-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: All Eyes On U.S. Inflation

EXECUTIVE SUMMARY

- FED'S EVANS SAYS HE EXPECTS SUBSTANTIAL PROGRESS LATER THIS YEAR (BBG)

- BOOSTER DOSES FOR NEXT YEAR COST GBP1BN AS AFTER PFIZER PUTS PRICE UP (Times)

- CHINESE COURT SENTENCES MICHAEL SPAVOR TO 11 YEARS IN PRISON (Globe & Mail)

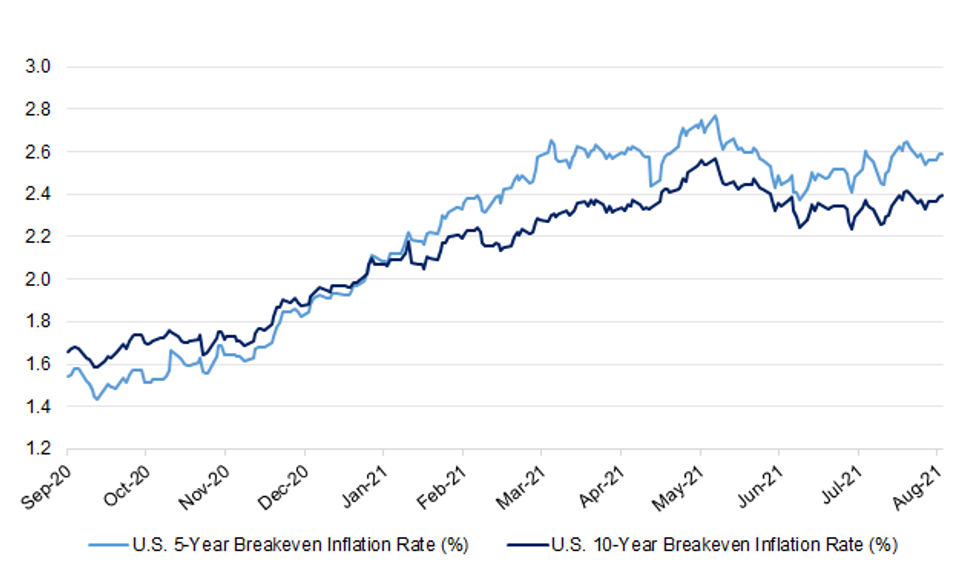

Fig. 1: U.S. 5- & 10-Year Breakeven Inflation Rates (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Britain has ordered 35 million doses of the Pfizer coronavirus vaccine for next year's autumn booster campaign at a significantly higher cost after the US drugmaker raised prices in response to demand, The Times has been told. The government is poised to announce a £1 billion deal for the doses this week after ministers were warned that the UK could run out of jabs in 2022, leading to further lockdowns. (Times)

CORONAVIRUS: Herd immunity is "not a possibility" due to the prevalence of the Delta variant, a scientist behind the Oxford vaccine has warned, amid signs that the UK's recent fall in Covid cases and hospital admissions is stagnating. (Independent)

BREXIT: Emergency powers to handle post-Brexit queues of lorries heading for France are being made permanent, signalling the government expects further cross-Channel disruption. Operation Brock, a traffic management system designed to cope with queues of up to 13,000 lorries heading for mainland Europe across Kent, was meant to end by October 2021, after being extended once when the Brexit transition period ended in December 2020. But ministers are planning to make the provisions indefinite by removing "sunset clauses" from the legislation that set out when the powers would expire, the Guardian has learned. (Guardian)

ECONOMY: The technology executive leading a white knight bid to take over Britain's biggest microchip factory has vowed to spend up to £300m on the plant amid a battle to prise it out of Chinese control. Ron Black said a consortium of six companies is ready to step in with a bid for the factory, Newport Wafer Fab, if the Government intervenes to block its acquisition by Shanghai-owned company Nexperia. (Telegraph)

