-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: RBNZ On Hold, For Now

- The RBNZ left its OCR at 0.25%, although the upbeat economic view, alongside the Bank's choice of rhetoric and fresh OCR projections point to at least 1 hike by year end.

- The 2-way reaction to the RBNZ decision provided the focal point in Asia-Pac dealing.

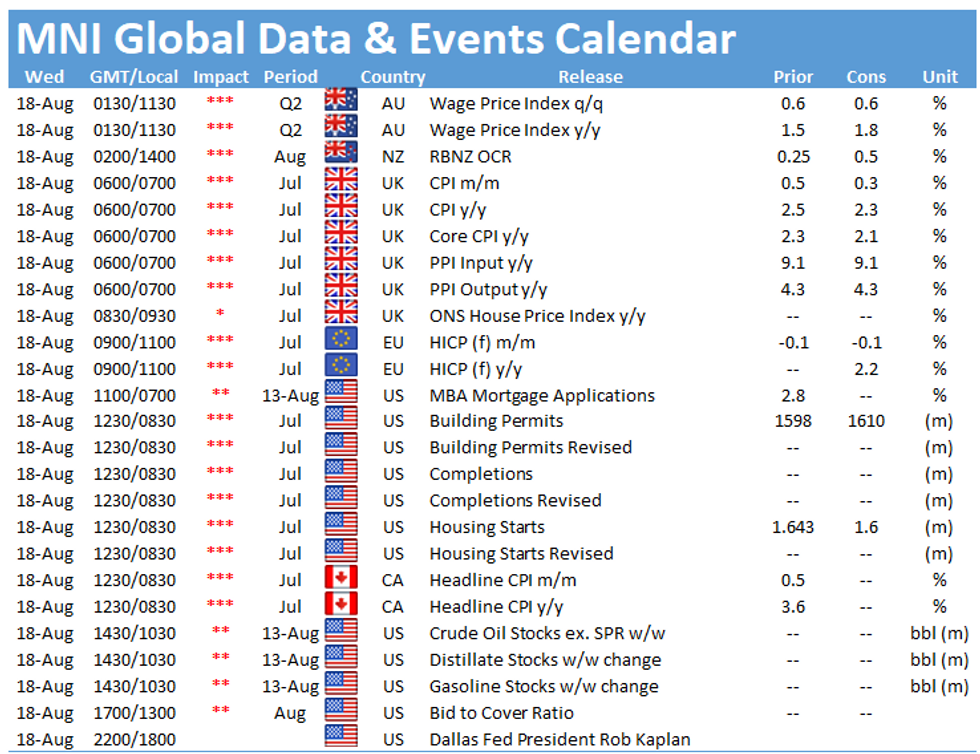

- Minutes from the most recent FOMC decision headline the broader docket on Wednesday.

