-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Gilt Week Ahead: Triple issuance week?

MNI US MARKETS ANALYSIS - French Politics Undermines EUR

MNI US OPEN - Trump Warns BRICS Over Moving Away From USD

MNI EUROPEAN OPEN: A Single COVID Case Ruffles The Feathers Of Kiwi Hawks

EXECUTIVE SUMMARY

- FED'S ROSENGREN BACKS TAPERING IN THE FALL BUT NO RATE HIKES UNTIL JOB MARKET IMPROVES (CNBC)

- ANALYSTS: CHINA LIKELY TO CUT RRR AGAIN IN Q4 (CSJ)

- RBA PREPARED TO ACT IF VIRUS SPREAD SETS BACK AUSTRALIA RECOVERY (BBG)

- NEW ZEALAND DETECTS FIRST COMMUNITY COVID CASE IN MONTHS

- BIDEN SAYS AFGHANISTAN WAR WAS A LOST CAUSE, VOWS TO CONTINUE AID AND DIPLOMACY (CNBC)

Fig. 1: Australia/New Zealand 2-Year Swap Spread (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

ECONOMY: Online spending hit a record high of £10 billion in July, the highest monthly figure this year, as the pandemic accelerated the shift away from the high street. The increase brings the total spent online in the UK this year to £64.9 billion, a rise of 18 per cent compared with the same period last year and 56 per cent higher year-on-year than in 2019, according to the Adobe Digital Economy Index. The research also found inflation online last month rose 2.8 per cent, year-on-year, amid a spike in demand and pressure on supply chains. (The Times)

U.S.

FED: Boston Federal Reserve President Eric Rosengren said Monday he would be prepared to start rolling back some of the central bank's easy monetary policy this fall but isn't ready yet to start thinking about raising interest rates. Echoing recent comments from multiple Fed officials, Rosengren told CNBC that it's probably appropriate to begin reducing, or tapering, bond purchases before the end of the year. He voiced support for an announcement on the matter over the next month or two and said he thinks the pullback of the minimum $120 billion a month program will start shortly thereafter. Raising rates, though, will have to wait for the job market to improve. (CNBC)

FED: Eric Rosengren, president of the Federal Reserve Bank of Boston, said his outlook for the U.S. economy has improved this year despite the recent Covid-19 outbreaks associated with the Delta variant, and he expects strong hiring to allow the central bank to soon begin reversing the extremely accommodative monetary policy adopted at the height of the coronavirus pandemic. The Fed could be in a position to start reducing its $120 billion in monthly asset purchases this fall and, if strong economic growth continues, the Fed might be able to end those purchases toward the middle of 2022, Mr. Rosengren said in an interview on Thursday, August 12. (WSJ)

ECONOMY: MNI REALITY CHECK: US July Retail Sales Seen Slipping

- The pace of retail sales faltered slightly in July as spending shifted away from goods toward services as in-person activities resumed, industry experts told MNI, although sales should still get a lift from back to school shopping and stronger-than-expected job growth. "It's possible that we could see a little deceleration in overall retail sales," said Jack Kleinhenz, chief economist at the National Retail Federation - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

CORONAVIRUS: Five states broke records for the average number of daily new Covid cases over the weekend as the delta variant strains hospital systems across the U.S. and forces many states to reinstate public health restrictions. Florida, Louisiana, Hawaii, Oregon and Mississippi all reached new peaks in their seven-day average of new cases per day as of Sunday, according to a CNBC analysis of data compiled by Johns Hopkins University. On a per capita basis, Louisiana, Mississippi and Florida are suffering from the three worst outbreaks in the country. (CNBC)

CORONAVIRUS: The number of people dying with Covid-19 in hospitals is hitting previous highs in some hot-spot states with low-to- average vaccination rates, upending hopes the virus has become less lethal. In Florida, an average of about 203 people a day are dying in the hospital with confirmed or suspected Covid-19, matching the state's November 2020 peak, according to U.S. Department of Health and Human Services data. That's a daily average of about nine per million residents, the data show. Louisiana, Arkansas and Missouri have also seen deaths among patients with Covid-19 soar in the past two weeks. (BBG)