EUROPE

ECB: MNI INTERVIEW: No Early ECB Review Impact On Italy Issuance

- The European Central Bank's new strategic policy framework hasn't and won't have any short-term direct impact on Italian debt issuance, Davide Iacovoni, the Treasury's general director of Public Debt told MNI in an interview Monday - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

GERMANY: Germany will expand Covid-19 testing requirements for non-vaccinated people and end free tests to prod more residents to roll up their sleeves. Starting later this month, negative results will be required for people who haven't been inoculated or can show they've recovered from the disease to eat in restaurants, go to the hairdresser and attend sporting events. The government will no longer pay for antigen tests as of Oct. 11. (BBG)

ITALY: MNI INTERVIEW: Italy 2021 L-T Debt Sales May Be Below Expected

- Italy's 2021 debt issuance should fall short of initial expectations with a clearer overall picture likely in coming months, Davide Iacovoni, the Treasury's general director of Public Debt told MNI Monday, although a new dollar bond could still be issued in the later in the year if 'market conditions' are right - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

POLAND: Poland's ruling nationalist coalition collapsed Tuesday after Prime Minister Mateusz Morawiecki fired the leader of a smaller partner party over disagreements on tax policy and a controversial media law that's set off a fight with the United States. The fracturing comes a day ahead of a key parliamentary vote on a law that would bar companies from beyond the European Economic Area from owning a majority stake in Polish media companies. Critics say this is largely aimed at the popular TVN broadcaster, owned by Discovery of the U.S., which irritates the government with its independent news coverage. Thousands of protesters took to the streets Tuesday evening to demonstrate against the bill, complaining it endangers press freedom. It's still unclear if the United Right coalition, led by the Law and Justice (PiS party) can soldier on without the 13 MPs who formally belong to the Accord grouping of Jarosław Gowin. (Politico)

US

FED: "I do expect that we are going to be at the point where we've seen substantial further progress later this year -- probably later this year. I don't think it's going to be into next year," Chicago Fed President Charles Evans says, referring to U.S. central bank's marker for tapering asset purchases. "It might actually start" next year if the judgment is made at the December Federal Open Market Committee meeting, Evans tells reporters Tuesday during a roundtable discussion with media. (BBG)

FED: Members of President Biden's economic team generally support nominating Federal Reserve Chairman Jerome Powell to a second term, but growing resistance from prominent Democrats including Sen. Elizabeth Warren (D., Mass.) could lead to his replacement, according to people familiar with the matter. Mr. Powell, who was appointed to his first term by former Republican President Donald Trump, has received high marks from some Democrats for steering the central bank toward a paradigm shift that has placed greater attention on reducing unemployment. That coincided last year with a forceful response to the coronavirus pandemic. But some progressives are unhappy with his bent toward easing financial regulations that were put in place after the 2008 crisis and think the central bank should have someone more in sync with Democratic politics in charge. (WSJ)

FISCAL: The Senate passed a $550 billion infrastructure plan that would represent the biggest burst of spending on U.S. public works in decades, sending the legislation to the House where its fate is in the hands of the fractious Democratic caucus. The bipartisan 69-30 vote Tuesday marked a significant victory for President Joe Biden's economic agenda. It was a breakthrough that has eluded Congress and presidents for years, despite both parties calling infrastructure a priority and an issue ripe for compromise. (BBG)

FISCAL: Most Republican senators have signed on to a pledge to force Democrats to raise the debt ceiling through procedures that don't rely on GOP votes, escalating the political tug of war over who is responsible for keeping the U.S. from defaulting. Sen. Ron Johnson (R.. Wis.) said in an interview that some 46 Republicans have signed on to a letter that he circulated during a rapid-fire series of votes on a budget resolution that kicks off Democrats' efforts to pass a $3.5trillion cornerstone of President Biden's agenda." They shouldn't be expecting Republicans to raise the debt ceiling to accommodate their deficit spending," Mr. Johnson said. (WSJ)

