-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: No Change For RBNZ OCR, But Hike Is Merely Delayed

EXECUTIVE SUMMARY

- FED'S ROSENGREN WARNS MASSIVE BOND PURCHASES ARE ILL-SUITED FOR US ECONOMY (FT)

- FED'S KASHKARI SEES TAPER COMING, PERHAPS AROUND YEAR END

- RBNZ DELAYS RATE HIKE AS FRESH COVID-19 OUTBREAK STOKES UNCERTAINTY (RTRS)

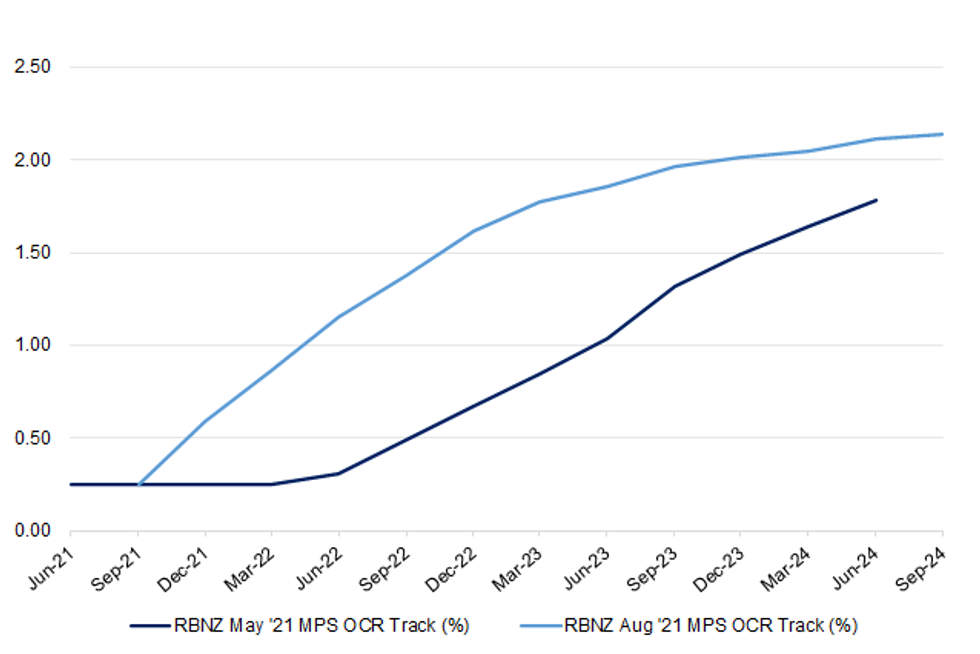

Fig. 1: RBNZ May '21 vs. Aug '21 MPS OCR Track (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

FISCAL: The pension "triple lock" guarantee long championed by the Conservative Government is set to be watered down next year in a move that will save the Treasury billions of pounds. The Telegraph can reveal that Boris Johnson has been advised by Cabinet ministers to temporarily alter the long-held promise on how to increase state pensions, due to a freak earnings rise. (Telegraph)

EUROPE

GERMANY: The leader of Germany's Greens has vowed to get tough on China and Russia and to reform Europe's fiscal rules should her party gain power in September, marking a sharp break from the policies of outgoing chancellor Angela Merkel. In a rare interview with the foreign press, Annalena Baerbock, the Green candidate for chancellor, called for looser limits on EU member states' budget deficits and debt levels if her party enters government after the federal election on September 26. (FT)

U.S.

FED: Federal Reserve Chair Jerome Powell predicted U.S. students who have been forced to cope with the Covid-19 pandemic will become an "extraordinary generation" that will mature faster and have a bigger impact on society. Speaking and answering questions in a town hall meeting Tuesday with educators and students, Powell didn't discuss the outlook for monetary policy or make specific comment on growth and the risks from the delta variant -- though he did flag that the pandemic is "still casting a shadow on economic activity." (BBG)