CORONAVIRUS: The U.S. Centers for Disease Control and Prevention's Advisory Committee on Immunization Practices will meet Aug. 24 to discuss additional doses of Covid-19 vaccine, including booster shots. Earlier Monday, Pfizer and BioNTech said they submitted early-stage data to U.S. regulators showing that a third dose of their Covid-19 vaccine led to higher levels of protective antibodies when given eight to nine months after the initial regimen. (BBG)

CORONAVIRUS: The Biden administration has decided that most Americans should get a coronavirus booster shot eight months after they completed their initial vaccination, and could begin offering the extra shots as early as mid-September, according to two administration officials familiar with the discussions. Officials are planning to announce the administration's decision as early as this week. Their goal is to let Americans know now that they will need additional protection against the Delta variant that is causing surging caseloads across the nation. (New York Times)

CORONAVIRUS: All health-care workers in the District of Columbia must have received at least the first dose of Pfizer Inc. or Moderna Inc. vaccine, or one dose of Johnson & Johnson shot by Sept. 30, Mayor Muriel Bowser said. (BBG)

EQUITIES: Here's a market milestone to encapsulate how stunning the recovery rally has been: The S&P 500 just doubled its level from its pandemic closing low. The broad equity benchmark has rallied 100% from its Covid trough of 2,237.40 on March 23, 2020 on a closing basis. It took the market 354 trading days to get there, marking the fastest bull-market doubling off a bottom since World War II, according to a CNBC analysis of data from S&P Dow Jones Indices. The S&P 500 closed at a record 4479.71 Monday, up 0.3% on the day and 100.2% higher than its low Covid close. (CNBC)

OTHER

U.S./CHINA: U.S. Securities and Exchange Commission Chair Gary Gensler issued his most direct warning yet on Monday about the risks of investing in Chinese companies. Gensler said in a video message that there is a lot that American investors don't know about some Chinese companies that are listed on U.S. stock exchanges. His remarks come just weeks after the regulator halted initial public offerings of Chinese companies until they boost disclosures and warned investors may not be aware that they are actually buying shares of shell companies instead of direct stakes in Chinese businesses. Gensler said on Monday that he's asked SEC staff to take "a pause for now" in green-lighting IPOs of shell companies that Chinese firms use to list shares in the U.S. and wants investors to have more information about how firms are structured. (BBG)

JAPAN: Japan plans to expand its current virus emergency now in place for Tokyo and other areas to seven more prefectures as well as extend it to Sept. 12, trying to stem a delta variant-fueled surge that has sent infections to records. Covid-19 czar and Economy Minister Yasutoshi Nishimura told an advisory panel Tuesday the government planned to add seven prefectures to the emergency, bringing the total to 13 areas. Prime Minister Yoshihide Suga was expected to make the decision official later Tuesday, local media including Kyodo News reported. Suga's office said he will hold a news conference at 9 p.m. to discuss the virus situation. "The health-care system is in a very severe situation and experts are saying it's near disaster levels," Nishimura told the panel, adding he has "an extremely strong sense of crisis." (BBG)

JAPAN: The Japanese government reached an agreement with Pfizer to receive 120m more doses of its Covid-19 vaccine next year for booster shots, Mainichi reports. The government is considering starting to give booster shots to medical workers and the elderly as soon as it completes the current phase of second vaccinations. (BBG)

AUSTRALIA: Australia's delta outbreak continues to spread despite more than half the nation's 26 million people being placed into lockdown. New South Wales state recorded 452 new cases on Tuesday, down from the record of 478 set the previous day, with the vast bulk of those infections detected in Sydney. Melbourne and national capital Canberra are also enforcing stay-at-home orders, and on Tuesday recorded 24 and 17 new cases respectively. Authorities are increasingly concerned that the outbreak's spreading into the continent's interior is threatening vulnerable Indigenous populations. On Monday, the tropical city of Darwin was placed into a snap lockdown, while on Tuesday it was confirmed the virus had reached the Outback town of Broken Hill. (BBG)