FISCAL: The Senate has kicked off an hours-long slog as Democrats try to pass a budget resolution that is a first step toward their $3.5 trillion spending plan. Senators are at the start of what is expected to be an hours-long vote-a-rama, where any lawmaker can force a vote on anything they want. Hundreds of potential amendments have already been filed. Republicans are expected to force dozens of messaging votes that let them highlight key areas of opposition to the massive spending plan, which Democrats are expected to try to pass without GOP votes later this year. (Hill)

POLITICS: New York Gov. Andrew Cuomo announced on Tuesday that he will resign from his post, effective in 14 days, after an independent investigation found that he sexually harassed multiple women in violation of federal and state law. What he's saying: "I would never want to be unhelpful in any way. And I think that given the circumstances, the best way I can help now is if I step aside and let government get back to government. And therefore that's what I'll do, because I work for you, and doing the right thing is doing the right thing for you," Cuomo said in televised remarks. New York Lt. Gov. Kathy Hochul (D) will be sworn in as governor once Andrew Cuomo's resignation goes into effect. (Axios)

OTHER

CANADA/CHINA: Canadian businessman Michael Spavor has been found guilty of espionage by a Chinese court and sentenced to 11 years in prison. A court in the northern Chinese city of Dandong said Mr. Spavor had been found guilty of spying and illegally providing state secrets to foreign entities. Mr. Spavor will have up to two weeks to file an appeal against this verdict, Canadian officials said. Speaking via video link from Dandong after meeting with Mr. Spavor, Canada's ambassador to China, Dominic Barton, said "we condemn in the strongest possible terms" the verdict and sentence, which were "rendered without due process or transparency." (Globe & Mail)

GEOPOLITICS: This week's Sino-Russian joint military exercise in northwest China is putting the PLA's latest combat tactics to the test as well as many of its newest weapons, which are being used by the Russians for the first time. (SCMP)

AUSTRALIA: Australian authorities on Wednesday extended a lockdown in Melbourne for another seven days until Aug. 19 as authorities fight to get on top of the highly infectious Delta variant. (RTRS)

SOUTH KOREA: South Korea's daily new coronavirus cases reached a new high of over 2,200 on Wednesday since the start of the pandemic in January last year in the face of month-long toughened virus curbs and a slower than expected vaccination campaign.(Yonhap)

NORTH KOREA: North Korea on Wednesday slammed South Korea and the United States again for going ahead with its joint military exercise, warning it will make the allies feel a serious security crisis every minute. Kim Yong-chol, head of the North's United Front Department handling inter-Korean affairs, made the remarks in a statement carried by the official Korean Central News Agency, saying the South Korean authorities have defied the opportunity to make a turn in relations. (Yonhap)

NORTH KOREA: North Korea did not answer South Korea's phone calls via liaison and military hotlines for the second consecutive day Wednesday, officials said, as Pyongyang is ramping up criticism against the South for going ahead with its summertime exercise with the United States. (Yonhap)

PHILIPPINES: The Philippine central bank said its holdings of government bonds rose almost 400% during the pandemic, and outlined a strategy of carefully reducing purchases when the economic recovery becomes sustainable. Bangko Sentral ng Pilipinas' outstanding government securities holdings was 1.52 trillion pesos ($30.2 billion) at end-June, up from 313.9 billion pesos at end-2019, it said in an emailed reply to questions Tuesday. As economic recovery becomes more sustainable, the central bank said it will "carefully unwind some of the government security purchases as part of its exit strategy from extraordinary monetary accommodation," without giving a timeframe. In the meantime, BSP said it will continue to "provide support to market players and ensure there is sufficient liquidity in the system." (BBG)

MALAYSIA: Prime Minister Muhyiddin Yassin faces a crucial day on Wednesday (Aug 11), after opponents ramped up pressure this week in a bid to prove to Malaysia's King that the government's majority has evaporated. Not only will the Parti Pribumi Bersatu Malaysia president have a pre-Cabinet audience with Sultan Abdullah Ahmad Shah, but he is also due to meet chiefs of his beleaguered Perikatan Nasional (PN) pact in the afternoon after a week where the premier appears to have slipped even further from the target of more than half the 220 members of Parliament, where two seats remain vacant. The Straits Times reported on Tuesday that letters representing the 105 MPs of the opposition were sent to the palace on Monday, confirming they reject Tan Sri Muhyiddin's leadership. (Straits Times)

