-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: ECB To Provide Less PEPP In Its Step?

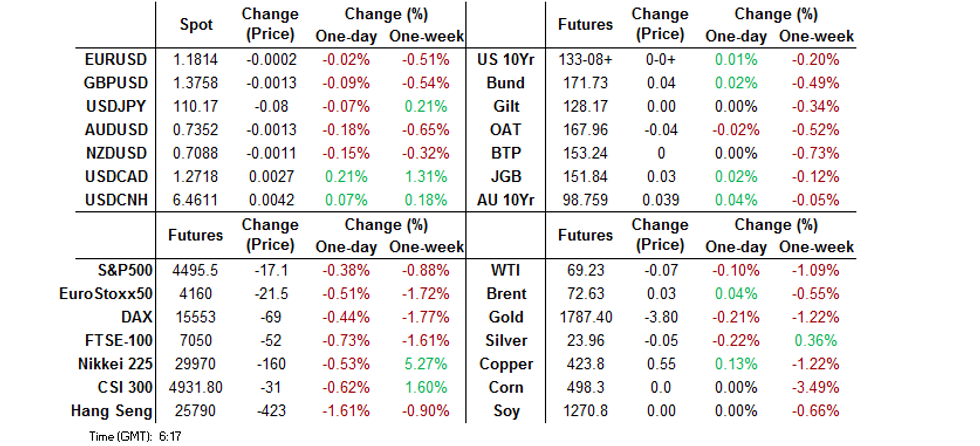

- Core markets generally stuck to tight ranges during Asia-Pac hours, sidelined ahead of the ECB decision.

- Familiar hawkish Fedspeak from Kaplan headlined, while Chinese PPI saw a larger uptick than was expected.