AUSTRALIA: Faith in the ability of government to handle the COVID-19 outbreak has deteriorated sharply, with the Morrison government as well as the NSW and Queensland state governments falling fastest. At the same time, the proportion of voters who felt Australia was handling the pandemic better than the rest of the world – a frequent boast during the first year of the pandemic – plunged from 79 per cent in February to 57 per cent in July. The findings are contained in the latest nationwide True Issues survey, conducted by JWS research. The periodic survey of people's concerns, and how voters rate the government's performance when handling these concerns, shows that approval of the Morrison government's overall performance is waning. But when it comes to the government's handling of COVID-19, it has "fallen off a cliff", said JWS director John Scales. (Australian financial Review)

RBA: The Reserve Bank of Australia said it will continue to review its bond-buying program based on economic conditions and the health situation as the nation faces lockdowns to combat the delta variant of coronavirus. "The board would be prepared to act in response to further bad news on the health front should that lead to a more significant setback for the economic recovery," the RBA said in minutes of its August meeting released in Sydney Tuesday. "Experience to date had been that, once virus outbreaks were contained, the economy bounced back quickly." The central bank had presented a bullish statement two weeks ago in which it stuck with a planned tapering of bond purchases and predicted the economy would bounce back quickly from a Covid-induced contraction this quarter. Yet Sydney's virus cases are still climbing and Melbourne and Canberra have had to extend their respective lockdowns. (BBG)

NEW ZEALAND: A positive case of Covid-19 has been identified in the community early this afternoon and is now under investigation. The link between the case and the border or managed isolation is yet to be established. The Ministry of Health is advising anyone in Auckland taking public transport this afternoon or who cannot socially distance in public spaces to wear a mask. Ministers will meet this afternoon once additional information is gathered to confirm a response. (NZ Herald)

RBNZ: MNI INTERVIEW: Former RBNZ Chair Calls For 50bps Rate Hike

- A former senior Reserve Bank of New Zealand official has called for a 50-basis points hike when the central bank meets on Wednesday. Arthur Grimes, a former RBNZ Chairman and chief economist, who is now a senior fellow at consultancy Motu Economic and Public Policy Research, said a 50 basis was his assessment, but a rise of 25 basis points is more likely - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

AFGHANISTAN: President Joe Biden defended his decision to pull U.S. troops out of Afghanistan on Monday afternoon, his first remarks since the Taliban ousted the Afghan national government on Sunday. "I stand squarely behind my decision. After 20 years I've learned the hard way that there was never a good time to withdraw U.S. forces," Biden said in a memorable speech delivered from the East Room of the White House. "I am president of the United States of America. The buck stops with me," he added. (CNBC)

AFGHANISTAN: The U.S. is in "constructive" talks with the Taliban in both Kabul and Doha, Qatar, as it seeks to restore order over Afghanistan's main airport and reach a political settlement to the country's decades-old conflict, State Department spokesman Ned Price said. The U.S. wants to make sure the Taliban understands that any attempt to target the U.S. will be met with a "swift and decisive response," Price told a briefing. "We have engaged with the Taliban, we have had discussions, I would say some of those discussions have been productive." Price said any recognition of Afghanistan's new leaders would depend on the Taliban's willingness to create an inclusive government that involves women and others. (BBG)

AFGHANISTAN: Chinese Foreign Minister Wang Yi told Secretary of State Antony Blinken on Monday that the hasty pullout of U.S. troops from Afghanistan had a "serious negative impact,"but pledged to work with Washington to promote stability in the country. (RTRS)

AFGHANISTAN: Russian Foreign Minister Sergei Lavrov and U.S. Secretary of State Antony Blinken discussed the situation in Afghanistan by phone and agreed to continue talks with China, Pakistan and the United Nations, Russia said on Monday. (RTRS)

AFGHANISTAN: Turkey has dropped plans to take over Kabul airport after NATO's withdrawal from Afghanistan but is ready to provide support if the Taliban request it, two Turkish sources said on Monday amid turmoil following the militant group's victory in Afghanistan. (RTRS)

