-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Equities Bid In Asia

- Friday's uptick on Wall St. provided some support to broader risk appetite during Monday's Asia session.

- This allowed the major regional equity indices and e-minis to move higher, while haven FX (USD, JPY & CHF) struggled in the G10 space.

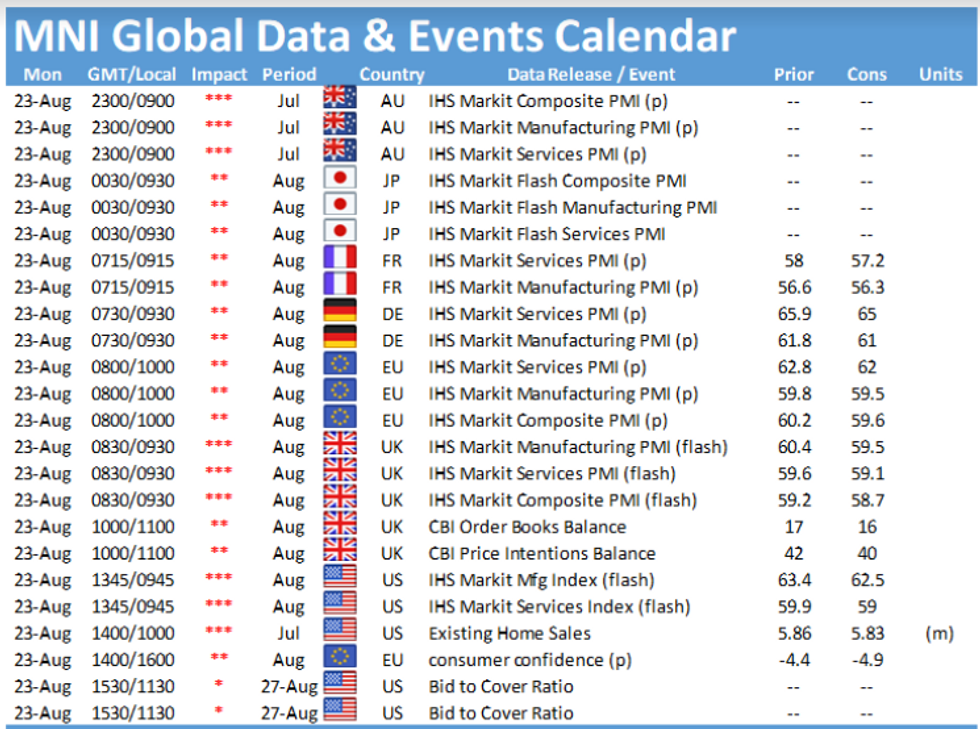

- Flash PMI data from across the globe headlines the broader economic docket on Monday.

BOND SUMMARY: Core FI A Little Lower As Equities Tick Higher In Asia

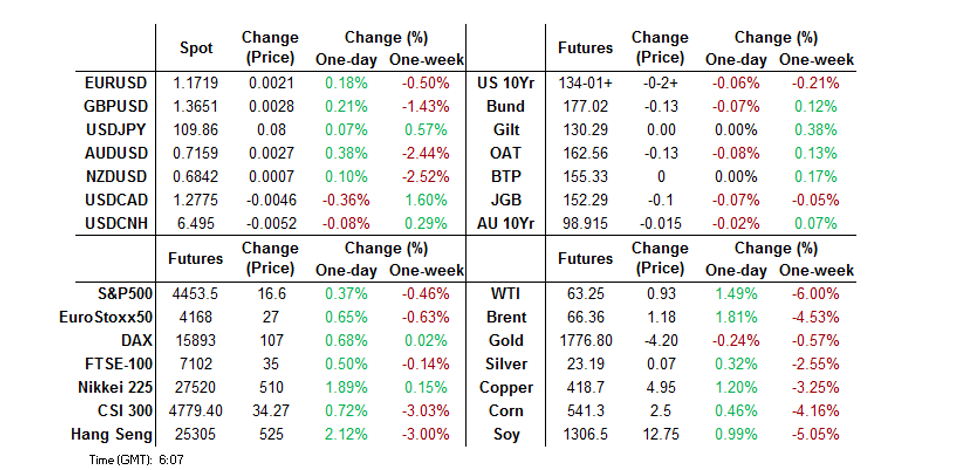

Friday's uptick on Wall St. has resulted in a move higher in the Nikkei 225 early this week (+1.8%), while e-minis have also ticked higher. This has resulted in some modest pressure for U.S. Tsys & core FI, while the havens (JPY, USD & CHF) find themselves at the bottom of the G10 FX table.