BRAZIL: Brazil's lower house of Congress voted down a plan by far-right President Jair Bolsonaro to alter the country's voting system on Tuesday, despite on an unusual display of military hardware by the armed forces. (RTRS)

PERU: Peru President Pedro Castillo's meeting with central bank chief Julio Velarde was postponed at the government palace's request, according to a person with knowledge of the situation. The meeting hasn't yet been rescheduled. (BBG)

SOUTH AFRICA: South Africa intends to finalize a plan on how to ease reliance on coal this fiscal year as the government prepares for rising energy demand amid ongoing strain on state utility Eskom Holdings SOC Ltd. Implementation of the road map should then take place in 2022/23, according to a draft National Infrastructure Plan for 2050 distributed late Tuesday. The state is also seeking to procure thousands of megawatts in emergency and renewable power in the months through March next year, it said. (BBG)

AFGHANISTAN: There are active discussions about a further drawdown of the US embassy in Kabul among State Department officials, according to two sources familiar with the discussions, as the Taliban continues to gain ground in Afghanistan. Those gains -- which have occurred much more rapidly than many US officials expected -- have made the situation more urgent and sped up the conversations that have been happening for some time now, one source said. US officials are no longer talking about six months as the likely timeline for the government of Afghanistan to collapse; they now believe it could happen much more quickly, the two sources said. (CNN)

AFGHANISTAN: A senior EU official on Tuesday pushed back against a plea from several EU countries to continue deportations of rejected Afghan asylum seekers, saying it was "hard to imagine" the bloc conducting "forced returns" to a country being overrun by Taliban militants. (Politico)

ETHIOPIA: Ethiopia's government on Tuesday summoned all capable citizens to war, urging them to join the country's military to stop resurgent forces from the embattled Tigray region "once and for all." The call to arms is an ominous sign that all of Ethiopia's 110 million people are being drawn into a conflict that Prime Minister Abiy Ahmed, a Nobel Peace Prize winner, once declared would be over within weeks. The deadly fighting has now spread beyond Tigray into neighboring regions, and fracturing in Africa's second most populous country could destabilize the entire Horn of Africa region. (AP)

CRYPTOCURRENCIES: Hackers perpetrated what is likely the biggest theft ever in the world of decentralized finance, stealing about $600 million in cryptocurrency from a protocol known as PolyNetwork that lets users swap tokens across multiple blockchains. Tens of thousands of people are affected by the hack, PolyNetwork said in a letter posted on Twitter. About $33 million of the stablecoin Tether that was a part of the theft has been frozen by Tether's issuer, making it unavailable to the attacker. (BBG)

CHINA

LIQUIDITY: The PBOC is expected to boost liquidity by increasing reverse repo operations or rolling over the maturing medium-term lending facilities when the anticipated rise in local government bond sales drains liquidity, the China Securities Journal reported citing analysts. About CNY1 trillion local government bonds may be issued in August, mainly concentrated in the second half of August, the newspaper said. This may pressure liquidity along with the maturing of CNY700 billion of MLFs as of Aug. 17 as well as the upcoming season of tax payments, the newspaper cited analysts as saying. (MNI)

BONDS: More local Chinese governments are expected to recapitalize their regional banks through selling the so-called special purpose bonds mandated by the Ministry of Finance, the Shanghai Securities News said. This form of recapitalization can burden regional governments with bad debt should these local banks, often with lower credit ratings, run into operational difficulties, the newspaper said. So far this year, eleven provinces have sold such bonds worth CNY112 billion, including Tianjin's CNY9.3 billion offering and CNY7.7 billion by Inner Mongolia, the newspaper said. The finance ministry in November allocated CNY200 billion quotas to be used by 18 provinces for the capitalization purpose, the newspaper said. (MNI)

