-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessECB Data Watch

MNI EUROPEAN MARKETS ANALYSIS: RBA Sticks With Taper, Juggles Life Of Initial Purchase Rate

- RBA sticks with plan to enact taper in the coming days, although elongates the guaranteed life of the initial step down to a $4bn/week run rate until "at least February," with initial AUD gains and pressure in ACGBs unwound on the heightened sense of economic uncertainty and tapering dynamics.

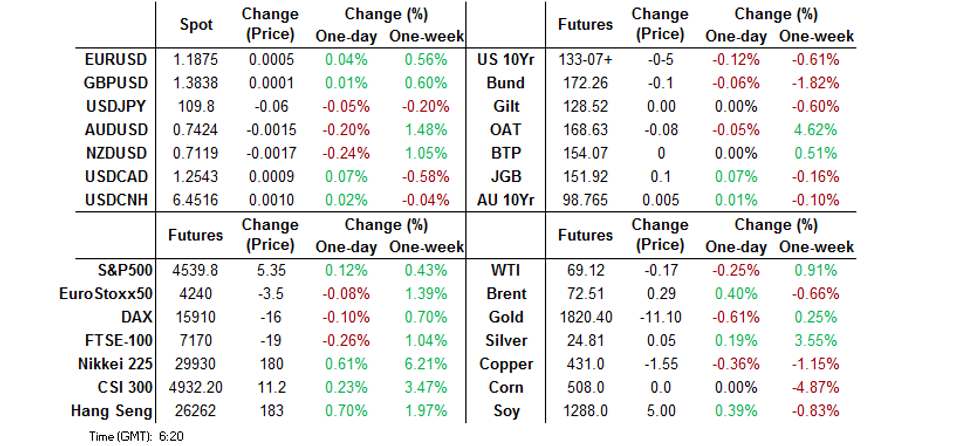

- DXY pares modest early Asia losses ahead of London trade.

- Eurozone GDP, the latest German ZEW Survey & industrial output as well as comments from & Saunders take focus from here.

BOND SUMMARY: Tsys Cheapen After Long Weekend, RBA Tapers, JGBs Outperform

T-Notes pushed through Monday's trough in overnight trade, before recovering from lows to last trade -0-04+ at 133-08, although the break of yesterday's low means that bears are now targeting the nearby 100-DMA support level. Cash Tsys experienced some twist steepening, with 2s seeing very modest richening, while 7+-Year paper cheapened by ~1.5bp. Headline flow remains light, but today's Asia-Pac session gave regional participants their first opportunity to trade cash Tsys in the wake of Friday's NFP report, so the moves may represent some post-data positioning. The uptick in regional equity markets will also be adding some light pressure to the space, with the post-RBA ACGB impetus allowing the space to move away from cheaps. Asia-Pac flow was headlined by a 2.5k block sale of TYZ1 futures. 3-Year Tsy supply headlines locally on Tuesday.

- JGBs meandered through the morning session after the early twist flattening, with futures supported, last +8 on the day. Comments from Japanese Finance Minister Aso failed to move the needle, as he pointed to a need to balance economic support with fiscal discipline, he also identified the need to boost government revenue while limiting spending. Aso noted that he doubts such measures would promote a weaker JPY and inflation owing to Japan's financial standing. Cash Jgbs saw some outperformance in the belly, which richened by 1.0-1.5bp. The lead up to and results of this afternoon's 30-Year JGB supply may have limited the longer end of the curve a little. The auction 30-Year JGB supply sees the cover ratio hold steady around the 3.00x mark (6-auction average 3.18x), while the tail narrowed a touch vs. the prev. auction as the low price matched broader expectations (proxied by the BBG dealer poll). All in all, it wasn't the firmest auction.

- Aussie bond futures knee-jerked lower on the RBA's decision to maintain its decision to implement a taper of its bond purchases in the coming days, but recovered on the fact that the guaranteed life of the previously outlined A$4bn/week bond purchases now runs until February '22 (it was previously set to be revisited in mid-November), with the Bank pointing to an increase in economic uncertainty and suggesting that the pace of the economic bounce-back is likely to be slower than that seen earlier in the year. YM & XM now print at unchanged levels.

FOREX: AUD Whipsaws After RBA Policy Announcement

Most major USD crosses held tight ranges in Asia, albeit the greenback underperformed at the margin for the bulk of the overnight session, with local markets set to reopen after a long weekend. JPY paid little attention to the Nikkei 225's first break above 30,000 since April.