IRAN: Iran has made progress in its work on enriched uranium metal, the U.N. nuclear watchdog said in a report to member states on Monday seen by Reuters, despite Western warnings that such work threatens talks on reviving the Iran nuclear deal. "On 14 August 2021, the Agency verified … that Iran had used 257 g of uranium enriched up to 20% U-235 in the form of UF4 (uranium tetrafluoride) to produce 200 g of uranium metal enriched up to 20% U-235," the International Atomic Energy Agency said, adding that this was step three in a four-step plan by Iran. The fourth includes producing a reactor fuel plate. (RTRS)

IRAN: U.S. has made clear continued nuclear escalations beyond JCPOA limits are "unconstructive and inconsistent" with a return to mutual compliance, State Department spokesperson Ned Price says in statement. Such escalations won't provide Iran negotiating leverage and will only lead to Iran's further isolation. "We are not imposing a deadline for negotiations, but this window will not remain open indefinitely," Price says. (BBG)

OIL: U.S. oil output from seven major shale formations is expected to rise by about 49,000 barrels per day (bpd) in September, to 8.1 million bpd, according to the Energy Information Administration's monthly drilling productivity report on Monday. The forecast is led by growing production in the largest formation, the Permian Basin, where crude output is estimated to rise 49,000 bpd in the month, offsetting falling output expected from the Bakken and other top regions. (RTRS)

OIL: Major U.S. oil industry groups on Monday sued the Biden administration for halting drilling auctions on federal lands and waters this year, arguing the government is required by law to hold regular sales. (RTRS)

OIL: The Biden administration has appealed a ruling from a Louisiana judge who ordered it to resume new oil and gas leasing on federal land. With their appeal today, lawyers for the federal government asked judges at the US Court of Appeals for the Fifth Circuit to take another look at a 44-page decision handed down in June, which said the US Interior Department likely doesn't have the power to stop leasing federal lands for oil and gas production without Congress's approval. President Biden ordered the department to suspend the oil and gas leasing program during his first week in office as part of several initiatives to address climate change. (WSJ)

OIL: Libya will struggle to sustain its current crude output if lawmakers don't overcome a lengthy dispute and pass the OPEC member's first nationwide budget in about seven years, the oil minister said. The North African nation is producing roughly 1.3 million barrels per day, with a target of 1.5 million by the end of 2021, Mohamed Oun said in an interview. But he said that depends on Libya's recently unified parliament finally agreeing on amendments to a 2021 spending plan that's had lawmakers at odds for at least four months. (BBG)

OIL: Rising calls to cut carbon emissions and to reduce global warming could generate more offshore partnerships and increase the output of cleaner oil for Brazil, the production chief of state-controlled Petrobras said in an interview. (RTRS)

CHINA

PBOC: China's central bank is likely to cut banks' required reserve ratio again in the fourth quarter of this year to further lower financing costs for the economy, China Securities Journal cites analysts as saying. PBOC is also expected to continue injecting liquidity into the financial system through open market operations as government bonds issuance accelerates. (BBG)

PBOC: The PBOC is likely to keep the benchmark LPR unchanged on the 20th of this month, but lenders may be more incentivised to quote lower rates as their cost of capital declines, the Securities Times said citing Wang Qing of Golden Credit Ratings, after the central bank kept the MLF rate at 2.95% on Monday. The central bank exceeded market expectations yesterday when it renewed CNY600 billion of the CNY700 billion maturing MLF. The backwardation between market rates and the 2.95% MLF rate rose to 30 bps on Aug. 13, limiting banks' demand for the MLF operation, the newspaper said. Lenders stood to save CNY13 billion in capital costs when the PBOC cut RRRs in July and helped them reduce costs of deposit in June, the newspaper said. (MNI)

POLICY: China's State Council on Monday urged officials to use funds including those unlocked through the July RRR cut to increase financial support to small businesses and invest in labour-intensive industries to boost employment. The authorities must increase cross-cycle measures to ensure reasonable growth amid new outbreaks, volatile commodities and natural disasters, Premier Li Keqiang's government said following an executive meeting. Officials also must ensure market supply and stabilize prices of raw materials including selling reserves, and investments and consumption should be boosted through selling special-purpose local government bonds, the government said. (MNI)