YUAN: China should expand the scope of yuan pricing and settlement, and facilitate the use of yuan in cross-border trade and finance to promote the internationalization of yuan, the China Securities Journal reported citing Tu Yonghong, deputy director of the International Monetary Institute at Renmin University. China should facilitate the use of yuan when conducting direct investment overseas by adopting a "closed-loop" yuan-based capital flow, the journal said citing Tu. Yuan settlement accounted for only 14.7% of China's foreign trade in H1, the newspaper said citing Guan Tao, a former FX regulatory official. (MNI)

OVERNIGHT DATA

JAPAN JUL MONEY STOCK M2 +5.2% Y/Y; MEDIAN +5.4%; JUN +5.8%

JAPAN JUL MONEY STOCK M3 +4.6% Y/Y; MEDIAN +4.7%; JUN +5.1%

AUSTRALIA AUG WESTPAC CONSUMER CONFIDENCE 104.1; JUL 108.8

AUSTRALIA AUG WESTPAC CONSUMER CONFIDENCE -4.4% M/M; JUL +1.5%

This is a significant further loss of confidence but better than might have been expected given virus developments. Most of NSW remains in an extended lock-down that is showing few signs of ending any time soon. Meanwhile Victoria and Queensland both imposed new snap lock-downs during the August survey week. Despite the deteriorating situation, sentiment has remained in positive territory, even in parts of the country facing the biggest virus challenges. At 104.1, the Index is now at its lowest point in a year but still well above the deeply negative lows seen during last year's national lock-down (75.6) and Victoria's 'second wave' restrictions (79.5). Remarkably, the Index is also comfortably above the readings seen over the twelve months prior to the pandemic (an average read of 97.5). The virus situation locally is clearly troubling, but consumers appear reasonably confident that it will come back under control, and that once it does, the economy will see a return to robust growth. The availability of effective COVID vaccines is a key source of support for confidence. Notably, sentiment is much stronger amongst those that have either been vaccinated or plan to get the jab. This group accounts 76% of all respondents and has a combined sentiment read 10.7pts above those not willing to get vaccinated or who have yet to decide. The gap is literally the difference between optimism and pessimism – in index terms, 106.6 vs 95.9 – and is apparent across all age groups. (Westpac)

SOUTH KOREA JUL UNEMPLOYMENT 3.3%; MEDIAN 3.8%; JUN 3.7%

SOUTH KOREA JUL BANK LENDING TO HOUSEHOLDS TOTAL KRW1,040.2TN; JUN KRW1,030.5TN

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS WEDS; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Wednesday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.1712% at 09:26 am local time from the close of 2.3561% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 39 on Tuesday vs 62 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4831 WEDS VS 6.4842

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4831 on Wednesday, compared with the 6.4842 set on Tuesday.

MARKETS

SNAPSHOT: All Eyes On U.S. Inflation

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 143.96 points at 28032.11

- ASX 200 up 24.939 points at 7587.5

- Shanghai Comp. up 9.548 points at 3539.479

- JGB 10-Yr future down 12 ticks at 152.02, yield up 1.1bp at 0.036%

- Aussie 10-Yr future down 2.5 ticks at 98.785, yield up 2.1bp at 1.221%

- U.S. 10-Yr future -0-02+ at 133-15, yield up 0.68bp at 1.356%

- WTI crude down $0.22 at $68.07, Gold up $4.03 at $1732.96

- USD/JPY up 10 pips at Y110.67

- FED'S EVANS SAYS HE EXPECTS SUBSTANTIAL PROGRESS LATER THIS YEAR (BBG)

- BOOSTER DOSES FOR NEXT YEAR COST GBP1BN AS AFTER PFIZER PUTS PRICE UP (Times)

- CHINESE COURT SENTENCES MICHAEL SPAVOR TO 11 YEARS IN PRISON (Globe & Mail)

BOND SUMMARY: Long-End Supply Headlines In Asia, Tsys Rangebound Ahead Of U.S. CPI