FED: A top Federal Reserve official has warned that the US central bank's emergency bond-buying programme is ill-suited for an economy held back by supply constraints, urging instead a speedy end to the stimulus to avoid burdensome debts and inflationary pressures. Eric Rosengren, president of the Boston Fed, told the Financial Times that he would support the central bank announcing next month that it would begin to wind down or "taper" its $120bn in monthly asset purchases this autumn and get on track to halt them by the middle of 2022. The purchases of Treasuries and agency mortgage-backed securities were no longer the right remedy in an environment of severe shortages of essential materials and workers, Rosengren said. The current situation was different from the aftermath of the 2008 global financial crisis, when the Fed faced a shortfall of demand and addressed it by reducing borrowing costs, he added in an interview on Monday. (FT)

FED: MNI BRIEF: Kashkari Sees Taper Coming, Perhaps Around Year End

- Minneapolis Federal Reserve President Neel Kashkari said Tuesday it's clear the U.S. economy is building up the substantial progress that will be needed before paring back asset purchases, and said such a move could be coming around the end of this year. On the idea of making substantial progress that would meet the Fed's test for pulling back on QE, Kashkari said "it's a question of when, not a question of if." Inflation at the moment appears high but mostly driven by transitory factors while a lot of slack remains in the job market, he said - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

CORONAVIRUS: The number of people getting a first dose of a Covid-19 vaccine has risen to almost half a million a day, a level last seen at the end of May when the U.S. vaccination campaign was still in full swing in much of the country. Unlike the spring rollout, however, the new bump in vaccinations has been driven by counties in the South, which earlier in the year were among the most resistant to getting the shots and still have lower rates of vaccination than many other places. Those regions, however, have been hit by a fast-moving wave of Covid infections that have sent thousands of people to the hospital. (BBG)

CORONAVIRUS: Hospitals in Mississippi and Alabama are sending patients across their borders to Kentucky even as Bluegrass State officials warn their hospitals are running short on available staff and beds. "We're very close to having all of our hospitals full," Kentucky Governor Andy Beshear, a Democrat, said Tuesday in Frankfort. "By the end of this week we expect to have more people in the hospital battling Covid than we've ever had in this pandemic." (BBG)

CORONAVIRUS: Los Angeles will require universal masking at outdoor mega events regardless of vaccination status, according to health officials. Masks are required to be worn by everyone at all times except when actively eating or drinking at these events, said the Los Angeles County Department of Public Health in a statement. Outdoor mega events are outdoor events with crowds greater than 10,000 attendees. (BBG)

CORONAVIRUS: Chicago is reinstating its indoor mask mandate starting Aug. 20 given the recent jump in cases, the city's department of public health said on Tuesday. The city's average number of new daily cases has topped 400 due largely to the delta variant and "the time to act is now to prevent further spread," Allison Arwady, the city's commissioner of public health, said in a statement. The daily average number of cases was under 50 two months ago, according to city data. (BBG)

CORONAVIRUS: New Mexico Governor Michelle Lujan Grisham ordered use of face masks in all public indoor settings regardless of vaccination status, as hospitalizations in the state is at a six-month high. In Colorado, Denver ordered mandatory mask use in schools and childcare settings for those 2 years and older, effective Wednesday. Meanwhile, in Florida, the state board of education directed the education commissioner to "take all legal steps" to enforce Republican Governor Ron DeSantis's ban on mask mandates in schools. (BBG)

CORONAVIRUS: President Joe Biden's administration plans to extend requirements for travelers to wear masks on airplanes, trains and buses and at airports and train stations through Jan. 18 to address ongoing COVID-19 risks, three sources told Reuters. Major U.S. airlines were informed of the planned extension on a call with the Transportation Security Administration (TSA) and Centers for Disease Control and Prevention (CDC) on Tuesday, the three people briefed on the matter said. A separate call with aviation unions is planned for Wednesday, a source said. (RTRS)

CORONAVIRUS: The U.S. National Park Service said it is requiring masks for crowded outdoor spaces and buildings "regardless of vaccination status or community transmission levels." (BBG)

POLITICS: President Joe Biden's approval rating dropped by 7 percentage points and hit its lowest level so far as the U.S.-backed Afghan government collapsed over the weekend in an upheaval that sent thousands of civilians and Afghan military allies fleeing for their safety, according to a Reuters/Ipsos poll. The national opinion poll, conducted on Monday, found that 46% of American adults approved of Biden's performance in office, the lowest recorded in weekly polls that started when Biden took office in January. It is also down from the 53% who felt the same way in a similar Reuters/Ipsos poll that ran on Friday. (RTRS)