ECONOMY: China should make good use of the current window to improve its economic structure while accepting a lower growth, the 21st Century Business Herald said in an editorial. The main challenge is to boost consumption, which needs better social distribution, the newspaper said, noting the finance, real estate sectors and some Internet platforms have benefited the most in the market and suppressed the real economy as well as pushed up residents' leverage and affect spending. The traditional countercyclical adjustment of boosting infrastructure and real estate investment is inefficient as such investment could not create long-term value compared with its huge input cost, but pressured the country's close-to-limit debt tolerance, the newspaper said. (MNI)

CORONAVIRUS: Covid cases in China are dwindling amid an intense slew of curbs authorities have put in place to slow delta's spread. Only six symptomatic infections were reported on Tuesday, down from 90 a week ago. In an interview with state-owned news agency Xinhua, Health Minister Ma Xiaowei vowed to keep the virus's spread under control by the end of August to ensure life returns to normal as soon as possible. (BBG)

MARKETS: BlackRock's research unit has said China should no longer be considered an emerging market and recommended investors boost their exposure to the country by as much as three times. The New York-based investment house's internal think-tank suggested the higher allocations to Chinese stocks and debt as the country's capital markets have boomed in size and sophistication. "China is under-represented in global investors' portfolios but also, in our view, in global benchmarks," Wei Li, chief investment strategist at the BlackRock Investment Institute (BII), said in an interview. "It has the second-largest equity market, the second-largest bond market. It should be represented more in portfolios." (FT)

EQUITIES: Online platform operators are banned to use technical means to conduct unfair competition, State Administration for Market Regulation saysin draft rules seeking public opinion. The rules are aimed at preventing unfair online competition, encouraging innovation and maintaining fair market order. (BBG)

OVERNIGHT DATA

JAPAN JUN TERTIARY INDUSTRY INDEX +2.3% M/M; MEDIAN +1.8%; MAY -2.7%

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 101.1; PREV. 98.6

Consumer confidence rose 2.5% last week, rising back above the neutral level of 100.This recovery was driven by a 7.5% increase in confidence in Queensland as the lockdown in its south-east ended. Sentiment also rose by 7.1% in Sydney, reflecting resilience even as daily COVID-19 cases are still rising in the city. Despite the current resilience in sentiment, the persistence of the highly infectious Delta variant means there is significant uncertainty about how things will evolve over the next few weeks. The jump in weekly inflation expectations is notable and something that may trouble policy makers if it continues to rise sharply. (ANZ)

NEW ZEALAND JUL NON-RESIDENT BOND HOLDINGS 53.0%; JUN 51.1%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS TUES; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Tuesday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.1833% at 09:25 am local time from the close of 2.1736% on Monday.

- The CFETS-NEX money-market sentiment index closed at 37 on Monday vs 39 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4765 TUES VS 6.4717

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4765 on Tuesday, compared with the 6.4717 set on Monday.

MARKETS

SNAPSHOT: A Single COVID Case Ruffles The Feathers Of Kiwi Hawks

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 10.17 points at 27513.09

- ASX 200 down 80.853 points at 7501.6

- Shanghai Comp. down 16.918 points at 3500.427

- JGB 10-Yr future up 2 ticks at 152.38, yield down 1.2bp at 0.010%

- Aussie 10-Yr future up 1.0 tick at 98.860, yield down 0.6bp at 1.150%

- U.S. 10-Yr future +0-00+ at 134-11, yield down 1.5bp at 1.250%

- WTI crude up $0.05 at $67.34, Gold down $0.25 at $1787.21

- USD/JPY up 8 pips at Y109.32

- FED'S ROSENGREN BACKS TAPERING IN THE FALL BUT NO RATE HIKES UNTIL JOB MARKET IMPROVES (CNBC)

- ANALYSTS: CHINA LIKELY TO CUT RRR AGAIN IN Q4 (CSJ)

- RBA PREPARED TO ACT IF VIRUS SPREAD SETS BACK AUSTRALIA RECOVERY (BBG)

- NEW ZEALAND DETECTS FIRST COMMUNITY COVID CASE IN MONTHS

- BIDEN SAYS AFGHANISTAN WAR WAS A LOST CAUSE, VOWS TO CONTINUE AID AND DIPLOMACY (CNBC)