Thin headline flow in Asia-Pac hours allowed participants to focus on today's U.S. CPI data, set to receive additional scrutiny after the latest rounds of Fedspeak fanned taper expectations. Adding to hawkish musings of his colleagues, Chicago Fed Pres Evans said Tuesday that he expects "substantial progress" towards tapering asset purchases later this year. The air of expectancy dominated, keeping T-Notes within a tight 0-02+ range, with the contract sitting -0-02+ at 133-15 as we type. Cash Tsy yields last trade a touch higher across the marginally steepened curve. Eurodollars are unch. to +1.0. There is more Fedspeak coming up today, with Bostic, George and Logan all due to speak. On the supply front, there is a 10-Year Tsy auction coming up today.

- Japanese MoF sold 30-Year JGBs, drawing bid/cover ratio of 3.07x (prev. 3.63x, highest since Nov 2020), with tail widening to 0.11 (prev. 0.03, tightest since May 2019) and low price matching BBG forecast. The offering had no material impact on JGB space and cash yields continued to sit marginally higher, with 10s underperforming. JGB futures were slightly heavy and slid to fresh one-month lows. The contract trades at 152.04, 10 ticks below last settlement.

- The AOFM auctioned A$300mn of the 3.25% 21 Jun '39 Bond, tapping it for the first time since Oct 2020. Cash ACGB curve remained bear-steepened, albeit 10s lagged. Aussie bond futures held narrow ranges, with YM last trading -1.0 & XM -2.5. Bills sit unch. to -1 tick through the reds. The local Covid-19 outbreak continued to provide interest, with a 4.4% monthly decline in Westpac Consumer Confidence reflecting the impact of restrictions on sentiment. Australia-U.S. 10-Year yield spread tightened further, reaching levels not seen since Mar 2020.

JGBS AUCTION: Japanese MOF sells Y734.0bn 30-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y734.0bn 30-Year JGBs:

- Average Yield 0.647% (prev. 0.680%)

- Average Price 101.31 (prev. 100.48)

- High Yield: 0.651% (prev. 0.681%)

- Low Price 101.20 (prev. 100.45)

- % Allotted At High Yield: 35.9782% (prev. 52.9631%)

- Bid/Cover: 3.071x (prev. 3.632x)

AUSSIE BONDS: The AOFM sells A$300mn of the 3.25% 21 Jun '39 Bond, issue #TB147:

The Australian Office of Financial Management (AOFM) sells A$300mn of the 3.25% 21 June 2039 Bond, issue #TB147:

- Average Yield: 1.7723% (prev. 1.4339%)

- High Yield: 1.7750% (prev. 1.4425%)

- Bid/Cover: 3.1033x (prev. 2.5080x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 53.5% (prev. 27.1%)

- Bidders 53 (prev. 51), successful 20 (prev. 23), allocated in full 12 (prev. 18)

EQUITIES: Moves Muted Ahead Of US CPI

Another mixed day with muted moves in Asia after a mixed lead from US markets where the Nasdaq dipped but other major indices hit fresh record highs. Markets in mainland China are slightly lower, hovering around neutral levels all session. Markets in South Korea are lower after a record high number of coronavirus cases. Markets in Japan, Australia and Hong Kong all saw small gains. In the US futures are mixed, e-mini Nasdaq seeing a marginal gain after dipping yesterday while e-mini Dow and S&P slip slightly. Markets await US CPI figures later in the day.

OIL: Oil Dips From Closing Highs

After bouncing on Tuesday oil is slightly off highs; WTI last down $0.06 from settlement at $68.21/bbl, Brent is down $0.06 at $70.57/bbl. WTI and Brent crude futures rallied smartly Tuesday, with oil topping the Monday open to touch new weekly highs. Despite the strength in energy products, the move below the 50-day EMA last week looks convincing, with support now exposes at $66.91 for Brent. To resume any incline, bulls need to again take out $74.47, the 76.4% retracement of the Jul 6 - 20 downleg. API inventory data yesterday was bullish, headline crude stocks fell 816k bbls, while downstream inventories of gasoline stocks also fell which is confirmed by official DOE figures would be the fourth straight weekly decline.

