-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: USD Holds Lower In Asia

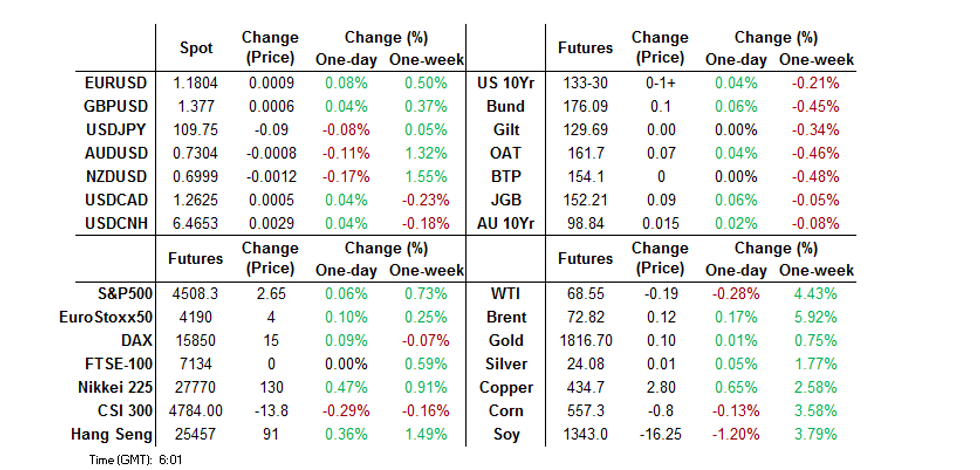

- The DXY held lower in Asia-Pac hours, struggling to gain upward momentum in the wake of Fed Chair Powell's Friday address.

- Political and geopolitical commentary dominated weekend news flow.

- German CPI data and comments from ECB's Schnabel are set to provide the highlights on Monday, with broader liquidity thinned by a London holiday.

BONDS: Core FI A Touch Better Bid In Asia

Much of the weekend's headline flow focused on goings on in Afghanistan, with the U.S. conducting a surgical strike against some of the plotters of the recent attack on Kabul airport, in addition to moving to foil another terror act in the city. Elsewhere, RTRS sources pointed to an intercepted missile attack, which fired on Kabul airport early on Monday morning.

- Incremental support has spilled over from Friday's post-Powell dealing into Asia-Pac trade, with T-Notes holding to a narrow 0-03 range thus far, last +0-01 at 133-29+ after a couple of tests of Friday's late NY high, but there was nothing in the way of a notable break, despite brief and shallow showings above. Cash Tsys trade little changed to ~0.5bp richer across the curve. There hasn't been much in the way of notable headlines/market flow observed thus far. As a reminder, TYU1 will see first notice on Tuesday.

- The cash JGB space has seen firming of 0.5-1.0bp across the curve, while futures initially showed higher before tapering off into the lunch break, last +8 on the day. The details of the latest round of BoJ Rinban ops revealed the following offer/cover ratios: 3- to 5-Year: 2.45x (prev. 3.02X), 5- to 10-Year: 2.93x (prev. 2.66X).

- There was no reaction from Aussie bonds to the latest round of Australian Q2 GDP partials, which saw a much slower than expected uptick in inventories during Q2, alongside a much larger than expected jump in corporate operating profits. YM +2.5, XM +1.5 at typing. Elsewhere, NSW lodged another record daily COVID case count (1,290), while there was a brisk start to the week for A$-denominated corporate issuance.

FOREX: Hugging Post-Powell Ranges

Major pairs fluctuated inside tight ranges with moves limited in Asia on Monday, consolidating after the greenback declined in the wake of FOMC Chief Powell at Jackson Hole.

- JPY slightly firmer, data earlier in the session showed July retail sales rose 2.4% Y/Y, above estimates of a 2.1% increase.

- AUD and NZD both a handful of pips lower. The COVID situation remains in focus, in Australia NSW reported another record rise in cases while in New Zealand there were reports the government will review current lockdown restrictions today. AUD largely ignored data which showed company operation profit rose 7.1%, well above estimates of 2.5%.

- Little movement seen in commodity currencies, markets brace for the impact of Hurricane Ida in the Gulf of Mexico, more than 95% of crude oil production in the region has been taken offline. WTI firmed at the start of the session but gave up gains after reports that Ida had moved inland.