BOND SUMMARY: Core FI A Touch Better Bid In Asia

U.S. Tsys drew support from a modest downtick in e-minis during Asia-Pac hours (after the S&P 500 lodged a fresh record high on Monday), with geopolitical tension centring on the Middle East, broader COVID worry and regulatory matters in China all presenting relatively familiar topics of headline flow. That allowed T-Notes to unwind their post settlement losses lodged late in the NY day, with that contract last dealing unchanged at 134-10+, while cash Tsys sit little changed to ~1.5bp richer on the day into European hours.

- JGB futures unwound their overnight losses to last trade +2, with Japanese COVID chief Nishimura outlining the touted longer and wider state of emergency that the government is looking to implement. Cash JGBs trade little changed to ~1.5bp richer on the day.

- Aussie bond futures also received some incremental support from the previously outlined risk-negative factors, although the space traded in a fairly limited fashion, YM +1.0, XM +0.5 last. The uncertainty created by the latest local outbreak of COVID seemed to be much more of an issue in the RBA meeting minutes (released today) than it was in text and communique that immediately followed the August decision, with the Bank ultimately stressing that "the bond purchase program will continue to be reviewed in light of economic conditions and the health situation, and their implications for the expected progress towards full employment and the inflation target. The Board would be prepared to act in response to further bad news on the health front should that lead to a more significant setback for the economic recovery." Still, the minutes underscored the Bank's thought process that fiscal support would be timelier, although the optionality that the RBA has clearly defined will become more of a discussion point the longer the lockdowns in Australia last. Elsewhere, the detection of a COVID case in the Auckland community supported the NZ rates space and impacted pricing re: RBNZ tightening, which may have provided some incremental support for ACGBs.

EQUITIES: E-Minis A Touch Lower After S&P 500 Hits Record, Asia Mixed

The major regional equity indices have lacked a sense of clear, coherent direction during Tuesday's Asia-Pac session, operating either side of unchanged at typing. U.S. e-mini futures have been biased a little lower vs. settlement levels after the S&P 500 registered fresh all-time highs on Monday (with the index doubling from its COVID-19 induced '20 low). Broader macro headline flow has been lacking since the NY closing bell, with the familiar themes of the geopolitical situation in the Middle East and broader COVID developments eyed.

OIL: Little Changed After Recovering From Lows On Monday

WTI & Brent sit a handful of cents higher vs. their respective settlement levels but have stuck to confined ranges during Asia-Pac hours. This comes after the crude oil benchmarks bounced from their intraday lows alongside equities on Monday, but still settled over $1.00 below Friday's levels. Monday's recovery from lows was further aided by RTRS sources reports suggesting that "OPEC and its allies, including Russia, believe oil markets do not need more oil than they plan to release in the coming months, despite U.S. pressure to add supplies to check an oil price rise." More broadly, COVID worries in China and general headwinds for the reflation/re-opening narratives are limiting the upside for crude at present.

GOLD: Holding Pattern After Last Week’s Sell Off & Recovery

Gold has stabilised over the last 24 hours or so, with little in the way of fresh macro impulses to drive the space since the early part of Monday's session. That leaves spot little changed during Asia-Pac hours, just shy of the $1,790/oz mark. Familiar technical boundaries remain in play.

FOREX: Kiwi Capitulates After Covid Case In Auckland Community Puts NZ On Alert

The kiwi tumbled after New Zealand health officials reported a positive Covid-19 case in Auckland community. The news came after it emerged that the Delta variant spread among people staying in a managed isolation facility after their doors were simultaneously opened for just a few seconds, although there is no known link between the two events as of yet. The impact of these headlines was amplified by the proximity of RBNZ monetary policy meeting, which had been widely expected to mark the beginning of the tightening cycle. The OIS strip now prices 19bp worth of tightening come the end of tomorrow's meeting, which puts implied odds of a full 25bp hike at 76%.