GOLD: Picks Up But Stays Within Range

The yellow metal picked up in Asia-Pac trade on Tuesday, gaining $4.49/oz to $1,733.42 but sticking inside Tuesday's range. Gold had a relatively more stable session on Tuesday when compared to Monday trade, with the precious metal trading inside a $20/oz range. Monday's pull lower found some support at the 61.8% retracement of the 2020 range, but the recovery off the low will have emboldened bulls. To reinforce any upside argument, bulls need to regain $1834.1, Jul 15 high, ahead of $1853.3, a Fibonacci retracement. Markets look ahead to US CPI data later today.

FOREX: Early Losses Recovered

AUD and NZD recovered early losses. AUD/USD dropped as low as 0.7335 before bouncing, last trades down 4 pips at 0.7346. Westpac consumer confidence fell 4.4% to 104.1 while Melbourne extended its lockdown by at least 7-days, and in NSW there were 344 new cases.

- NZD/USD is up 3 pips. For New Zealand BNZ said that NZ job ads rose 1.7% M/M in July and now sit 28% above pre-Covid levels. There is little of note left on the local docket today, but New Zealand's REINZ House Sales, food price index & the RBNZ's measure of inflation expectations will all hit the wires tomorrow.

- USD/JPY is 7 pips higher, NHK released a poll showing that support for the cabinet fell 4pp to 29% in another sign of rapidly faltering support for beleaguered PM Suga. Flash machine tool orders are due later today, with PPI coming up tomorrow.

- USD/CNH is down 55 pips, offshore yuan declined for a third straight session yesterday. Markets continues to digest the PBOC's quarterly monetary policy report which many view as confirming the Central Bank's dovish bias.

FOREX OPTIONS: Expiries for Aug11 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1700-15(E669mln), $1.1750(E557mln), $1.1795-00(E744mln)

- USD/JPY: Y108.65-70($715mln), Y109.85-90($1.4bln)

- EUR/GBP: Gbp0.8450(E655mln)

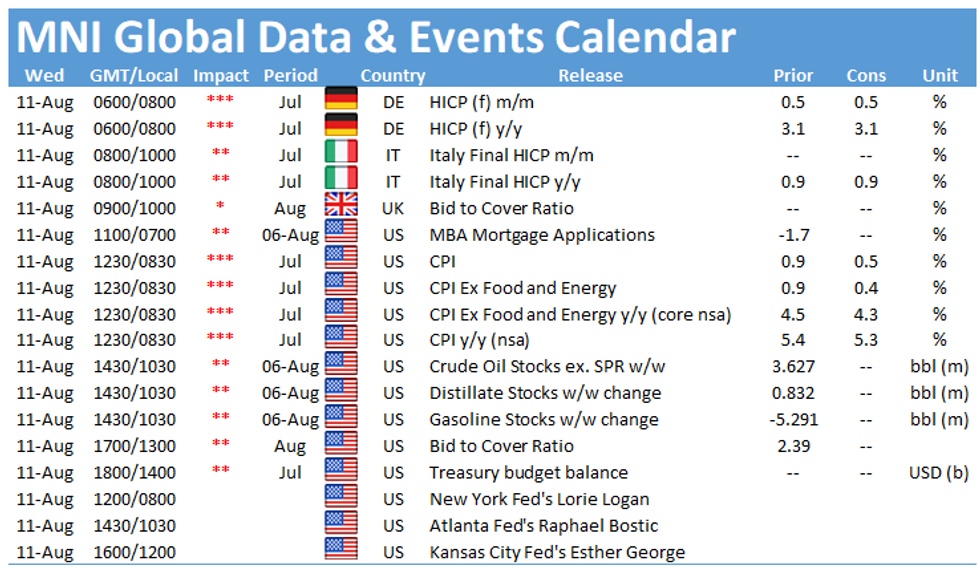

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.