- AUD wavered ahead of the RBA's monetary policy decision. The currency bounced after the RBA decided to stick with its bond tapering plan and said that the setback to economic expansion is expected to be only temporary. The AUD failed to hold onto those gains and retreated into negative territory without much delay as the RBA stressed the level of heightened economic uncertainty and provided an elongated guaranteed life of the A$4bn/week bond purchase run rate.

- NZD clung to the coattails of its Antipodean cousin, ending up as one of the worst G10 performers. A round of comments from RBNZ Gov Orr included little in the way of fresh insights.

- Final EZ GDP, German ZEW Survey & industrial output as well as comments from BoE's Mann & Saunders take focus from here.

FOREX OPTIONS: Expiries for Sep07 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1840-50(E706mln)

- USD/JPY: Y110.00($639mln), Y110.30-50($708mln), Y111.60($525mln)

- AUD/USD: $0.7410-15(A$663mln)

- USD/CAD: C$1.2540($840mln), C$1.2635-40($984mln)

- USD/CNY: Cny6.40($500mln)

ASIA FX: IDR Leads Gains, KRW Lags Peers

Most Asia EM currencies higher as the greenback softens at the margin amid a broadly positive risk environment.

- CNH: Offshore yuan is flat, hugging a narrow range through the session. Trade data was better than expected, exports rose 23.1% in yuan terms against expectations of 18.5%.

- SGD: Singapore dollar is stronger, coronavirus concerns linger, there were 235 new local cases yesterday, officials refused to rule out tightening restrictions again.

- TWD: Taiwan dollar is stronger, but off best levels of the session. There is chatter state banks have stepped in to defend the 27.5 level in USD/TWD.

- KRW: Won is slightly weaker. Data earlier showed current account surplus slightly narrowed in July due to reduced trade surplus.

- MYR: Ringitt gained slightly, there were reports that the main opposition alliance Pakatan Harapan told PM Ismail Sabri last week that they would only abstain in a potential confidence vote rather than back the Premier.

- IDR: Rupiah is higher, Indonesia's positive Covid-19 test rate has plunged to a record low. The gov't yesterday extended curbs in Java and Bali through Sep 13 and through Sep 20 in other areas but also decided to relax some restrictions.

- PHP: Peso rose, consumer prices rose 4.9% Y/Y in August after a 4.0% increase in July, topping the BBG estimate of +4.4%. Inflation was fastest since January 2019, with food prices providing a significant driver of headline reading.

- THB: Baht gained, Thailand reported its lowest daily Covid-19 case count since Jul 22, declaring 13,821 new infections.

ASIA RATES: RBI Liquidity Drain Weighs

- INDIA: Long end yields higher in early trade, curve twist steepens. Bonds fell yesterday, snapping a five day winning streak, after the RBI announced it would drain INR 500bn of liquidity from the system via 7-day variable rate reverse repos, the operation is in addition to the INR 3.5tn 14-day reverse repos. This is the first 7-day reverse repo operation in around 18 months and is seen as the first step in normalising monetary policy by some participants and could indicate concerns from the RBI over financial stability despite assurances from RBI Governor Das that the Central Bank were not close to adjusting policy settings. Markets look ahead to state debt auctions later today.

- SOUTH KOREA: Futures lower in South Korea, while the cash space sees some flattening. The 2-Year auction from the MOF saw bid/cover drop to 2.77 from 3.65 previously despite a 7bps yield premium. Data earlier showed current account surplus slightly narrowed in July due to reduced trade surplus, although exports maintained strong growth.

- CHINA: The PBOC drained a net CNY 40bn via OMO's today, taking away the last of the additional liquidity injected heading into month-end. Repo rates are higher but remain within recent ranges with the overnight and the 7-day rate inverting again; the overnight rate up 7.95bps at 2.1995% the 7-day rate up 3.73bps at 2.1873%. Bonds futures are lower on track for a fourth day of declines, the 10-Year contract is down 2 ticks at 110.19 as equity markets see another session of gains.

- INDONESIA: Yields higher, curve flattens. Indonesia's positive Covid-19 test rate has plunged to a record low. The gov't yesterday extended curbs in Java and Bali through Sep 13 and through Sep 20 in other areas but also decided to relax some restrictions. Elsewhere Fitch said that Indonesia's plan to extend the burden sharing arrangement with the central bank will help to finance a larger fiscal deficit through 2022 but increases the risk of weakening macroeconomic stability which could negatively affect ratings.