- German CPI data is on the docket for the European session. Further afield markets await the August US NFP print on Friday after Powell indicated the labour market has not reached the FOMC's threshold to taper just yet.

ASIA FX: Playing Catch Up With Weaker Dollar

Most EM Asia currencies gained as the greenback held Friday's losses after a less hawkish than expected Powell at Jackson Hole, risk sentiment was generally constructive but after initial moves ranges were narrow.

- CNH: Offshore yuan is slightly weaker giving back some of Friday's gain. The PBOC injected CNY 40bn via OMOs for the fourth day, while the country reported 23 new coronavirus cases all of which were imported.

- SGD: Singapore dollar fractionally weaker, Health Minister Ong said on Sunday that the 80% vaccination target had been hit, further reopening actions are expected to follow.

- TWD: Taiwan dollar is stronger, over the weekend lawmakers from Japan's ruling LDP party backed Taiwan's entry into the TPP, a move that is seemingly intended to counter China's influence, in the latest effort by Tokyo to declare its public support to Taiwan.

- KRW: Won is stronger, Finance Minister Hong said the government will set aside KRW 6.3tn in the budget to support non-memory chip, bio-health and next-generation vehicle sector and also set out details of the latest cash handouts to residents.

- MYR: Ringgit gained, higher for a sixth straight session. The number of coronavirus cases continues to drop which has fueled hopes that lockdown restrictions with be further relaxed.

- IDR: Rupiah is higher, posting its best daily returns in over a month. Markets look ahead to CPI data later this week, a Central Bank survey sees CPI up 0.01% M/M.

- PHP: Market closed for National Heroes Day.

- THB: Baht is stronger but off best levels, data showed manufacturing production rose 5.12% in July, below estimates of 12.3%. As a reminder Thailand is set to relax some movement restrictions from September 1.

ASIA RATES: Rising Tide Lifts Asia Bonds

- INDIA: Yields lower in early trade, tracking a move in US tsys. The RBI sold INR 340bn on debt on Friday against an INR 310bn target, the auctions were taken down smoothly with primary dealers able to avoid having to mop up the sales. RBI Governor Das spoke on Friday and reassured markets that the RBI will telegraph any shifts in policy stance well in advance of making any changes, and added the Bank is in no hurry to remove monetary accommodation. Markets look ahead to GDP data and fiscal deficit figures due tomorrow.

- SOUTH KOREA: Futures higher in South Korea, the gains follow a rise in US tsys after a less hawkish than expected appearance from FOMC Chair Powell at Jackson Hole on Friday. Futures are still off highs seen post-BOK last week, with markets now assessing the prospect of further hikes in 2021 after initially interpreting the 25bps rate increase with one dissenter as a so-called "dovish hike". There are two meetings left in 2021, chatter seems to be that the presence of one dissenter means back to back hikes are unlikely but the December meeting could be on the table. On Friday the MOF announced it would sell KRW 11tn of bonds in September and would purchase KRW 2tn of bonds from the market. In August the MOF sold KRW 16tn of bonds against plans to sell KRW 12.5tn. 30-Year sale was taken down smoothly.

- CHINA: The PBOC injected a net CNY 40bn of liquidity into the system via OMOs today, the fourth straight day of injections bringing the total to CNY 160bn. The PBOC has reiterated that the injections are to ensure liquidity into month end and should not be seen as easing, the Central Bank injected a net CNY 40bn at the end of July and CNY 100bn at the end of June. Repo rates are lower, but the 7-day repo rate at 2.33% is still slightly above the prevailing 2.20% PBOC rate. Futures rose with the move higher accelerating after equity markets gave back early gains. Elsewhere China will accelerate the issuance of local government special bonds moderately to ensure substantial work at the end of this year and early next year, the 21st Century Business Herald reported. Meanwhile Huarong finally got round to releasing earnings on Sunday, the report showed a loss of CNY 102.9bn while the firm cut shareholder equity by nearly 85%. The firm's key capital level was substantially below regulatory requirements as of June

- INDONESIA: Yields lower across the curve tracking a move in US tsys after a less hawkish appearance from FOMC's Powell on Friday. The government is expected to provide an update on movement restrictions later today, the country reported 599 COVID-19 deaths on Friday, the lowest since July 5. Markets look ahead to tomorrow's bond auction as well as CPI data later this week, a Central Bank survey sees CPI up 0.01% M/M.

