowe's address. A$700mn of ACGB Nov '25 supply passed smoothly, with the weighted average yield printing 0.75bp through prevailing mids at the time of supply (per Yieldbroker). The latest AOFM weekly issuance schedule sees a slightly longer long bond on offer next week (ACGB 3.25% 21 June 2039), although the size of that auction will be a tiny A$300mn (A$523K DV01).

FOREX: Lowe Sends Aussie Lower

It was a typically subdued pre-NFP Asia-Pac session, with the AUD taking a hit as RBA Gov Lowe welcomed the depreciation of local currency, although he stated that policymakers are not targeting the exchange rate. Further deterioration in Sydney's Covid-19 situation may have added some pressure to AUD, making it the worst G10 performer.

- USD garnered some strength ahead of today's NFP report, with the DXY rising past yesterday's peak to fresh weekly highs. The loonie was the second strongest G10 currency, diverging from its oil-tied peer NOK, with Canadian jobs report also coming up.

- The final PBOC fix of this week fell in line with sell-side expectations, allowing spot USD/CNH to remain broadly directionless in rangebound trade.

- While U.S. labour market data takes centre stage today, German industrial output and Canadian unemployment will also provide some interest. There are no notable central bank speakers today.

FOREX OPTIONS: Expiries for Aug06 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800(E970mln), $1.1825(E625mln), $1.1895-00(E509mln)

- USD/JPY: Y109.50-70($608mln), Y110.00-10($626mln)

- EUR/GBP: Gbp0.8400(E890mln)

- AUD/USD: $0.7400(A$582mln)

- USD/CAD: C$1.2450-60($1.6bln), C$1.2525($1.1bln), C$1.2600($1.0bln)

- USD/CNY: Cny6.45($725mln)

US DATA PREVIEW: Primary Dealer Nonfarm Payroll Estimates

| Dealer | Estimate | Dealer | Estimate |

|---|---|---|---|

| Jefferies | +1.20mn | Citi | +1.15mn |

| Goldman Sachs | +1.15mn | Credit Suisse | +1.10mn |

| Nomura | +1.05mn | Morgan Stanley | +1.025mn |

| Amherst Pierpoint | +1.015mn | BNP Paribas | +1.00mn |

| Deutsche Bank | +1.00mn | TD Securities | +1.00mn |

| UBS | +953K | HSBC | +900K |

| J.P.Morgan | +900K | RBC | +880K |

| Wells Fargo | +865K | Societe Generale | +825K |

| Scotiabank | +800K | Mizuho | +775K |

| Barclays | +750K | Bank of America | +750K |

| Daiwa | +750K | NatWest | +700K |

| BMO | +675K | ||

| Dealer Median | +900K | BBG Whisper | +895K |

ASIA FX: Dovish Central Banks & Coronavirus Dampen Sentiment

The greenback gained a handful of pips in a quiet pre-NFP session, risk tone slightly negative.

- CNH: Offshore yuan is flat, USD/CNH has stuck to a tight range since Friday last week, keeping a 200 pip range and coiling as the week goes on. One-month CNH implied volatility slid for a sixth day on Thursday to intraday lows of 4.1125%, denoting the longest decline since June. Trade data is due over the weekend.

- SGD: Singapore dollar is weaker, but off worst levels of the day. There were 96 coronavirus cases in the past-24 hours, below 100 for a third day. The government are due to review social distancing measures soon.

- TWD: Taiwan dollar is slightly weaker, snapping a four-day winning streak. There were reports that Taiwan to extend Covid level 2 alert until Aug. 23.

- KRW: Won is slightly stronger but off best levels of the session. There were 1,704 new coronavirus cases in the past 24 hours, it was reported earlier that South Korea will extend its tough social distancing restrictions for two more weeks through Aug. 22

- MYR: Ringgit is weaker, Malaysia reported a record 20,596 new Covid-19 cases Thursday while UMNO sources told the Star that at least 19 lawmakers will meet with Dep PM Ismail Sabri today to decide whether to stick with PM Muhyiddin.

- IDR: Rupiah is lower, FinMin Indrawati said that economic expansion could hit the upper end of the government's +4.0%-5.7% Y/Y forecast range this quarter if the outbreak of coronavirus Delta variant is contained.

- PHP: Peso fell, dropping toward a 13-month low. The capital region started a two-week lockdown, while Central Bank said this week a reserve-ratio cut is on the table. The trade deficit widened more than expected.