- Headline flow has been limited during Asia-Pac hours, with much of the focus falling on the regional COVID situation and headwinds for global trade.

- T-Notes last print -0-03 at 134-01, sticking to the confines of a 0-06 range and operating on relatively limited volume. Cash Tsys run 0.5 to 1.5bp cheaper across the curve, with the belly leading the way lower ahead of this week's 2-, 5- & 7-Year supply schedule. Asia flow was headlined by a 10K screen seller of the TYU1 135.00 calls. European flash PMI data may set the tone ahead of NY trade. Monday's U.S. docket will see the release of flash PMI data, the latest Chicago Fed national activity index reading and existing home sales data.

- JGB futures last print -10 on the day, which represents a marginal extension of the overnight weakness as an uptick in domestic equities adds some light pressure to the space. The major cash JGB benchmarks run little changed to 1.0bp cheaper on the day with 7s leading the way lower, suggesting the move may be futures driven. Longer dated swap spreads are marginally wider on the day. There has been little in the way of idiosyncratic news flow to note for the space, outside of the previously identified political headlines.

- The Aussie bond space was also biased a touch lower, although the broader ranges once again remain contained. YM -1.5 & XM -1.0 at typing. There is plenty of discussion doing the rounds re: the potential for the first round of positive weekly RBA-purchase adjusted AOFM net supply in some time, given the previously flagged syndication of the new Nov '32 index linked line from the AOFM, which is set to price on Tuesday. Local COVID matters failed to impact the space.

FOREX: Commodity Currencies Rebound

Risk sentiment was positive in the Asia-Pac session as Friday's theme's continued following a less hawkish tilt from Fed's Kaplan on Friday.

- AUD and NZD both started lower as local COVID dynamics caused some concern, but positive sentiment saw both lifted with AUD the winner on the day as worries in New Zealand abound that authorities have failed to contain the latest COVID-19 outbreak. The move in AUD accelerated after Australian PM Morrison said that individual states should stick to plans to reopen from lockdowns despite still elevated case counts in both NSW and Victoria. Commodity currencies were further supported by a rebound in oil prices with crude futures rising by over 1%.

- Offshore yuan strengthened, USD/CNH dipping back below the psychological 6.50 handle. On the coronavirus front China reported no new cases for the first time in over a month. China stepped up testing to isolate breakouts and utilized sweeping quarantines to isolate infections.

- Markets look ahead to European flash PMI readings coming up, while broader focus for the week will fall on the Fed's annual Jackson Hole Economic Symposium, with commentary from FOMC Chair Powell on Friday headlining that (now virtual) event.

ASIA FX: Supportive Risk Environment

Risk sentiment rebounded in Asia which helped support Asia EM currencies.

- CNH: Offshore yuan strengthened, USD/CNH dipping back below the psychological 6.50 handle. On the coronavirus front China reported no new cases for the first time in over a month.

- SGD: Singapore dollar is stronger, Singapore is seeking to add more countries to its vaccinated travel lane after allowing vaccinated visitors from Germany and Brunei from next month.

- KRW: Won gained, South Korea's daily new coronavirus fell to 1,418 on Monday due to fewer tests over the weekend, as health authorities extended the toughest virus curbs for another two weeks

- TWD: Taiwan dollar is higher, Taiwan has begun administering its first domestically developed Covid-19 vaccines Monday as it seeks to rely more on local options after struggling to secure sufficient supply of the major international shots

- MYR: Ringgit gained, on Friday the King named Ismail the country's third prime minister in just 18 months, marking the return to power of UMNO.

- IDR: Rupiah is higher, gaining from a three-week low. The economic docket is empty this week, markets looks ahead to CPI data next week, a central bank survey seeks M/M CPI rising 0.04%.