EQUITIES: Mostly Positive

Most equity markets in the Asia-Pac region saw gains on Monday, though moves were limited in a subdued session; markets continue to weigh comments from FOMC Chair Powell at the Jackson Hole Economic Symposium on Friday, US equity markets finished last week with gains after Powell was less hawkish than expected. Chinese tech stocks saw gains, building on an advance last week which constituted the biggest weekly gain since January. The Hang Seng was a beneficiary of the rally though early gains of up to 1.5% were eroded as the session wore on. Brokerages in China took a hit after reports in state media that regulators have told brokerages to step up oversight of non-compliant margin trading activities. Markets in Japan are higher, data earlier showed retail sales rose above estimates. US futures are slightly higher, indices seeing gains of less than 0.1% heading into the European open. Markets await US NFP data on Friday after Powell indicated the labour market has not reached the FOMC's threshold to taper just yet.

GOLD: Holding On To Powell-Inspired Gains

It has been a fairly limited round of Asia-Pac trade for bullion, with spot consolidating Friday's post-Powell gains to trade little changed after the Fed Chair walked back some of the hawkish commentary that various regional Fed Presidents put forth before his address. Fed Vice Chair Clarida also presented a relatively measured view on the taper discussion. A tapering announcement and the first actions re: such a move may be implemented by the end of the year, but Powell & Clarida didn't seem to be in any particular rush. Spot last deals little changed just shy of $1,820/oz, with the initial resistance/bull trigger located at the July 15 high ($1,834.1/oz).

OIL: Early Gains For WTI Eroded As Ida Moves Inland

Oil is mixed in Asia-Pac trade on Monday; WTI lower by around $0.10/bbl from settlement while Brent is up $0.26 from settlement levels. WTI was earlier in positive territory as markets braced for the impact of Hurricane Ida in the Gulf of Mexico, more than 95% of crude oil production in the region has been taken offline. However, the gains were eroded as the session wore on with reports that Hurricane Ida is moving inland.

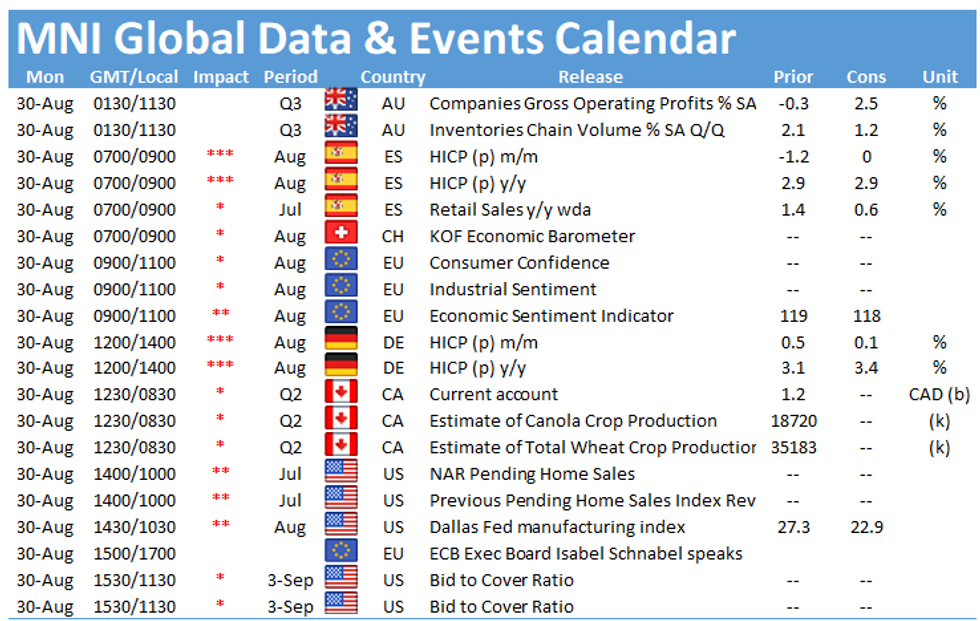

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.