OTHER

U.S./CHINA: Republican Senator Marco Rubio on Tuesday called on President Joe Biden to block short-form video app TikTok in the United States after China took an ownership stake in a key subsidiary of ByteDance, the Beijing-based parent company of TikTok. (RTRS)

CORONAVIRUS: A top World Health Organization official said data from some countries may suggest that the delta variant causes an increased risk of hospitalization in those infected, but it isn't necessarily killing more people than other strains. "In terms of severity, we have seen some countries suggest that there is increased risk of hospitalization for people who are infected with the delta variant. We haven't seen that translate to increased death," said Maria Van Kerkhove, WHO's technical lead on Covid-19. People infected with the delta variant "have not died more often than with the other strains," she said. (CNBC)

AUSTRALIA: New South Wales state recorded 633 new cases of the delta strain on Wednesday -- a 32% surge from the previous daily high recorded on Monday as the virus spreads throughout Sydney despite Australia's largest city being in lockdown for almost two months. "What the data is telling us in the last few days is that we haven't seen the worst of it," New South Wales Premier Gladys Berejiklian told reporters in Sydney. The outbreak is spreading away from the outbreak's epicenter in Sydney into other areas of the nation, forcing more than half of Australia's 26 million people into lockdown. They include Melbourne, which recorded 24 new cases on Wednesday, national capital Canberra, and more remote regions with high Indigenous populations. The surge in cases is increasing pressure on Prime Minister Scott Morrison to ramp up the nation's tardy vaccination roll-out. (BBG)

RBNZ: New Zealand's central bank delayed raising rates on Wednesday as policymakers quickly changed gears after the country was put into a snap COVID-19 lockdown over a handful of new cases, but the bank still expects a hike before year-end. (RTRS)

NEW ZEALAND: New Zealand began a strict nationwide lockdown as it faces an outbreak of the delta variant, which on Wednesday was linked to the worsening Covid-19 crisis in neighboring Australia as cases in New South Wales rose to a record high of more than 600. A further six cases have been identified in New Zealand, all connected to the single delta infection discovered Tuesday, Prime Minister Jacinda Ardern told reporters in Wellington. That was the first community case detected in the nation since February, with genome testing of the original case showing a clear link to the outbreak in Australia's New South Wales state. (BBG)

SOUTH KOREA: South Korea wants to have 70% of its population vaccinated by the end of September, the premier said, speeding up one of the lowest inoculation rates among major Asian economies as cases surge to record highs. Prime Minister Kim Boo-kyum, at the forefront of the government's pandemic policy, said Tuesday that South Korea would keep funneling aid to small businesses hurt by strict social distancing measures aimed at stemming a record Covid-19 wave powered by the delta variant. Kim indicated Seoul would do all it can to avoid a lockdown. (BBG)

SOUTH KOREA: Authorities judge the recent USD/KRW gain is an overshooting following a short-term demand-supply imbalance including foreign investors' stock sales, Finance Ministry director Oh Jaewoo says by phone. Authorities are closely monitoring for possibility of excessive FX moves by speculative trades taking advantage of temporary supply-demand factors. (BBG)

CANADA: Employers in Ontario's public education and several key health-care settings will need to have COVID-19 vaccination policies in place for staff in the coming weeks, the province announced Tuesday. As the provincial government navigates a fourth wave of the pandemic, it issued a news release saying the policies are required to help combat spread of the highly infectious delta variant as fall and winter approach. Ontario will therefore remain in the final step of its "Roadmap to Reopen" plan for now, pressing pause on further lifting remaining restrictions and workplace safety measures — despite surpassing vaccination targets. The province will also offer booster shots to certain vulnerable populations and expand eligibility for vaccination to children turning 12 this year. (CBC)

CANADA: MNI DATA BRIEF: Canada CPI Again Seen Above BOC Range

- Canadian inflation likely quickened to 3.4% in July from 3.1% in June according to an economist consensus, keeping it above the top of the central bank's 1%-3% target band for a fourth month. Energy costs, some base effects against comparisons to last year's weakness, and rising service costs as the economy re-opened are expected to push prices up. The expected increase in the Statistics Canada report due at 0830EST would move inflation closer back towards the decade-high pace of 3.6% set in May - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