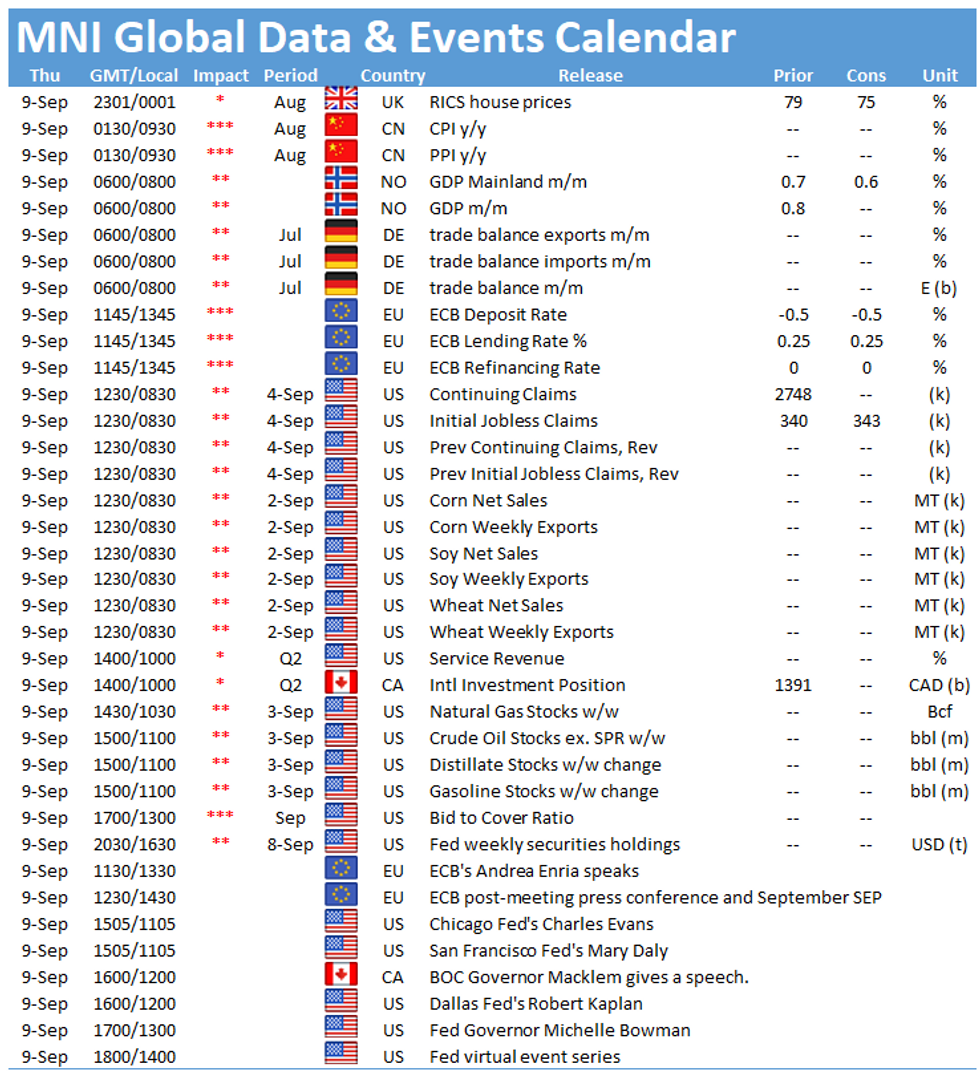

- The aforementioned ECB decision headlines the broader docket on Thursday. Easing financial conditions since the July GC meeting, coupled with an improvement in economic conditions and an acceleration in inflation, suggest that the ECB is likely to announce a reduction in the PEPP purchase rate.

BOND SUMMARY: Core FI Tight In Asia, 5-Year JGB Supply & Futures Rolls Dominate

T-Notes +0-00+ at 133-08+, sticking to the confines of a 0-02+ range in Asia dealing, while cash Tsys sit unchanged to ~1.0bp firmer on the day. There has been little to note on the headline front, outside of hawkish reutterances from Dallas Fed President Kaplan, who pointed to a need to get underway with tapering in October. A 5.0K block buy of TYV1 134.00 calls headlined on the flow side. Thursday will bring weekly initial jobless claims data & 30-Year Tsy supply, while the latest ECB monetary policy decision will garner attention. We will also get plenty of Fedspeak, with Bowman, Williams, Evans & Daly all due to make addresses (although some may not comment on monetary policy).

- JGB futures retraced into the overnight range after a brief look above at the re-open, with a lack of fresh tier 1 headline catalysts observed. Plans to extend the state of emergency in play across 19 prefectures were confirmed by Economy Minister Nishimura after press reports pointed to such a move overnight. Futures +2 vs. settlement last. Cash JGB trade sees the major benchmarks little changed to ~1.0bp richer, with 5s outperforming. Strength in the belly was aided by a well-received round of 5-Year JGB supply. The low price just about topped broader dealer estimates (which stood at 100.50 per the BBG dealer poll), while the cover ratio moved higher (4.42x vs. 6-auction average of 3.70x), likely supported by the relative value appeal and recent cheapening that we flagged ahead of the auction. The price tail remained very tight, showing some incremental narrowing.

- Aussie bond futures were fairly stagnant, clinging onto the bulk of their overnight gains, with roll activity dominating (sellers of the rolls have driven most of the activity thus far). The space continues to look through the local COVID case numbers, with NSW outlining its path out of lockdown, centring on a 70% fully vaccinated ratio. YM +0.7 & XM +3.1 at typing, with the long end of the cash ACGB curve richening by ~3.5bp on the day.

JAPAN: Japan Returns To Net Buying Of Foreign Bonds

The weekly international security flow data revealed that Japanese investors put money back into foreign bonds last week, breaking a 2-week run of net sales and lodging the largest round of weekly net purchases seen since April in the process.

- Meanwhile, net flows on the part of foreign investors into Japanese bonds slowed from last week's elevated levels but printed in positive territory for a second straight week.