BOND SUMMARY: Some RBNZ Inspired Chop Livens Up A Limited Session

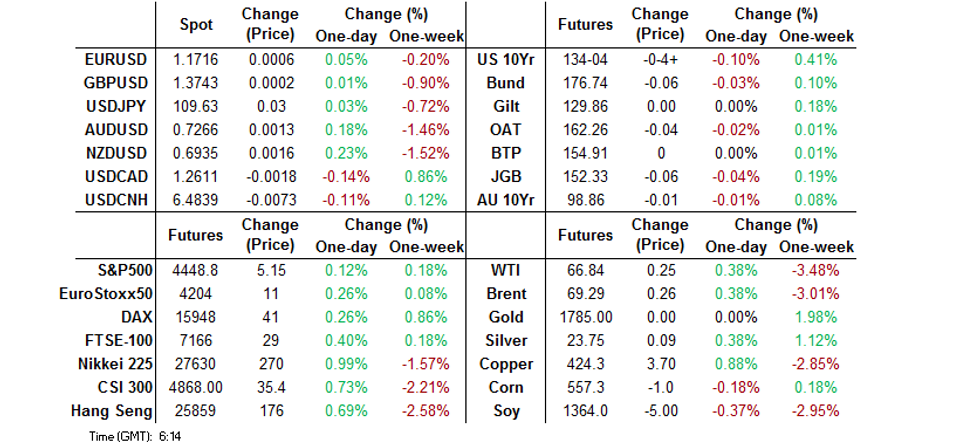

U.S. Tsys have softened a touch in Asia, with the major cash benchmarks running little changed to 1.5bp cheaper ahead of European hours. There has been a lack of tier 1 macro news flow, but e-minis managed to unwind their early, modest losses to print a touch higher on the day, while some spill over from the latest RBNZ decision was also observed. T-Notes last trade -0-04+ at 134-04, within the confines of a 0-06+ range. Flow in the space was headlined by a 10K block buyer of the TYU1 135.00 calls. NY hours will see the release of the minutes from the FOMC's latest monetary policy decision, comments from St. Louis Fed President Bullard ('22 voter), building permits & housing starts data and 20-Year Tsy supply.

- For Aussie bonds most of the focus was on goings on across the Tasman. The space saw some initial, modest support as the RBNZ left its OCR unchanged in light of the recent COVID developments in NZ, before moving lower as the market reacted to the Bank's focus on a modest delay to the start of its hiking cycle. YM unch., XM -1.0 at typing. In terms of local matters, the Q2 wage price index provided a slight miss vs. exp., while the latest round of ACGB Jun '31 supply was easily digested, with the cover ratio in the mid 3s and weighted average yield printing 0.45bp through prevailing mids at the time of supply.

- JGB futures last print 7 ticks lower on the day, hugging a tight range with a lack of idiosyncratic news flow evident. The major cash JGB benchmarks trade either side of unchanged, but within -/+0.5bp boundaries. The offer/cover ratios witnessed in the latest round of 1- to 10-Year BoJ Rinban operations were little changed to a touch lower vs. the previous operations for the respective buckets.

FOREX: Kiwi Whipsaws After Hawkish Hold From RBNZ, Risk Appetite Firms

The RBNZ admitted that they were on the course to tightening policy, but they chose to leave the OCR unchanged in light of the government's decision to place the whole country under strict lockdown. The NZD tanked in the initial reaction as the decision to leave policy settings on hold caught hawks off guard. The downswing was promptly retraced as the focus turned to updated projections in the MPS, in which the Committee anticipated a lift in the OCR later this year. When the dust settled, the Kiwi found itself atop the G10 scoreboard.

- New Zealand identified a couple of further Covid-19 cases linked to the current outbreak, bringing the total case count to 7. Officials said that the original case can be traced back to Australia's NSW. Some fresh clarity on the Covid-19 front appeared to lend a modicum of support to the NZD ahead of the RBNZ announcement.

- NZD/USD printed a fresh YtD trough at $0.6870 before bouncing off there. Implied volatilities faltered across the board, with the overnight tenor staging a sharp pullback to 12.09%.

- Yesterday's risk aversion evaporated, reducing demand for safe haven assets. The yen was the main laggard despite little in the way of notable headline flow out of Japan.

- Commodity-tied FX traded on a firmer footing amid an uptick in crude oil prices and wider post-RBNZ gyrations.

- USD/CNH extended losses after a marginally firmer than expected PBOC fix. China's central bank set its central USD/CNY mid-point at CNY6.4915, 15 pips shy of sell-side estimate.

- Key releases due after Asia hours include inflation data from the UK, EZ (f) & Canada. The FOMC will publish minutes from their latest monetary policy meeting, while Fed's Bullard will discuss U.S. economic outlook.