- THB: Baht weakened, a Bangkok court will today decide on revoking the government's order, which restrained reporting on Covid-19 news. The country reported a record 21,379 new cases and a record 191 deaths today, while officials flagged Thursday that 100,000 Bangkok residents remain in home isolation.

ASIA RATES: RBI Holds Rates, Yields Rise

- INDIA: The RBI voted to keep rates on hold and retain the accommodative stance. Interest rates are unchanged for a seventh straight meeting, the Bank reiterated the focus remains bringing the economy back on growth path, rather than controlling inflation as fears of a third wave loom large. Das was largely upbeat about the economy, acknowledging the recovery was fragile but said consumption should pick up with vaccinations, he said inflation was a concern but was transitory. The MPC voted 5-1 to keep rates unchanged.Yields rose in the immediate aftermath of the announcement despite the dovish tone, potentially factoring in a dissenter at the meeting or possibly some scepticism over the transitory inflation narrative.

- SOUTH KOREA: Futures are lower, on track for a third session of declines. Equity markets in South Korea are slightly lower on the day. The cash space has twist flattened. On the coronavirus front there were 1,704 new cases in the past 24 hours, in the 1,700s for a third day. It was reported earlier that South Korea will extend its tough social distancing restrictions for two more weeks through Aug. 22.

- CHINA: The PBOC injected CNY 10bn of liquidity into the system via OMOs today, equating to a net drain of CNY 20bn. Repo rates have risen slightly but are within recent ranges, overnight rate up 13bps at 1.8305%, 7-day repo rate is up 3.9bps at 1.989%. Futures are lower but off worst levels as equity markets struggle. There were reports that local government bond sales will increase in August and September due to slower issuance in the first seven months.

- INDONESIA: Yields higher across the curve today, FinMin Indrawati said that economic expansion could hit the upper end of the government's +4.0%-5.7% Y/Y forecast range this quarter if the outbreak of coronavirus Delta variant is contained. Econ Min Hartarto noted that GDP growth could top +5.0% Y/Y in Q4. This followed Indonesian Q2 GDP data beating expectations yesterday, as the economy grew 7.07% Y/Y. On the data front, focus turns to Indonesia's consumer confidence data. Danareksa Research's gauge is expected to hit the wires today.

EQUITIES: Indices A Touch Softer Ahead Of NFP

Mostly negative sentiment in Asia with major equity markets in minor negative to flat territory as coronavirus concerns continue to dampen sentiment across the region while the energy sector weighed as oil posts its worst week this year. Markets in Hong Kong and mainland China are the laggards, down by around 0.7%. There were reports in state media of a continuation of the regulatory crackdown with calls for greater scrutiny on marketing of baby-milk formula. Markets in Japan were hovering around flat, Nintendo tempered upside after missing estimates in its latest earnings report. In the US futures are slightly lower after equity bourses hit a record high yesterday, participants await the latest US NFP data later in the session.

GOLD: Still Within The Lines, But Bears Look To Test Support

An uptick in the DXY during Asia-Pac hours and consolidation of yesterday's gains in U.S. real yields leaves spot gold trading around the $1,800/oz mark at typing, a handful of dollars below settlement levels. Still, the technical picture we have outlined on many occasions remains intact.

- Initial support is located at the July 23 low ($1,790.0/oz) and initial resistance is seen at the July 15 high/bull trigger ($1,834.1/oz).

- Friday's NFP print represents the clear risk event ahead of the weekend.

OIL: Benchmarks On Track For Worst Week Since October

Oil is slightly higher in Asia-Pac trade on Friday, holding gains from Thursday. WTI is up $0.07 from settlement at $69.16/bbl, Brent is up $0.09 at $71.38. Oil is on track to decline around 6.5% this week, which would be the worst weekly performance since October 2020. The bounce Thursday was preceded by lower lows for both contracts, meaning lower lows have now been printed for five consecutive sessions. Hawkish comments from the Israeli defense minister Gantz may have provided a floor for now, as he stated Israel would be willing to adopt a war footing with Iran should the situation require it. For Brent specifically, the move below the 50-day EMA this week looks convincing, with support now exposed at $66.43. To resume any incline, bulls need to again take out $74.47, the 76.4% retracement of the Jul 6 – 20 downleg.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.