- The degree of both of the reported rounds of net equity flows widened but printed in the same direction in the previous week.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 1043.1 | -546.9 | 973.5 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -455.7 | -42.6 | -529.3 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 432.9 | 1480.7 | 1849.9 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 421.6 | 24.1 | 94.7 |

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

FOREX: Risk Aversion Prevails, ECB Decision Eyed

Cautious mood prevailed as participants reassessed economic recovery outlook, with Antipodean currencies bearing the brunt of resultant risk-off flows. That being said, major G10 crosses were happy to hold relatively tight ranges in Asia-Pac hours.

- Traditional safe havens CHF and JPY outperformed at the margin. Japan extended Covid state of emergencies in 19 prefectures including Tokyo and Osaka, as touted in earlier press reports.

- The release of China's inflation data inspired only a limited amount of volatility in USD/CNH, which remained within the confines of yesterday's range. Consumer prices grew slower than forecast, while factory-price inflation proved faster than expected.

- The latest monetary policy decision from the ECB will take focus in European hours, with policymakers likely set to announce a reduction in the PEPP purchase rate.

- U.S. jobless claims and comments from RBA Dep Gov Debelle, BoC Gov Macklem and a number of Fed speakers will also provide some interest.

FOREX OPTIONS: Expiries for Sep09 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1725-30(E863mln), $1.1750(E1.0bln), $1.1800-10(E988mln), $1.1870-80(E1.4bln), $1.1895-05(E1.0bln)

- USD/JPY: Y109.10-30($1.1bln), Y109.50-70($1.6bln), Y110.00-20($874mln), Y110.30-50($1.2bln), Y110.60-80($618mln), Y111.00($721mln)

- GBP/USD: $1.3815-40(Gbp1.0bln)

- AUD/USD: $0.7330-40(A$625mln), $0.7375-80(A$1.0bln)

ASIA FX: Mixed Fortunes

Narrow ranges observed for most Asia EM currencies, returns were mixed despite broad risk off sentiment.

- CNH: Offshore yuan is flat, inflation data released earlier showed that CPI slowed while PPI accelerated. CPI rose 0.8% in August against expectations of a 1.0% rise, PPI rose 9.5% compared to 9.0% expected.

- SGD: Singapore dollar is flat, recoverin early losses and sticking to yesterday's range. There were 349 coronavirus cases in the past 24 hours, the highest in a year.

- TWD: Taiwan dollar is slightly stronger but off best levels. Markets continue to mull a spike in local COVID-19 cases. The government announced it would extend tax cuts for biotech firms by 10 years.

- KRW: Won declined again, lower for a third session and inching closer to 2021 lows. There were 2,049 coronavirus cases in the past 24 hours, above 2,000 for a second day.

- MYR: Ringgit gained, Bank Negara Malaysia are widely expected to leave the Overnight Policy Rate unchanged today.

- IDR: Rupiah declined, Indonesian Financial Services Authority yesterday lowered their 2021 loan growth forecast to +4.0%-4.5% Y/Y and said they would be more optimistic if the vaccination drive accelerates and there are no new coronavirus variants which could exacerbate the outbreak.

- PHP: Peso is stronger, Philippine trade deficit shrank a tad to $3.291bn in July from $3.397bn recorded in June, but was wider than forecast in BBG survey of analysts ($2.950bn). The annual growth in exports was slower than expected, which was coupled with a larger than anticipated annual jump in imports.

- THB: Baht rose, consumer confidence slipped slightly in August printing 39.6 from 40.9, economic confidence slipped to 33.8 from 35.3

ASIA RATES: RBI Address Liquidity

- INDIA: Yields lower in early trade, bonds benefiting from risk aversion evident in Asia-Pac markets. Risk off sentiment sparked outflows and pressured the rupee and stocks for a second day yesterday, INR declined with USD/INR hitting the highest since August 27. Bond were bid meanwhile, yields reversing some of the rise earlier this week, a yield premium over the US and general demand for safe havens spurring inflows. As a note markets are on alert for RBI tweaks to liquidity operations after a Deutsche Bank note said the RBI could introduce longer-tenor reverse repos in its October policy to soak up excess liquidity from the banking system. It was announced yesterday that the RBI will hold an INR 3.5tn 15-Day Reverse Repo Auction today to manage excess banking system liquidity. Further drains in liquidity via longer-tenor and larger size operations could set the stage for normalising policy through an increase in the reverse repo rate. Markets look ahead to a total INR 310bn auction today.