MEXICO: An appearance before senators by Arturo Herrera, who's been nominated to be the next Banxico chief, has been suspended, El Economista reports. The president of the senate committee Herrera was going to speak to announced the meeting would be postponed, according to El Economista. Herrera, the former Finance Minister, had been scheduled to talk to lawmakers on Thursday. Another date for the meeting hasn't yet been set. (BBG)

BRAZIL: Expectations of growth in Brazil have stabilized for 2021 but the country has had some downward revisions for 2022, in part consequence of political noise said central bank's president Roberto Campos Neto in an online event. Campos Neto said that central bank will meet the inflation target. "Be disciplined is the best way to grow the economy in a sustainable manner", he said. (BBG)

BRAZIL: Brazil's lower house of Congress on Tuesday postponed a vote on a tax reform bill that would introduce taxation of company dividends because it faced defeat due to a lack of consensus. The bill would slap a 20% tax on dividends and cut the corporate income tax rate. Business lobbies oppose the proposal saying it would increase an already heavy tax burden on companies in Brazil. (RTRS)

AFGHANISTAN: U.S. President Joe Biden spoke with British Prime Minister Boris Johnson on Tuesday on the situation in Afghanistan and they agreed to hold a virtual G7 leaders' meeting next week to discuss a common strategy and approach, the White House said. (RTRS)

AFGHANISTAN: The Taliban has told the United States it will provide safe passage for civilians to reach the airport in Afghanistan's capital Kabul, U.S. national security adviser Jake Sullivan said on Tuesday. Sullivan also told a White House news briefing that the United States believes the Kabul evacuation can go until Aug. 31 and it is talking to the Taliban about the exact timetable. (RTRS)

AFGHANISTAN: The Taliban pledged to build an inclusive government, protect the rights of women "within the bounds of Shariah law," and prevent Afghan territory from being used to target any other country, seeking to allay concerns the group intends to reimpose Islamic fundamentalism on Afghanistan. The rhetoric from the militant group on Tuesday fits a pattern of reassuring comments since the Taliban seized the capital of Kabul on Sunday. But history argues against it: Their prior stint in power, until they were ousted by the U.S. military in 2001, was marked by an extremely conservative interpretation of Shariah laws that saw women face stoning or execution for non-compliance. "We assure the international community and especially the U.S. and neighboring countries that Afghanistan won't be used against them." (BBG)

OIL: India has begun selling oil from its Strategic Petroleum Reserve (SPR) to state-run refiners as it implements a new policy to commercialise its federal storage by leasing out space, three sources familiar with the matter said. (RTRS)

CHINA

POLICY: China's top economic leadership stressed the need to balance between preventing major financial risks and stabilizing economic recovery, defuse systemic risks and ensure overall economic and financial stability, Xinhua News Agency reported following a meeting of the Central Leading Group on Financial and Economic Affairs on Tuesday, chaired by President Xi Jinping. Authorities are also asked to promote common prosperity and expand the middle-income group, according to the Xinhua report. China will increase wealth adjustment measures including taxation, social securities and transfer payments, Xinhua said. China must increase the education of its people to create opportunities for more people to get rich while insisting on public ownership as the major entity along with diverse ownerships, Xinhua said. (MNI)

FISCAL: China is expected to ramp up special local government bond sales and fiscal spending to bolster the economy in 2H, Securities Daily reports, citing researchers including Minsheng Bank's Wen Bin. The government is expected to boost expenditure in areas linked to people's livelihood and stabilize employment in 2H, report cites Citic Securities analyst Ming Ming as saying. Chinese authorities seek to address long-term structural problems as well as short-term cyclical fluctuations in the economy with cross-cyclical adjustments. (BBG)

PENSIONS: The state pension fund's investment return value reached 378.7b yuan last year, up about 30% from that in 2019, China Securities Journal reports, citing National Council for Social Security Fund. Last year's investment return included 204.6b yuan in realized profit and 174.1b yuan in fair-value gains. Investment return ratio was 15.84%, much higher the average investment yield of 8.51% since establishment of the pension fund in 2000, according to the report. (BBG)