FOREX OPTIONS: Expiries for Aug18 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800-05(E707mln), $1.1850(E587mln)

- USD/JPY: $110.00-20($2.0bln)

- AUD/USD: $0.7405(A$712mln), $0.7480(A$2.6bln)

- USD/CNY: Cny6.55($561mln)

ASIA FX: Won Catches Bid With Korean Finance Ministry On Lookout For Excessive Moves

Most Asia EM currencies outperformed the struggling USD as yesterday's risk aversion evaporated. The won topped the pile as participants digested comments from the Finance Ministry, who pledged to keep an eye on FX markets, monitoring the risk of excessive moves.

- CNH: Offshore yuan picked up some strength and a slightly firmer than expected PBOC fix likely helped USD/CNH extend losses. China's central bank set its USD/CNY midpoint at CNY6.4915, 15 pips below sell-side estimate.

- KRW: Spot USD/KRW pulled back from a fresh YtD high just shy of the KRW1,180 figure as the Finance Ministry took the floor. The pair sold off as Finance Ministry Director Oh noted that the recent upswing in USD/KRW is an overshooting after a short-term demand-supply imbalance including stock sales by foreign investors.

- IDR: The rupiah stuck to a tight range, with pent-up risk-off impetus preventing it from firming alongside most regional peers. Indonesian markets were closed for a public holiday on Tuesday.

- MYR: Spot USD/MYR reopened on a firmer footing, but swung to a loss later in the session. Ismail Sabri Yaakob, who is UMNO Vice President and was Deputy PM in the Muhyiddin Cabinet, seems to be the front-runner in the race for prime ministerial nomination.

- PHP: The peso strengthened a tad, before shedding most gains. Participants assessed a Philippine Daily report, which noted that Metro Manila mayors would decide today whether to ease curbs in the capital region, while Manila Times reported that Philippine economic planners would revise macroeconomic assumptions today.

- THB: USD/THB took a dip and narrowed in on support from Aug 13 low of THB33.143. The edited minutes from the BoT's latest monetary policy meeting provided little fresh insight and showed that policymakers deemed financial measures to be more effective in stimulating the economy than another rate cut. The baht shrugged off the second straight record increase in Thailand's daily Covid-19 death count.

- SGD: The Singapore dollar appreciated in sympathy with most of its peers from the region, with USD/SGD unwinding some of its yesterday's gain.

- TWD: Spot USD/TWD printed a two-week high but erased gains thereafter. Taiwan will report monthly export orders and quarterly BoP current account balance later today.

EQUITIES: Flat To A Touch Higher In Asia

The major Asia-Pac equity indices inched higher on Wednesday, with a sense of stability seemingly in the air. A reminder that Chinese tech names struggled during Tuesday's session in the wake of the latest regulatory crackdown in Beijing.

- U.S. e-mini futures recovered from worst levels of overnight trade to sit a touch above settlement levels into European hours, with broader macro headline flow limited. This comes after the major Wall St. benchmarks lost ground on Tuesday (on the back of well-defined/discussed risks and softer than expected U.S. retail sales data), although they managed to recover from worst levels into the close.

OIL: Just Above Settlement Levels

WTI & Brent crude futures sit ~$0.10 above settlement levels after showing a lack of lasting/notable reaction to roughly in line with exp. drawdowns across the headline crude, Cushing and gasoline stock inventories in the weekly API report. Distillate stocks saw a modest build in the same report.

- A reminder that crude came under some modest pressure on the broader risk-negative backdrop that we outlined on Tuesday, with some respite on the back of U.S. economic data, before fading again as we moved through the NY day.

- The weekly DoE inventory report provides the point of focus on Wednesday.

GOLD: Familiar Territory

Spot gold continues to operate within well-trodden territory after last week's sell off and subsequent recovery. This comes after Tuesday's early risk-off bid faded as the DXY pushed higher and U.S. real yields moved away from their intraday troughs. The technical picture remains unchanged, with spot last dealing $5/oz or so higher, just above $1,790/oz as the broader USD edges away from yesterday's peak during Asia-Pac trade.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.