- NZD/USD tanked to its lowest point since Aug 2 amid panic selling of the Kiwi dollar, while NZD/USD overnight implied volatility surged to 19.44%, its highest level since March 17. AUD/NZD surged off multi-month lows in tandem with an aggressive bounce in Australia/New Zealand 2-Year swap spread.

- The Antipodean cross advanced even as AUD went offered in reaction to the minutes from the RBA's latest monetary policy meeting, which noted that the Board "considered the case for delaying the tapering of bond purchases to A$4bn a week currently scheduled for September 2021". The post-minutes downswing in AUD/USD was boosted by a technical break of $0.7316, which represents the low print of Aug 10. AUD was the second-worst G10 performer.

- Participants retreated into safe havens as Covid-19 angst and China's continued regulatory crackdown soured risk appetite.

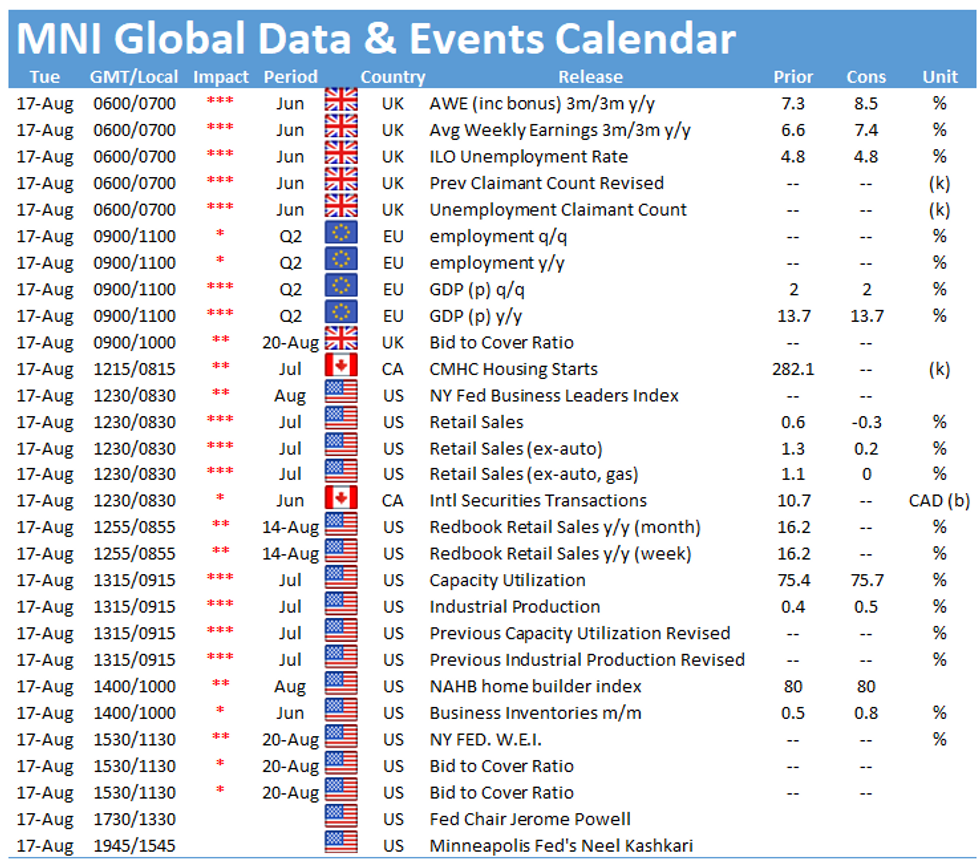

- Looking ahead, comments from Fed's Powell & Kashkari will grab attention today, while the data docket features U.S. retail sales & industrial output, UK jobs data and flash EZ GDP.

FOREX OPTIONS: Expiries for Aug17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1775(E556mln), $1.1815-25(E1.6bln), $1.1850-55(E900mln)

- USD/JPY: Y109.05-10($586mln), Y110.00($723mln)

- GBP/USD: $1.3810-25(Gbp535mln)

- AUD/USD: $0.7200(A$800mln), $0.7325-30(A$1.1bln), $0.7450(A$546mln)

- NZD/USD: $0.7050(N$597mln), $0.7080(N$593mln)

- USD/CNY: Cny6.4900($1.1bln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.