SOES: China Huarong Asset Management Co. is poised to receive about 50 billion yuan ($7.7 billion) of fresh capital as part of an overhaul plan that would shift control of the embattled company to state-owned conglomerate Citic Group, people familiar with the matter said. The plan, some details of which are still being finalized and could change, calls for Citic to assume the Chinese government's controlling stake in Huarong from the Ministry of Finance, the people said, asking not to be identified discussing a private matter. The capital injection would come from a Citic-led consortium, two of the people said. (BBG)

SMES/NPLS: Chinese small and medium-sized banks could face as much as CNY5.34 trillion capital gap by 2022 as their hidden non-performing loans pile up due to policies deferring loan repayments for SMEs weakened by the pandemic, the 21st Century Business Herald reported citing a report by China Securities. Banks are accelerating capital replenishment since August to refinance with convertible bonds, private placement, perpetual bonds, as well as local government special bonds. The gradually exposed corporate credit defaults, increased non-performing assets and demand for write-off have accelerated capital consumption, the newspaper said citing Wen Bin, chief researcher of China Minsheng Bank. Many smaller banks are seeking capital because regulators want to treat them as "critical financial institutions" and place them under closer watch, with stricter requirements over capital and leverage ratios, the newspaper said. (MNI)

OVERNIGHT DATA

JAPAN JUL TRADE BALANCE +Y441.0BN; MEDIAN +Y196.4BN; JUN +Y384.0BN

JAPAN JUL TRADE BALANCE ADJ +Y52.7BN; MEDIAN +Y125.1BN; JUN -Y62.7BN

JAPAN JUL EXPORTS +37.0% Y/Y; MEDIAN +39.4%; JUN +48.6%

JAPAN JUL IMPORTS +28.5% Y/Y; MEDIAN +35.3%; JUN +32.7%

JAPAN JUN CORE MACHINE ORDERS +18.6% Y/Y; MEDIAN +15.6%; MAY +12.2%

JAPAN JUN CORE MACHINE ORDERS -1.5% M/M; MEDIAN -2.8%; MAY +7.8%

AUSTRALIA Q2 WAGE PRICE INDEX +1.7% Y/Y; MEDIAN +1.9%; Q1 +1.5%

AUSTRALIA Q2 WAGE PRICE INDEX +0.4% Q/Q; MEDIAN +0.6%; Q1 +0.6%

AUSTRALIA JUL WESTPAC LEADING INDEX -0.11% M/M; JUN -0.07%

The Leading Index continues to slow but is still consistent with above trend growth over the next 3 to 9 months. No Leading Index can accurately predict the impact of sudden virus lockdowns, although the direct effects of measures will start to become more apparent in the August Index. With the deteriorating outlook in NSW and Melbourne, Westpac has revised down its forecasts for the September quarter to a contraction of 2.6% to be followed by a recovery in the December quarter of 2.6% and very strong growth of 5.0% in 2022. We are expecting growth to resume at a solid above trend pace once the economy emerges from current lockdowns but are mindful of the uncertainties associated with the current health situation. (Westpac)

NEW ZEALAND Q2 PPI INPUT +3.0% Q/Q; Q1 +2.1%

NEW ZEALAND Q2 PPI OUTPUT +2.6% Q/Q; Q1 +1.2%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS WEDS; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Wednesday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.0814% at 09:29 am local time from the close of 2.1078% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 42 on Tuesday vs 37 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4915 WEDS VS 6.4765

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4915 on Wednesday, compared with the 6.4765 set on Tuesday, marking the weakest parity since Jul 29.

MARKETS

SNAPSHOT: No Change For RBNZ OCR, But Hike Is Merely Delayed

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 199.62 points at 27622.65

- ASX 200 down 2.03 points at 7509.3

- Shanghai Comp. up 19.355 points at 3466.331

- JGB 10-Yr future down 4 ticks at 152.35, yield down 0.5bp at 0.010%

- Aussie 10-Yr future down 0.5 tick at 98.865, yield up 0.7bp at 1.145%

- U.S. 10-Yr future -0-04 at 134-04+, yield up 1.34bp at 1.275%

- WTI crude up $0.19 at $66.78, Gold up $2.92 at $1789.09

- USD/JPY up 4 pips at Y109.64

- FED'S ROSENGREN WARNS MASSIVE BOND PURCHASES ARE ILL-SUITED FOR US ECONOMY (FT)