- SOUTH KOREA: Futures higher, tracking a move in US tsys and given an extra boost by a sell off in domestic equity markets with the KOSPI down over 1%. After declining yesterday 10-Year futures gapped higher at the open, the contract last up 22 ticks at 127.23 while the 3-Year is up 1 tick at 110.27. There were 2,049 new coronavirus cases in the past 24 hours, above 2,000 for the second day. Health authorities warned again that new infections may further rise ahead of a major national holiday when millions travel. The 50-Year auction was smoothly taken down with cover rising from the previous sale thanks to a smaller sale size and yield premium.

- CHINA: The PBOC matched injections with maturities, repo rates are lower and well within recent ranges. Futures have risen alongside regional peers and retraced most of the previous day's decline, boosted by declines in Chinese equity markets and worries over corporate bond contagion after reports that Evergrande plans to suspend interest payments on loans from two banks due Sept. 21. and asked a lender to wait for instructions about an extension plan, as a reminder Fitch cut Evergrande to CC from CCC+ yesterday.

- INDONESIA: Yields higher, curve bear flattens. Indonesian Financial Services Authority yesterday lowered their 2021 loan growth forecast to +4.0%-4.5% Y/Y and said they would be more optimistic if the vaccination drive accelerates and there are no new coronavirus variants which could exacerbate the outbreak. As a reminder the official consumer confidence index published by Bank Indonesia tumbled to 77.3 in August, its lowest point in 16 years. The update came a day after the Danareksa Research Institute said that their gauge of consumer sentiment rose to 71.2 from 62.1.

EQUITIES: Risk Off Extends To A Second Day

A negative day for equity markets in the Asia-Pac region, taking a lead from the US where bourses extended losses to a third day. Tech shares were hit hardest in Asia, the Hang Seng nursing losses of over 1.5%. Markets mull a warning from Chinese regulators over antitrust issues and a further caution that gaming firms should not be focuses solely on profit. The ASX 200 is on track for its worst day since June as iron ore sells off and weighs on miners. In Japan markets snapped an eight-day winning streak. In the US futures are lower with markets on track for the longest losing streak since July.

GOLD: Latest USD Uptick Weighed On Wednesday

Spot gold deals little changed, just shy of $1,790/oz, sticking to a very narrow range in Asia-Pac hours. To recap, Wednesday's modest uptick in the broader USD seemed to keep a lid on bullion, with spot failing to make a notable, sustained push above $1,800/oz, even as our weighted U.S. real yield monitor pulled lower. Initial support is now located at the August 19 low ($1,774.5/oz). Initial resistance remains at the July 15 high and bull trigger ($1,834.1/oz).

OIL: Creeps Higher

Crude futures are virtually unchanged on the day into European trade. Both WTI and Brent crude futures finished in positive territory on Wednesday, shrugging off a poor showing from equity markets as well as the rebounding dollar. Buoyant NatGas prices led the way higher, with the active contract printing the highest levels since 2014 as supply concerns feed directly into prices. Forecasts for winter NatGas stockpiles are being downgraded, with solid summer demand pressuring reserves that'll meet Winter heating requirements across the West Coast. The move higher was supported US API stockpile data which showed headline crude stocks fell 2.88m bbls, markets look ahead to official US DOE inventory data which is forecast to show a 4.75m bbl decline in stocks. Markets will also keep an eye on a fresh wave of protests at Libyan oilfields and ports which threatens to impact output.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.