EQUITIES: Japan Leads Gains Again

Another mostly positive day for equity markets in Asia; Japan leads gains again with the Nikkei 225 briefly looking above the 30,000 level. Japanese front pages are dominated by political headlines, momentum still seems to be behind Taro Kono, Japan's vaccine czar. Markets in China also higher, tech shares lead gains but upside is broad based after better than expected trade data. In the US futures edged higher as markets prepare to return after the US Labor Day holiday.

GOLD: As You Were

Gold consolidated below $1,830/oz in holiday-thinned Monday trade, with an uptick in the USD and equities applying some light pressure to the metal. Spot is little changed around $1,820/oz at typing, with a familiar technical overlay in play. Our weighted U.S. real yield monitor has nudged higher in the wake of last week's NFP release but remains well within the confines of the recent range.

OIL: Creeps Higher In Asia As USD Softens

Oil has ground higher through the Asia-Pac session, but is still slightly lower versus Friday settlement levels after ebbing through the session on Monday in holiday thinned trade; the closure of US markets for Labor Day keeping volumes, price action and newsflow relatively muted. A pause in the USD's near-term decline weighed on energy markets on Monday, while the greenback has come under pressure in Asia which has helped crude futures higher. As a reminder Saudi Arabia will cut oil prices for sales to Asia next month by more than double the expected amount, the decision follows OPEC agreement to go ahead with production increases.

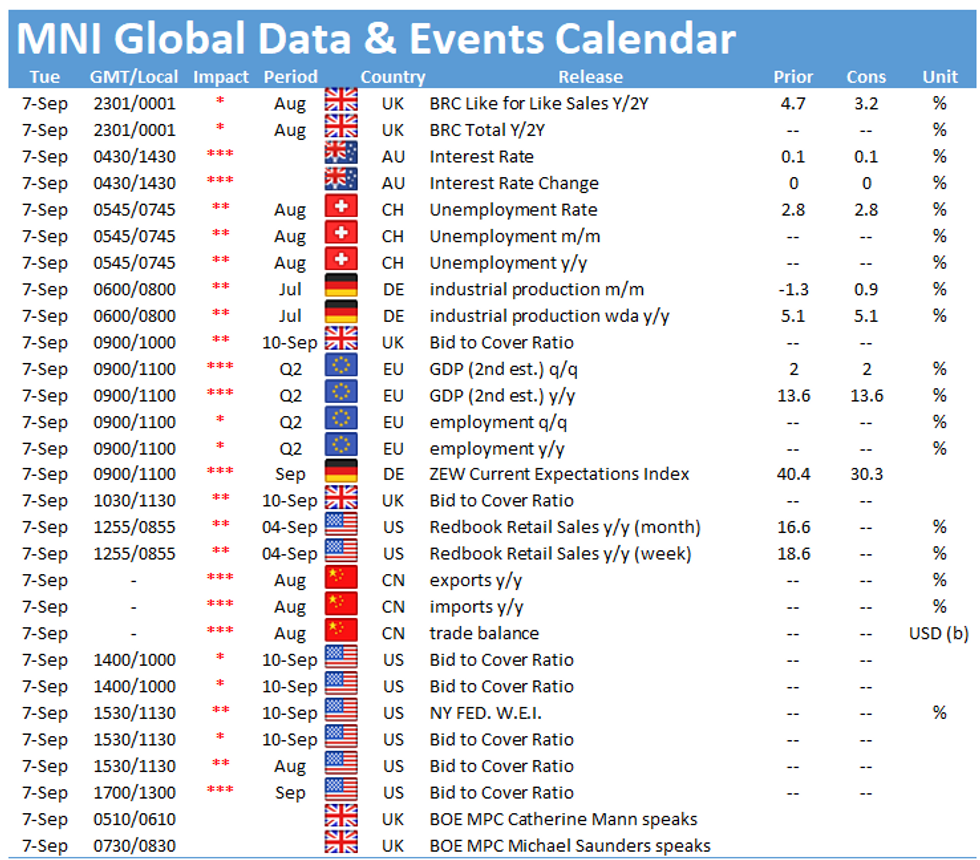

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.