- FED'S KASHKARI SEES TAPER COMING, PERHAPS AROUND YEAR END

- RBNZ DELAYS RATE HIKE AS FRESH COVID-19 OUTBREAK STOKES UNCERTAINTY (RTRS)

BOND SUMMARY: Some RBNZ Inspired Chop Livens Up A Limited Session

U.S. Tsys have softened a touch in Asia, with the major cash benchmarks running little changed to 1.0bp cheaper ahead of European hours. There has been a lack of tier 1 macro news flow, but e-minis managed to unwind their early, modest losses to print higher on the day, while some spill over from the latest RBNZ decision was also observed. T-Notes last trade -0-03+ at 134-05, within the confines of a 0-06 range. Flow in the space was headlined by a 10K block buyer of the TYU1 135.00 calls. NY hours will see the release of the minutes from the FOMC's latest monetary policy decision, comments from St. Louis Fed President Bullard ('22 voter), building permits & housing starts data and 20-Year Tsy supply.

- For Aussie bonds most of the focus was on goings on across the Tasman. The space saw some initial, modest support as the RBNZ left its OCR unchanged in light of the recent COVID developments in NZ, before moving lower as the market reacted to the Bank's focus on a modest delay to the start of its hiking cycle. YM unch., XM -0.5 at typing. In terms of local matters, the Q2 wage price index provided a slight miss vs. exp., while the latest round of ACGB Jun '31 supply was easily digested, with the cover ratio in the mid 3s and weighted average yield printing 0.45bp through prevailing mids at the time of supply.

- JGB futures last print 4 ticks lower on the day, hugging a tight range with a lack of idiosyncratic news flow evident. The major cash JGB benchmarks trade either side of unchanged, but within -/+0.5bp boundaries. The offer/cover ratios witnessed in the latest round of 1- to 10-Year BoJ Rinban operations were little changed to a touch lower vs. the previous operations for the respective buckets.

AUSSIE BONDS: The AOFM sells A$800mn of the 1.50% 21 June 2031 Bond, issue #TB157:

The Australian Office of Financial Management (AOFM) sells A$800mn of the 1.50% 21 June 2031 Bond, issue #TB157:

- Average Yield: 1.0895% (prev. 1.3320%)

- High Yield: 1.0900% (prev. 1.3350%)

- Bid/Cover: 3.5938x (prev. 3.6700x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 70.0% (prev. 50.0%)

- Bidders 45 (prev. 43), successful 14 (prev. 23), allocated in full 5 (prev. 14)

EQUITIES: Flat To A Touch Higher In Asia

The major Asia-Pac equity indices inched higher on Wednesday, with a sense of stability seemingly in the air. A reminder that Chinese tech names struggled during Tuesday's session in the wake of the latest regulatory crackdown in Beijing.

- U.S. e-mini futures recovered from worst levels of overnight trade to sit a touch above settlement levels into European hours, with broader macro headline flow limited. This comes after the major Wall St. benchmarks lost ground on Tuesday (on the back of well-defined/discussed risks and softer than expected U.S. retail sales data), although they managed to recover from worst levels into the close.

OIL: Just Above Settlement Levels

WTI & Brent crude futures sit ~$0.10 above settlement levels after showing a lack of lasting/notable reaction to roughly in line with exp. drawdowns across the headline crude, Cushing and gasoline stock inventories in the weekly API report. Distillate stocks saw a modest build in the same report.

- A reminder that crude came under some modest pressure on the broader risk-negative backdrop that we outlined on Tuesday, with some respite on the back of U.S. economic data, before fading again as we moved through the NY day.

- The weekly DoE inventory report provides the point of focus on Wednesday.

GOLD: Familiar Territory

Spot gold continues to operate within well-trodden territory after last week's sell off and subsequent recovery. This comes after Tuesday's early risk-off bid faded as the DXY pushed higher and U.S. real yields moved away from their intraday troughs. The technical picture remains unchanged, with spot last dealing $5/oz or so higher, just above $1,790/oz as the broader USD edges away from yesterday's peak during Asia-Pac trade.