- THB: Baht is higher, Thailand reported its lowest daily COVID-19 case count since July 30.

- PHP: Peso strengthened; the government is expected to propose a record budget of PHP 5.024tn today, up 11.5% from the current year's budget.

ASIA RATES: RBI Minutes More Hawkish Than Expected

- INDIA: Yields higher as markets assess the latest set of RBI minutes which had a more hawkish than expected tilt. On Friday the RBI sold INR 260bn of bonds at auction, though yields were above cut offs which indicated weak bidding and put pressure on the space through the rest of the session on Friday. Markets await the RBI's conversion operation today, the Bank will convert a total of INR 100bn from five bonds maturing in 2022 and 2023 into securities due 2031 and 2035. Elsewhere Indian PM Modi said that the government will lay out a plan today to raise funds from the sale of state infrastructure assets over a four year period in order to help minimize the budget deficit.

- SOUTH KOREA: Futures lower in South Korea, following the move lower in US tsys on Friday as risk sentiment rebounded. There were reports earlier that the budget increase for 2022 could be bigger than expected at around 8%, previously thought o be around 6. Details will be finalized later this week after meetings between officials but it is thought that the budget will be KRW 600tn in 2022 from KRW 558tn in 2021. The increased spending will be to address to resurgence in coronavirus and subsequent drop in activity. Elsewhere there were reports on Friday that South Korea plans to buy a total of KRW 2tn in government bonds between August 25 and 31 August in a bid to pay off part of its national debt. The planned bond buyback will be the largest size among debt repayments carried out with extra budgets. The finance ministry said the purchase will lower the debt/GDP ratio by 1ppt to 47.2%.

- CHINA: Futures slightly lower in China, pressured as equity markets rise amid positive risk sentiment. On the coronavirus front China reported no new cases for the first time in over a month. China stepped up testing to isolate breakouts and utilized sweeping quarantines to isolate infections. The PBOC matched maturities with injections at its OMO's, repo rates rose but stayed within recent ranges. The overnight and the 7-day repo rate did invert with the overnight rate up some 12bps to 2.1833%.

- INDONESIA: Yields mixed in Indonesia, yields in the belly lower while the wings move higher. The economic docket is empty this week, markets looks ahead to CPI data next week, a central bank survey seeks M/M CPI rising 0.04%. Elsewhere data showed that global funds bought a net $40.8m of Indonesian bonds on Aug. 19

EQUITIES: Rebound After Last Week's Sell Off

A positive day for equity markets in the Asia-Pac region, rebounding after last week's sell off. Markets in mainland China are up just shy of 2% heading into the European open, while bourses in Hong Kong, Japan and South Korea have seen similar gains. Bourses in Australia and New Zealand have seen more muted moves amid concern over the local COVID dynamic. In South Korea markets are higher after robust export data for the first 20 days of August. Risk assets rebounded with commodities also benefitting. Markets look ahead to European flash PMI today while broader focus for the week will fall on the Fed's annual Jackson Hole Economic Symposium, with commentary from FOMC Chair Powell on Friday headlining that (now virtual) event.

GOLD: Familiar Territory As Participants Look To Jackson Hole

A softer DXY and little in the way of meaningful movement for U.S. yields is supporting gold during Asia-Pac dealing, with spot last +$5/oz just above $1,785/oz. Bullion continues to operate in well-trodden territory with the Fed's Jackson Hole Symposium presenting the major focal point for participants this week.

OIL: Crude Futures Rebound After Losing Streak

Oil gained in Asia on Monday, rebounding after its worst weekly loss since April 2020 and a seven session losing streak, both WTI and Brent are up over 1% after an ~8% drop last week. Risk sentiment has been broadly positive in Asia which has seen equities and commodity markets rise. WTI is dealing around $63.25 and has resistance at $65.00, the Aug 9 low, Brent sees resistance at $68.14/70.04 the low Aug 16/high Aug 18. There were reports over the weekend that the Libyan Central Bank Governor has called for a boost in domestic oil output of around 40% of its current level in order to boost spending and facilitate the economic recovery.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.