FOREX: Kiwi Whipsaws After Hawkish Hold From RBNZ, Risk Appetite Firms

The RBNZ admitted that they were on the course to tightening policy, but they chose to leave the OCR unchanged in light of the government's decision to place the whole country under strict lockdown. The NZD tanked in the initial reaction as the decision to leave policy settings on hold caught hawks off guard. The downswing was promptly retraced as the focus turned to updated projections in the MPS, in which the Committee anticipated a lift in the OCR later this year. When the dust settled, the Kiwi found itself atop the G10 scoreboard.

- New Zealand identified a couple of further Covid-19 cases linked to the current outbreak, bringing the total case count to 7. Officials said that the original case can be traced back to Australia's NSW. Some fresh clarity on the Covid-19 front appeared to lend a modicum of support to the NZD ahead of the RBNZ announcement.

- NZD/USD printed a fresh YtD trough at $0.6870 before bouncing off there. Implied volatilities faltered across the board, with the overnight tenor staging a sharp pullback to 12.09%.

- Yesterday's risk aversion evaporated, reducing demand for safe haven assets. The yen was the main laggard despite little in the way of notable headline flow out of Japan.

- Commodity-tied FX traded on a firmer footing amid an uptick in crude oil prices and wider post-RBNZ gyrations.

- USD/CNH extended losses after a marginally firmer than expected PBOC fix. China's central bank set its central USD/CNY mid-point at CNY6.4915, 15 pips shy of sell-side estimate.

- Key releases due after Asia hours include inflation data from the UK, EZ (f) & Canada. The FOMC will publish minutes from their latest monetary policy meeting, while Fed's Bullard will discuss U.S. economic outlook.

FOREX OPTIONS: Expiries for Aug18 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800-05(E707mln), $1.1850(E587mln)

- USD/JPY: $110.00-20($2.0bln)

- AUD/USD: $0.7405(A$712mln), $0.7480(A$2.6bln)

- USD/CNY: Cny6.55($561mln)

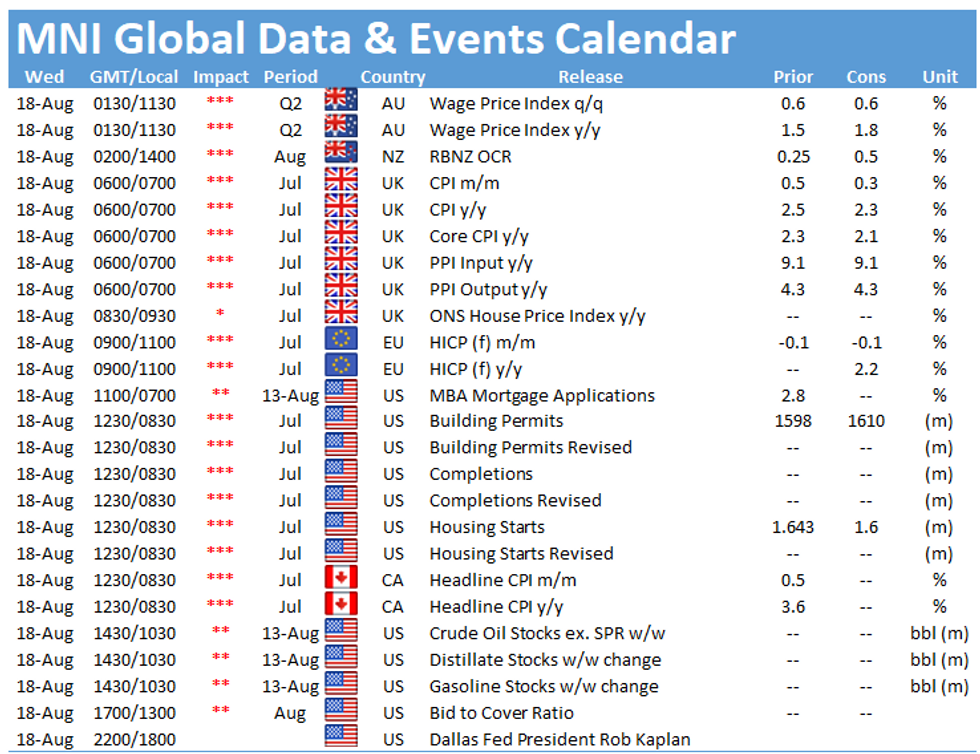

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.